Arbitrum Vs Optimism: Who Will Win the L2 Race?

TechFlow Selected TechFlow Selected

Arbitrum Vs Optimism: Who Will Win the L2 Race?

There are already many different choices for Ethereum layer-2 solutions, with Arbitrum and Optimism considered the two most competitive players in the market.

Author: Emperor Osmo

Compiled by: TechFlow

There are now many different options for Ethereum layer-2 solutions, with Arbitrum and Optimism widely regarded as the two most competitive players in the market. However, the issue is that crypto whales (such as Andrew Kang) have been purchasing millions of dollars worth of $ARB while largely avoiding $OP.Does this indicate that $ARB remains undervalued, prompting heavy accumulation by whales?

In this article, crypto analyst Emperor examines this question through key metrics such as TVL and contract deployments.

Following the announcement of the Arbitrum airdrop, we observed increased whale activity around $ARB, often involving purchases worth millions of dollars.

In contrast, $OP has not experienced similar activity. Generally speaking, whales only accumulate projects they perceive as undervalued—here’s why they’re favoring $ARB.

On March 16, $ARB announced its airdrop date as March 23. This marked Arbitrum’s most active day, sharply contrasting with Optimism’s relative quiet.

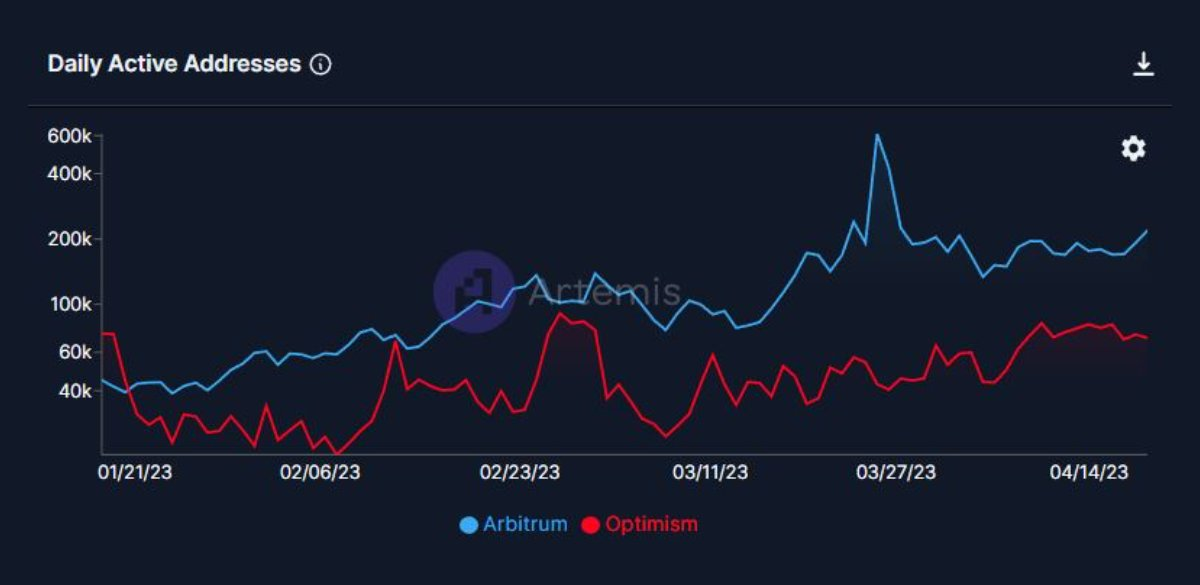

On the airdrop day, the number of active addresses on each chain was:

-

$OP: 42,000

-

$ARB: 611,700

Demonstrating strong momentum for Arbitrum.

