Bitget Wallet 2026 Trend Forecast Report: When On-Chain Finance Enters Daily Life

TechFlow Selected TechFlow Selected

Bitget Wallet 2026 Trend Forecast Report: When On-Chain Finance Enters Daily Life

This report takes a wallet-centric perspective to review key developments in the on-chain ecosystem in 2025 that are closely tied to everyday finance, and based on this, explores the evolution of on-chain finance in 2026.

Author: Bitget Wallet

TL;DR

- Over the past two decades, fintech has evolved from digitalization (1.0) to mobilization (2.0), and is now entering Fintech 3.0, built on blockchain. Onchain finance will reconstruct the financial system at the settlement layer, making fund flows cheaper, faster, and globally accessible.

- Wallets are evolving from simple asset management tools into the primary entry point for users handling diverse daily financial tasks, gradually becoming common financial applications covering trading, payments, and asset management—frequently appearing in everyday life and fund flows—thereby forming a user-centric onchain daily finance experience.

- Stablecoin Payments: Stablecoins have become critical infrastructure for global value settlement, deeply embedded in B2B2C cross-border payments, local payment networks, and card network systems. Wallets will serve as the unified frontend and routing node for stablecoin payment capabilities.

- AI: As protocols like x402 mature, AI agents will autonomously execute payments and transactions within authorized frameworks, driving a qualitative shift in the frequency and form of value exchange. Wallets will become the execution and risk-control layer for agent-driven financial behavior.

- Privacy: Privacy will become the default prerequisite underpinning payments, asset management, and institutional onboarding to chain. Privacy capabilities will be integrated into major wallets as infrastructure functions—not via isolated privacy assets.

- On-chain Credit: Onchain credit will gradually move beyond single over-collateralized models, building a tiered system around users’ long-term behavior, time dimension, and履约 stability. Wallets will provide cross-chain, cross-cycle continuous data support throughout this process.

- RWA: Real-world assets (RWAs) will evolve into tradable, composable financial instruments. RWA Perps and RWA × DeFi will become key growth drivers. Wallets are emerging as vital channels connecting onchain users with global assets, offering users global asset exposure.

- Perp DEXs: Perpetual DEXs will enter a competition phase centered on stability, efficiency, and user retention. Native perp trading inside wallets will become a high-frequency use case, significantly boosting user stickiness.

- Prediction Markets: Catalyzed by major real-world events—including the FIFA World Cup and U.S. midterm congressional elections—prediction markets will enter an accelerated expansion phase. Frontend innovation will prioritize event discovery, signal interpretation, and seamless order placement—not liquidity aggregation.

- Meme: Attention toward some meme trading may be diverted to prediction markets. Wallets will optimize features such as address relationship and cluster analysis to help users more efficiently identify sentiment and capital flow trends.

Evolution of the Wallet Role: From Onchain Entry Point to Daily Finance Carrier

For a long time, crypto wallets were primarily viewed as onchain traffic gateways and operational tools, with core functions focused on asset storage, connecting to decentralized applications (dApps), managing contract permissions, and performing swaps—essentially solving how users access the chain and complete basic interactions, without yet directly supporting full-fledged financial use cases.

This perception began shifting significantly in 2025. As stablecoin volumes continued expanding and onchain transaction and settlement infrastructure matured, real-world use cases—including payments and yield generation—emerged and were repeatedly validated onchain. Accordingly, crypto assets themselves transformed: no longer used solely for passive holding or speculative trading, they are increasingly deployed for payments, yield management, and cross-border transfers—actual financial activities. In this process, wallet positioning also elevated, progressively evolving into the core application for onchain daily financial activity.

Today’s crypto wallets are assuming the role of an “onchain daily finance frontend”:

- The primary interface for managing stablecoin balances and fund flows

- A critical payment tool bridging the real-world payment network and the onchain ecosystem

- The execution and risk management layer for trading and managing diverse assets—including memes, RWAs, and prediction markets

The wallet’s role is transforming from a simple asset management tool into the main entry point for users handling varied daily financial tasks. This change isn’t triggered by any single product innovation but stems from an evolving user expectation toward wallets overall. Early adopters used wallets for airdrops, experimenting with DeFi protocols, and completing basic trades; later, swap and cross-chain functionality became standard; eventually, yield management and portfolio construction emerged as key needs. Wallets are no longer just tools for executing onchain operations—more users rely on them for daily financial tasks, treating them as common financial applications covering trading, payments, and asset management, frequently appearing in everyday life and fund flows.

This evolution of the wallet role closely mirrors broader shifts in the financial system itself. At a macro level, financial infrastructure over the past two decades has roughly progressed through three phases: first, digitization of financial services—moving banking online; second, mobilization—new financial apps dramatically improved usability, though underlying clearing and settlement rails remained unchanged; third, onchain finance—blockchain-based finance is now restructuring the financial system at the foundational rail level, enabling cheaper, faster, and globally accessible fund flows.

Compared to the first two phases, Onchain Finance introduces change rooted in a transformation of financial access methods and underlying architecture. Built on a permissionless, open network, global users can access the same financial system at lower cost and higher efficiency; composability of assets and smart contracts allows financial products and applications to be built and iterated rapidly; in this system, users and institutions operate under identical rules and infrastructure—finance is no longer solely a service delivered by institutions, but increasingly an open system anyone can participate in and build upon.

As financial infrastructure migrates onchain, wallet use cases continue expanding. Functions previously scattered across bank accounts, payment apps, trading platforms, and crypto tools are now being consolidated into a single wallet application—creating a user-centric onchain daily finance experience. More users enter the onchain world not only for speculation or yield, but to reduce reliance on traditional centralized financial systems for fund management, cross-border movement, and value storage. Non-custodial solutions are becoming a crucial starting point for onchain finance: users want direct control over their assets and freedom to use them globally.

In this context, wallets have become key vantage points for understanding real onchain usage. Questions such as why users enter the chain, which assets they predominantly use, which behaviors demonstrate persistence, and which scenarios reflect genuine adoption cannot be fully answered using exchange or single-protocol data alone. Wallets sit naturally at the intersection of all onchain behaviors, offering a more direct reflection of users’ real onchain financial activity.

Based on this, this report takes a wallet-centric perspective to briefly review key developments in 2025’s onchain ecosystem closely tied to daily finance—and then explores the trajectory of onchain finance in 2026.

Outlook for 2026: The Real Emergence of Onchain Daily Finance

1. Stablecoin Payments

2025 marked the turning point when stablecoin payments were genuinely embraced by mainstream finance. From Circle’s IPO to the passage of the U.S. “Genius Act,” stablecoin regulatory boundaries were progressively clarified. If 2024 was still a period of mutual probing between regulators and markets, then in 2025, the world’s three largest economies collectively established a “legislation + licensing + enforcement” framework—propelling stablecoins out of their previous gray zone and into a widely adoptable, compliant financial infrastructure layer:

- North American Market: In July 2025, the formal passage of the U.S. “Genius Act” became the year’s milestone. This act established a federal regulatory framework and issuer eligibility requirements for payment-focused stablecoins, effectively breaking down the capital barrier between traditional banks and onchain issuers.

- Asian Market: On August 1, 2025, Hong Kong’s “Stablecoin Issuer Regulatory Regime” officially came into effect. This regulation brought stablecoin activities under the supervision of the Hong Kong Monetary Authority (HKMA) and subsequently advanced issuer licensing—drawing active participation from institutions including Standard Chartered Bank and JD.com in launching HKD-pegged stablecoins. Japan initiated its JPY stablecoin pilot program.

- European Market: With the EU’s MiCA regulation entering its first full year of comprehensive enforcement, EUR stablecoins escaped their prior illiquidity in 2025 and began listing on major exchanges. EU member states including Germany launched national-regulation-based stablecoins under the MiCA framework, while the UK initiated its GBP stablecoin pilot.

Driven by the establishment of these three compliance frameworks and explosive onchain demand, the stablecoin market experienced significant revaluation. Macro data shows that stablecoin issuance volume and onchain transaction activity both hit record highs in 2025:

- Breakthrough Market Growth: Total stablecoin market cap surged from $205 billion at year-start to $308 billion at year-end—a net increase of $103 billion, representing over 50% growth.

- Quantum Leap in Onchain Settlement Volume: Annual onchain transaction value reached a staggering $33 trillion. Stablecoins have substantively surpassed certain national fiat currencies as global value-transfer settlement networks.

