2025 Crypto Industry Workplace Survey: 70% Earn Less Than $4,000 Monthly, Severance Package N+1 a Distant Dream

TechFlow Selected TechFlow Selected

2025 Crypto Industry Workplace Survey: 70% Earn Less Than $4,000 Monthly, Severance Package N+1 a Distant Dream

Restoring the most authentic anxieties, desires, and survival rules of Web3 workers.

By: TechFlow

While Xiaohongshu is still spreading Web3 "get-rich-quick myths" and stories of "six-figure annual salaries," what does the real industry landscape actually look like?

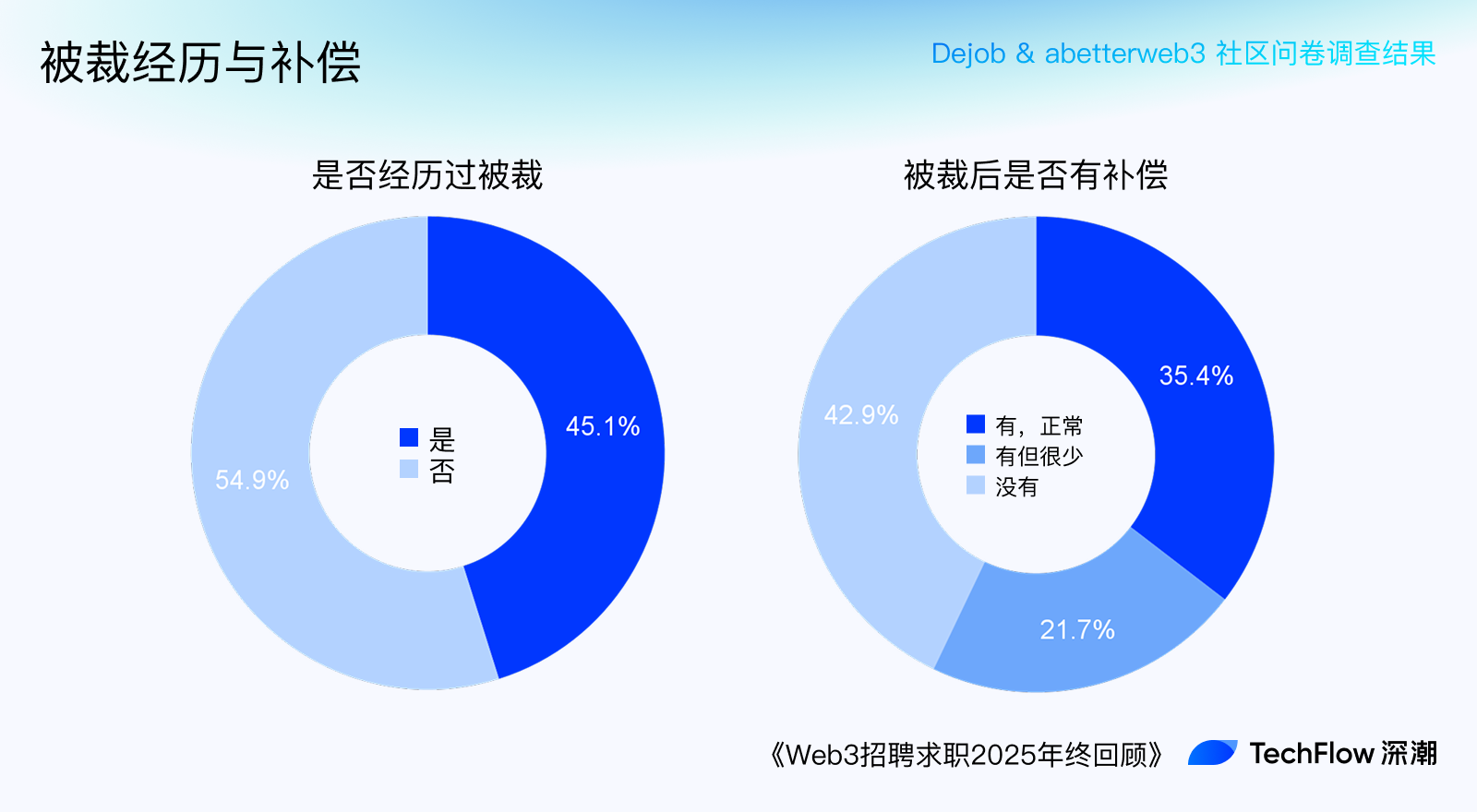

We conducted an honest dialogue with industry practitioners through 506 survey responses. The results are surprising—and even somewhat harsh: there's no gold everywhere. Over 70% earn less than $4,000 per month, lower than levels in developed regions such as Europe and North America. A quarter are even operating at a loss, essentially "paying to work." There is also little job security—nearly half have experienced layoffs, and most did not receive standard severance (e.g., N+1).

