What does it truly mean to be crypto-native?

TechFlow Selected TechFlow Selected

What does it truly mean to be crypto-native?

As the cornerstone of cryptocurrency, Bitcoin's decentralization philosophy and trustless mechanism originate the Crypto Native concept.

Since 2021, "Crypto Native" has gradually entered the crypto industry lexicon. Almost every newcomer has heard this term, often repeated by veterans in the space. Yet, if you ask these veterans what exactly it means, some may struggle to provide a clear answer.

The definition of what it means to be Crypto Native varies from person to person. But does it simply mean refreshing Twitter constantly for crypto news, transferring most of one's wealth into BTC or ETH, monitoring market data daily, or casually throwing around terms like "decentralization"? It might include some or all of these behaviors—but perhaps not.

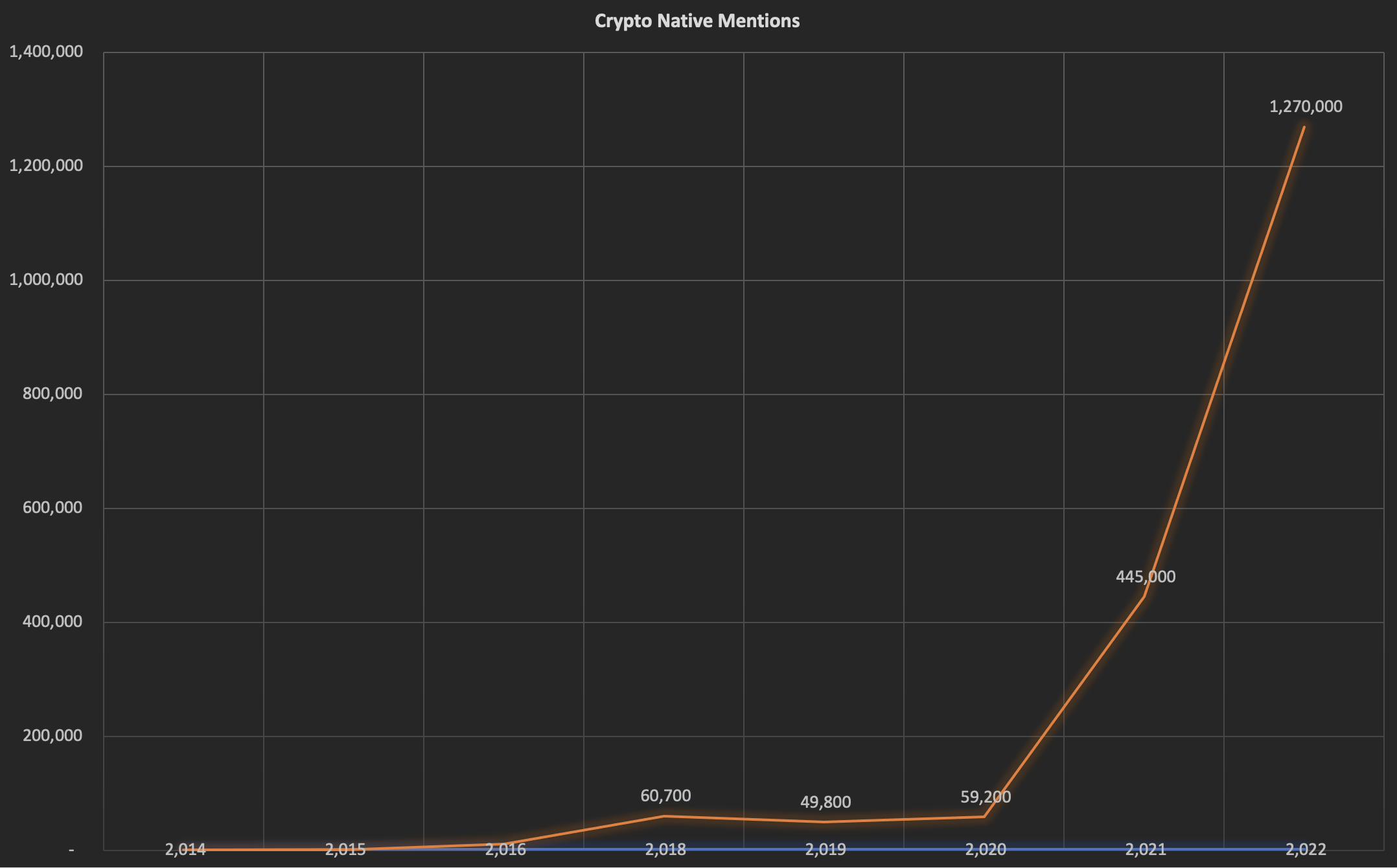

We can observe the rising interest in the term "Crypto Native" across the web. Mentions increased 5.57-fold in 2018 compared to the previous year, rose another 7.52-fold in 2021, and grew 2.85-fold in the first 11 months of 2022 versus the same period prior. Over time, public interest in Crypto Native has followed an exponential growth pattern—with no signs of slowing down.

Interest in Crypto Native – Data source: Meltwater.com

The Origins of Crypto Native

In the world of cryptocurrency, "Crypto Native" represents the inheritance of native decentralized cryptographic ideals. The narrative of Crypto Native begins with Satoshi Nakamoto and Bitcoin. As the foundation of cryptocurrencies, Bitcoin’s underlying principles—decentralization and trustless mechanisms—form the origin of the Crypto Native philosophy.

From Bitcoin’s emergence in 2008, the world saw its first cohort of Crypto Natives.

Following the Mt. Gox hack and the impact of Silk Road on the dark web, Bitcoin peaked in 2011 before entering a prolonged winter. This early group—who owned and transacted Bitcoin—believed in cryptographic algorithms and blockchain technology, championing the idea of “Code is Law.” At that time, a Crypto Native was someone who believed in cryptography and actively held and used Bitcoin.

Over time, Bitcoin became known as “digital gold,” with its commodity attributes overshadowing its monetary ones. With increasing participants and capital inflows, the early infrastructure of the crypto industry matured during this period—mining hardware, payment use cases, trading platforms, and financial derivatives all developed rapidly. The explosive growth in Bitcoin’s hash rate stands as strong evidence.

