Reasons why BTC might be overtaken by ETH before the next cycle arrives

TechFlow Selected TechFlow Selected

Reasons why BTC might be overtaken by ETH before the next cycle arrives

Maybe ETH will surpass BTC earlier than expected.

Written by: Dan Smith

Compiled by: TechFlow

Perhaps ETH will surpass BTC sooner than expected.

Bitcoin aims to become the global reserve currency, while Ethereum aims to become the infrastructure of the global digital economy. Both visions are massive, so it's better to compare the likelihood of each network capturing its respective market share.

Bitcoin has never generated meaningful transaction revenue relative to its security budget, instead heavily subsidizing security through block rewards. This current model is unsustainable and weakens its potential to become a global reserve currency.

Ethereum has already become the foundational layer for the largest dApp ecosystem and possesses the best economic system in crypto.

The network currently holds:

- $24.6 billion in DeFi TVL

- $84.7 billion in stablecoins

In 2022 alone, it facilitated over:

- $1.2T in DEX spot trading volume

- $52.6B in NFT trading volume.

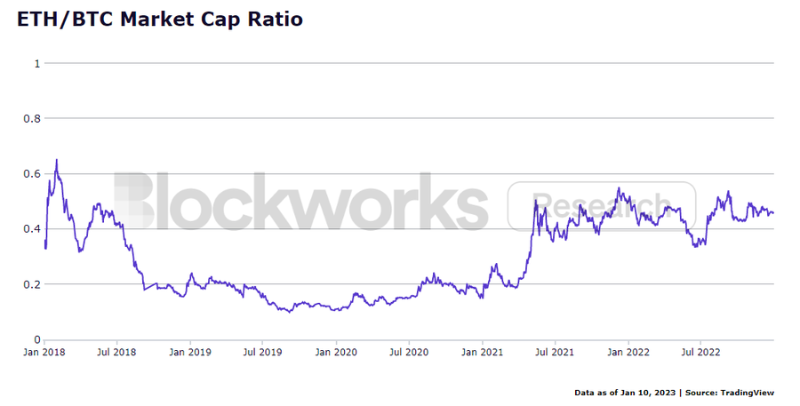

I expect Ethereum to surpass Bitcoin before the end of the next cycle. Ethereum’s market cap lags by about $150 billion, but its outstanding post-merge performance will serve as a strong fundamental catalyst for ETH.

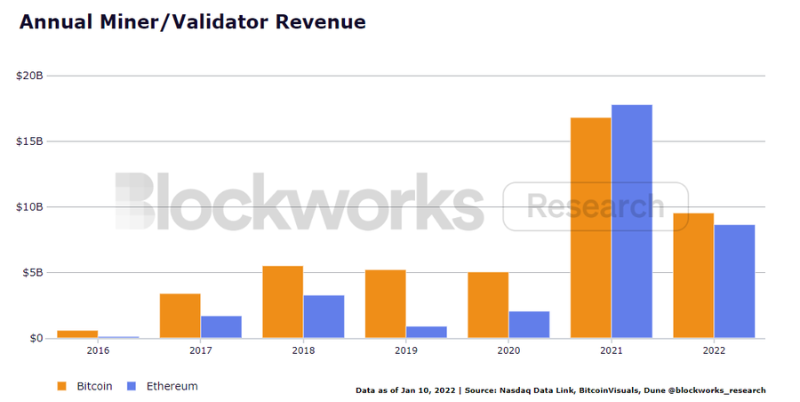

If you only look at miners' revenue in dollar terms, Bitcoin appears to be doing better.

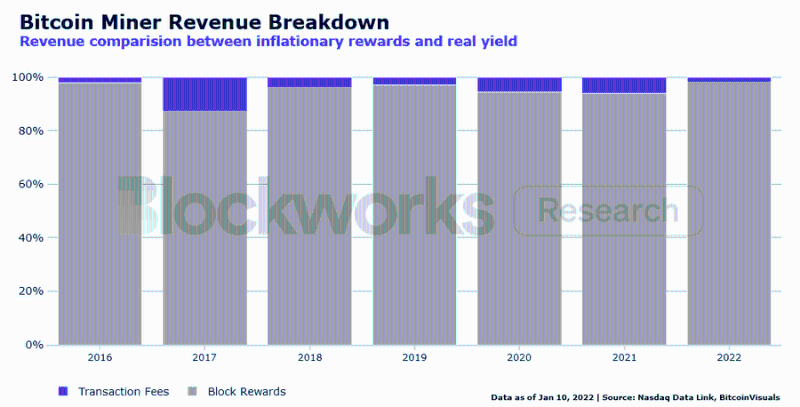

Since 2016, Bitcoin miners’ annual revenue has been on an upward trend.

