Is There No “Absolute Loser” in the Perpetual Futures Market? Demystifying Its “Non-Zero-Sum Game” Reality

TechFlow Selected TechFlow Selected

Is There No “Absolute Loser” in the Perpetual Futures Market? Demystifying Its “Non-Zero-Sum Game” Reality

Using Four Major Platforms as a Mirror: Moving Beyond the “Winner-Takes-All” Myth to Understand the True Logic of Winning and Losing

Author: tradinghoe

Translated by: Saoirse, Foresight News

Trading perpetual contracts is not a team sport that requires you to “pick a side.”

Yet, spend just five minutes browsing crypto Twitter (CT), and you’ll reach the opposite conclusion. This “extremist mindset” has infected most traders, eroding their competitive edge—the very edge they could preserve through curiosity.

If you post about trying a new decentralized perpetual exchange (Perp DEX), the replies are often steeped in extremism—not curiosity or constructive discussion. Ironically, those under attack are usually just seeking better alternatives to improve their trading strategies; yet, to extremists, “exploration” equals “betrayal.”

The Real Winners and Losers

In the perpetual contract market landscape, there are no “winners” and “losers” as imagined by extremists. Multiple platforms can coexist profitably because they serve distinct needs—sometimes catering to different types of traders, sometimes fulfilling different needs for the same trader across varying scenarios.

Yet, among traders, a genuine distinction between “winners” and “losers” does exist—not based on which platform they use, but whether they prioritize “outcome optimization.”

Market Landscape: “Specialized Contributors,” Not “Rivals”

To understand the perpetual contract market, one must first discard the “winner-takes-all” mindset. These platforms aren’t locked in a life-or-death battle; rather, they operate through “specialized division of labor” within their respective domains.

Hyperliquid

Hyperliquid is a decentralized exchange built atop its proprietary Layer-1 blockchain, HyperEVM—a chain purpose-built for high performance and scalability. By adopting a “fully on-chain order book model,” Hyperliquid overcomes the inherent limitations of automated market makers (AMMs) and off-chain matching engines.

Source: Hyper Foundation

- HyperBFT Consensus Mechanism: Hyperliquid employs a custom consensus algorithm, HyperBFT, derived from HotStuff and related technologies. Both the algorithm and underlying network architecture have been optimized from the ground up to meet the unique demands of a Layer-1 blockchain—capable of processing up to 200,000 orders per second with ~0.2-second latency.

- Dual-Chain Architecture: Hyperliquid consists of two core components—HyperCore and HyperEVM:

- HyperCore: The native execution layer responsible for managing the core functions of the trading platform—an ultra-efficient “engine” supporting deep order books and requisite liquidity.

- HyperEVM: An Ethereum Virtual Machine (EVM)-compatible layer where developers can deploy smart contracts and build decentralized applications (dApps), while natively accessing Hyperliquid’s liquidity and performance advantages.

A key architectural advantage lies in the “state consistency” between HyperCore and HyperEVM: no cross-chain bridges, no risk of data inconsistency, and zero latency. Applications built on HyperEVM can read/write HyperCore’s deep liquidity in real time.

HyperEVM Ecosystem

The HyperEVM ecosystem has attracted a cohort of core protocols spanning lending, derivatives, yield aggregation, and infrastructure.

Within this ecosystem, flagship protocols—including HypurrFi, Felix, Harmonix, Kinetiq, HyperBeat, HyperLend, and Project X—jointly form the “pillars” enabling cross-chain capital flow.

Understanding HyperEVM begins at the “capital entry point”:

HyperEVM Ecosystem Details:

https://hyperliquid-co.gitbook.io/wiki/ecosystem/projects/hyperevm

- Protocols like HypurrFi and Felix construct debt infrastructure via lending markets, synthetic dollar instruments (USDXL, feUSD), and cash-flow products.

- Kinetiq converts staked HYPE tokens into yield-bearing liquidity tokens (kHYPE), preserving staking rewards while enabling DeFi composability. Additionally, it supports permissionless HIP-3 exchange deployment via crowd-sourced validator staking.

- Harmonix transforms idle capital into “yield-generating liquidity” using automated delta-neutral strategies and validator staking screening—delivering 8%–15% APY on stablecoins.

- Project X is an AMM-based decentralized exchange supporting cross-chain aggregation, enabling zero-fee trading across EVM-compatible chains, sub-50ms confirmation times, and simplified liquidity provision UX.

Fee Structure

Perpetual contract fees follow a tiered model based on users’ trading volume over the prior 14 days. Taker and maker fees decrease proportionally depending on user category and total volume.

Perpetual and spot trading use separate fee schedules—but volumes are aggregated to determine the applicable tier, with spot volume weighted twice: (14-day weighted volume) = (14-day perpetual volume) + 2 × (14-day spot volume).

