Bloodsucking, Migration, and the Capital Game: The Story Behind the Move Blockchain Craze

TechFlow Selected TechFlow Selected

Bloodsucking, Migration, and the Capital Game: The Story Behind the Move Blockchain Craze

The Future of Web3 or Another Capital Game?

Produced by: TechFlow & Aptos World

Author: Julian

Editor: Mall

"This Aptos Builder community had nearly 200 members before anyone started talking. Everyone was familiar with each other from the Solana ecosystem — we all silently understood not to speak up until more newcomers joined and the group finally became active." Tom, founder of a top-five TVL project in the Solana ecosystem, told TechFlow.

The Aptos builder community Tom refers to was initiated in June this year by Ian Macalinao, co-founder of Saber Labs — a stable asset trading protocol on Solana — and an early Solana developer. In July, he and another Solana developer, Dylan, announced the launch of Protagonist, a $100 million fund dedicated to investing in the Aptos ecosystem.

Ian Macalinao personally invited over a hundred established projects and developers from the Solana ecosystem into the Aptos Builder community via direct messages. Today, the group has grown to over 800 members. However, this Solana-centric Aptos community didn't attract much attention at first.

It wasn’t until July, when Aptos announced it had raised $350 million in funding so far this year, followed closely by Sui — the other "twin" Move-based chain — announcing a $300 million Series B round, that people began to notice something striking: not only did Aptos and Sui share largely the same investors as Solana, but also significant overlap among their projects, developers, and even team members.

Compared to Solana’s “full-scale migration” enabled by its Rust support, Polkadot — another major Rust-supported blockchain — is quietly undergoing similar shifts. Like Solana, many existing Polkadot projects are now simultaneously developing for both Aptos and Sui ecosystems.

Regarding the surging interest in Move-based chains like Sui and Aptos, TechFlow and AptosWorld interviewed over 20 venture capital firms, project teams, and developers across China and the U.S. to uncover the story behind the hype.

What Does Leaving Solana Mean?

"Execution layer challenges are far greater than consensus. Consensus is 'relatively simple.' We don't see Avalanche or BNB Chain as Solana's main competitors — we see Aptos and Mysten."

In July, during an online meeting hosted by Dragonfly partner Haseeb, Solana co-founder Anatoly Yakovenko made this statement.

Indeed, Aptos’ first move in challenging Solana has been to poach talent and projects.

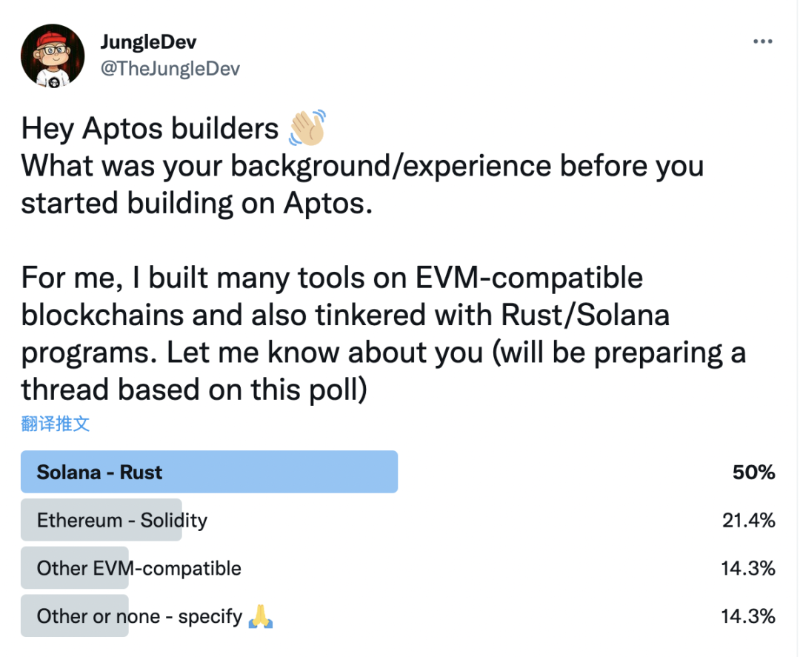

Beyond Ian Macalinao’s $100 million ecosystem fund driving large-scale migration from Solana to Aptos, one Aptos developer even conducted a poll asking, “What was your background/experience before building on Aptos?” Half of respondents identified as former Solana ecosystem developers.

After speaking with numerous Solana-based project teams, we found that migrating or deploying multi-chain on Move-based chains has almost become a consensus within the Solana ecosystem.

From the perspective of these teams, regardless of whether Move chains will ultimately surpass Rust or EVM/Solidity chains, migrating or deploying multi-chain on Move chains is essentially a bet on themselves — a way to “go long” on their own potential.

