SBF on What's Missing in Modern Finance: Blockchain Is Not Hype, Cryptocurrencies Will Transform Payment and Financial Systems

TechFlow Selected TechFlow Selected

SBF on What's Missing in Modern Finance: Blockchain Is Not Hype, Cryptocurrencies Will Transform Payment and Financial Systems

So far, how many fields have undergone a crypto revolution?

Even though an increasing number of institutions have adopted cryptocurrencies in this bull market, skepticism about crypto and blockchain being merely hype has grown louder amid the sharp decline in crypto assets. FTX CEO SBF also shared his views on potential applications of cryptocurrency via Twitter, including payments, market structure, and social media.

FTX CEO Sam Bankman-Fried (hereinafter "SBF") recently shared on Twitter his thoughts regarding potential use cases for cryptocurrencies, including payments, market structure (referring to the architecture of financial trading markets), and social media.

"This thread isn't about investing, so I won't talk about investment-related uses like 'buying tokens might go up' advice. Instead, I'll focus on three areas: a) payments b) market structure c) social media."

Domestic and Cross-Border Payments

SBF pointed out that thanks to internet advancements, payment methods have evolved from cash transactions to credit cards or digital payments. However, he believes transaction fees for everyday payments are still too high. He cited a 1% fee, although data shows that cash-out processing fees for mobile payment providers in Taiwan currently range between 2.2–3%. Of course, service providers often offer corresponding incentives such as point rebates.

If domestic payment fees are just a minor issue, then the challenges with cross-border payments are as obvious as an elephant in the room.

SBF noted that difficulties with international wire transfers are evident—not only are fees high, but the process is also time-consuming:

"Suppose a U.S. company wants to wire $100 million to a European company, choosing traditional bank wire transfer. One day later, your bank executes the transfer, and over the next week, the funds will pass through approximately three intermediary banks. Sometimes, the money gets stuck at one of these banks, requiring special actions to release it.

Oh, and you’ll also pay around 1% in foreign exchange (FX) fees plus roughly $50 in wire transfer fees."

Wire transfers typically incur both “foreign exchange fees” (FX fees) and “wire transfer fees.”

International transfers involve currency conversion. FX fees are additional charges applied when customers purchase non-U.S. dollar currencies through foreign banks, usually amounting to 1%–3% of the transaction value.

Wire transfer fees refer to the processing fees charged for the transfer itself.

Beyond fees, current clearing systems are not real-time.

SBF explained that interbank transfers and credit card settlements can take anywhere from one day to even a month. For example, employees may receive their salaries four days after payroll is issued; landlords might need weeks to cash a tenant’s check.

"I'm citing these examples to illustrate: making payments is hard. There are many reasons behind this, but they all revolve around a core question: What does it actually mean to send money to someone? And what does 'settlement' really mean?"

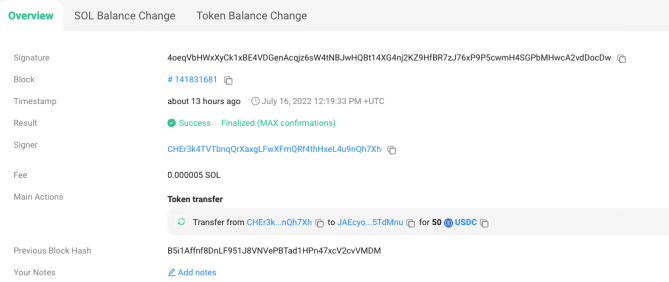

Both domestic and cross-border payments face numerous issues. In contrast, using cryptocurrencies for payments drastically reduces both cost and time. SBF conducted an experiment on the Solana network by creating two addresses and transferring $50—resulting in a transaction fee of just $0.0002.

"Blockchain allows anyone to create wallets to send or receive tokens, including USD stablecoins. These payments settle within seconds, with fees under ten cents. No more long waits, no uncertainty about account balances."

Of course, this doesn’t mean applying blockchain technology to modern electronic payments would solve everything perfectly—but it highlights the immense potential of blockchain for everyday payments.

On-chain data of the transaction

Transforming Financial Product Trading Structures

Another application of blockchain is "changing market structure."

What SBF means is leveraging blockchain-based clearing and "tokenization of securities" to transform the operations of traditional brokers, simplifying the trading process instead of adding unnecessary layers.