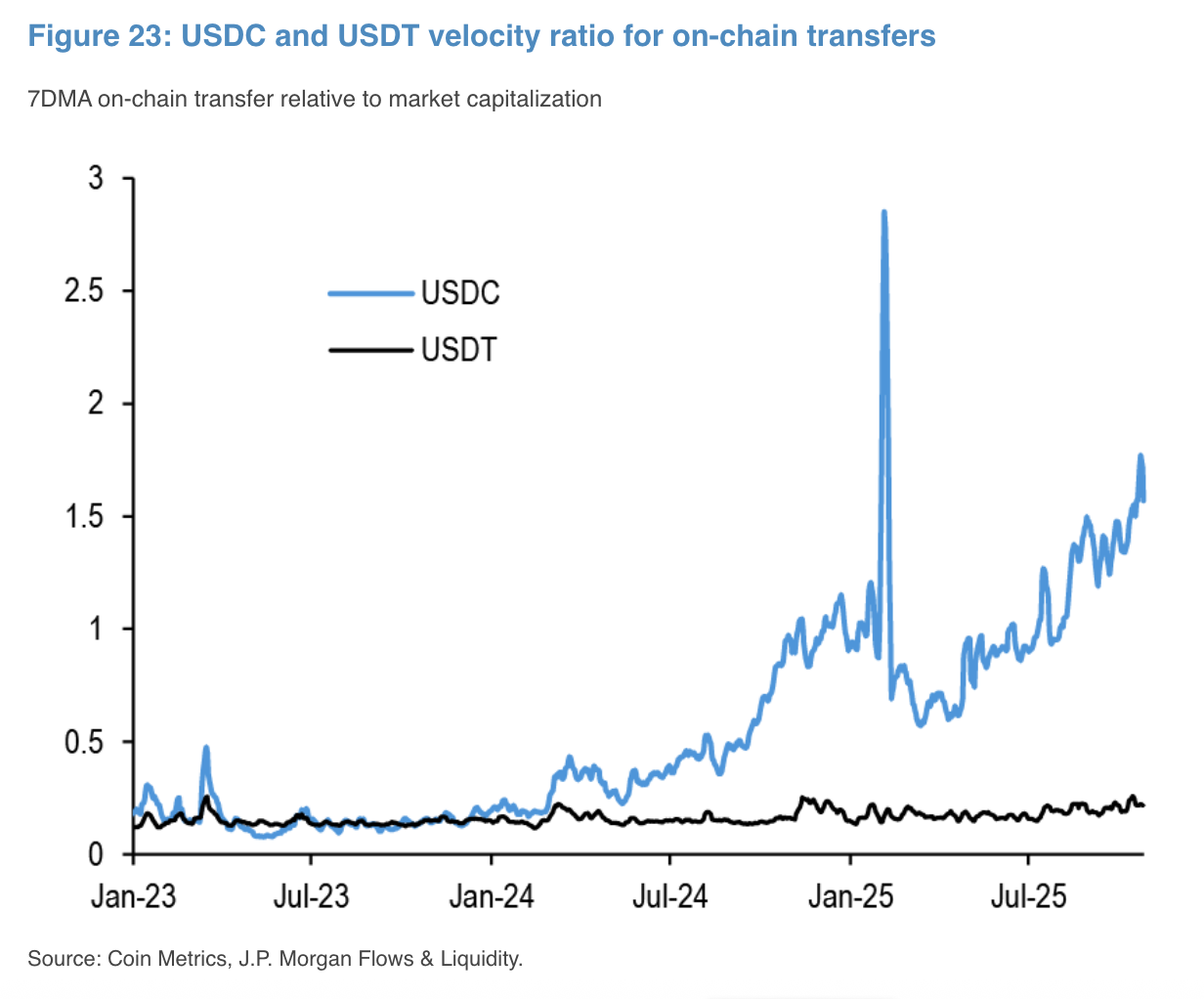

Notably, 2025 saw a highly symbolic structural reversal in market composition: although USDT retained leadership in market cap, USDC’s annual onchain transaction volume ($18.3 trillion) surpassed USDT’s ($13.3 trillion) for the first time. This shift stemmed mainly from USDC’s higher capital reuse rate in DeFi protocols and Western institutions’ preference for the more compliant USDC for large-scale settlements and cross-border payments following the Genius Act’s enactment.

At the application level, the most notable feature in 2025 was deep integration with traditional finance and payment networks—traditional finance and payment infrastructures began embedding stablecoins into critical funding pathways:

- Brokerages & Account Systems: A New Compliant Onramp. Interactive Brokers officially enabled retail clients to fund personal brokerage accounts using stablecoins—marking stablecoins’ breakthrough beyond insular crypto circles into the capital onboarding process for traditional securities trading.

- Payment Networks: Restructuring the Settlement Backbone. Stablecoin settlement is becoming standard for card networks and payment giants. After acquiring stablecoin infrastructure firm Bridge, Stripe launched its own stablecoin product; PayPal expanded PYUSD onto the Stellar network, targeting cross-border micro-payments and onchain payments; Visa announced gradual rollout of USDC settlement in the U.S.

- Emerging Markets: A Real Necessity Amid Currency Crises. Next-generation neobanks like BVNK and Mesh act as bridges linking onchain assets to real-world consumption. By offering IBAN account linkage services similar to banks, they deliver novel cross-border fund solutions—“onchain storage, global payments”—to users in high-inflation regions like Argentina and Turkey.

Looking ahead to 2026, we anticipate further growth in stablecoin payment adoption, with breakthroughs expected across three dimensions:

- Real cross-border payment demand will stem from commercial-scale deployment of the B2B2C model. The market is establishing standardized hybrid architectures combining fiat frontends with stablecoin backends. Such solutions integrate stablecoin settlement layers deeply into local instant payment networks—like Brazil’s PIX or Mexico’s SPEI—via API interfaces, enabling efficient international fund transfers while remaining invisible to end users.

- PayFi (Payment Finance) will reshape the time value and flow logic of funds. Stablecoins are evolving beyond mere value carriers, integrating with DeFi protocols to become programmable, yield-bearing funds. This enables funds in transit during payment settlements to automatically capture onchain yield—achieving coexistence of liquidity efficiency and asset returns.

- Non-USD stablecoins will explode alongside onchain foreign exchange markets. With compliance-governed non-USD stablecoins—led by central banks in nine Eurozone countries—expected to launch in H2 2026, non-USD stablecoins will enter a new era. These assets will transcend their current role as simple trading instruments to assume critical “local rails” functions for domestic fund inflows/outflows, jointly building a diversified, interoperable onchain currency market system to meet real-world multi-currency commercial settlement needs.

Under these trends, wallets will assume increasingly distinct distribution roles in the stablecoin payment ecosystem:

- Unified Entry Point for Payment Capabilities: As compliant stablecoins and traditional payment networks deepen integration, users and merchants no longer interact directly with underlying onchain protocols. Wallets will become the primary interface for hosting and invoking stablecoin payment capabilities—shielding users from onchain complexity while enabling transfers, payments, and settlements.

- Interface Layer Between Onchain Funds and Real-World Payment Networks: By integrating card networks, virtual account systems, local payment networks (e.g., PIX, SPEI), and stablecoin settlement layers, wallets will serve as the pivotal node connecting onchain assets with real-world funding channels—enabling stablecoin usability in the real economy.

- Programmable Payment and Fund Orchestration Execution Layer: As PayFi and stablecoin yield products mature, wallets will manage fund orchestration and scheduling during payments—ensuring settlement funds satisfy efficiency requirements while automatically capturing onchain yield.

- Multi-Currency Settlement and Routing Hub: As non-USD stablecoins and onchain FX markets develop, wallets will serve as the switching and settlement routing layer for multi-currency stablecoins—automatically selecting currencies, converting exchange rates, and optimizing settlement paths behind the scenes, maintaining unified and simplified user experiences.

2. AI and the Agent Economy

The intelligent economy is entering a new phase where agents participate deeply—value exchange no longer relies entirely on human-initiated actions, but begins occurring autonomously by AI agents within predefined authorization and rule frameworks. However, the internet lacks native, low-friction value transfer mechanisms, and traditional account systems and subscription-based billing models struggle to accommodate agents’ high-frequency, on-demand, cross-service invocation characteristics—long constraining AI’s autonomous execution capability in real commercial contexts.

