Web3 Growth Hacker Series: How to Gain Deep Insights into GameFi Players?

TechFlow Selected TechFlow Selected

Web3 Growth Hacker Series: How to Gain Deep Insights into GameFi Players?

After all, from a certain perspective, GameFi seems to be the only hope for Web3 to achieve mainstream breakthrough.

TL;DR

-

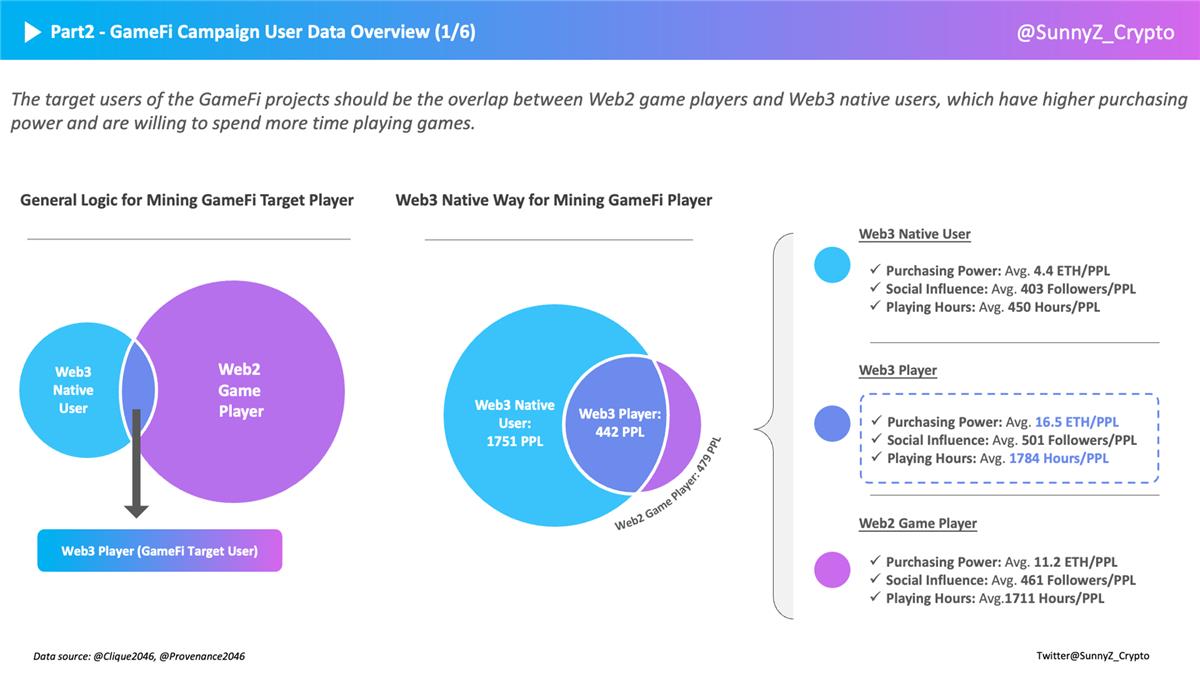

Understanding Web3 player behavior preferences is crucial for optimizing game project operations and adjusting game and revenue mechanism designs. Compared to average users, Web3 players have approximately 4x the purchasing power, 1.2x social influence, and around 4x average total gameplay time;

-

Many Web3 games attempt to extend user engagement duration and game lifecycle through tokenomics, but from a data perspective, focusing on playability may be more effective in solving this issue;

-

The 0.5 step toward massive adoption in GameFi might be discovering and identifying target users—only by clearly understanding who your target audience is and whom you're monetizing can you even begin discussing mainstream breakthroughs.

Background

Following my previous growth experiment, over the past month I've launched a new growth experiment focused specifically on the GameFi sector.

Why choose GameFi as the target sector?

Firstly, GameFi is widely seen as one of the most promising fields for achieving mass user adoption. Identifying overlapping users between Web3 natives and Web2 gamers—i.e., Web3 players—is an important entry point.

Secondly, GameFi has relatively high active user numbers, with many projects still operating despite the bear market. On-chain data shows approximately 200,000 active addresses in the last 24 hours, and currently there are over 900 active GameFi projects.

Although GameFi's overall scale remains small compared to the broader cryptocurrency market—with the global GameFi market valued at about $6 billion by mid-2023—the unique gameplay mechanics and earning models continue attracting growing numbers of players.

Understanding Web3 player behavior preferences is critical whether for optimizing project operations or refining game and revenue design.