As one of the few hotspots during this bear market, if Move chains succeed, migrating projects can continue raising funds and telling narratives in both primary and secondary markets. Even if the Move ecosystem underperforms or progresses slowly, the cost for projects is limited to a few months of development effort — a small price to pay in a bear market. But if successful, they gain access to a new wave of wealth opportunities.

Ian Macalinao echoed this sentiment, stating that “leaving” is too strong a word. Most skilled developers lose nothing by spending time in the Move ecosystem, especially since the current market is extremely tough for projects without product-market fit (PMF).

For example, Dialect — a Web3 smart messaging platform built on Solana — announced a $4.1 million seed round in March led by Multicoin Capital and Jump Crypto.

Although Dialect shares key investors with Aptos — suggesting possible capital-driven incentives behind the deployment — Dialect officially explained its choice of Aptos as follows:

Solana's unique architecture enables blazing-fast speeds and ultra-low costs, but the future is multi-chain. If Dialect isolates itself on any single network, it cannot deliver the best service to users.

We will continue supporting Solana developers with our tools, while eagerly collaborating with Aptos developers to explore the incredible things they're building.

On the other hand, controversy around the Aptos ecosystem is growing. With investor overlap between Aptos and core Solana backers, and many projects originating from Solana, questions arise: Are VCs who profited heavily from Solana now orchestrating another Solana clone?

Perhaps due to pressure from losing ecosystem projects, according to information on the Solana Foundation’s GitHub page, the team has included the Move language in its development roadmap.

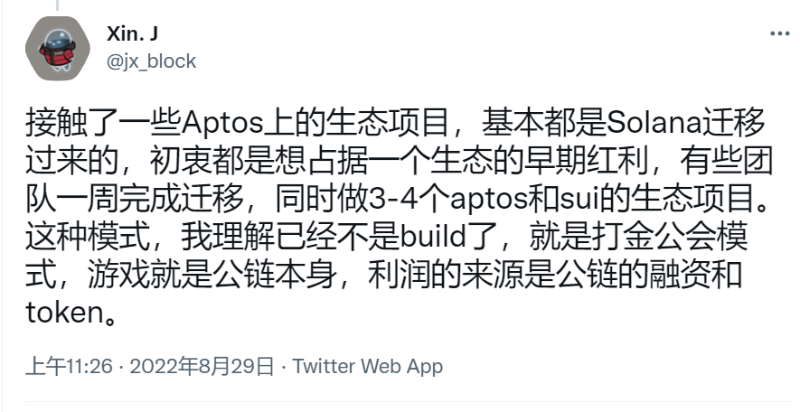

Notably, preliminary statistics from TechFlow and AptosWorld show that nearly every DeFi category in the Aptos ecosystem is dominated by Solana-native DeFi projects. From DEXs, NFTs, lending, derivatives, to cross-chain bridges, each sub-sector already has two or three mature Solana-based projects actively developing Move versions. This means competition has begun even before these migrated or multi-chain projects launch.

Yet, many industry participants argue such “bubble-like phenomena” are inevitable in the early stages of most major blockchains.

An influx of mixed-quality or trend-chasing projects occurs initially, followed by market filtering to identify the strongest ones — a necessary path for any thriving blockchain ecosystem. Moreover, developer mobility across open-source communities is entirely normal.

Allen Ding, Partner at Nothing Research, noted that developers from other ecosystems can rapidly enrich the Move ecosystem. An initial focus on forks and migration projects isn't problematic. Core applications like DEXs, lending, and stablecoins in DeFi have already reached maturity and standardization. For new blockchains, filling out the ecosystem quickly matters more than pursuing application-layer innovation. In today’s DeFi 2.0 era, composability — building higher-level applications atop foundational ones — is what truly matters.

Lessons from Polkadot Project Migrations

Besides Solana projects eyeing the rewards of Move chains, another force is watching closely — Polkadot.

Among the few public partnerships listed by Aptos is Pontem Network, which received a grant from the Polkadot Web3 Foundation in late 2020. After announcing cooperation with Aptos in April, Pontem stated its test incentive tokens would be issued on Aptos.

Beyond Pontem, we learned that many Polkadot-based projects are now simultaneously developing for both Aptos and Sui ecosystems.

In early September, a Polkadot-based project held a Move developer conference in Hangzhou and invited Sam Blackshear — creator of the Move language and CTO/co-founder of Sui — to deliver a video keynote.

At the event, multiple Polkadot projects presented their upcoming products and plans for deployment on Aptos and Sui, with some teams already having deployed over five products in the Move ecosystem.