Yet despite this, over 80% choose to stay. Is it because of the 70% remote work flexibility? Or the shared dream of retiring with $5 million?

In this report, we attempt to use cold data to reveal the true anxieties, aspirations, and survival rules of Web3 workers.

This content presents the survey results from "Web3 Recruitment & Job Hunting 2025 Year-End Review: Who’s Making Money, Who’s Paying to Work?" For the full report, visit:

https://www.techflowpost.com/article/detail_29702.html

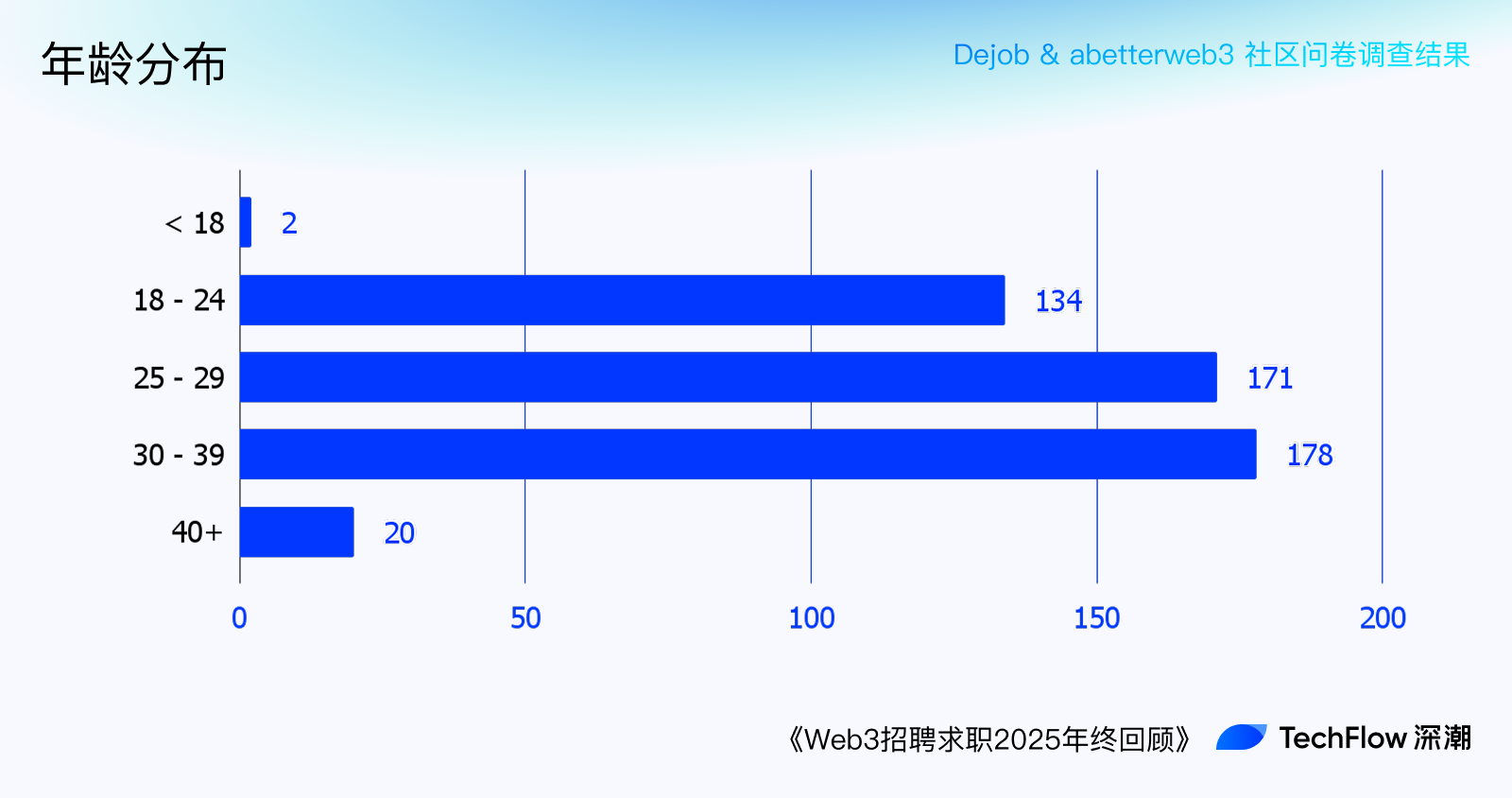

In terms of age distribution, young professionals aged 18–29 form the majority, but mid-career and older practitioners (>30 years old) are also well represented. This may be due to the fact that Web3 companies do not enforce the so-called "age-35 cutoff" as strictly as traditional tech firms. Compared to internet companies, Web3 firms place greater emphasis on experience, capability, and efficiency, often seeking seasoned professionals who can quickly build products “out of the box.”

