Exclusive Interview with Zee Prime Capital's Founding Partner: Unveiling the Mystery of the Crypto World's "Top Player"

TechFlow Selected TechFlow Selected

Exclusive Interview with Zee Prime Capital's Founding Partner: Unveiling the Mystery of the Crypto World's "Top Player"

The Nansen team analyzed the wallet of one of the top traders in the cryptocurrency space and interviewed the wallet's owner.

Interview and article: Nansen

Translation: Amber

Interviewee: Fiskantes, Founding Partner of Zee Prime Capital

After an early phase where they were modestly labeled as “and others capital” (a common media shorthand in crypto coverage for lesser-known investors omitted from funding announcements), Zee Prime Capital emerged prominently during the latter part of the 2020–2022 crypto market cycle, establishing a comprehensive investment portfolio spanning Layer 1 blockchains, infrastructure, DeFi, and gaming applications.

Zee Prime’s rise has been largely driven by the influence of its founding partner, Fiskantes. This self-described "risk communist" is known on Twitter for his sharp, edgy commentary on markets and society, often sharing remarkably prescient insights. He correctly predicted that high-throughput blockchains would eventually become congested—drawing from a 200-year-old energy consumption paradox—and foresaw the explosive growth of the NFT sector, both of which have been key to Zee Prime's continued success. The firm now manages multiple funds, including Zee Prime II, which recently raised $35 million.

Yet Fiskantes’ journey has not been smooth sailing. Once an obsessive poker player and an unsuccessful cheese trader who nearly went bankrupt, he later rebuilt his finances through real estate investments before achieving significant success in the cryptocurrency space.

During our conversation, we learned that Fiskantes’ vast knowledge stems largely from a lifelong habit of reading and self-education. Zee Prime also owns one of the most well-known Smart Money wallets tracked by Nansen, and according to Fiskantes, mastering your emotions is essential to succeeding in crypto investing.

The following is the full transcript:

Nansen: How did you get started with investing? Did you receive any formal training?

Fiskantes: I remember trying to save as much money as possible during university, taking summer jobs like working security at events. I worked in a warehouse at IKEA. I was also reading books about achieving financial freedom. Studying law became very boring to me—I started feeling I needed to do something else.

I came across trading challenges launched by stock brokers promoting their services on campuses—they’d give you a simulated account with $100,000, and whoever achieved the best returns within a set period would win a prize.

Keep in mind, I’m from a very small town in a very small country, so I had zero prior knowledge of the stock market before this. I just randomly picked some stocks based on luck and ended up doing surprisingly well. At that point, I didn’t truly understand the market yet—but once I realized it could be profitable, I decided I needed to start saving to make real financial investments.

I read a lot about investing back then, including a PR article published by PokerStrategy.com on how to become a professional online poker player and earn money. Later I found out that article was written by Pavel, who’s now one of my business partners—though that’s not the main point here. After reading it, I flew straight to Gibraltar to learn from them, and that’s how I began earning money through professional poker tournaments. After five or six years of playing, I accumulated substantial savings while also investing on the side.

Around 2011, I started studying value investing, which turned out to be quite different from what generated massive returns over the past 12 years in crypto or even equities. At the time, the PokerStrategy.com team launched another project called Tradimo, focused on trading and investment education. I wasn’t deeply involved, but helped build the community in its early days.

They kept talking about Facebook’s IPO and the bright future of tech growth stocks. I was the one pushing for more content around value investing methods, but nobody really cared. Everyone wanted to chase tech stocks—and looking back, that actually turned out to be the better strategy. Tech stocks have vastly outperformed Buffett-style value investing since the bubble burst.

Within the Tradimo team, a guy from the Netherlands bought Bitcoin—that was my first exposure to Bitcoin. He said, "This is something new—we should pay attention, we should write about it." I wasn’t a decision-maker at the platform, but I thought it was stupid. Let’s focus on serious things, right? So after my first encounter with Bitcoin, I ignored it for three years.

It wasn’t until I started playing poker at online rooms that accepted Bitcoin payments that I slowly entered the cryptocurrency world. It was a fascinating evolution—from being a total skeptic skeptical of everything, to meeting hackers from these crypto-anarchist movements. Through conversations with them, my perspective shifted dramatically between 2016 and 2017. To me, cryptocurrency’s value at that time was more about ideological transformation than making money.