Subsector Sample

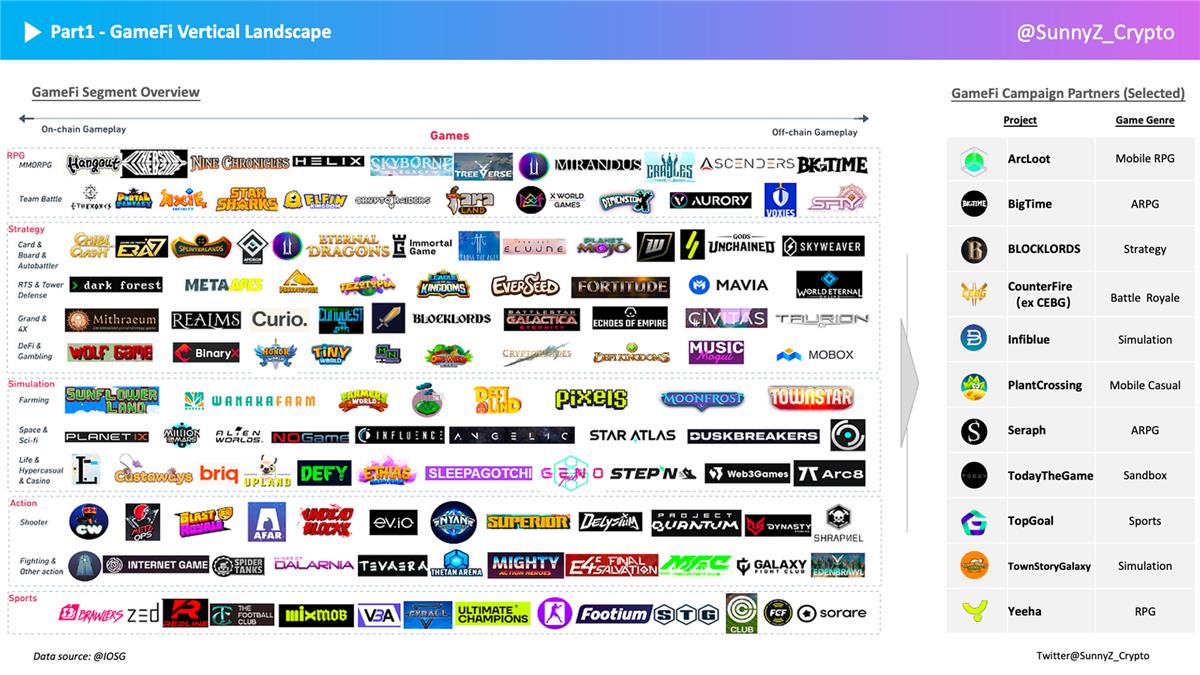

The GameFi ecosystem consists of eight main components—user aggregators, games, multi-game platforms/publishers, liquidity providers/financial tools, blockchain solution providers, game engines, developers/studios, and blockchains.

To better understand the real user profile of Web3 players, all sampled projects in this study belong to the gaming category. This follows IOSG's classification of Web3 games (based on Steam categories and top-grossing mobile game types). Web3 games are primarily divided into five major categories:

-

RPG (Role-Playing Games): Players assume roles within a game world, improving character abilities through quests and leveling up—including MMORPGs and team battle formats. Participating projects in this category include BigTime, ArcLoot, Seraph.

-

Strategy Games: Players must develop strategies, manage resources, build economies, and create armies—including card games, board/auto-battlers, real-time strategy, and tower defense. The participating project BLOCKLORDS falls under this category.

-

Simulation Games: Simulate real-life scenarios such as managing businesses, driving vehicles, farming, space flight, lifestyle & leisure & casino experiences. Projects including Infiblue, TownStoryGalaxy, PlantCrossing, TodayTheGame fall into this group.

-

Action Games: Characterized by fast-paced action requiring jumping, attacking, dodging, etc.—including shooters, fighters, and other action genres. The participating project CEBG belongs here.

-

Sports Games: Simulate sports like football, basketball, tennis, etc. The participating project TopGoal fits this category.

Based on the above, 10 games shown on the right side of the image were selected as key analysis targets.

