The man who climbed Taipei 101 barehanded yesterday is a trading software spokesperson.

TechFlow Selected TechFlow Selected

The man who climbed Taipei 101 barehanded yesterday is a trading software spokesperson.

In an industry with an extremely high liquidation rate, simply surviving is the best advertisement.

By Kuli, TechFlow

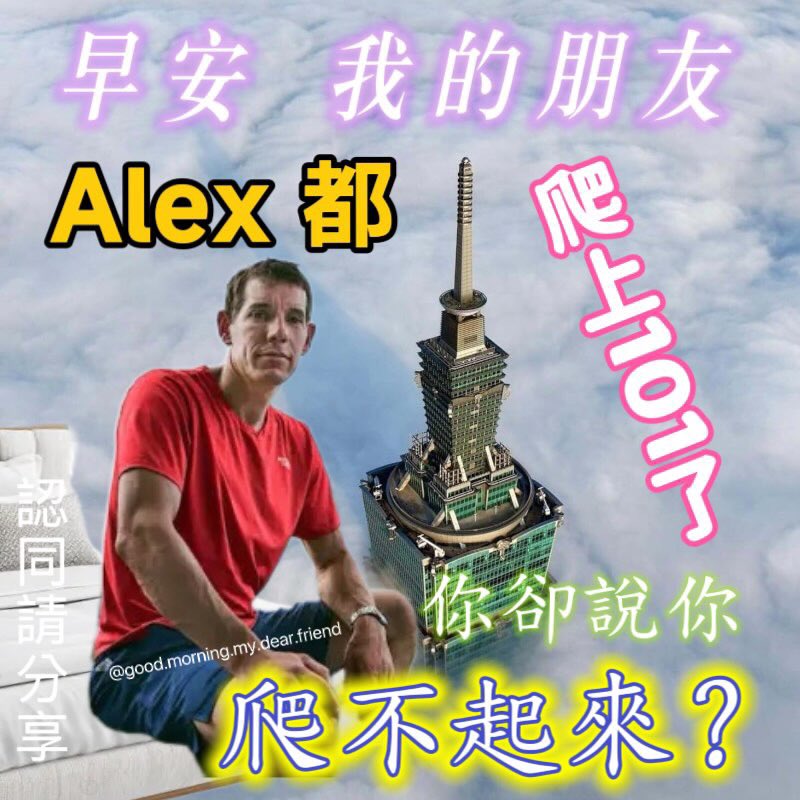

Yesterday, millions of people worldwide watched a live stream: a man climbing Taipei 101—unaided and without ropes.

No ropes. No safety gear. 508 meters. 101 floors. Netflix broadcast the entire climb live—lasting 1 hour and 31 minutes—and he successfully reached the rooftop.

This man is Alex Honnold, 40, a professional rock climber.