Nansen: It sounds like you’ve been learning skills across multiple domains simultaneously. Do you think this helped shape your development? How did all these pieces come together organically?

Fiskantes: Honestly, sometimes I feel anxious simply because I know I don’t have enough time in life to learn everything I want to. When it comes to learning, my preference is extremely broad—I never really specialize in one thing because I can’t afford to spend too much time on just one subject.

Compare that to some of my friends in poker—they dive so deep into the game that they’re almost autistic about it, knowing every possible scenario inside out, but might be clueless in other aspects of life. They could get lost buying a chair at IKEA.

For people like that, when poker stops being profitable, they have few options outside of crypto. Many of them are now in crypto because it’s another fascinating game. But I always wanted to do more. I always wanted to run businesses. I always wanted to step out and try things beyond just playing cards—maybe something more meaningful.

After dropping out of law school, I studied applied psychology for three years because I wanted a degree. Also, it fascinated me—understanding how the human mind works, especially under pressure during poker games, gave me an edge.

So for me, the priority has always been learning as broadly as possible and finding my own path. I believe to gain an advantage, either you need deep expertise—say, in real estate, if you invest in places you know intimately, prices, future developments—or if you lack that, you go into brand-new, uncharted frontiers.

Before diving fully into crypto, I spent considerable time exploring virtual reality (VR), which saw a mini-hype cycle around 2016. But to me, it wasn’t really actionable—just an interesting hobby. I experimented with many things back then, but once I got serious about crypto, I invested almost all my savings—the money I earned from poker and my entire bank balance—into a company that might sound a bit “weird” to you.

This is a story I’ve probably never shared, but it’s super interesting. There was a company in Eastern Europe focused on the cheese market, specializing in aged cheeses like Gouda, aging them for months before exporting for solid profits. To me, it seemed simple: you just need secure storage infrastructure and distribution channels—sell to supermarkets, wine shops, etc.—and profit handsomely.

On paper, the numbers looked great. I invested heavily. I knew the founder, though perhaps not well enough—he had a massive undisclosed debt, and the business essentially collapsed. I lost a lot.

Around 2016, as I grew increasingly interested in crypto—not just using Bitcoin to buy poker chips anymore—I read the Bitcoin whitepaper and began experimenting with crypto trades. Looking back, trying to invest in physical-world businesses, actually building something in the food industry, seems crazy to me now. It’s hard to imagine—it’s incredibly difficult to penetrate industries like food.

The cheese business failed quickly. As I began understanding crypto, I knew it wouldn’t keep growing indefinitely—but navigating this space still felt far easier than operating in the real world.

Nansen: What did you learn from being scammed in the cheese investment?

Fiskantes: The biggest lesson was obviously risk management—even though I’d already learned some lessons earlier, this one hit harder. Another takeaway: there’s a huge gap between ideas and numbers on paper versus actual execution.

I’m convinced that if someone else ran that business—with more resources, better distribution networks, stronger organization—it could’ve made serious money quickly, possibly rivaling some tech ventures. But it all comes down to team and execution. If I’d had more experience dealing with people and evaluating teams, I might’ve spotted red flags earlier. But I didn’t. And that’s very different from investing in stocks or playing poker.

Nansen: Your early experiences seem like the perfect preparation for entering crypto. You studied psychology, gambling strategies, poker psychology, and markets. You entered the crypto space equipped with exactly the skills you'd wish others had.

Fiskantes: In a way, yes, I was far better prepared than some people I know—lawyers or professionals trying to treat crypto as a side hustle. But crypto in its early days was still a wild beast, and I made plenty of mistakes.

Of course, after the cheese business failure, I never made another critical mistake. I’ve never used leverage, nor overcommitted to a single project to the point of getting burned. But I did participate in the ICO boom—some projects looked polished and convincing, but most ultimately failed.

Yes, I’d say I absolutely entered the crypto market with better knowledge than most, even psychologically. I don’t mind volatility. I don’t mind losing money. To me, it’s normal. I don’t obsess over price charts, wondering where Bitcoin is headed next. That’s also an advantage.

Nansen: We’ve talked about early failures and lessons learned. Are there any notable successes worth sharing?

