Maverick Crypto: Poor network effects suggest Lido's valuation may be overstated

TechFlow Selected TechFlow Selected

Maverick Crypto: Poor network effects suggest Lido's valuation may be overstated

The bear market hasn't ended yet, and Lido still has time and capital to build its network effects and establish a positive feedback loop when the market recovers.

Written by: Asa Li

Translated by: TechFlow

Today, we will briefly introduce our observations on the adoption of stETH and liquid staking on Ethereum, which we believe has underperformed expectations.

TLDR:

-

The share of stETH and LSDs in total ETH staking is losing market share.

-

stETH has not achieved real DeFi network effects and cannot meaningfully differentiate itself from smaller liquid or illiquid competitors offering better yields.

-

It is far harder for stETH to surpass WETH in DeFi than many imagine. Behavioral inertia, focus on native tokens, declining community momentum, and Lido’s slow governance model all pose headwinds to Lido’s adoption.

-

Given stETH’s weaker-than-expected adoption, we believe investors should apply a slight discount—not a premium—to Lido’s consensus value (ETH price x EL active fees), factoring in the risk of declining “stETH / total staked ETH” market share due to market fragmentation.

Observation: More Users Are Choosing Illiquid Staking Over Liquid Staking

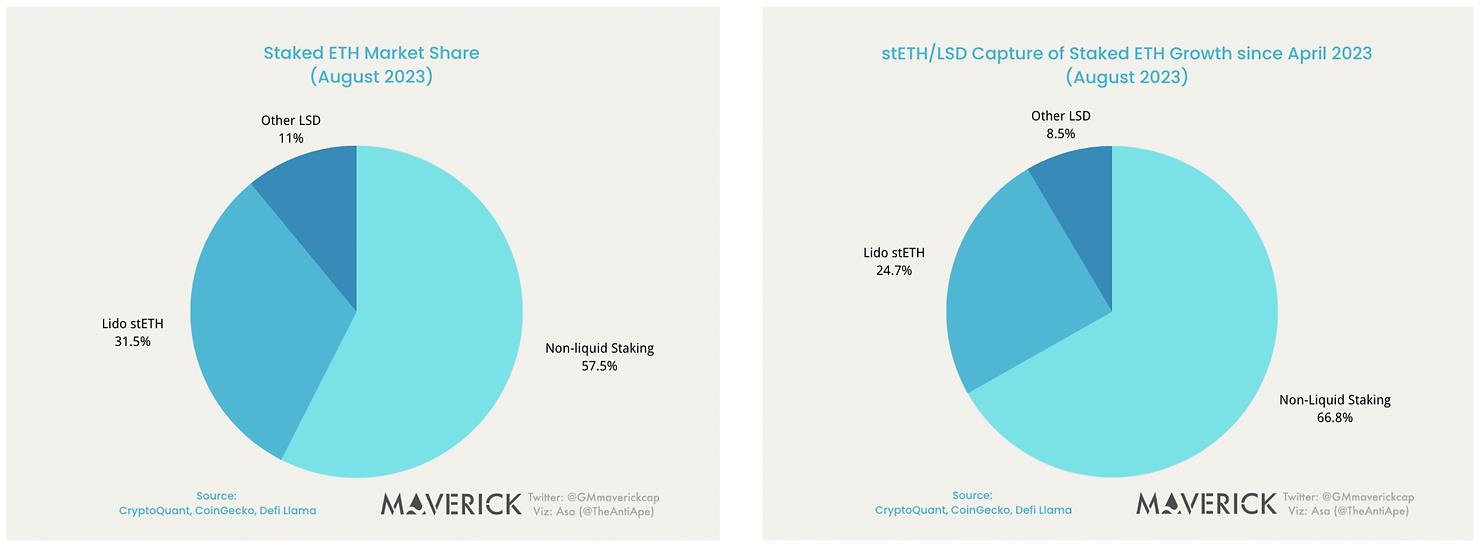

From April 2023 to August 2023, Ethereum's staking ratio grew from 14.13% to 21.32%, a 50% increase in just four months.