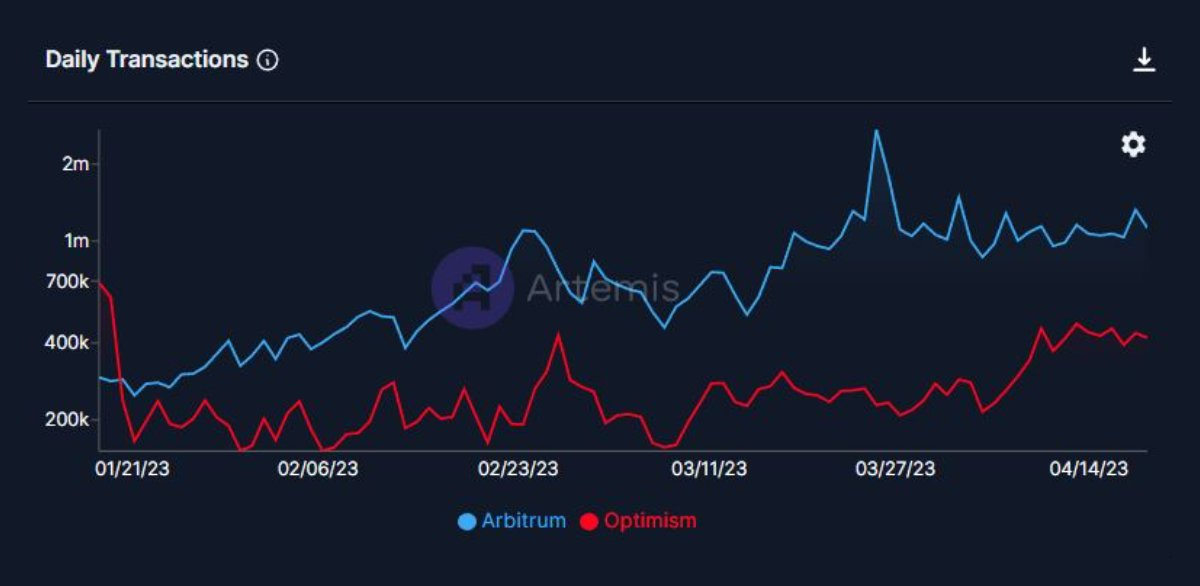

Daily transaction counts show a similar pattern. On airdrop day:

-

$OP transactions: 228,000

-

$ARB transactions: 2.7 million

It's worth noting that Optimism did see significant growth in transaction activity, narrowing the gap between the two chains.