Fiskantes: My value investing strategy in stocks performed okay, but never delivered outsized returns, so I basically abandoned it and moved to passive ETF investing. Even if it did well, I wouldn’t call my stock investments a major success. But one decision was clearly right: buying an apartment in 2014.

At the time, buying that apartment was a huge investment for me—I put down 50% via mortgage. I thought, okay, this might be the biggest financial decision of my life, so I need to take it seriously and pay close attention. Compared to what I own now, the amount isn’t large, but back then, it was a fortune.

I spent a lot of time doing due diligence with the help of a consultant—an independent building inspector hired by homebuyers. Every time I visited a property, I paid him to come along with his tools—measuring wall moisture, checking window insulation, everything—and advising me on fair pricing. He played a crucial role. I looked at over 30 apartments before choosing one that initially looked terrible.

The location was excellent, but the condition was awful. If you were swayed by emotion or appearances, you wouldn’t touch it. But he told me, “This is the best deal we’ve seen so far. I know it looks bad, but reconstruction will be easy, and structurally everything is sound. The location, neighborhood, and price are ideal—you should buy it immediately.” So I did.

I renovated it and sold five years later at a price far exceeding average real estate market returns during that period. The whole process felt rewarding. I thought maybe I could scale this into more real estate investments. But then crypto exploded, and I dropped the idea. Still, this was probably my biggest non-crypto investment win—not just luck, but the result of thorough research and preparation.

Nansen: I noticed in these stories, you often seek direct conversations with experts in the field. When starting poker, you went to Gibraltar. When buying property, you hired a consultant. Do you still do this? Before Zee Prime makes an investment, do you bring in domain experts? How do you conduct due diligence today?

Fiskantes: Crypto is a fast-moving new industry—you don’t really have traditional domain experts. But last year, we started focusing on gaming. Mainly because one of our partners—Pavel, mentioned earlier, the guy from the Gibraltar-based poker company—built a major gaming company covering not just poker but other games too. He’s been a gaming expert for 11 years, understands what makes games fun and profitable, and knows more than most VCs investing in crypto gaming today. It was lucky timing—we successfully brought him on board and leveraged his network to hire more specialists in the field.

We’ve built our own small team now, focused specifically on gaming. Beyond that, we’re hiring smart, young, hungry minds from traditional finance—not necessarily experts, but sharp analysts now digging into DeFi opportunities. Early on, we were more of a diverse group coming together, but as we grow, we’re systematically building dedicated teams focused on each area we invest in.

Maybe we’re lucky—we’re generating strong returns. In the future, we may expand into other areas we believe are essential for advancing human civilization. We might bring in external experts and advisors to support those investments—perhaps more passively, not as hands-on as we are with crypto. But in the next three to seven years, we’re seriously considering it… I don’t want to reveal too much, as it’s still internal brainstorming. But we’re having real discussions. With enough capital, we could help realize dreams that currently seem out of reach. That said, we won’t be experts ourselves, so we’ll likely need outside help and may shift toward more passive investing.

Nansen: You've mentioned this several times in the interview, and I’ve seen you tweet about it—investing with a higher purpose seems to be a driving force for you.

Fiskantes: Yes, flipping coins is fun, and I’ve done my part, especially with NFTs. It’s entertaining, but it’s never been the main driver. After a while, you realize that a bigger yacht or a larger number on your screen won’t make you happier. I don’t know what others do with money, but you can either stop focusing so intensely on your career and investments and shift to other things—like health—or at least define a higher purpose: why are you accumulating these numbers, and what will you use them for?

I try to do both. My partners and I feel a need to give back—to identify areas that can genuinely advance humanity, ones that are underdeveloped, where capital is misallocated, or where inefficiencies exist. We want to rethink how to approach them differently, redirecting efforts toward outcomes that benefit all of us more.

It might sound cliché, but I think, at the end of the day, this is the purest form of motivation. You need dreams bigger than yourself and try to contribute to something that outlives you.

Interestingly, that’s exactly what crypto is doing. So many people become wealthy very early in life—without waiting 20 years to exit a startup. We don’t want to see the world deteriorate by the time we’re old. So I believe shifting from purely “how high can our assets go” to “let’s live in a greener, more joyful world” is far more meaningful.

Nansen: The crypto world has produced many “prodigies.” Do you think some people are naturally suited for trading? Is it something learnable? Can it be trained?

