Aptos (APT) Price Prediction: Could Rise to $89 in 2025

TechFlow Selected TechFlow Selected

Aptos (APT) Price Prediction: Could Rise to $89 in 2025

Aptos (APT) has performed exceptionally well recently, rising about fourfold in just half a month.

Aptos (APT) has recently performed exceptionally well, surging about fourfold within just half a month.

With nearly a 300% return in just two weeks, what could possibly be more astonishing?

As previously mentioned by Xiao Mifeng, we can try to estimate APT's potential peak during the 2025 bull market. Let’s run the numbers today.

❖Benchmarking against Solana❖

➤Comparison

Due to similarities in performance characteristics and positioning, Aptos is often compared with Solana—some even calling Aptos the successor to Solana (their logos even bear a striking resemblance).

Of course, Aptos’ team originated from the Libra project, so it cannot literally be considered Solana’s continuation.

However, both Aptos and Solana are high-performance blockchains supporting parallel processing, targeting web3 ecosystem development, and backed by substantial investments. Therefore, comparing them remains reasonable.

➤Solana (SOL) funding-to-market-cap multiplier

Let me compare how SOL grew from its fundraising amount to market capitalization:

According to Tianyancha data, Solana raised funds totaling approximately $415 million when conservatively aggregated and slightly rounded up.

Now let’s examine Solana’s market cap in 2021:

In the first half of 2021, Solana reached a peak market cap of $13.5 billion. At that time, it had not yet raised the full $314 million—the total funding was under $1 billion—making this a 135x multiple of its fundraising amount.

In the second half, Solana peaked at $75.66 billion, representing an 182x multiple of its total funds raised.

(We deliberately inflate the fundraising figure here to lower the calculated multiples, aiming for a conservative estimate.)

❖Market Cap Estimation❖

➤Diminishing growth rates

We shouldn’t directly apply Solana’s appreciation multiple to Aptos.

While markets still cycle between bull and bear phases, over time and as blockchain technology becomes more mainstream, the upside potential gradually shrinks.

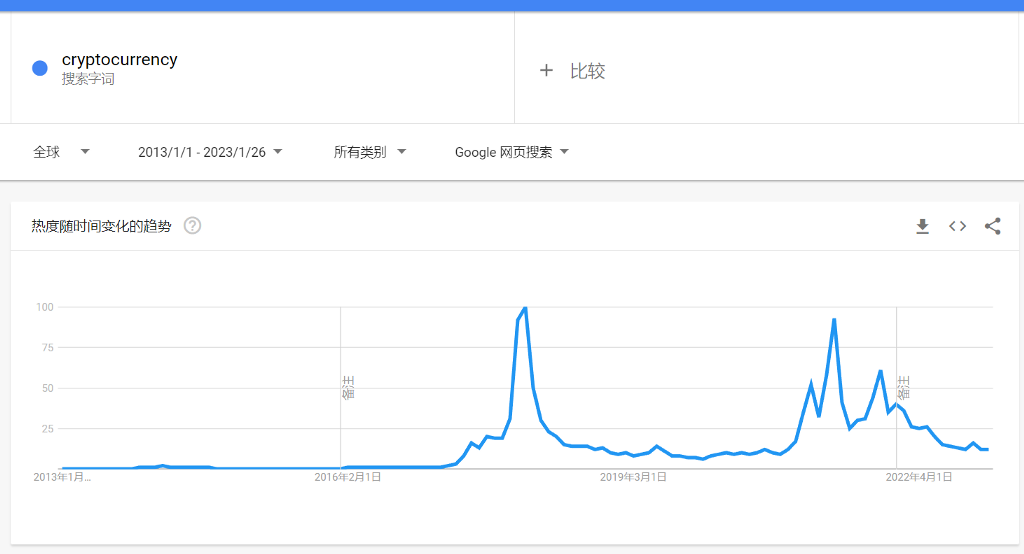

Google Trends clearly illustrates this trend:

Search interest for the term "cryptocurrency" shows 2018 as the year with the highest search volume, while 2021 saw a decline.

Upon reflection, this makes sense. As an experienced crypto user, you’d likely search for specific terms like Bitcoin, Litecoin, or Ethereum—you probably wouldn’t search “cryptocurrency.” Those who do search “cryptocurrency” are more likely newcomers, whose influx ultimately determines the market’s upward potential.

In 2018, “cryptocurrency” peaked at a Google Trends score of 100, dropping to 93 in 2021—a 7% decrease.

➤Multiplier adjustment

Therefore, I’ll reduce Solana’s 135x and 182x multipliers accordingly. Conservatively applying twice the 7% decline—i.e., a 14% reduction—the adjusted figures become 116x and 157x respectively.

Then, considering other unknown factors such as competition from Sui, I’ll be even more conservative and use 100x and 140x for calculations.

