Bài học rút ra từ việc rà soát lại các tài sản tiền mã hóa ngoài Bitcoin trong các đợt tăng giá trước đó

Tuyển chọn TechFlowTuyển chọn TechFlow

Bài học rút ra từ việc rà soát lại các tài sản tiền mã hóa ngoài Bitcoin trong các đợt tăng giá trước đó

Làm thế nào để tồn tại trong bẫy thị trường tăng giá?

Tác giả: BowTied Bull

Biên dịch: Bạch thoại Blockchain

Khi năm 2025 đến, vào thời khắc giao thừa giữa cũ và mới, theo thói quen chúng ta đều sẽ tổng kết quá khứ và nhìn về tương lai.

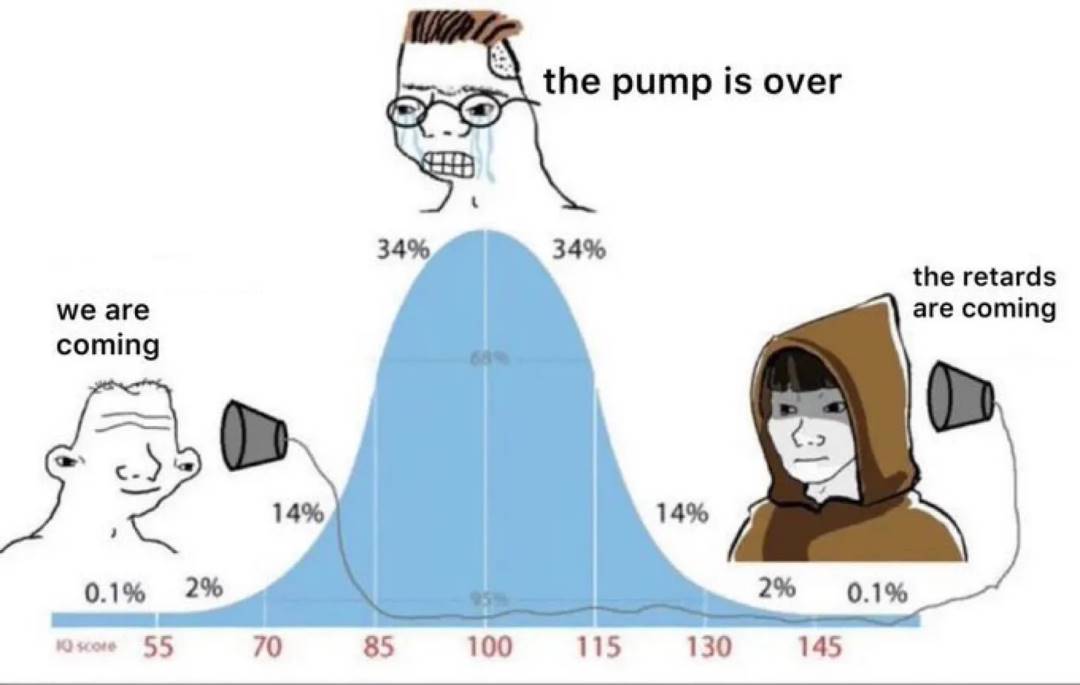

Nhìn lại hành trình của ngành tiền mã hóa, chúng ta có thể nhận thấy một hiện tượng thú vị: cứ bốn năm lại có một "mùa altcoin", trong giai đoạn này, mọi thứ trong ngành đều tăng giá. Có thể bạn sẽ nghe nói chú ruột nghiện rượu của mình cũng đã mua một đồng tiền meme hình động vật nào đó và kiếm được一笔 lớn – thậm chí là thực hiện giao dịch đó trong trạng thái say xỉn.

Tính đến năm 2025, mùa altcoin thực sự vẫn chưa thực sự bắt đầu. Dù không ai có thể dự đoán được lần này sẽ điên rồ đến đâu, nhưng ở đây tôi muốn nhắc nhở mọi người rằng, xu hướng giá của các altcoin thường diễn ra rất nhanh và mất kiểm soát, và cũng có thể kết thúc đột ngột. Một khi sụp đổ, mức giảm không chỉ dừng lại ở -99,99%, mà thậm chí có thể sụp đổ hoàn toàn.

