Will 2023 be the inaugural year for mining opportunities in the Move ecosystem?

TechFlow Selected TechFlow Selected

Will 2023 be the inaugural year for mining opportunities in the Move ecosystem?

The Move ecosystem is still in an early stage.

Public blockchains remain a perennial mainstream narrative in the crypto world. Despite already having over 30 major Layer 1s supporting millions of DeFi, NFT, GameFi, and SocialFi DApps, the sector is still extremely early.

The term "early" reflects that current blockchains can only support usage by millions of users—still at least two orders of magnitude short of Web 2.0 platforms like WeChat or Facebook with over a billion users. New public chains aiming to bridge this gap will play a significant role.

In the vision for Web 3.0, one of the most important aspects is the complete restructuring of existing internet infrastructure and applications—from foundational communication protocols, through middle-layer SaaS, to upper-level applications—all expected to run on next-generation high-performance public blockchains, with market expectations reaching into trillions of dollars. As Peter Smith, co-founder of Blockchain.com, put it: “In this bull market, we’ve seen the success of Solana, Avalanche, and Near Protocol, delivering exceptional returns in the short term. The next wave of Layer 1s will be led by Aptos and Sui.”

There’s now broad market consensus that the future belongs to Move-based blockchain ecosystems, while in reality, many have long been frustrated with Ethereum-like systems.

Before diving into Move, let’s briefly review some persistent challenges facing blockchain technology.

Current State of Blockchain Infrastructure

Performance Bottleneck: Contradictions Have Reached a Critical Point

By 2022, the central contradiction in blockchain had become clear: the growing demand from users for fast, low-cost, real-time networks versus today’s slow, expensive, and delayed public chains.

During the DeFi Summer surge beginning in 2020, on-chain user numbers first surpassed the million mark. This brought about exorbitant gas fees on Ethereum—peaking at over $100 per transaction—creating a whale-driven squeeze-out effect against retail users and raising concerns about centralization within the crypto space.

With Ethereum's dominance weakening, ambitious challengers saw their opportunity. High-performance newcomers such as Solana and Avalanche stepped onto the historical stage. Objectively speaking, these two chains achieved transaction throughput (TPS) two orders of magnitude higher than Ethereum, approaching the settlement capabilities of Web 2 giants like Visa. However, Solana’s repeated outages proved this wasn’t the final solution.

Ethereum responded by advancing EIP-1559 and the London hard fork, promoting various L2 Rollups, and preparing for its full Merge into Ethereum 2.0 next year, which could eventually boost TPS into the 100,000 range.

However, dYdX’s departure from the Ethereum ecosystem signaled a temporary setback for Ethereum. “A thousand years is too long”—the crypto world demands high performance now.

Time waits for no one. In the era of Web 3.0, more external users will enter the crypto rabbit hole. We must deliver user experiences surpassing those of Web 2.0 to demonstrate the superiority of DeFi, NFTs, and GameFi.

It’s time to seriously consider whether a new generation of blockchains could replace Ethereum—one truly capable of meeting the needs of blockchain’s next decade, a mission that Solidity-powered Ethereum cannot fulfill.

Solidity: The Achilles’ Heel of Smart Contracts

Ethereum’s success was built upon both Bitcoin’s foundation and Solidity, neither of which could be dispensed with. We can summarize this as follows:

• The PoW mining mechanism allows miners to compete for block validation rights via hash power, providing a physical basis for individual fairness in participating in Ethereum.

• Smart contracts form the foundation for complex logic operations in DeFi, NFTs, GameFi, etc., enabling the first true Crypto Native ecosystem built from on-chain assets.

Success has a price. While Solidity itself isn't flawed, it helped create the EVM—the biggest moat in Ethereum’s ecosystem. Other chains often need EVM compatibility to encourage app migration. Thus, before 2022, the competition in the Layer 1 space was essentially between Ethereum and other Ethereums.

