Let the data speak: a comprehensive analysis of "BNB's earnings"

TechFlow Selected TechFlow Selected

Let the data speak: a comprehensive analysis of "BNB's earnings"

It's normal for a breakout project to leave a stronger impression than three mid-to-high-level projects.

Author: CapitalismLab

Binance LaunchPad has recently received mixed reviews, yet the sentiment of "even in poverty, never skimp on education" still vividly reflects the warmth and promise that LaunchPad brings to the crypto community.

We’ve dug into LaunchPad’s historical data since 2021, using numbers to assess current returns, uncovering why it feels “underwhelming,” and comparing BNB holding yields against ETH staking returns. This comprehensive analysis dives deep into the question of “BNB’s yield.”

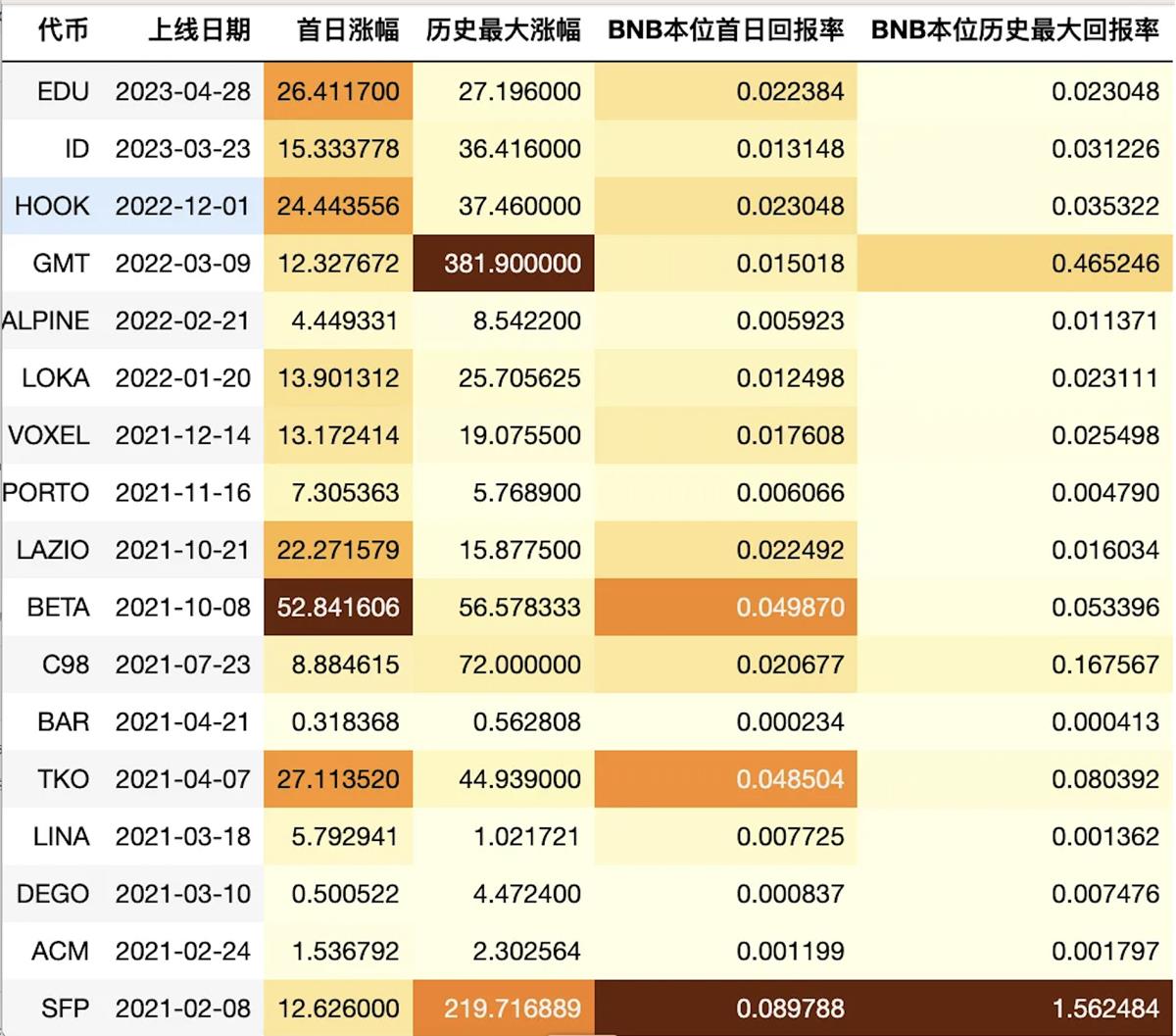

Metric Explanations

First-day return: Price increase at the first UTC+0:00 after listing compared to IDO price

All-time max return: Highest historical price increase compared to IDO price

BNB-denominated first-day return: Amount of BNB you receive by selling tokens on day one after investing 1 BNB in the launch

BNB-denominated all-time max return: Maximum amount of BNB you could obtain by selling at the highest historical price after investing 1 BNB

Performance Assessment

Taking the median across all projects: first-day return is 12.6x, all-time max return is 25.7x, BNB-denominated first-day return is 0.015, and BNB-denominated all-time max return is 0.031.

