How to understand the difference between real yield models and token incentive models in DeFi?

TechFlow Selected TechFlow Selected

How to understand the difference between real yield models and token incentive models in DeFi?

Prematurely assigning value may hinder a project's potential growth trajectory.

Written by: Eli5 DΞFi

Compiled by: TechFlow

Let's talk about DeFi yields. What are the types (and sources) of yield in DeFi? How can we move toward a more sustainable model through real yield?

In DeFi, it's common to see astronomical APYs (1,000%+), but most people hesitate when they see them. They wonder where these returns come from—what’s the source?

They're right to question it—it doesn’t make sense. Such APYs are primarily derived from token price appreciation and can easily collapse under the dilution of token inflation.

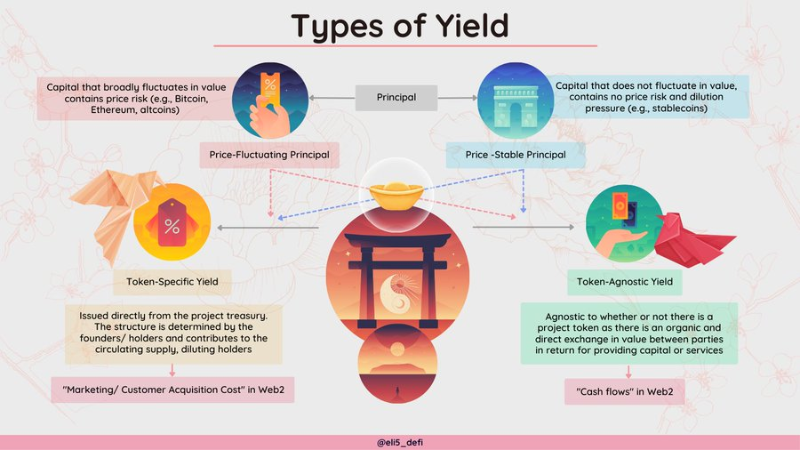

Currently, there are two main types of yield:

-

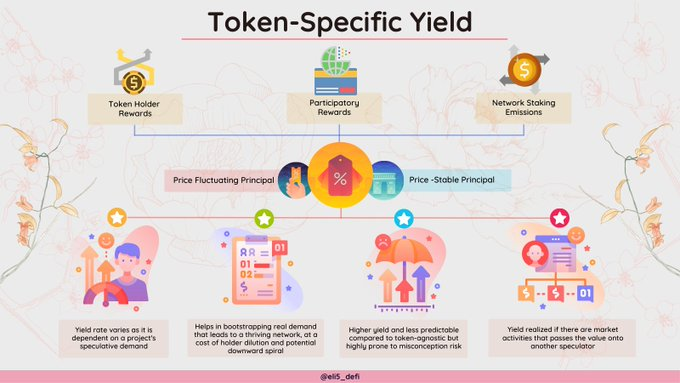

1) Token-specific yield,

-

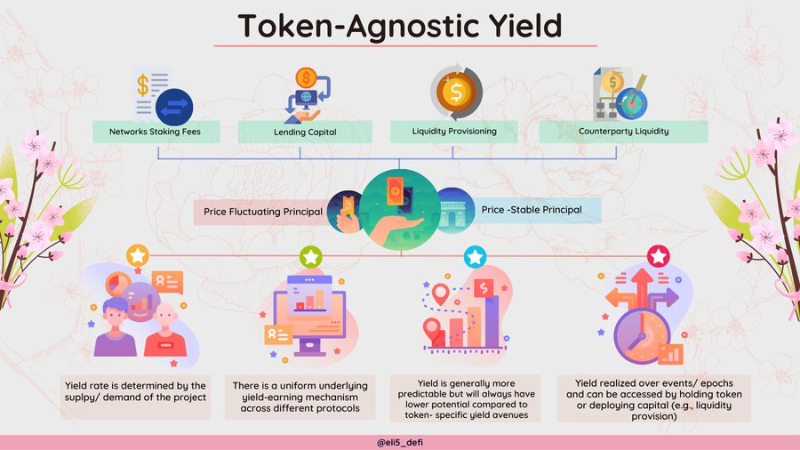

2) Token-agnostic yield.

The former is analogous to CAC (Customer Acquisition Cost) in Web2, while the latter corresponds to cash flow in Web2.

- Token-agnostic yield is driven by demand for the underlying product or service provided by the project, making it generally more predictable and sustainable.

- Token-specific yield, when used appropriately, is a powerful tool for bootstrapping networks (i.e., solving the "cold start" problem).

However, this model relies on speculators, making it less robust than token-agnostic yield.