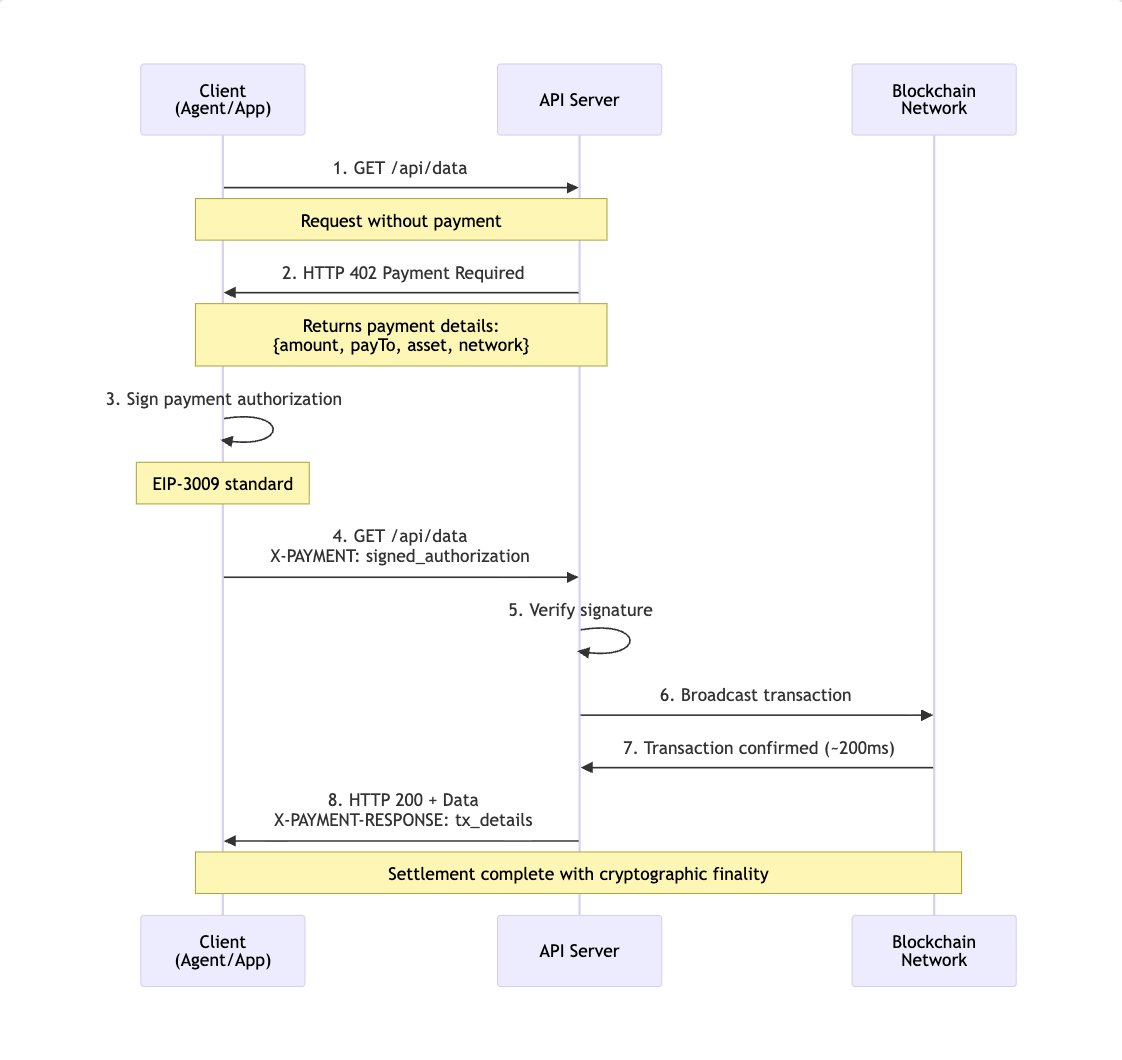

This issue saw structural progress in 2025. The x402 protocol—championed by institutions like Coinbase and Circle—embedded stablecoin payments into HTTP requests and service calls in a standardized way for the first time, establishing the foundational architecture of an AI-Native Payment Layer. By reactivating the HTTP 402 (“Payment Required”) status code, x402 enables AI agents to perform payments and settlements as seamlessly as calling APIs—eliminating the need for additional account systems or manual intervention, fundamentally changing the externally bolted-on nature of payments in machine economies. This shift also transforms AI’s business model—from human-user subscriptions to agent-based, per-call or per-intent payments—allowing agents to dynamically purchase data, compute, or service APIs based on task needs, unlocking vast amounts of previously unpriced long-tail resources.

With x402 completing its V2 upgrade by end-2025—improving latency, session reuse, and auto-discovery—the groundwork may be laid for broader-scale adoption in 2026. 2026 could become the year Agentic Commerce enters acceleration. AI is transitioning from decision support to authentic economic participants acting on behalf of individuals or enterprises. Consumer-side behavior paths may shift from “search → compare → order” to “authorize → verify → confirm”; many highly repetitive enterprise processes—including reconciliation, procurement, and supply chain coordination—will begin becoming viable candidates for systematic takeover by agents.

Source: x402 Developer Documentation

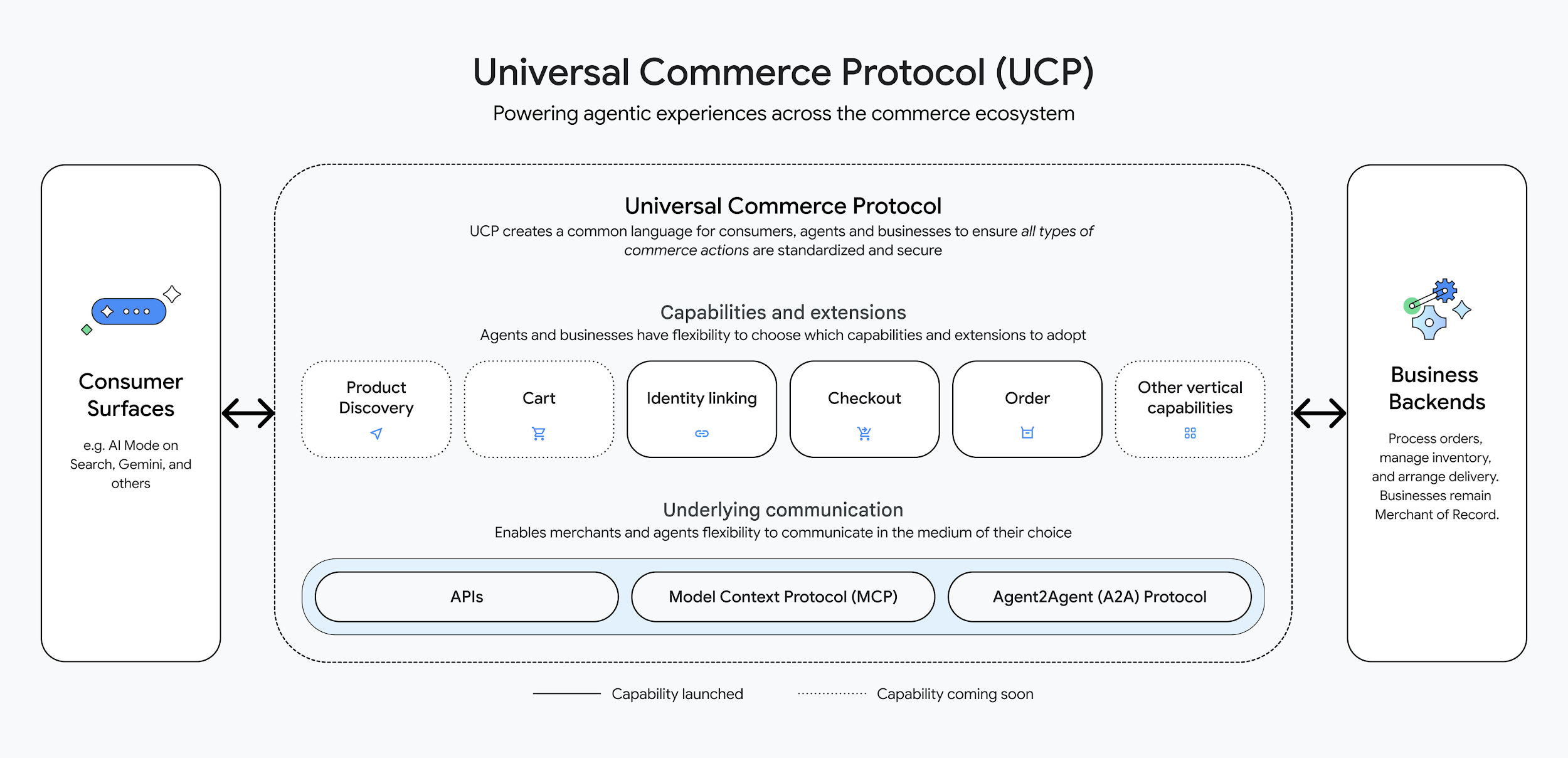

This trend is gaining wider standard-layer resonance. Google’s recently proposed Universal Commerce Protocol (UCP) signals mainstream tech ecosystems beginning to establish unified specifications for “agent-understandable commerce interfaces.” UCP seeks to create open interfaces among product discovery, transaction intent expression, and settlement processes—enabling AI agents to complete full decision-to-transaction loops across platforms. With UCP expressing commercial semantics and x402 handling value settlement, the two form a layered collaboration—providing clearer technical pathways for automated transactions between agents, and between agents and merchants.

Source: Google Official Twitter

As numerous non-human entities begin holding funds and participating in transactions, new trust and compliance challenges emerge. Traditional KYC systems—centered on natural persons—struggle to cover the complex scenarios of the agent economy. KYA (Know Your Agent) will become a key topic for market discussion and resolution in 2026, with ERC-8004 likely seeing widespread adoption. Without compromising privacy, KYA must establish verifiable identity identifiers for agents, cryptographically binding them to their underlying authorizing entities, permission scopes, and responsibility boundaries—combined with code audits and behavioral monitoring—to strike a new balance between efficiency and risk. Such trust frameworks won’t merely fulfill compliance functions—they’ll also become essential prerequisites for agents to engage in more complex financial activities.

Meanwhile, wallets will evolve from tools serving only human operations into execution layers for AI agent financial behavior—serving as the default entry point for agents engaging in economic activity under user authorization:

- Unified Fund Entry and Settlement Hub: By integrating multi-chain assets, stablecoins, and payment protocols, wallets can offer agents consistent fund management and payment capabilities—enabling cross-chain settlements and value transfers without agents needing to perceive underlying network differences.

- Agent Behavior Visualization and Risk Awareness Interface: Wallets naturally reside at the intersection of user assets and agent behavior, enabling aggregation and display of agents’ live trading activity, historical performance, and key risk metrics—helping users understand “what the agent is doing, based on what decisions, and bearing what risks”—establishing clear cognitive boundaries between automated participation and risk control.

- KYA Execution and Security Buffer Layer: As KYA mechanisms roll out, wallets can serve as execution nodes for agent identity and permissions—managing agent identification, enforcing permission constraints, and monitoring anomalous behavior across the ecosystem. When systems detect operations exceeding authorized scope or abnormal fund flows, wallets can introduce necessary risk controls or manual verification—without disrupting overall automation—to provide a safety net for user assets.

3. Privacy

In 2025, privacy re-entered the core discourse of crypto markets. Privacy assets like ZEC showed multiple periods of strength during the year—making privacy a frequently discussed topic. In an onchain environment long predicated on transparency as the default assumption, such price performance acts more like a forward-looking signal—reflecting renewed market assessment of privacy’s necessity in the next phase of crypto finance.

From a longer-term perspective, assets can embody privacy preferences—but cannot solve privacy consistency issues across protocols, applications, and user tiers. Once privacy demands shift from “a choice for a few users” to “a prerequisite for most scenarios,” the coverage capacity and scalability of single-asset approaches begin revealing limitations. To achieve mass onchain adoption, privacy must descend into infrastructure-level capability—existing in a low-friction, composable, and default-available manner—not reliant on isolated assets or applications for delivery.

