RWA Attracts Investors to U.S. Treasury Market: Top 6 Most Active RWA Lending Protocols

TechFlow Selected TechFlow Selected

RWA Attracts Investors to U.S. Treasury Market: Top 6 Most Active RWA Lending Protocols

This article will primarily introduce the most active lending protocols connected to real-world assets and track their latest developments, based on monitoring by Nansen and Rwa.xyz.

Author: Jaden, LD Capital

Preface

As traditional finance risk-free interest rates rise and DeFi yields decline, investors are flocking to the U.S. Treasury market. To expand their scale and offer users more sustainable and stable returns, DeFi protocols are turning to real-world assets (RWA) as collateral sources or new investment opportunities.

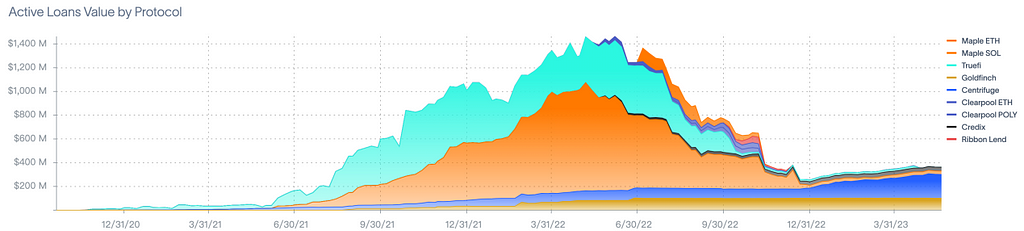

RWA lending protocols have accumulated $4.4 billion in total borrowing volume, peaking at $1.4 billion in May 2022. Currently, RWA lending protocol borrowings stand below $500 million (excluding MakerDAO). Particularly during the deleveraging phase in 2022, institutions withdrew funds consecutively, resulting in bad debts across some lending protocols. Despite growing market attention toward the RWA sector, borrowing volumes have yet to show significant recovery. Over the past year, capital growth in the RWA sector has primarily centered around U.S. Treasury subscription services.

This article, based on tracking data from Nansen and Rwa.xyz, introduces the most active lending protocols integrating real-world assets and reviews their latest developments. These protocols include MakerDAO, Maple Finance, TrueFi, Goldfinch, Centrifuge, and Clearpool.

Figure: Active Loan Volume of RWA Protocols

Source: rwa.xyz, LD Research

MakerDAO

Rank #70

MakerDAO is a stablecoin protocol that allows users to deposit crypto assets as collateral to borrow Dai, a USD-pegged stablecoin.

