Service sector segmentation: Which L1 and L2 projects are worth watching?

TechFlow Selected TechFlow Selected

Service sector segmentation: Which L1 and L2 projects are worth watching?

This article will explore public blockchains in the service-specific niche赛道, introducing some recent high-progress projects in this space, including Layer1, Layer2 blockchains, and application-specific chains.

Published by: LD Capital Research

Author: Noise Zhou

Preface

Rewind to 2020. With the arrival of a bull market, increasing on-chain Web3 users, and the emergence of Uniswap, Opensea, and more DeFi- and NFT-related DApps, public blockchains like Ethereum began to buckle under pressure. Soaring gas fees, network congestion, and rampant MEV (Maximal Extractable Value) bots severely degraded the user experience for Web3.

At this time, some unconventional blockchains or infrastructure projects took alternative paths, attempting to break through the limitations faced by Ethereum and other general-purpose chains, carving out their own unique identities.

For example, Terra focused on algorithmic stablecoins, FLOW on NFTs, Cosmos and Polkadot on multi-chain and cross-chain interoperability, Avalanche through its innovative three-layer X, P, C network architecture, and NEAR via sharding for higher speed. These blockchains challenged the blockchain trilemma—seeking better scalability and security, greater decentralization, or improved user experiences by focusing on specific technical challenges.

By 2022, with technological advancements such as Layer2, zkEVM, MOVE language, sidechains, and application-specific chains, specialized blockchain projects have begun exploring new research directions and innovations.

Specialization Drives Change

Blockchains are broadly categorized into public blockchains (public chains), consortium blockchains, and private blockchains. Among them, Ethereum leads in both total value locked (TVL) and user count. Beyond Ethereum, other public chains differentiate themselves through distinct positioning and niche features, competing with Ethereum via differentiation.

The previous article discussed innovative architectures such as modular blockchains. This article focuses on service-specific blockchain projects and introduces several fast-moving L1 and L2 chains—including application chains—that target specific niches.

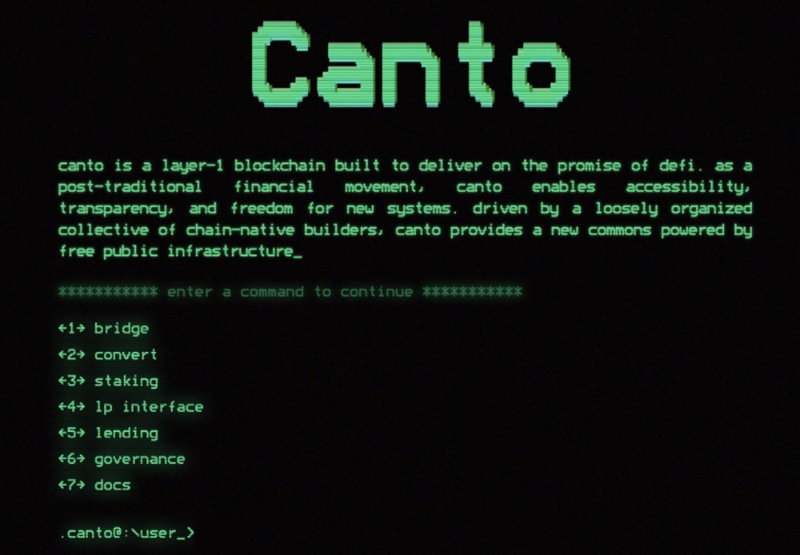

Canto | A Cosmos-Based DeFi Chain

Canto is a Layer1 blockchain whose vision is to make financial systems open, transparent, permissionless, decentralized, and free through DeFi and smart contracts. Initiated by @scott_lew_is (on Twitter), Canto is a community-driven project where any member can freely create resources, channels, and assets as noted in its GitBook. The official website does not disclose team members or funding details.

Data source: Canto.io

After analyzing DeFi’s evolution—from DAI’s launch in late 2017 to the surge of DeFi projects in 2020–2021—the team concluded that the DeFi ecosystem rests on three core components: DEXs, lending markets, and decentralized stablecoins. As ecosystems mature, these projects tend to issue governance tokens.

Thus, Canto proposes a radical idea: DeFi’s core elements should exist as free, permissionless public infrastructure to foster broader ecosystem growth.

As a DeFi-focused chain, Canto officially launched three DApps: Canto DEX, Canto Lending Market (CLM), and the $NOTE token.

Canto DEX

The official DEX uses an automated market maker (AMM) model for asset pricing, similar to most DEXs. To prevent rent-seeking behavior, it will operate permanently without charging fees, cannot be upgraded, remains ungoverned, and will never introduce tokens or additional charges over time.

Canto Lending Market (CLM)

A fork of Compound v2, CLM allows LP tokens from Canto DEX to be used as collateral. While users can deposit LP tokens as collateral, they cannot borrow them. Governance of CLM rests with $CANTO stakers. To promote ecosystem development and user incentives, stakers share aligned interests and thus refrain from extracting rents at the application layer.

$NOTE Token

$NOTE is an over-collateralized token and the core of the Canto blockchain, algorithmically stabilized to $1 USD. Key features include over-collateralization, high capital efficiency, decentralization, and full automation.