Source: https://hyperliquid.gitbook.io/hyperliquid-docs/trading/fees

All asset types—including perpetuals, HIP-3 perpetuals, and spot—share the same fee tier per user.

Hyperliquid Vault

The Hyperliquid Vault is a feature allowing users to “follow and copy trade” to earn returns, divided into two categories: protocol vaults and user vaults.

- Protocol Vaults (e.g., Hyperliquidity Provider, or HLP): Operated directly by the platform, earning revenue via market making and liquidations—and distributing profits (and losses) to all participants. Any user may deposit USDC to share in the vault’s P&L.

- User Vaults: Managed by “vault managers.” Users become managers by depositing at least $100 USDC and staking 5% of the vault’s total value as their own collateral. Managers execute trades on behalf of the vault and receive 10% of the profits generated.

Example: If you deposit $100 USDC into a vault holding $900 USDC, your share is 10%. If the vault grows to $2,000 USDC, you may withdraw $190—i.e., $200 (your 10% share) minus $10 (the manager’s 10% cut).

Hyperliquid does not run a designated market maker (DMM) program, offers no special rebates or fee discounts, and grants no latency advantages—all users may participate in market making equally.

Source: https://app.hyperliquid.xyz/vaults

Team

Hyperliquid was developed by Hyperliquid Labs, founded by Jeff Yan and lliensinc—two Harvard alumni who jointly lead the Hyperliquid team.

Other team members hail from elite institutions including Caltech and MIT, and previously worked at Airtable, Citadel, Hudson River Trading, and Nuro.

Jeff Yan led high-frequency trading system development at Hudson River Trading before founding Chameleon Trading, a crypto market-making firm. lliensinc brings deep expertise in blockchain technology.

Moreover, Hyperliquid Labs operates on a self-funded basis—raising no external capital—enabling the team to focus solely on building core product without external pressure.

Tokenomics

Hyperliquid’s native token is HYPE—the ecosystem’s central utility token—with a fixed supply of 1 billion tokens. The exchange distributed 310 million HYPE (31% of total supply) via airdrop to 94,000 users.

Core uses of HYPE include governance rights (token holders vote on platform upgrades) and staking rewards (~2.37% APY).

Token allocation breakdown:

- 38.888% (388.88 million tokens): Reserved for future issuance and community incentives

- 31%: Genesis distribution

- 23.8%: Core contributors (locked until 2027–2028)

- 6%: Hyper Foundation budget

- 0.3%: Community grants

- 0.012%: HIP-2 distribution

HIPs: Hyperliquid Improvement Proposals

Governance in the Hyperliquid ecosystem is driven by the native HYPE token.

Token holders participate in platform decision-making by casting on-chain votes on “Hyperliquid Improvement Proposals (HIPs).” Any qualified participant may submit a HIP proposal; voting weight is proportional to staked HYPE holdings. Once sufficient support is reached, the core team implements the proposal.

HIP-3: Developer-Deployed Perpetuals

Hyperliquid’s protocol enables “permissionless developer-deployed perpetuals”—a critical milestone toward fully decentralized perpetual listing.

Specifically, HIP-3 allows any user staking 1 million HYPE tokens to create new perpetual markets on the Hyperliquid blockchain (not the Hyperliquid DEX itself).

If a perpetual market exhibits malicious behavior or poor operations, HIP-3 enables slashing of the deployer’s staked HYPE as punishment.

Tradexyz

Tradexyz is a decentralized, non-custodial perpetual contract platform built on Hyperliquid’s HIP-3 infrastructure. Users can trade cryptocurrencies, stocks, indices, forex, and commodities 24/7 using leveraged perpetuals—without depositing funds with centralized entities.

Source: DefiLlama

XYZ is the first project deployed on Hyperliquid via HIP-3, supporting XYZ perpetual trading.

XYZ perpetuals track traditional (non-crypto) asset classes, settled in cash like all perpetuals, and maintain price alignment with underlying assets via funding rates. All Hyperliquid perpetual mechanics—including margin management, leverage adjustment, margin modes, and order types—apply to XYZ perpetuals.

The XYZ100 Index Perpetual is XYZ’s inaugural perpetual product, tracking a “float-adjusted market-cap-weighted index” of 100 large non-financial U.S.-listed companies. Like other Hyperliquid perpetuals, its funding rate is calculated using oracle prices, while mark price is used for margin calculation, liquidation, take-profit/stop-loss triggers, and unrealized P&L computation.

Differences Between HIP-3, HIP-1, and HIP-2

HIP-1 and HIP-2 were early governance proposals focused on spot trading, whereas HIP-3 centers on perpetuals:

- HIP-1: Introduced token listing standards and a governance-driven process for spot listings—allowing communities to create new tokens on Hyperliquid and bid for spot listing eligibility via HYPE staking.

