5 Crypto VCs' 2023 Investment Focus: Infrastructure, DeFi, and GameFi Remain Key Priorities

TechFlow Selected TechFlow Selected

5 Crypto VCs' 2023 Investment Focus: Infrastructure, DeFi, and GameFi Remain Key Priorities

Decentralized finance (DeFi) leads, followed by gaming finance (GameFi), and then blockchain infrastructure—these sectors dominate the investment portfolios across various venture capital firms.

Written by: DefiNapkin

Compiled by: TechFlow

Following top venture capital firms ("smart money") investment trends and strategies is a great way to uncover emerging narratives. Despite market conditions falling short of expectations in the first quarter of 2023, leading cryptocurrency VCs continued focusing on certain key areas. In this report, crypto researcher DefiNapkin dives deep into these trends, analyzing the investment strategies of top-tier VCs and explaining why they are choosing these specific sectors.

Here are the five major trends being explored by top crypto VCs in 2023:

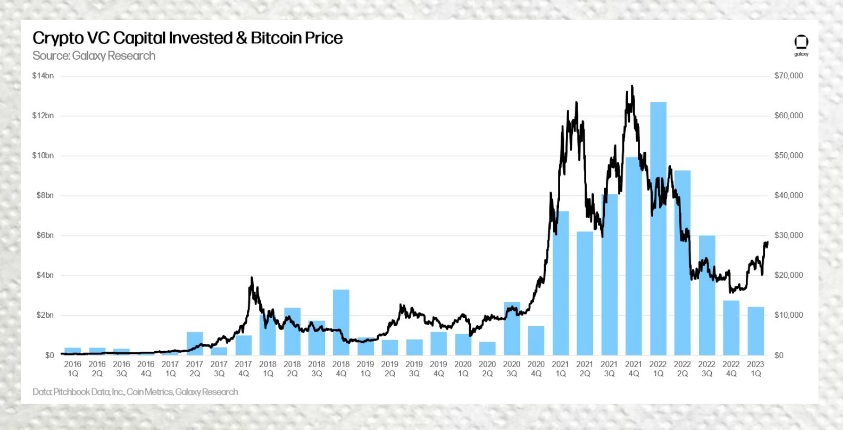

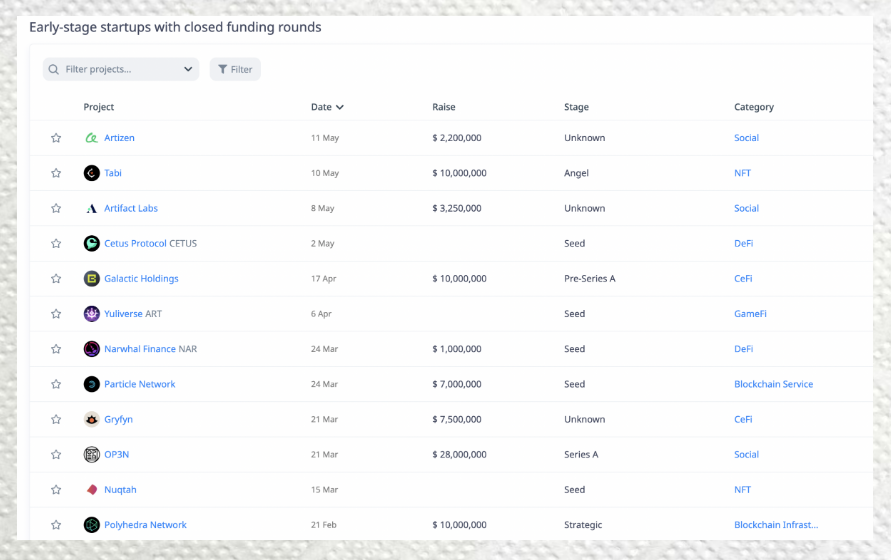

As shown in the chart below, fundraising remained largely stalled throughout Q1 2023, except for March.