Tuy nhiên, trước đó, tất cả mọi người đều chìm đắm trong bầu không khí thịnh vượng và giải trí. Vậy thì, giờ đây hãy cùng nhìn lại những mùa altcoin trước đây, xem xét tình hình phát triển của chúng, để xem liệu chúng ta có thể rút ra được bài học quý giá nào không?

Mùa altcoin 2012-2013: Thời kỳ nhà đầu tư cuồng nhiệt ban đầu, vốn hóa cao nhất đạt 15 tỷ USD

Chúng ta biết rằng, những người mù quáng chạy theo đám đông trên thị trường hiện nay rất có thể sẽ lại xuất hiện. Tình trạng này từng xảy ra vào năm 2013, và diễn biến trở nên cực kỳ thú vị.

Vào "mùa altcoin" năm 2013, Bitcoin vẫn đang ở giai đoạn sơ khai, vốn hóa thị trường khoảng 1 tỷ USD, và một giao dịch lớn (whale) lúc đó chỉ khoảng 100.000 USD. Khi ấy, sàn giao dịch Mt. Gox vẫn đang hoạt động, còn các nhà đầu tư chủ yếu là những người thường xuyên xuất hiện tại các sự kiện trao đổi thẻ bài Magic: The Gathering (đây cũng là bối cảnh dẫn đến sự kiện Mt. Gox).

Lúc đó, người ta đưa ra ý tưởng cải thiện tốc độ giao dịch Bitcoin, cho rằng việc rút ngắn thời gian tạo khối có thể tăng tốc độ giao dịch — điều này khi ấy được coi là một sáng kiến mang tính cách mạng.

Litecoin: Hiện vẫn tồn tại cho đến ngày nay, toàn bộ ý tưởng (do Charlie Lee đề xuất) là rút ngắn thời gian khối từ 10 phút của Bitcoin xuống còn 2,5 phút.

Giá Litecoin tăng từ khoảng 10 cent lên 48 USD, mức tăng khoảng 47.900%, sau đó lại tăng mạnh vào năm 2017, rồi Charlie Lee bán hết toàn bộ số lượng nắm giữ và tuyên bố rằng "Bitcoin sẽ ổn mà không cần anh ta" (mọi người đều hiểu việc người sáng lập bán sạch 100% lượng nắm giữ nghĩa là gì).

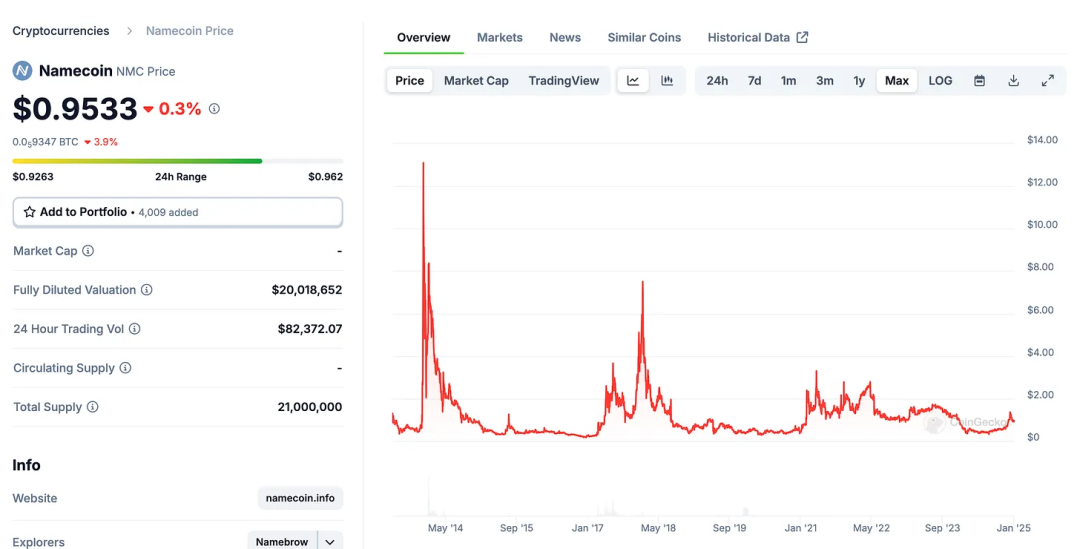

Namecoin: Là một đồng fork từ Bitcoin, nhằm mục đích tạo tên miền phi tập trung (tương tự như ENS với khái niệm mở rộng ".eth"). Giá của nó từng tăng vọt lên khoảng 13 USD, nhưng nhanh chóng rơi vào đáy. Từ điểm thấp nhất đến cao nhất, giá tăng khoảng 30 lần. Thực tế là nó vẫn tồn tại đến nay, đang giao dịch gần mức 1 USD.