The three tokens launched since HOOK have performed above average. Their median first-day return of 24.4x is 1.9 times the historical median; all-time max return is 1.4 times higher; BNB-denominated first-day return is 1.5 times; and BNB-denominated all-time max return is 1.3 times higher. In other words, these bear-market launches have actually outperformed most bull-market projects.

Current policies are also more favorable for arbitrageurs. Compared to the inconsistent returns previously seen, the recent three projects all delivered BNB-denominated returns around 2%. If future LaunchPad terms remain similar, users employing spot-long/futures-short strategies or borrowing BNB via Venus can expect relatively stable yields.

Why It Feels Underwhelming

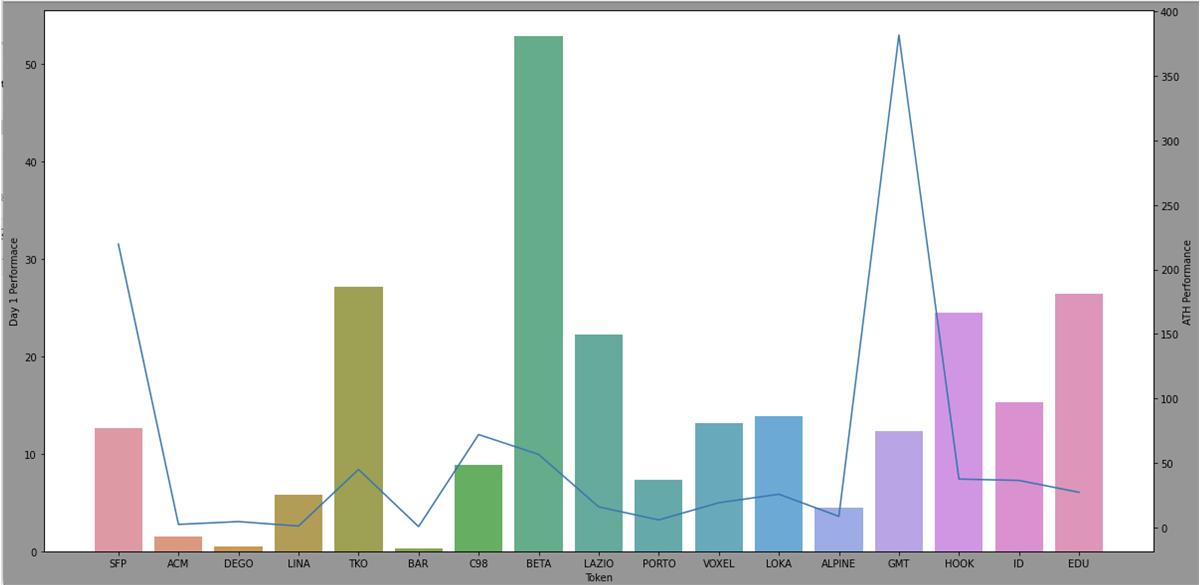

So why does it feel less exciting than before? The main reason is the lack of breakout hits. In 2021–2022, projects like SFP and GMT delivered hundreds-of-times returns—holding one such winner could outweigh ten average ones. The gap between SFP and GMT was about a year; now, another year has passed since GMT without a comparable high-flyer.