However, among the additional 8.6 million ETH staked, the vast majority (67%) went into illiquid staking. Lido’s stETH accounted for less than 25% of the growth in total staked ETH. This means Lido’s market share of total staked ETH declined from 35% in April to 31.5% in August.

Even accounting for increased issuance from higher staking ratios and excluding volatile factors like execution layer rewards, Lido’s total revenue actually decreased between April and August, despite the circulating supply of stETH growing from 5.8 million to 8 million.

Why is this happening? We hypothesize several reasons:

-

Pricing: Lido’s 10% fee rate hurts staker incentives. Other validator service providers offer 4.4% annualized yields, while Lido’s stETH currently offers only 3.8%.

-

Lack of Network Effects: stETH/wstETH currently has only one real use case—being used as collateral for USDC/DAI loans on AAVE and Maker. But with net borrowing rates at 4%–5% and maximum loan-to-value (LTV) ratios at 72%, leveraged borrowing alone is insufficient to drive strong demand for stETH. Moreover, stETH lacks genuine composability or network effects in DeFi.

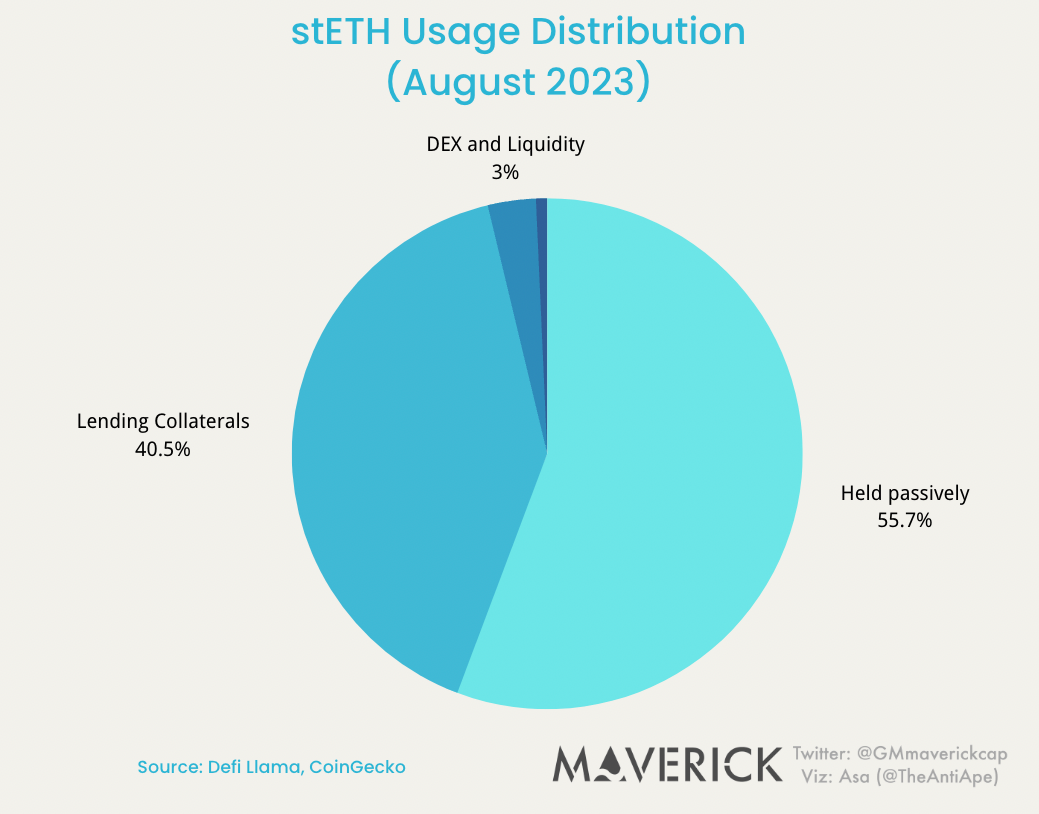

Where Is stETH Used Today?

Let’s take a broad look at stETH across the DeFi ecosystem.

