HT plunges, triggering mass liquidations and uproar, as Sun Yuchen pledges $100 million to boost liquidity

TechFlow Selected TechFlow Selected

HT plunges, triggering mass liquidations and uproar, as Sun Yuchen pledges $100 million to boost liquidity

As of March 13, over 90% of affected Huobi users have received compensation.

On March 10, affected by the collapse of Silicon Valley Bank (SVB) in the United States and earlier reports that Biden would propose changes to cryptocurrency transaction tax treatment to raise $24 billion, the crypto market declined across the board, with Bitcoin falling below $20,000 to a nearly two-month low.

Amid worsening macro conditions and frequent negative news, another sharp volatility hit the crypto investment market. According to Coinglass data on that day, total liquidations across the network reached $279 million on March 10, including $104 million in Bitcoin and $69.94 million in Ethereum. HT plunged to as low as 0.3138 USDT at 5 a.m. on March 10, triggering over $2.77 million in liquidations.

Suddenly, phrases like "What year is this? Such extreme price spikes," "Still the familiar taste of Sun cutting," and "Brother Sun dumps and abandons Huobi to flee" flooded social media, placing the recently restructured Huobi and Sun Yuchen—publicly claiming to be a member of Huobi’s Global Advisory Committee—back in the spotlight. However, whether this was merely market-driven volatility or yet another instance of Sun harvesting investors' losses requires factual analysis.

Sun's Tweets Fail to Convince; Huobi Data Reveals Truth

Shortly after HT’s crash and margin calls, Sun Yuchen quickly took to Twitter to explain: “Huobi Exchange operations are fully normal—wallets, operations, and backend systems are all functioning properly. The incident stemmed solely from leveraged positions held by some users in spot and futures HT tokens triggering a chain reaction of liquidations. All operations are proceeding steadily with no emergencies—this is purely market behavior and volatility.”

Users were unconvinced by this explanation and expressed strong dissatisfaction in the comments. Remarks such as “I was about to invest more in HT, but now I see Sun’s true colors,” “Sun is still Sun, and Huobi is no longer the Huobi it used to be,” and “Everything at Huobi is fine—except users lost their money” reflected deep disappointment in the once-reputable exchange, further cementing Sun’s image as someone who repeatedly cuts investors’ gains.

Yet rumors spread easily, often obscuring the full truth. Whether Huobi truly operates normally as Sun claims—that the spike and margin calls were simply due to market movements—requires objective data for verification. According to previous official Huobi and CoinMarketCap figures, Huobi’s average daily trading volume over the past month was $2,954,910,255.87 USDT, while its 24-hour trading volume on the day of the incident reached $3,310,761,162 USDT. Huobi’s official asset audit data shows that as of March 1, 2023, Huobi wallet assets totaled 193,870,908 HT, user assets amounted to 188,224,182 HT, and HT reserve ratio stood at 103%.

* Image sourced from Huobi official website

* Image sourced from Huobi official website

A rational analysis of currently available data indicates that Huobi’s platform trading metrics remain within normal ranges, and HT reserves are sufficient to ensure 100% user redemption. Data does not lie—the truth lies within. Sun’s statements on Twitter appear factually accurate. While users suffering significant losses may understandably vent frustration through criticism, the truth will eventually emerge clearly.

Although Huobi’s disclosed data clarifies the facts, the situation did not improve as optimistically as expected.

Sun’s $100M Move Sparks Rumors; Huobi’s Full Compensation Settles Matter

Just one hour after his initial clarification tweet, Sun Yuchen posted again: “Huobi will fully bear all losses incurred by leveraged margin calls caused by HT market fluctuations. We sincerely apologize for the market impact caused by a small number of users’ leveraged liquidations. To further enhance multi-coin liquidity on the Huobi platform, we will establish a $100 million liquidity fund to continuously improve mainstream coin and HT liquidity depth, strengthen leverage warnings and liquidity capacity. We will keep the community updated on developments regarding this event.”

Despite Sun’s swift apology and promise to cover all losses and allocate $100 million to secure HT liquidity and depth, public sentiment spread faster than anticipated. Not only users, but also prominent international institutions and media outlets such as Nansen and CoinDesk began scrutinizing Sun Yuchen’s on-chain transfer records related to Huobi.

Nansen tweeted that Justin Sun had withdrawn approximately $60 million worth of Ethereum-based stablecoins from Huobi within the past 24 hours (March 9). This immediately raised suspicions linking the withdrawal to HT’s sudden crash and liquidation. In response, Sun did not issue an immediate statement but instead acted decisively—injecting $100 million.

According to CoinDesk, at 11:27 a.m. Beijing time on March 10, a blockchain wallet address identified as belonging to Sun Yuchen transferred 100 million USDC to Huobi to prevent a cliff-like drop in HT and comprehensively enhance asset liquidity within the exchange.