This view received systematic responses from the Ethereum ecosystem in H2 2025. The Ethereum Foundation elevated privacy to a long-term strategic priority for the ecosystem, explicitly stating privacy should become Ethereum’s “first-class property.” Toward this goal, the Foundation simultaneously advanced organizational and roadmap adjustments—including forming privacy clusters and institutional privacy task forces, restructuring the PSE team, and publishing a multi-year privacy technology roadmap—dividing privacy work into three directions: private writes, private reads, and private proofs—corresponding respectively to transactions and contract interactions, onchain data access, and data validity verification in key scenarios.

Source: Ethereum Foundation Website

Looking ahead to 2026, privacy urgently needs to transition from experimental R&D to systematic implementation in real-world usage:

- For Web2 users: Privacy is a default expectation—bank transfers, securities accounts, and corporate financial systems don’t require users to accept full public disclosure of assets and transaction paths; the high transparency of onchain states instead creates psychological and usability barriers.

- For native Web3 users: In certain scenarios, users wish to conceal holdings, trading strategies, governance stances, or address associations—avoiding involuntary exposure of behavioral footprints.

- For institutions and real-world asset tokenization: Privacy is a prerequisite—if minimal disclosure and controlled-access mechanisms are absent, traditional assets, contracts, and identity data cannot safely migrate onchain.

Three main technical approaches to onchain privacy have formed in the Ethereum ecosystem, and we expect stealth addresses and privacy pools to see broader mainstream adoption first:

- Stealth Addresses (e.g., ERC-5564): Generate one-time addresses for recipients, reducing linkability between addresses and identities—providing foundational privacy protection for payments, airdrops, payroll disbursements, etc., without altering existing asset forms or account models.

- Zero-Knowledge Privacy Pools (zk-SNARK Privacy Pools): Pool multiple transactions into anonymous sets and validate them via zero-knowledge proofs—strongly hiding sources, destinations, and amounts of funds. Suitable for high-privacy-demand financial and asset management scenarios.

- Privacy-Native Chains: Introduce default privacy assumptions at the protocol layer—keeping transactions and state inherently unlinkable. Maximizes reduction of explicit privacy operations from a UX perspective. Still experimental, facing challenges including ecosystem fragmentation, complex cross-chain interaction, and high integration costs with mainstream assets and DeFi systems.

Against the backdrop of converging performance and fee structures, privacy will begin exhibiting strong usage stickiness and network effects. In public settings, cross-chain migration incurs virtually no extra cost; once entering a privacy environment, migration inevitably introduces identity, timing, and behavioral linkage risks—users thus tend to remain within existing privacy contexts.

In this evolutionary path, wallets will become one of the most pragmatic landing points for privacy capabilities:

- Privacy isn’t a function easily layered atop applications—it must be systematically supported across the entire user journey: opening the wallet, reading onchain data, signing transactions, and identity interactions.

- As private read and private write capabilities advance, wallets will progressively serve as users’ first onchain privacy boundary—ensuring asset queries, transaction initiations, and contract interactions no longer inherently expose full behavioral footprints.

- As private proof capabilities mature, wallets will become critical execution nodes for “minimal disclosure” data circulation—helping users strike a balance between trust and privacy in identity verification, asset attestation, and compliance scenarios.

4. On-chain Credit

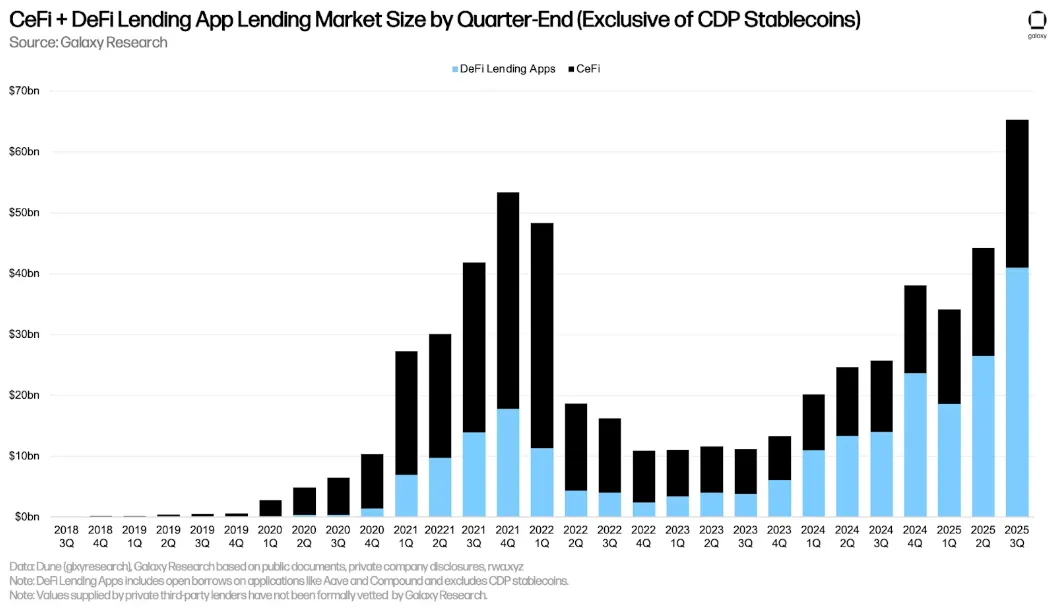

Historically, onchain credit revolved almost exclusively around “whether collateral is sufficient.” While this design provided protocols necessary security buffers during DeFi’s bootstrap phase—and drove rapid lending market expansion—its limitations became apparent as onchain activity extended beyond single-purpose trading and arbitrage into payments and asset management: distinguishing genuine creditworthiness and risk differentiation among onchain participants proved difficult.

Most onchain lending behavior revolves around leverage, arbitrage, circular borrowing, and position management—functioning more like an efficient fund orchestration mechanism than true time-value-of-money exchanges rooted in real financial needs. DeFi effectively operates a highly liquid, fast-entry-and-exit, instant-risk-priced market system—catering to high-frequency, short-cycle, strategy-oriented capital—with little effective recognition or incentive for long-term, stable usage behavior. This leads to long-term users and short-term speculators being treated identically in risk pricing and usage permissions—forcing protocols to raise collateral ratios to cover overall uncertainty, suppressing capital efficiency, and preventing genuine onchain behavior from crystallizing into identifiable credit premiums.

Onchain lending has already scaled to billions of dollars—but structurally remains collateral-dependent. Credit deficiency is a systemic issue—not due to insufficient demand. Source: Galaxy Research

Looking ahead to 2026, onchain credit is more likely to land first as embedded capabilities. As onchain finance expands from speculative use toward payments, consumption, and asset management, credit systems capable of identifying and serving long-term, genuine users will more readily achieve stickiness and scalable retention. Practices represented by 3Jane and Yumi show that the first step in credit system development often lies in user identification and segmentation—extracting stable, continuous, interpretable behavioral trajectories from onchain noise to model onchain credit:

- Time Dimension and Behavioral Stability: Credit is viewed as a state updated over time. Protocols continuously observe features like asset volatility ranges, interaction frequency, fund turnover rhythm, historical fulfillment, and risk incidents—mapping these features to permissions, limits, and risk thresholds. Credit changes synchronously with behavior—enabling proactive risk control embedded in behavioral workflows and reducing uncertainties from one-time credit grants.

- Building Reputation and Identity Layers: First complete user identification and persona segmentation, then map reputation to differentiated product permissions and experience—such as lower friction costs, higher operation limits, broader risk thresholds, or better fee structures. The advantage of leading with a reputation layer is controllable risk exposure: systems can complete user segmentation and long-term incentives under low financial risk—providing data foundations and risk control experience for subsequent, more complex credit products.

In this evolution, the wallet layer’s importance will become prominent. A single protocol or chain captures only fragmented user behavior, whereas credit system construction depends on cross-chain, cross-protocol, cross-cycle data continuity. As the aggregation entry point for all user onchain interactions, wallets naturally collect multi-chain asset distributions, long-term interaction trajectories, and payment authorization behaviors—the closest current ecological position to a holistic user view. Whether treating users’ long-term behavior as core assets—and building differentiated permission systems and service experiences accordingly—will become a critical foundation for applications to build lasting user relationships and competitive moats.

5. RWA

RWA development received strong policy tailwinds in 2025. From April to June, the SEC held four consecutive crypto regulatory roundtables, with the May session explicitly focused on “asset tokenization,” exploring development pathways for RWA tokenized markets. SEC Chair Atkins, in his keynote speech, proposed new thinking on tokenization regulation across “asset issuance, custody, and trading,” and stated clearly: “Security tokenization can revolutionize outdated traditional models and benefit the U.S. economy.”

With Ondo Finance concluding its SEC review by end-2025, the regulatory environment materially improved. The SEC’s proposed “Innovation Exemption” approach permits compliant entities to pilot security tokenization within regulated sandboxes—signaling a regulatory pivot from purely defensive risk mitigation toward institutionalized acceptance and limited experimentation. This establishes clearer legal legitimacy for asset issuance and clears key legal barriers for large-scale institutional entry.