The only way to obtain $NOTE is by borrowing it from CLM. Borrowing interest flows into the ecosystem and is managed by the Canto DAO.

Price stability for $NOTE is maintained through algorithmic interest rate adjustments. The contract updates every six hours: if $NOTE trades below $1, deposit rates increase; if above $1, deposit rates decrease.

By deeply focusing on DeFi and offering free, open infrastructure along with a structured algorithmic stablecoin, Canto attracts users and gains traction within the DeFi niche.

Aztec Network | Privacy-Focused zk-Rollup L2

Aztec is Ethereum’s first privacy-preserving zk-rollup, enabling anonymous transactions between accounts using the underlying Plonk proof system, and allowing private interactions with DeFi protocols via Aztec Connect.

Plonk was co-created by Aztec team members Ariel Gabizon and Zac Williamson, representing an innovative zk-SNARK zero-knowledge proof scheme.

Data source: aztec.network

The team believes decentralization must be grounded in individual rights. Without privacy, our ability to live and earn freely is compromised.

Hence, privacy is central to Aztec’s mission, with goals centered on: privacy (via privacy-first zk-rollups and confidential access to Ethereum DApps), usability (lowering interaction costs while preserving privacy), and compliance (privacy programming language supports auditability and regulatory alignment).

Current offerings include zk.money and Aztec Connect. Upcoming is Noir—a Rust-based privacy programming language developed by Aztec Network that enables developers to build secure, privacy-preserving smart contracts on Aztec.

zk.money

zk.money is a Layer2 privacy application built on the Aztec network, using Plonk (zk-SNARK) to ensure anonymity when sending and receiving tokens, without publishing transaction data publicly. Ethereum users can leverage it to protect their transaction privacy. Through Aztec Connect, zk.money already integrates with dApps like Lido, Aave, Curve, Uniswap, and Liquity.

Aztec Connect

Aztec Connect is a suite of privacy tools linking Ethereum DeFi protocols to Aztec, enabling composable private DeFi operations on Ethereum. These tools currently include Bridge Contracts (interfaces connecting Ethereum smart contracts to Aztec) and SDKs (frontend toolkits supporting web-based access to Aztec Connect integrations).

In simple terms, Aztec Connect acts like a bridge—using rollup contracts as proxies—to interact privately between the Aztec network and Ethereum DApps, while saving users gas fees.

By integrating seamlessly with Ethereum, Aztec eliminates the need for users to switch to a separate privacy chain. It combines Ethereum’s DeFi liquidity with Aztec’s privacy capabilities, effectively addressing key privacy pain points for users.

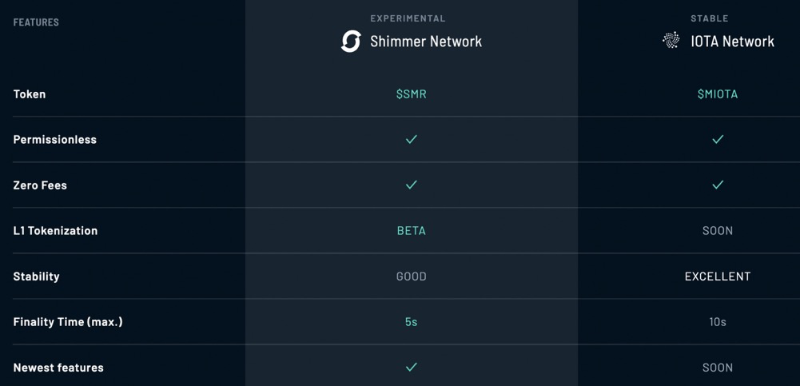

Shimmer | IOTA 2.0's Pioneer Modular Network

Shimmer is a Layer 1 network based on IOTA’s parallelized DAG (Directed Acyclic Graph, known as “Tangle”), enhanced through iterative upgrades and new features such as native tokens, output types, Layer2 support, and increased decentralization. Together with IOTA, it is building a new distributed architecture—scalable, modular, and decentralized—and serves as a testbed to validate cutting-edge technologies before deployment on the IOTA mainnet.

Shimmer adopts the Stardust protocol, an upgrade from IOTA 1.5 (Chrysalis), enabling IOTA to evolve into a multi-asset capable public chain with smart contract functionality.

Stardust serves as the foundational layer for smart contract chains. Compared to earlier IOTA versions, it introduces: customizable tokens, conditional transfers, NFTs capable of storing tokens (acting as wallets), protocol improvements protecting node resources, eliminating client trust assumptions, and enhancing network load balancing.

Data source: shimmer.network

Data Cap / Byte Cost: Since storage is a finite resource for any blockchain, Stardust imposes a data cap per transaction, which scales with the number of tokens included. This ensures fair space allocation, keeps Shimmer lightweight, and prevents uncontrolled block size growth seen in many blockchains. Maximum block size is limited by existing token supply, restricting indefinite data storage in blocks. The required token value tied to a transaction is called "byte cost."