GameFi Event Data Mining

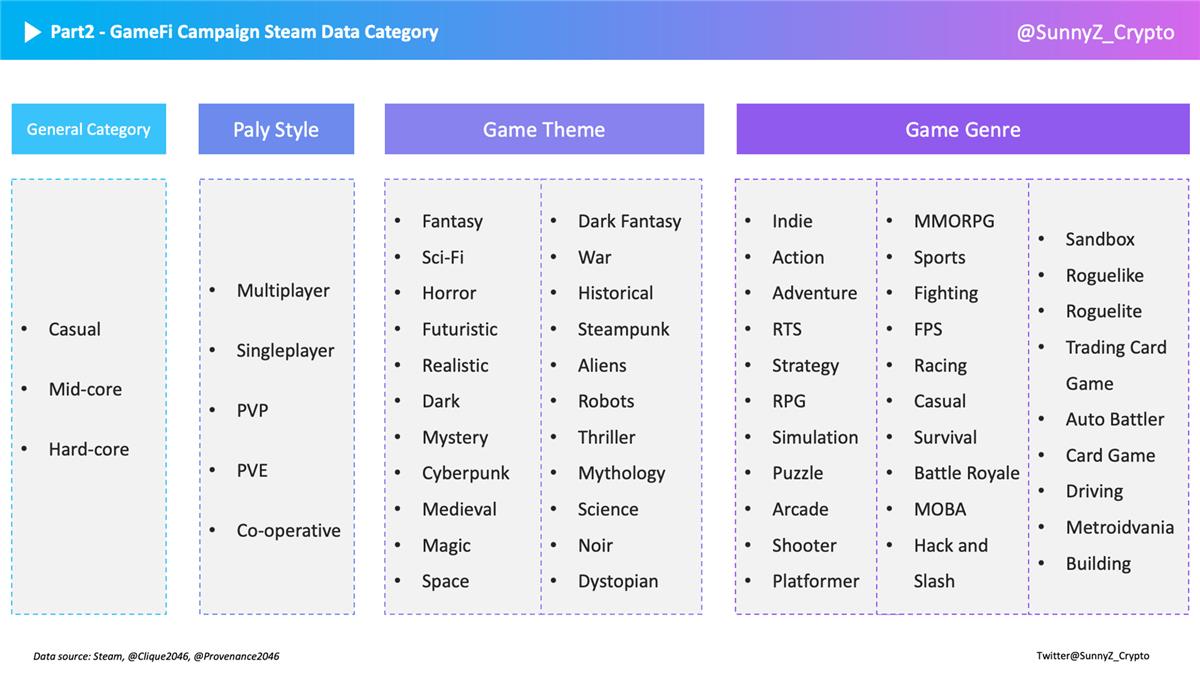

In addition to standard metrics such as engagement, spending power, and influence indicators, this GameFi event introduced Steam-based behavioral preference data, detailed below:

Steam Behavioral Metrics

-

Player time spent across different game genres on Steam

-

Preferred game types, themes, and styles

There are 5 play styles, 22 game themes, and 30 game genres defined.

Breakdown of Steam game types, themes, and styles

Explanation of Key Metrics

-

3-General Game Category

-

Casual Games: Typically simple, easy-to-learn games with low difficulty, suitable for casual players. These require little prior experience or skill and usually involve shorter play sessions.

-

Mid-core Games: Moderately difficult with relatively complex gameplay, requiring some experience and skill—ideal for intermediate players. These typically demand significant time and effort to master.

-

Hard-core Games: Highly challenging with very complex mechanics, designed for expert players. Mastery requires extensive time, deep expertise, and long-term commitment.

-

-

5-Play Style

-

Singleplayer: Players prefer playing alone without interacting with others.

-

Multiplayer: Players enjoy playing alongside others, either cooperatively or competitively.

-

PVP (Player vs Player): Players enjoy competing directly against each other to demonstrate superiority.

-

PVE (Player vs Environment): Players prefer battling game environments, such as fighting monsters or completing challenges.

-

Co-op (Cooperative Play): Players enjoy teaming up with others to complete tasks, such as raiding dungeons or finishing missions together.

-

-

22-Game Theme

-

Fantasy: Games featuring magic, mythical creatures, epic heroes, and legendary stories.

-

Sci-Fi: Includes robots, aliens, futuristic technology, and space exploration elements.

-

Horror: Features horror narratives, ghosts, zombies, vampires, and monsters.

-

Futuristic: Encompasses future tech, cities, transportation systems, and weapons.

-

Realistic: Based on real-world activities such as sports, warfare, and simulators.

-

Dark: Conveys dark, twisted, unsettling, or depressive atmospheres.

-

Mystery: Involves exploration, puzzle-solving, and uncovering strange phenomena.

-

Cyberpunk: Depicts dystopian future cities with advanced tech, crime, and rebellion.

-

Medieval: Features knights, castles, wars, and kingdoms.

-

Magic: Focuses on spells, wizards, magical beings, and arcane forces.

-

Space: Involves space travel, alien civilizations, planets, and interstellar conflicts.

-

Dark Fantasy: Combines fantasy settings with dark, disturbing tones.

-

War: Covers historical or modern warfare, combat, and military strategy.

-

Historical: Based on real historical figures, events, and battles.

-

Steampunk: Features steam-powered machinery and Victorian-era aesthetics.

-

Aliens: Centers around extraterrestrial life, alien tech, and alien cultures.

-

Robots: Involves robotic characters, AI, and future robotics.

-

Thriller: Emphasizes tension, suspense, and fear.

-

Mythology: Draws from ancient myths, legends, gods, and heroes.

-

Science: Involves scientific discovery, experiments, and technological innovation.

-

Noir: Inspired by detective noir films, involving crime and conspiracy.

-

Dystopian: Set in bleak futures with oppressive societies and political intrigue.

-

-

30-Game Genre

-

Indie: Developed by small studios or individuals, often innovative and highly polished.

-

Action: Fast-paced gameplay emphasizing movement, attacks, and evasion.

-

Adventure: Focused on exploration and puzzle-solving to advance the story.

-

RTS (Real-Time Strategy): Requires base-building, troop recruitment, and strategic combat.

-

Strategy: Involves resource management, economic development, and army creation.

-

RPG (Role-Playing Game): Players take on character roles, progressing via quests and level-ups.

-

Simulation: Mimics real-life scenarios like running shops, flying planes, or driving vehicles.

-

Puzzle: Centered on solving logic puzzles and brain teasers.

-

Arcade: Known for fast-paced, simple controls and high difficulty.

-

Shooter: Gameplay centered on shooting, including FPS and TPS variants.

-

Platformer: Requires precise jumping, climbing, and obstacle avoidance.

-

MMORPG: Large-scale online RPGs where players interact, form parties, and engage in PvP/PvE content.

-

Sports: Simulates real sports such as soccer, basketball, and tennis.

-

Fighting: Combat-focused with emphasis on mastering movesets and combos.

-

FPS (First-Person Shooter): Played from a first-person perspective with shooting as core mechanic.

-

Racing: Racing-themed games where players compete on tracks.

-

Casual: Easy-to-play games ideal for relaxation and short sessions.

-

Survival: Players must survive harsh conditions and overcome environmental threats.

-

Battle Royale: Multiplayer survival arena where players fight until one remains.

