Protocol Revenue Data Analysis: Which Five DeFi Protocols Were the Most Profitable Over the Past Six Months?

TechFlow Selected TechFlow Selected

Protocol Revenue Data Analysis: Which Five DeFi Protocols Were the Most Profitable Over the Past Six Months?

Below is a list of the five most profitable DeFi protocols over the past six months, which have gained significant prominence in the decentralized finance industry.

Author: Poopman

Compiled by: TechFlow

Below is a list of the five most profitable DeFi protocols over the past six months, which have taken prominent positions in the decentralized finance industry. These protocols generate revenue through various fee models—such as lending, trading, and market making—as well as token incentives designed to encourage user participation and holding. Let’s take a closer look at the characteristics and earnings of these protocols.

Defining "Profitability"

DeFi protocols employ different fee structures, but overall, they generate profits in the following ways:

- Trading fees

- Lending fees

- Stability fees (e.g., Liquity Protocol)

Additionally, DeFi protocols distribute profits through three main channels:

- Protocol treasury

- Token holders

- LPs (Liquidity Providers)

Although the first two can be considered protocol revenue, LP profits are distinct. LP profits represent “supply-side revenue,” meaning the earnings are redistributed to those providing liquidity in the pools. For example, Uniswap generates over $700 million in fees annually, yet it is not highly profitable because the majority of this income is returned to LPs.

To assess a project's profitability, “revenue” serves as a better metric, representing the “pure income” after distributing fees to LPs. In short, revenue = fee income - token incentives. Now that we've defined what “profitability” means, let’s dive deeper.

Top Five Most Profitable DeFi Protocols

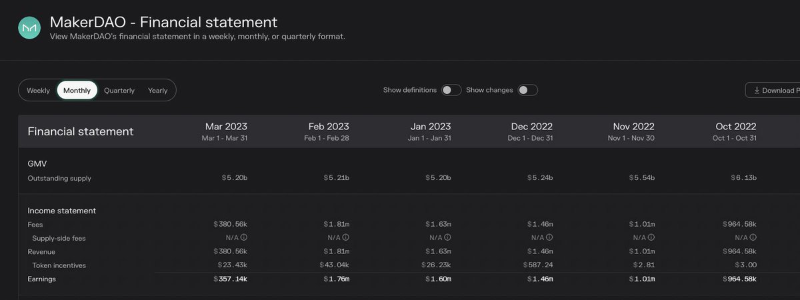

First Place: MakerDAO ~ $7.16 Million

MakerDAO allows users to deposit ETH/BTC/USDC/LINK as collateral and borrow its USD-pegged stablecoin, $DAI.

Fee Model

When users borrow via MakerDAO, they must pay a stability fee. These fees are used to buy back and subsequently burn $MKR tokens.

Over the past six months, MakerDAO generated $7.25 million in fee revenue. After deducting $93,200 in token incentives, MakerDAO’s net revenue totaled $7.16 million, securing the top spot on the earnings leaderboard.

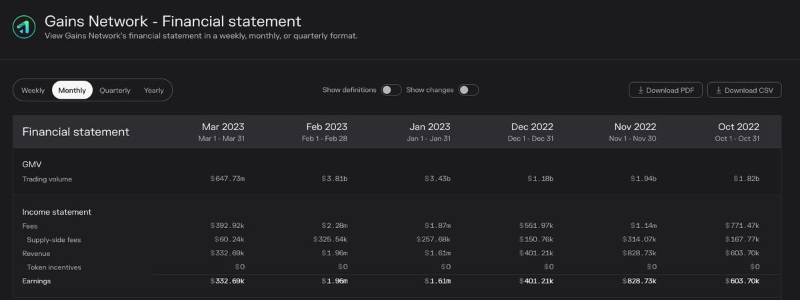

Second Place: Gains Network ~ $5.73 Million

Gains Network is a derivatives trading platform built on Arbitrum and Polygon, offering users cryptocurrency and forex trading options with leveraged positions.

Fee Model

Gains charges trading fees whenever users open, close, or modify trades. Additional fees include rollover fees, funding fees, and liquidation fees. Over the past six months, Gains earned $7 million in fees. However, $GNS offers no token incentives, so only $1.27 million was paid out as supply-side costs.

This resulted in approximately $5.73 million in net revenue for Gains Network, placing it second on the highest-revenue list.

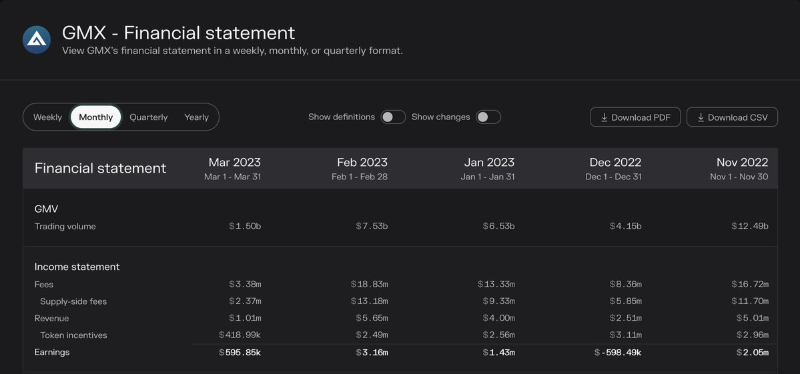

Third Place: GMX ~ $3.64 Million

GMX is a popular perpetual contracts trading platform that achieves low swap fees and zero price impact trades on Arbitrum. Users can trade spot and perpetual futures on GMX with leverage up to 50x.