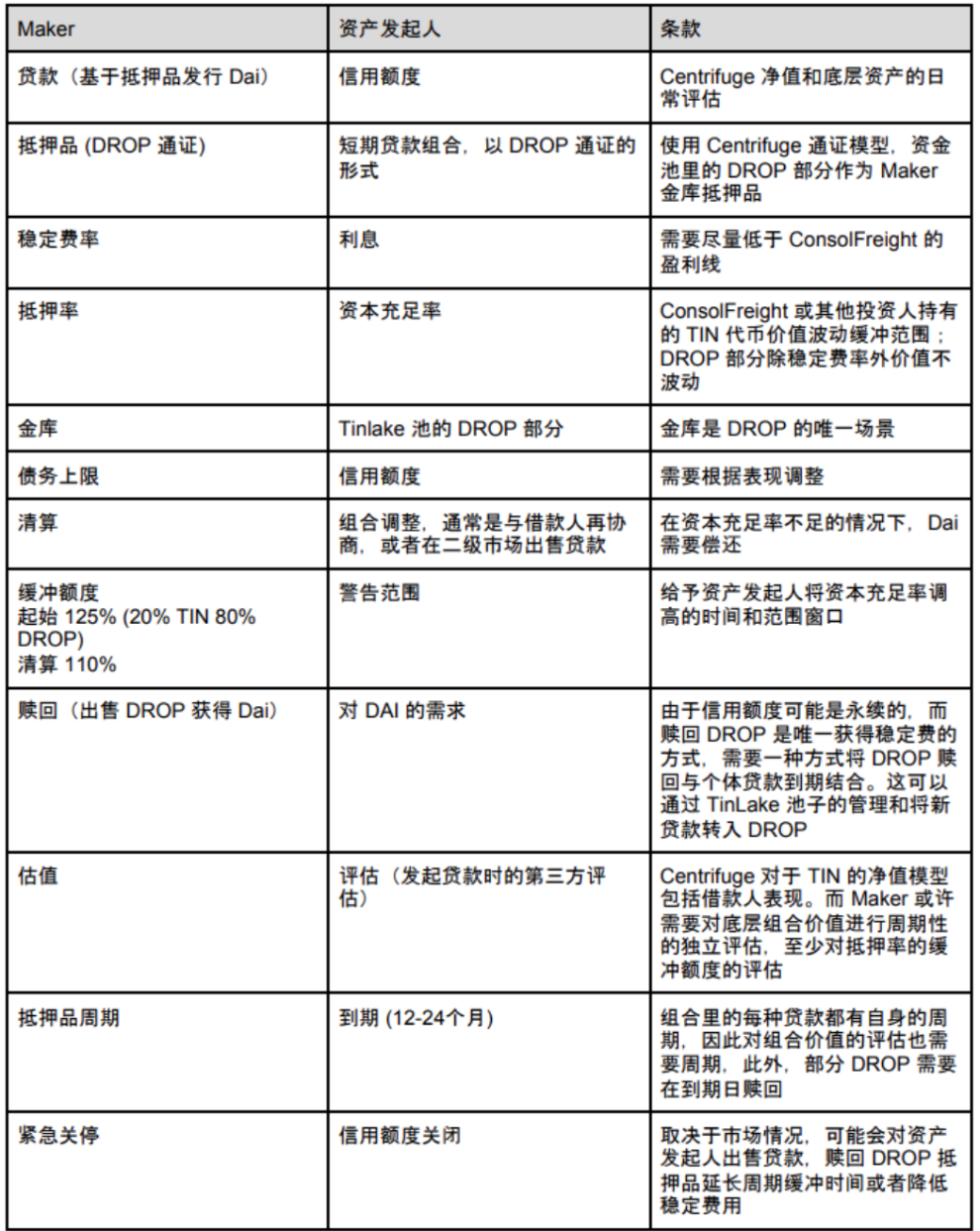

MakerDAO's RWA segment consists of two parts. First is MIP21, which supports RWAs as collateral for borrowing and uses Centrifuge Tinlake as its underlying infrastructure. It typically charges a 4% stability fee, with the proposal approved in November 2020. Second is MIP65, which enables acquiring USDC via the PSM module and deploying it into strategic investments through Monetalis. The initial debt ceiling was set at $500 million and was increased to $1.25 billion in March 2023. Of this additional $750 million, 12 tranches will be used over the next six months to purchase U.S. Treasury bonds.

