A Deep Dive into Hong Kong's Blockchain Development Journey, Ecosystem, and Future Prospects

TechFlow Selected TechFlow Selected

A Deep Dive into Hong Kong's Blockchain Development Journey, Ecosystem, and Future Prospects

As a traditional financial hub, Hong Kong is actively exploring how to maintain its position in the world of Web3.

Executive Summary

-

Starting June 1, Hong Kong officially implements virtual asset regulations, accelerating the development of its blockchain market.

-

Strict regulatory frameworks are being established to protect investor assets and facilitate the entry of more institutional players and foreign capital.

-

Hong Kong has launched the Web3Hub Ecosystem Fund to actively promote local Web3 projects.

-

Crypto wallets remain the best way for users to interact with blockchain networks and manage their digital assets.

Background and Current State of Blockchain in Hong Kong

In May, the Securities and Futures Commission (SFC) of Hong Kong officially announced that virtual asset regulations would take effect starting June 1, allowing retail investors to trade virtual assets on licensed platforms as early as the second half of the year. CZ also shared a CCTV2 Economic Information Daily report on Twitter about the implementation of crypto regulations in Hong Kong. As a result, tokens associated with Hong Kong and China experienced a sharp rally.

Additionally, Foresight News will host a "Dialogue Between Hong Kong Legislators and the Web3 Industry" Twitter Space event on June 1, where BitKeep COO Moka will represent Web3 wallets and discuss opportunities and challenges in Hong Kong’s Web3 landscape, sharing insights into potential opportunities under the new policies.

Notably, China Central Television aired a report on Hong Kong's acceptance of cryptocurrencies—though only 98 seconds long, it contained no negative commentary on crypto, marking a stark contrast to mainland China’s stance in 2019.

Hong Kong’s Status as a Financial Hub

With the rise of blockchain technology, Web3 is gradually replacing Web2 as the next-generation internet framework. As a traditional financial center, Hong Kong is actively exploring how to maintain its status in this evolving Web3 world.

As an international financial hub, Hong Kong has become a hotspot in the blockchain and digital asset space. Unlike neighboring Asian countries, Hong Kong is increasingly embracing and promoting blockchain technology, attracting more companies to establish headquarters or branches there. Moreover, Hong Kong is advancing regulation and standardization efforts in digital assets and blockchain to meet growing market demand and investor needs.

Current State of Blockchain in Hong Kong

2023 is shaping up to be a year full of momentum. In the first half alone, trends like the Ordinals protocol, BTC NFTs, memecoins, and LSDFi have fueled strong market sentiment, with the current wave of memecoins extending for the first time into the Bitcoin ecosystem. As Asia's leading financial center, Hong Kong sees blockchain technology as a new opportunity for its financial sector, and the city's blockchain market continues to grow rapidly.

With its increasingly open attitude toward blockchain, Hong Kong has now joined global cities like London, New York, and Singapore as another key player in the virtual asset industry, potentially emerging as a regional hub in Asia. In fact, Hong Kong has been building its blockchain presence for years—since launching the “FinTech Talent Scheme” in 2018 to encourage local enterprises to participate in blockchain and other tech sectors, the number of fintech firms in Hong Kong has surpassed 600, covering areas such as mobile payments, cross-border wealth management, investment services, compliance tech, and virtual asset trading. The city has also launched virtual asset ETFs and hosted multiple major blockchain summits.

The Evolution of Blockchain Development in Hong Kong

From initial skepticism about cryptocurrency's financial legitimacy to hosting the 2023 Hong Kong International Web3 Festival, Hong Kong's regulatory stance has grown progressively clearer alongside the maturation of the crypto industry. Financial markets move forward or fall behind—Hong Kong, as an Asian financial powerhouse, understands that failing to embrace innovation risks ceding ground to more progressive jurisdictions like Singapore.

Early Stage of Skepticism

In the past, the Hong Kong government took a cautious and skeptical view of cryptocurrencies. In 2013, the Hong Kong Monetary Authority (HKMA) stated that Bitcoin and similar digital currencies did not meet definitions of money or financial instruments, thus requiring no regulation. In 2018, the SFC issued warnings about fraudulent ICOs and unregulated digital asset exchanges. Domestic Chinese crypto exchanges were ordered to halt operations and cease serving Chinese citizens. Following China’s nationwide crypto ban, mining operations shut down en masse, causing China to drop out of the top ten global hash rate rankings.