- HIP-2: Added a native liquidity engine to automatically inject liquidity into order books, ensuring deep liquidity on day one for newly listed tokens.

Developer Code

Developer Code is a unique identifier enabling any developer to connect their frontend to Hyperliquid’s backend. Every transaction executed via this identifier routes directly to Hyperliquid’s order book—and automatically pays the developer a share of the trading fee. Taker fee rebates cap at 0.1% for perpetuals and 1% for spot.

Source: OAK Research

In practice, any trading bot, mobile app, or wallet can integrate Hyperliquid as its backend infrastructure to offer crypto trading services—and earn fee rebates.

Adoption & Key Metrics

The Hyperliquid team launched Developer Code in October 2024; adoption surged rapidly over the following months.

The chart below compares revenue generated by protocols using Developer Code (top 20 highlighted):

Source: hypeburn.fun/builders

But Hyperliquid’s true success stems not merely from product quality or crypto’s largest-ever airdrop—it lies in having built “the deepest liquidity pool in the market.”

Liquidity is finance’s “only truth.” Yet while DeFi was founded on “open access,” that very openness has spawned countless blockchains and apps fiercely competing to attract and retain liquidity.

DeFi’s history is essentially a “repeating cycle”: protocols launch, attract liquidity via incentives or airdrops, and lose users the moment a superior alternative emerges. In this cycle, liquidity remains a zero-sum game.

Hyperliquid’s infrastructure, however, possesses the rare ability to “retain liquidity.”

Source: https://defillama.com/pro/rpzjq3mf5e0w40u

Hyperliquid stands firm thanks to “depth of liquidity,” “distinctive technical architecture,” and “market diversity.” It delivers deep order books across major trading pairs and dozens of perpetual markets—valuable for traders managing diversified portfolios or large positions. Users needn’t fragment capital across multiple platforms to trade diverse tokens.

Liquidity depth comparison for a $500,000 BTC position (measured by slippage)

Lighter

Lighter is a decentralized exchange built on a custom Ethereum zero-knowledge rollup (ZK-Rollup).

Lighter employs a custom ZK circuit to generate cryptographic proofs for all operations—including order matching and liquidations—with final settlement occurring on Ethereum. This architecture achieves tens of thousands of orders per second at millisecond-level latency—while guaranteeing every trade’s fairness is verifiable on-chain.

Both Hyperliquid and Lighter achieve “verifiable trade execution”—but via fundamentally different architectures.

Lighter Core Architecture Diagram

Lighter Core

Lighter Core comprises a set of coordinated components, operating as follows:

- Users submit signed transactions: Orders, cancellations, liquidations—all require user signatures to prevent forgery and ensure deterministic outcomes (same input → same output).

- Transactions enter the system via API servers (top of architecture diagram):

- Sequencer & Soft Finality: At the system’s heart sits the sequencer, ordering transactions on a strict FIFO basis—and delivering “soft finality” to users via API, replicating the smooth experience of centralized exchanges (CEXs).

- Witness Generator & Prover: The “core technical layer”—sequencer outputs feed into the witness generator, converting data into circuit-compatible inputs; then Lighter’s prover—custom-designed for exchange workloads—generates hundreds of thousands of execution proofs in parallel.

- Multi-layer Aggregation: To reduce Ethereum gas costs, Lighter employs a multi-layer aggregation engine compressing thousands of individual proofs into a single “batch proof,” verified once on Ethereum.

Escape Hatch

This feature defines “true asset ownership”: In extreme cases—such as sequencer compromise or refusal to process user withdrawals—Lighter Core triggers “escape hatch mode.”

The protocol permits users to submit “priority requests” directly on Ethereum; if the sequencer fails to process such a request within a predefined timeframe, the smart contract freezes the entire exchange. Users may then reconstruct their account state using previously published compressed data blocks on Ethereum—and withdraw all assets directly on-chain, independent of Lighter’s team or off-chain coordination.

Custom Arithmetic Circuits

A major challenge facing current Layer-2 scaling solutions is “technical debt”—arising from the need to emulate the full Ethereum Virtual Machine (EVM), retaining numerous redundant opcodes irrelevant to financial use cases.

Lighter solves this by “building custom arithmetic circuits from scratch”:

- These circuits are designed exclusively for exchange logic—covering only core operations: order matching, balance updates, and liquidations.

- Technical benchmarks show that eliminating EVM overhead allows Lighter’s prover to outperform zkEVM competitors significantly in speed and resource efficiency—critical prerequisites for low-latency high-frequency trading (HFT).

Multi-layer Aggregation

Lighter offers retail users “zero transaction fees”—not via short-term subsidies, but through the “structural cost advantage” enabled by multi-layer aggregation.