Peercoin (PPC): Là một trong những token Proof-of-Stake (PoS) đầu tiên (cơ chế hiện nay dùng để bảo mật ETH), trải qua hai lần tăng giá mạnh. Lần đầu vào năm 2013, lần thứ hai vào năm 2017 khi cơn sốt ICO của ETH bùng nổ. Giá của nó từng tăng vọt lên khoảng 7 USD, mức tăng đạt 60-70 lần. Tất nhiên, nó không đạt được sự chấp nhận phổ biến, cuối cùng giảm xuống còn 0,42 USD. (Tuy nhiên, hiện tại có thể đưa ra kết luận rằng, trừ những trò lừa đảo Ponzi thuần túy như Bitconnect hay LUNA, phần còn lại trên thị trường hiện nay sẽ không thực sự về bằng 0.)

Cơn sốt: Bitcoin cuối cùng đạt mức 1.200 USD, các tiền mã hóa này tăng giá nhờ sự quan tâm ngày càng tăng đối với lĩnh vực mã hóa. Bất kỳ dự án nào đăng bài trên BitcoinTalk cũng có thể tăng nhanh chỉ nhờ đầu cơ. Ngày nay, điều gần nhất với tình huống này có lẽ là một memecoin do người nổi tiếng quảng bá hoặc được đặt tên theo người nổi tiếng.

Sự sụp đổ của Mt. Gox: Khi Mt. Gox sụp đổ, buổi tiệc狂欢结束了. Sự sụp đổ này xảy ra do một vụ hack nghiêm trọng, khiến giá Bitcoin giảm mạnh, khoảng 85-90% (tùy cách xác định đáy), và các altcoin giảm hơn 99%.

Mùa altcoin 2017: Cơn sốt ICO và sự trỗi dậy của Ethereum, vốn hóa cao nhất đạt 800 tỷ USD

Sau đó, trong giai đoạn thị trường gấu, nhiều sự kiện thú vị đã xảy ra. Ethereum ra đời như một nền tảng hợp đồng thông minh, với mục đích tạo ra tiền tệ lập trình được. Đây là một sáng tạo thực sự, vì nó không chỉ cho phép chuyển token mà còn tạo ra các hợp đồng thông minh, từ đó hoàn toàn thay đổi cục diện.

Như nhiều thứ khác trong lĩnh vực tiền mã hóa, Ethereum cũng đi kèm những rủi ro phổ biến. DAO (Tổ chức Tự trị Phi tập trung) của Ethereum từng bị hacker tấn công, thiệt hại hơn 100 triệu USD, cuối cùng dẫn đến việc phân nhánh blockchain, tạo thành hai chuỗi ETH và ETC. Đến nay, vẫn có người cho rằng quyết định phân nhánh lúc đó là sai lầm, nhưng hôm nay chúng ta không bàn sâu vấn đề này, chỉ đơn giản ôn lại lịch sử.

Đến khoảng năm 2016, người ta nhận ra rằng có thể phát hành token mới trên blockchain Ethereum, từ đó hình thành nên lần phát hành token đầu tiên (ICO). Trong ICO, các dự án bán trực tiếp token cho nhà đầu tư. Năm 2017, cơn sốt ICO chính thức bùng nổ, hàng loạt dự án lừa đảo bạn có thể nghĩ đến đều xuất hiện lúc này.

Ethereum (ETH): Do việc phát hành token đòi hỏi ETH, điều này thúc đẩy giá ETH tăng vọt, từ khoảng 8 USD lên tới 1.400 USD vào tháng 1 năm 2018 — mức lợi nhuận gần như không tưởng lúc bấy giờ. Hiện tại, ETH đang giao dịch ở mức khoảng 3.650 USD.

Ripple (XRP): Vẫn được coi là "đồng tiền ngân hàng", lý thuyết là Ripple sẽ thay thế SWIFT (hệ thống thanh toán quốc tế) trong một đêm, trở thành tiêu chuẩn tài chính thực tế. Mặc dù Ripple tập trung hóa (nhưng đa số người dùng không quan tâm), nó vẫn thu hút hàng triệu USD. Giá XRP tăng từ khoảng 1 cent lên 3,80 USD, hiện đang giao dịch ở mức 2,41 USD.

