Analyzing Arbitrum Airdrop Data: Is the Traditional Airdrop Model Coming to an End?

TechFlow Selected TechFlow Selected

Analyzing Arbitrum Airdrop Data: Is the Traditional Airdrop Model Coming to an End?

Airdrops have long existed as a way to attract users, but they are becoming increasingly ineffective.

Author: KODI

Compiled by: TechFlow

Airdrops have long been used as a way to attract users, but they are increasingly becoming ineffective. The traditional one-time airdrop model is easily exploited by airdrop farmers, while anti-Sybil detection consumes time and resources and may backfire.

In this article, researcher KODI analyzes issues surrounding airdrops. Below is the original text:

As the first rays of dawn slowly rise over the horizon, digital farmers wake up, ready to begin another day of labor.

He slowly gets out of bed and puts on his work clothes: an old “APE SZN” hoodie and a messy T-shirt. He doesn’t wear boots—just one flip-flop. He walks to his computer and launches MetaMask.

With the precision of an experienced harvester, he begins his daily routine. He sends a small amount of ETH from a centralized exchange to his wallet, bridges it across chains, experiments with various testnets, and executes several tiny trades on decentralized exchanges lacking liquidity. He repeats these same actions across multiple wallets within a single day—all for the sake of claiming some free airdropped tokens.

The above describes an airdrop farmer—an activity that more and more people are being drawn into every day.

Before the Arbitrum (ARB) airdrop, airdrop farming seemed limited to only a few individuals. But ARB’s airdrop brought “airdrops” into mainstream headlines.

So far, airdrop farmers have achieved tremendous success. However, their success could ultimately lead to project failure—unless changes are made in how airdrops are conducted.

First, let's briefly review how protocols benefit from airdrops.

What Are the Benefits of Airdrops?

There are indeed several key benefits: marketing, bootstrapping liquidity, and decentralization—all crucial for many projects.

Let’s quickly go through each and explain why airdrop farmers can undermine these benefits.

Marketing

Few things outside of SEC lawsuits make a protocol's name as widely known as an airdrop. People talk about your protocol, interact with it, hoping to receive free tokens, and so on.

Now, the purpose of any marketing effort is to get people using your protocol. But if users only engage with your protocol to qualify for an airdrop and leave immediately after receiving tokens, you're back to square one—and now with fewer tokens left in your treasury.

Liquidity

Tokens are meant to be traded. Unless you want your token to die a slow death, you need to cultivate a healthy market around it. Since initially only the team and early investors hold the tokens, you need a way to distribute them to other users.

Unless you sell some tokens directly to retail via ICO or IDO—risking regulatory backlash—the best way to bootstrap trading pairs is through an airdrop. This ensures some level of distribution from day one, creating a tradable and liquid market right away.

However, if most of the airdropped tokens go to farmers who aren't real users, this approach becomes ineffective—they’ll simply dump your token at the first opportunity.

Decentralization

Distributing a large portion of supply across the crypto ecosystem should help decentralize a project. The key word here is “should,” because if recipients do nothing but wait to dump their tokens immediately, all your efforts are wasted.

But just how much do airdrop farmers dominate token distributions? Let’s try to answer that by examining the most recent major airdrop—Arbitrum.

The Great ARB Harvest

Arbitrum’s airdrop had all the hallmarks of a successful drop—both in terms of smooth execution and sheer scale.

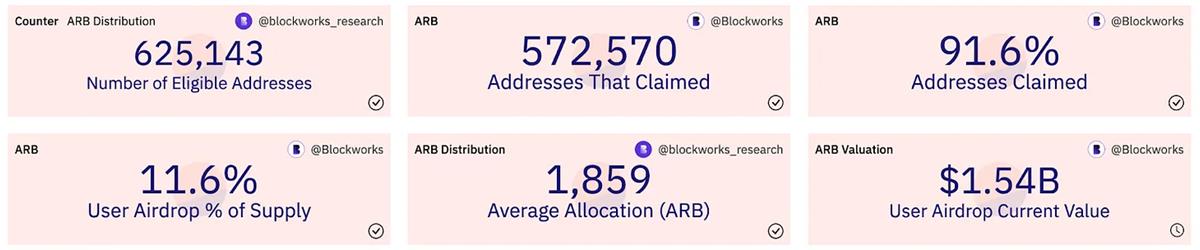

This airdrop accounted for 11.6% of total ARB supply, worth $1.54 billion at current prices.