Source: https://assets.lighter.xyz/whitepaper.pdf

The verification process resembles a “data compression pipeline”:

- Batching: The prover generates execution proofs in parallel for thousands of micro-transactions.

- Aggregation: The system collects hundreds of thousands of sub-proofs and compresses them into a single batch proof.

- Final Verification: Ethereum’s smart contract verifies only this one final proof.

The economic implication: The marginal cost of verifying one additional transaction approaches zero—giving Lighter a sustainable operational cost advantage.

Fee Structure

Currently, Lighter charges no taker or maker fees for standard accounts—enabling free trading across all markets. Advanced accounts incur taker and maker fees.

Lighter Vault

LLP is Lighter’s native market-making vault.

The platform maintains a “public liquidity pool,” where users contribute liquidity and earn yield based on trading activity. LLP tokens represent users’ shares in these pools—and can be reused across Ethereum DeFi ecosystems (e.g., Aave) to compound yields via composability.

While LLP’s primary role is ensuring deep order-book liquidity and tight spreads, it is not the sole market maker—other HFT firms may also run custom market-making algorithms.

Team

Vladimir Novakovski is Lighter’s founder and CEO, with backgrounds in quantitative trading at Citadel, machine learning at Quora, and engineering leadership at Addepar. He co-founded social platform Lunchclub and holds a Harvard degree.

Funding

Lighter closed a funding round on November 11, 2025, raising $68 million at a reported $1.5 billion valuation. Terms were undisclosed.

The round was co-led by Ribbit Capital and Founders Fund, with participation from Haun Ventures and online brokerage Robinhood.

Additionally, Lighter secured backing from top-tier VCs and angel investors—including Andreessen Horowitz (a16z), Coatue, Lightspeed, CRV, SVA, 8VC, and Abstract Ventures.

Tokenomics

Per official disclosures, Lighter’s native token LIT has a fixed supply of 1 billion tokens. Token allocation achieves a balanced 50/50 split between “internal stakeholders” and “external community,” as follows:

- 26%: Team

- 25%: Airdrops

- 25%: Ecosystem development

- 24%: Investors

Lighter established its market position through “extreme cost control.” Its zero-fee model may be the decisive factor determining profitability for high-volume traders.

For example, with $10 million in monthly trading volume, Lighter saves traders thousands of dollars per month versus platforms charging 0.03%–0.05% taker fees—amounting to tens of thousands annually. Lighter precisely identified that for some traders, “zero fees” outweighs “hundreds of trading markets” in appeal.

It optimized its product for these users—and those users clearly felt the value.

Fee comparison: Hyperliquid, Lighter, and other platforms

Extended

Extended is a decentralized perpetual exchange (Perp DEX) built by former Revolut (UK digital bank) engineers, with a distinctive product vision centered on “global unified margin.”

The platform aims to deliver a “full-category trading experience”—integrating perpetuals, spot trading, and embedded lending markets under one unified margin system.

Extended’s “global unified margin” network allows all applications within the network to access users’ available margin and share a common liquidity pool—enhancing overall liquidity depth. For users, all trading activity feeds into a “single global margin account” (shared across multiple applications), eliminating the need to manage isolated app-specific accounts—and enabling capital efficiency maximization via cross-dApp margin sharing.

Extended adopts a “hybrid centralized limit order book (CLOB)” architecture: Order processing, matching, position risk assessment, and sequencing occur off-chain, while trade validation and settlement happen on-chain via Starknet (an Ethereum Layer-2 network).

Extended’s hybrid architecture combines strengths of both centralized and decentralized components:

- On-chain settlement + validation + oracle pricing: Every trade settles on-chain; on-chain validation of trading logic prevents fraudulent or erroneous trades; and the platform sources mark prices from multiple independent oracles—reducing price manipulation risk.

- Off-chain trading infrastructure: Off-chain order matching and risk engines—paired with its unique settlement architecture—deliver exceptional throughput, end-to-end latency, and trade settlement speed—rivaling CEXs and surpassing other hybrid or decentralized exchanges (DEXs).

Extended Technical Architecture Diagram

Extended strives for “fully trustless operation,” achieved through two core principles:

Self-custody of funds: All assets reside in smart contracts on Starknet—Extended cannot access or control user assets under any circumstances.

On-chain validation of trading logic: Any trade violating on-chain rules—including improper liquidations—is rejected outright.

All Extended trades settle on Starknet. Though Starknet doesn’t require every transaction to rely on Ethereum Layer-1, it inherits Ethereum’s security by publishing zero-knowledge proofs to Ethereum every few hours—verifying state transitions on Starknet and ensuring system integrity and correctness.

Team

Extended was founded by the former Revolut team, with core members including:

- @rf_extended, CEO: Former Head of Crypto Operations at Revolut, previously at McKinsey.

- @dk_extended, CTO: Architect of four crypto exchanges—including Revolut’s recently launched crypto exchange.