Điều kỳ lạ là, cộng đồng nhà đầu tư XRP vẫn chủ yếu là các nhà đầu tư cá nhân. Trong đợt tăng giá gần đây, bạn có thể thấy hiện tượng tương tự — XRP thống trị TikTok, thu hút nhiều thảo luận, thậm chí có người đặt câu hỏi: "Nếu vốn hóa của nó đạt mức như Bitcoin thì sao?" Những cuộc tranh luận về "vốn hóa bốn nghìn tỷ đô la Mỹ" thật sự khó hiểu.

Litecoin (LTC): Như đã nói, Litecoin lại tăng giá, từng đạt đỉnh 360 USD. Dù Charlie Lee đã bán hết toàn bộ LTC của mình, nhưng vào năm 2021 nó vẫn tăng trở lại mức 384 USD!

EOS: EOS gây quỹ 4 tỷ USD qua ICO, tự xưng là "kẻ giết chết Ethereum". Giá của nó từng tăng vọt lên 22 USD, nhưng kể từ đó chưa bao giờ lập kỷ lục mới.

NEO: Một dự án khác tự xưng là "kẻ giết chết Ethereum", được gọi là "Ethereum của Trung Quốc", giá NEO tăng từ 0,20 USD lên 200 USD, đạt lợi nhuận 1.000 lần.

Bitcoin Cash (BCH): Roger Ver, một nhân vật nổi tiếng trong cộng đồng Bitcoin, tham gia tranh luận về khối lớn và ủng hộ Bitcoin Cash. Tại khối 478.559 vào tháng 8 năm 2017, người dùng sở hữu 1 BTC sẽ nhận được 1 BCH. Nhờ sự ủng hộ của Roger Ver, giá Bitcoin Cash từng tăng vọt lên khoảng 3.800 USD, nhưng sau đó dần phai nhạt khỏi ánh đèn sân khấu.

Các "kẻ giết chết Ethereum" khác: Trong giai đoạn này, một số token khác cũng được quảng bá là "kẻ giết chết Ethereum" (như ADA, Tron...). Chỉ cần một token có "sách trắng", dường như có thể thúc đẩy giá tăng 10, 100 lần. Các token khác như Filecoin và Tezos cũng ra mắt trong giai đoạn này.

Lừa đảo lợi suất: Nếu bạn nghĩ BlockFi, LUNA, Celsius và Voyager là những vụ lừa đảo lợi suất đầu tiên, thì bạn đã nhầm! Trên thực tế, vụ lừa đảo Ponzi lợi suất quy mô lớn đầu tiên là Bitconnect, khiến nhiều người mất hàng triệu USD.

Cơ quan quản lý can thiệp: Giống như chu kỳ năm 2021, sự can thiệp của cơ quan quản lý và việc các vụ Ponzi bùng nổ đã hủy diệt toàn ngành. Ủy ban Chứng khoán Mỹ (SEC) bắt đầu truy cứu các dự án như EOS, thị trường trải qua đợt điều chỉnh vững chắc 85%, đến tháng 3 năm 2020, giá Bitcoin giảm xuống khoảng 3.500 USD.

Trong giai đoạn đó, phần lớn các token chỉ là lừa đảo, do đó thị trường altcoin trải qua mức giảm gần như -99,999999%. Lúc đó, nếu token của bạn xuất hiện trong quảng cáo Super Bowl, giá có thể tăng vọt gấp năm lần ngay lập tức. Ví dụ điển hình là VIBE.

Giá VIBE từng tăng từ 0,04 USD lên hơn 2 USD, nhưng cuối cùng vốn hóa thị trường chỉ còn 262 USD.

Mùa altcoin 2021: DeFi, NFT và Memecoin, vốn hóa cao nhất đạt 3 nghìn tỷ USD

Năm 2021, do những nguyên nhân众所周知, mọi người đều làm việc tại nhà, ngồi trước máy tính và điện thoại rảnh rỗi. Chính phủ Mỹ in thêm 10 nghìn tỷ USD, và đó chỉ là chi tiêu của riêng chính phủ Mỹ.