-

MOBA: Teams battle to destroy enemy bases while defending their own.

-

Hack and Slash: Action-RPG hybrid with rapid combat mechanics.

-

Sandbox: Open-ended gameplay allowing free exploration, building, and creation without fixed goals.

-

Roguelike: Turn-based with procedurally generated levels, permadeath, and loot collection.

-

Roguelite: Similar to Roguelike but allows retention of progress or items between runs.

-

Trading Card Game: Uses collectible cards for combat and deck-building.

-

Auto Battler: Players select units/cards and watch automated battles unfold.

-

Card Game: Traditional card games like poker or bridge.

-

Driving: Vehicle operation-focused, including cars, trucks, etc.

-

Metroidvania: Side-scrolling action-adventure with exploration and ability progression.

-

Building: Focuses on constructing and managing cities, bases, and infrastructure.

-

Note: Disclosure — All data in this article comes from Clique

Overview of Web3 Player Profiles

Typically, GameFi user acquisition follows two paths: First, traditional publishing and paid ads as primary, supplemented by Web3 community promotion. This approach is common among established game studios transitioning into GameFi, as ad channels are stable and ROI is controllable. Allocating part of the budget to Web3 marketing, converting several hundred genuine players would be considered successful.

Second, alpha community outreach and launchpad/task platform acquisition as primary, supported by traditional social media promotion. This method is more native to Web3, similar to launching fair drops. It casts a wide net but results in imprecise targeting and lower-quality users, with uncontrollable costs—making it hard to achieve strong performance during bear markets.

For most GameFi projects, regardless of path chosen, the first step is accurately identifying Web3 players.

From this sampling, around 2,000 actual players were covered (defined as those with both non-zero wallet balances and Steam gameplay time), with Web3 players accounting for about 20%. The average ETH holding per Web3 player was 16.5, average Twitter followers around 500, and average Steam gameplay time 1,784 hours. Compared to regular users, Web3 players have roughly 4x purchasing power, 1.2x social influence, and about 4x average total gameplay time.

The next step is converting these Web3 players into game participants.

Game Behavior Preferences

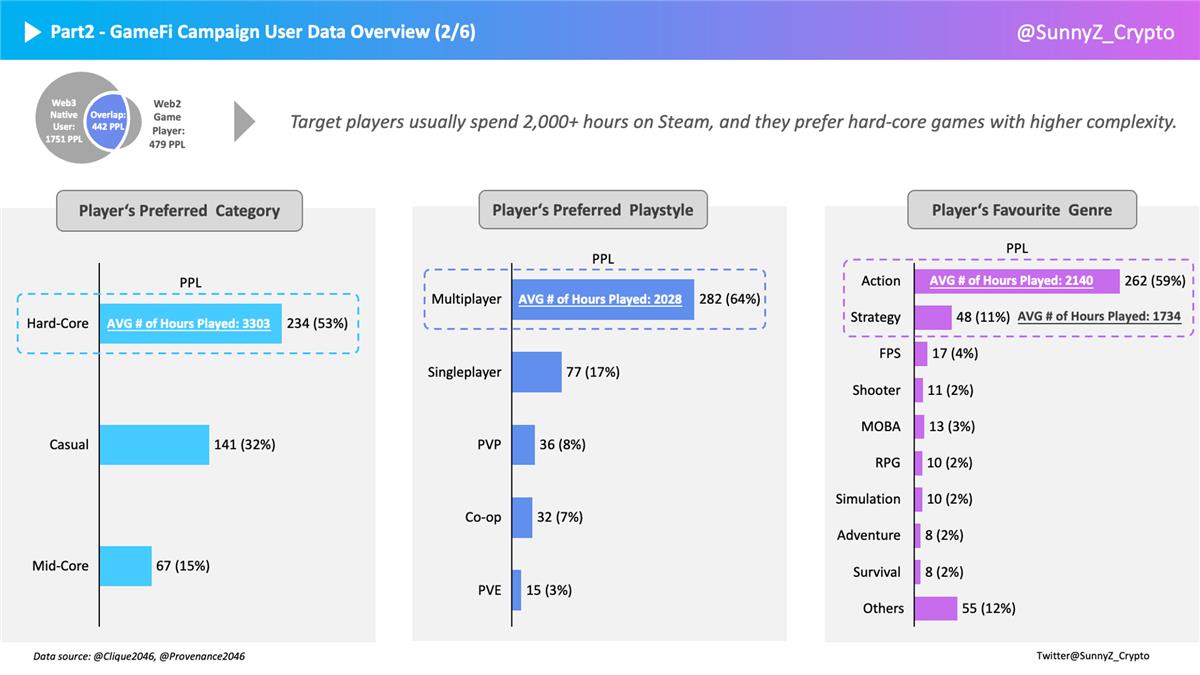

Overall, Web3 players involved in this event spent over 2,000 hours on preferred game genres, showing clear preference for multiplayer, action-oriented hardcore games.

-

Over half of Web3 players prefer hardcore games—difficult, complex titles requiring substantial time and effort—resulting in an average total gameplay time of 3,303 hours;

-

Players strongly favor multiplayer experiences, whether cooperative or competitive, which encourage deeper engagement—average total gameplay time reaches 2,028 hours;

-

Action and strategy games are particularly popular, collectively favored by 70% of players, each averaging over 1,700 hours of total gameplay time.

