With current encryption, holding on continuously means continuous losses.

TechFlow Selected TechFlow Selected

With current encryption, holding on continuously means continuous losses.

In 2026, as in every previous year, the winners will not be "the right people."

Author: 𝗰𝘆𝗰𝗹𝗼𝗽

Compiled by: TechFlow

TechFlow Editorial: In the crypto market, 100x growth stories still exist—but the rules have completely changed. Veteran trader 𝗰𝘆𝗰𝗹𝗼𝗽 argues that with token supply exploding (tokens per capita up 24x), the traditional "buy and hold" strategy has become a graveyard for wealth.

This article dives deep into the evolution of market paradigms from 2017 to today, revealing how liquidity rapidly rotates among airdrops, Solana memecoins, real-revenue protocols (like HYPE), and "casino-style" platforms.

Standing at the threshold of 2026, the author presents a new practical framework: don’t try to find the one 10,000x coin—instead, capture cyclical rotations across “value → casino → structural extraction,” leveraging compounding to achieve bourgeois-level financial transformation. For investors stuck in a bear-market mindset yet hungry to reclaim their peak, this is not just a guide—it’s a complete cognitive overhaul.

The full article follows:

Over the past two years, I turned $8,000 into seven figures in crypto.

Most people think such returns can’t be replicated—I disagree. I believe now is the best time to go from $10,000 to $1 million (even though it sounds insane).

(Serious warning: This article is long. Save it now so you don’t lose it, but make sure to read all the way through—it might change how you see this market.)

Even though no one talks about "altseason" anymore, most people still cling to the same old mindset:

They’re waiting for one massive wave when everything pumps together—just buy a bag of alts and ride it to riches.

- Hold forever

- Search for “the one coin”

- Ignore sector rotation

- Pray the market rewards patience

This approach worked when token supply was limited and narratives could last months.

In 2024, it’s usually wrong. In 2025, it’s wrong most of the time. By 2026, it will be definitively wrong—not because 100x gains are impossible.

But because the way to achieve 100x has changed.

Part One: What Changed Between 2017–2021?