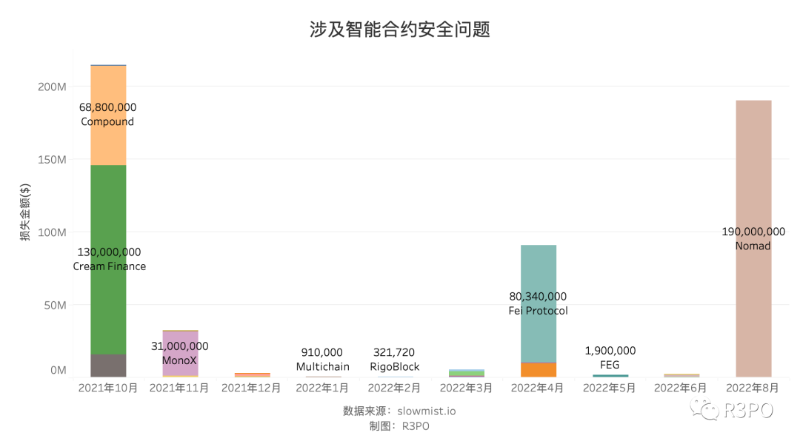

But failure also stems from the same source. Smart contracts written in Solidity frequently suffer vulnerabilities. At its core, Solidity was not designed specifically for managing digital assets but rather as a general-purpose tool for writing smart contracts. In Solidity, assets are represented using standard data types—time, integers, floats, booleans—and thus remain vulnerable to traditional attack vectors. Given that Solidity underpins vast amounts of on-chain value, security becomes the giant’s heel—an ever-present shadow.

To sum up, here are the pros and cons of Solidity:

Dynamic Language: Easy to develop and debug vs. difficult to catch bugs during compilation;

Flexible Syntax: Supports dynamic calls vs. risks compromising asset security;

Asset Attributes Supported: Foundation for smart contracts vs. requires developers to implement flawless logic;

Centralized Resource Storage: Easier asset management vs. a single contract vulnerability can jeopardize all associated assets.

We must acknowledge both the strengths and weaknesses of Solidity when envisioning the evolution of programming languages for next-generation high-performance blockchains.

Move language represents a further refinement based on prior work. Now, it’s time for Move to usher in a transformative new era.

Origins and History of Move

Before entering the public eye, Move had already lived through a dramatic rise and fall—a veritable prince’s revenge story.

Born into privilege as a corporate-backed project, it later fell into obscurity after being sold off, only to be revived by backing from top-tier investors like a16z, FTX, and Coinbase, ultimately forming the Move ecosystem—the first blockchain ecosystem named after its programming language, a testament to its excellence.

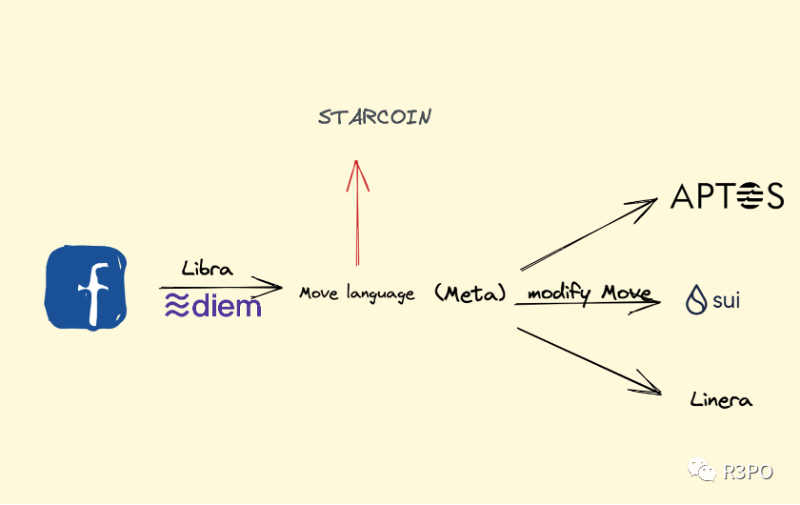

In fact, Move is not a newly invented language—it has been under development for several years. Originally created by Facebook for its Diem project, Move entered a prolonged slump after regulatory pressure forced Facebook to sell the Diem team.

During Move’s darkest days, the Starcoin technical team remained committed, publishing tutorials to attract developers and pioneering the use of Move to build a blockchain and ecosystem, proving the language’s potential to both developers and the market.

Their persistence eventually paid off. Starting in March 2022, Move-based blockchains began drawing mainstream attention as Sui, Aptos, and Linera successively secured funding. Their striking similarities and high degree of homogeneity quickly captured market interest.

