Understanding Frax Finance AMO: How to Become the "Federal Reserve" in DeFi

TechFlow Selected TechFlow Selected

Understanding Frax Finance AMO: How to Become the "Federal Reserve" in DeFi

DeFi will become the monetary infrastructure layer of the internet, and Frax Finance will be its central bank.

Author: Ishan B

Translation: TechFlow

DeFi will become the monetary infrastructure layer of the internet, and Frax Finance will be its central bank.

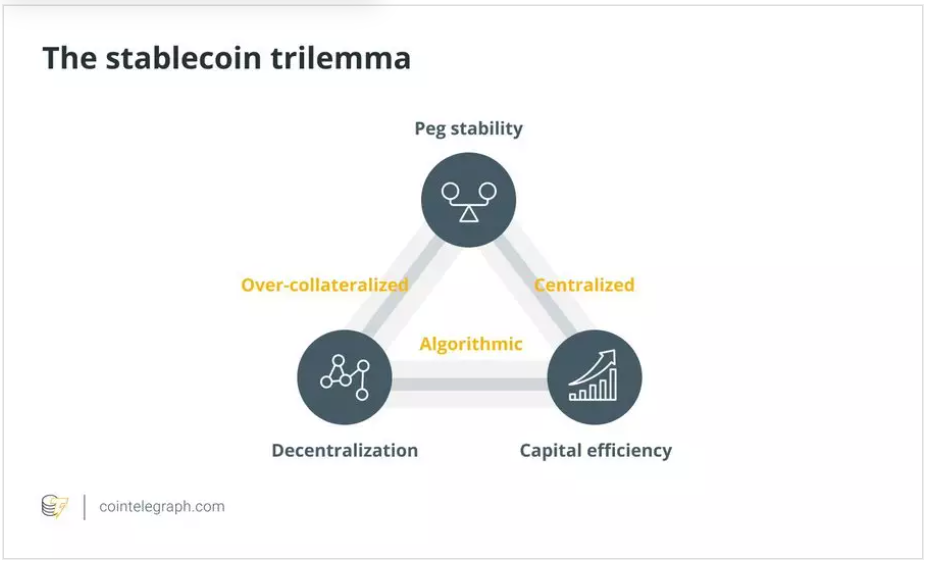

FRAX is a stablecoin launched by Frax Finance that uses collateral and algorithmic mechanisms to maintain its peg to $1. However, this article does not aim to explore the stablecoin mechanism of FRAX, but rather to understand why it will become the central bank of the internet's monetary infrastructure layer.

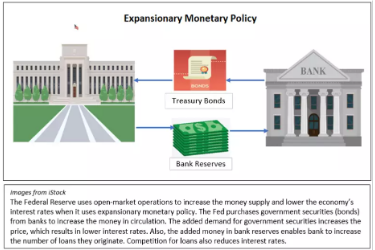

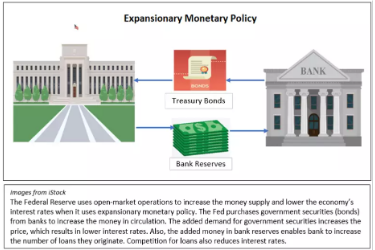

One reason $FRAX can become the central bank of the internet’s monetary infrastructure layer is Automated Market Operations (AMO).