However, in recent years, as blockchain and crypto have advanced globally, Hong Kong’s position has softened slightly. In 2019, the SFC chair indicated Hong Kong’s intention to allow crypto investors to operate under regulatory oversight rather than imposing a blanket ban. Meanwhile, the HKMA has been actively researching central bank digital currencies (CBDCs) and collaborating with countries like mainland China and Thailand on cross-border digital payment systems.

Overall, while the government was not fully open at the time, Hong Kong has gradually shifted its stance toward these new asset classes amid broader technological advancements.

Acceleration Phase Since 2017

Since 2017, Hong Kong’s blockchain industry has entered a period of accelerated growth, driven by support from both the government and private sector. That year, the HKMA launched a sandbox initiative to explore the feasibility of using blockchain technology within interbank networks. This marked the beginning of rapid expansion. In 2018, the Hong Kong Special Administrative Region government established a dedicated blockchain task force aimed at positioning Hong Kong as a global leader in blockchain innovation. More companies began operating blockchain businesses locally, including Ant Blockchain (a subsidiary of Ant Group) and Coinsuper backed by Sequoia Capital.

At the same time, Hong Kong’s blockchain ecosystem has continued to mature. For example, the Hong Kong Institute of Industrial Research partnered with Wharton School to launch a blockchain certification program, equipping professionals with relevant knowledge and skills. In 2022, Hong Kong rolled out Asia’s first publicly offered crypto asset ETFs and hosted numerous blockchain and digital asset events and summits—including the Asia Blockchain Summit—providing platforms for collaboration and exchange. With post-pandemic economic reforms, rebuilding of Hong Kong’s financial hub status, and strengthened development strategies, the city is poised for significant growth in the crypto space.

Regulatory Environment and Policy Measures

Coinbase CEO Brian Armstrong once tweeted: “The U.S. risks losing its financial leadership long-term due to unclear crypto regulations and a hostile regulatory environment. While crypto markets expand elsewhere—first in the EU and UK, now in Hong Kong.”

Only under appropriate regulation can investor protection improve and attract more conservative investors to participate. On the regulatory front, Hong Kong’s first step is issuing operating licenses to centralized exchanges (CEX), which is crucial. Many exchanges cannot operate in certain countries simply because they aren’t legally recognized. Take Bitget as an example—it holds multiple international licenses and is expected to obtain a Hong Kong license soon. Recent policy updates clearly define participation requirements for institutions, enterprises, and individuals—for instance, individuals must have over HK$8 million in investable assets, or institutions based in Hong Kong must possess over HK$40 million.

Hong Kong has actually moved quickly on blockchain regulation. As early as September 5, 2017, the SFC released a statement on Initial Coin Offerings (ICOs), noting that tokens involved might qualify as securities under the Securities and Futures Ordinance, requiring teams or funds conducting ICOs to register with the SFC and comply with supervision.

The latest round of guidance includes the “Guidelines for Virtual Asset Trading Platform Operators,” “Anti-Money Laundering and Counter-Terrorist Financing Guidelines (for Licensed Corporations and SFC-Licensed VASP Providers),” “Guidelines on AML/CFT for Connected Entities of Licensed Corporations and SFC-Licensed VASPs,” “SFC Disciplinary Sanctions Guidelines,” along with existing laws like the Securities and Futures Ordinance and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance. Additionally, the SFC stated that licensed virtual asset platforms must implement comprehensive investor safeguards before offering services to retail investors, covering client onboarding, governance, disclosure, token due diligence, and listing procedures. Services such as stablecoins, proprietary trading, and lending remain temporarily prohibited.

Proper regulation ensures healthy market growth, attracts international enterprises, and brings in institutional investors and fresh foreign capital.

Ecosystem Development and Construction in Hong Kong’s Blockchain Sector

The Hong Kong Web3 Festival has become one of the most prominent international events in the crypto space in recent years, drawing leaders across various sectors. Event participation has grown exponentially, focusing greater global attention on Hong Kong as a financial metropolis. Protocols like Avalanche, Conflux, EOS, and Fantom have joined the Hong Kong Web3Hub Ecosystem Fund, fueling bullish sentiment in secondary markets and showcasing vibrant project performance.