All three are primarily developed by former Diem team members, marking the formal emergence of the Meta lineage;

All use Move as their primary development language, though Sui modified native Move;

All were funded by a16z, suggesting strong confidence in Move’s future given none have launched mainnets yet;

All raised substantial capital: Sui secured $236 million, Aptos $350 million, and Linera $6 million;

Move itself is a programming language derived from Rust, with syntax designed to surpass Solidity. Key features of Move include:

Generic + Static Programming: Abandons Solidity’s dynamic calls, instead using generic tools for efficient development while ensuring contract vulnerabilities are caught at compile time, preventing post-deployment asset losses.

Language-Level Formal Verification: Formal verification mathematically proves contract correctness—the most secure method available. In Solidity, this is typically done post-development by specialized firms like SlowMist or PeckShield. Move integrates this capability directly into the language, making it accessible to developers.

Resource-Oriented Programming: In Move, resources are special types that exist uniquely under a single owner at any timestamp, and can only be in one state (exist or destroyed), fundamentally eliminating risks like infinite minting or ownership ambiguity, ensuring end-to-end security from development to deployment.

Distributed Resource Storage: In Solidity-based contracts, resources are stored in centralized fashion—breaching one point compromises all assets. In Move, resources are stored in parallel, each tied to specific owners, so even if attacked, the entire contract doesn’t fail.

Fueled by rapid investment, the market went wild over three chains that hadn’t even launched mainnets—memes about Move developers earning $1,200/hour quickly went viral, clearly signaling a far cry from Starcoin’s earlier struggles.

Move is no longer just theoretical—Starcoin has already deployed its ecosystem, Aptos testnet has entered its third phase, and Sui and Linera are close behind. Will the Move ecosystem fully replace Solidity?

Talk is cheap. Let’s now explore the actual ecosystems built on high-performance blockchains using Move.

Current State of the Move Ecosystem

This time, the rallying cry has quietly shifted toward Web 3.0, taking center stage in Aptos’ recent announcements. These aren’t just chains for DeFi or NFTs—they’re foundational layers for migrating the next generation of the internet to Web 3.0. Seven billion people need high performance, privacy requires new chains, and seamless user experience demands robust ecosystems.

Among the four chains, Starcoin leads with a relatively mature application ecosystem including DeFi, NFTs, metaverse, and hardware wallet integrations. Sui raised funds early but currently shows weak ecosystem development, with only a few applications emerging—warranting further observation.

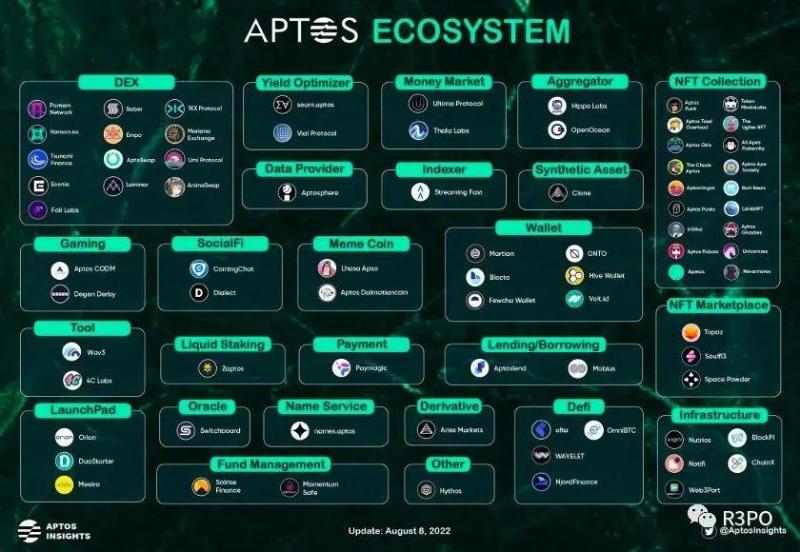

Aptos, however, has pulled off a remarkable comeback—growing from just 30 apps in July to over 80 awaiting launch by mid-August, making it the current frontrunner.

Linera remains in development and won’t be covered here.

Teams deeply committed to building the MOVE ecosystem and advancing Web3.0 deserve close attention.

Aptos’ Four-Phase Strategy

Aptos’ rise owes much to contributions from Solana developers, many of whom migrated en masse to the Aptos testnet hoping to replicate Solana’s success across market cycles.