The Market Has Been Diluted Into a Token-Minting Machine

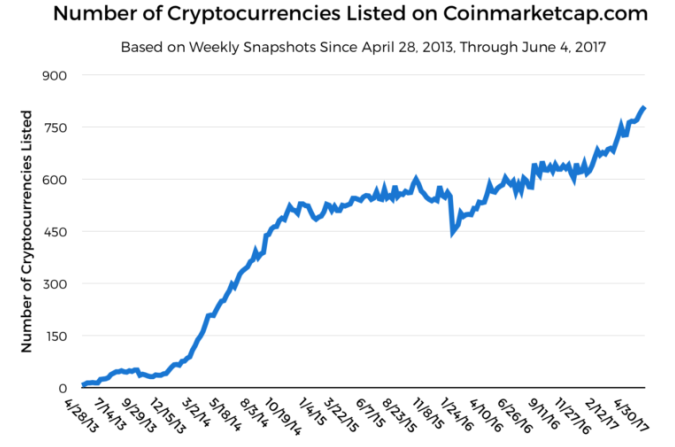

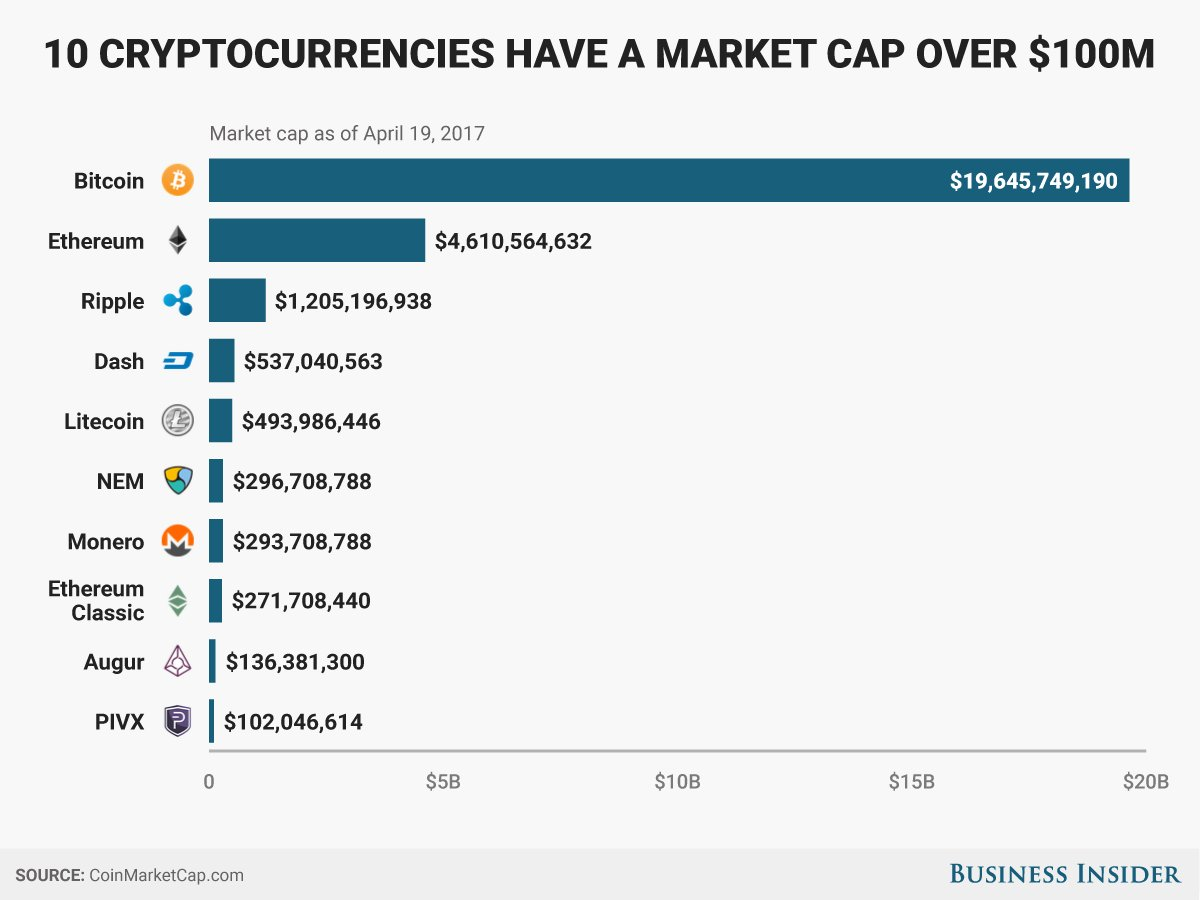

In early 2017, CoinMarketCap tracked around 796 cryptocurrencies. That’s not a typo—fewer than 1,000. Back then, ~800 tokens already felt like “a lot.” Today? According to CoinGecko, roughly 5,300 new tokens are created every day in 2024.

In practice, this meant:

- “Discovery” was real. There weren’t infinite alternatives.

- If you got exposure (listed on CMC, on an exchange, basic narrative + some marketing), liquidity had few places to go—so it actually flowed to you.

- People bought random things because the menu was small, and everyone was learning in sync.

This is why simply being listed on CMC + gaining attention was an edge during 2017–2021. Everyone had room to survive.

The Attention-to-Supply Ratio Has Collapsed

The most important shift since 2021 is this:

Attention hasn’t scaled. But token supply has exploded.

Crypto users have increased.

But the number of tokens has grown far more dramatically, making attention per token worth less and less.

Crypto.com estimates:

- 106 million crypto holders in January 2021

- 295 million in December 2021

- 580 million in December 2023

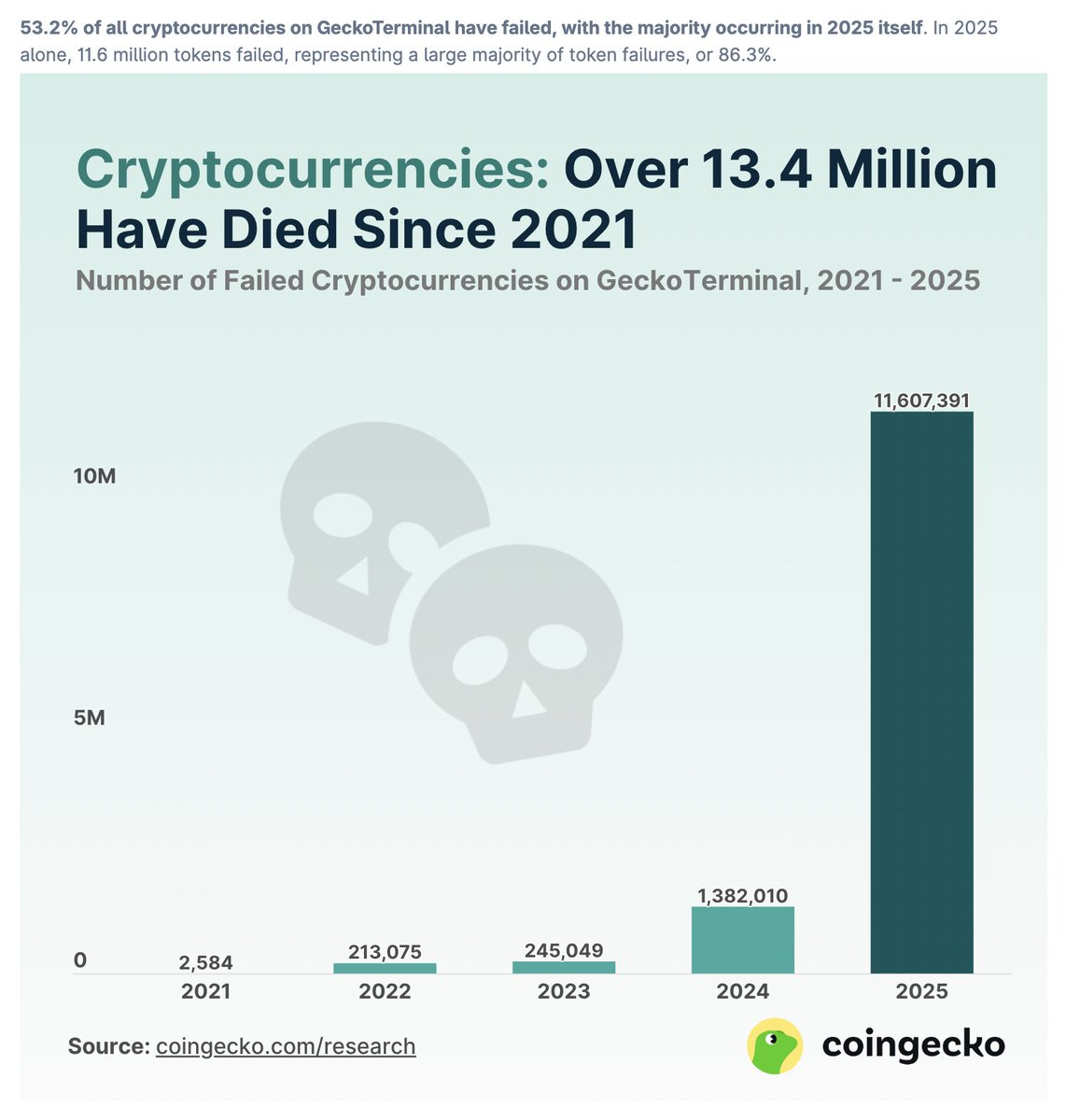

Supply side (coins/projects): GeckoTerminal data from CoinGecko shows:

- 428,383 projects in 2021

- 20,170,928 projects by 2025

Now here’s the core insight: How diluted has the market become?

In 2021, there was roughly 1 token per 689 crypto holders. By 2025, it’s about 1 token per 29 holders.

In just a few years, tokens per capita have increased by ~24x.

This means: back then, attention had nowhere else to go—so even random coins could get discovered.

Now, you compete daily against a sea of new tokens—so “holding a bag and waiting” is no longer a strategy.

New Launches Are Now Designed to Underperform

In previous cycles, many low-priced token launches offered genuine upside. The current pattern is now:

- High fully-diluted valuation (FDV) at launch

- Low float

- Heavy token unlocks

- Early holders seeking exit liquidity

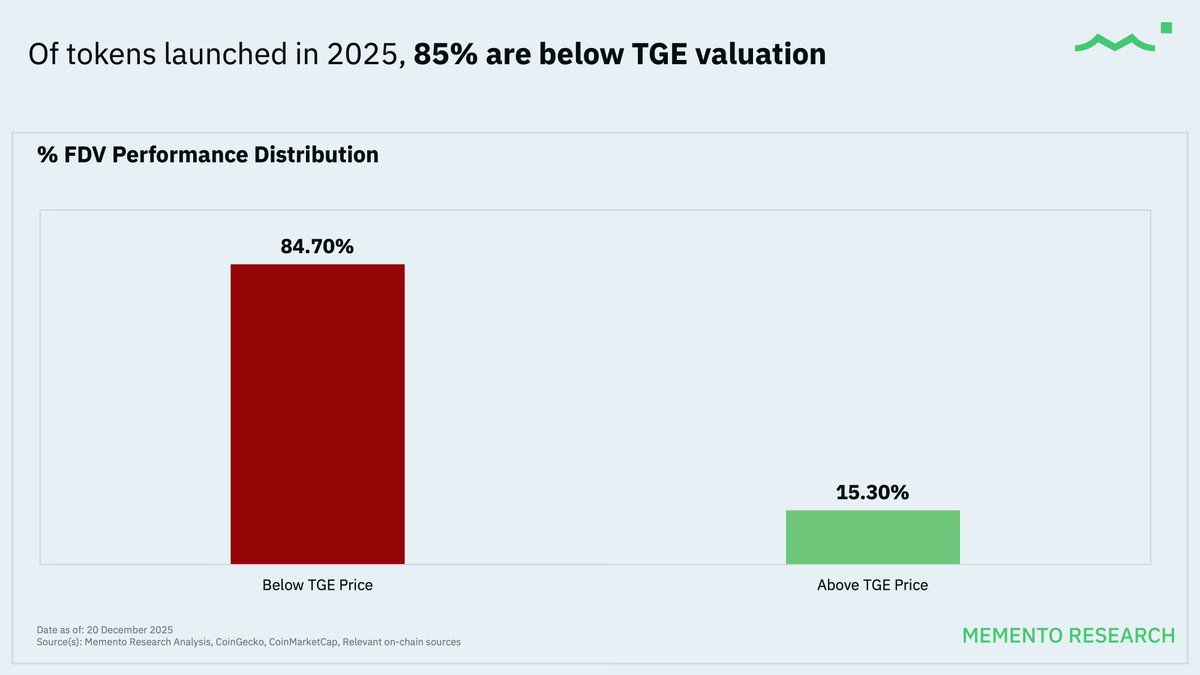

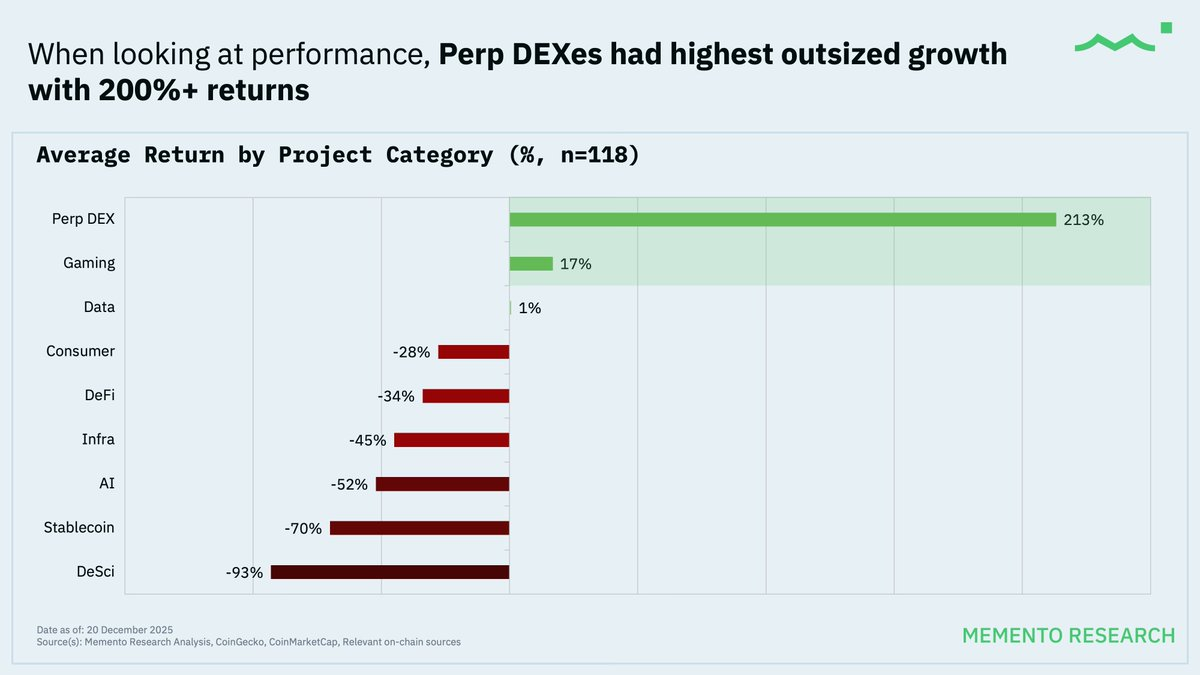

Memento Research tracked 118 major token launches in 2025:

- 84.7% traded below their TGE price

- Median performance: -71.1% from FDV at launch, -66.8% in market cap

This is why “only buying new listings” has become a suicide strategy. But here’s the twist:

Even in this diluted, brutal market—if you pick the right narrative early, you can still profit. (More on this later.)

