Review of Current Popular Crypto Narratives and Trends: Arbitrum Ecosystem, AI, LSD, NFTFI...

TechFlow Selected TechFlow Selected

Review of Current Popular Crypto Narratives and Trends: Arbitrum Ecosystem, AI, LSD, NFTFI...

Summary of major narratives and catalysts for February/March.

Written by: Onchain Wizard

Compiled by: TechFlow

From a market perspective, risk is back—ETH has rallied roughly 22% from the "market bottom," and certain altcoins like BONE have seen even more significant year-to-date gains, even after recent pullbacks. Narratives and catalysts are returning, so here’s a summary of the key narratives and catalysts for February and early March.

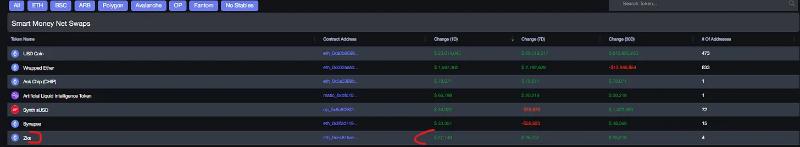

Despite recent ETH corrections and sharper sell-offs in some tokens, smart money (per Nansen) hasn't shown major shifts in stablecoin holdings, indicating that risk appetite clearly remains:

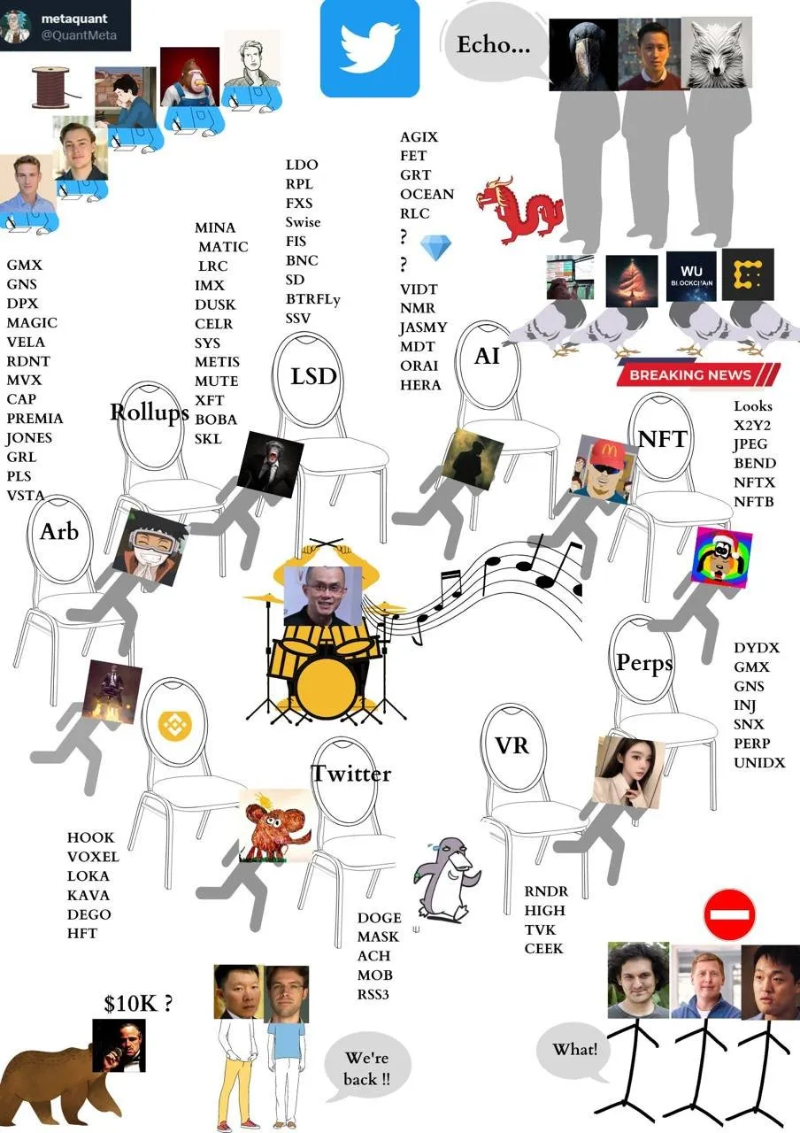

QuantMeta provides a quick visual summary covering markets such as Arbitrum tokens, AI tokens, LSD (renewed focus since CEX staking crackdown), and more:

Below is a quick roundup of all the exciting developments in crypto today, listed in no particular order (this is not financial advice—do your own research).

In late January, rDPX v2 documentation was released again, pushing the token up to $60. Since then, it has pulled back to $42, but with its testnet launch and full rollout expected in the coming months, another surge seems likely.

Perps remain active—GNS hit an ATH of $8 last week. GMX also reached its ATH this month (at $76). Other smaller perpetual DEXs have performed well too; newly launched VELA has surged 2.7x since late January and now has a $26 million market cap.Other new Perp DEXs are also performing strongly, including LVL, which is up 21x year-to-date!

GRAIL—this token has already reached its ATH of around 3000, over 10x up from launch. Every hot new product on Arbitrum appears on Camelot, and we’ll be watching GRAIL’s narrative as a potential Arbitrum blue-chip. We continue to expect GRAIL's ongoing narrative as an Arb blue-chip.

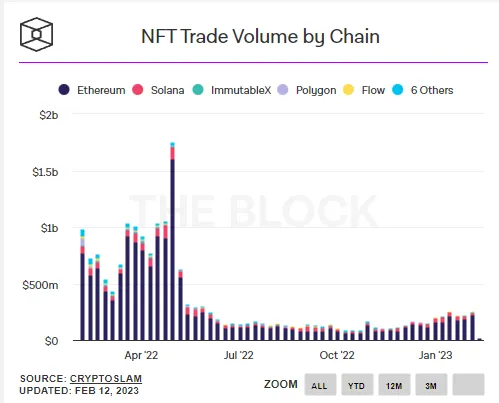

NFTs are making a comeback, with trading volume recovering from sub-$100M monthly lows last fall → exceeding $200M in February.

Further evidence of NFT resurgence: data shows over half of NFT mints are now profitable.

FCTR could become a future Arbitrum blue-chip token, with a public sale scheduled for February 20 (watch out for scams). Given the platform already has 1,700 beta registrants, if this adoption rate holds, the project should have significant upside potential.

ZK narrative: This appears to be the current shift in crypto, with MINA, DUSK, PIVX, and ROSE performing well. Other small-cap tokens that could rise include FIRO and ZKS.

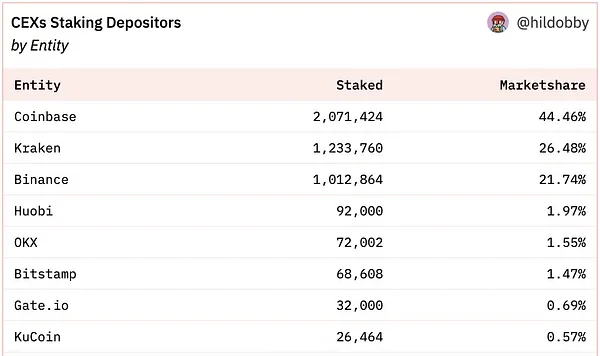

Liquid staking derivatives (LSD) are also a hot topic, reignited by the SEC’s charges against Kraken over CEX staking (LDO, RPX, FXS).Notably, FXS now ranks third in LSD market share via its FRAX Ether. If all U.S. CEX staking were sanctioned, up to 4.4 million ETH could be impacted (according to Hildobby).

AI is another popular narrative, though it's unclear how much more upside remains. With ChatGPT raising substantial funding and other practical AI projects gaining attention, the next sector rotation could come quickly. Tokens include: FET, ORAI, AGIX, VXV, NMR, OCEAN.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News