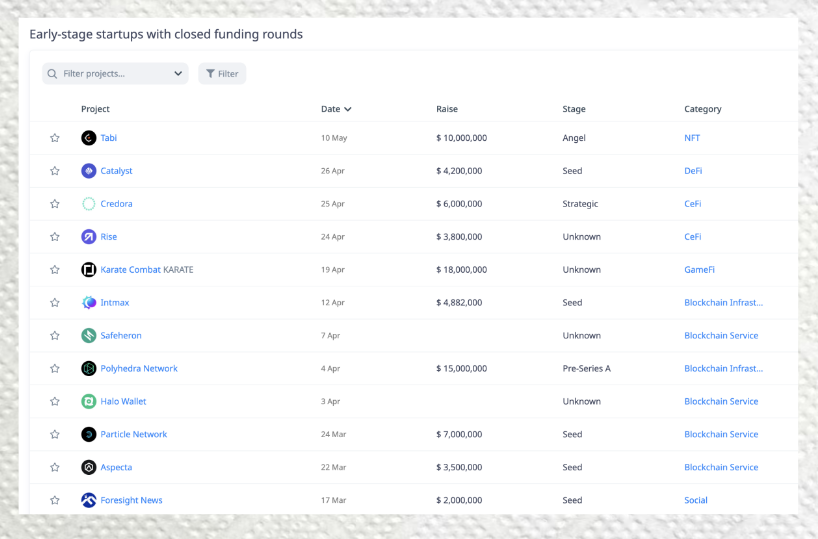

Crypto VC funding often correlates with price movements, as illustrated clearly in the chart below.

Upon closer inspection, we can see that funding tends to follow price surges with a slight lag. Therefore, I suspect funding activity may increase in the second quarter.

Last year, we reached the price bottom. It wasn't until Q1 2023 that Bitcoin prices began to recover slightly. The logical inference is that crypto venture capital activity will also rebound in Q2 2023.

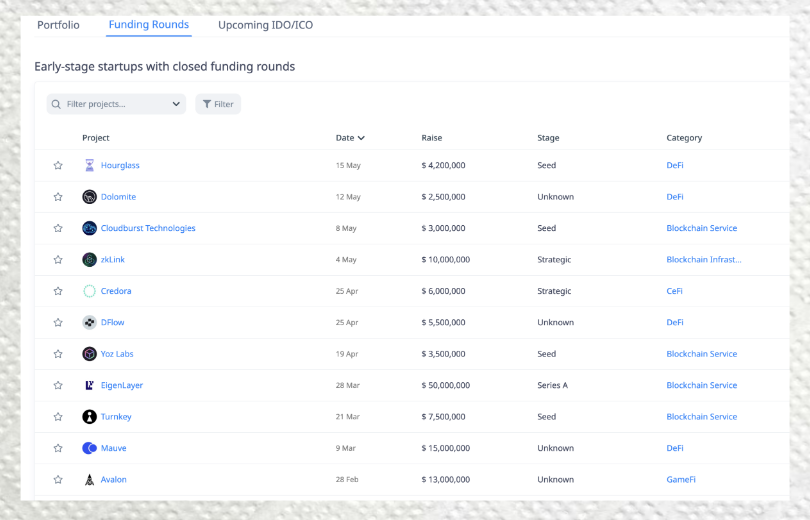

Despite a downward trend in capital deployment, transaction volume in Q1 2023 increased in terms of deal count, reaching 439 deals compared to 366 in Q4 2022—primarily due to a slowdown in pre-seed activity during Q4 2022, which saw only 42 pre-seed deals.