Part Two: How Small Players Get Exploited by Default Paths

The Illusion of “Fair Launch”

Retail no longer trusts VCs or wants to buy overvalued altcoins post-TGE, so the market created a new product: a casino where anyone can “enter early.” No VCs. No high valuations at TGE.

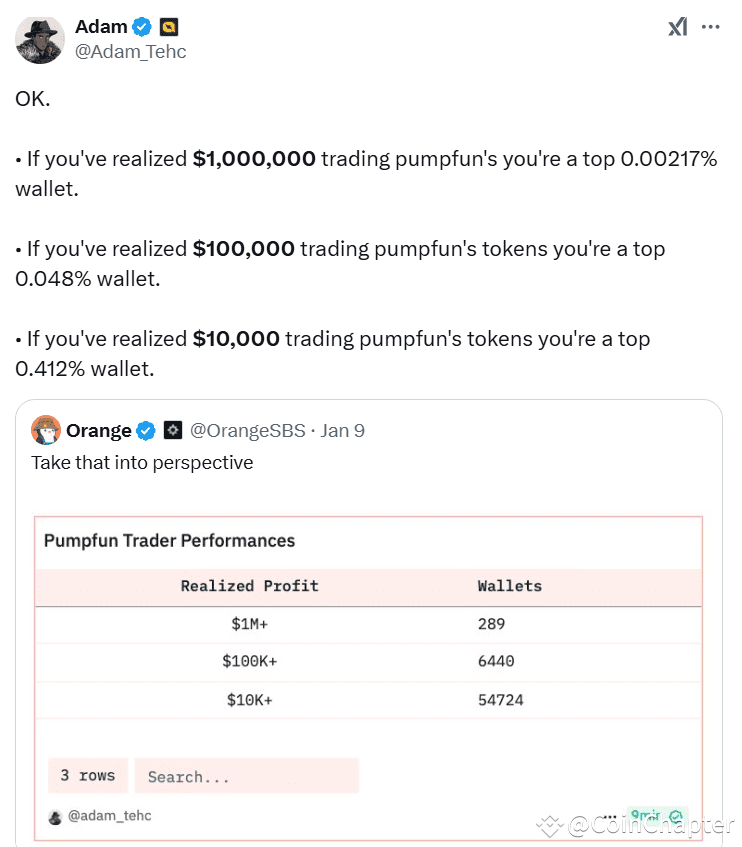

Welcome to the Pump.fun era. Some stats:

- 13.55 million Pump.fun wallet addresses

- Only 55,296 (0.4%) made over $10,000 in profit

- Meaning 99.6% didn’t hit the target, and over 90% lost money

Yes, a tiny group wins big.

But the median outcome is donating liquidity to token devs, their insider friends, paid KOLs, Pump.fun developers—or simply faster players and trading bots. While users fight over scraps, the house prints money relentlessly.

- Pump.fun has collected over $935 million in fees since launch

The same dynamic exists in prediction markets: An analysis cited by Finance Magnates found over 70% of Polymarket’s 1.7 million traders were unprofitable.

If your plan is “I’ll be the exception,” you need real edge. Otherwise, you’re just a random variable in a negative distribution.

Part Three: Rotation Is the Theme of 2026, Not Altseason

In a diluted market where most new tokens underperform, liquidity behaves differently:

- Liquidity concentrates heavily

- Liquidity moves fast

- Liquidity needs a story

- Liquidity exits faster than you imagine

So the winning method isn’t “picking alts.” It’s:

- Identify the next rotation early

- Ride it

- Take profits before the next shift begins

This is why 100x gains still happen in 2026—not from one coin, but from stacked rotations + position management + pro-level exits.

Part Four: Rotation Was the Only Real Winning Strategy From 2023–2025

Looking back over the past 2–3 years, the pattern is clear: You didn’t win by “holding one coin.” You won by catching the right rotation early—and rotating again.

Rotation 1 – Airdrops (Where I Made My First Six Figures)

When my capital was small, I didn’t aim to out-trade others. I sought asymmetry—opportunities where returns didn’t depend on capital size.

Airdrops fit perfectly. They reward time, not capital—so I was equal to someone with six-figure assets.

When the market was dead and no one cared (BTC at lows), I did boring work—staying active, using protocols. Later, when the market revived, everyone started farming. By then, the edge was gone. That’s why early effort paid off.

