OFR Partner: Bull Market Not Here Yet, Alpha Hard to Find, Trading Is Cultivating the Mind

TechFlow Selected TechFlow Selected

OFR Partner: Bull Market Not Here Yet, Alpha Hard to Find, Trading Is Cultivating the Mind

A prudent long-term investor should wait for market fluctuations to create lows, aiming to minimize the cost basis of their holdings in mainstream assets.

Author: Xin.sats, Partner at Old Fashion Research

Trading Is Cultivating the Mind

A genius who once managed a billion-dollar fund told me that trading is primarily about mindset. Under 30 years old, he had already accumulated hundreds of times returns across three bull markets. He knew macro trends, candlestick techniques, and value investing inside out, yet still believed mindset was the most critical area for improvement in his trading journey—so I’d like to start from here.

Long-Termism

At some point, my real-world friends who’ve genuinely made money through trading all started stepping back—resting, enjoying life, ignoring market movements. Have they achieved financial freedom and lost motivation? I don’t think so. Rather, they understand when to step away from market volatility and become “friends of time.” They view daily market fluctuations through the lens of long-termism. Sometimes, knowing when to rest is far harder than staying glued to the market. Imagine your portfolio crashing after going all-in, or sharply rising while you’re fully out (as happened in June)—traders with poor mental discipline easily fall into buying high and selling low. But from a long-term investor’s perspective, these swings are merely bottom-range shaking before the next bull run. Many may have already built positions at the lowest levels, and stepping away from the market is an effective way to remain unshaken by volatility.

There are also friends around me spending 12 hours a day glued to screens and phones, chasing every Twitter update and short-term profit. I’ll admit, it’s sometimes tempting to see them double or triple their capital in a single day. Yet I believe most short-term traders experience volatile ups and downs, and overall struggle to outperform the broader market.

This is why I emphasize not over-relying on WeChat trading groups or alpha-sharing communities—most information there is emotional noise that interferes with independent thinking and judgment.

Bull Market Not Here Yet—PvP Within the Arena

After two months of gradual decline, the overall market recovered losses within a week, with Bitcoin reclaiming $30,000. Interpretations vary: some cite macro factors such as the U.S. pausing rate hikes; others attribute it to resolution of prior negative sentiment following SEC lawsuits against major exchanges, leading to a rebound.

Both views hold merit—but each has flaws. Pausing rate hikes could be positive, but higher terminal rates and looming recession risks remain negatives. On the news front, new compliant exchanges launched by big players might seem bullish, but existing compliant platforms like Bakkt show little volume—will adding another really attract more capital?

Back to my earlier point: from a long-term investor’s standpoint, both macro analysis and news-driven narratives often amount to post-hoc rationalization—they cannot serve as reliable decision-making bases. These factors may influence investor sentiment and cause short-term volatility, but long-term investors should remain indifferent to emotional swings.

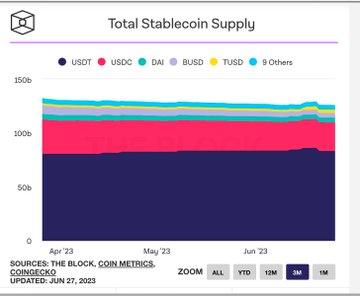

Zooming out, we’re still deep in a prolonged bear market—stablecoin supply hasn’t significantly increased. However, we may have already passed the deepest lows of this cycle, as shown by on-chain NUPL data for Bitcoin (blue line). For long-term investors, decisions thus become relatively clear for the second half of the year: accumulate on dips, hold, and wait. Sudden shifts in sentiment—SEC policy changes, exchange-related FUD, or other risk events—are actually good accumulation opportunities. Every seemingly solid bearish argument based on macro policies or breaking news can later be reinterpreted during a bull market as a sign of “bad news priced in”—an ideal moment to add exposure. The same applies inversely to bullish catalysts.

Low liquidity due to PvP (player-versus-player) dynamics and market maker withdrawals creates ideal conditions for manipulation. Examples include new exchange tokens backed by former 3AC elites and BCH’s recent strength after being added to EDX—both reflect how investor attention concentrates more easily in bear markets compared to bull runs. The meme coin frenzy is also a symptom of innovation drought, akin to 2019’s exchange IEOs and mining tokens during the last bear market.

Alpha Is Hard to Find

In the previous cycle, the biggest alpha opportunity—smart contract platforms—was already overvalued by VCs at the primary stage. Most Rollups, upcoming zkEVMs, and RaaS (Rollup-as-a-Service) offerings left secondary market participants with little chance beyond simply buying ETH. Similarly, Move-based chains were already fairly priced during early funding rounds. While smart contract platforms remain a high-conviction sector, they no longer offer meaningful alpha.

Let’s examine key categories within the Ethereum (and EVM-compatible) ecosystem:

DEXs: Uniswap demonstrates excellent product innovation, staying one step ahead of competitors. However, its token lacks utility, and there’s no near-term prospect of change. Thus, innovation now happens around Uni V4’s ecosystem—projects leveraging hooks and composability. DEXs building on Uni V3 pursue independent development paths (e.g., Trader Joe, Maverick), whereas V4 raises barriers so high that new entrants are better off integrating into the Uniswap ecosystem rather than competing standalone.