By 2014, a pivotal moment arrived: Ethereum founder Vitalik Buterin released the initial whitepaper and conducted ETH’s presale on July 24, 2014. The subsequent creation of the Ethereum Virtual Machine (EVM) and smart contracts marked a new era for the crypto industry. Likewise, the scope of Crypto Native expanded beyond Bitcoin to include Ethereum and other cryptocurrencies—yet this group still firmly believed in the cryptographic and blockchain-based system of digital currencies.

With the establishment and maturation of the Ethereum ecosystem, imagination around public blockchain ecosystems flourished. As ICOs emerged as a novel fundraising method, more dApps demonstrated blockchain’s real-world utility. Moreover, on-chain financial derivatives such as futures contracts and lending products began to develop, further fueling the growth of centralized exchanges.

Examining Twitter posts after 2017 reveals evolving interpretations of the term. Jessica Verrilli (@jess) was among the first to use “Crypto Native” on Twitter, on October 26, 2017, referring to college student entrepreneurs working on crypto-related projects. A new generation of “internet-native” or “mobile-native” individuals was emerging. Just as earlier X-native groups showed natural adaptability to certain lifestyles and mindsets, they could grasp complex aspects quickly and enter the space faster. Clearly, a key characteristic of Crypto Native at this stage was age and career path—specifically, young people whose first professional exposure was to crypto-related work.

In 2017, the term remained relatively obscure on Twitter. Andrew Spence, in December 2017, framed Crypto-native as pointing toward a new era and a new way of life—where crypto would subtly yet profoundly transform how people live.

Another Twitter user, Ryan Sean Adams, posted in October 2018 suggesting that Crypto Native describes a new mode of corporate operation—one built on contracts and settled via legal systems, succeeding the Legal-native joint-stock company. Instead, it would be built through code and settled on blockchains. Here, Crypto-native leans toward a foundational governance logic: whether rules stem from law or code, and which set of institutional norms drives business operations. When behavioral norms originate from code, we arrive at what is now well-known as DAOs (Decentralized Autonomous Organizations).

Beyond literal definitions, Crypto Native also represents a business model. In December 2020, Daniel articulated the concept from two angles—Crypto Native Person and Crypto Native Business:

-

A Crypto Native Person is someone who purchases cryptocurrency before acquiring any other assets (such as stocks or bonds).

-

A Crypto Native Business is a decentralized protocol that supports functionalities currently provided by CeFi or TradFi.