-

55% of stETH tokens are passively held outside DeFi contracts (value storage).

-

40% of stETH tokens are held in lending protocols like AAVE and Maker (lending/collateral).

-

3% are used as liquidity provision on Curve and Uniswap to facilitate ETH/stETH swaps (medium of exchange).

-

Less than 1% of stETH is used in newer "LSDFi" protocols like Pendle.

Lending Markets / Collateral

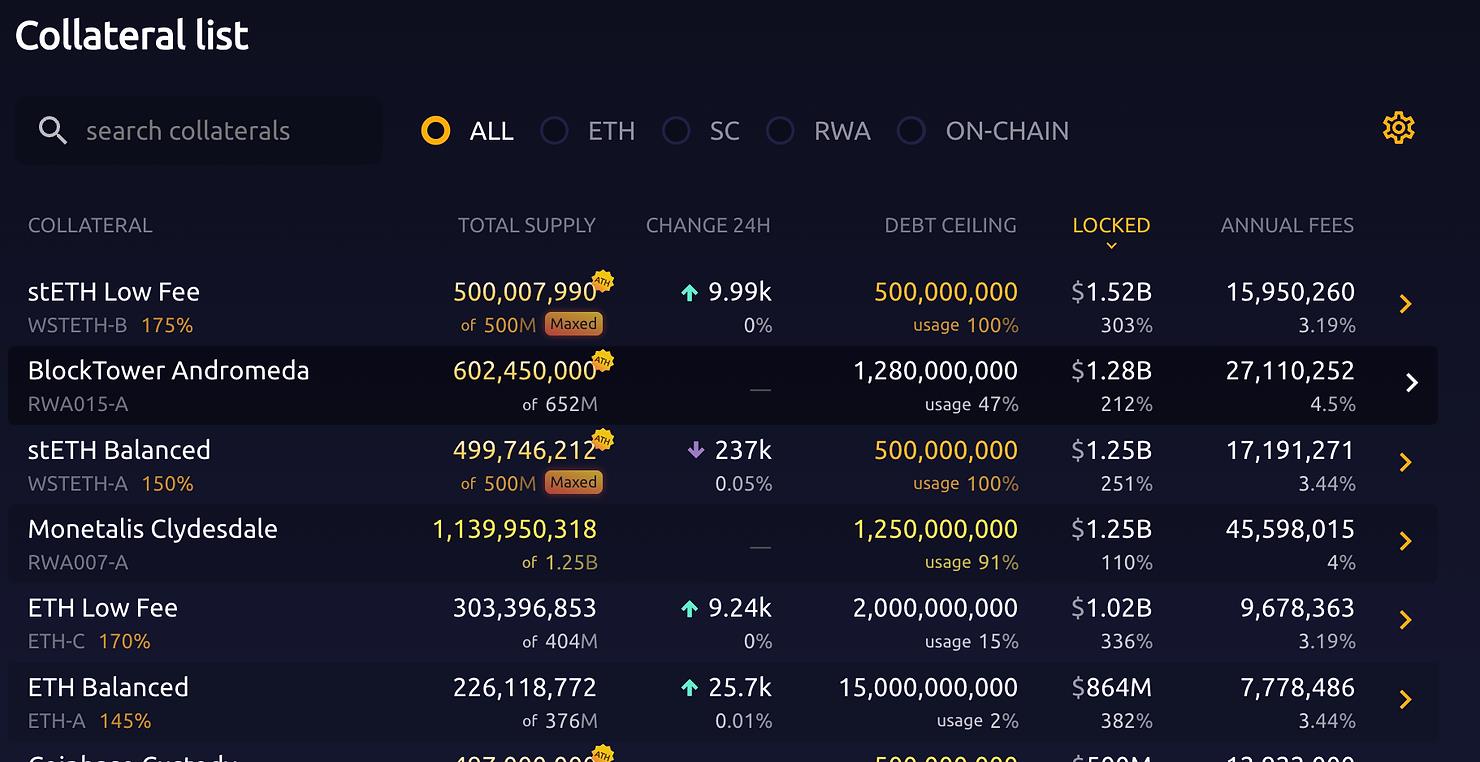

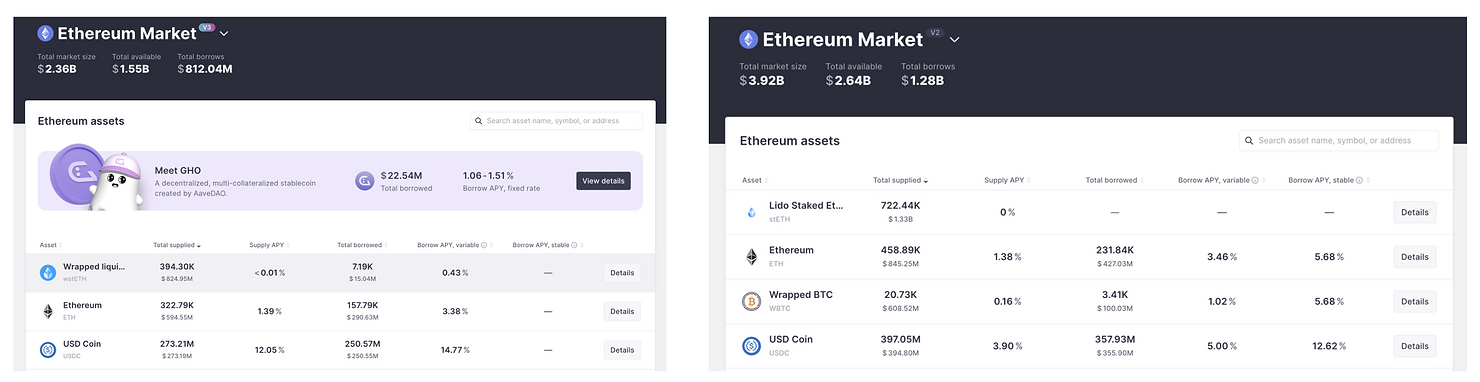

Lending/collateral is by far stETH’s most successful use case. stETH has surpassed ETH to become the top collateral asset on all major lending platforms on Ethereum L1.

As shown below, stETH/wstETH is the most commonly used collateral on Maker and AAVE. On the other hand, almost no wstETH/stETH is borrowed from AAVE, resulting in a 0% annualized supply yield. This indicates a lack of use cases beyond collateralization.

An important point here is that as a use case, collateral does not generate significant network effects: AAVE can accept 10 different LSD variants. The existence of stETH does not affect rETH’s loan-to-value (LTV) ratio or interest rates. Even if stETH becomes the largest deposited asset, that fact alone gives no one extra incentive to buy, hold, or borrow stETH over rETH.