These findings suggest that sufficient playability is essential to attract true gamers. Current Web3 games are often better described as Fi+Game rather than Game+Fi, lacking adequate gameplay depth and thus failing to sustain long-term user engagement.

While many Web3 games try to extend engagement and lifespan via tokenomics, data suggests that enhancing playability may be a more effective solution.

Game Type Preferences

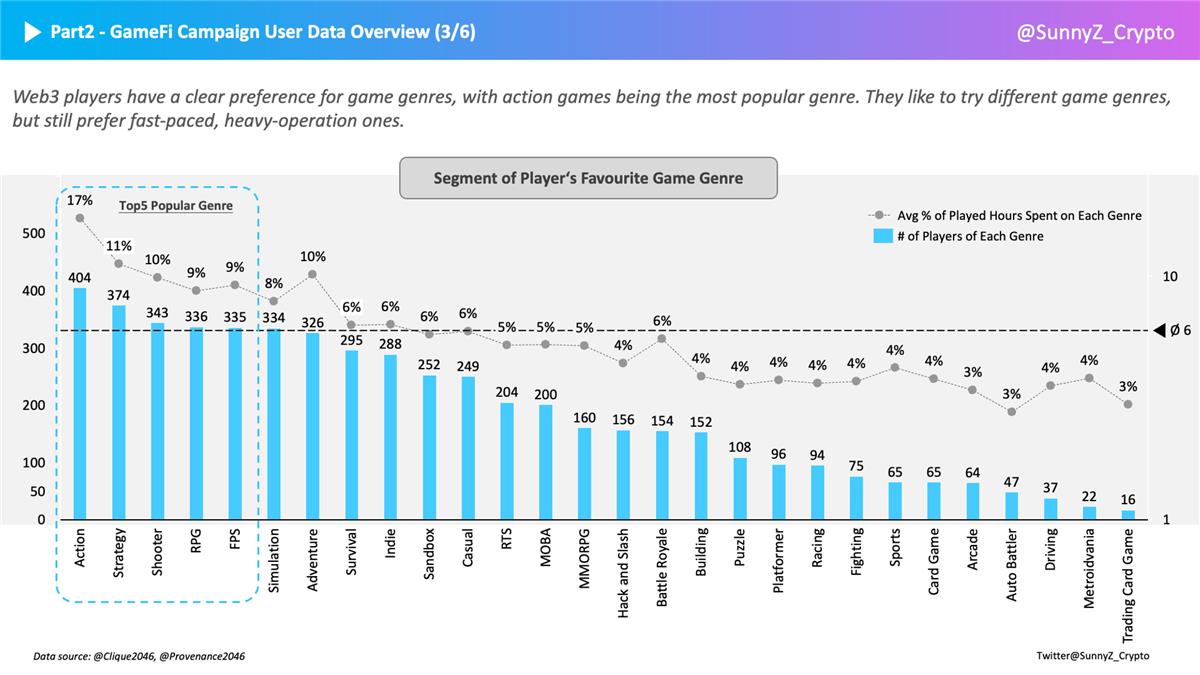

Web3 players show clear preferences in game types—they favor fast-paced, skill-intensive games. While they may try various genres, they only invest significant time in specific ones.

-

Action, Strategy, RPG, and Shooter games are the most popular, with players spending 10–15% of their total gameplay time on these genres;

-

Despite having 30 available genres, over 45% of players have tried more than 67% of them. However, time allocation indicates minimal investment in non-preferred genres—typical of "tried it, but not deeply engaged" behavior.

Traditional players are accustomed to high-complexity titles like PUBG, Elden Ring, and RDR2. When designing gameplay, projects should reference popular genres and consider which types resonate with players and suit integration of Web3 elements. The core idea is ensuring the game naturally creates demand for asset trading, ideally engaging community participation to offload operational burden. As GallonLabs (TW@gallonwang) noted:

-

MMORPG: Large online RPGs like "Fantasy Westward Journey" already feature account/item trading and guild battles—naturally compatible with NFT asset trading in Web3;

-

SLG (Strategy Games): A major genre in traditional gaming with inherent material trading and guild battle needs. Low operational cost allows sustainability with fewer users, especially popular among Western audiences;

-

Simulation Games: Mirror web2 simulators with leveling-up mechanics, simple operations, and natural item/asset trading demand. Adding light social features can activate Web3 community dynamics.

Some genres are unsuitable for Web3 integration at this stage—for example, MOBA games have high development and operational costs, long lifecycles, and currently lack competitiveness in the GameFi landscape.