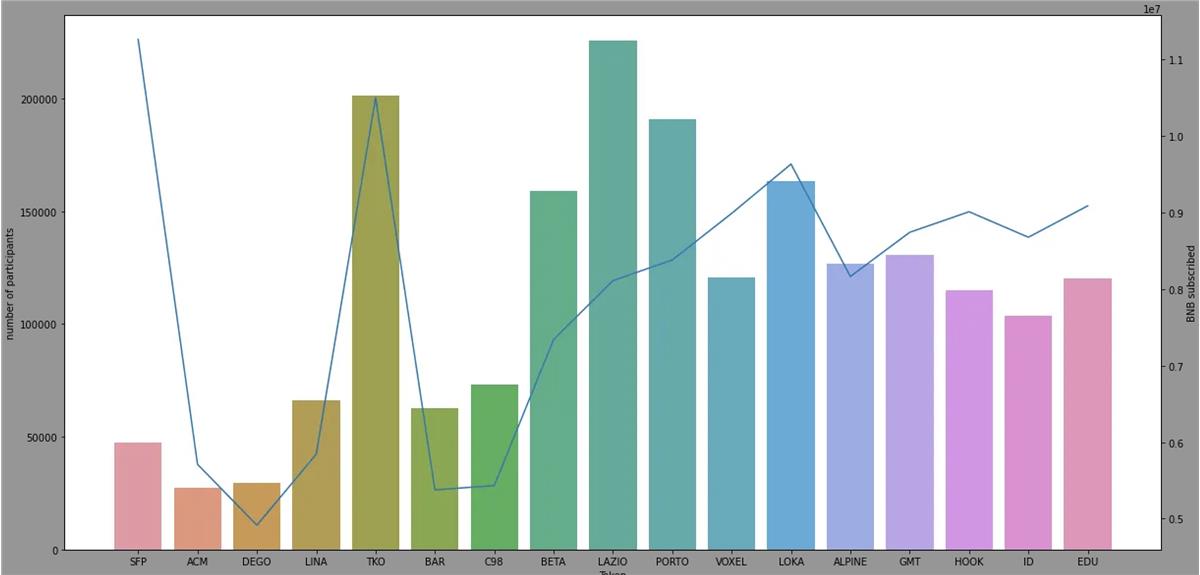

It's natural that one standout project leaves a stronger impression than three solid but unspectacular ones. When viewing the chart below, your eyes likely go straight to GMT. What does a BNB-denominated all-time max return of 0.46 mean? It means 1 BNB invested in GMT’s launch could be sold for 0.46 BNB at its peak. SFP was even better—1 BNB could net you 1.56 BNB! No wonder those memories stick. By contrast, current 0.0X-level maximum returns feel somewhat dull.

Interestingly, both SFP and GMT had relatively modest first-day returns—only 12x, half of Hook or EDU. The three new projects haven’t been live long, and in the current bear market, Ponzi-style schemes struggle to gain traction, so expectations should remain tempered for now.