Of the 625,000 lucky recipients, 91.6% have already claimed their tokens. Can you believe Arbitrum has over 600,000 users?

Yeah, I couldn’t believe it either.

After running community-driven detection algorithms with stricter criteria than Arbitrum itself, some groups found:

- Among the 624,136 addresses that received the airdrop, 279,328 (45%) were linked to “duplicate entities”—meaning multiple addresses controlled by the same individual.

- These addresses received 557 million tokens, accounting for 48% of the total airdrop.

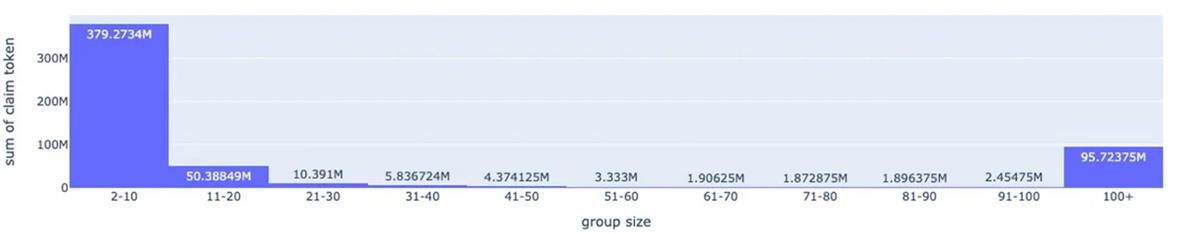

Here is a histogram showing the number of tokens received by duplicate entity addresses:

430 million tokens (37% of the airdrop) went to Sybil attackers controlling between 2 and 20 addresses. Another 95 million tokens—about 8% of the airdrop—went to self-proclaimed “farmers” holding over 100 wallets each.

Airdrop farmers reaped massive rewards. Then they moved on to the next shiny new project.

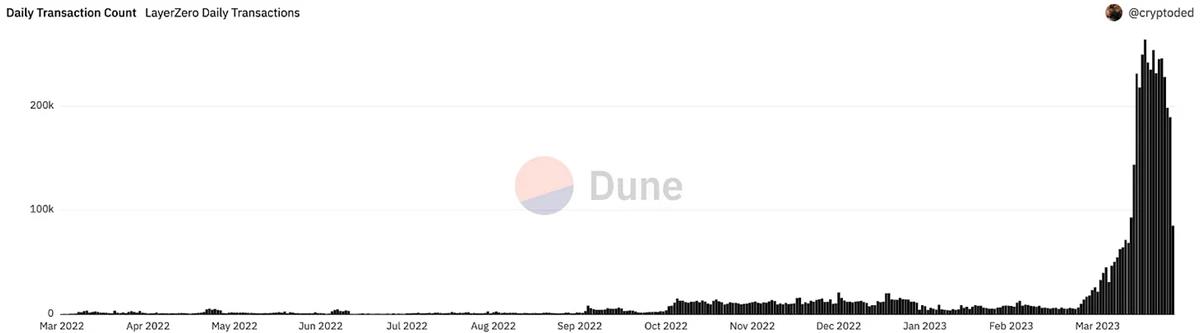

LayerZero is a cross-chain communication protocol expected to launch an airdrop soon (though not yet confirmed). Below is a chart showing daily transaction counts on its network.

From the chart above, can you guess when the ARB airdrop happened?