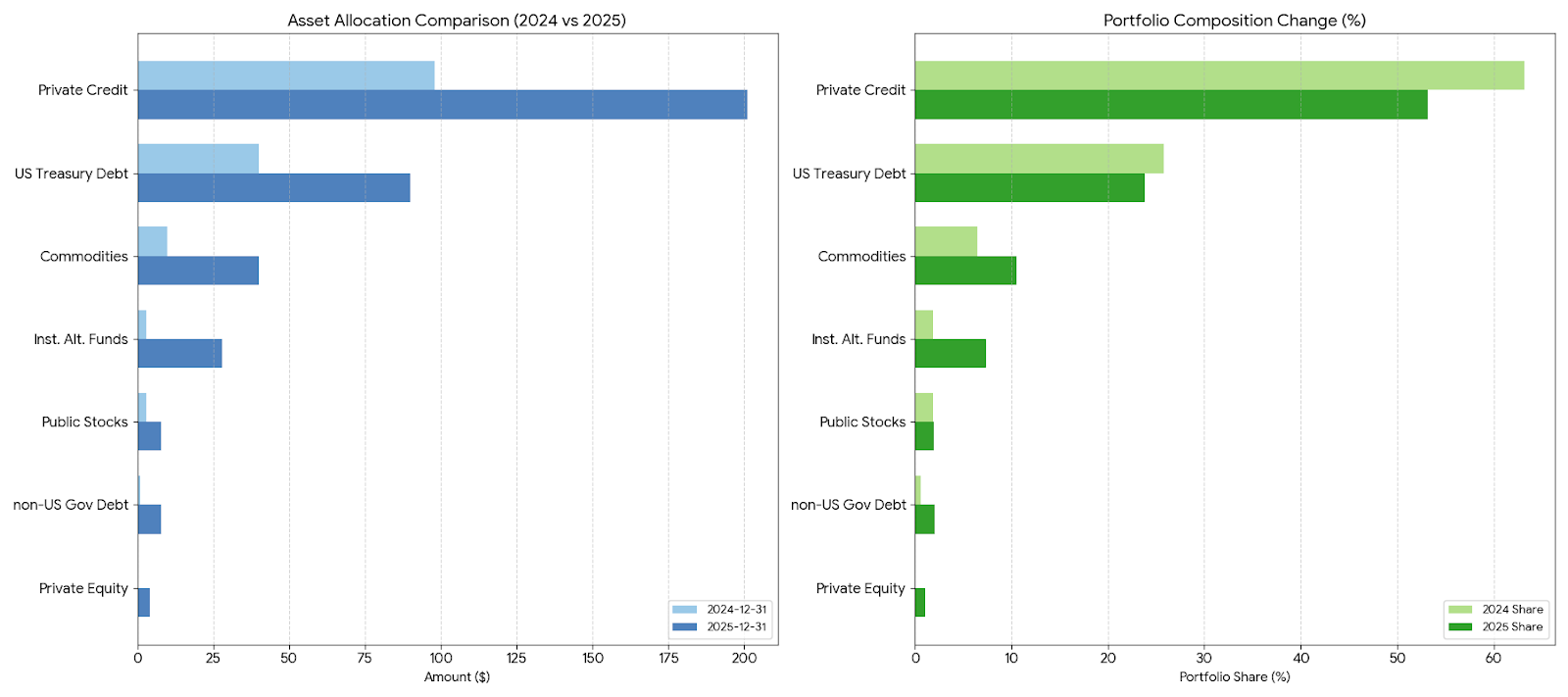

From late 2024 to late 2025, all RWA sectors achieved positive growth—and fund flows underwent pronounced structural shifts:

- Asset scale doubled: Market total存量 surged from $15.5 billion to $37.7 billion in just one year—a 2.4x increase.

- Position structure shifted from monopolar concentration to multi-polar balance: Private credit’s share dropped from 63.2% in 2024 to 52.8%, with incremental funds dispersing across other sectors.

- Alternative assets became new growth engines: Institutional alternative funds (~9x growth) and non-U.S. government bonds (~8x growth) stood out as annual highlights—reflecting investor risk appetite shifting from single-source stable returns toward diversified alpha-seeking.

- All-weather inflation-hedging system: Commodities grew ~4x YoY (share rising to 10.6%), and private equity completed its initial allocation from zero—forming an RWA market structure of “equities + bonds + commodities + alternatives,” laying foundations for onchain all-weather strategies.

Due to rwa.xyz platform data methodology adjustments, figures in this table were derived by the author from original methodologies

Trading Card Games (TCGs), representing long-tail RWA forms, also demonstrated relatively strong market performance in 2025. Taking scarce cards (e.g., 1st Edition Charizard) as examples, their onchain trading increasingly exhibited clear liquidity premiums. These assets exhibit relatively low correlation with traditional equities and bond markets; their non-financial premiums—stemming from cultural and collectible attributes—make them meaningful alternative asset options within the RWA ecosystem, providing investors with more diversification-enhancing portfolio supplements.

We anticipate that in 2026, with compliance frameworks further solidified, market focus will shift from mere “asset tokenization” to deeper “trading business”—especially RWA Perps and RWA × DeFi, which will become core growth drivers:

(1) Evolution of Trading Formats: Rise of RWA Perps and Synthetic Assets

In 2026, the key variable for RWAs is shifting from “whether assets are onchain” to “how they’re traded.” As oracles and Perps DEX infrastructure mature, RWAs’ boundaries are being reshaped by synthetic assets. Under this logic, RWAs are no longer confined to physically custodied or legally titled assets—but evolve into “any fairly priced data stream made tradable.” Beyond stocks and bonds, private company valuations, macroeconomic indicators (e.g., CPI, NFP), and even weather data can bypass physical delivery constraints via synthetic structures to become onchain trading instruments—Everything Perpetualized is becoming reality.

(2) Enhanced Capital Efficiency: DeFi Composability and All-Weather Strategies

In 2026, RWA sector competition will shift from asset issuance to capital efficiency. As underlying infrastructure matures, RWA assets and DeFi protocols will integrate more deeply—“yield generation + hedging”有望成为新模式。Taking Aave’s Horizon protocol as an example, investors can earn stable yields holding Treasury RWA while simultaneously using it as collateral to establish macro hedges onchain. This model reduces idle capital, truly unleashing RWA potential—retaining TradFi’s safety cushion while capturing DeFi’s liquidity leverage—to construct genuine all-weather investment portfolios.

(3) Asset Class Expansion: Non-USD Assets and Fixed-Income Systems Onchain

At the asset class level, RWA expansion will no longer be limited to USD-denominated assets. Accompanying USD depreciation trends, non-USD asset tokenization is poised to become a key 2026 direction—including European equities, Japanese equities, Korean equities, and G10 currency-related assets beyond USD. Simultaneously, money market funds and more fixed-income derivatives tokenized onchain will further enrich the low-volatility onchain asset pool—providing wallets more dimensions for asset allocation and trading.

From the wallet perspective, RWA’s core value doesn’t lie in whether a single asset successfully tokenizes—but whether it can be naturally integrated into users’ daily asset allocation and trading behaviors. As trading formats evolve from hold-oriented RWAs to tradable, composable RWAs, wallets are becoming vital channels connecting users with global assets—offering users diversified asset exposure beyond local markets and single-currency systems—pushing onchain finance from crypto asset management toward broader cross-market asset allocation.