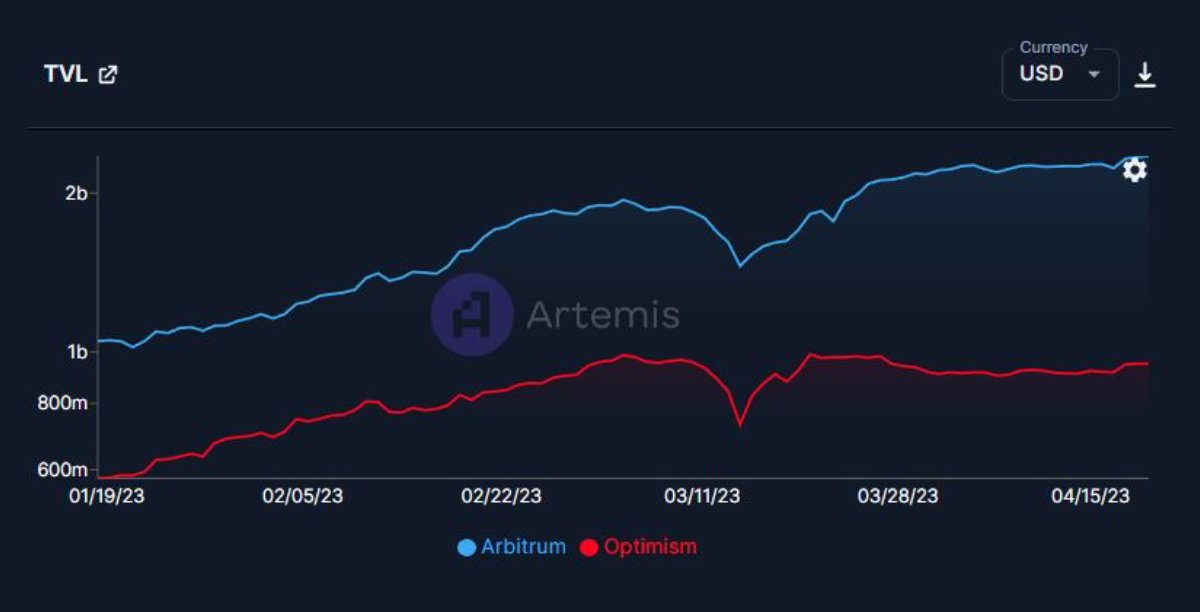

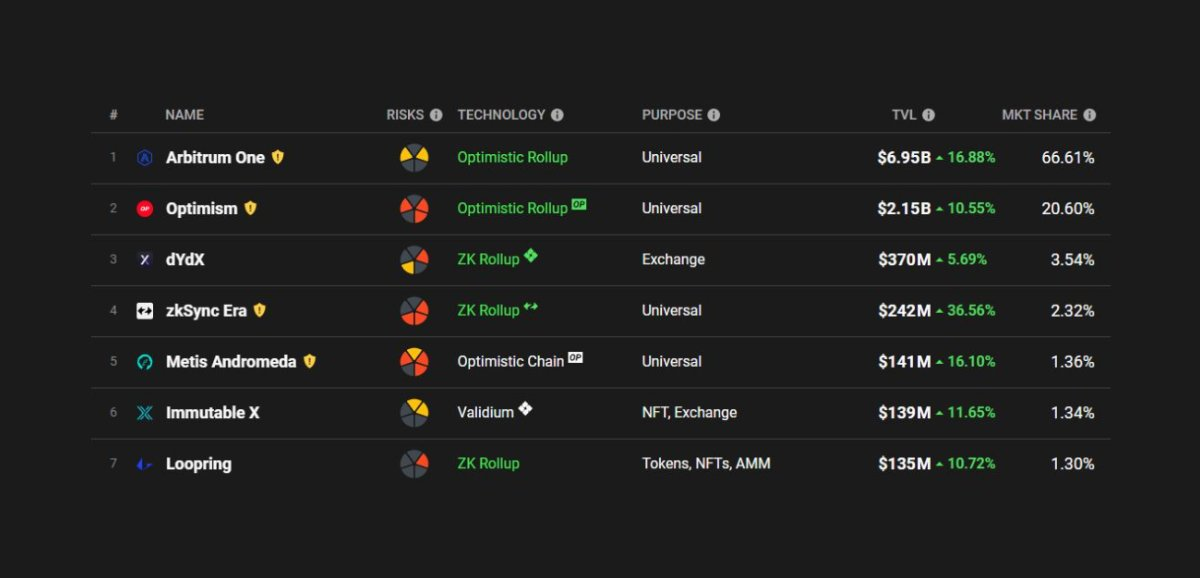

TVL growth had a major impact on the Arbitrum ecosystem. On airdrop day, we recorded the following TVL figures:

-

$OP: $976 million

-

$ARB: $2.1 billion

Since then, Arbitrum’s TVL has grown by 9%, while Optimism’s TVL has declined by 3%.