Spam Attack Prevention: Enabled by byte cost, permanent data storage requires locking tokens. Spam attacks that inflate block sizes become economically feasible only if attackers are willing to pay, deterring frivolous data flooding.

Output Unlock Conditions: When transferring custom tokens, users must send a certain amount of native tokens alongside to cover data storage costs.

To address this, Stardust introduces unlock conditions: senders can require recipients to replace the sender’s deposit with their own upon receiving custom tokens, after which the sender’s deposit is automatically refunded. Senders may also impose time limits; if recipients fail to replace the deposit within the timeframe, tokens or NFTs are automatically returned.

Modularity: As the Assembly smart contract framework evolves, various application chains built on top will integrate with IOTA 2.0 and Shimmer as settlement layers, enabling diverse composability.

Shimmer’s relationship with IOTA resembles that of Kusama and Polkadot. Shimmer serves as IOTA’s canary network, where new innovations and technologies are deployed first. Users can experience cutting-edge features ahead of IOTA 2.0, and upcoming modular features like Assembly-built application chains will debut on Shimmer.

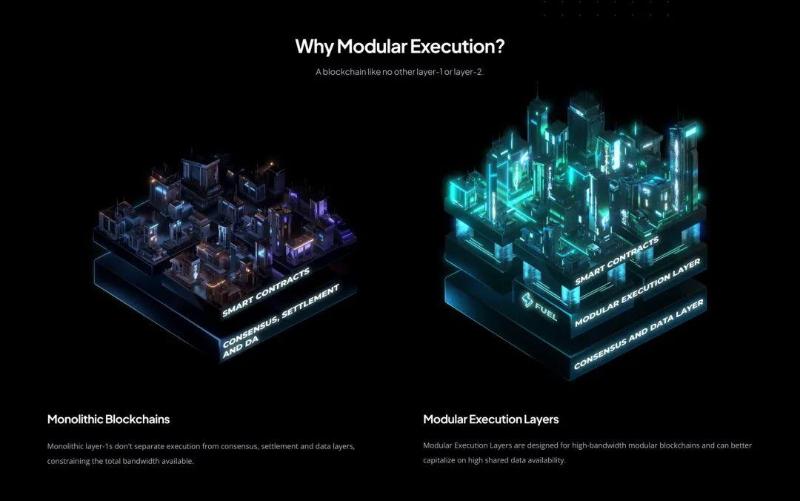

Fuel | High-Speed Modular Execution Layer

Fuel V1 initially launched as an Ethereum Layer2 using Optimistic Rollup at the end of 2020. Today, Fuel has evolved into the V2 plan—a high-speed modular execution layer.

The team believes blockchain architecture is shifting—from tightly coupled consensus, data availability, and execution (like Ethereum)—toward modular designs where execution is decoupled from consensus and data availability (as in future Ethereum or Celestia). This separation enables specialization at the base layer, increasing bandwidth. Fuel’s design leverages this extra capacity. As a modular blockchain execution layer, Fuel offers high security, flexible throughput, and interoperable, Turing-complete smart contracts.

Data source: fuel.network

Parallel Transactions: Using the UTXO model with strict state access lists enables parallel transaction execution, delivering unmatched processing power.

FuelVM: Designed to reduce wasted computation in traditional blockchain VMs while vastly expanding developers’ design possibilities.

Superior Developer Experience: Features Sway and Forc (Fuel Orchestrator), tools developed in-house to improve the developer environment. Sway is a domain-specific language for FuelVM, based on Rust, optimized specifically for the Fuel blockchain.

Fuel has grown steadily since inception, with nearly 50 contributors listed on its website and backing from prominent investors. As a team founded in 2019, Fuel V2 deployment is likely to proceed smoothly. However, long-term ecosystem success depends not only on team execution but also on strong modular foundations, including a reliable consensus layer.

Conclusion

With Ethereum’s Merge approaching and Layer2 solutions maturing, some developers realize that merely copying Ethereum’s monolithic design won’t set them apart.

Instead, teams are targeting niche blockchain markets to win favor among mainstream users, developers, and crypto-native communities.

Today, FLOW continues advancing the NFT ecosystem through youth-oriented and mainstream IPs, while others like Canto, Aztec, Shimmer, and Fuel—mentioned in this article—are building specialized chains focused on modularity, privacy, developer and user experience, NFTs, and Layer2 innovation.

We believe that combinations of specialized service chains with major blockchains like Ethereum will ultimately deliver safer, more private, faster, and life-integrated blockchain experiences for Web3 users, developers, and future mainstream adopters.

Compared to newly launched chains with sky-high valuations even in bear markets, we should not overlook promising niche chains with reasonable valuations—whether currently under development or yet to emerge. The chain that surpasses Ethereum may not be another fork, but rather a truly breakthrough solution that helps mature Web3 into its ideal form.

[References]

[1]https://canto.io

[2]https://docs.canto.io/overview/about-canto

[3]https://canto.mirror.xyz

[4]https://aztec.network

[5]https://medium.com/aztec-protocol

[6]https://shimmer.network

[7]https://blog.shimmer.network/

[8]https://fuel-labs.ghost.io/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News