6. Perpetual Contract Trading

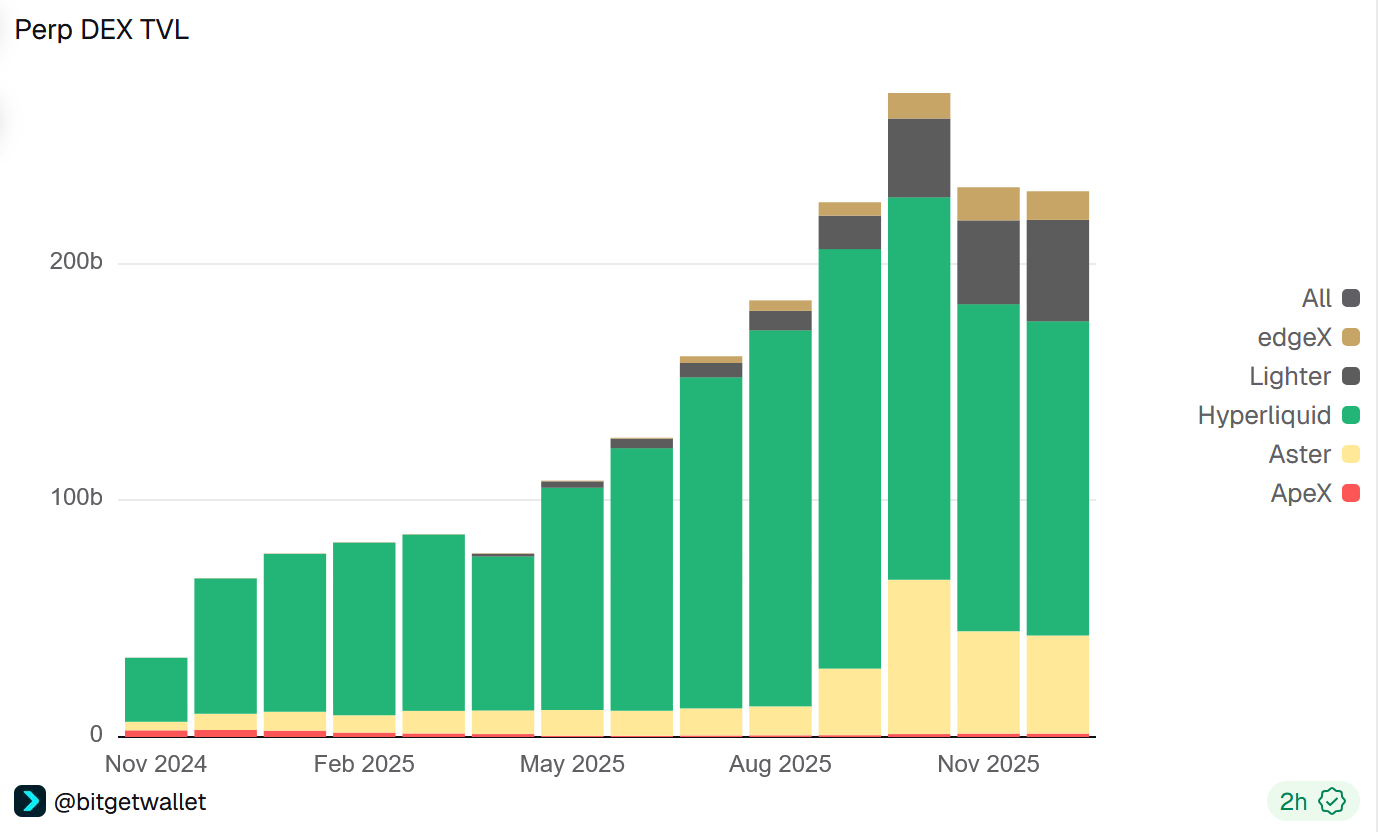

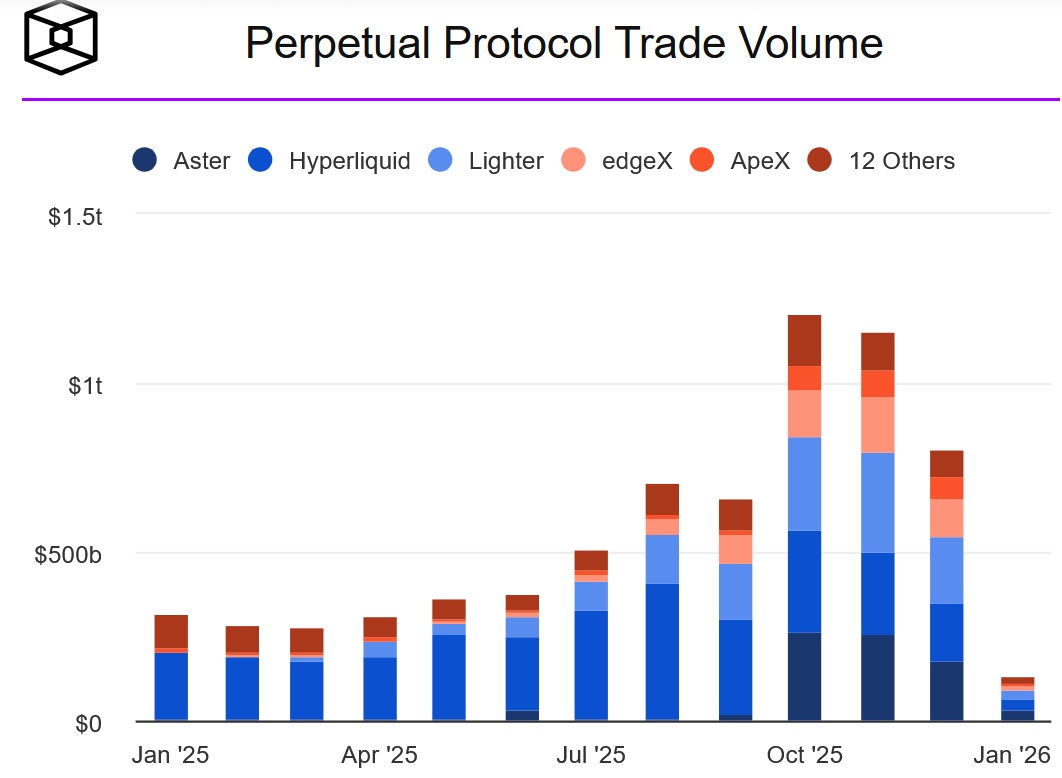

2025 marked a pivotal inflection point for liquidity dynamics in onchain decentralized perpetual contract trading (Perp DEX), achieving explosive growth in both fund size and trading activity.

In absolute terms, industry TVL demonstrated exceptional fund retention capacity—remaining steadily above $230 billion after its October peak. In trading volume, mainstream protocols exceeded $500 billion in average monthly trading volume since H2 2025—and breached $1 trillion in October and November peaks—proving onchain liquidity depth is now sufficient to handle institutional-grade capital.

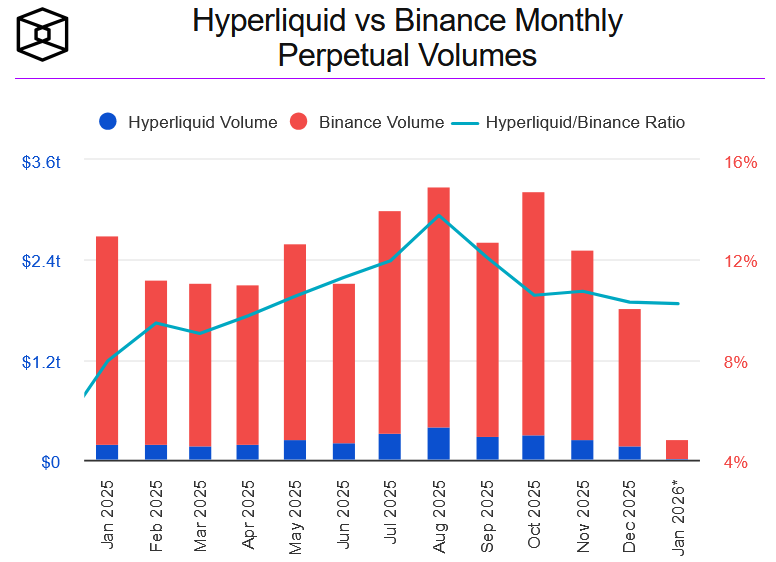

Relatively, the Perp DEX / CEX futures trading volume ratio rose from 6.34% at year-start to nearly 20% at November’s peak. For example, Hyperliquid’s monthly derivatives volume vs. Binance rose from 8% to nearly 14% over the year. These figures indicate that, with infrastructure improvements and shifting user habits, Perp DEXs have broken through liquidity bottlenecks—gradually challenging traditional spot DEXs as the next-generation core traffic pool for onchain capital.

Source:Dune Analytics

Source: The Block

Source: The Block

Another notable feature of the Perp DEX sector in 2025 was rapid competitive restructuring. The market evolved from Hyperliquid’s absolute dominance at year-start to multipolar competition by H2. According to The Block, Hyperliquid’s trading volume share fell below 60% for the first time at mid-year—while new entrants like Aster and Lighter began capturing shares among specific user groups and trading scenarios via points campaigns. Yet this shift doesn’t signify substantive动摇 of top-tier liquidity: perpetual trading inherently possesses strong network and scale effects—deeper liquidity means lower slippage, making it easier to become traders’ long-term home. Historically, whether in CEXs or DEXs, derivatives sectors often exhibit winner-takes-all structures—the core challenge for Tier-2 players remains building self-sustaining liquidity flywheels.

Looking ahead to 2026, ~20–30 Perp DEX projects remain slated for TGE rollout. Trading mining, points incentives, and market-making subsidies largely reflect existing user competition—not substantive market expansion. Against stable overall derivatives demand, Perp DEX competition is expected to shift from traffic acquisition to efficiency, stability, and user retention. Matching efficiency, system stability during extreme market conditions, fund-carrying capacity, and sustained depth across major trading pairs will become key determinants of long-term protocol positioning.

At the application level, native integration with top Perp DEXs like Hyperliquid has already validated the feasibility of in-app derivatives trading (In-App Perps) at real-user and real-trading levels. Perp DEX is becoming a key incremental scenario within wallets—users completing Perp orders, risk control, and asset management inside wallets is evolving into a more natural usage path.

Note: Data sourced from Dune, as of December 31, 2025; different wallets exhibit structural differences in user scale, trading frequency, and asset preferences—cumulative trading volume and daily active users reflect only relative positioning within in-app perpetual contract trading scenarios.

As the frontend closest to users’ assets and decision paths, wallets will assume more critical distribution and承接 roles in the Perp DEX ecosystem. Amid diminishing new-token wealth effects and large-volume trading returning to core assets like BTC/ETH, in-wallet Perp trading provides users with higher-frequency, more continuous usage rationale. For wallets, Perp trading is no longer just a functional add-on—it’s a key scenario connecting onchain liquidity, enhancing user stickiness, and increasing usage frequency. We expect that in 2026, with infrastructure maturing further and user habits migrating continuously, deep integration between Perp DEXs and wallets will become a long-term structural trend in the onchain derivatives market.

7. Meme

Reviewing 2025, memes remained one of the most important attention gateways onchain. Trump-themed tokens, Web2 celebrity coins, Pump.fun livestreams, and Chinese meme waves successively created multiple rounds of activity cycles—releasing tangible wealth effects in phases. In these structural rallies, massive numbers of users downloaded wallets for the first time, executed their first onchain trades, and grasped concepts like gas, slippage, and failure rates for the first time—memes became the most direct, lowest-barrier onramp into the onchain world.

Internal Bitget Wallet user and trading data shows this trend especially clearly: New users in 2025 accounted for ~65% of annual trading users and contributed ~61% of total trading volume. Memes genuinely served as the “new user onboarding → first trade → frequent usage” onchain启蒙 role—their periodic rallies often directly corresponded with synchronized rises in wallet downloads, address creation, and swap activity.