Long-Term Holding Returns of BNB

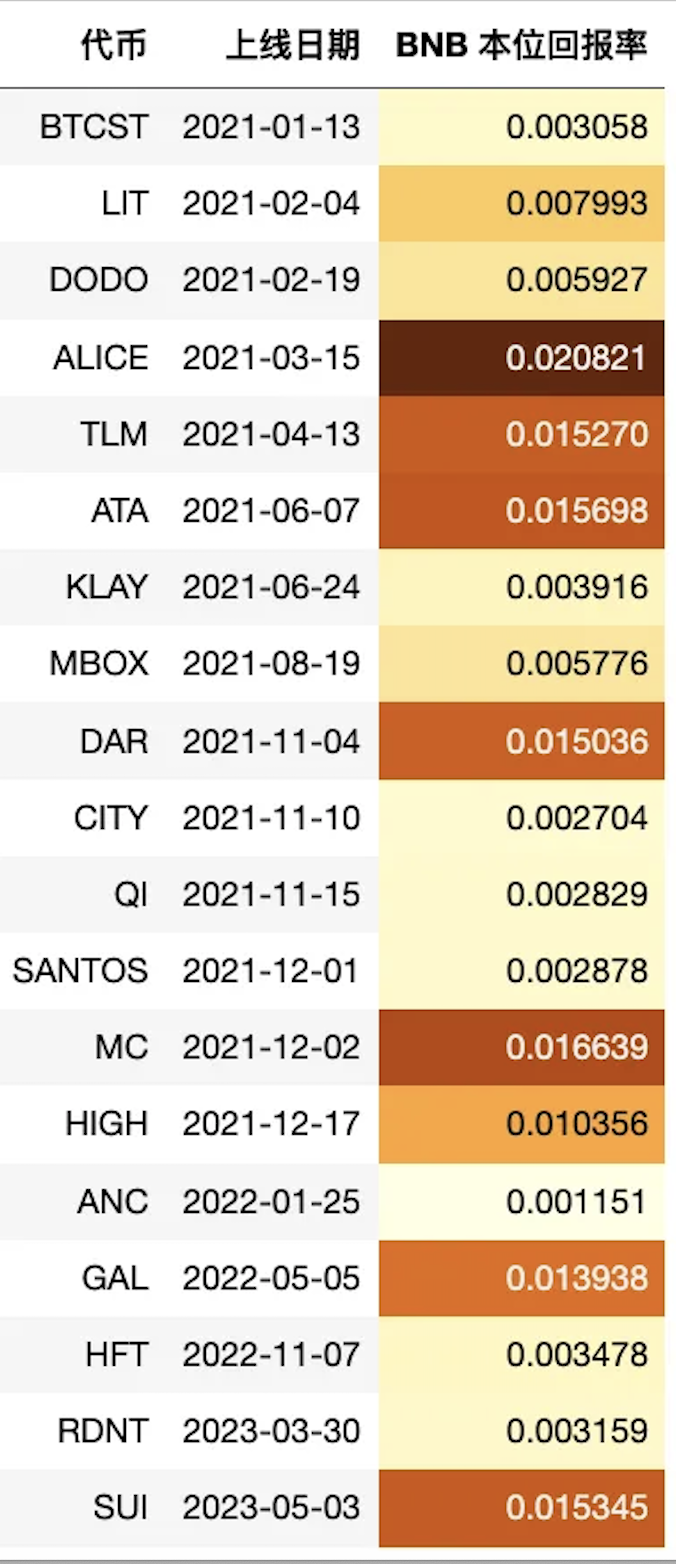

BNB LaunchPad’s annualized return can be benchmarked against ETH staking. Over roughly two and a half years since 2021, selling tokens on the first day would have yielded a total BNB-denominated return of 36%, or about 14% annualized—slightly higher than ETH staking over the same period.

But BNB also offers Launchpool rewards. Adding in Launchpool farming yields, the total BNB-denominated return rises to 52%, or 21% annualized—more than double ETH staking returns during the same timeframe.

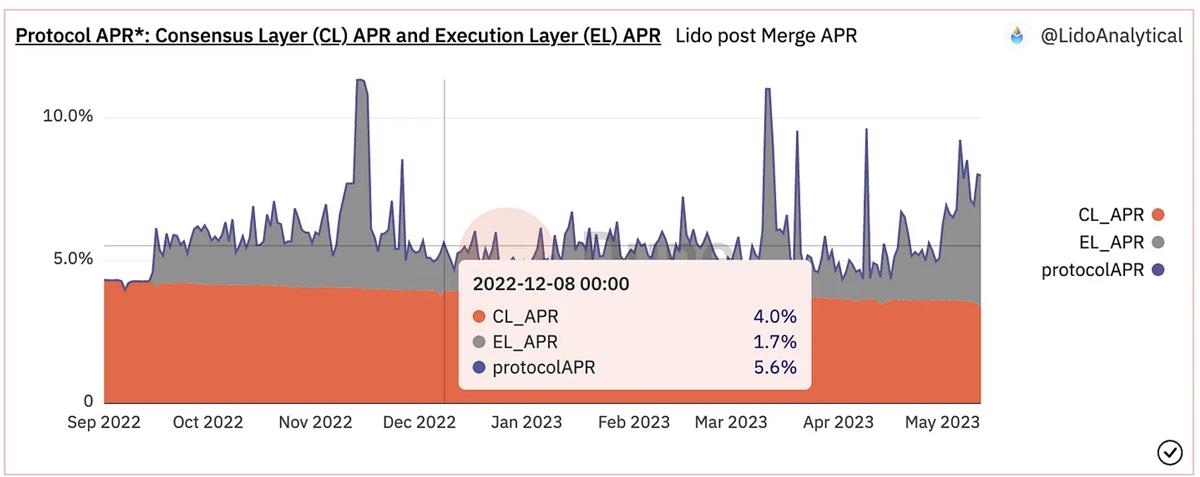

Over the past year (bear market), total project returns were approximately 9.5%. Meanwhile, post-Merge ETH staking APR, boosted by MEV income, stands around 6%. This means BNB launchpad returns still exceed ETH staking yields by over 50% even in a bear market.

If a bull market returns, as suggested by this tweet, ETH staking could benefit further from MEV revenue, while BNB LaunchPad may experience a double boost in both quantity and price surges. However, ETH’s current staking ratio remains low, with 2–3x room for growth compared to other L1s—increased staking might dilute individual yields. In contrast, BNB LaunchPad allocations have remained stable around $10M in both bull and bear markets, and the allure of “all-time max returns” gives BNB greater upside potential.

Of course, both BNB and ETH are undergoing deflationary burns, with BNB burning at a significantly faster rate. These burn benefits directly reflect in token prices. Historically, the BNB/ETH ratio has trended upward, though it has largely traded sideways since 2021. Therefore, directly comparing staking and launchpad yields remains reasonable.

Summary

Since the bear market began, the three LaunchPad projects have delivered combined returns in the upper-middle historical range, with all metrics ranging from 1.3x to 1.9x the historical median. Current BNB-denominated first-day returns are consistently around 2%, making them attractive for arbitrage.

It has been a year since we’ve seen breakout performers like SFP or GMT, which allowed investors to turn 1 BNB into up to 1.5 BNB. Market sentiment may be negative largely due to this absence.

Compared to ETH staking, long-term BNB holding currently yields an annualized launch return of about 9.5%, roughly 1.5 times that of ETH. During previous bull markets, BNB returns were over twice those of ETH, and in future bull runs, BNB is expected to maintain greater upside elasticity.

Still, don’t just rely on calculators. In the next bull cycle, real-world use cases for ETH and BNB will ultimately determine their returns. While ETH L2s are advancing well, whether BNB Chain can keep innovating will be a critical factor to watch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News