Like Solana, Polkadot was one of the biggest value-capturers during the last bull cycle. Its ecosystem offers valuable lessons, especially regarding how projects can maximize returns during a new chain’s infancy when infrastructure remains incomplete.

On capturing and monetizing blockchain value, Max, founder of Dharma Protocol and originator of the DeFi concept, posed an interesting question back in 2019: "Projects burn money daily through fundraising for development and operations. If Ethereum remains so congested, expensive, and inaccessible, should we really wait three to five years to build on it?"

Today, years later, multiple answers have emerged. While Ethereum 2.0 remains incomplete, chains like Solana, Polygon, and BSC have completed full cycles of growth, and various Layer 2 solutions have developed sizable ecosystems.

The near-standard playbook from Polkadot ecosystem projects is: during a new chain’s early days, aggressively pursue official grants for credibility and fundraising; when infrastructure is still immature, deploy mirrored versions on established chains and launch tokens early to capitalize on hype; once infrastructure improves, extend narrative longevity via parachains, parathreads, or crowdloans.

Take official grants — Polkadot’s Web3 Foundation grants were crucial for most Polkadot projects, particularly for branding, fundraising, and ecosystem collaboration. Now, many teams migrating or deploying multi-chain on Move chains are actively applying for Aptos and Sui grants. So high is demand that Aptos temporarily paused its grant application portal.

One project offering DID solutions and an Elixir SDK said it previously won awards in hackathons sponsored by multiple blockchains. Recently, it made it onto Aptos’ second batch of grant recipients (note: the list is still under review and not officially released), and final confirmation is underway.

Thus, even with numerous projects in Aptos, those failing to secure official grants or backing from top-tier VCs risk becoming mere “scams” or “shitcoins” in the Move ecosystem.

In response to the prevalence of projects “straddling two chains,” some blockchain foundations have started implementing countermeasures.

An anonymous DeFi project founder shared that while they received a Web3 Foundation grant, the foundation did not immediately announce their approval or disburse funds in full. Instead, funding is released in tranches based on development progress — preventing teams from using the “grant endorsement” to jump to another chain and repeat the process. Currently, they develop in Rust during the day and study Move at night for testing and development on Aptos.

Regardless, projects vote with code, and moving toward the Move ecosystem has become an unstoppable trend.

"The Move ecosystem could even give projects that failed to gain traction on Polkadot or other chains a chance to rise again."

Allen Ding emphasized that in the current bear market, capital tends to cluster. Aptos and Sui represent the best available options. Developers naturally gravitate toward places with users and capital. It’s not just Solana and Polkadot projects — developers from other chains are also paying close attention to Move’s evolution, and many are joining in.

Chinese Presence in the Move Ecosystem

Looking back at the history of Layer 1 development, Chinese capital has played a pivotal role.

Whether it’s early networks like Ethereum, BTS, EOS, or later stars like Polkadot, Cosmos, NEAR, Filecoin, Flow, Dfinity (Internet Computer), or Solana, nearly all featured deep involvement from Chinese crypto VCs. These investors often actively supported ecosystem building — for instance, DFG backing Polkadot, Distributed Global supporting Filecoin and Flow, SNZ supporting ICP. Even if financial returns from ecosystem investments weren’t high, they profited handsomely from their positions in the L1s themselves.

However, in the case of Aptos and Sui, Chinese VCs have been relatively absent, leading to weaker investment enthusiasm. In contrast, Chinese developers have shown greater initiative.

From the investor lineup, Aptos and Sui are primarily backed by U.S.-based crypto heavyweights like a16z, FTX Ventures, and Jump Crypto. Additionally, sky-high valuations deter many investors — for example, Aptos’ earliest valuation was already $1 billion, with a latest equity valuation of $2.8 billion and a token FDV reaching $4.2 billion.

While some domestic individuals and institutions have participated via SPVs, most remain casual participants. Currently, among Chinese-backed VCs, only Bixin Ventures and A&T have publicly committed to investing in and supporting the MOVE ecosystem.

Bixin Ventures invested in both Aptos and Sui. Partner Wangxi told TechFlow that Bixin began researching the Move language very early and started supporting Starcoin in 2019 to understand and foster Move’s development — a key factor linking them to Aptos and Sui.

"Because we’re familiar with the Move ecosystem and the Libra (later renamed Diem) framework, we believe the Aptos and Sui teams will become challengers to the current blockchain status quo."

Wangxi added that the innovation of Aptos and Sui extends beyond technology. As projects carrying immense market expectations and backed by elite capital, their innovation is holistic — a major reason for Bixin’s involvement. Bixin is also willing to support outstanding projects migrating to Aptos and Sui.