LayerZero isn’t a new project. It launched Stargate in March 2022. As far as I know, it hasn’t released any major new features recently.

Yet despite Stargate’s fees being significantly higher than most other cross-chain bridges, transaction volume has surged. People must really love using Stargate, right?

How Should We Change?

Airdrops originally emerged as a powerful tool to launch protocols, encourage user participation, and stimulate network growth. I believe they can still fulfill all these functions.

But if farmers continue exploiting airdrops and draining their benefits, fewer protocols will use them. If this trend continues, airdrops might disappear like the dodo bird—with farmers ultimately killing their own food source.

If we want airdrops to survive, the way projects conduct them must change.

Reward Useful Behavior

You wouldn’t leave part of your inheritance to someone you’ve only shaken hands with once. Protocols shouldn’t send tokens to anyone who merely interacts with them. Doing so attracts a flood of short-term opportunists, diluting token value.

Protocols should only incentivize useful behaviors.

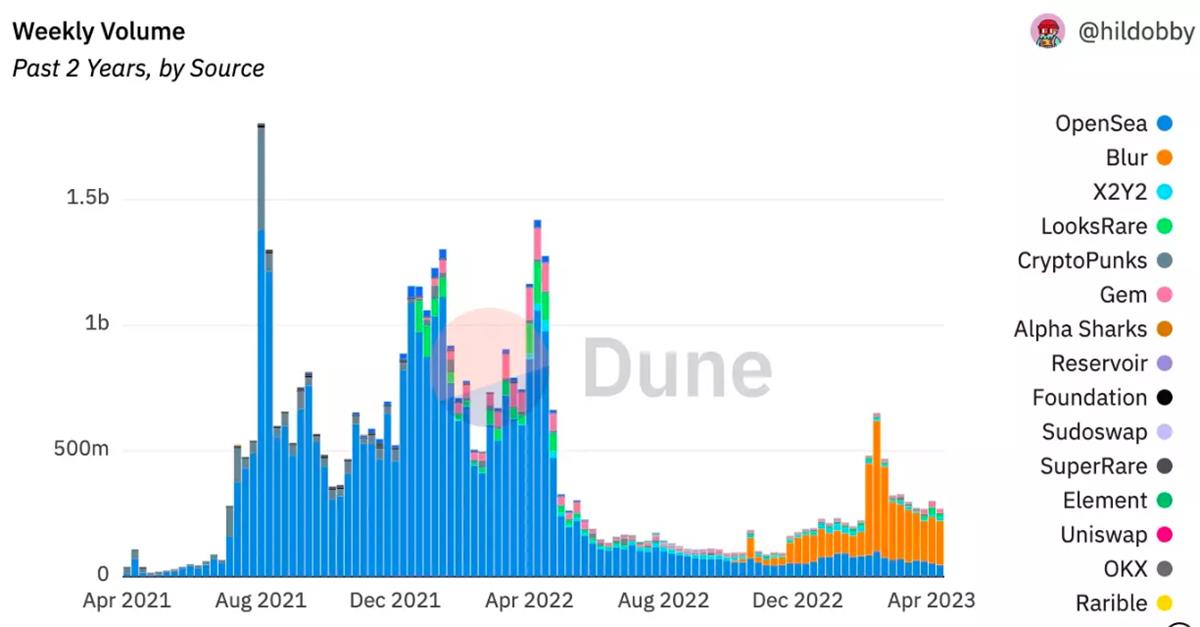

This is exactly what NFT marketplace Blur did to challenge OpenSea.

Unlike failed OpenSea killers like LooksRare or X2Y2, Blur chose not to reward trading volume. If you give away free tokens based on trade volume, users will simply conduct fake trades like madmen and cash out your tokens.

Instead, Blur decided to reward users who provide liquidity on their platform. The first token distribution occurred on February 14. Since February 1, Blur has become the largest NFT exchange by volume.