Fiskantes: I think you need a certain base level of knowledge. Of course, much of it can be trained. If people haven’t been trained from a young age or aren’t accustomed to taking big risks, it’s hard to accumulate wealth quickly in crypto.

Especially for trading—you’re glued to the screen, trying to make rapid decisions with large sums amid noise. You need a certain mindset… I don’t know how to describe it, but I think you need to let something inside you “die.”

Nansen: Specifically, what needs to “die”?

Fiskantes: Something inside you must be dead—or rather, you need to become indifferent to certain things. Some people get overly excited just thinking about money. We have a game with poker players—we go to a bar, have drinks, and challenge the bartender to a coin flip. If we lose, we pay triple. If we win, he pays for our drinks out of his own pocket.

For bartenders, even though it’s clearly a positive expected-value bet (50% chance to win 3x your loss), most refuse.

Most people are extremely risk-averse—the pain of losing outweighs the thrill of winning more. So I think you need to be someone who doesn’t fear risk too much—but also not addicted to gambling. Many do get hooked on the dopamine rush from numbers going up and down wildly.

For me, numbers aren’t that exciting. I remember playing poker—it was just a grind. I’d sit there, play a few hours, then happily move on. Others get addicted, unable to leave the table.

Nansen: What causes you pain? In trading, surely there are moments that truly tear you apart. What hurts?

Fiskantes: For example, missing out on a successful project due to carelessness. Or overlooking something obvious. When everything is rising fast, those missed opportunities can feel overwhelming. Yes, careless mistakes hurt—even if I didn’t actually lose money.

But another source of pain, more from an investor’s perspective, is seeing builders under immense stress. These are the people creating important, innovative things. And they face so much hate, so much pressure. I feel they work incredibly hard. Yet our only thought is dumping their tokens for profit.

So it pains me when I see amazing projects and well-intentioned teams struggling—not because of fundamentals, but because symbolic factors or timing caused them to collapse, and the community piles blame on them. That’s often what makes me consider leaving the space or taking a long break.

We’re happy to support founders or developers, even if they have eccentric personalities or flawed designs, as long as they’re trying to fix things. I’ve always favored those who create buzz in innovative spaces—even if the project fails, if it captures attention, I feel the world is moving forward.

Nansen: I noticed very few wallets linked to Zee Prime are publicly tagged on Nansen—is this due to security concerns?

Fiskantes: Regarding OPSEC, since I’m probably the most public-facing member of our team, I personally don’t control any funds beyond my own. Occasionally I test new projects or buy NFTs, and I’m a backup signer on some multisig wallets, but I never proactively sign transactions—I’m very cautious about that.

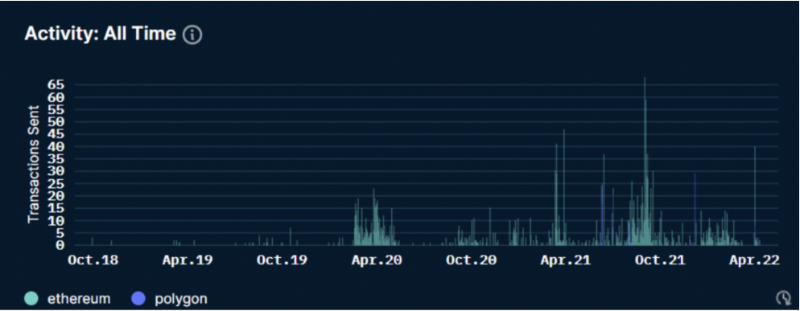

Nansen: Let’s talk about NFTs. I reviewed your personal wallet’s on-chain activity—it shows a massive spike around October 21, which is precisely when you started engaging with NFTs. Was there anything particularly attractive about this market?

On-chain activity of Fiskantes' personal wallet

Fiskantes: Honestly, within our team, my views on NFTs have always been unconventional. Almost everyone says it’s just a random fashion trend, but I kept urging them to dig deeper, explore the space, find opportunities.

Back when I played poker, there was a proprietary trading firm in Eastern Europe hiring traders to do high-frequency trading on smaller, illiquid exchanges like Warsaw and Vienna. You could manually do what market-making algorithms do today—very basic tactics, but highly profitable. That’s where I learned some order book “gaming” techniques.

