USDD: A small step in redemption, a giant leap in scenario expansion

TechFlow Selected TechFlow Selected

USDD: A small step in redemption, a giant leap in scenario expansion

This process may be full of controversy, but it is equally meaningful.

Sun Yuchen's stablecoin USDD has recently taken new steps.

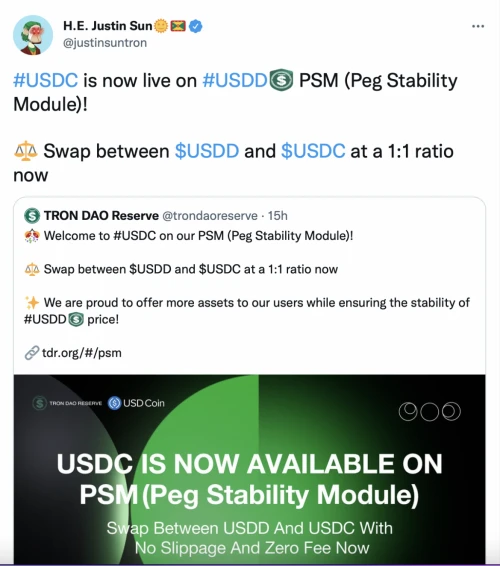

On August 18, Sun announced via social media that the USDD Peg Stability Module (PSM) now supports USDC, allowing users to exchange USDD and USDC at a fixed 1:1 rate (previously supporting USDT), with zero slippage and no fees.

What does this mean for USDD and its users?

Since its inception, amid endless controversy and skepticism, USDD has continuously demonstrated its determination to maintain price stability while systematically expanding its use cases. The recent addition of USDC support on PSM is a perfect example.

Considering many readers may not be familiar with the background, we offer this analysis to help you quickly understand USDD’s latest developments and their potential impact.

Support for Multi-Currency Exchange: Advancing Openness and Stability

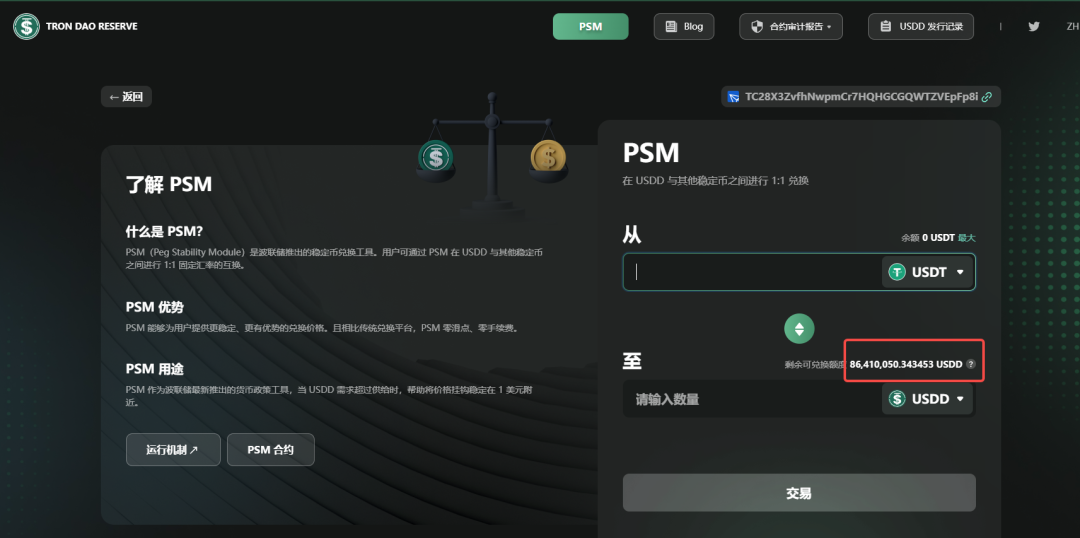

The TRON DAO Reserve (TDR) website has recently been updated.

In addition to previously displayed information on USDD’s collateral reserves and issuance records, it now features the aforementioned PSM (Peg Stability Module)—literally meaning “peg stability module.” In simple terms, think of it as a stablecoin exchange pool:

Holders of USDD can now exchange it for USDC or USDT within the PSM; conversely, holders of USDC/USDT can also convert into USDD at a fixed 1:1 ratio. For users, there are no slippage or fees when swapping—enabling instant, equal-value conversion between USDD and USDC/USDT anytime.

This design resembles token swap functions in DeFi, but the value USDD gains through inter-stablecoin exchange goes far beyond mere swapping.

Indeed, we can observe several key changes from this new functionality.

1. Greater openness: ordinary users can now participate in USDD issuance

In the original USDD design, issuance was fully controlled by the TRON DAO Reserve. Even though USDD operates on a two-way mint-and-burn mechanism based on TRX, regular users had no public channel to mint USDD.

