Solana Remains Resilient After FTX Collapse

TechFlow Selected TechFlow Selected

Solana Remains Resilient After FTX Collapse

Solana's relationship with FTX and Alameda has been like a rollercoaster ride.

Authors: Henry Ang, Mustafa Yilham, Allen Zhao & Jermaine Wong, Bixin Ventures

Translated by: Evan Gu, Wayne Zhang, Bixin Ventures

Preface

Solana has long been closely associated with Sam Bankman-Fried, FTX, and Alameda Research—the most iconic example being SBF’s viral tweet in January 2021.

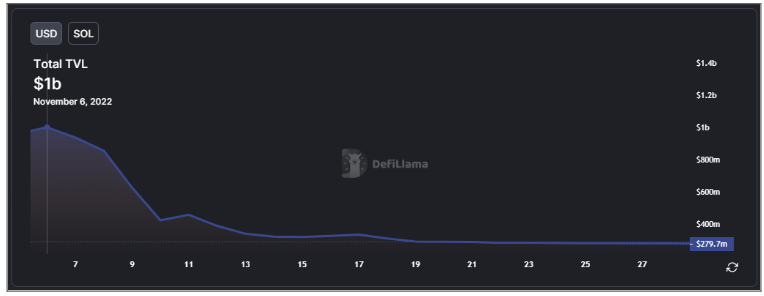

This close relationship fueled rapid growth for Solana and its ecosystem projects in 2021. However, since the collapse and bankruptcy of FTX—and the resulting negative impact on Solana—SOL’s token price has dropped approximately 58% from its peak, while TVL (in USD) has declined by about 70%.

The ripple effects have also impacted on-chain user activity. Over the past 30 days, Solana had only 7.15 million active accounts, lagging behind BNB Chain (17.9 million), Polygon (13.7 million), and Ethereum (9.94 million) on this metric.

However, amidst this turmoil, there is a silver lining. Despite the FTX collapse, the Solana developer community continues to express strong commitment to building on Solana.

A recent survey of the developer community reveals their intent to continue adopting Solana. Notably, about 73% of developers see no need to leave Solana, and around 67% choose to deploy exclusively on Solana. This suggests that even the remaining developers remain optimistic about Solana's future and are committed to continuing development on the platform.

Should We Be Bullish or Bearish on Solana?

We should calmly assess Solana’s future by first examining its fundamentals.

The network has seen explosive growth in users, developers, and on-chain activity since inception, with NFTs being particularly popular.

While user counts, developer numbers, and on-chain metrics have all suffered due to the FTX fallout, it’s important to recognize Solana’s progress since launch. Solana’s recent post comprehensively covers various statistics—we highlight some key figures we find interesting:

As of October 2022, Solana had over 11.5 million active accounts, including 1.7 million active paying users (those who paid gas fees). The historical peaks for these two metrics were 22.4 million and 2.7 million respectively.

Open-source repositories and developer activity have grown exponentially. As of November 2022, there were 20,717 repositories and 1,114 programs—a 7.6x and 8.3x increase respectively since August 2021.

DAO tools and adoption are growing rapidly. Since August 2021, approximately 15 million SOL have been managed across 1,700 DAOs—an increase of roughly 43.3x and 1,700x respectively.

NFTs have been a breakout use case on Solana, attracting millions of new users to the network. Users have minted over 21.9 million NFTs across 7.2 million wallets, with $1.1 billion in primary sales and $2.5 billion in secondary market trading volume.

Solana has addressed its network instability issues.

Since early 2022, Solana has faced criticism for network instability. In early July, we discussed Solana’s long-term viability and potential fixes aimed at improving network stability.

The following fixes have already been implemented:

1. QUIC protocol introduced: Originally developed by Google, QUIC allows validators better control over transaction flow traffic.

2. QoS (Stake Weighted Quality of Service) built: Ensures any validator holding X% stake can forward at least X% of transaction packets to the leader validator.

3. Priority fees introduced: Allows users to signal transaction urgency by specifying additional fees, which are paid during execution and block inclusion.

These three improvements work together to reduce spam and enhance network stability. QUIC enables validators to limit incoming traffic for more efficient block production, while QoS prevents any single validator from dominating the network. These enhancements reduce the likelihood of spamming the leader validator. Users wanting faster transaction confirmation should utilize priority fees to ensure quicker inclusion in blocks.

These optimizations have led to improved network stability—even during the extreme volatility caused by the FTX collapse, the network remained operational.

Solana will become faster and more reliable

With Firedancer—an independent validator client developed by Jump—Solana will push the boundaries of blockchain throughput.