According to official documentation, Aptos has hosted one hackathon and launched a Grant program in June to support ecosystem growth. Its testnet incentives consist of four rounds:

AIT 1: Launch phase, involving 119 nodes from 43 countries;

AIT 2: Staking phase, involving 226 nodes from 44 countries;

AIT 3: Governance and upgrade phase, currently ongoing;

AIT 4: Dynamic validator topology;

Phase AIT 3 triggered a Cambrian explosion in the Aptos ecosystem, covering DEXs, GameFi, NFTs, oracles, and other essential infrastructure. Rather than attracting established apps like other chains, Aptos aims for applications to grow alongside the chain, enabling a smooth transition to mainnet while retaining users and developers.

Performance Bottleneck: Contradictions Have Reached a Critical Point

Notable projects include:

Liquidswap – AMM-based DEX. Co-developed by Aptos and Pontem Network, its Move VM supports cross-chain operations, initially compatible with Rust-based Polkadot. Modeled after Uniswap, Liquidswap aims to become the dominant native DEX on Aptos.

Econia – Orderbook DEX powered by Block-STM. Leverages Aptos’ parallel processing to batch process orders, reducing impermanent loss and improving matching efficiency.

Following the momentum of AIT 3, Aptos’ market热度 continues to rise. We may witness significant progress toward realizing a truly high-performance Aptos blockchain this year.

Sui’s Patient Long-Term Approach

Unlike Aptos’ aggressive market presence, Mysten Labs behind Sui maintains a more reserved and patient stance. Unlike Aptos, Sui uses a modified version of Move, notable for splitting network fees into computation and storage components. Users pay only for active storage and can delete data when no longer needed, emphasizing privacy protection.

Mysten Labs has launched Sui’s DevNet testnet, with flagship applications including the Sui Wallet browser extension offering token and NFT management. Other ecosystem developments remain slow.

As early as March this year, Sui released developer guides for gaming and NFTs, clearly indicating stronger interest in commercial applications like NFTs and games.

Starcoin’s Strategy and Future Outlook

Unlike Aptos and Sui, still struggling in testnet phases, Starcoin has already launched real products for users, recording over 8 million transactions with an average fee of just $0.000016. Its ecosystem is vibrant and rapidly expanding.

The ecosystem includes wallets, DEXs, NFT marketplaces, mining pools, and stablecoins—offering a comprehensive view of what a Move-based blockchain ecosystem can achieve.

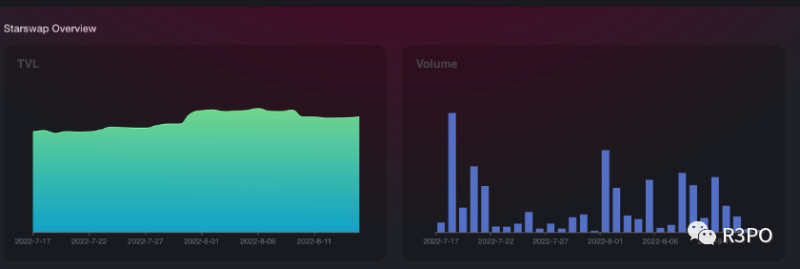

Take Starswap, an AMM-based DEX built natively in Move. It currently holds $800K in TVL, supports trading among five assets—WEN, FAI, XUSDT, STAR, and STC—and enables cross-chain bridging for additional assets, serving as a starting point for Move’s financial ecosystem.

Within DeFi, native on-chain assets receive seamless support via the over-collateralized stablecoin FAI, which can be minted by staking STC or ETH—providing a decentralized alternative to increasingly centralized stablecoins like USDC and strengthening the Move ecosystem.

Off-chain, Starcoin has partnered deeply with OneKey hardware wallet, now supporting Starcoin dApps. From software to hardware, Move ensures on-chain asset security while hardware wallets safeguard physical assets.

Beyond DeFi, Starcoin is actively developing NFT and metaverse initiatives. Unlike Ethereum’s high fees and latency, Kiko Verse—built on Move—is a trendy metaverse platform integrating NFTs, tokenomics, and meme culture.

While DeFi demands low latency, metaverse platforms require high-load capacity. Thanks to Move and Starcoin’s support, Kiko Verse seamlessly integrates Game/NFT/DeFi functionalities, becoming a gateway to our future digital lives.

Conclusion and Outlook

The Move ecosystem is still in its early stages. On one hand, Move demonstrates clear technical advantages and immense potential in design and functionality. On the other hand, compared to the mature EVM ecosystem, Move-based projects remain nascent. The beauty of blockchain lies in its limitless possibilities and inclusivity—anyone can participate. For developers and early adopters eager to explore new frontiers, Move represents an unmissable opportunity in 2023.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News