But analyzing the revenue composition reveals underlying issues... Bitcoin heavily subsidizes security through inflationary block rewards. 95% of Bitcoin miners’ income comes from inflationary block rewards, while only 5% is real revenue from transaction fees.

PoW is inherently energy-intensive by design. This is good for security, but it creates forced sellers, as miners need to offset their production costs (electricity). Even with lower inflation, 95% of miner sales consist of newly minted BTC because fee generation is minimal.

Bitcoin does not support smart contracts, so BTC is the only form of value that can exist on the network. Users must pay fees in BTC to transfer BTC. Therefore, fee generation depends on BTC’s velocity, yet users claim to be HODLers…

In contrast, ETH serves as money transacted within a digital economy. Users pay ETH to transfer ETH, stablecoins, and other tokens, or to interact with DeFi applications. Ethereum expands possible actions beyond simply sending, receiving, and holding BTC.

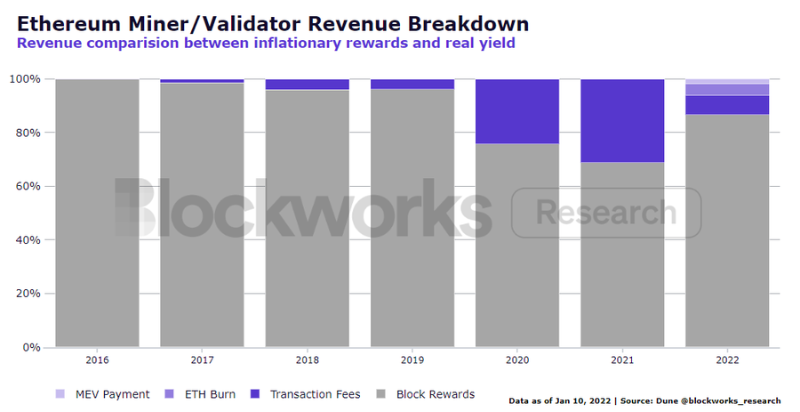

During bull markets, Ethereum’s percentage of real yield increases alongside total revenue, highlighting the network’s reflexivity. However, when on-chain activity declines, reflexivity suffers—as seen in the pullback of Ethereum’s real yield percentage in 2022.

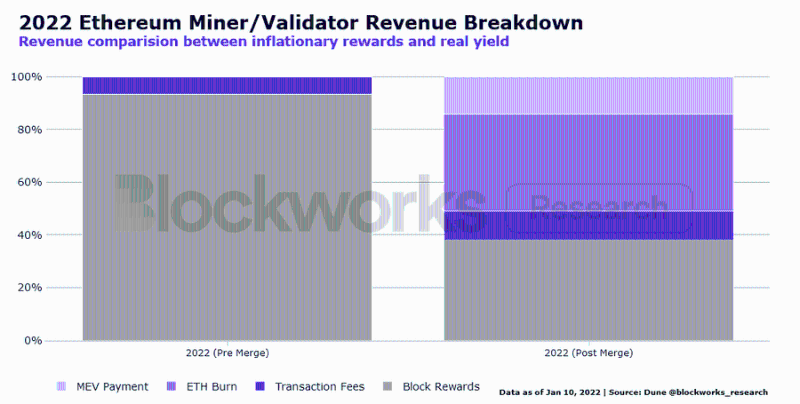

Dividing 2022 into pre- and post-merge eras shows how Ethereum addressed inflation through diversified validator income. After the merge, Ethereum validators earned 62% of their income from real sources—transaction fees, ETH burning, and MEV payments.

ETH burning and MEV are also correlated with levels of on-chain activity. Higher transaction volumes lead to greater base fee burns and more MEV opportunities. Yet even in bear markets, Ethereum’s net issuance approaches zero, creating positive value for stakers.

Migrating to PoS led to a reduction of $1.7 billion in ETH emissions within just 117 days. This is significant for liquidity dynamics, as ETH requires less buying pressure to maintain the same price. Impact on inflation? Ethereum’s 30-day annualized inflation rate reached as low as 0.00%.

Likewise, Bitcoin is not dead. It saw widespread adoption by individuals, public companies, and nations during 2021–2022. Its community may soon prioritize sustainability, but its current trajectory suggests it will lag behind Ethereum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News