Subsequently, Sun addressed the $60 million withdrawal, stating: “The funds withdrawn were my personal assets and the action was entirely individual, unrelated to the Huobi platform. Moreover, the withdrawal occurred before HT’s abnormal volatility and could neither predict nor influence the events of March 10. This explanation has since been verified by both Nansen and CoinDesk.”

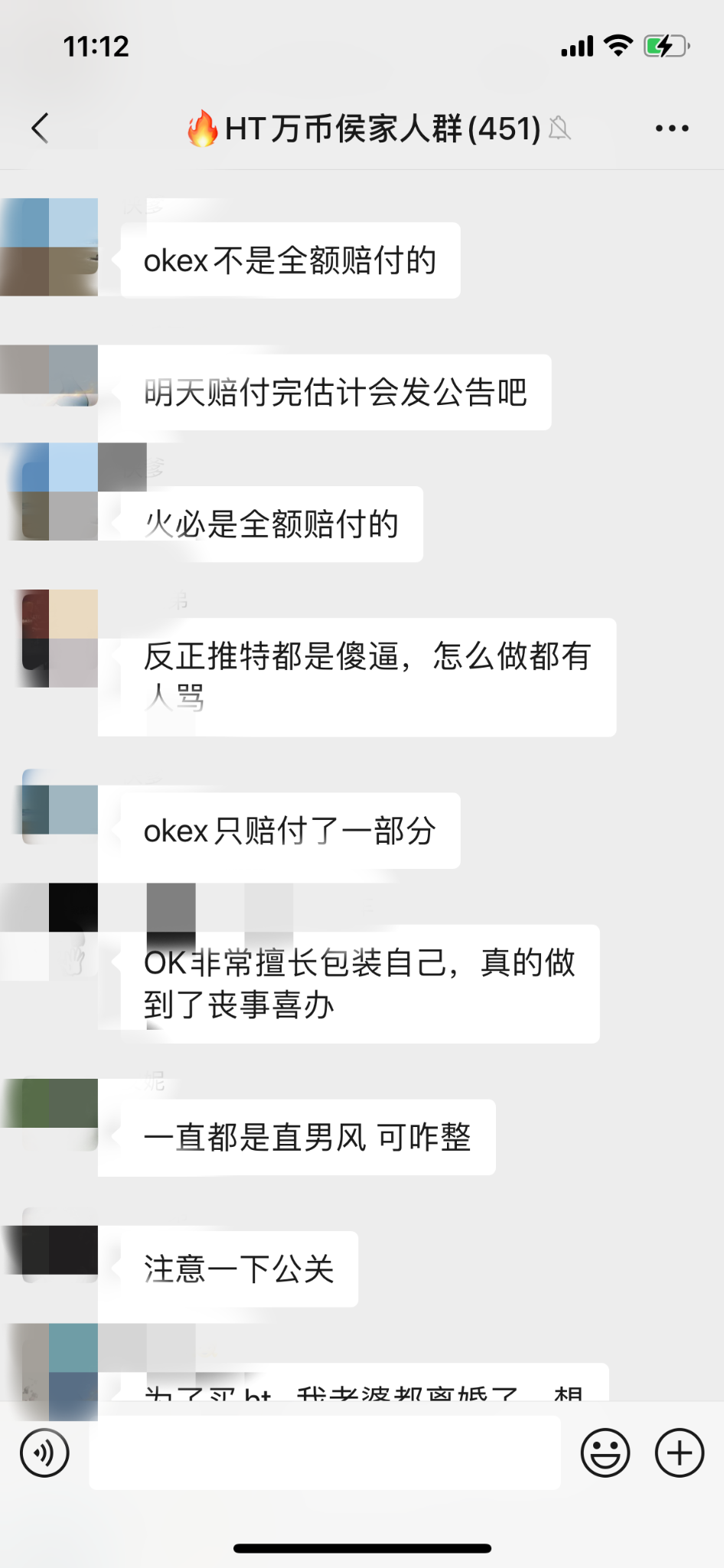

Two days after the incident, according to information from Huobi-related communities, Huobi had already completed compensation for over 90% of affected customers, with dedicated account managers resolving cases individually. Based on leaked chat screenshots, Huobi is offering full compensation for user losses—an approach far more sincere compared to how other exchanges have handled similar incidents.

Thus, the HT crash and margin call event was effectively settled by Huobi’s full compensation—a definitive resolution. Judging from data, facts, and compensation efforts, the incident was most likely triggered by severe market volatility driven by macroeconomic factors. Blaming Sun Yuchen and Huobi entirely due to prior negative perceptions appears unjustified. If Sun truly intended to cash out and flee, why would he inject $100 million into Huobi? And why would Huobi offer full compensation?

“To wear the crown, one must bear its weight.” It is hoped that under Sun Yuchen’s leadership, Huobi can withstand the pressure and deliver a compliant, secure, and transparent trading environment for users. May HT overcome its slump and bring fresh surprises to the market!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News