I stayed there for three weeks, realized I didn’t want to wear a shirt and tie and go to an office every day, so I quit—but I learned valuable skills. Last year, I realized you could apply similar tactics in NFTs because these markets are illiquid and hard to automate. So I did it—but really, I was just buying lottery tickets, seeing what might emerge.

Order book strategies aren’t complicated. By the way, you could’ve done this on Kraken in late 2016 or early 2017. Basically, you spot assets with large bid-ask spreads.

Realized PnL record of Fiskantes

I don’t do this often, but I figured out it’s a viable strategy. If it weren’t for Ethereum’s sky-high gas fees, it might be the best place to learn such trading—but it’s not suitable for everyone.

Also, when someone accidentally lists a rare NFT at a low price, you should snap it up immediately. I did that. If I focused solely on this, I could’ve earned solid returns. But by then, we were running our fund, and I wasn’t interested in spending my days “sniping deals”—that was my five-year poker grind. It shouldn’t be my life forever.

Now, I feel the NFT market is saturated. Full of knockoffs, not as exciting as it once was. I no longer recommend buying NFTs directly—instead, study NFT gaming apps or NFT infrastructure projects.

Nansen: In the crypto market, people often claim powerful players like you secretly control industry trends. What do you think of that view?

Fiskantes: I’m not part of those exclusive private chat groups people imagine. If there were any chats powerful enough to move markets, I definitely wouldn’t join. But insider deals and information asymmetry are inevitable. I don’t think it’s different from other industries—only that because crypto is new and fast-moving, small information advantages are far more valuable here.

Now I’m a bit tired, not as starry-eyed and naive as four or five years ago. Back then, I believed more in crypto’s promise of equal opportunity, decentralization, democratization.

In some ways, it’s still progressing toward that. Anyone, anywhere, can build smart connections—equal opportunity for all. The common denominator is pure skill: figuring out how to play DeFi/MEV games better than others without backing. And if the game is global, it can happen anywhere. All you need is a computer, and suddenly you’re in. You could even generate ten-figure assets from your mom’s basement in Pakistan.

Wallet Analysis

As part of the interview, Fiskantes shared some of Zee Prime’s most successful investments, including early bets on Synthetix and Solana, and buying Luna at $1. He also revealed that Zee Prime is rapidly expanding, with multiple entities operating under one roof. This includes Sigil, a DeFi-focused liquidity staking tool, and a newly added family member: Devmons.gg.

For active NFT traders, Devmons might sound familiar—a highly active GameFi and NFT player identified by this ENS address.

Realized PnL record of Devmons.eth

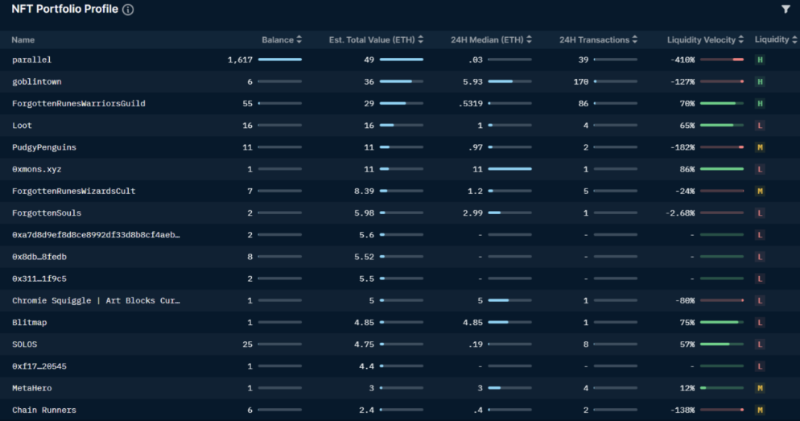

Devmons holds a collection of over 1,600 Parallel NFT cards and achieved major success during hype cycles around series like Goblintown and Forgotten Runes Wizards Cult.

Their current portfolio is dominated by Parallel, alongside significant holdings in derivatives of Forgotten Runes Wizards Cult, Loot, and Pudgy Penguins.

NFT portfolio of Devmons.eth

Over recent months, the address has focused on increasing its Loot holdings and experimenting with cutting-edge gaming projects. Additionally, Devmons is an “airdrop pro,” successfully claiming numerous token airdrops—earning over twenty NFTs from just the Forgotten Runes Warriors Guild project, worth more than 5.5 ETH.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News