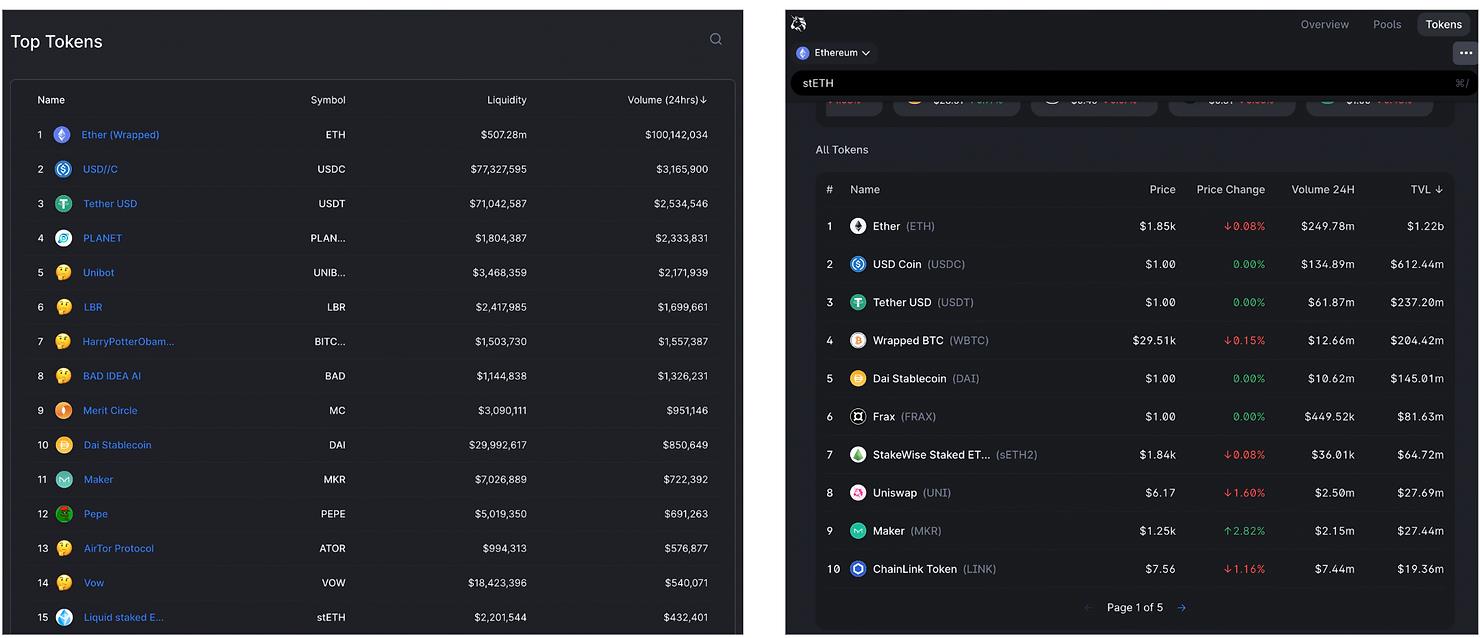

Medium of Exchange: No Progress on Uniswap

A key aspect of liquid staking is DeFi compatibility: one day, stETH could become what WETH is today. An important step in that process is establishing stETH as a medium of exchange—if people see stETH as the most convenient token to swap into any other token, they’ll casually hold it, and large holders will provide liquidity on venues like Uniswap.