This cautious approach made sense early on—to maintain relative independence from volatile external markets, learning from past failures of other stablecoins during market turbulence.

As USDD’s issuance volume grows and its market expands, gradually enabling user participation reflects a more open philosophy: now users can directly withdraw authorized but unissued USDD via the PSM, effectively increasing USDD’s circulating supply through their market actions.

2. Enhanced security: capped exchange limits and sustained over-collateralization

This openness still operates within defined safety boundaries. As shown below, the total amount of unreleased USDD is approximately $1.2 billion, yet only $86 million is available for exchange within the PSM pool.

This means TDR hasn’t released all unissued USDD into the exchange pool. Instead, only a portion is authorized to the underlying smart contract (Safe Vault), allowing market-driven exchanges. This setup also enables monitoring of market demand and supply dynamics before deciding whether to authorize additional releases.

Balancing prudence with increasing openness, USDD’s model proves more rational than fully delegating minting power to the market.

Moreover, on the security front, TDR consistently maintains an over-collateralization ratio exceeding 300%. USDD is backed by major assets including BTC, ETH, USDT, USDC, and TRX, with full details of collateral holdings and related contracts publicly accessible on the official website. Greater transparency typically equates to higher security—making public the amounts, flows, and real-time changes of collateral assets is already a rare achievement in the industry.

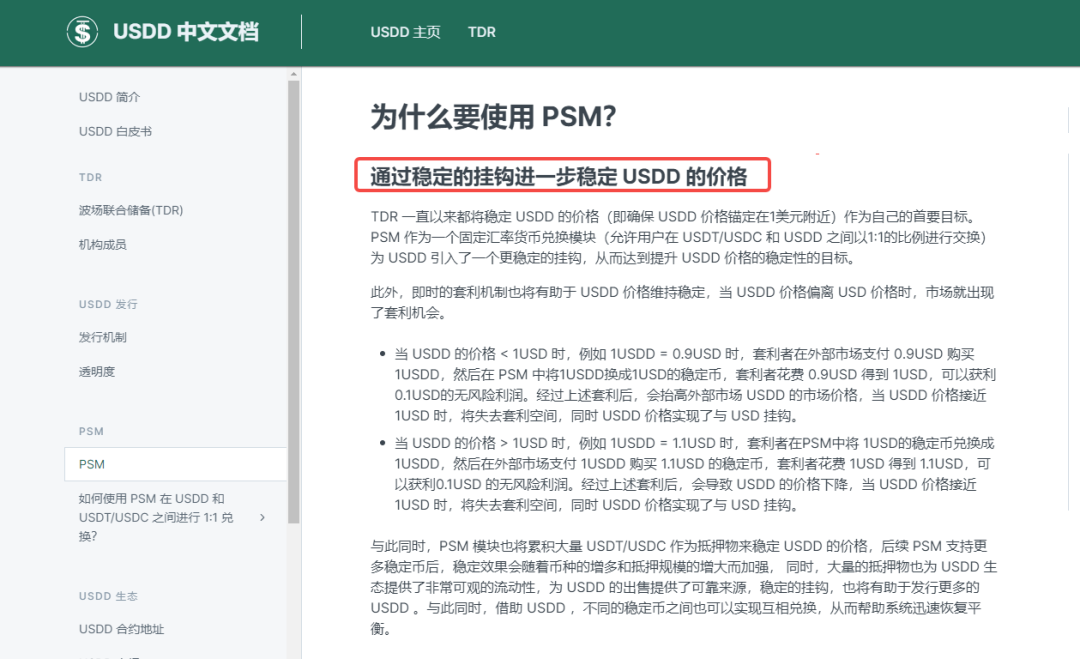

3. Improved stability: leveraging market arbitrage to naturally guide price pegging

Alongside facilitating easy exchange between USDD and other stablecoins, a latent arbitrage mechanism emerges.

When you notice USDD can be exchanged 1:1 with USDC/USDT, any deviation from the peg—say USDD drops to $0.90—creates immediate arbitrage opportunities. Rational market participants will buy USDD at $0.90 externally and redeem it for USDC/USDT via PSM (with zero slippage and fees), earning a risk-free $0.10 profit per unit.

This buying pressure lifts USDD’s price back toward $1.00 until the arbitrage window closes. Conversely, if USDD trades above $1.00, users can mint USDD via PSM and sell it on open markets to capture profits, pushing the price back down.

Through this mechanism, USDD’s price is naturally guided back to its peg by market incentives. This principle is explicitly outlined in USDD’s design documentation. Additionally, since USDC itself is part of USDD’s collateral basket, the exchange mechanism further enhances USDD’s liquidity.