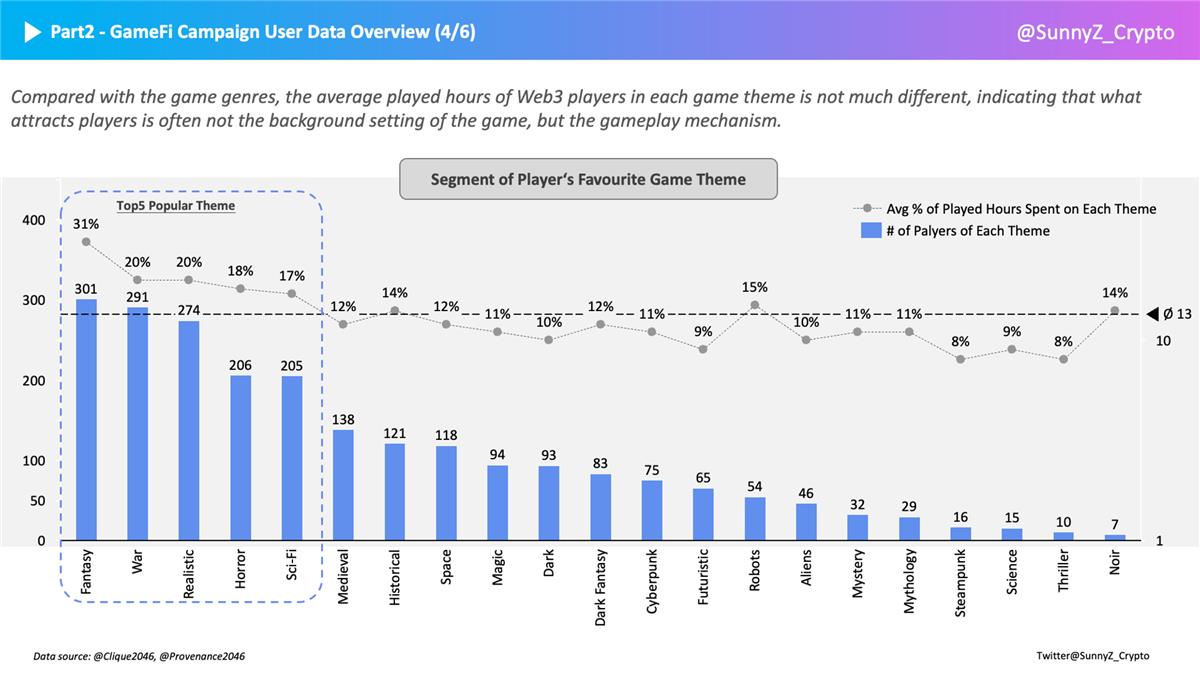

Game Theme Preferences

-

Compared to game types, Web3 players show less pronounced preference for game themes—time distribution across themes is fairly even, averaging around 13% of total gameplay time;

-

Themes and genres complement each other. Fantasy, Sci-Fi, War, Horror, Realistic are the most common themes, often forming the basis of Action and Strategy games. Elements like war, monsters, and magic easily create intense atmospheres. Games sharing the same theme tend to have similar plots, settings, and character designs, leading to homogenization;

-

Players experiment with various game types but remain consistent in narrative or setting preferences, suggesting themes have limited impact—what truly engages players are gameplay mechanics and mission structures.

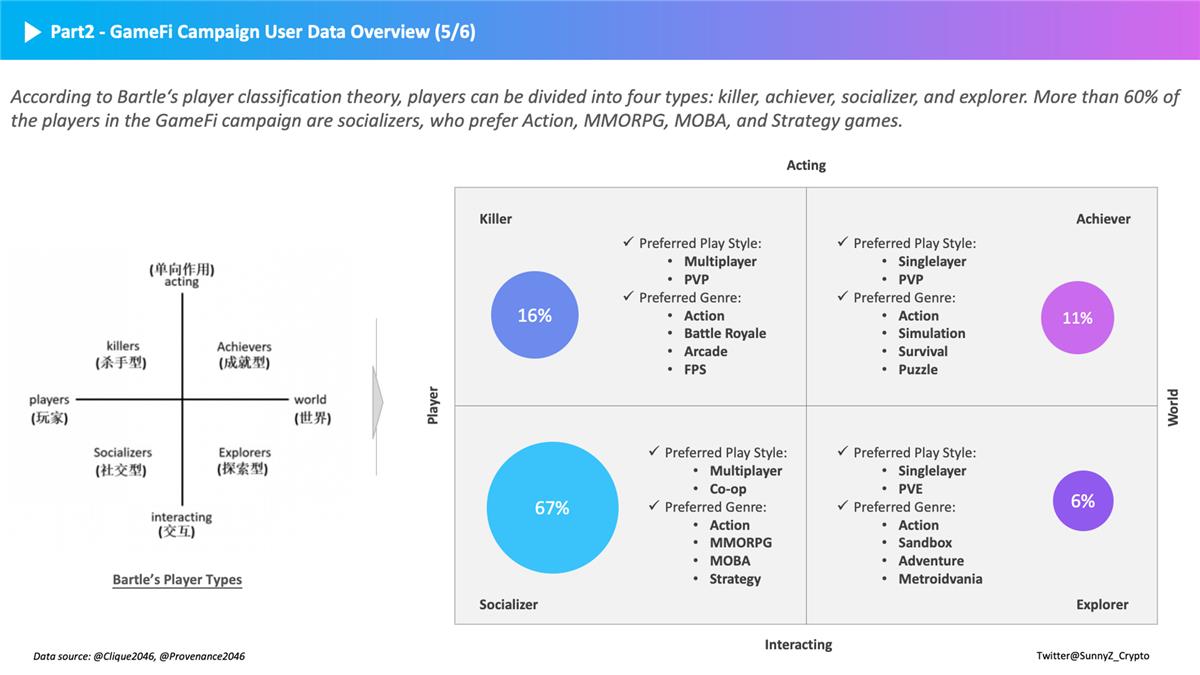

Web3 Player Segmentation

Using the classic Bartle player taxonomy based on interaction object (Player/World) and interaction style (Acting/Interacting), players are categorized as Killers, Achievers, Socializers, and Explorers—a model equally applicable to Web3 players.