Over the past three months, Blur has captured 50% to 80% of all NFT trading volume on Ethereum. Once-unstoppable NFT king OpenSea averaged around 40% market share in February and has since dropped to 20% or lower over the past two months.

LooksRare and X2Y2, which incentivized trading with their own tokens, rarely achieved more than 10% market share, often below 5%.

Besides providing liquidity, here are other useful behaviors protocols could incentivize:

- Developer contributions.

- Bug bounties.

- Content creation and education.

- Data analysis: protocols could reward Dune analysts who build dashboards for their protocol.

- Staking on PoS chains.

Persistent Airdrops

Traditional airdrops carry a somewhat dismissive tone: “Hey, here are your tokens, goodbye!” This one-off approach doesn’t make much sense. Distributing rewards gradually over time would improve user retention and foster long-term engagement.

In a persistent airdrop model, only a fraction of the total allocated tokens is distributed in stages rather than all at once. Activity snapshots are taken periodically to determine eligibility. This encourages users to stay engaged with the ecosystem, as continued participation is required to keep earning rewards.

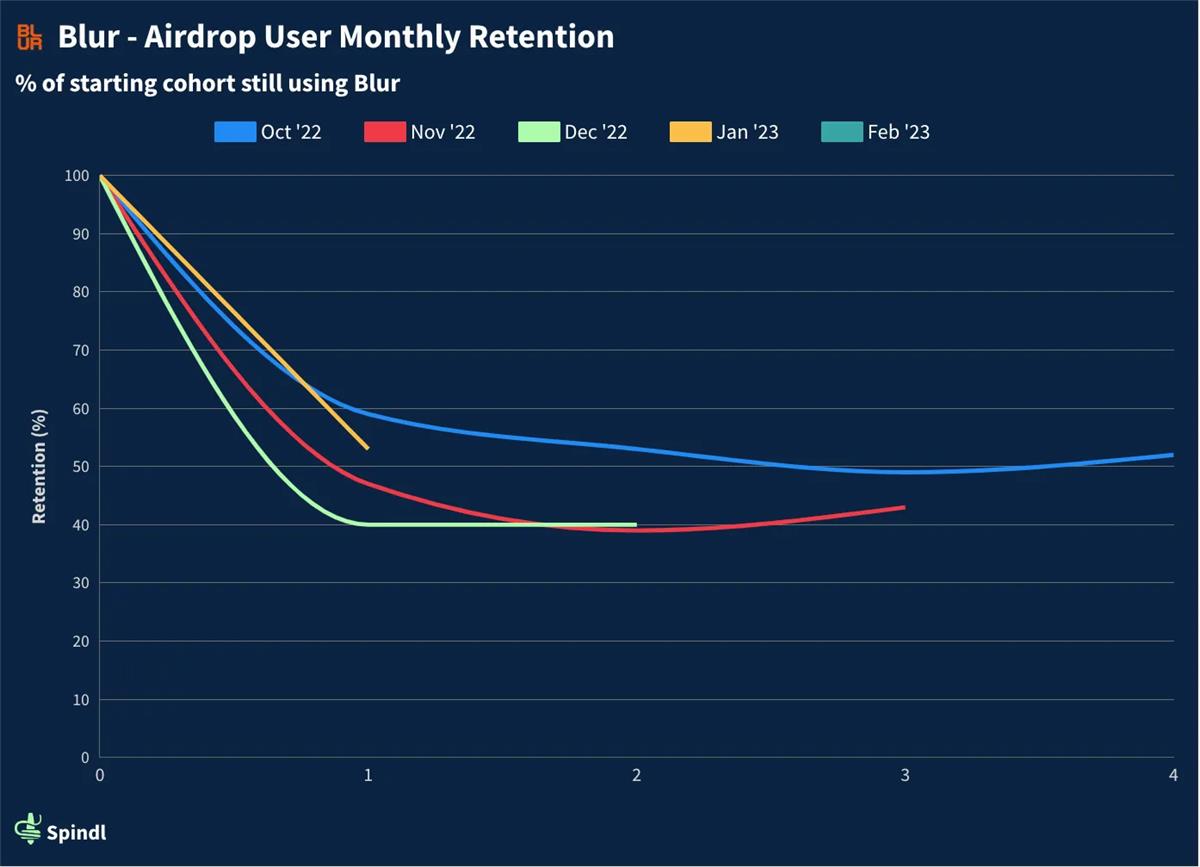

Let’s look at Blur again. Here is monthly retention data for non-airdropped users:

Less than 20% retention after one month, dropping into single digits within two months. Pretty bad.

What happens when users receive an airdrop?

That’s much better, don’t you think?

Retention stays between 40–50% after one month and slowly increases over time—exactly opposite to the steady decline seen among non-airdropped users.

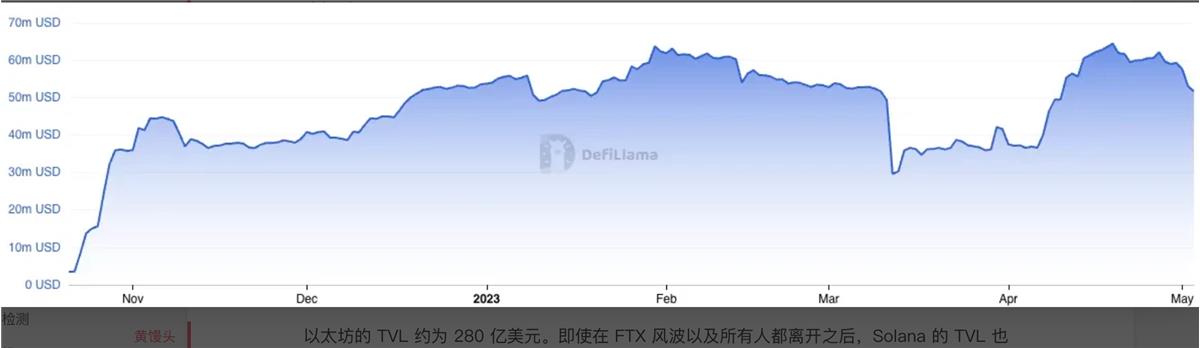

Now let’s compare this to Aptos. Aptos conducted a one-time airdrop in October 2022. Since launch, its total value locked (TVL) has looked like this:

Ethereum’s TVL is around $28 billion. Even after the FTX fallout and mass exodus, Solana still reached $270 million in TVL. So far, Aptos’ TVL stands at $50 million—not quite living up to expectations.

Therefore, to increase long-term engagement, simply spread out airdrops over an extended period.

I know what you’re thinking. Does a persistent airdrop mean you’re constantly paying users to stay? Yes—that’s exactly what you’re doing.

So, don’t make airdrops one-off events—make them recurring.

Anti-Sybil Detection

Sybil attacks occur when a single user or entity creates multiple fake accounts to farm airdrops. Preventing this sounds like a great solution in practice, but it’s extremely difficult to implement.

Most projects have already attempted anti-Sybil measures. The problem is that airdrop farmers adapt and innovate to bypass detection. Anti-Sybil efforts consume significant team time and resources, distracting from core development and reducing the chances of long-term protocol success.

Moreover, denying legitimate users access to airdrops due to flawed anti-Sybil algorithms leads to terrible PR. It may permanently alienate certain users (e.g., Paraswap).

Overall, projects are better off outsourcing anti-Sybil detection and lowering expectations. The goal of anti-Sybil systems shouldn’t be to eliminate all farmers—but to make farming costly enough to deter mass exploitation.

Finally, there’s reason for optimism: projects like Gitcoin Passport aim to solve on-chain identity challenges.

Don’t Airdrop

I mean, the best way to prevent manipulation is simply not to airdrop at all.

In reality, some protocols don’t truly need airdrops to succeed. Some don’t even need a token.