- @spooky_x10, CBO (Chief Business Officer): Former Chief Engineer of Revolut Crypto and a core contributor to the Corda blockchain.

During their tenure at Revolut, the team witnessed millions of retail users enter crypto during the last bull market—but also observed a scarcity of high-quality products and generally poor DeFi experiences outside top-tier exchanges. This gap inspired them to build Extended.

Fee Structure

Extended designed a simple fee structure for its perpetual markets:

- Taker fee: 0.025% of nominal trade value

- Maker fee: 0.000% (i.e., zero fee for maker fills)

For users, this means “low cost for market orders,” while submitting “limit orders” (executed as makers) incurs no direct fees.

Developer Code

Extended supports “Developer Code”: Developers building alternative frontends for Extended can route trades via this code—and earn “developer fees.” These fees are 100% retained by developers and configurable per order.

Multiple external teams are already advancing Developer Code collaborations.

Wallet Trading Integration

Beyond expanding product scope, Extended integrates natively with wallets—enabling users to trade perpetuals directly within wallet interfaces (similar to current wallet swap functionality). This integration exposes perpetual trading to more retail users.

Extended Vault

This vault actively quotes across all Extended-listed markets using “automated market-making strategies.” Its quoting behavior is constrained by “global and per-market exposure controls,” “dynamic capital allocation,” and “spread management logic,” including:

Exposure Management:

- Global Exposure Cap: If vault leverage exceeds 0.2x, quoting is restricted to markets where the vault already holds exposure—and only in directions that reduce existing exposure. This acts as a “circuit breaker” against excessive leverage.

- Per-Market Exposure Limit: Each market imposes a “hard cap” on vault exposure—tighter for lower-liquidity assets to mitigate liquidity risk.

Quoting Behavior:

- Adaptive Spread Quoting: Spreads dynamically widen/narrow based on market conditions—tightening during stability and widening during volatility to mitigate adverse selection risk; spreads must remain within preset bounds to qualify for rewards.

- Exposure-Aware Adjustment: The vault asymmetrically adjusts quotes across directions based on existing exposure—reducing quote size and widening spreads for directions that would increase exposure.

Additionally, the vault earns “maker rebates” from market-making activity.

One of Extended’s key differentiators is its vault system—enabling traders to earn yield while trading perpetuals. Via “Extended Vault Shares (XVS),” depositors earn ~15% base APR—and additional yield tied to trading activity.

“Additional yield” depends on the user’s “trading tier”: Higher tiers yield higher APR bonuses. Extended’s trading tiers are percentile-based and linked to user trading activity:

- Tiers update weekly, aligned with points distribution—based on users’ “total trading points.”

- Passive vault depositors have no trading tier; their additional yield multiplier is 0.

- Active traders are segmented into five percentile tiers: Pawn (bottom 40%), Knight (next 30%), Rook (15%), Queen (10%), King (top 5%).

The platform allows XVS to serve as margin—with up to 90% of its value usable as collateral. This means traders can simultaneously “earn passive yield on capital” and “execute leveraged trades with that same capital.”

For traders holding substantial capital on perpetual platforms, this “dual-use collateral” (serving both as trading margin and yield-bearing deposits) delivers capital efficiency unavailable on traditional platforms.

Extended Vault Shares (XVS) Usage Guide

Variational

Variational is a peer-to-peer (P2P) trading protocol operating on a “fundamentally different model.” Unlike order-book-based DEXs, Variational uses a “request-for-quotation (RFQ) model.” It offers “zero trading fees” across 500+ markets—while redistributing earnings via “loss refunds” and “trading rebates.”

Variational Revenue Flow & Reward Mechanics

OMNI: Perpetual Futures Trading

The first live application on the Variational protocol is Omni—a perpetual trading platform for retail users. Omni enables narrow-spread, zero-fee trading across hundreds of markets—and provides loss refunds and other rewards.

The protocol employs “in-house market makers”—Omni Liquidity Providers (OLPs)—whose liquidity originates from CEXs, DEXs, DeFi protocols, and OTC markets. OLP is the first vault to run complex market-making strategies *and* act as the sole counterparty for all user trades: When users submit RFQs, OLP sources optimal prices from full-market liquidity. OLP profits from typical 4–6 basis-point spreads—and charges users zero fees.

Furthermore, because the RFQ model only requires OLP to provide liquidity “at trade initiation,” OLP can quote competitively across hundreds of trading pairs simultaneously.

Variational redistributes a significant portion of earnings to users via two mechanisms:

- Loss Refunds: Traders closing losing positions may receive immediate full loss refunds—refund probability ranges from 0% to 5%, scaled by “reward tier” (from unranked to “Grandmaster”). To date, over $2 million in refunds have been disbursed across 70,000+ trades—with single refunds exceeding $100,000. Funding comes from 10% of OLP spread revenue.