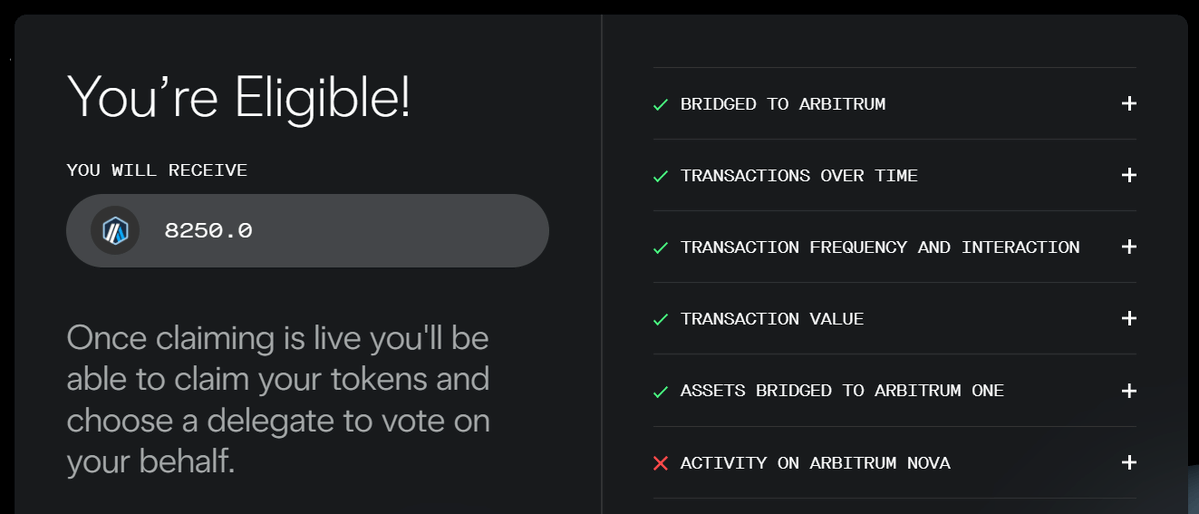

Arbitrum ($ARB) launched March 23, 2023. Optimism ran multiple airdrop rounds—the same rotation logic: Early + consistent = big rewards.

This is how I got my first real capital—not from a miraculous 100x bag, but by entering a meta-narrative before it got crowded. I started with $8,000, spent only ~$400 farming a few drops, and walked away with six-figure profits.

Rotation 2 – Early Solana Memecoins (Where I Made My First Seven Figures)

After airdrops (“helicopter money”), liquidity rotated into “casinos.” Money came fast and left fast. The market craved novelty—Solana memes became the cleanest answer.

I found POPCAT at ~$2.5M market cap, WIF at ~$30M (they later hit $2B and $4B)—gains of 100–1000x.

I succeeded not because I’m a trading genius, but because I lived in the market 24/7. At the time, the market was dull, and these “shiny new Solana coins” were essentially the only meta with real momentum. Fewer than five coins had >$1M market cap—so if you entered early, winners were easy to spot.

Rotation 3 – “Real Revenue” Becomes the New Status Symbol (Template: HYPE)

After meme-fueled dopamine, the market craved something else—not “utility in two years,” not “vibes”—but something explainable in one sentence that sounded like a real business.

That’s why Hyperliquid ($HYPE) hit so hard. It wasn’t just “another new token.” Its story was:

- Real trading activity

- Real fee revenue

- Token benefits directly via buybacks

Love it or hate it, this is where a market tired of casinos and extraction turned: visible value capture. Even if you’re not “smart,” you could see it—when everyone grew tired of memes, they started paying for mature narratives.