Figure: MakerDAO RWA Collateralized Lending Mechanism

Source: MakerDAO blog, LD Research

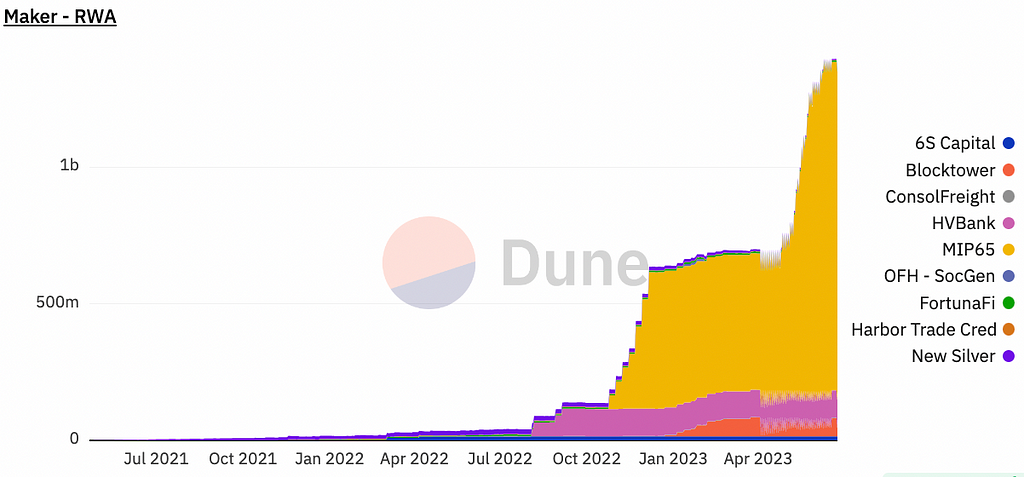

As of June 24, 2023, according to Dune analytics, MakerDAO’s RWA operations amount to nearly $1.4 billion, representing 41% of MakerDAO’s balance sheet and generating $5.3 million in revenue—accounting for 52.2% of the protocol’s annualized income.

Figure: MakerDAO RWAs

Source: dune.com, LD Research

Token Model

The total token supply is 1 million MKR. Due to mechanisms for minting (to cover bad debt) and burning (from protocol profits), the current circulating supply stands at 977,631.03.

MKR tokens are primarily used for governance, with future plans to add staking and yield farming functionality for the Spark protocol.

Centrifuge

Rank #257

Founded in 2017 by Lucas Vogelsang, Maex Ament, and Martin Quensel, Centrifuge was developed with support from Berlin’s Pro FIT investment banking program and co-funded by the European Regional Development Fund (ERDF). On January 29, 2022, Centrifuge won Polkadot’s 8th parachain slot auction by locking 5,435,100 DOT.

Its product, Tinlake, allows users to pledge assets and receive an NFT to raise financing. Each asset pool issues two types of tokens with different risk profiles: Tin and Drop. Centrifuge charges a 0.4% platform fee.

Tinlake serves as the underlying infrastructure for MakerDAO’s RWA collateralized lending. In April 2021, financial institution New Silver launched a fix-and-flip real estate loan pool using Tinlake contracts, completing its first loan via MakerDAO as the credit facility.

In December 2022, BlockTower Credit partnered with Maker and Centrifuge to bring $220 million in real-world assets into DeFi. Maker will issue Dai loans backed by these RWAs, Centrifuge will handle on-chain issuance and tokenization, and BlockTower Credit will act as the asset manager.

In February 2023, Centrifuge proposed introducing real-world assets (RWA) into Aave and using them as collateral for Aave’s native stablecoin GHO. Centrifuge stated it would submit a formal proposal once GHO is ready.

From January to June 2023, Centrifuge made no major progress.

Although Centrifuge’s platform fees are low, it accesses large capital pools and was among the first protocols to implement risk-tranching.

Token Model

Centrifuge initially issued 400,000,000 CFG tokens, distributed to the foundation, early contributors, core team, investors, and validators. An estimated 3% additional CFG is minted annually to fund PoS block rewards. However, transaction fees paid in CFG are burned to stabilize the total supply. Given minimal mainnet transactions, very few tokens are burned. Some CFG has been bridged to Ethereum. CFG is mainly used for staking, paying transaction fees on the mainchain, and governance participation.

Maple Finance

Rank #395

Launched in 2020 and officially going live in May 2021, Maple Finance operates on both Solana and Ethereum. Its primary business is offering unsecured loans to institutions. Historically, its user base consisted mostly of crypto companies, leading to $52 million in bad debt during the 2022 deleveraging cycle.

According to Defillama, March 2023 marked Maple Finance’s all-time low in TVL ($24M). Following the launch of a U.S. Treasury cash management pool in May, TVL began to rebound. Compared to TrueFi’s upcoming Treasury bond pool, Maple Finance does not impose a minimum subscription threshold. However, on-chain records still indicate large-sized subscriptions dominate. On June 12, an open-ended loan pool was introduced to enhance protocol flexibility. As of June 24, 2023, Maple Finance’s TVL reached $62.82M, with $22.83M attributed to its RWA segment.