-

Players: Represent personal experience, achievement, and growth—the sum of individual attributes

-

World: Represents NPCs, environments, storylines, and fictional layers within the game universe

-

Acting: Refers to purposeful player actions such as quest completion and combat—active manipulation of avatars

-

Interacting: Denotes player-to-player interaction and social aspects

Due to data limitations, player segmentation in this event was broadly determined by preferred game types, styles, and playtime. Results show 67% are Socializers, 16% Killers, 11% Achievers, and 6% Explorers.

1. Socializers [67%]

1) Basic Profile: Prefer Multiplayer and Co-op styles; favor Action, MMORPG, MOBA, and Strategy games;

2) Player Persona: Motivated by interacting with others, making friends, and participating in guild battles. They’re familiar with off-game trading and community culture, often overlap with meme creators;

3) Strategy Reference: Enhance social mechanics in gameplay; assign these users community moderator roles to drive engagement and connect with whales/core contributors.

2. Killers [16%]

1) Basic Profile: Prefer Multiplayer and PVP; enjoy Action, Shooter, Battle Royale, and Arcade games;

2) Player Persona: Driven by victory and competition. Will learn advanced techniques to climb leaderboards. Unlike Achievers, they care only about winning—not how they win—and may pay-to-win or grind excessively, sometimes exploiting bugs or using cheats;

3) Strategy Reference: Optimize leaderboard systems and enhance competitive PvP modes to stimulate competitiveness. Encourage spending on upgrades to satisfy their desire for dominance.

3. Achievers [11%]

1) Basic Profile: Prefer Singleplayer and PVP; enjoy Action, Adventure, Simulation, Survival, Puzzle games;

2) Player Persona: Proactively complete quests and objectives. Completing the game is baseline; some set personal challenges. Highly sensitive to rewards—rare drops bring great joy;

3) Strategy Reference: Balance task complexity with reward rarity. Offer special incentives when players start burning out to maintain motivation.

4. Explorers [6%]

1) Basic Profile: Prefer Singleplayer and PVE; enjoy Action, Sandbox, Adventure, Indie games;

2) Player Persona: Deeply curious about the game world—hidden lore, easter eggs, bugs. Their goal is mastering game mechanics and becoming knowledge hubs, eager to help newcomers and share discoveries.

3) Strategy Reference: Include more easter eggs and hidden content; involve them in feedback groups for deep co-design input; empower them as game ambassadors to guide new players.

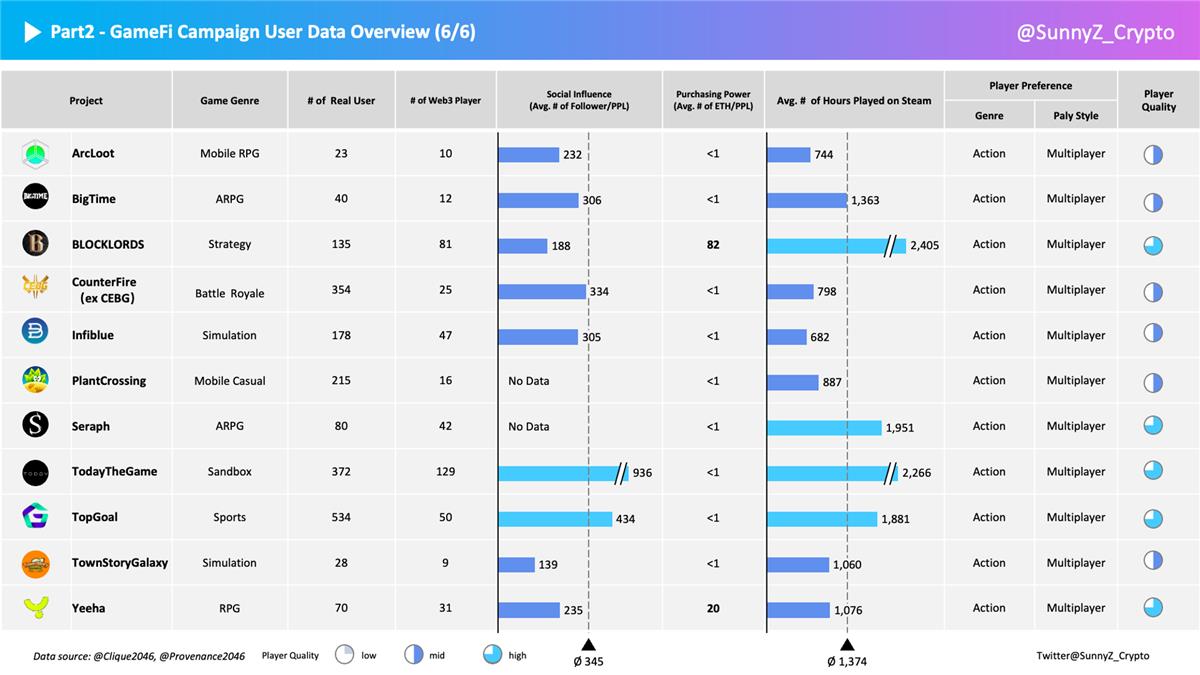

Project-Level Analysis

Since most Steam games are PC-based, the sample’s relevance to mobile-focused projects is limited. Nevertheless, clear differences emerge in user profiles based on acquisition methods, illustrated by two case studies: CounterFire (Ex CEBG) and BLOCKLORDS.