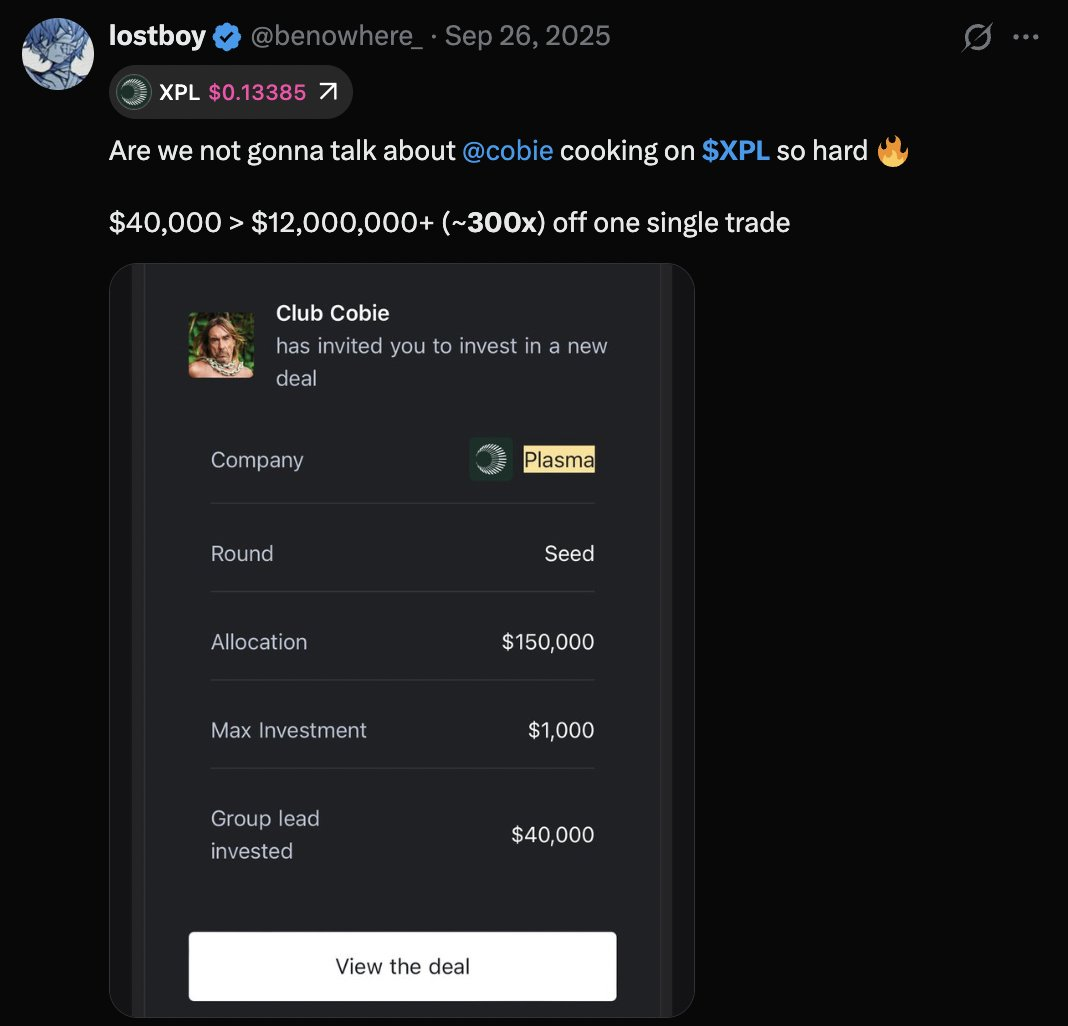

Rotation 4 – Meta-Evolution: “Don’t Play at the Casino—Own the Casino”

This is the most fascinating part of crypto. People gamble on 5,000 memes… then suddenly realize the only guaranteed winners are the platforms collecting fees.

This is when “house tokens” and “platform plays” start shining. Pump.fun is a perfect example: users fight over scraps, bots extract everyone, and the house quietly prints money daily. This isn’t a moral judgment—it’s just how the market operates.

The rotation is always the same:

- First, you trade tokens

- Then, you trade the platforms extracting from those tokens

Rotation 5 – When the Market Overindulges, It Swings Back to “Real World” Narratives

Eventually, people get tired. They want narratives that can survive without pure hype:

- Stablecoins

- Payments

- Settlement rails

- Things real humans actually use

These are deliberately boring. And boring narratives often win late—they’re the only ones that don’t require a constant stream of new greater fools buying at higher prices. That’s why we later see more focus shifting toward PayFi / stablecoin infrastructure stories.

So, what’s next?

First, let’s face reality. BTC is now ~$91K–$93K—on paper “bullish,” but in feel, the opposite. We’re still ~25% below the October 2025 all-time high (~$124.7K), and market sentiment remains in “bear mode.”

Why? Because we just experienced the largest liquidation event most have ever seen—around $19 billion wiped out in 24 hours around October 10–11, 2025.

In such a market, capital concentrates into 1–2 currently working directions—everything else bleeds. This is just like the pre-altseason airdrop phase: the market is half-dead—but if you’re early enough, that one meta can still make you rich.

So the task now isn’t “find 50 promising coins.” It’s: identify the few rotations that can run without retail participation—and dig deeper than others.

Current sentiment: Most tokens are useless, especially L1/L2

This is the dominant market mood: Most tokens are meaningless and will eventually go to zero because they:

- Lack real utility

- Generate no real revenue

- Exist primarily as exit liquidity

This hits L1/L2 hardest. You can’t keep playing this game: raise at absurd valuations, launch at sky-high FDV, have 8 users, earn $20/month, and pretend you’re worth $15B. (Starknet, zkSync, Aptos—you know who I mean.)