Jump is rebuilding from scratch without technical debt, layer by layer, following the data path of packet ingress, runtime, and consensus, to optimize Solana for speed. During Solana Breakpoint 2022, it was officially announced that Firedancer demonstrated a potential of 1.2 million TPS under test conditions, bringing Solana closer to its vision of becoming “a state machine that processes transactions at the speed of light.”

Firedancer will be written in C/C++, reducing shared dependencies with the existing validator client and increasing network reliability. It also lowers hardware requirements and makes running nodes cheaper and easier through performance improvements.

Blockchain infrastructure, developer tools, and programmability are continuously improving to help developers build on Solana.

Google Cloud

During Solana Breakpoint, Google Cloud made several announcements aimed at enhancing node and data query infrastructure. Google Cloud has been operating a block-producing validator on Solana and plans to leverage its experience to introduce a Blockchain Node Engine for Solana in 2023. This will allow one-click deployment of Solana nodes in the cloud—previously prohibitively expensive due to high hardware requirements (128 GB RAM, 2.8GHz CPU, 24 cores/24 threads).

Google Cloud will also begin indexing Solana’s historical data and enable BigQuery access in Q1 2023, allowing developers in the Solana ecosystem to access historical chain data. Given the high cost of maintaining archive nodes and the complexity of interpreting on-chain data, this initiative is a major boost for developers using Solana data. Google Cloud will also accept USDC as payment for services—a significant advantage for crypto-native projects whose revenue is primarily in cryptocurrency.

Account Compression

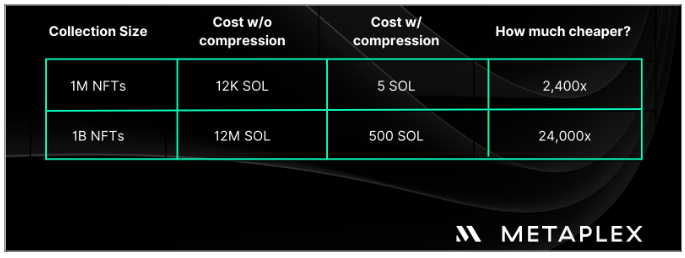

With the vision of achieving global state synchronization at light speed, on-chain storage will inevitably grow over time. To proactively address this challenge, Solana Labs and Metaplex Studios have been collaborating closely on account compression technology to reduce on-chain data storage. Compressed NFTs will store their on-chain state within Merkle trees, while detailed account data can be retrieved from data stores managed by RPC providers. This ensures developers can easily implement account compression using familiar RPC infrastructure. The first use cases will focus on NFTs, with Solana Labs’ Concurrent Merkle Tree program (Gummyroll) and Metaplex Foundation’s compressed NFT program (Bubblegum) now available. This means storage costs no longer scale linearly and significant savings can be achieved, as shown below:

Looking ahead, account compression will expand beyond NFTs into social media apps, gaming, ticketing, metaverse, enterprise use cases, and more—enabling developers to build increasingly innovative applications.

xNFTs

xNFT is a revolutionary new standard that tokenizes ownership. In its first iteration, Backpack, it reimagines how Web3 wallets are built. Like other wallets, it manages your private keys and connects to dApps—but uniquely, it is asset- and protocol-agnostic, enabling developers to build permissionless asset management tools on a unified interface. It is open-source, meaning anyone can request interfaces to add new core functionalities, creating a testing ground for new features and applications. Ultimately, xNFTs will drive better mobile experiences and broader user adoption.

Token 2022

A new program is being developed to add enhanced token functionality. Previously, adding composability to tokens required integrating new programs into the existing token standard—a cumbersome process. With Token2022, extensions can be appended after the standard 165-byte token account, supporting many new use cases such as:

1. Confidential transactions: Hiding transfer amounts to enhance privacy, though counterparties can still view relevant information on-chain

2. Interest-bearing/resettable tokens: Enables new capabilities for staking pools and lending protocols

3. Memo-required transactions: Customer-facing applications processing consumer payments can restrict transactions to those with specific memos, simplifying payment categorization

4. CPI protection extension: Forces dApps to transact via delegation, meaning users allocate only specific quantities or types of tokens that a program can use. This reduces wallet draining risks when interacting with low-quality dApps

Click here to explore extensive resources on Token 2022 extensions and implementations.

This positions Solana as an innovation hub for diverse applications capable of mass-market adoption.

While numerous applications are currently being built on Solana, we want to highlight projects across different verticals that have significant potential to attract the next wave of non-crypto-native users.

Dialect

Dialect has partnered with over 50 projects on Solana to launch its smart messaging specification, supporting actionable link previews. Users will be able to send money, mint and buy NFTs, vote on DAO proposals, and play games—all within the Dialect app using a wallet-to-wallet mobile messaging layer. They’ve also launched a $100,000 incentive program to encourage developers to build on their smart messaging layer. In our view, messaging is a critical communication layer currently missing in Web3, and Dialect can help bridge this gap while preserving user privacy.