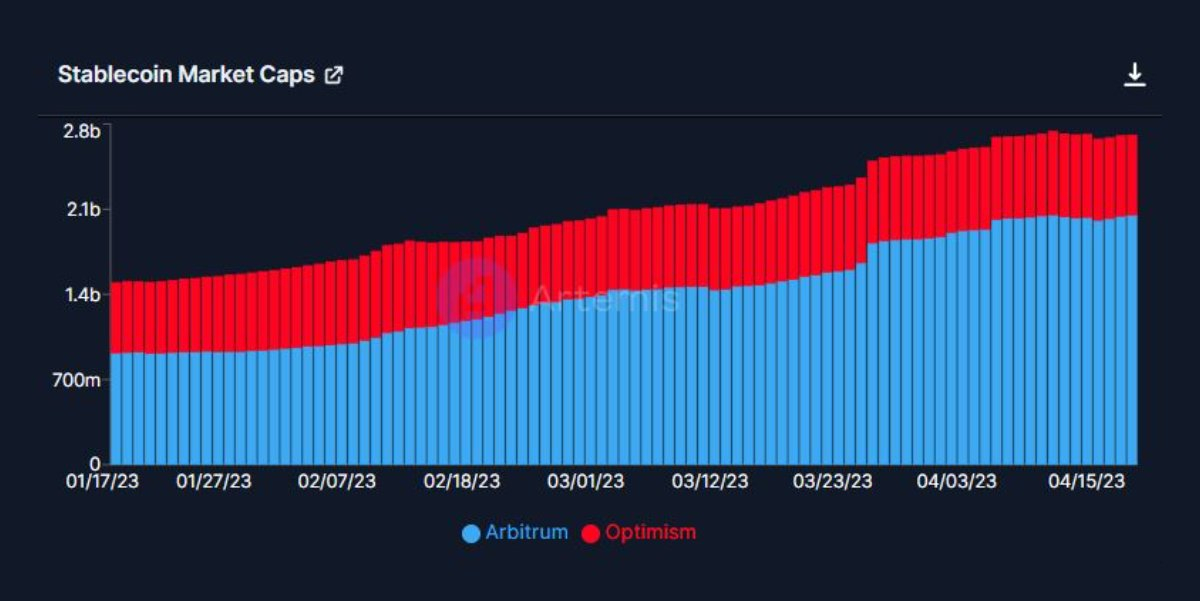

The difference becomes even more pronounced when examining stablecoin liquidity. On airdrop day, liquidity values were:

-

$OP: $693.7 million

-

$ARB: $1.7 billion

Arbitrum’s stablecoin liquidity has since grown by 27%, while Optimism’s stablecoin liquidity has declined by 6% year-to-date.

The following projects are clear beneficiaries of this shift:

- $RDNT

- $GMX

- $UNI

- $CVX

- $PENDLE

- $GRAIL

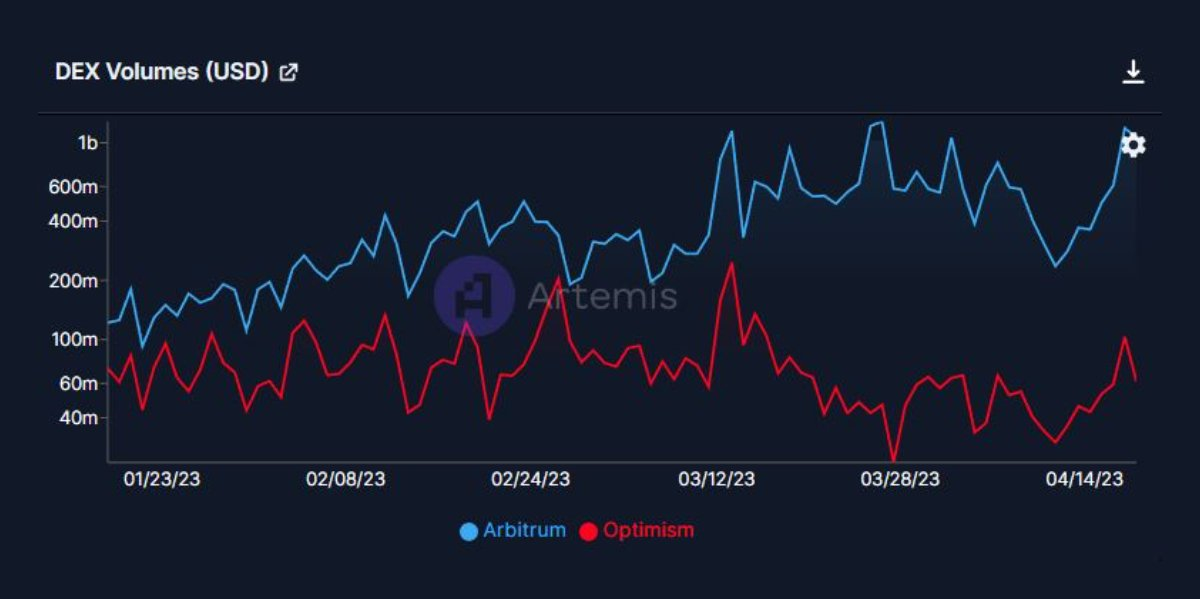

Of course, increased liquidity has led to a surge in the number of DEXs on Arbitrum, significantly boosting trading volume. During the airdrop period, DEX trading volume on $ARB nearly reached an all-time high of $1.4 billion.

Meanwhile, $OP’s trading volume was approximately $100 million.

Is Arbitrum overvalued?

In my view, when comparing their TVLs, it is actually Optimism that appears overvalued.

Currently, both $OP and $ARB have a market cap to TVL ratio of 0.9.

The recent surge in $ARB’s value reflects Arbitrum’s growing market capitalization over the past week.

Currently, Arbitrum holds the majority of the market share, and I don’t believe this liquidity will ultimately shift to Optimism. Total transactions per second (TPS) data is as follows:

- $ARB - 15.52

- $OP - 4.85

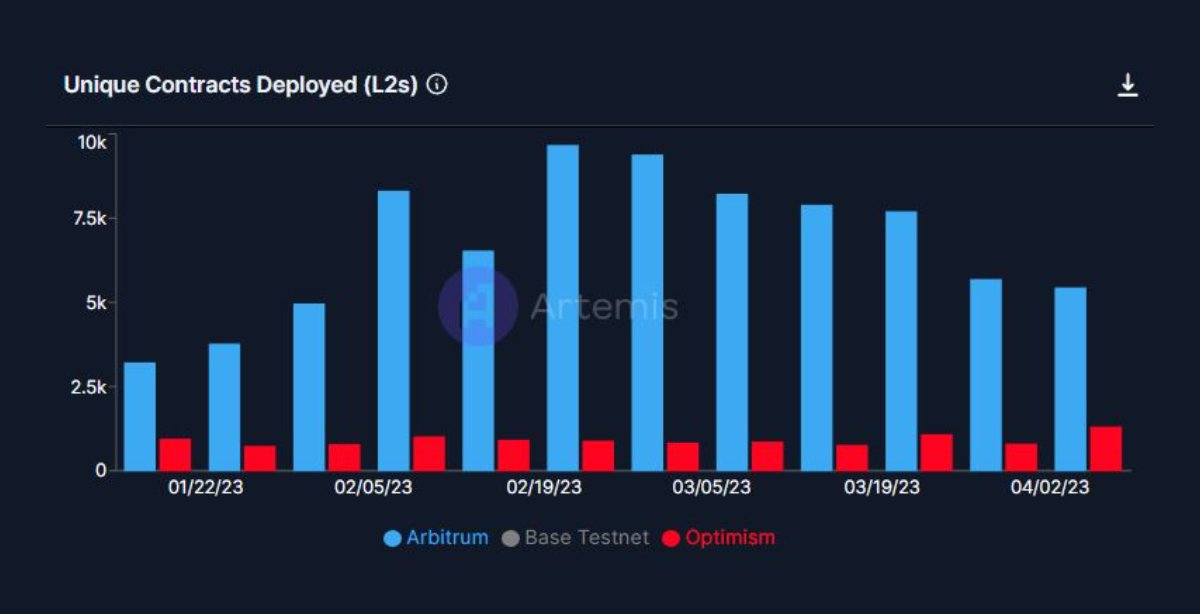

The final metric I’m monitoring is the number of on-chain contract deployments, which to me represents value creation.

On average, $ARB has deployed over 6,000 contracts, while $OP has deployed only about 1,000.

Yes, these two ecosystems offer different value propositions.

However, compared to Optimism, Arbitrum continues to hold greater significance in terms of innovation and technology—a value that has yet to be fully reflected by the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News