Jolestar, core developer of Starcoin, noted that after Libra launched in June 2019, they began experimenting with Move — including testing a layered state channel solution where contracts executed within the channel, proving Move’s feasibility for hierarchical smart contracts. In early 2020, they began designing Starcoin, a Move-based blockchain. The mainnet launched in June 2021, making Starcoin the first Move chain. At the time, no one had experience building DeFi apps on Move, so the team worked closely with ecosystem projects to explore Move’s applications in Swap, StableCoin, NFT Market, CrossChain Bridge, etc. Development tools and documentation were initially inadequate, but after a year of effort, documentation, testing tools, and developer experience have greatly improved.

As one of China’s earliest Move developers, Jolestar believes Move has the greatest potential to build an ecosystem rivaling — or even surpassing — Solidity:

Move’s contract dependency and calling mechanisms enable maximum module reuse, making it ideal for layer-by-layer construction of smart contract infrastructure. Move’s “free state” model allows digital assets to flow across contracts, enabling type-based composability. Thanks to these two features, Move can unlock greater value in layer-2 scaling solutions — enabling cross-layer contract reuse, composition, and arbitrary state transfers. Originally designed for Libra, Move has evolved into an open-source community project, supporting multi-chain designs and adoption by more infrastructure projects, paving the way for a larger ecosystem.

In short, Starcoin helped cultivate and educate China’s earliest Move developers, and the Asia-Pacific region remains one of the most active hubs for Move development.

When Mysten Labs, SUI’s developer, closed its latest $300 million funding round, it announced the capital would be used to invest in the Sui ecosystem and expand further into the Asia-Pacific region.

Will Move-Based Chains Kill Other Blockchains?

Controversy has surrounded Move-based chains since their first funding announcements.

Some view it clearly as a “capital game”: playing the same game twice, without hiding it, starting at such high valuations that even speculative opportunities are limited.

Yet others in the industry welcome it, especially seeing a new language like Move potentially bringing meaningful change.

"Aptos and Sui seem to possess nearly every trait of a top-tier project: royal lineage, star-studded teams, the public chain赛道, a blockchain-friendly Move language, technical innovations, developer momentum, and Tier-0 investor backing."

Allen Ding believes Aptos and Sui signal the arrival of a new public chain era. Previous Layer1s mainly captured overflow value from Ethereum, lacking standout vertical use cases or technological breakthroughs. In contrast, Aptos and Sui are crafting narratives that break free from Ethereum — clear use cases built outside the EVM/Solidity framework. This could define the next generation of public chain storytelling.

We’re still frequently asked: "Why create another Layer 1?"

With so many Layer 1 blockchains already in existence, is this just capital reinventing the wheel? Should blockchain aim for consolidation rather than fragmentation? Is it worth rebuilding entire ecosystems just because Move might be better than Solidity or other languages?

Another common comparison: from day one, developers have drawn parallels between Move and Rust, Aptos and Solana, even dubbing Aptos/Sui the “Solana killers,” just as Solana once claimed to be the “Ethereum killer.”

To answer these questions, consider Binance CEO CZ’s response about BSC vs. Ethereum: the user bases differ. After BSC launched, Ethereum transaction volume didn’t drop — but it stopped growing, hitting its technical ceiling of 15–20 TPS. Meanwhile, BSC provided a cheaper network for underserved regions like Southeast Asia, India, and Africa, enabling broader blockchain adoption.

Bixin Ventures’ Wangxi adds that one of the most common criticisms of Web3 is the lack of a “killer app.” Blockchain performance bottlenecks are likely the main culprit. Aptos and SUI aim to break through this limitation. Aptos aims for 160,000 TPS, SUI around 120,000 TPS, both achieving sub-second finality.

Aptos and SUI challenge traditional blockchain scalability paradigms, introducing novel approaches like modularity and parallel execution. Despite slight differences in technical approach, both focus on building secure, scalable, and upgradeable blockchain systems for Web3 — enabling developers to easily build consumer-grade applications and infrastructures capable of serving billions, delivering decentralized, fast, and affordable user experiences.

Therefore, as Aptos World sees it, this isn’t merely reinventing the wheel to create another Layer 1. Just as Solana isn’t “the next Ethereum” nor its killer, but created an entirely new market, the same applies to today’s so-called “chain killers” — Aptos and Sui. They won’t kill existing chains, but they will serve markets those chains currently don’t.

Of course, for most people, whether Aptos and Sui can truly succeed in enabling mass Web3 adoption may not matter. To them, Move chains represent a new narrative — a fresh opportunity for investment and speculation that must not be missed.

"Whether Aptos and Sui are bubbles, whether they stay hot — none of that matters. As long as they burn bright for a while and don’t fizzle out too quickly, that’s enough," said one investor currently incubating a Move-based project.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News