Dự án DeFi thúc đẩy khai thác thanh khoản, NFT đưa ảnh JPEG trở thành hiện tượng (bán với giá hàng triệu USD), và memecoin đạt mức định giá phi lý. Bitcoin vượt ngưỡng 69.000 USD, ETH đạt 4.800 USD, tổng vốn hóa thị trường tiền mã hóa vượt 3 nghìn tỷ USD vào tháng 11 năm 2021.

Dogecoin: Ban đầu chỉ là một trò đùa, nhưng khi Elon Musk thể hiện sự quan tâm đến đồng tiền này, giá bắt đầu tăng theo đường parabol, trở thành chủ đề nóng trên Reddit. Ngày nay, nó gần như trở thành đồng tiền biểu tượng của Elon, đại diện cho Bộ phận Hiệu quả Chính phủ. Giá tăng từ khoảng 0,5 cent lên 74 cent, mức tăng khoảng 15.000%.

Solana: Được quảng bá là "kẻ giết chết Ethereum" tiếp theo, thu hút sự chú ý nhờ tốc độ giao dịch nhanh và phí thấp. Toàn bộ điều này chủ yếu được SBF (hiện đã vào tù) tuyên truyền. Giá tăng từ 1 USD lên khoảng 260 USD, mức tăng 26.000%.

Shiba Inu: Một memecoin bắt chước Dogecoin, tạo ra hàng loạt triệu phú. Nếu tính từ mức vốn hóa gần như bằng 0, mức tăng của nó đạt 500.000%.

Token DeFi: Các token DeFi như AAVE, UNI, SUSHI, YFI tăng từ 10 đến 50 lần, giá trị bị khóa (TVL) trong tài chính phi tập trung (DeFi) vượt hàng trăm tỷ USD. Ngày nay, TVL của nhiều dự án DeFi thậm chí còn cao hơn so với thời điểm đó!

NFT:

CryptoPunks: Được bán với giá hàng triệu USD, CryptoPunk rẻ nhất cũng trên 100 ETH.

Bored Ape Yacht Club (BAYC): Trở thành hiện tượng văn hóa, mức giá thấp nhất cũng đạt mức khó tin.

Cơn sốt Airdrop: Đối với người dùng lâu năm của một số dự án, chỉ cần sở hữu một tên miền .eth trị giá 100 USD, bạn có thể nhận được airdrop trị giá 40.000 USD. Bạn thậm chí có thể nhận được lợi suất 2% trong một ngày hoặc một tuần chỉ bằng cách vượt qua một cây cầu (thực hiện một số thao tác). Các dự án NFT như BAYC còn airdrop hàng loạt NFT thuộc các bộ sưu tập khác có định giá cao, tổng giá trị airdrop lên tới hàng chục tỷ USD.

Điều điên rồ hơn nữa… gần như tất cả các token đều tăng giá, các token như SAFEMOON được Dave Portnoy và nhiều người khác cổ vũ. Các người nổi tiếng như Snoop Dogg và Paris Hilton cũng quảng bá cho nhiều dự án. Tom Brady và Stephen Curry quảng bá cho các sàn giao dịch tiền mã hóa. Ngay cả FTX (đã sụp đổ) cũng từng trả tiền để mua quyền đặt tên cho đội Miami Heat. FTX (đã sụp đổ) thậm chí đã mua quyền đặt tên cho đội Miami Heat của NBA.

Lừa đảo Ponzi: Hàng loạt vụ lừa đảo Ponzi xuất hiện. Dù một số người đổ lỗi cho chúng tôi liên quan đến các vụ lừa đảo này, nhưng thực tế chúng tôi không tham gia. May mắn thay, nhiều người đã tránh được tổn thất lớn. Việc đầu tư vào các sản phẩm này và giao tài sản của bạn cho người khác luôn là một lựa chọn thiếu khôn ngoan.

Xoáy tử thần: Khi thanh khoản bắt đầu cạn kiệt (nguồn hỗ trợ tài chính trước đó cho các dự án không còn xuất hiện), chúng ta chứng kiến sự sụp đổ của các vụ lừa đảo Ponzi đã nêu. Ngoài ra, FTX sụp đổ do ăn cắp tiền người dùng, tiếp theo đó, Ủy ban Chứng khoán Mỹ (SEC) lại ra tay giám sát. Các vụ lừa đảo quy mô lớn và cắt韭菜 liên tiếp xảy ra, cuối cùng dẫn đến việc các kênh vào/ra của ngành tiền mã hóa bước vào giai đoạn giám sát nghiêm ngặt.