Maple Finance charges a 0.66% platform fee and a 2.5% performance fee (paid as a percentage of interest upon loan repayment).

Figure: Maple TVL on Ethereum

Source: Defillama, LD Research

Token Model

Maple Finance issues two tokens: MPL on Ethereum and SYRUP on Solana, each with a total supply of 10,000,000. Users who stake MPL receive xMPL. 50% of protocol revenue is used to buy back MPL tokens and reward xMPL holders. The current circulating supply of MPL is 7.96 million, with 30.41% staked and 30,010 MPL repurchased to date.

TrueFi

Rank #429

TrueFi is an unsecured lending protocol created in 2020 by TrustToken for institutional investors. TrustToken previously launched TUSD but sold that business to Techteryx in 2020.

TrueFi’s TVL has fallen below $10 million with no signs of recovery, and the protocol currently lacks active lending pools. Adapt3r Digital is preparing to launch a U.S. Treasury bond pool with a minimum subscription of $100,000, now in the registration phase.

The protocol charges a 0.5% platform fee.

Figure: TrueFi TVL

Source: Defillama, LD Research

(The protocol dashboard shows TVL at $17.25M, including $7.17M in outstanding loans, differing from Defillama data)

Token Model

TRU has a maximum supply of 1.45 billion. Current token supply is 1,198,450,773, with a circulating supply of 1,061,445,050 and 251 million tokens burned. As of May 22, 2023, team statistics show approximately 140 million tokens locked under team allocations, token sales, liquidity incentives, and governance.

TRU value accrual comes from:

1) Staking to approve or reject new loans;

2) Reserves;

3) Liquidity incentives;

4) Governance.

Goldfinch

#737

Goldfinch Finance primarily provides loans to real-world enterprises, targeting clients such as debt funds and fintech companies, offering them USDC credit lines.

According to Dune data, Goldfinch’s active loan volume and protocol TVL have largely stagnated since May 2022, maintaining total loan exposure around $100 million. This is mainly due to the extensive due diligence required for unsecured lending and the mismatch between lenders’ and borrowers’ risk-return expectations during bear markets.

Goldfinch generates revenue from borrower interest and LP withdrawal fees, with the DAO collecting 10% of these revenues. LPs pay a 0.5% fee when withdrawing from the senior pool, which is also allocated to the DAO.

Figure: Goldfinch Active Loan Volume / TVL

Source: dune.com, LD Research

Token Model

Total token supply is 114,285,714. A moderate inflation plan may be introduced in two years, subject to community decision. Current circulating supply is 51.9 million, representing 45% of total supply. Nearly 55% of tokens will be released over three years post-TGE, with approximately 1.76 million tokens released monthly.

Clearpool

Rank #960

The protocol launched on Ethereum mainnet in Q1 2022. Team members primarily come from traditional financial institutions. Its products include permissionless and permissioned pools.

A permissionless pool allows anyone to lend, though borrowers must apply to be whitelisted. Pool size is dynamic, with no cap on liquidity providers. Borrowers can optimize pool utilization via interest rate curves, with no fixed repayment schedule and dynamically calculated interest. Its lending model resembles Aave and other collateralized lending protocols. However, pool utilization must remain below 95%. When utilization exceeds 95%, no further borrowing is allowed. If it surpasses 99%, lenders cannot withdraw, and borrowers must repay part of the loan.

Prime is Clearpool’s upcoming permissioned pool built on Polygon, currently in testnet phase. All participants in Prime pools must undergo KYC and AML checks.

March 2023 marked the protocol’s lowest TVL ($2.6M). Current TVL stands at $28.49M, although growth has slowed since May.

Figure: Clearpool TVL

Source: Defillama, LD Research

Token Model

CPOOL has a total supply of 1 billion. The public sale valuation was $40 million, and the token is currently trading below its initial price.

Until January 2024, 3.11% of the total token supply is released on the 28th of each month.

Token value accrual comes from:

1) 5% of protocol revenue used for buybacks;

2) Staking rewards;

3) Governance participation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News