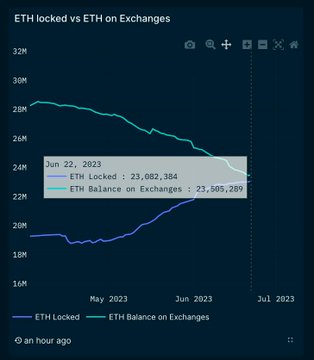

LSD/LSDFi: The main catalyst for liquid staking derivatives (LSD) is Ethereum’s transition to PoS, making ETH a yield-bearing asset. A large number of users stake ETH and receive LSTs (like stETH). What can these LSTs be used for? DeFi degens created two major types of products: first, over-collateralized stablecoins backed by LSTs (represented by Lybra and Prisma); second, interest rate swaps like Pendle, allowing trading of future yield rights.

-

The challenge with the first category—over-collateralized stablecoins—is finding use cases. Curve, the largest on-chain stablecoin trader, is itself launching crvUSD and accepts LSTs as collateral. It's hard to imagine new entrants disrupting Curve in this space.

-

Pendle targets a newer market, hence enjoys a higher valuation ratio (TVL/MC) than the first category. But its total addressable market is limited, and current valuations appear fair—leaving little room for outsized returns. The best investment window for Pendle was catching its turnaround story via LSDfi momentum.

Derivatives DEXs: After GMX, no new models have emerged—still a zero-sum game. Orderbook-based perpetuals will launch on high-performance chains outside Ethereum’s ecosystem, which won’t be discussed further here. Overall, this segment requires continued observation.

NFT Markets: Still lacking fresh innovation or excitement. Recently, Azuki’s launch drew attention, though I’m personally skeptical. This type of release essentially extracts more value from loyal fans without attracting new users. I prefer Pudgy Penguins’ approach—selling toys on Amazon to reach mainstream audiences. Though monetization pales in comparison to Azuki, one focuses on extracting value internally while the other expands externally. From both business logic and emotional alignment, I support the latter. One more note: BAYC’s price collapse resulted from excessive fan extraction. Count how many different NFT and token series Yuga Labs has sold—all revenue-generating, none cash-flow-producing assets.

Other emerging sectors like on-chain gaming, ZK, and social layers are either still fundraising from VCs or await bull market momentum—far from offering actionable opportunities in the secondary market.

In summary, even within Ethereum—the largest and most vibrant ecosystem—innovative sectors have been largely priced in by primary market capital during this bear market. Alpha opportunities in blue-chip projects (e.g., Uniswap in DEXs, Aave in lending, Lido in LSD) are now effectively market beta. Limited alpha remains in tier-two leaders within these ecosystems—such as projects built on Uni V4 or LSDFi protocols. If top-tier projects can reach top 30 by market cap, tier-two leaders might only climb to ranks 200–300.

Some Speculations

1. Filling the Gaps in Bitcoin’s Ecosystem

Bitcoin’s ecosystem has seen two speculative waves this year. First, meme-driven hype centered on BRC20 and Ordinals—a reflection of pent-up capital seeking emotional outlets amid innovation drought in bear markets. Compared to Ethereum memes, Ordinals benefit from additional narrative depth via NFTs, combining meme + NFT appeal, potentially spawning breakout phenomena like Doge or Shiba Inu. Second, Stacks’ Layer 2 narrative, amplified by Bitcoin halving speculation, will likely face repeated pump-and-dump cycles in secondary markets.

From a market cap perspective, Ethereum’s ecosystem follows a clear hierarchy: ETH as foundational infrastructure and store of value, Layer 2s as application computing platforms, and DeFi/LSD/stablecoins/NFTs forming respective application ecosystems—with market caps generally following ETH > Layer 2 > Tier-1 leaders > Tier-2 leaders. Given Bitcoin’s highest market cap, its ecosystem ceiling is theoretically the highest. But what fills the roles below BTC? BTC > L2? BTC > LN (Lightning Network)? Or BTC > Nostr?

We still lack consensus on what kinds of applications belong on Bitcoin, and what middleware and infrastructure are needed to support them. Stacks aims to replicate Ethereum-style apps on Bitcoin; Ordinals/BRC20 gained traction but haven’t proven sustainability, relying on centralized indexing. Lightning Network offers a more coherent vision—native, decentralized, with real use cases like payments and orderbook DEXs—but progress is painfully slow. By the time Lightning sees mass adoption, the next bull market may already be over.

2. Cosmos Ecosystem

Projects on Cosmos hardly form a cohesive ecosystem—each builds its own silo. Non-composability outweighs composability, forcing every project (every chain) to reinvent the wheel. Unlike Ethereum where each Layer 2 uses nearly identical infrastructure, Cosmos chains each build differently. Beyond high token inflation, there’s no unified standard to evaluate Cosmos projects. Currently, it’s mostly a pricing game: Neutron’s public sale FDV of $160M appears attractive versus Sei’s $800M and Berachain’s $400M, making Neutron’s public sale or sub-$0.4 secondary entries favorable picks.

I’m still studying Cosmos’ technical evolution logic—experts are welcome to share insights.

Conclusion

In sum, the market lacks paradigm-shifting investment opportunities—alpha is scarce. Conservative, long-term investors should patiently wait for market dips to lower their cost basis in major assets, maximizing exposure to market beta while gradually increasing positions. More aggressive traders and degens can dynamically capture opportunities in emerging tier-two projects and sentiment-driven meme assets for potential alpha, but must strictly manage position sizing and risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News