Teleport

Solana is Teleport’s choice. Teleport is a rideshare company aiming to eliminate centralized matching between riders and drivers through TRIP, a decentralized marketplace where various ride-hailing apps can integrate. Riders will pay via USDC credit card, while drivers receive direct payouts to their bank accounts or in USDC. Ridesharing is deeply embedded in urban life globally, and we believe Teleport has the potential to disrupt existing operators and attract new Web3 users through real-world utility.

Helium

Helium is another application capable of attracting millions through real-world utility. Initially a network for IoT devices, Helium has expanded into wireless mobile networks and recently migrated to Solana. The project aims to eliminate coverage blind spots in the Helium network through a partnership with T-Mobile, offering mobile plans as low as $5 per month. Each subscriber will receive a Solana wallet immediately upon sign-up. This is a subtle yet powerful onboarding tool, introducing new Web3 users to applications seamlessly, while pushing for greater composability among apps on Solana.

Through Saga and its mobile dApp store, Solana is demonstrating the significance of Web3 for mobile users.

Phones are carried everywhere, regardless of whether they’re actively used. Mobile experiences shape the daily lives of billions—and Saga aims to showcase the benefits of Web3 through mobile devices. Saga will deliver a familiar smartphone experience with asynchronous notifications—for example, alerting you when an NFT is minted or when someone requests a payment. Saga can act as a digital gateway, enabling payments via Solana Pay, biometric authentication, and seamless crypto gaming integration into everyday routines.

Saga’s key features include Seed Vault and the Solana dApp Store. Seed Vault is a deeply integrated key custody solution embedded in both hardware and software stacks, securely protecting private keys. It provides a trusted user interface—Android cannot see your seed phrase input, take screenshots, or perform keystroke logging. This allows users to freely sign transactions anytime, knowing their keys are secure. The Solana dApp Store will be a free application center with crypto-friendly policies for DeFi, gaming, wallet, and NFT apps. This empowers developers to focus on building products accessible to billions of users anytime, anywhere. The Solana dApp Store will open submissions in January 2023—we look forward to the innovative applications that will emerge.

In our view, this is the right approach to onboard the next wave of users to Solana. While most other blockchains focus solely on improving underlying technology, Solana has simultaneously advanced both technical infrastructure and user experience.

Community-driven initiatives like Solana Spaces, SuperteamDAO, and Metacamp are quietly impressive and have helped countless aspiring developers and new users join the network.

Solana Spaces is an experiential space allowing people to learn about and interact with Solana in real life. Inside, Phantom is set up so visitors can learn about self-custody wallets, then scan QR codes to complete tutorials—such as learning DeFi with Orca, exploring blockchain gaming with Aurory, discovering NFTs via JustApe, or experiencing 1/1 art on Formfunction. All experiences occur within Phantom wallets provided in-store, and users earn NFT rewards upon completing each tutorial—building deeper relationships with end users. Since launching three months ago, they’ve hosted over 30,000 visitors and completed over 10,000 tutorials across physical locations in New York and Miami. They are now expanding this model via SpacesDAO, enabling anyone interested in running their own Solana store to participate. It’s an open-source retail model—anyone can use all IP related to design and construction, from architectural blueprints to fixture drawings, software, and merchandise. Interested parties can join by acquiring a GeoNFT representing the store’s physical coordinates, granting them redemption rights and real-world legal protection and territorial exclusivity through a contract with the DAO. To kickstart this initiative, SpacesDAO and the Solana Foundation offer loans or grants of up to $50,000 to entrepreneurs opening new stores.

SuperteamDAO is a foundational resource hub, community-led and designed for aspiring developers looking to build on the Solana ecosystem. Organized by four local Super Teams in India, Germany, Turkey, and Vietnam, the organization revolves around three pillars: Learn, Earn, and Build. Aspiring developers gain deeper knowledge of Solana Core, find earning opportunities through bounties, draw inspiration from a content library, and apply for no-equity grants within 48 hours.

Metacamp is a Singapore-based NFT membership co-working space that brings together investors, startups, and talent from Southeast Asia’s Web3 industry. This Solana-focused space offers members educational programs, community events, and corporate workshops to further develop professionals’ skills in the Web3 field.

Given the above, the Solana network has made tremendous improvements and now possesses the right infrastructure and tools to empower developers to build new applications capable of attracting the next billion users. Saga will further expand developer reach by exposing them to untapped user segments in Web3.

How Can Solana Reverse Public Perception?

Despite having sound technical foundations, public sentiment and perception around Solana remain largely negative and pessimistic. Below are several ways we believe could shift this narrative and redirect public attention toward Solana’s inclusive community and technological progress.