High-Quality Projects Under the “Hong Kong Narrative”

-

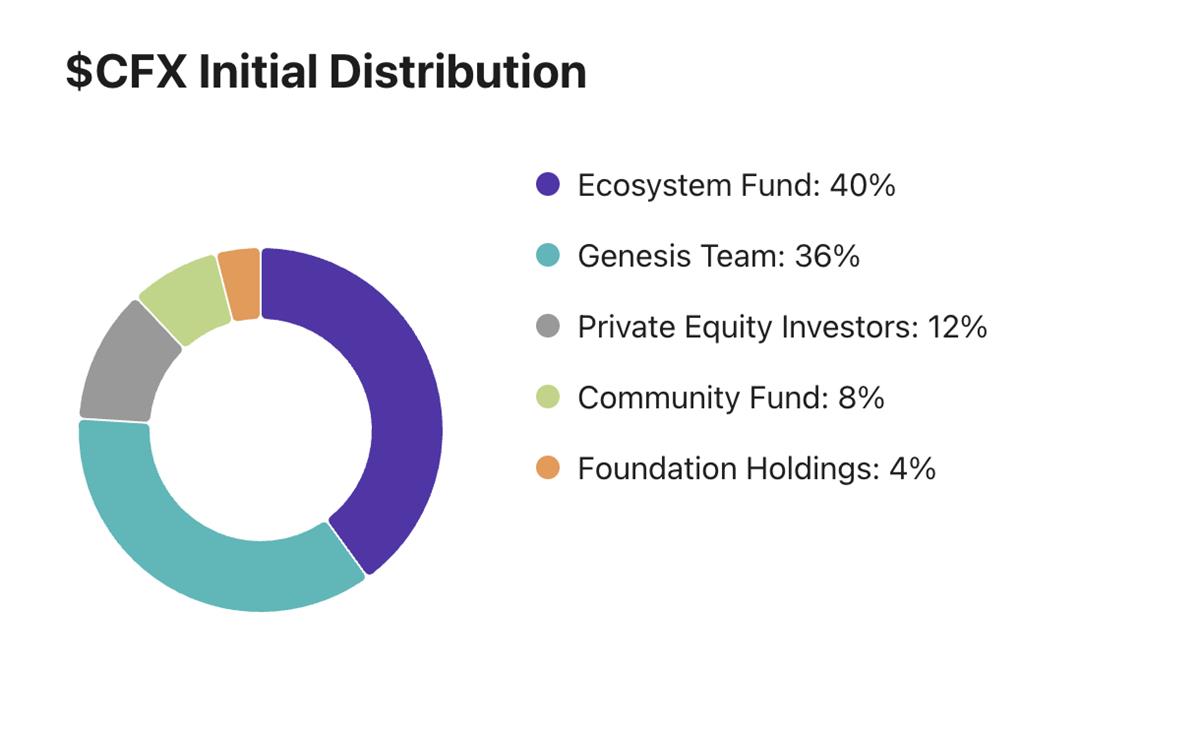

Conflux Network($CFX)

As the flagship of the Hong Kong narrative, Conflux token $CFX saw the most dramatic surge, gaining nearly tenfold in the short term following favorable news from Hong Kong.

Conflux boasts a strong core team, having formed strategic partnerships with Xiaohongshu (Little Red Book), co-launched an on-chain stablecoin with the Shanghai government, and collaborated with major corporations like China Telecom. It’s evident that Conflux’s ecosystem primarily focuses on B2B applications with robust government backing, forming a unique niche.

As an established public chain, Conflux’s on-chain ecosystem hasn’t stood out recently. To maintain its leadership, developing high-quality decentralized applications will be critical. Therefore, instead of focusing solely on the chain itself, attention should shift to its ecosystem. Achieving another tenfold gain may be difficult through internal efforts alone, but could become feasible if one or more of its ecosystem projects succeed. Investors should closely monitor existing or upcoming projects on Conflux for the next breakout opportunity.

-

AlchemyPay ($ACH)

AlchemyPay is a payment solution built on Ethereum and BNB Chain, known as one of the lowest-cost and secure fiat-to-crypto on-ramps. BitKeep OTC already supports AlchemyPay transactions.

Officially supporting Apple Pay, Google Pay, Visa, and others, AlchemyPay offers broad real-world utility and is often dubbed the “Alipay of crypto.” Beyond its own strength, it partners with major players like Binance, Polygon, Avalanche, OKX, and MEXC. Even CZ has expressed optimism about Alchemypay’s future. However, its classification as a native blockchain project is debatable—it functions more as a bridge between the real world and Web3, making it beginner-friendly for newcomers.