- Trading Rebates: Active traders earn rebates and spread discounts based on volume—the higher the volume, the greater the value returned to traders.

Variational covers 500+ markets—the broadest coverage among Perp DEXs. Through its “automated onboarding engine” (which aggregates liquidity from CEXs, DEXs, DeFi protocols, and OTC markets), new assets can list in hours. Additionally, Variational features a “customizable internal oracle” enabling rapid new-asset support—and plans to launch “exotic assets” and innovative markets in the future.

On Omni, the “on-chain transaction processor” absorbs users’ deposit/withdrawal gas fees—and pays gas when transferring funds from OLP to new settlement pools. This eliminates user friction in managing gas fees across trading operations.

For traders prioritizing “downside risk protection,” “access to exotic markets,” and “trading-activity-based yield redistribution,” Variational’s model uniquely fulfills those needs.

PRO: Institutional OTC Derivatives Trading

While Omni focuses on perpetual markets, Pro targets “institutional traders needing beyond-standard perpetuals.” Pro extends the RFQ model by enabling “multiple market makers to compete in real time for the same RFQ”—offering greater transparency and superior pricing than current Telegram-group negotiations.

Pro aims to “democratize and automate OTC derivatives trading”—transforming this “slow, opaque, high-risk market” into an “efficient, fair, on-chain infrastructure.”

Team

Variational was co-founded by Lucas Schuermann and Edward Yu. They met as engineering students and researchers at Columbia University—and founded hedge fund Qu Capital in 2017. In 2019, Qu Capital was acquired by Digital Currency Group (DCG); Lucas and Edward subsequently served as Engineering VP and Quantitative Trading VP, respectively, at Genesis Trading (DCG’s institutional crypto trading arm).

In 2021—after handling hundreds of billions in trading volume at Genesis (then one of crypto’s largest trading teams)—Lucas and Edward left to found proprietary trading firm Variational. The firm first raised $10 million, ran trading strategies successfully for years, and integrated with virtually all CEXs and DEXs. Then, they decided to build the “Variational Protocol” using Variational’s trading profits.

Lucas and Edward’s goal in developing the Variational Protocol was twofold: Return market-making profits to traders via Omni—and solve “institutional OTC pain points” they experienced firsthand via Pro, bringing OTC trading on-chain.

Variational’s engineering and quant teams comprise industry veterans active in crypto algorithmic trading since 2017—former employees of Google, Meta, Goldman Sachs, and GSR; core engineering staff hold 10+ years of software engineering or quant research experience.

Funding

Variational closed a funding round on June 4, 2025, raising $11.8 million.

The project received backing from leading industry institutions—including Bain Capital Crypto, Peak XV (formerly Sequoia India/Southeast Asia), Coinbase Ventures, Dragonfly, Hack VC, North Island Ventures, Caladan, Mirana Ventures, and Zoku Ventures.

Fee Structure

Omni charges no trading fees whatsoever.

Omni levies a flat $0.10 fee per deposit/withdrawal—to deter spam and cover gas costs.

OLP (Omni Liquidity Provider)

The Omni Liquidity Provider (OLP) is a “vertically integrated market maker”—acting as the sole counterparty for all trades on the Omni platform.

OLP comprises three core components: Vault, Market-Making Engine, and Risk Management System.

Vault: The vault is a smart contract storing OLP’s operational capital (USDC)—serving both as OLP’s margin source and the repository for OLP’s market-making revenue.

Market-Making Engine: OLP runs “complex market-making strategies” to generate “competitive quotes” for every Omni trade—and acts as the counterparty. OLP employs “proprietary algorithms” analyzing real-time data from CEXs and on-chain sources (e.g., fund flows, volatility) to determine fair prices; the engine’s core objective is “maintaining the narrowest possible spreads across all markets.”

The market-making engine powering OLP is the same core technology refined and deployed by Variational’s founders over the past seven years.

OLP as Sole Counterparty

On Omni, both OLP and users must meet “margin requirements” for each trade—posting collateral into a “settlement pool,” with liquidation triggered if collateral falls below thresholds.

A key design difference distinguishing Omni from other platforms is that “OLP is the sole counterparty for all trades”—delivering multiple advantages to traders:

- Zero Fees: Since Omni’s market making is fully internalized by OLP (no external market makers required), the platform needs no fee revenue.

- Loss Refunds: A portion of spread revenue flows back to traders via the loss refund mechanism.

- Market Diversity: OLP can launch new markets with only “reliable price sources,” “quoting strategies,” and “hedging mechanisms”—all internally built and maintained. This enables Omni’s current coverage of ~500 tradable markets—and future support for “real-world assets (RWAs)” and other exotic markets.