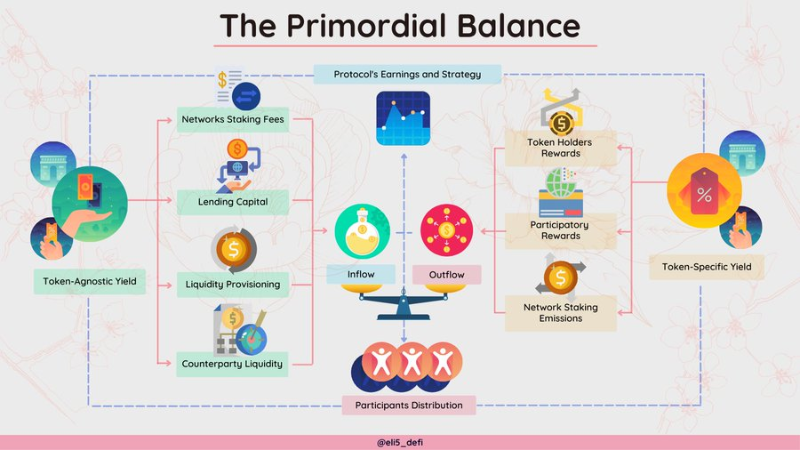

Both types of yield can (and should) coexist to bootstrap and sustain growth. Finding the right balance isn't easy, but every project must find its own equilibrium.

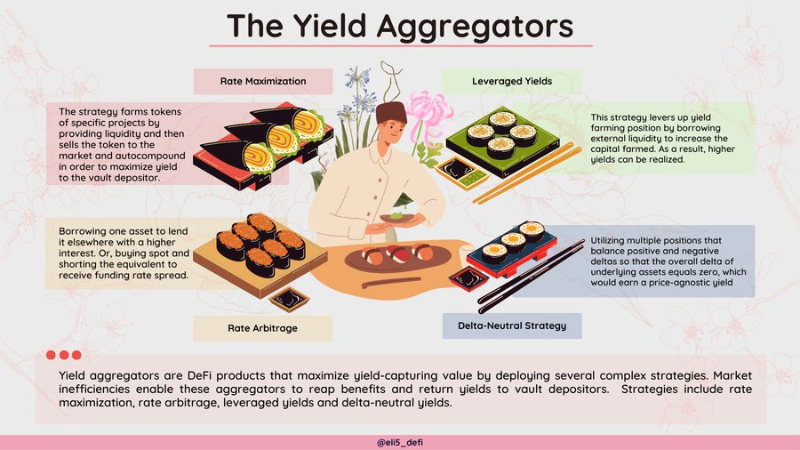

Yield aggregators (YAs) operate within vaults. By pooling funds into vaults, fixed costs (e.g., network fees) are shared among depositors, enabling higher compounding frequency. Broadly speaking, they help optimize risk profiles or maximize returns.

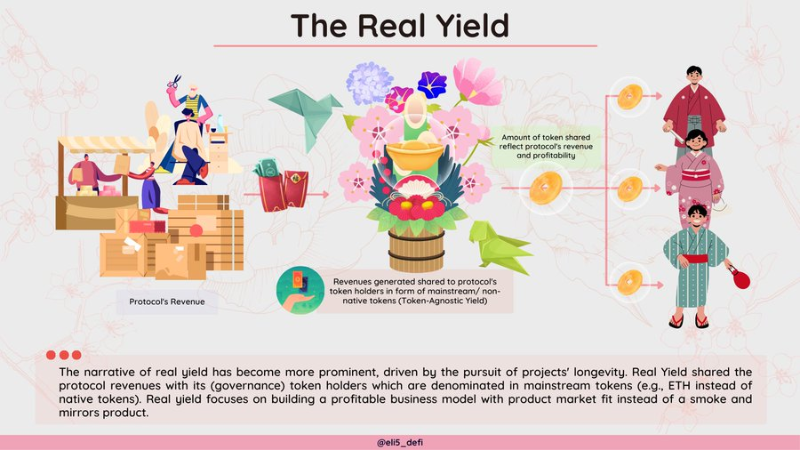

Real yield will not just be a trend or narrative—it will become a necessity (at least for most models). Real yield models will allow these projects to be valued more "realistically" or fairly based on their actual earnings/perceived value.

Real yield is essential because it gives us another dimension to more easily distinguish between sustainable and unsustainable projects.

However, premature value accrual may hinder a project’s potential growth trajectory.

Therefore, a hybrid approach using both incentive mechanisms should be adopted in the future.

Each project should find its own balance—only then can the true value of the token be revealed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News