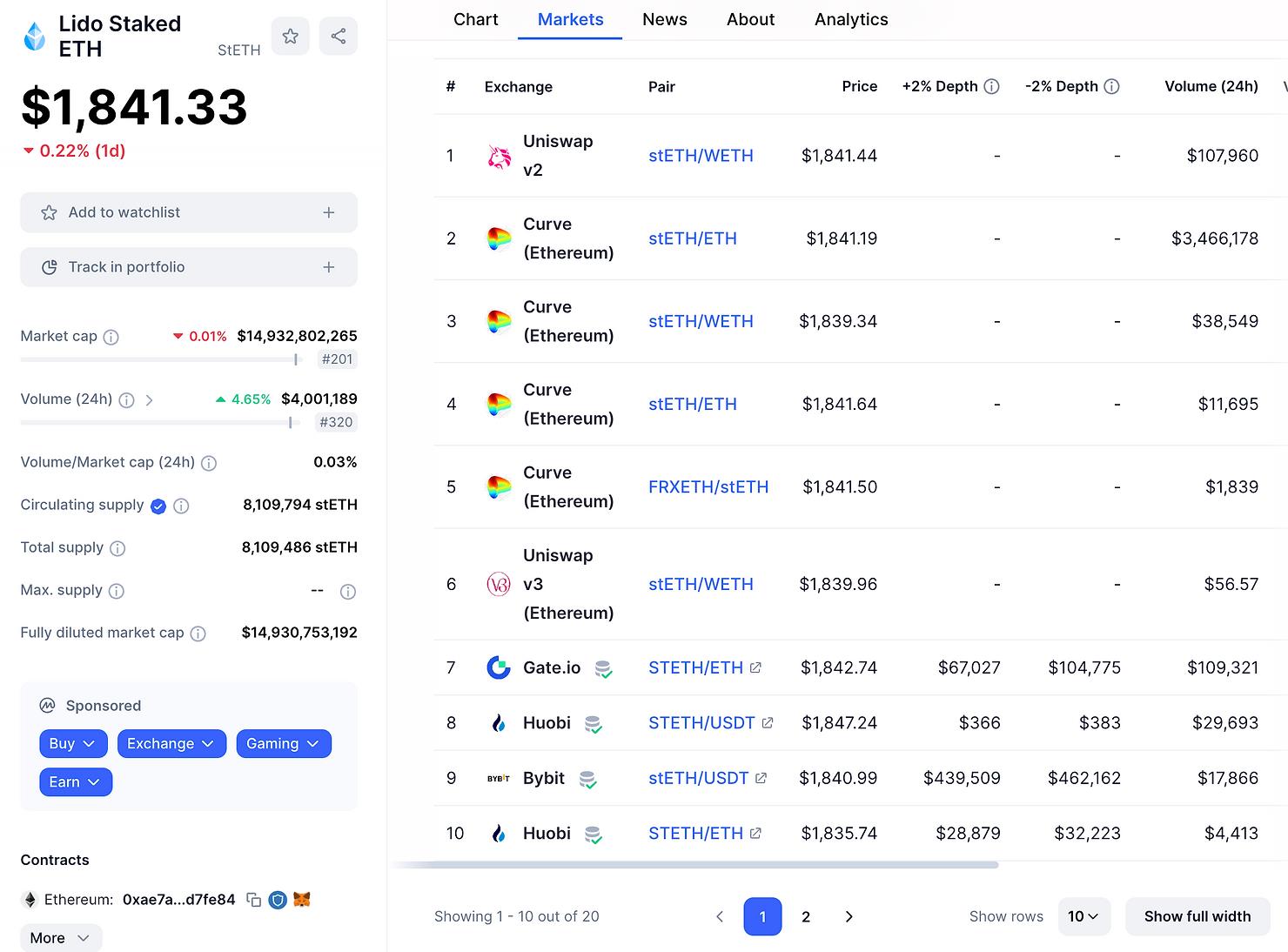

Yet on Uniswap V2 and V3, despite hundreds of new pairs launched each month since April, nearly all are based on WETH. stETH has minimal presence on Uniswap and is treated more as a commodity to be swapped from WETH/USDC (the consensus medium of exchange) rather than as a medium of exchange itself.

It's also worth noting that centralized exchanges (CEXs) show even less interest in stETH than decentralized exchange (DEX) liquidity providers. This suggests there is indeed a higher cognitive barrier to adopting stETH versus ETH. Newcomers who’ve heard of Ethereum’s magic or checked CoinMarketCap will likely continue happily using and holding ETH in trading. (Native ETH will soon be natively supported on Uniswap V4. Goodbye, WETH.)