➤Market cap forecast

According to Tianyancha, Aptos has raised at least $350 million. We’ll exclude any unconfirmed amounts for a more conservative estimate, using exactly $350 million as the base.

If the peak occurs in the first half of 2025, APT’s market cap would reach 3.5 × 100 = $35 billion.

If the peak comes in the second half of 2025, APT’s market cap would reach 3.5 × 140 = $49 billion.

❖Price Forecast❖

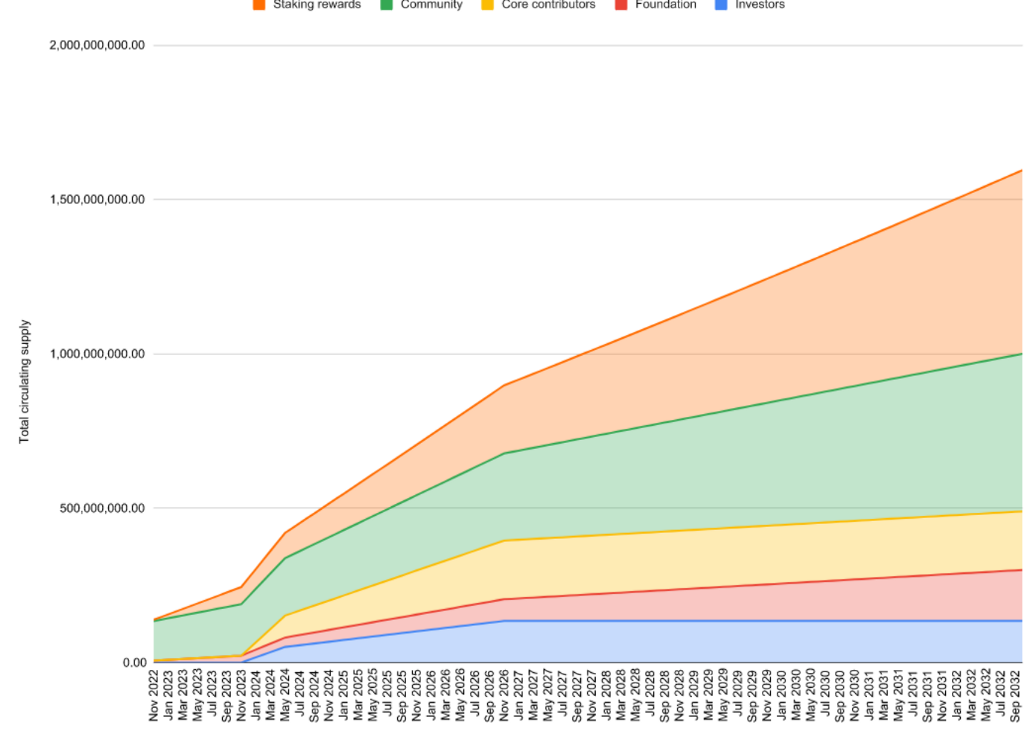

Finally, we must consider APT’s token release schedule.

Using this APT release chart, I’ve estimated the circulating supply visually.

Using Photoshop (by cropping the image and calculating proportions based on dimensions), I roughly estimate that by June 2025, the circulating supply of APT will be approximately 646 million tokens.

By November 2025, it will reach about 719 million tokens.

(Why June and November? For conservatism. Why not December? Historically, peaks tend to occur in November rather than December.)

➤Neutral estimate

-

If APT peaks in H1 2025, the price could reach 35 / 0.646 ≈ $54.

-

If APT peaks in H2 2025, the price could reach 49 / 0.719 ≈ $68.

➤Optimistic estimate

If we use Solana’s original multiples:

-

If APT peaks in H1 2025, the price might reach (3.5 × 135) / 646 ≈ $73.

-

If APT peaks in H2 2025, the price might reach (3.5 × 182) / 719 ≈ $89.

❖This article is purely speculative❖

Potential inaccuracies in the estimates include:

First, the estimation of declining growth rates in the crypto market lacks rigorous scientific basis;

Second, the impact of Sui is hard to quantify, especially since Sui hasn’t launched yet;

Third, unforeseen external factors.

However, the analysis also incorporates conservative assumptions:

First, Solana’s fundraising amount was inflated to reduce the market-cap-to-funding ratio;

Second, Aptos’ fundraising figure was reduced to lower the base for market cap calculations;

Third—and not explicitly stated earlier—while 2025 is likely to feature similarly accommodative U.S. dollar policies as in 2021, Solana raised funds during a loose monetary period (first half of 2021), whereas Aptos raised funds during a tightening cycle (March–September 2022).

Solana’s fundraising and surge occurred amid the same hyper-loose monetary environment. Aptos raised funds during a tightening phase but will grow during a future easing cycle.

Note: This article is for analytical purposes only and does not constitute investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News