Bài học then chốt

1) Chốt lời kịp thời: Thị trường thay đổi nhanh chóng, bạn rất dễ cảm thấy tham lam. Nếu bạn nhận thấy mình đang nói "Ước gì mình mua thêm 2 lần số lượng token XYZ", thì có lẽ điều bạn nên làm là bán một nửa, hài lòng với lợi nhuận đã có. Bán Bitcoin, Ethereum hay stablecoin đều không quan trọng, điều quan trọng là đừng tham lam.

2) Chu kỳ炒作 lặp lại: Mỗi mùa altcoin đều có một chủ đề câu chuyện: fork Bitcoin, ICO, DeFi, NFT hoặc memecoin. Nếu bạn tìm thấy một chủ đề, hãy kiên trì theo đuổi nó, bởi vì kiến thức bạn tích lũy trong lĩnh vực đó thường sẽ nhanh chóng mất giá khi chu kỳ kết thúc. Thay vì nhảy lung tung, hãy tập trung vào một lĩnh vực và hái lấy chiến thắng cuối cùng.

3) Quản lý rủi ro là tối quan trọng: Lợi nhuận rất hấp dẫn, nhưng mỗi người mỗi khác. Bạn khác tôi, tôi khác hàng xóm tôi. Hãy tự xây dựng kế hoạch phù hợp với bản thân và kiên trì theo đuổi, đừng vì một người có 100.000 USD nói rằng "10 triệu USD vẫn chưa đủ để nghỉ hưu" mà liên tục điều chỉnh mục tiêu của mình.

4) Người sống sót sẽ phát triển mạnh mẽ: Altcoin đến rồi đi, nhưng Bitcoin và Ethereum thống trị trong mọi chu kỳ. Nếu một dự án đã tồn tại lâu như vậy, rủi ro về bằng 0 của nó tương đối thấp. Nếu Solana có thể tìm thấy ứng dụng thực tế vượt xa Pump.fun vào năm 2025, nó có thể tiến gần đến mức đó.

Chúng ta đã học được gì từ các vụ lừa đảo Ponzi? Thực ra là chưa. Từ những gì chúng ta thấy, mọi người vẫn chưa hiểu khái niệm "Not Your Keys, Not Your Coins (không nắm private key, tức là không sở hữu coin)", bạn có thể mua cổ phiếu mã hóa hoặc các tài sản đòn bẩy mã hóa khác thông qua công ty môi giới, nhưng cần hiểu rằng nếu bạn nắm giữ các cổ phiếu đó hoặc ETF mã hóa, thực chất bạn không sở hữu bất kỳ tiền mã hóa nào. Và bạn cũng sẽ không bao giờ biết được các công ty hay dự án đó sẽ xử lý tài sản bạn đầu tư ra sao.

Trong thị trường tăng giá, chúng ta thường bị chỉ trích vì không tham gia炒作 vào memecoin mới nhất. Dù các hành vi đầu cơ này có vẻ rất nóng hổi, nhưng nếu bạn quan sát kỹ, bạn sẽ thấy những người kiên trì với chiến lược của mình, giữ bình tĩnh, đã dần tích lũy được thành quả.

Ngược lại, những kẻ đầu cơ chỉ nghĩ đến việc "kiếm lời 10 lần" để làm giàu nhanh chóng, mặc dù trong ngắn hạn có thể thu hút sự chú ý của thị trường, nhưng quy mô tài sản và chiến lược của họ hoàn toàn không thể so sánh với những đại gia vô danh thường xuyên đầu tư ổn định hàng tháng, tích lũy của cải. Những đại gia này thường có nền tảng tài chính vững chắc hơn và kế hoạch dài hạn rõ ràng hơn. Cuối cùng, thị trường và dữ liệu sẽ chứng minh chiến lược nào mới thực sự là chìa khóa thành công.

Chúc mọi người may mắn trong năm 2025.

Chào mừng tham gia cộng đồng chính thức TechFlow

Nhóm Telegram:https://t.me/TechFlowDaily

Tài khoản Twitter chính thức:https://x.com/TechFlowPost

Tài khoản Twitter tiếng Anh:https://x.com/BlockFlow_News