Severing Ties with FTX/Alameda

According to recent reports, the Solana Foundation has a $1 million cash exposure to FTX—less than 1% of its total funds—and holds no assets custodied by FTX. The Foundation also holds approximately 3.24 million shares in FTX Trading, 3.43 million FTT tokens, and 134.54 million SRM tokens, most of which have lost nearly all value. On the other hand, Solana Labs has no exposure to FTX.

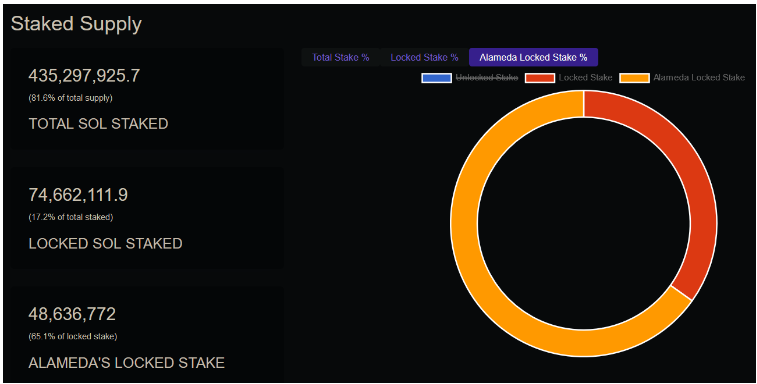

Regarding Alameda’s holdings of SOL, none of the tokens are currently circulating—the earliest unlock date is 2025, with vesting extending through 2028. Alameda currently holds 48.6 million SOL, accounting for 65% of all locked equity, all of which is currently locked and staked. Even when staked tokens begin unlocking, given Alameda’s Chapter 11 bankruptcy proceedings—which may take years to resolve—Alameda may not be able to access these tokens.

Although these tokens will eventually enter the market, our view is that Solana will rebuild a thriving ecosystem through its vibrant developer community, driving high user activity that translates into token demand. As Alameda enters liquidation, its Solana assets are likely to be more evenly distributed among investors and creditors.

Addressing Decentralization and Censorship Resistance

Public perception still views Solana as a centralized chain. Anatoly defines decentralization by the number of independent copies of usable state history. As of today, Bitcoin has over 15,000 full nodes, while Ethereum and Solana have approximately 8,000 and 3,000 full state copies respectively. By this definition, Solana is currently the third most decentralized blockchain.

Solana also demonstrates impressive operational diversity among its ~2,000 consensus-participating validators, with stake distributed across 230 unique data centers—none exceeding 9% concentration. It also has a Nakamoto Coefficient of 31, outperforming AVAX and Thorchain (29 and 28 respectively).

Looking ahead, Solana is committed to Diet (lightweight) clients to lower validation costs. These clients will improve the trust-minimization assumptions for most consensus participants. Consequently, if the majority becomes untrustworthy, Solana could adopt a user-activated soft fork similar to Ethereum’s proposed mechanisms. For those interested in censorship resistance in PoS networks, we provide an in-depth discussion here.

Addressing the “Business Development” Challenge

Although Solana is often praised for its “great technology,” it has historically lagged behind Polygon in business development. Ben Sparango, Head of Business Development, recently mentioned in a podcast that while existing Web2/Fortune 500 companies remain target partners, the team is taking a gradual approach—many such companies are occupied with other priorities and do not directly contribute to increased blockchain usage or activity. A successful example is the recent ASICS-StepN collaboration with Solana, where ASICS integrated Solana Pay, selling 3,000 units for $600,000 in USDC—without credit card processing fees. Each sale included an NFT that later traded for around 1,000 SOL on secondary markets.

Conversely, the Foundation’s priority is attracting more foundational developers to build unique applications that leverage Solana’s technical advantages. Applications that achieve product-market fit will naturally become new growth vectors for Solana and attract the next wave of users. This was validated when Stripe announced support for fiat-to-crypto payments—11 out of 16 pilot apps were from Solana (Magic Eden, Audius, Orca, etc.).

Conclusion

To summarize, Solana’s relationship with FTX & Alameda has been a rollercoaster. While Solana’s future may appear bleak today, peeling back the layers reveals a promising community and a high-performance, scalable blockchain. Solana is innovating across multiple fronts—becoming the platform of choice for consumer-facing applications like Dialect, Helium, and Teleport, and opening an entirely new user segment through its flagship Saga phone in the mobile space.

We believe Solana can overcome this setback, reshape public perception regarding its ties to FTX/Alameda, decentralization shortcomings, and slow business development, and pave the way for groundbreaking applications that attract the next billion users.

If you're a builder on Solana, feel free to reach out—we’d be happy to support you in any way we can.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News