-

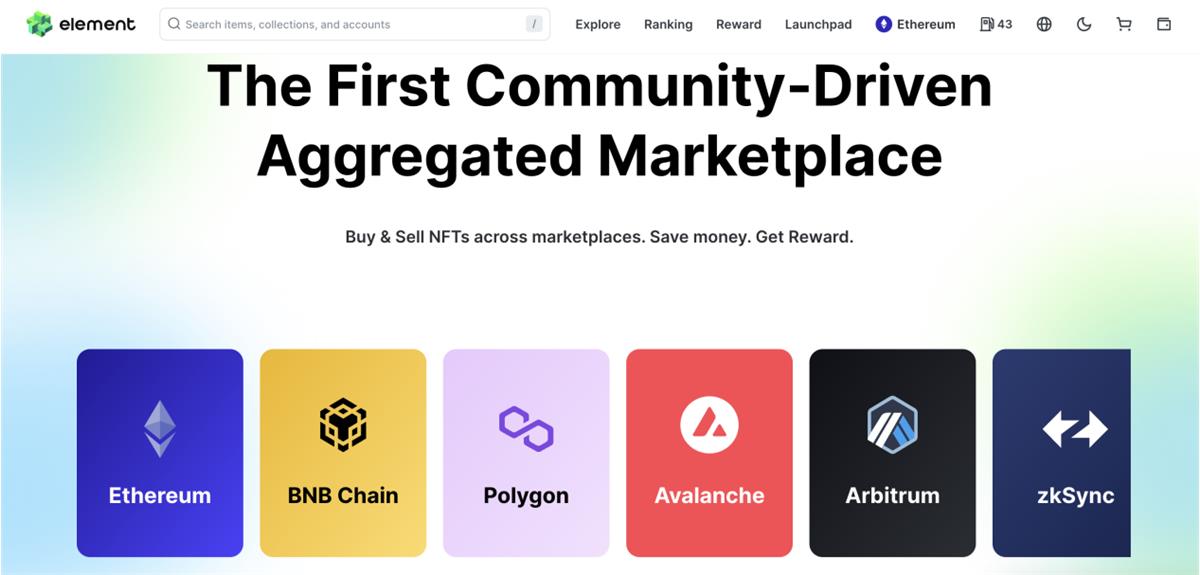

Element NFT Platform

Element has long targeted the Hong Kong market and is headquartered there, making it one of the better Chinese-led NFT platforms. With many multinational consumer goods companies based in Hong Kong having NFT issuance needs, we’ve seen brands like Nike, Li-Ning, and Starbucks successfully use NFTs as a new brand storytelling tool. As more brands join the NFT marketing trend, fresh capital flows into the NFT space, lowering user barriers and strengthening ties between NFTs and the real economy. If Element can effectively capture this influx, its prospects look promising.

-

SELFKEY($KEY)

SELFKEY is another recently popular Hong Kong-themed project. As a DID (decentralized identity) platform, it empowers users to control their identities and digital assets. Key features include digital identity verification, communication privacy, digital asset management, smart contracts, KYC/AML integration, and more. Notably, SELFKEY is developed by a fully Hong Kong-based team.

However, the DID space is crowded. To stand out beyond just riding the “Hong Kong narrative,” SELFKEY must enhance its functionality. Investors should also assess the overall health of the DID sector, which currently lacks strong momentum, warranting caution.

-

The Sandbox($SAND)

Founded in 2012, The Sandbox is one of the leading metaverse projects—a decentralized, community-driven gaming ecosystem where players can create NFTs, upload them to an in-game marketplace, and integrate them into gameplay. The project has raised $95.1 million across two funding rounds, backed by SoftBank Vision Fund, Animoca Brands, Blue Pool Capital, Polygon Labs, Liberty City Ventures, Samsung Next, and others.

Future Prospects of Blockchain in Hong Kong

Globally, Hong Kong is currently the only jurisdiction combining crypto-friendly policies with a vibrant market capable of influencing the global stage—an impactful combination that excites the entire industry.

On May 14, Hong Kong established the Web3Hub Ecosystem Fund to foster the development of its Web3 environment. Comprising blockchain, cloud services, media, and other Web3 sectors, the fund supports overseas Web3.0 companies setting up in Hong Kong. Chaired by Financial Secretary Paul Chan, the fund’s management committee includes experts from fintech, blockchain, and cryptocurrency fields.