Daniel Chainview was the first to clearly categorize and define Crypto-native—as a collective defined by specific keywords such as “buy,” “asset,” and “decentralized.” Here, Crypto-native Business refers to decentralized alternatives to services offered by TradFi or CeFi.

From 2020 to 2022, DeFi, NFTs, and GameFi surged dramatically, spawning countless projects and injecting excitement into the industry. Crypto had never seen such expansive imagination or sky-high valuations. But hype eventually fades, and speculation fails. When the tide recedes, those left exposed become visible. All Crypto Natives must now reevaluate the fundamentals and intrinsic value of the crypto industry—and return to its original vision.

Related Concepts of Crypto Native

Decentralization

The opposite of centralized or single-point control. Under this philosophy, no central authority performs macro-level regulation. For example, Bitcoin is managed by a decentralized network, making it independent and fearless. It resists control by individuals, corporations, or nations. If one country bans Bitcoin and other cryptocurrencies, another may readily adopt them—to attract blockchain-based entrepreneurs or miners seeking low-cost energy. Even if governments worldwide united to completely ban Bitcoin and related cryptos, as long as individuals retain communication and connections, cryptocurrencies cannot be eradicated.

Trustless Mechanisms

Contrasted with trust assumptions, trusted setups, or trusted parties. The most Crypto Native approach to transactions in the crypto industry relies on trustless mechanisms, offering a fundamentally new product unlike traditional systems. These products provide only basic rules and methods of proof without comprehensive subjective oversight. At its core, the crypto industry enables a rule-based, highly efficient form of global human cooperation—one free of costly trust dependencies. It operates on objective proofs (mathematical or cryptographic), not subjective promises, discarding reliance on formerly trusted entities. A prime example is Fox Tech. As an Ethereum scaling solution using zkRollup, Fox employs the zero-knowledge proof system zkFOAKS, requiring no trusted setup. Through pure cryptography and mathematics, it ensures consistency, completeness, and verifiability—delivering greater security, efficiency, and lower costs.

Permissionless

The opposite of permission-based access. Take Web3 infrastructure and base resources as an example. Its defining feature is a decentralized, barrier-free market. “Permissionless” means anyone can enter this market. This market typically involves two-sided relationships: resource providers and resource consumers. Permissionless implies that anyone can supply resources, and anyone can consume them—a fundamental contrast to Web2. For instance, AWS, a storage provider, imposes barriers on suppliers; only AWS itself can act as the centralized provider. While open to all users on the consumption side (no consumer-side barriers), it is not considered permissionless. In contrast, Arweave, a decentralized storage network, allows free entry for suppliers and is therefore deemed permissionless. Crypto Native holds that regardless of identity or role, anyone should be able to provide and consume resources. Such market structures were rare before Web3—now both supply and demand sides are becoming permissionless.

Individual Sovereignty

Crypto Native strongly emphasizes individual sovereignty—a key distinction between Web3 and Web2, particularly regarding ownership of tokens and data. On traditional Web2 platforms, writing articles, posting, chatting, or commenting results in content that can be reviewed and potentially deleted. In the Web3 era, users truly own their data, which gains resistance to censorship and becomes far less likely to be lost. Why can Web3 establish ownership while Web2 struggles? A crucial technical advancement lies in verifiability at the moment of data creation—enabling true asset and data ownership. The instant content goes on-chain, blockchain generates a verifiable timestamp sequence, establishing ownership consensus. When our posts and content reside on centralized servers—possibly with backups—all are managed by service providers who may issue ownership claims, but ultimate ownership remains entirely with these centralized entities. Contrast this with Mirror, a content platform that mints NFTs on Ethereum and stores content on decentralized networks like Arweave. Even if Mirror shuts down, anyone can retrieve the data, rebuild the platform, and trace, verify, and reclaim ownership of assets and information.

More people than ever are now focused on telling compelling crypto stories, breaking free from the constraints of centralized finance, networks, and society, and building a freer, more equitable world. This wave feels unprecedented in both intensity and reach throughout human history. The deeper aspiration embedded within Crypto Native is the belief that the technologies of the crypto world can solve many deep-rooted problems in the real world. Standing on the grand stage of Web3, the Crypto Native community is putting Decentralized ideals into practice, refining Trustless products, and constructing Permissionless markets—ultimately shaping a society that effectively protects individual sovereignty. This is precisely the light I see shining in the eyes of Crypto Native practitioners.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News