-

CounterFire (Ex CEBG)

-

New vs Existing Users: High participant count, nearly all new players (97%), indicating effective user acquisition for CEBG;

-

Player Profile: Most wallets hold less than 1 ETH; average Steam playtime ~800 hours (11 players exceed 1,000 hrs, max ~3,000 hrs); 17 users have over 1,000 followers, 2 over 10k, peak at 22k;

-

This cohort shows moderate spending power but authentic gaming interest and relatively strong social reach. With lightweight assets, solid community stickiness and activity are achievable.

-

-

BLOCKLORDS

-

New vs Existing Users: 36% new players via campaign; Web3 players make up 60% of total users—indicating precise targeting;

-

Player Profile: Clearly hardcore gamers + crypto OGs. Thirteen users hold over 100 ETH, two over 1,500 ETH, one with over 2,300 ETH—clear whale potential. Average Steam playtime: 2,400 hours (23 >3k hrs, 16 >5k hrs), topped by a Russian player nearing 9,000 hours;

-

As a time- and skill-intensive strategy game, BLOCKLORDS aligns well with its user base. Players enjoy multiplayer, action-oriented hardcore games. Post-conversion, minimal user education is needed—they already understand item trading and guild warfare, facilitating self-sustaining community dynamics.

-

Before scrolling down, pause and examine the chart below—can you guess which acquisition path CounterFire (Ex CEBG) and BLOCKLORDS used?

Note: Single-event data may contain bias—use actual operational metrics for decisions.

CounterFire (Ex CEBG) followed Path One: traditional publishing and paid ads as primary + Web3 community promotion as secondary; BLOCKLORDS followed Path Two: alpha community outreach and launchpad/task platform acquisition as primary + traditional social media as secondary.

Data-wise, I initially assumed CEBG used native Web3 growth due to user profiles resembling typical task platform users—lower spending power but high activity. Interviews revealed otherwise: Facebook and other ad channels brought in twice as many Web2 users as Web3 users, explaining their limited on-chain assets.

Paradoxically, without referencing traditional platforms like Steam or Epic Games, we often mislabel low-wallet-balance users as farmers, overlooking their conversion potential due to heuristic bias. Fortunately, multidimensional data helps avoid such pitfalls—data never lies.

Interestingly, despite both originating from major game studios, BLOCKLORDS and CEBG adopted vastly different growth strategies.

BLOCKLORDS relies heavily on Web3 channels, deliberately setting Web3 barriers during IMX and Polygon NFT sales and beta tests. They avoid campaigns targeting speculative Web3 users, instead focusing on product quality and core game assets—over time, this builds a loyal OG community.

The Necessary Path to GameFi Breakthrough

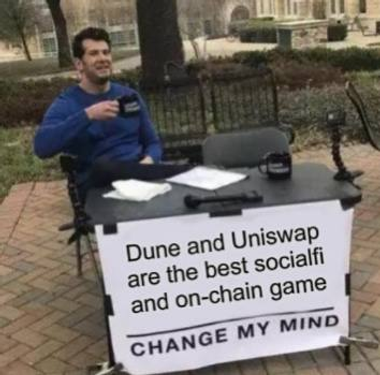

This event gave me some reflections on GameFi user acquisition and mainstream breakthroughs. Let’s get philosophical for a moment—I recently saw a meme that resonated:

Though ironic, it reflects reality. Most GameFi projects are Ponzi schemes disguised as games—with few real players.

At one point, GameFi was expected to lead mass adoption, fueled by the success of Axie and Stepn.

Yet today, product-level issues persist—poor gameplay, unstable and unsustainable economies, fragile ecosystems; user-level constraints—lack of genuine players—limit GameFi’s long-term growth. It remains unclear when GameFi Summer will return.

To break through, change is necessary.

Beyond refining products and economic models, understanding Web3 players and attracting Web2 gamers is a hurdle that must be cleared.

Among the GameFi projects I’ve interacted with, few truly understand growth strategy or know how to analyze Web3 player behavior. Many operate blindly—unaware of their user demographics, behavioral preferences, target communities, or even their own player types.

The first step in building any project is clarity: Who is your target user? Who are you monetizing? This determines whether to convert Web2 users or mine Web3 audiences, shaping game economy and design priorities. Game development is expensive—high playability extends lifespan organically, increases experiential players, and shifts some operational load to the community, enabling self-sustainability. This helps balance the impossible triangle of development cost, operational difficulty, and longevity.

Fortunately, I’ve noticed a positive trend: many projects still actively building during the bear market prioritize playability, no longer leaning solely on financialization. After all, games are ultimately consumer products—they need real consumers (players).

Whether digging deep into niche Web3 core users or converting larger Web2 player pools, there’s no one-size-fits-all answer. Black cat or white cat—as long as it catches mice. Every approach is exploration, and pioneers pave the way for those who follow.

After all, from a certain perspective, GameFi may be Web3’s last best hope for mainstream breakthrough.

Contact for Collaboration

Thank you so much to all participating projects for supporting this event—wishing you all continued success! Special thanks to Puzzle’s Harry, 7x’s yinghao, Tabi’s Momo, Yeeha’s Xiaodian… and many others who helped. Huge

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News