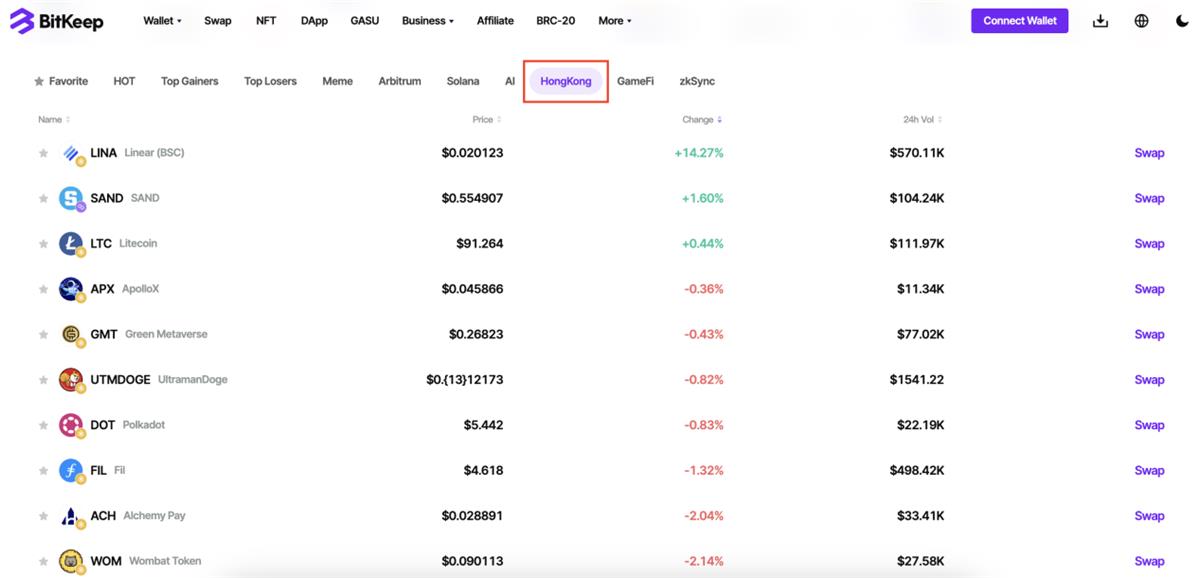

Now, various sectors are beginning to embrace the “Hong Kong narrative.” The market remains nascent and lacks essential infrastructure. BitKeep Wallet, serving millions of users as a gateway to Web3, provides seamless asset management with support for over 90 major blockchains and 250,000+ on-chain assets. Features like NFT marketplaces and one-click swaps are readily available. BitKeep has also launched a dedicated “Hong Kong-themed Tokens” section, complete with live price charts, project details, and real-time alerts—making it easy for beginners to experience the magic of blockchain.

As blockchain application scenarios continue to expand, Hong Kong’s blockchain industry is poised for further growth. At the same time, deeper research and broader adoption of blockchain technology will be necessary.

Risks and Opportunities in Hong Kong’s Blockchain Sector

Given that the digital asset industry is still in its early stages, ensuring sustainable development in Hong Kong requires future efforts to clarify the legal status of crypto assets, define regulatory responsibilities among financial authorities and government bodies, establish comprehensive laws and regulations for virtual assets, set industry standards, and refine entry and exit mechanisms for entities like virtual asset exchanges and funds.

Regulation remains the top challenge. New rules strictly limit tradable tokens and permissible exchange services. Cryptocurrencies must meet stringent SFC criteria: they must be non-security tokens, have at least 12 months of trading history, and be included in two major crypto indices. Exchanges are prohibited from offering interest-bearing deposit products, lending, or custody services. Derivatives trading, including perpetual contracts, is also banned—though regulators acknowledge the importance of derivatives and plan to study them further.

Asset security remains a primary concern for all participants. Due to blockchain’s decentralized nature, regulatory oversight is challenging, making it difficult for governments to fully control data and financial safety. Additionally, high market volatility increases investment risk, while technical complexity introduces inherent security vulnerabilities.

Recent years have seen frequent exchange collapses and exit scams, raising concerns over fund safety. As Hong Kong’s blockchain sector thrives and attracts new capital, crypto wallets offer the best way for users to interact securely with blockchain networks and assets. The adage “Not your keys, not your coins” underscores the importance of self-custody. Unlike centralized exchange wallets, decentralized wallets give users full control over their private keys—though irreversible loss occurs if keys are misplaced. BitKeep Wallet, for example, features a clean, intuitive interface ideal for beginners, enabling smooth transactions and real-time portfolio tracking. To safeguard assets, BitKeep employs its proprietary DESM encryption algorithm, protecting user funds even if devices are lost. Additionally, a million-dollar security fund backs user assets for added protection.

Conclusion

Hong Kong’s Web3 development remains experimental, with multiple possible outcomes. If desired goals aren't achieved within a given timeframe, or if regulatory issues trigger financial incidents, policy reversals could occur. Hence, the Hong Kong government places great emphasis on regulation, striving to draw clear red lines and uphold fundamental safeguards.

Hong Kong’s sound regulatory system is creating an orderly and reliable investment environment for the blockchain market. More crypto assets are expected to enter the Hong Kong market in the future. Overall, Hong Kong’s blockchain industry is still in its early stages. Under strict government oversight and leveraging its unique advantages, the sector is poised for healthy, sustainable growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News