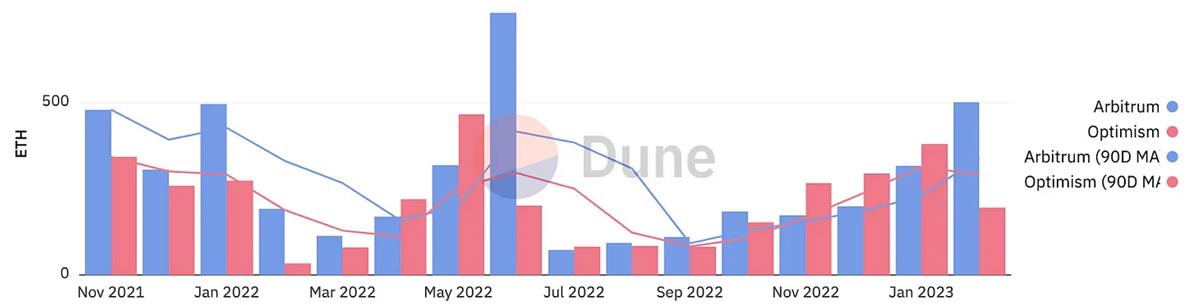

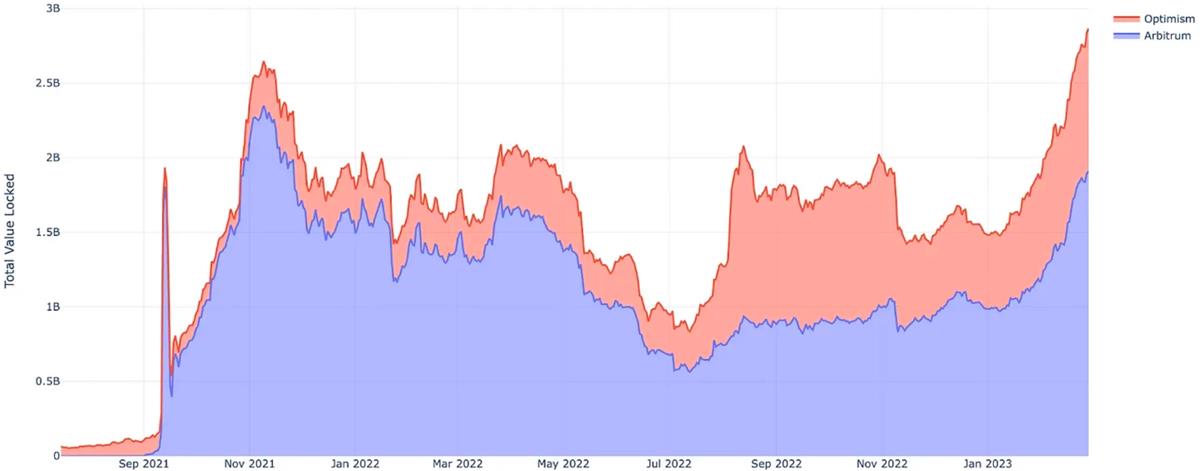

Take Arbitrum, for example. It’s easy to argue that it didn’t really need an airdrop. Even before launching its token, it consistently had more deployed smart contracts and higher TVL than its competitor Optimism.

Optimism only appeared to compete with Arbitrum during summer 2022—right after its airdrop and incentive program.

One of the biggest advantages of not having a token or airdrop is managing expectations: people assume you might launch one someday. As a result, they keep using your protocol, hoping to qualify for a potential future airdrop that never comes.

Conclusion

Airdrop farming, like trading and life itself, can be seen as a long game. In this game, participants adapt to changing “rules” to gain control. Airdrop farmers have already profited enormously and figured out how to manipulate traditional airdrop models for maximum gain.

As we’ve seen above, airdrops can benefit projects. But with the rise of Sybil attacks, most of those benefits are being eroded. If airdrops are to remain effective tools, projects must evolve.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News