Sun Yuchen live-streams USDD 2.0 analysis, discusses HTX's unique competitive advantages

TechFlow Selected TechFlow Selected

Sun Yuchen live-streams USDD 2.0 analysis, discusses HTX's unique competitive advantages

APY subsidies as high as 20%, fully decentralized USDD is trustworthy.

On February 5, Justin Sun, global advisor of Huobi HTX and founder of TRON, went live on Huobi HTX's Twitter Space, passionately addressing the community under the theme "Can we still trust Brother Sun on USDD?" He delivered an in-depth explanation of USDD 2.0 and answered questions from the community regarding USDD and Huobi HTX. The livestream sparked strong engagement within the crypto community, peaking at over 12,000 concurrent viewers.

Pegged 1:1 to the US dollar, multiple mechanisms make USDD "rock solid"

Official information shows that USDD 2.0 is a decentralized stablecoin project on the TRON blockchain, launched on January 25 this year.

During the livestream, Justin Sun mentioned that although stablecoins like USDT and USDC already exist in the current crypto market, there remains a lack of a truly trustless, censorship-resistant, fully decentralized, non-freezable, secure, and reliable stablecoin—this is precisely why he remains committed to launching USDD.

According to him, USDD 2.0 ensures its 1:1 peg to the US dollar through multiple mechanisms including over-collateralization, liquidation and auction systems, risk management with real-time monitoring, the PSM (Peg Stability Module), and decentralized governance, making USDD "rock solid."

The most critical component among these is the PSM module. The PSM module is the key technology ensuring USDD’s 1:1 peg to the US dollar, allowing users to instantly swap USDD with other stablecoins at a 1:1 ratio with second-level speed, requiring only a small gas fee. This mechanism significantly reduces arbitrage risks and quickly stabilizes price during supply-demand imbalances.

In addition, users who have already minted USDD know that they must over-collateralize with eligible assets (TRX, USDT) to begin minting. Even amid market volatility—thanks to USDT’s stability and TRX’s status as a mainstream public chain token with high liquidity and strong ecosystem support—the overall price fluctuation remains relatively manageable. The collateral value always exceeds the amount of USDD minted, providing ample stability and minimizing risk.

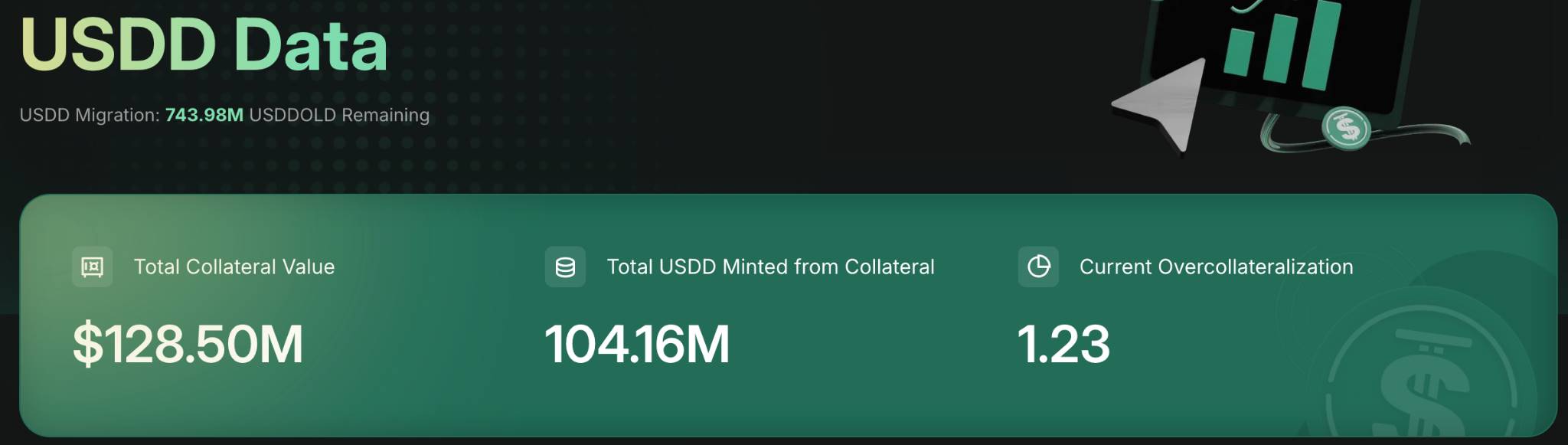

Official data shows that as of 16:30 on February 6, the total collateral for USDD was close to $130 million, with a 1.23x over-collateralization ratio.

Justin Sun emphasized during the livestream, "If you don’t understand USDD, just treat it as a mirror proxy of USDT."

APY subsidies up to 20%, fully decentralized USDD is trustworthy

During the livestream, Justin Sun explained that the ability to exchange USDT 1:1 anytime without limits offers seamless, frictionless, and barrier-free experience. Using USDD on the TRON network is no different from using USDT—except for the higher interest.

How high is the interest? It is reported that the annualized yield for USDD staking in Phase T1 is 20%, funded by subsidies from TRON. Additionally, Huobi Earnings is currently offering limited-time interest rate subsidies for its USDD flexible product, bringing the adjusted APY to 20% as well. After launching this subsidy, the deposit volume for the USDD flexible product on Huobi Earnings increased nearly tenfold week-on-week. This means users can earn a steady 20% yield by depositing USDD directly on Huobi HTX or JustLend DAO. Of course, users may also collateralize USDD to borrow USDT, convert it back to USDD and stake it, or directly borrow USDD to deposit and amplify their returns.

It is reported that the USDD staking address marked as "LendSafeVault", TDrc3zH9wWufmQJyS7QLxBYH8GS27drW5N, has deposited USDD worth $1,380,822.00.

During the livestream, community members expressed particular concern about the safety of the 20% yield subsidy for USDD. Justin Sun responded frankly, "What is the value of a fully decentralized stablecoin on the TRON blockchain? Just consider that it's the only decentralized option available for the 6 billion USDT on TRON, and you’ll understand the value of USDD."

Regarding USDD’s application scenarios, Justin Sun revealed that USDD will initially serve use cases on the TRON network where USDT support is limited. Meanwhile, efforts are underway to strengthen cooperation with centralized exchanges such as Huobi HTX and Poloniex, which may support using USDD-USDT as equivalent margin for futures trading, launch one-click USDD swap functionality, and introduce USDD-based versions of money market funds like Yu'Bi Bao. In addition, collaboration between USDD and RobinHood is also being actively pursued.

Justin Sun also pointed out that it's only a matter of time before the Trump family's crypto project, World Liberty Financial (WLFI), increases its holdings in USDD.

Huobi HTX shows strong momentum, $HTX to be listed on a major regulated exchange

Notably, during the livestream, Justin Sun revealed that $HTX will soon be listed on a major regulated exchange, and further empowerment of $HTX will continue in the future—a competitive advantage unmatched by other centralized exchanges.

Additionally, when discussing Huobi HTX’s development, Justin Sun stated that its listing strategy places strong emphasis on wealth creation effects, with all listing decisions based entirely on independent research and investment analysis by the team. It also places special focus on listing efficiency, which serves as a unique competitive edge for Huobi HTX. Driven by these two factors, Huobi HTX has maintained strong growth over the past two years. Going forward, Huobi HTX and Justin Sun himself will focus heavily on the AI sector and may launch AI-related projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News