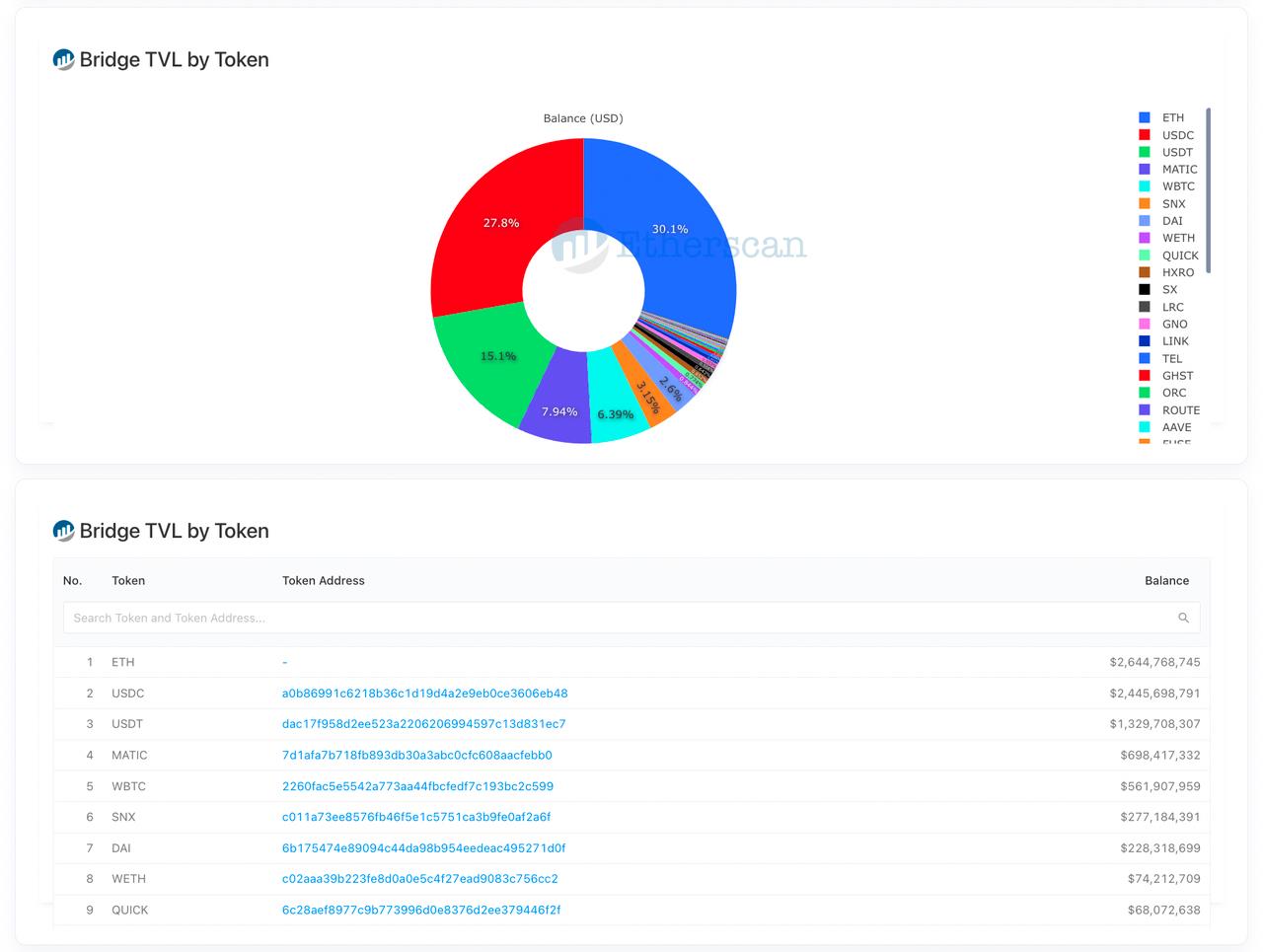

Inter-EVM Chain Currency: No Progress on L2s or Cross-Chain Bridges

Another potential use case for stETH is cross-chain transactions. As more Ethereum DeFi innovation happens on L2s, it is strategically important for Lido to make stETH available at the frontier of DeFi innovation. Yet, if we examine cross-chain data between EVM chains, WETH and USDC firmly dominate as the primary bridged currencies, while stETH is nowhere to be seen.

New Frontiers: Pendle and Lybra

The final piece of the puzzle is what the market calls “LSDFi” innovation. One might argue: “Forget old DeFi toys—stETH is succeeding big time in the new areas?”

Well, yes. Two leading projects in this space today are Pendle and Lybra. Let’s discuss them.

-

Pendle is an APY-based yield asset swap market. Pendle’s liquidity depends on stETH’s market cap. From real-world interest rate swaps, a derivatives market is unlikely to drive adoption of the underlying asset.

-

As stETH yields gradually decline, Lybra’s heavily subsidized Ponzi-like economy will face increasing pressure. While we acknowledge eUSD has a theoretical chance of breakthrough success, the odds of launching a new successful stablecoin in today’s DeFi landscape are extremely low. (Just look at Maker and Luna.) Systemic downside risks from mass redemptions/liquidations of eUSD would put stETH in a difficult position.

In short, we have not yet seen encouraging signs that “LSDFi innovations” will drive stETH adoption in the near future.