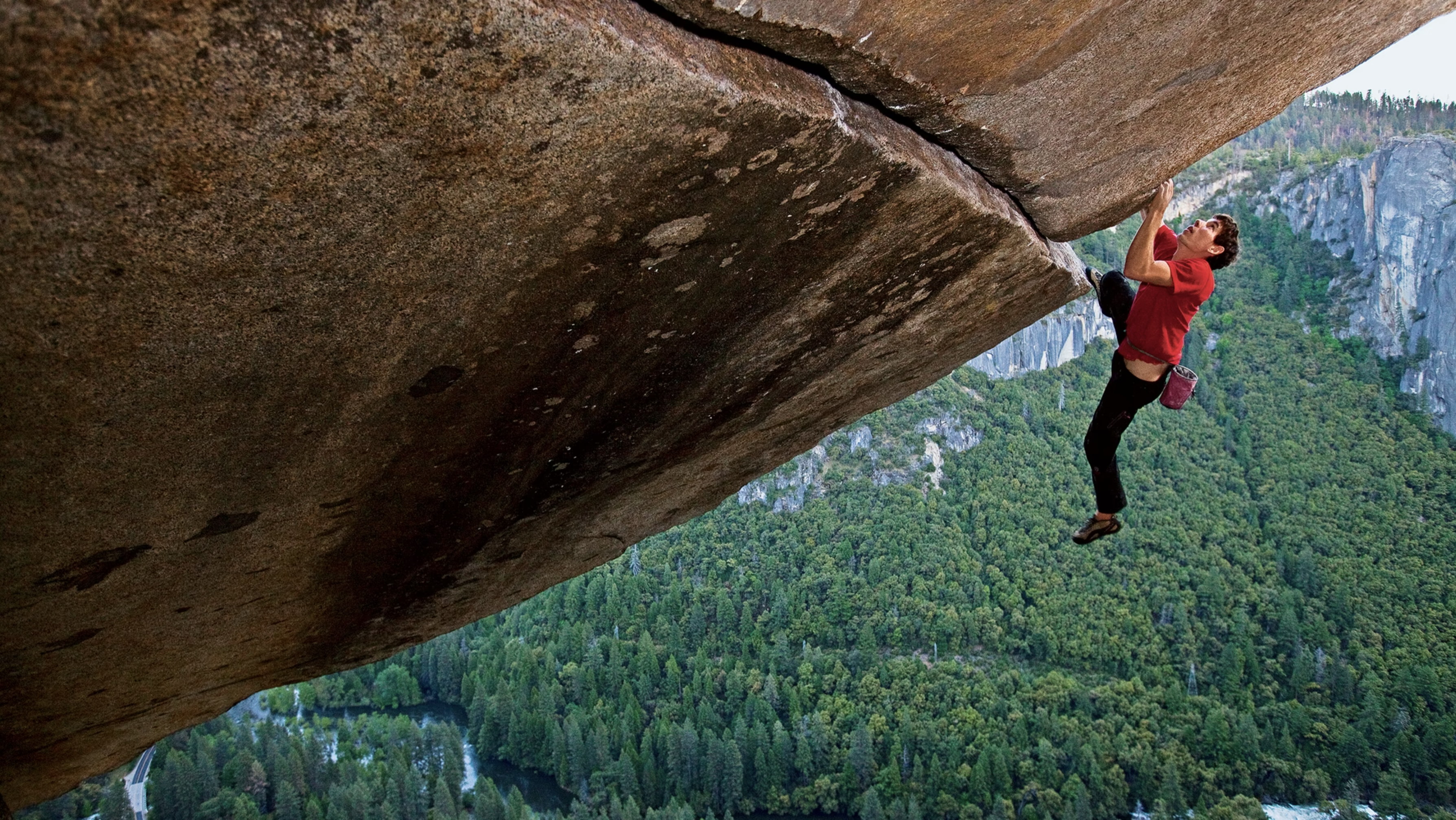

In 2017, he free-soloed El Capitan in Yosemite—a 900-meter granite monolith—with no ropes or protective gear whatsoever. The documentary Free Solo captured the feat—and won an Academy Award.

The New York Times hailed it at the time as “one of the greatest athletic achievements in human history.”

But that’s not what I want to talk about today.

