One-Stop Guide to StarkNet's Perpetual DEX RabbitX: Fast, Low-Cost, and Orderly Liquidation Mechanism

TechFlow Selected TechFlow Selected

One-Stop Guide to StarkNet's Perpetual DEX RabbitX: Fast, Low-Cost, and Orderly Liquidation Mechanism

RabbitX, the hottest new perpetuals exchange, is coming soon to StarkNet.

Written by: 0xbread, TechFlow

Finding protocols with 10x/50x/100x potential isn't easy—especially in a bear market where low market cap doesn't guarantee survival into the next bull cycle.

Yet this hasn't stopped hot narratives from emerging. RabbitX, currently the most talked-about perpetual exchange, is about to arrive on StarkNet.

Now, let's start from the beginning and understand the RabbitX protocol.

RabbitX is a permissionless perpetual exchange built on Starknet. With RabbitX, you can trade using an order book and access up to 20x leverage.

Built using low-latency ZK-STARK technology, RabbitX offers users extremely fast confirmation speeds, zero gas fees, and full security inheritance from Ethereum L1.

Combined with these three advantages and 24/7 access to cryptocurrency markets, RabbitX is truly a DeFi product. Instant experience, high security, and zero gas fees make it highly appealing to users—and more accessible even to blockchain newcomers.

RabbitX’s Vision

DeFi user experience and technology still need improvement—DeFi trading remains slow and expensive: if it's fast, it sacrifices stability like Solana does. The RabbitX team believes DeFi shouldn’t require such trade-offs—speed and security are equally important.

The team aims to build a solution that accelerates the DeFi revolution—preserving DeFi’s permissionless, open-access nature while delivering speed and security comparable to traditional finance. That’s how RabbitX was born.

RabbitX changes people’s relationship with financial markets by providing financial freedom and accessibility to everyone seeking financial independence.

True to DeFi’s mission, RabbitX provides open access to global financial markets for everyone. Now, it’s time to dive down the rabbit hole.

Liquidations

Since it's a perpetual exchange, liquidation is an unavoidable topic. Let’s take a look at the solution RabbitX offers.

RabbitX’s risk management engine is based on rigorous research and testing, designed to ensure fair and orderly liquidations. RabbitX’s cutting-edge risk model protects both traders and the exchange.

RabbitX’s margin requirements are: liquidation margin—2%, maintenance margin—3%.

Based on these figures, RabbitX has established a 3-step waterfall structure to manage liquidations:

Waterfall 1:

When an account’s equity falls below the maintenance margin requirement, it undergoes partial liquidation until the account’s equity rises back above the maintenance margin level.

During liquidation, users cannot place new orders, cancel existing orders, or withdraw funds. Once the account’s net value recovers above the maintenance margin threshold, it exits liquidation status.

Waterfall 2:

If an account’s equity drops below the liquidation margin, the position will be forcibly closed at zero price (setting the account equity to zero).

If RabbitX can liquidate the position at a price better than zero, the surplus goes into the insurance fund. If RabbitX cannot liquidate the position at a price better than zero, the loss is covered by the insurance fund.

Waterfall 3:

If the RabbitX insurance fund balance drops below zero, opposite positions will be automatically reduced at the insurance fund’s zero-price point. Auto-deleveraging only occurs as the final step when the insurance fund’s net value is negative.

RabbitX takes all possible measures to avoid auto-deleveraging, including implementing algorithms to minimize its impact.

Insurance Fund

RabbitX uses an insurance fund to prevent auto-deleveraging of trader positions. This fund acts as a buffer for liquidation orders before the auto-deleveraging system takes over.

As previously mentioned, if a position is liquidated at a price better than zero, the fund grows; if liquidated at a worse price, the fund is depleted.

Fees and Rates

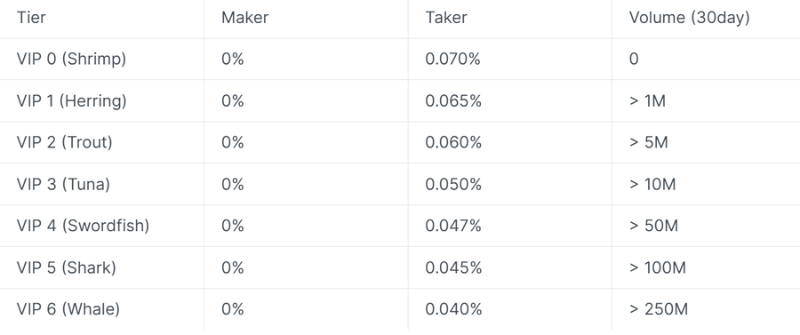

RabbitX’s fee structure has unique features. Trading fees vary by tier, ranked according to 30-day trading volume. RabbitX classifies traders from Shrimp to Whale, but Makers receive 0 fees regardless of tier.

RabbitX calculates hourly funding rates using an index price designed to track the underlying spot market. This index price is computed as the median of market prices across multiple exchanges (both CEXs and DEXs).

When the perpetual contract trades above the spot index price over a 1-hour TWAP, the funding rate is positive, so longs pay shorts (and vice versa).

Users only pay/receive funding if they hold a position at the time of funding (at the beginning of each hour). To prevent market manipulation, RabbitX sets an absolute cap on funding rates at 1% per hour and commits to charging no fees on funding payments.

Funding Background

RabbitX operates under Strips Finance. In mid-2021, Strips Finance raised $2.5 million in a seed round led by Crypto.com Capital, Finlink Capital, and Mechanism Capital. By the end of 2021, it raised another $8.5 million, led by Multicoin Capital, with participation from Sequoia Capital India, Fabric Ventures, Morningstar Capital, and others.

Conclusion

RabbitX is a perpetual exchange built on Starknet, and launching on Starknet may give it a first-mover advantage.

RabbitX’s features—speed, security, and low cost—are highly attractive to traders.

Moreover, the team behind RabbitX inspires confidence among potential investors, and the funding they’ve secured supports development and expansion even during this bear market. For now, the best move is to stay tuned and patiently await the public testnet launch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News