OLP’s profit flow works as follows:

- OLP continuously determines “fair spreads” for each asset;

- Users trade with OLP at quoted prices;

- OLP hedges directional exposure accumulated from user trades via external platforms as needed.

The Variational protocol allocates “10% of Omni’s spread revenue” to a “refund pool” disbursing refunds to losing traders. This mechanism effectively returns part of OLP’s profits to users—providing “downside risk buffering” while strengthening platform retention.

Funding Sources for OLP

Initially, the Variational team seeded OLP (Omni Liquidity Provider) with capital. Once the system proves stable on mainnet—and establishes a strong track record generating market-neutral returns—the team plans to open deposits to users via a community vault.

Variational Oracle: Provides pricing and market data for all assets supported by the Variational Protocol.

Variational Data Flow:

The oracle works by streaming multiple real-time data feeds for each listed market—and generating final pricing via a weighted combination of exchange prices. With its customizable internal oracle, Variational can rapidly support new assets—and (in the future) launch specialized and innovative markets.

Omni’s “permissionless perpetual listing” is enabled by its custom oracle—which autonomously evaluates price reliability, decentralization, and market activity before activating new markets.

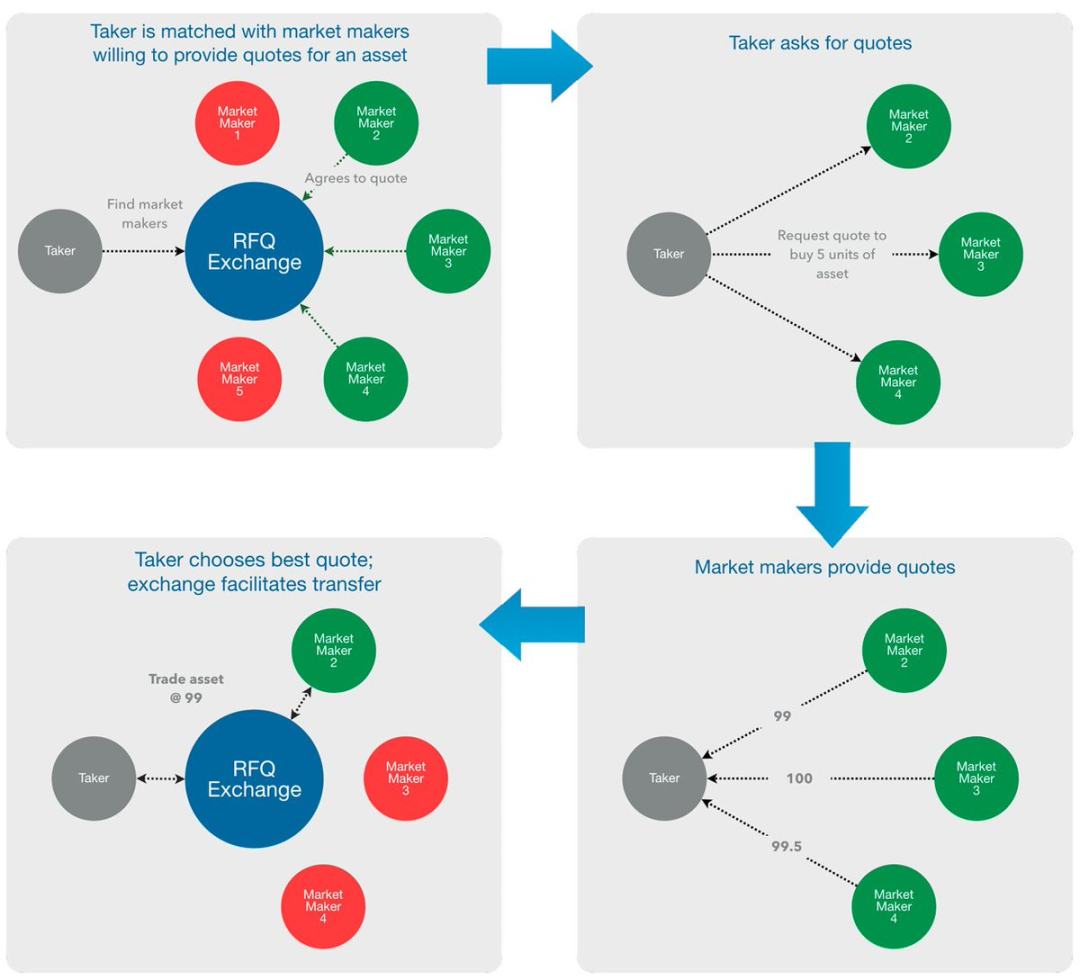

Trading via Request-for-Quotation (RFQ)

Variational is an RFQ-based protocol—not an order-book exchange.