Currently, the process for retail investors buying stocks is quite complex.

First, individual investors place orders through platforms like brokerage firms or Robinhood. These orders aren't sent directly to exchanges but are routed to Payment for Order Flow (PFOF) companies ¹, such as Citadel or Virtu.

Some of these PFOF firms may route orders again through Alternative Trading Systems (ATS) ², which then forward the orders to another PFOF firm. Ultimately, though, these orders reach official stock exchanges and settle two days later via DTCC (Depository Trust & Clearing Corporation).

[Note*1]: Payment for Order Flow refers to compensation received by stock brokers from market makers in exchange for routing their clients’ trades to them.

[Note*2]: ATSs can trade listed stocks like exchanges but without bearing full regulatory responsibilities.

Assuming a customer successfully purchases stock, the journey of that stock from the exchange to the broker/platform looks like this:

Nasdaq → Clearing agent of PFOF#2 (DTCC) → ATS → DTCC of PFOF#1 → Broker's DTCC account.

Thus, to buy one share of AAPL, about 10 settlements occur among 11 different entities over several days. Theoretically, each settlement could fail.

The most prominent example was the short squeeze triggered by GME in January last year.

"On January 28, 2021, most securities brokers shut down. Users couldn't buy, and sometimes couldn't even sell stocks. On certain platforms, some users were liquidated despite holding no leverage at all.

This wasn't due to stock shortages or other reasons—it was simply because the system collapsed."

At the time, short-selling institutions heavily shorted GameStop stock (GME). Retail investors seized the opportunity, buying large amounts of spot shares and options, triggering a massive short squeeze and significant losses for institutional players. Multiple brokerage firms urgently suspended trading of the stock.

"On January 28, 2021, retail trading volume surged dramatically, meaning dozens of counterparties needed days to clear billions of dollars in transactions. As GME’s price rose, the potential loss from failed settlements increased accordingly.

Ultimately, this risk became too great for brokers, forcing them to halt trading on certain pairs."

How can cryptocurrencies solve this?

SBF stated that on the FTX exchange, everyone can send orders directly to the exchange. So if securities were tokenized, the cost and time required for stock delivery would be nearly zero.

"Imagine we tokenize securities—stock trades wouldn't need to wait two days for settlement. Instead, you'd simply swap APL tokens for USD tokens on the blockchain. This entire process takes about 10 seconds, costs around $0.002, and eliminates settlement uncertainty and risk."

Applications in Social Media

According to SBF, the biggest problem with current social media is lack of interoperability.

Simply put, if you post something on Twitter, your friend on Facebook cannot see it. In the past, this siloed model worked because different groups lived in separate social circles. But in the Web3 era, where borders are dissolving, the inability to integrate across platforms has become a major drawback.

"Social media networks are isolated and non-interoperable. This forces everyone to manage 10 different social apps simultaneously, fragmenting our conversations with others."

Additionally, today’s social networks exhibit "pseudo-monopolies," where tech giants use massive network effects to crush competitors. Another critical issue is censorship.

SBF suggests that if posts/content were published on the blockchain—say, on a Blockchain-Twitter (BT)—then your friends using Blockchain-Facebook (BF) could also see your post, since BF could automatically pull data from the blockchain.

"By transmitting messages (i.e., posts) through a public blockchain infrastructure, we can unify different social networks. You can use any single platform yet still communicate seamlessly with friends on other platforms. Moreover, you own your content and network—you can migrate your data from Platform A to Platform B whenever needed."

This brings another benefit: enabling genuine competition. Since switching platforms becomes nearly frictionless, platforms must compete—including in how they design their content moderation policies.

SBF mentioned that the potential applications he currently sees center on payments, market structure, and social media. But this doesn't mean blockchain’s uses end here—he believes there are many more areas ripe for innovation, including DeFi and Web3 gaming.

Finally, while there are many promising applications and early impacts, none of these fields have experienced a true crypto revolution yet. So the real challenge lies in practical implementation:

"Take a step back—how many domains have truly undergone a crypto revolution so far? I’d say the answer is 'none yet.'

Crypto technology has begun to make an impact, but it hasn't been comprehensive. So the real question is: how do we move from partial influence to widespread adoption?"

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News