What insights can we gain from analyzing the top 200 DeFi protocols?

TechFlow Selected TechFlow Selected

What insights can we gain from analyzing the top 200 DeFi protocols?

The services most frequently offered by DeFi platforms—decentralized exchanges, liquid staking, yield farming, and lending—are also associated with the highest average total value locked.

Written by: Ren & Heinrich

Compiled by: TechFlow

In this article, I will share insights gained from analyzing the top 200 DeFi projects. This is not an academic study, but the findings are valuable for cryptocurrency investors.

Let’s get started!

Dataset

I used public data from DefiLlama for the analysis. My analysis includes the top 200 DeFi projects ranked by total value locked (TVL) as of the end of October 2022.

Total Value Locked

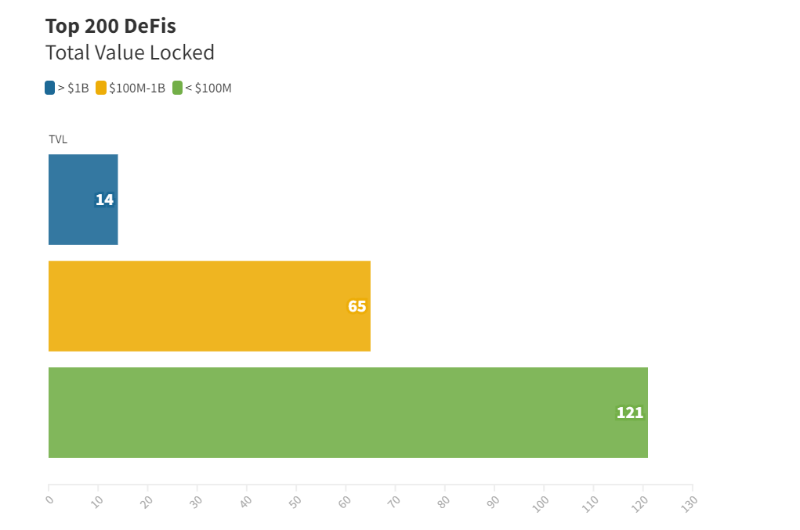

The chart below shows the distribution of total value locked across platforms.

Fourteen platforms have a TVL exceeding $1 billion. Sixty-five platforms fall between $100 million and $1 billion. The remaining 121 platforms have a TVL below $100 million, with the lowest at $23 million.

TVL distribution follows a Pareto pattern. The top 40 (20%) DeFi protocols on this list account for 80% of all TVL.

Supported Blockchains

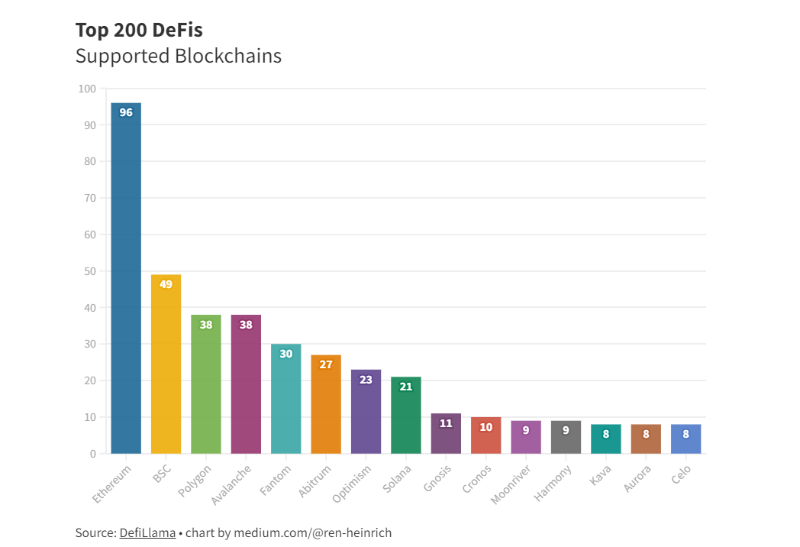

When it comes to DeFi, Ethereum is undoubtedly the leader. Ninety-six of the projects analyzed operate either exclusively or partially on Ethereum.

BSC, Polygon, and Avalanche follow at a distance.

Five platforms operate across more than 10 different blockchains. Thirty-six use between 2 and 10 blockchains. The remaining 159 operate on just one blockchain.