Fee Model

GMX distributes fees generated from swaps and leveraged trading to $GMX stakers and $GLP liquidity providers. Over the past six months, GMX collected $67.54 million in fees, of which $47.27 million (70%) went to GLP holders as supply-side rewards. The remaining $20.26 million was treated as protocol revenue, but $16.6 million (82%) of that was allocated to token incentives.

Despite strong performance during the bear market, GMX’s net profit remains relatively modest due to high token incentive costs, landing it third place on the list of most profitable projects.

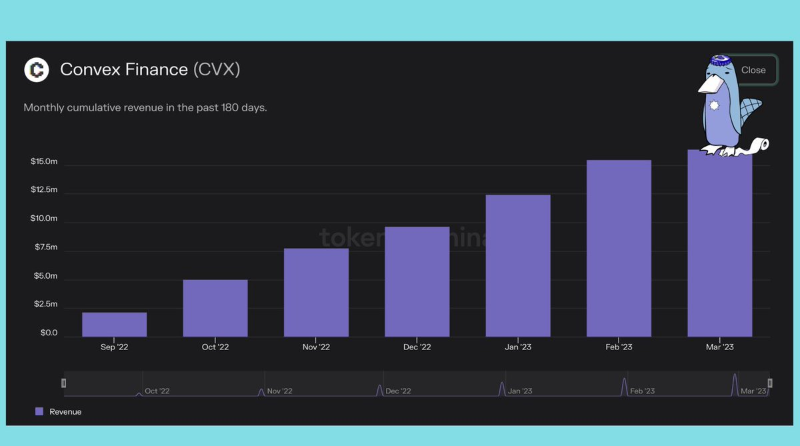

Fourth Place: Convex ~$1.57 Million

Convex is a yield amplifier built atop Curve Finance. By controlling over 50% of veCRV, Convex leverages its governance power to boost CRV rewards within Curve, thereby enhancing yields.

Fee Model

Convex earns revenue from 3CRV yield, $CRV emissions, and other liquidity mining rewards. Over the past six months, Convex generated $70.51 million in fees, with 80% ($56.31 million) distributed to Curve LP market makers.

Of the remaining $14.17 million in revenue, most was used for token incentives ($CVX), leaving only $1.57 million in net profit.

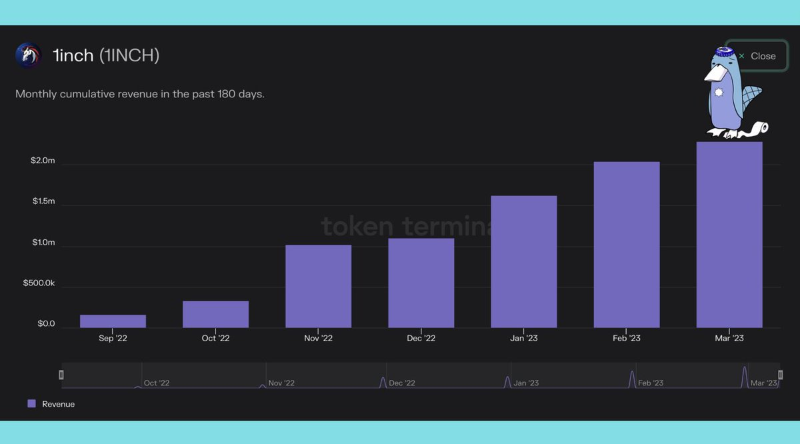

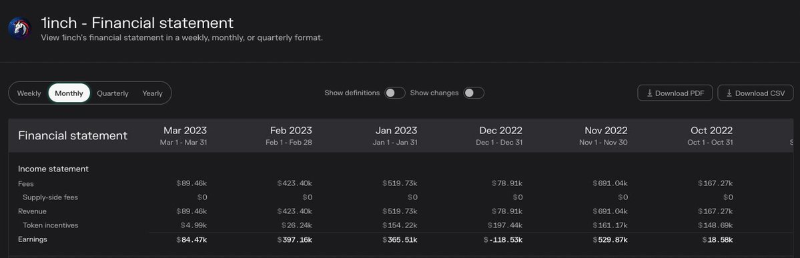

Fifth Place: 1inch ~ $1.27 Million

1inch is a non-custodial DEX aggregator operating on Ethereum and BSC.

Fee Model

Over the past six months, 1inch generated $1.97 million in revenue. After subtracting $693,000 in token incentives, 1inch achieved $1.27 million in net revenue, securing fifth place on the list.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News