Let’s Try to Guess Why: Behavioral Inertia and Déjà Vu with Early Maker

History: A Tough Game

Liquid staking is a tough game. Look at Solana. It offers high staking yields (initially over 8%), a high staking ratio (over 70%), and very low friction costs (<$0.001 gas fees). Yet Marinade Finance, Solana’s main LSD provider, has less than $200 million in total value locked, while over $7 billion in SOL is staked. That’s much worse than Lido’s numbers. Similar to stETH’s current struggles, even during Solana’s DeFi heyday, mSOL was only used as loan collateral and for same-type pool swaps.

The story is broadly similar for PoS leaders including Polygon, BNB, Polkadot, Avalanche, and Luna.

Behavior: Network Inertia

-

Lending is relatively easy. stETH is a transparent synthetic asset backed by ETH’s credibility. Voters on AAVE and Maker can easily approve a new asset. No strong network effect is needed here.

-

But decentralized exchanges (DEXs) and Layer 2s (L2s) are hard. To transition from WETH to stETH on Uniswap or across an entire L2, Lido must convince everyone to switch at roughly the same time. Otherwise, behavioral inertia and fragmented liquidity will block the shift.

-

Mindset and learning curve: Everyone who owns ETH knows ETH is the legitimate native token of the chain. For newcomers to the on-chain world, understanding stETH involves a steeper learning curve. Especially after Shanghai and with attention shifting elsewhere, LSD adoption will lose further momentum—fewer DeFi protocols today are actively discussing LSD integration.

-

Paying gas fees and interacting with centralized exchanges (CEXs) still requires the native token. Like most people using just one credit card, stETH feels optional in comparison.

Logically, overcoming network inertia requires aggressive efforts in adoption incentives, partnership development, brand awareness, and L2 expansion. But such initiatives have historically been incompatible with Lido’s chosen path of slow, steady, decentralized governance. Lido’s current situation reminds us of early MakerDAO.

-

Both are building public goods for Ethereum and Web3.

-

Both face powerful competitors with strong network effects (USDT and ETH).

-

Neither has chosen to expand beyond Ethereum L1.

-

Both have made slow progress in DeFi integrations beyond lending.

Will DAI’s decline become stETH’s tomorrow? We hope not—but we’re concerned.

Conclusion and Comparison With Bullish Views

Finally, we want to compare our view with some of the most important bullish arguments for LDO. We aim to highlight two flaws in bullish reasoning and add one strategic risk.

-

Staking rewards do not grow linearly with the ETH staking ratio. In fact, the relationship is closer to the square root of the staking ratio. For example, if the ETH staking ratio increases from the current 22% to a remarkable 88%, total rewards would only double—not quadruple. This limits the upside potential of Lido’s revenue.

-

LSD market share is shrinking, not growing. We believe Bryan used the wrong comparison here. While stETH performs better than Coinbase and Binance’s LSD offerings, LSDs are losing market share against illiquid “validator-as-a-service” solutions. We already discussed this in the first section.

Strategic Risk: When investigating why LSD market share is declining, we find stETH has failed to build moats in areas where network effects matter—DEXs, CEXs, or cross-chain lockups.

-

Lack of network effects may hinder stETH’s future growth.

-

Without network effects, stETH’s current use cases (SOV and lending collateral) are fairly generic. Lido will continue facing competition from illiquid staking and other LSDs, potentially leading to fee compression.

Of course, we do not dispute the bullish argument that Lido benefits from ETH appreciation and ETH network activity fees. For investment purposes, we believe our article provides two contrarian points:

-

Before stETH achieves network effects, secondary LSDs still have room to compete with Lido on price and fragment the LSD market.

-

Prior to stETH achieving network effects, Lido’s exposure to ETH should be discounted due to its long-term declining market share (whether against illiquid staking or fragmented LSD competition). This risk may manifest directly as lost market share leading to lower revenue, or through fee reductions to match competitors.

The bear market isn’t over yet. Lido still has time and capital to build network effects and set up positive feedback loops when the market recovers. We’ll keep watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News