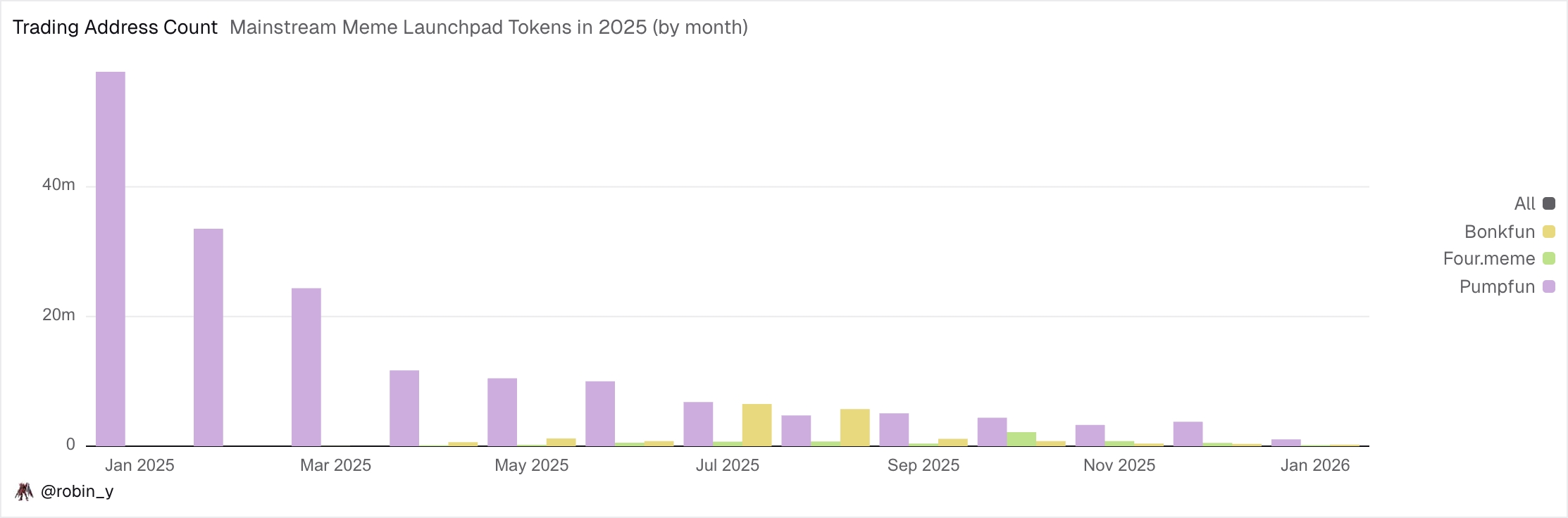

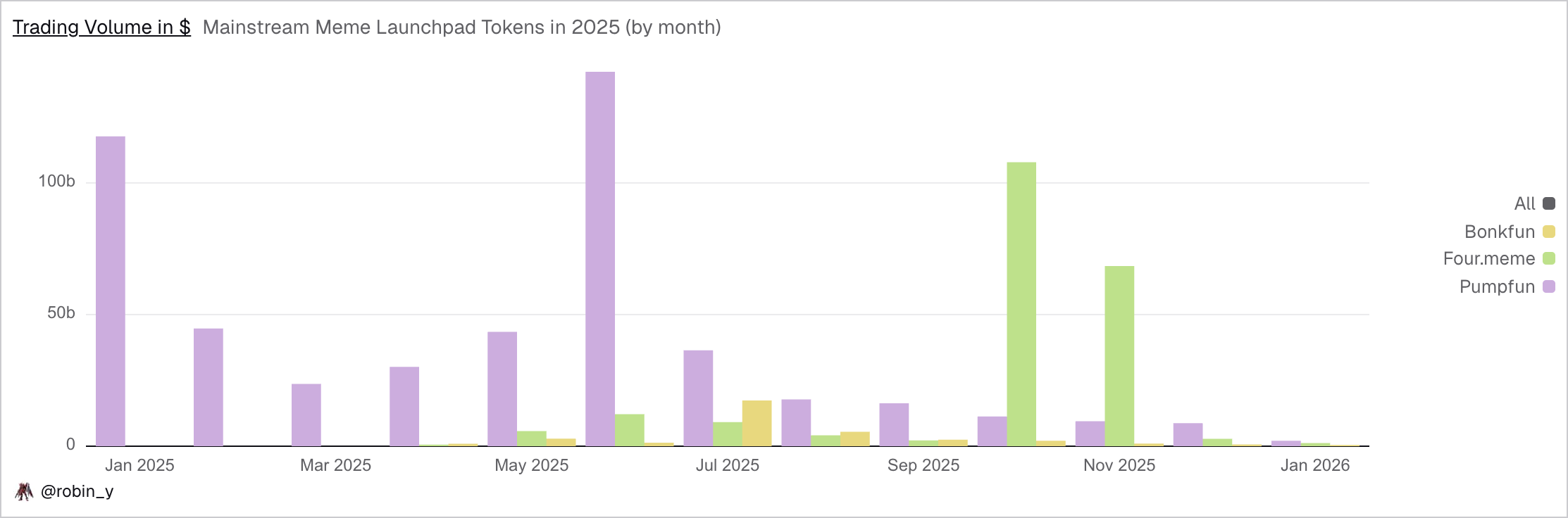

However, judging from trading volume and address counts on major meme launchpads, repeated meme hotspots haven’t concurrently driven sustained recovery of overall onchain liquidity. Broad-market meme seasons like early-2025’s Trump coin are increasingly difficult to replicate—and 2026 memes are more likely to manifest as structural rallies: periodic speculative opportunities emerging around specific hot topics and narrative windows.

Source:Dune Analytics

Source:Dune Analytics

Another uncertainty for 2026 meme rallies stems from “hot-topic assetization”分流 via new formats. Pump.fun rapidly converts hot topics into tokens, while Polymarket converts them into topics and odds—both essentially competing for the same attention and risk appetite. As prediction markets offer lower participation thresholds for hot events, more direct expression formats, and product shapes closer to大众 understanding, memes may face further attention and onchain liquidity diversion in certain scenarios.

In memes’ ongoing evolution, more projects continually attempt attracting external incremental users via multi-channel strategies—shifting memes from consensus-centric internal assets toward more diffusive, clearly defined cultural symbol outputs—and attempting to exert reverse influence on real-world events and public discourse. Meanwhile, although various launchpads have validated fair issuance and efficiency advantages, creator incentive mechanisms, long-term value sustainability, and sustained onboarding of non-crypto users still require further refinement.

Yet undeniably, memes represent one of crypto’s most attractive and vital experiments—the fair launch, permissionless onchain issuance, and participation model. Future expectations remain focused on value-level upgrades: Will memes remain stuck in highly zero-sum short-term PvP games—or can they once again produce phenomenon-level memes capable of carrying cultural expression and creator participation, attracting broader external user groups?

From a product and tool perspective, disruptive innovation in meme trading itself may be unlikely—entering a stage centered on “intelligence and refinement.” Trading tools are enhancing user onchain awareness in liquidity-thinning environments through finer-grained data presentation, more intuitive risk warnings, and more proactive intelligent services—enabling faster, more stable decisions. Address relationship and cluster analysis products will become more widespread, forming foundational configurations for more users—delivering transparent, understandable onchain behavioral analysis for the general public will become the next-phase optimization focus for trading tools and wallet features.

8. Prediction Markets

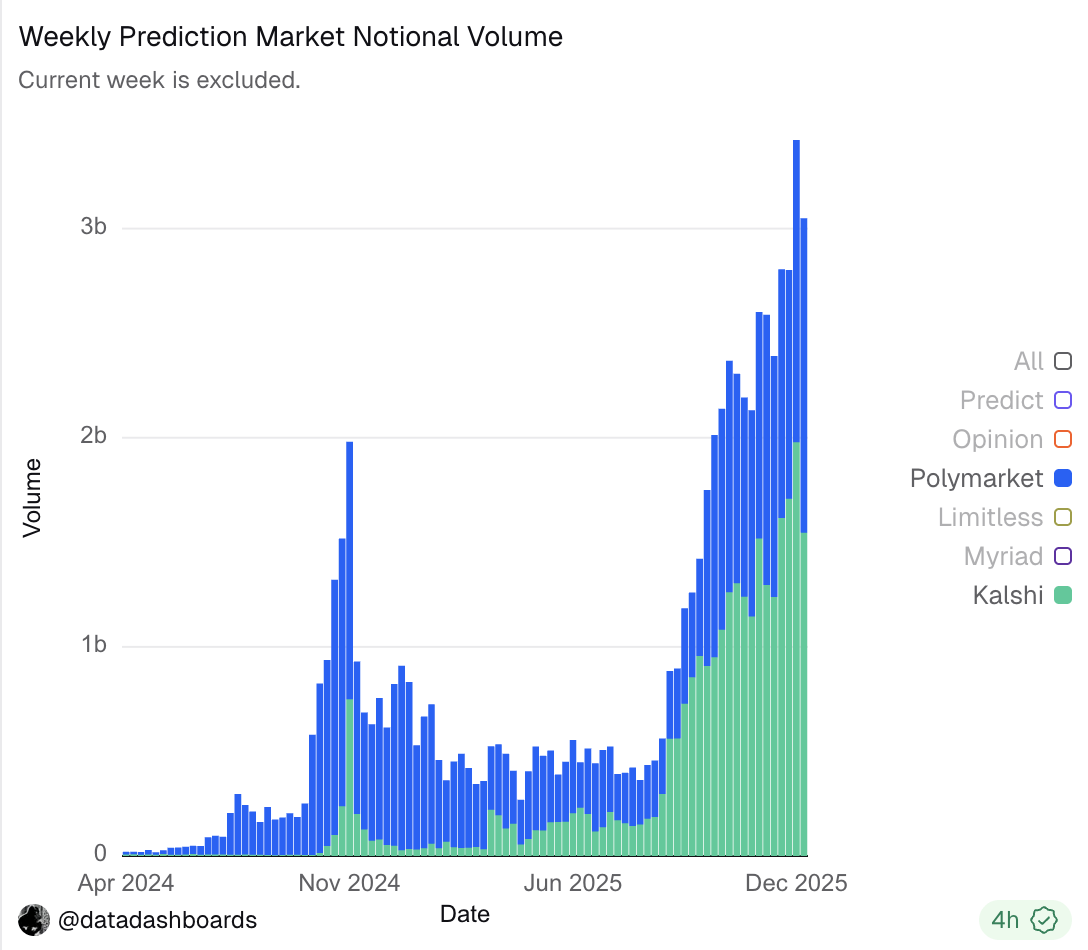

In 2025, prediction markets completed a critical leap—from crypto-adjacent products to nascent mainstream financial applications—with significant uplifts in overall trading volume and participation. Current mainstream prediction markets’ monthly trading volume has stabilized above $10 billion, with cumulative annual trading volume exceeding $40 billion. Though their absolute scale remains markedly smaller than mature financial markets like equities and futures, as an independent new asset class, prediction markets demonstrate exceptionally steep growth curves—entering a clear acceleration phase.