DeFi Use Cases

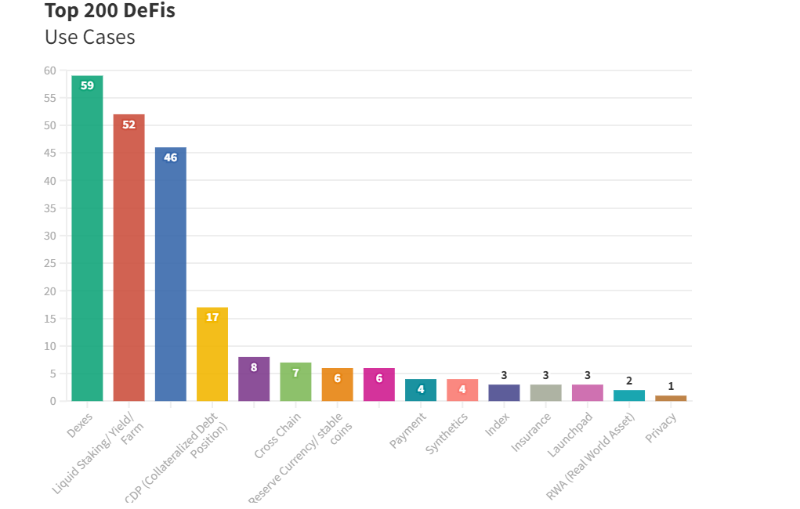

The chart below illustrates the most common use cases among the platforms examined. DEXs, liquid staking, yield farming, and lending are the most prevalent features across DeFi platforms.

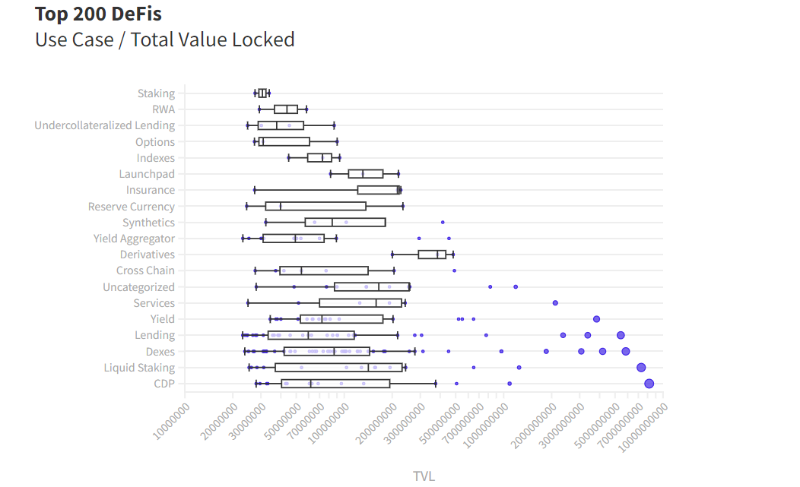

Which of these use cases involves the most funds? The chart below clarifies this. "Collateralized debt positions, liquid staking, indices, and lending" are associated with the highest TVL.

DeFi Market

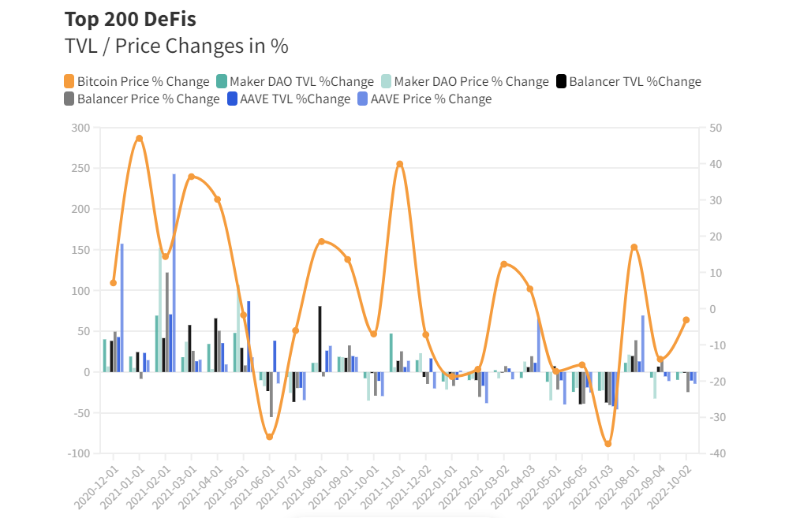

I compared three high-TVL platforms (Maker DAO, Balancer, AAVE), showing the monthly percentage changes in TVL and platform token prices. The lines represent the monthly percentage change in Bitcoin's price.

Notably, each platform exhibits similar market trends.

This is likely because most funds deposited into various DeFi products are cryptocurrencies. Since individual tokens are highly correlated with Bitcoin’s movements, it's no surprise that platform trends appear aligned.

Summary

This analysis shows that the services most frequently offered by DeFi platforms—decentralized exchanges, liquid staking, yield farming, and lending—are also associated with the highest average TVL.

While some projects operate on only one or two public blockchains, others exist across 15 or even 20 chains.

However, the analysis indicates that the number of blockchains a project operates on has no relation to its success. It is difficult to conclude whether certain use cases are on the rise. Generally, the overall DeFi market is heavily influenced by Bitcoin's price.

Moreover, there are indications that TVL appears to be a strong indicator of a DeFi platform’s success and quality. Platforms with higher TVL tend to perform better in terms of price, meaning they are on average better investments over time—either appreciating more or losing less value compared to lower-TVL DeFi projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News