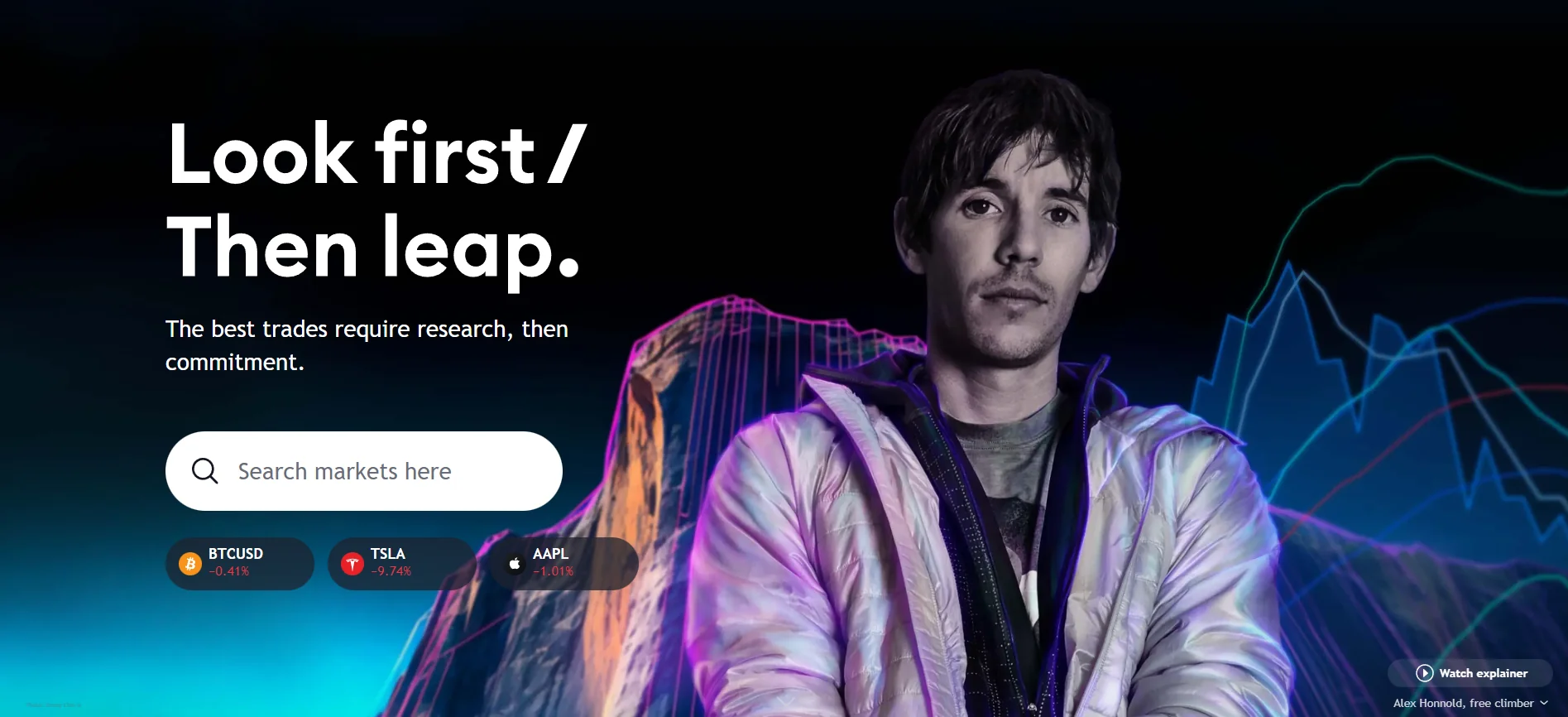

Have you noticed a detail? Alex Honnold is actually the official spokesperson for TradingView—a charting and analysis platform widely used by stock, crypto, and forex traders.

TradingView helps users analyze market charts and price action. In 2021, during its brand refresh, TradingView signed Alex Honnold—and adopted the slogan “Look first / Then leap.”

Observe first. Then act.

At first glance, it seems odd: why would a financial charting platform choose a free-solo climber as its face?

What’s he supposed to demonstrate? That after reading a candlestick chart, you should jump off a building? Yet upon reflection, this cross-industry endorsement is surprisingly apt.