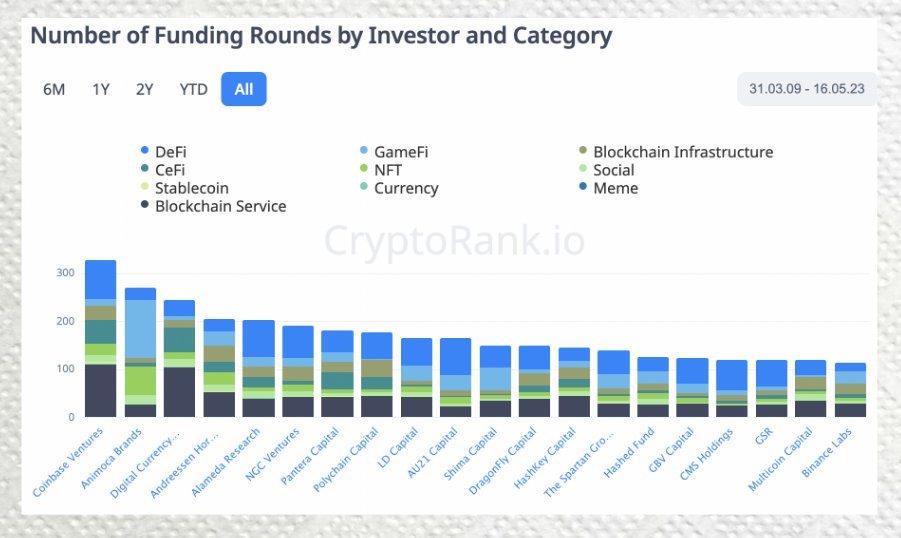

Now let's examine round counts by investor and category.

Overall, decentralized finance (DeFi) leads, followed by GameFi, then blockchain infrastructure—these domains dominate the investment portfolios across major VCs.

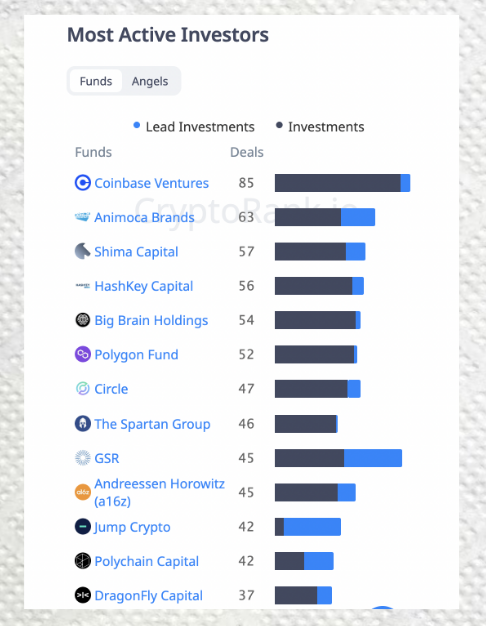

Let’s take a closer look at these top VCs:

-

Coinbase Ventures;

-

Animoca Brands;

-

Shima Capital;

-

HashKey Capital;

-

Big Brain Holdings.