Source: https://hummingbot.org/blog/exchange-types-explained-clob-rfq-amm/#request-for-quotation-rfq-exchanges

At a macro level, RFQ systems consist of two parties: the “requestor” initiating the quotation request, and the “market maker” responding with bid/ask prices. A generic on-protocol RFQ flow proceeds as follows:

- The requestor creates an RFQ by selecting the desired product structure—for example, an Ethereum futures contract expiring January 1, 2026. The requestor may broadcast the RFQ globally to all market makers—or send it only to a pre-approved whitelist.

- Eligible market makers respond with quotes. Each quote includes the following terms:

- Execution Price: Market makers may quote bilateral prices (bid + ask) or unilateral prices (bid only or ask only).

- Settlement Pool: The pool where the trade settles—either an existing collaborative pool (if one exists) or a newly created pool for this trade. Regardless of pool type, margin requirements, liquidation penalties, and other pool parameters must be specified before quote acceptance.

- If terms meet expectations, the requestor selects a quote. At this stage, the requestor approves a smart contract call to transfer collateral into the pool—but crucially, funds do not move until the market maker enters the “final confirmation” phase.

- The market maker retains “final review rights” to confirm the trade and all terms. Upon approving the smart contract call for final “confirmation,” the pending trade enters liquidation; if a new settlement pool is required, it is created here. Collateral from both parties is then transferred into the pool, the trade is formally recorded, and the new position appears on the pool’s ledger.

In summary, Variational represents a radically different derivatives trading paradigm. By combining an RFQ-based execution model with a vertically integrated liquidity provider (OLP), Variational functions as a mature perpetual DEX aggregator—consolidating fragmented liquidity from CEXs, DEXs, DeFi protocols, and OTC markets into a single zero-fee trading interface.

The resulting system delivers institutional-grade pricing, extensive market coverage, and efficient capital utilization—while returning a portion of market-making profits directly to traders via loss refunds and rebates. In contrast to traditional Perp DEXs reliant on external market makers and fee extraction, Variational internalizes liquidity provision, aligns incentives across stakeholders, and eliminates unnecessary intermediaries. This design transforms Variational from a mere perpetual trading venue into an execution layer connecting retail and institutional trading—within a unified on-chain framework.

Key Takeaways

The long-term evolution of decentralized exchanges (DEXs) is not a “winner-takes-all” race—but a progressive improvement cycle driven by self-custody demand and capital efficiency. As traders increasingly prioritize asset control, DEXs will continue gaining appeal.

Yet, as the Perp DEX boom surges, dozens of teams inevitably rush to launch low-cost forks and points-driven clones—not designed to optimize trader experience, but to extract fees from users chasing “the next big DEX” before the opportunity window closes. This late-cycle behavior recurs in every successful industry wave—and signals market saturation, where capital preservation becomes the optimal strategy.

Today’s market dynamics mirror broader crypto cycles with striking similarity:

- Paradigm Shift & Breakthrough Success: High-quality pioneers reshape industry expectations. For example, Hyperliquid pioneered deep on-chain liquidity and unique technical architecture—setting a new benchmark.

- Value-Driven Followers: Protocols like Lighter (LIT) and Variational stand out via concrete structural advantages—Lighter champions zero trading fees, while Variational delivers zero-fee, RFQ-based aggregation with trading rebates.

- Market Saturation & Low-Quality Latecomers: As hype peaks, late entrants and derivative forks flood the space—most offering little true differentiation beyond speculative yield. This mirrors saturation phases seen in NFTs, interest-bearing stablecoins, ICOs—and early perpetual markets dominated by GMX and its many forks.

This pattern is a structural feature of crypto narratives:

- Pioneers capture outsized opportunity by establishing new paradigms—most traders haven’t yet priced them in.

- Early followers can still gain meaningful market share—if they achieve clear differentiation.

- Latecomers face two realities:

- Most platforms never achieve real liquidity—or deliver meaningfully superior service to professional traders.

- For users, once a sector becomes crowded, preserving capital is usually wiser than dispersing it across redundant liquidity mining projects.

Differentiation drives paradigm shifts:

- Hyperliquid catalyzed a paradigm shift by integrating deep unified liquidity, fully on-chain order books, and CEX-grade performance—on its own Layer-1 network.

- Lighter differentiated itself through a clear, unwavering positioning: zero trading fees.

- Variational chose a completely divergent path—leveraging an RFQ-based aggregator model to consolidate fragmented liquidity across platforms—and returning part of market-making profits to traders.

Industry paradigms constantly evolve; competitors may persist in certain cases—but survival ultimately hinges on the unique value they deliver.

If you’re participating in liquidity mining on a Perp DEX whose features closely mirror those above (Hyperliquid, Lighter, Variational, etc.)—identical order books, promises of value without pre-token economics, identical points programs—you’ve likely missed the optimal entry window.

“If I’m not catching the next great opportunity, what’s the point of staying?” — JEZ

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News