Support for USDC/USDT may just be the first step for USDD. As more stablecoins—or even other asset types—are integrated, USDD’s ecosystem could expand significantly. The ability to connect diverse use cases and scenarios greatly amplifies the value of a stablecoin.

Combining Regulation and Market Forces for a More Rational Stability Mechanism

As noted earlier, exchanging USDD via PSM allows external market forces to influence its supply.

But what happens if stablecoin issuance is entirely left to the market? The collapse of UST serves as a stark lesson. To sustain price stability, market-driven behavior and arbitrage mechanisms must be complemented by active oversight.

For USDD, that oversight comes from the TRON DAO and TRON DAO Reserve (TDR). According to official data, TDR now includes nine institutional members, covering top-tier market makers and OTC trading firms. Pooling their market insights and capital management expertise leads to more rational decision-making than relying on a single entity.

Operationally, USDD issuance uses a multi-signature mechanism requiring consensus from a threshold of members before new tokens are authorized. This ensures two key safeguards:

First, while individual members may misjudge market or liquidity conditions, it’s highly unlikely all members will err simultaneously, so the multi-sig system probabilistically ensures sound issuance decisions.

Second, TDR holds substantial crypto assets as collateral, maintaining a collateral ratio over 3x the outstanding USDD supply (publicly verifiable on-chain). Even under extreme market conditions, TDR has sufficient financial strength to act. Here, having capital truly is a decisive advantage.

These over-collateralization and multi-sig issuance mechanisms serve as built-in passive safeguards, ensuring a floor for USDD’s security. Beyond these, TDR employs more proactive and flexible strategies:

-

Interest Rate Adjustment: Across partnered DeFi protocols, TDR can adjust USDD’s APY based on market conditions. For instance, if USDD dips below $1, raising interest rates can incentivize staking, reducing circulating supply and pushing the price back up.

-

Open Market Operations: By buying or selling USDD and its reserve assets on CEXs/DEXs, TDR flexibly adjusts both the circulating supply of USDD and its own reserve levels according to market needs.

-

Window Guidance: Under extreme conditions, TDR may collaborate with select institutions (e.g., JustLend, CEXs) to control lending volumes of USDD and TRX—or even suspend them—to prevent malicious short attacks.

-

TRX/USDD Two-Way Minting: A foundational feature since launch, TDR adjusts USDD supply based on market demand and sends equivalent TRX to burn contracts. Unlike algorithmic stablecoins, control remains centralized with TDR, preserving some independence from external markets and resilience against extreme volatility.

Overall, USDD adopts a hybrid model combining institutional oversight with market dynamics—maintaining control while implementing flexible issuance policies. While market reactions are often faster than institutional decisions, macro-level interventions remain essential when markets fail. Thus, blending regulation with market forces strengthens USDD’s price-pegging effect.

More Than a Stablecoin: Targeting Broader Application Scenarios

PSM’s support for stablecoin exchange may only mark the beginning of USDD’s journey into broader application scenarios.

Initially tied to TRX and confined within native DeFi platforms, USDD’s early reach seemed limited to its own ecosystem. But now, being able to exchange 1:1 with mainstream stablecoins like USDC marks a shift—not just adding a simple swap function, but signaling USDD’s expansion across Web3.

As established hard currencies in the crypto space, USDC and others have penetrated DeFi, GameFi, social apps, and metaverse projects. If USDD can be freely swapped at par, could it, over time and with growing awareness, become an alternative option for fundraising, marketing, and user incentives across Web3 sectors?

Starting from one exchange function, gradually linking more sectors and projects, USDD’s ambition to become Web3’s new financial infrastructure is now evident. Yet clearly, such ambition requires continued practical execution.

In Web2, such steps are already underway. On August 10, leading international travel platform Travala announced support for TRX and USDD as payment methods—bringing USDD into real-world use cases. With more such partnerships and leveraging Sun Yuchen’s influence, USDD could emerge as a key payment bridge between Web2 and Web3, empowering broader applications.

In terms of scale, TRON has surpassed 100 million users and over 3.7 billion transactions. The circulating supply of stablecoins on TRON has exceeded Ethereum’s USDT volume, ranking first globally. Total on-chain stablecoins and financial assets exceed $55 billion, with cumulative settlement volume reaching $4 trillion.

Given TRON’s significant scale and momentum, USDD and TRON increasingly reinforce each other positively. Leveraging TRON’s ecosystem and influence, USDD can access wider use cases beyond just being a stablecoin. Conversely, USDD’s development strengthens TRON’s cross-ecosystem liquidity, transforming it from a single blockchain into a hub connecting broader Web3 resources, projects, and scenarios—solidifying its potential to lead industry evolution.

With greater scale comes the hope that TRON and USDD will unlock more applications and deliver more stable value.

This journey may be filled with controversy—but equally rich in significance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News