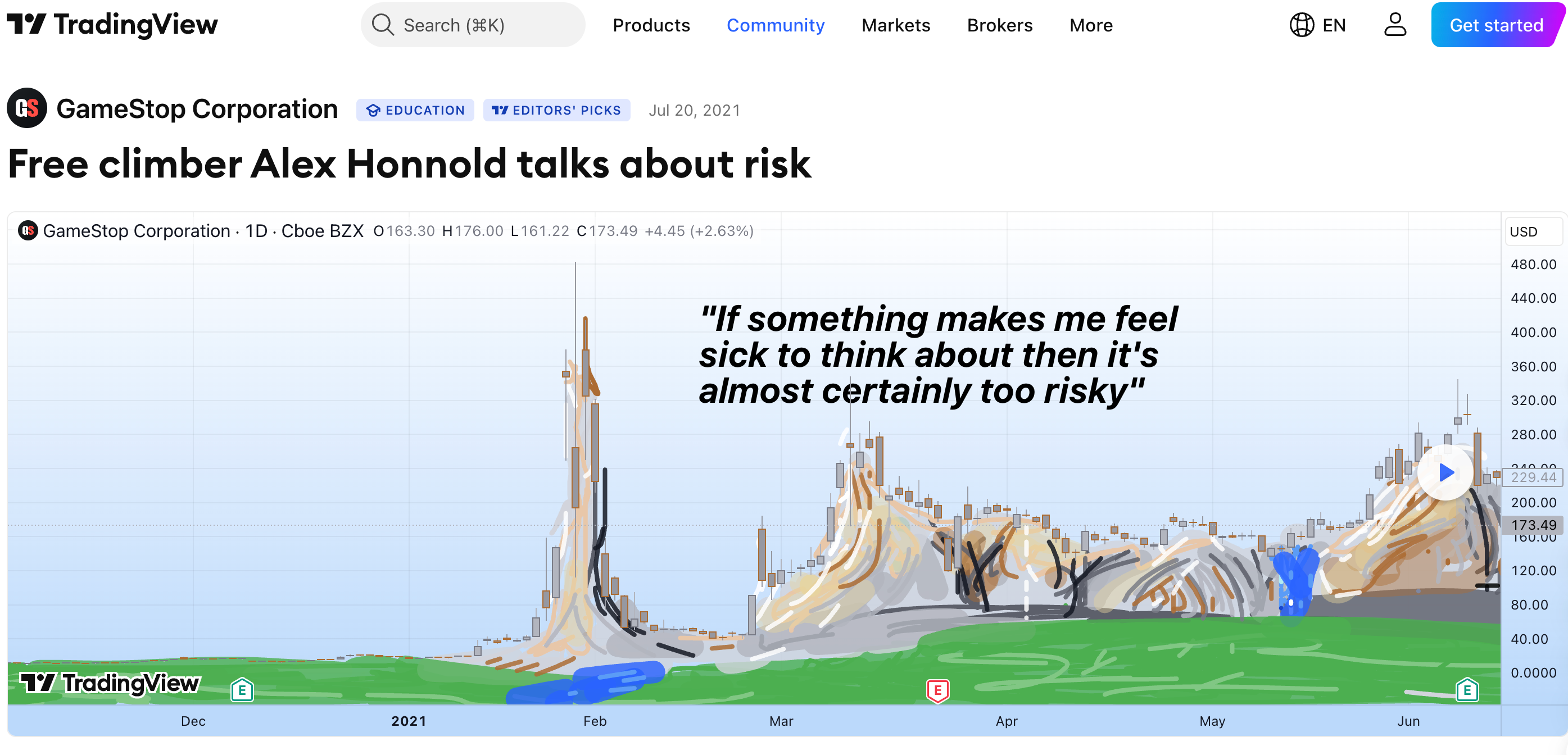

In a TradingView interview, Alex shared his view on “risk”:

“For me, risk means uncertainty—rolling the dice and seeing what happens. And that’s precisely what I strive to avoid in climbing.”

Alex’s discipline—free soloing—is often mischaracterized as extreme sport or recklessness.

But if you’ve watched the documentary about his 900-meter ascent of El Capitan, you’ll see his methodology is profoundly conservative.

He spent nearly a decade planning the climb—and over a year and a half preparing for it. He rehearsed every section dozens of times with ropes, until he could navigate each move blindfolded: where to place his hands, where to step.

He carried a notebook, documenting every critical movement in meticulous detail.

One of his quotes applies just as well to trading as it does to climbing:

“If thinking about a move makes me feel nauseous, it means the risk is still too high—I’m not ready yet.”

Fear is a signal—not an obstacle to overcome.

The same rigor applied to his rope-free climb of Taipei 101. Before the live broadcast, he conducted full rehearsals—with ropes—to test every grip point on every floor. Originally scheduled for the 23rd, the livestream was postponed to the 24th due to weather—and then again to the 25th.

He waited—for wind to subside, for conditions to align—before acting.

What Alex Honnold does appears among the world’s most dangerous acts: no protection, certain death if he falls. Yet his underlying methodology is the ultimate expression of risk management:

Ten years of preparation. Relentless rehearsal. Patience for ideal conditions. Rejection of uncertainty.

By contrast, many seemingly routine activities—walking a dog, opening a derivatives position, buying a token—may rely on far more aggressive methodologies than Alex’s. People rush in based on social media signals; they copy trades the moment they see someone else enter.

In meme coin and perpetual contract markets—where “dog”-themed tokens dominate and missing a single second feels like forfeiting a profit opportunity—waiting has become the antithesis of profitability. Forget ten years of preparation: sometimes we don’t even calculate our own liquidation price.

Alex says he strives to avoid rolling the dice.

Yet open any derivatives trading interface—and you’ll find most participants *are* rolling the dice. They just think they’re analyzing.

Back to TradingView’s choice: perhaps Alex wasn’t selected to represent courage—or “extremes.”

Rather, he represents survival.

In an industry with sky-high liquidation rates, simply staying alive is the strongest possible endorsement. The ultimate goal of Free Solo isn’t summiting—it’s summiting *alive*, descending *alive*, and returning tomorrow to climb again.

The same holds true for trading.

Alex Honnold succeeded on El Capitan not because he was fearless—but because he knew, with absolute precision, exactly where each foot and hand would land.

He prepared for ten years.

What about you?

Note: Alex Honnold’s endorsement partnership with TradingView began in 2021. “Look first / Then leap” is TradingView’s official brand slogan. His quote on risk is drawn from an official TradingView interview.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News