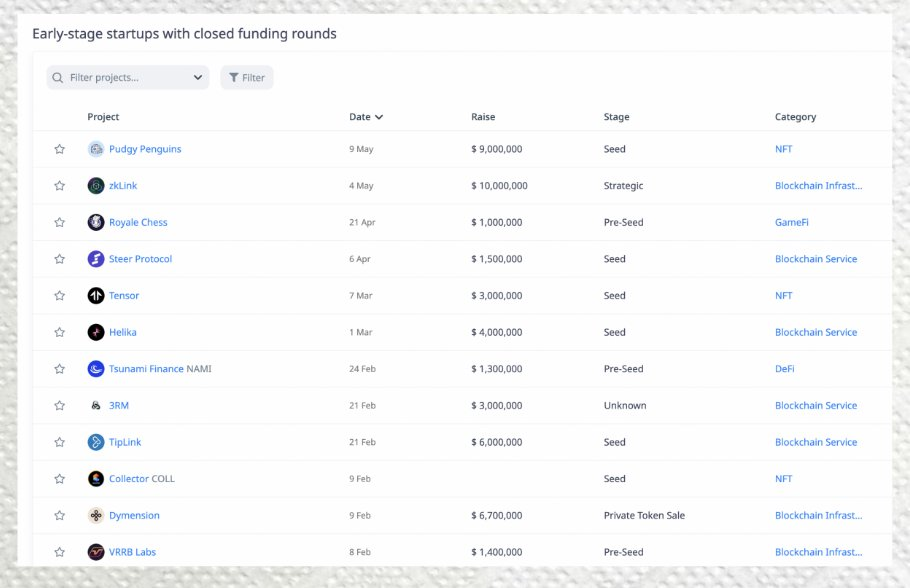

What did they invest in during Q1 2023?

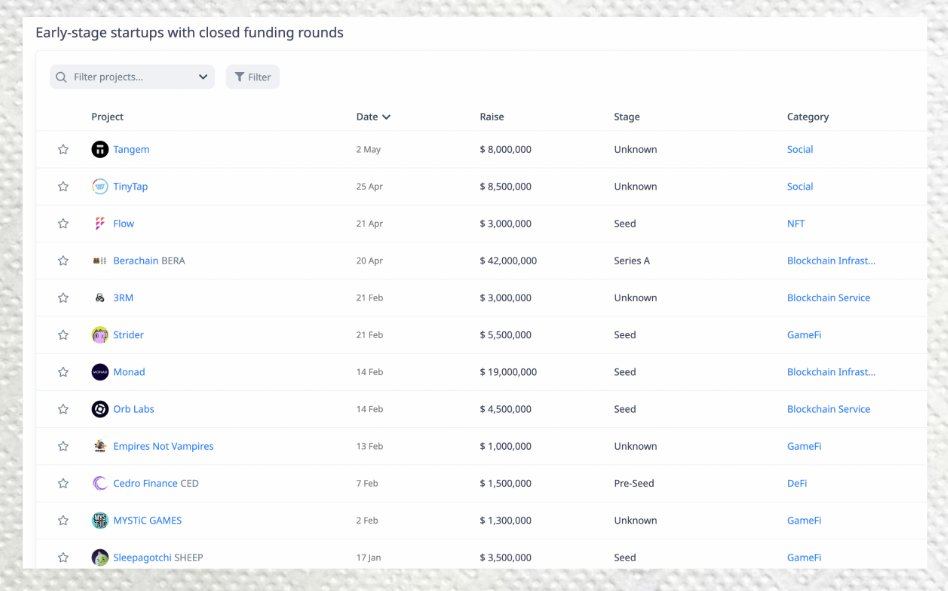

Coinbase Ventures

Currently focused primarily on blockchain services, followed by DeFi.

Animoca Brands

Currently focused primarily on GameFi, followed by NFTs.

Shima Capital

Currently focused primarily on GameFi, followed by DeFi.

HashKey Capital

Currently focused primarily on blockchain services, followed by DeFi.

Big Brain Holdings

Currently focused primarily on DeFi, followed by blockchain services.

Emerging Trends and Sub-Sectors

Clearly, the largest VCs are investing in blockchain infrastructure, DeFi, and GameFi.

Why are top VCs investing in blockchain services, DeFi, and GameFi? They're preparing for mass adoption.

-

Blockchain services serve as the foundational infrastructure for DeFi. They typically generate the highest revenue and are relied upon by decentralized applications (dApps).

-

DeFi is the birthplace of innovation, continuously generating new products and possibilities.

-

GameFi represents a massive, upcoming, and untapped market.

Investment volume may appear to have declined—especially when compared to the past two years, which is true. However, from a broader perspective, VC and investment activity remains multiple times higher than four years ago.

We can assume this depends on Bitcoin price movements and overall crypto market performance. My outlook for the future is bullish, which aligns with the coming regulatory clarity—without a doubt, clearer regulations are inevitable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News