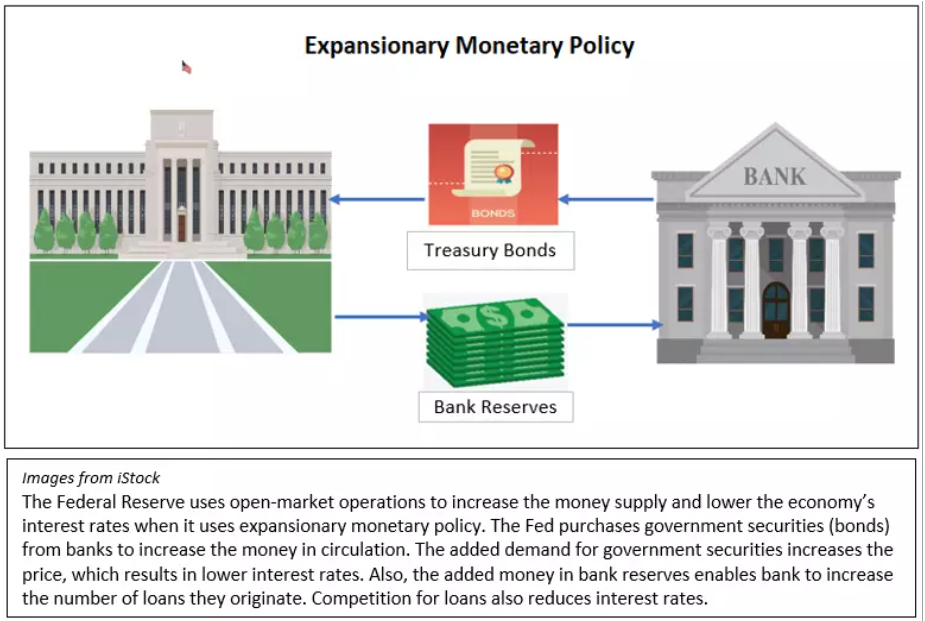

AMO will generate the cash flow needed for FRAX, scale the protocol, and incentivize growth—without inflation or Ponzi-like finance—and its cash flow efficiency could even surpass that of the Federal Reserve.

Unlike pure over-collateralized models ($DAI), in traditional models the debt from minting is held by the owner of the debt position (CDP). In fractional models like $FRAX, the protocol itself holds the debt and must ensure it can redeem against collateral.

This creates greater flexibility for $FRAX expansion. The mechanism allows them to mint additional $FRAX (as long as it remains pegged) to participate in AMO strategies that help scale the protocol.

AMO can:

- Increase the supply of FRAX;

- Reduce borrowing rates in lending markets ($AAVE, $EULER, etc.);

- Create money cheaply to improve capital efficiency;

- Generate revenue for the protocol;

This is essentially what the Federal Reserve does.

Each distinct AMO has four attributes:

- De-collateralization: Also known as lowering the collateral ratio (CR);

- Market operations: Actions that do not change CR / operate at equilibrium;

- Re-collateralization: Increasing CR;

- FXS 1559: Liquidation of AMO proceeds—how much $FXS can be bought and burned, and how much profit is ultimately realized.

Initially, Frax had four AMO strategies:

1. Investor AMO;

2. $CRV AMO;

3. Lending AMO;

4. Liquidity AMO;

1. Investor AMO

The AMO deploys protocol collateral into yield aggregators and money markets such as Yearn.finance, Aave, OlympusDAO, etc. These collaterals have no withdrawal waiting period, so they remain liquid and can be redeemed from FRAX.

2. $CRV AMO

Deploy idle $USDC and newly minted $FRAX into the FRAX3CRV pool. It earns trading fees, management fees, and CRV rewards, while improving FRAX liquidity and strengthening the peg.

3. Lending AMO

Directly inject FRAX into money market pools such as Compound or Aave. Users can borrow against over-collateralized assets instead of going through the standard FRAX minting process (more convenient), and the protocol earns income from interest payments on loans.

4. Liquidity AMO

Combine newly minted FRAX with collateral to provide liquidity on Uniswap V3 and earn transaction fee revenue.

But that's not all—Sam Kazemian and his team are planning to launch four new AMO strategies:

5. FRAX Base Pool

Projects can create pools to easily trade between Frax, USDC, and other tokens—just like the 3CRV pool. If pricing is favorable, projects will pay for FraxBP liquidity.

6. FraxSwap

A competitor to Uniswap’s xy=k AMM, but with added features such as TWAMM for large trades. FraxSwap will help projects better manage their tokenomics by gradually selling or repurchasing governance tokens.

7. Fraxlend

A competitor to FEI/Rari (with lessons learned from their mistakes). Anyone can create a lending market between any ERC-20 tokens (permissionless lending markets), allowing protocols to integrate FRAX and use CreditDAO loans for DAO-customized lending.

8. fxsETH

A competitor to LidoFinance and Rocket Pool in liquid staking. Lido is one of the most cash-flow-positive projects on Ethereum mainnet, and fxsETH will help decentralize the liquid staking market while generating revenue along the way toward more decentralized ETH.

Right now, everyone only talks about sustainable yields—but Frax has eight complete methods to achieve exactly that.

Most importantly, FRAX’s AMO is algorithmic and programmatic—the contract determines how to manipulate the money supply in an open, trustless manner to maintain the peg, thereby freeing monetary policy from politics, human error, and manipulation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News