How does Chainlink become the middleware and infrastructure layer between Web2 and Web3?

TechFlow Selected TechFlow Selected

How does Chainlink become the middleware and infrastructure layer between Web2 and Web3?

Chainlink is the only project building this functionality at scale alongside DECO, CCIP, VRF, FSS, and others.

Author: Minty

Compiled by: TechFlow

While many view Chainlink primarily as an oracle solution for price feeds, its vision extends far beyond that. This article will explore the value proposition of $LINK and how Chainlink is positioning itself as the foundational layer connecting Web 2 and Web 3.

While most projects discussed on Twitter focus on blockchain applications (NFTs, lending, Perps), few pay attention to the infrastructure required to manage these applications.

Chainlink is the only project building this functionality at scale, together with DECO, CCIP, VRF, FSS, and others.

CCIP

CCIP is a cross-chain protocol architecture enabling interoperability between different blockchains. It aims to become the foundational layer for Web 2 institutions entering Web 3, bridging them together.

Although CCIP shares similar use cases with products like LayerZero, it’s more than just a bridge with programmable features. Hybrid smart contracts will enable interactions between on-chain and off-chain smart contracts, along with cross-chain execution.

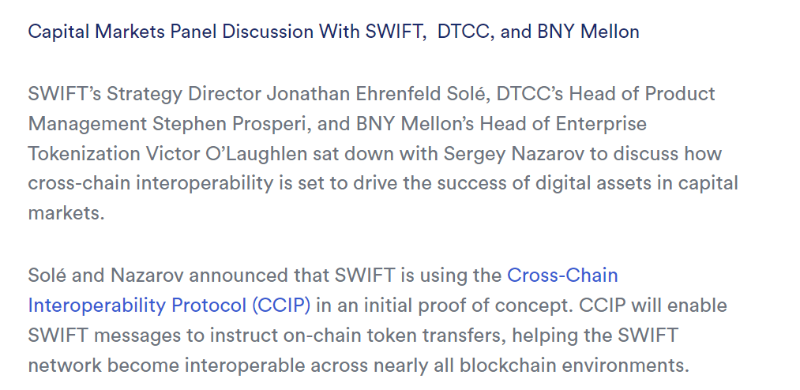

If successful, CCIP could solve fragmented liquidity and serve as a bridge between Web 2 and Web 3 networks through its enterprise solutions. We’ve already seen early signs in the team’s close collaborations with SWIFT and BNY Mellon.

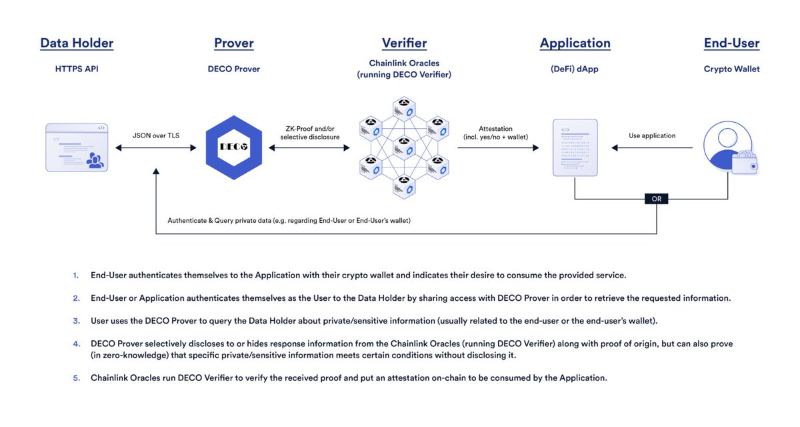

DECO

Why use Chainlink as a bridge to Web 2?

The answer is simple: DECO. Chainlink’s implementation of zero-knowledge proofs allows information to be shared on-chain without revealing sensitive data such as identity.

This is core infrastructure that Web 2 institutions require before considering blockchain for data storage and transfer. To my knowledge, Chainlink is the only team actively advancing DECO.

Relationships with Web 2

It's no secret that Chainlink has strong institutional relationships. In 2021, Chainlink hired former Google CEO Eric Schmidt as an advisor, significantly expanding its network among major institutions. Just look at the guest list of SmartCon 2022—you’ll see how well-connected Chainlink is. Representatives from Swift, BNY Mellon, DTCC, Microsoft, and other big names attended the event to discuss Chainlink and Web3.

Establishing connections with these large players in TradFi is key to getting them to collaborate. Chainlink is researching what services Web 2 needs to adopt Web 3—and building those solutions in advance.