Will this sentiment reverse? Maybe. But I don’t even need to predict that—the implication is obvious…

The market now wants a new model: real revenue + buybacks

After three years of “extraction,” people finally see the class structure: Creators → VCs → KOLs → Bots/Traders → Everyone who bought too late

For most retail, this game has negative expected value: you buy a token and pray you’re not the final exit liquidity. That’s why the market now desperately craves “corporate-style” tokens.

A simple model: If a token has a $1B market cap, its protocol earns $800M in real revenue annually, and 50% is used to buy back tokens… then the asset has a valuation floor. Unless revenue collapses, it won’t go to zero overnight.

This is classic stock market value investing logic: when sentiment is trash and everyone is fearful, people stop buying “dreams” and start buying “cash flow.” Cash flow is the best narrative in a fearful market.

Then helicopter money returns—and casinos come back

This is the part everyone forgets. The “value phase” doesn’t last forever. At some point, the market starts printing money again: something explodes, people get lucky, airdrops rain down, a new wave puts cash back in pockets.

Once people feel rich again, the market instantly shifts from “show me revenue” to “show me the fastest 10x.” That’s when the casino phase returns. Memes, NFTs, whatever new dumb thing gets invented—doesn’t matter. The pattern is always the same: it has no value, but it offers insane multiples, and everyone wants quick money.

Then it crashes. After the crash…

The market enters the next “extraction narrative” (ICO, utility tokens, structured issuance)

After getting rugged in casinos, the market doesn’t immediately turn “fundamental.” It usually shifts to a more structured form of extraction where people can spend again, such as:

- ICOs / “public rounds”

- Points metas

- “Utility tokens”

- Launch mechanisms where you pay for access, and others sell it to you later

So the cycle goes: Value (revenue) → Helicopter money → Casino → Crash → Structured extraction → Repeat

Nothing in crypto grows forever. What grows is whatever the market emotionally craves at that moment. So the 2026 winning path isn’t “hold and pray.” It’s: Spot early rotation → Ride it → Exit before it becomes obvious.

Part Five: How to Actually Achieve 100x Growth in 2026

100x in 2026 won’t come from one trade. It comes from stacking rotations. You win by riding the right phases—not praying you found the one true coin.

This is my system:

Pick at Most 2 Rotations

One solid rotation (revenue/infrastructure) + one aggressive rotation (casino/structured). Track 10 metas, and you’ll be late to all of them.

Buy Triggers, Not Vibes

Before I commit serious capital, I need clear triggers. Examples:

- Fees/revenue trending up for several weeks

- Users returning organically, without crazy incentives

- Distribution channels opening (integrations, big platforms, real attention)

- Narrative spreading but not yet mainstream

No trigger? No entry.

Define Invalidation Before Entry Most people lose not because they’re wrong—but because they don’t know when to leave. No one went bankrupt from taking profits (even just $1). Remember that. Your invalidation checklist should be boring:

- Usage collapses

- Revenue is fake

- Liquidity has rotated away

- Tokenomics/unlocks start dumping

If any invalidation condition is met—you exit. No debate.

Position Management – Three-Layer Stack

This is how you capture massive gains without going to zero:

- Beta (liquidity leaders within the rotation)

- Water sellers (infrastructure that wins regardless)

- Lottery tickets (small-cap tokens perfectly aligned with the narrative)

Only lottery tickets = gambling odds. Only beta = capped upside.

Profit-Taking Is the Real Edge

Rotations end faster than you think. So:

- Trim positions during strong rallies

- Don’t fall in love with midcaps

- Always know where you’ll rotate next

If you don’t have a next destination, you’ll ride the rollercoaster back down.

Part Six: The Traps That Keep Most People Stuck

The trap is thinking: “If I just hold long enough, it’ll eventually go up.” That worked when the market was small. It doesn’t work now.

Because now:

- Supply is infinite

- New tokens are launched to dump

- Most tokens exist solely to extract from you

So if your strategy is still:

- Buying random new tokens

- Holding midcaps for “the big cycle”

- Chasing already-hot trends

…you’re playing a game designed specifically to extract from you.

Rotation is the exploit. Because rotation reflects how liquidity actually behaves today.

Every week I track:

- Which sectors show real fee growth

- Which apps are seeing user return

- Where volume and open interest are shifting

- Where liquidity incentives are deployed

- Whether a narrative is early or already being discussed by top-10 coin holders

Most people don’t miss narratives. They arrive after they’ve become obvious.

So in 2026, as in every year, winners won’t be “right.” They’ll be “early”—and they’ll keep rotating.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News