With trading depth improving and participation structure refining, their functionality is undergoing substantive change. In increasingly many scenarios, prices no longer merely reflect opinions or sentiment—but rather information already possessed (though not yet publicly confirmed) by some participants. Fund flows themselves become vehicles for information release—enabling markets to form price signals ahead of factual disclosures.

Contract structure evolution further reinforces this trend: as prediction markets expand from simple binary judgments to finer-grained event decomposition and composite pricing, their prices acquire actionable financial meaning. In select cases—when market scale is large enough and relevant parties highly attentive to price changes—prediction markets may even feed back into participants’ behaviors, making price signals themselves variables influencing real-world decisions.

From a broader perspective, prediction markets can be understood as a more structured attention trading mechanism:

- Meme trading is essentially a博弈 over narratives and sentiment—its linkage to real-world events is often indirect and unstructured, usually relying on devs or communities for subjective interpretation and mapping, lacking unified, reusable event structures, and more prone to parallel circulation of same-name, same-angle assets—with dissemination and discussion often confined within crypto circles.

- Prediction markets use highly explicit real-world events as trading subjects—directly converting publicly significant events (politics, macroeconomics, industry dynamics, celebrity events, sports, etc.) into tradable, verifiable probability assets—around clearly defined occurrence conditions and settlement rules (e.g., whether, when, or how it occurs).

In this sense, prediction markets possess stronger dissemination and discussion value—and clear positive externalities: researching questions, gathering information, and judging trends can be converted into economic returns via market mechanisms—and earlier, clearer outcome signals themselves carry strong social value.

Source:Dune Analytics

Prediction market accuracy is significantly surpassing traditional Wall Street analyst systems. Source: Kalshi Research

2026 will be a year densely packed with events. The FIFA World Cup, U.S. midterm congressional elections, and other major events with clear outcome endpoints will continuously provide high-quality, sustainable trading subjects for prediction contracts. Against the backdrop of amplified trading scale, maturing platform capabilities, and increasingly clear compliance pathways, the dense occurrence of real-world events is poised to generate significant amplification effects for prediction markets—driving them into broader-scale growth in 2026.

As underlying platform numbers increase and event coverage improves, prediction market competition is also shifting: from whether platforms possess market supply capacity—to who can host users’ primary trading entry points. At this stage, user experience, information organization, and trading efficiency are becoming key differentiators among platforms.

Looking ahead to 2026, prediction markets are more likely to see innovation first at the interface and product layers—not through complete liquidity aggregation. This judgment stems from prediction markets’ structural characteristics: events are highly fragmented; different platforms lack unified standards for defining the same event, splitting options, and settlement rules; variations in account systems, fund custody, and order logic across platforms also hinder seamless cross-platform matching and fund consolidation—as seen in DEXs.

Against this background, most retail users’ core needs remain concentrated on event discovery, quick judgment, and convenient order placement—not cross-platform odds comparison or complex arbitrage execution. At this stage, the more realistic and feasible evolution direction for prediction markets may be unification at the information and interface layers: lowering users’ cognitive and operational costs through more efficient event filtering, odds display, and position management—thus enhancing overall decision-making efficiency.

As the frontend closest to users’ assets and decision paths, wallets naturally possess the conditions to become the primary entry point and distribution layer for prediction markets. As prediction markets expand from crypto-native users to broader consumer groups, their strong linkage to real-world events will continue amplifying this entry-point value. We look forward to witnessing wallets evolve from simple aggregators of trading functions into core entry points for event-driven daily financial behaviors.

Conclusion

Combining the above observations, we believe onchain activity in 2026 will continue shifting from transaction-driven to usage-driven—from reliance on cyclical market momentum and traffic toward reusable, retainable daily financial behaviors. In this process, wallets will progressively evolve into the core frontend application connecting users, the onchain ecosystem, and the real-world financial system. Based on this judgment, we summarize the 2026 evolution paths across the eight directions into the following three trend insights:

- Stablecoin payments and AI agent consumption extend the value exchange network’s reach—wallets become the settlement routing layer between onchain and real-world economies

As stablecoins continue breaking through in regulation, issuance scale, and adoption, they’ve become a critical component of the global value settlement network—deeply embedding into cross-border B2B2C payments, local instant payment systems, and card network clearing and settlement systems; protocols like x402 enable AI agents to independently execute payments and settlements within predefined authorizations—significantly expanding the participant base and frequency of value exchange; these two shifts jointly drive onchain value flows outward—from crypto-native scenarios into real-world economies and automated business models. By integrating stablecoin systems, real-world payment networks, and multi-chain assets, wallets will provide users with currency conversion, path orchestration, and fund scheduling—progressively evolving into the core settlement routing layer connecting onchain and real-world economies.

- Privacy and credit enter preparation stages for scaled adoption—wallets become the infrastructure layer for long-term onchain financial relationships

As payment and asset management scenarios grow in onchain activity, privacy and credit are shifting from peripheral topics to prerequisites for daily finance. Privacy is no longer just a preference for a few users—it will gradually become a default capability required for crypto’s mass adoption; onchain credit will also depart from single-collateral logic—beginning to build tiered systems around users’ long-term behavioral trajectories, time accumulation, and fulfillment stability; implementing both needs relies on continuous cross-chain, cross-protocol, cross-cycle data. As the aggregation entry point for users’ onchain behaviors, wallets will begin serving as the practical landing points for privacy boundaries and credit states—systematically integrating asset queries, transaction initiation, identity interactions, and permission controls—to provide infrastructure support for long-term, reusable onchain financial relationships.

- Memes, RWAs, Perps, and prediction markets reshape onchain trading asset structures—wallets become the primary trading execution layer

Diversification of onchain trading asset classes will comprehensively cover varying user risk appetites and investment needs. Memes—as key onchain attention assets—will continue exhibiting structural rallies; onchain trading volume growth and fund depth will gradually migrate toward more financially grounded, real-world anchored asset classes like RWAs, perpetual contracts, and prediction markets. RWAs will evolve into freely tradable and composable DeFi financial instruments—meeting stable-return and diversified-allocation needs; Perp DEXs—after enhanced liquidity and stability—will continue attracting high-frequency and professional traders; prediction markets—through event-probability pricing—will provide new risk exposures for opinion-expressing and information-driven users. Users’ trading and asset management behaviors will concentrate increasingly in wallets offering multi-asset selection and unified, permissionless operational experiences—making wallets the primary entry point for global asset allocation and cross-market trading.

These outlooks constitute only a阶段性 summary and articulation—not definitive answers. The industry remains rapidly evolving, many paths remain undefined, and many questions remain inadequately discussed. We hope this report systematically presents Bitget Wallet’s observations and reflections on onchain daily finance in 2025–2026—offering the industry some reference perspectives amenable to continuous validation and discussion.

Whether you’re a crypto-native builder, researcher, or developer—or a participant from traditional finance and tech—we look forward to ongoing dialogue with you: calibrating judgments through open discussion, refining understanding through practical feedback—and advancing onchain finance toward more authentic, sustainable development with fellow travelers—reshaping the global financial infrastructure for the next era.

About Bitget Wallet

Bitget Wallet is Asia’s largest and a globally leading all-in-one Web3 wallet—serving over 90 million users worldwide. It supports multiple wallet formats including mnemonic phrases and social logins, covering 130+ public blockchains and millions of tokens. Product features include Swap trading, wealth management, payments, RWA trading, and derivatives—aggregating hundreds of leading DEXs and cross-chain bridges, supporting the broadest multi-chain trading, and backed by a $700 million risk protection fund for comprehensive asset security.

Our vision is Crypto for Everyone—building a consumer-grade Web3 wallet usable daily by one billion people—making crypto simpler, more trustworthy, and truly integrated into everyday life.

Learn more at: Website | Twitter | Telegram | Discord

Disclaimer

This report is provided for informational and research purposes only and may involve products, features, or services not currently available—or unavailable—in various jurisdictions. This report does not constitute, nor should it be construed as: (i) investment advice, recommendations, or opinions of any kind; (ii) offers or solicitations to buy, sell, or hold any crypto assets, digital assets, or related products; (iii) financial, accounting, legal, or tax advice of any kind.

Crypto and digital assets (including stablecoins) carry high risk. Their prices and values may fluctuate significantly in short periods, exposing investors to principal loss. Before engaging in any related transactions or using any related products or services, readers should thoroughly assess their financial situation, risk tolerance, and applicable legal and regulatory environments—and consult qualified professionals (including but not limited to legal, tax, or investment advisors) as needed.

Information contained in this report—including but not limited to market data, statistics, trend assessments, and forward-looking views—is intended for general disclosure and industry research purposes only. Although reasonable efforts were made during compilation to ensure reliability of information sources and accuracy of content, Bitget Wallet assumes no express or implied liability for any factual errors, omissions, or consequences arising from decisions based on such information. Views expressed herein reflect judgments formed at the time of writing based on publicly available information and research assumptions—and do not guarantee continued validity in the future.

This report is intended for non-commercial reading and citation only. With proper attribution, up to 100 characters may be quoted or republished in full. Any adaptation, derivative work, or other use requires prior written permission from Bitget Wallet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News