Sustainable LINK Economics

Many seem to associate Chainlink 2.0 solely with the introduction of $LINK staking. However, Chainlink 2.0 represents a broader shift—guiding the ecosystem toward creating sustainable economies that can operate without external incentives.

Chainlink 2.0 achieves this through:

- Build and Scale;

- Staking;

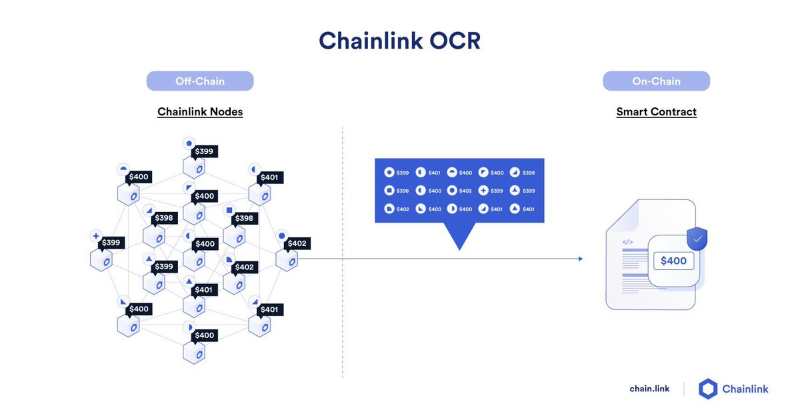

- OCR 2.0;

One concern I have about Chainlink is whether many institutions will actually purchase $LINK tokens to use the protocol. The launch of Build and Scale addresses this by aligning incentives between protocols and node operators.

Through Build, protocols can allocate part of their token supply to Chainlink in exchange for certain functionalities. This diversifies revenue sources for node operators while making Chainlink’s services more accessible.

Scale works similarly—projects can cover oracle operating costs in exchange for more advanced oracle solutions. This helps operators reduce expenses and improve profitability even without node incentives, which are a major source of selling pressure.

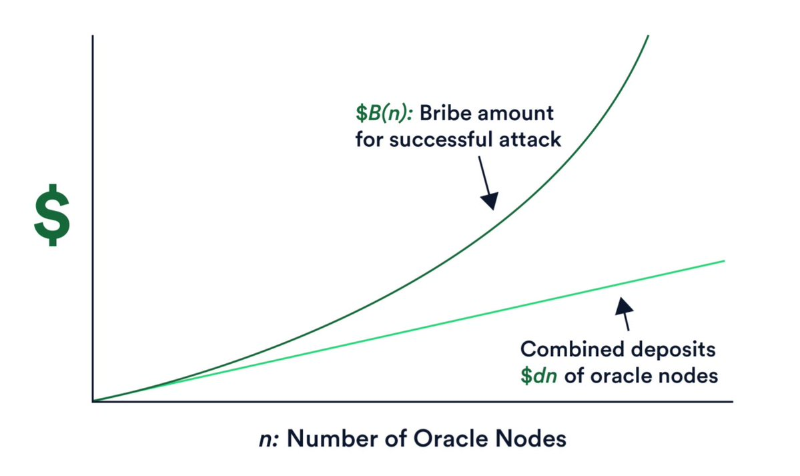

Chainlink staking has several unique features that make it an essential component of protocol security rather than just another inflationary mechanism.

Node operators with more $LINK staked will receive higher-quality jobs, incentivizing them to generate better returns for stakers. Super-Linear Staking also helps secure Chainlink with less capital.

OCR 2.0 aims to reduce gas costs by approximately 25% and enables customizable data transmission via oracles. This further supports node operator profitability while allowing more off-chain data to be brought on-chain.

OCR 2.0 can scale oracles beyond just price feeds. Imagine transmitting real-time data for real-world assets (RWA) or having transparent insurance quotes. By improving cost efficiency, it makes a blockchain-driven future possible.

These visions will take considerable time to realize, and $LINK holders may not see immediate results until node operators can function profitably without rewards. LINK 2.0 is designed to enhance node operator profitability, enabling truly sustainable economics.

Once node operators become profitable, Chainlink can begin accruing more value to the $LINK token. But this will take time.

Conclusion

Chainlink is building cutting-edge products to support Web 2 companies that want to use blockchain.

If Chainlink succeeds in achieving its vision of sustainable development, it could become not only critical infrastructure for DeFi but also for global applications.

It all starts with ensuring node operator profitability. Once that’s achieved, Chainlink can begin accumulating more value for the $LINK token.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News