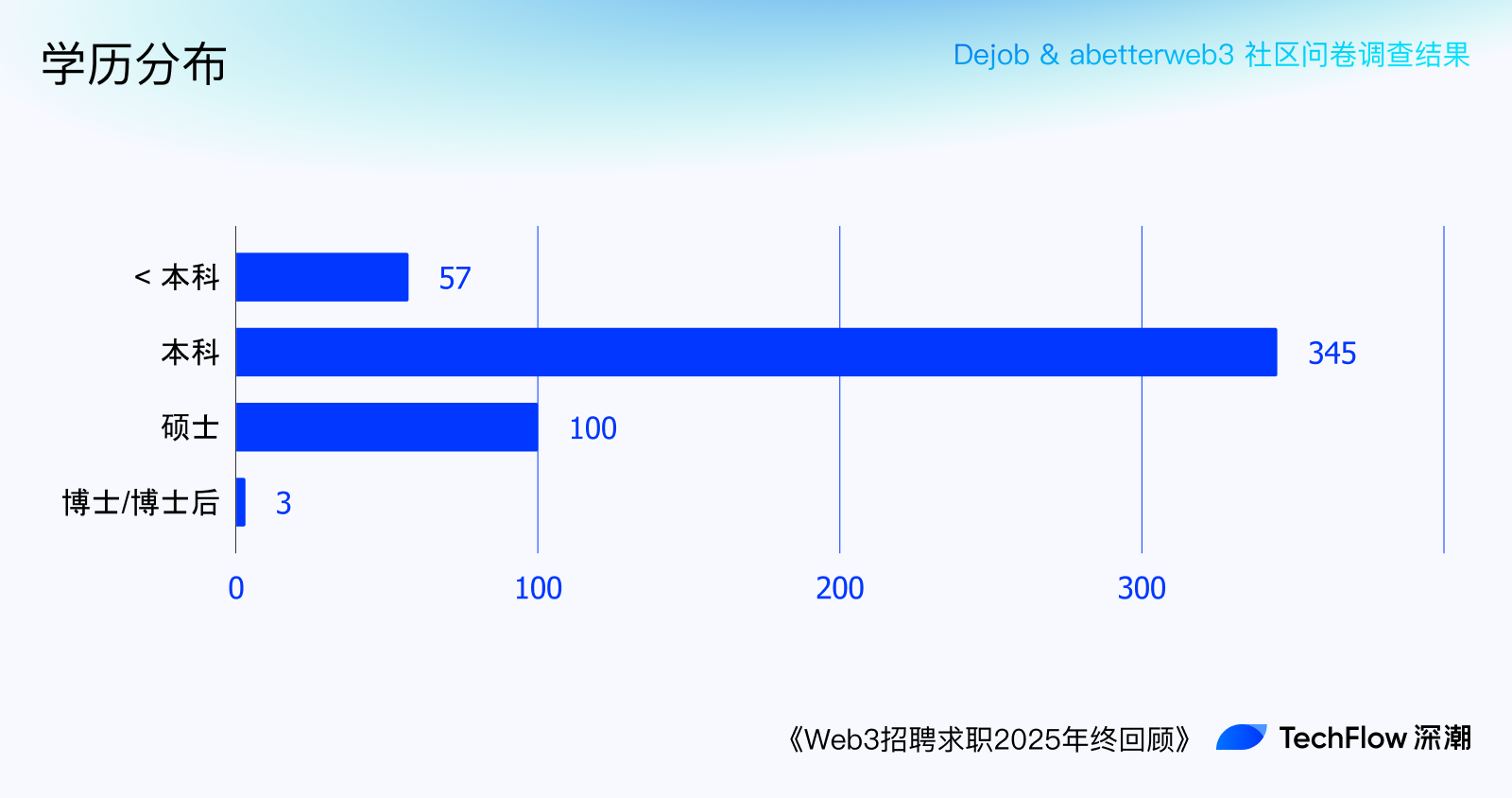

Educational background distribution aligns closely with previous talent data, dominated by bachelor’s degrees. Respondents included those with less than a bachelor’s degree as well as master’s and PhD holders, though the proportion of advanced degree holders remains relatively low.

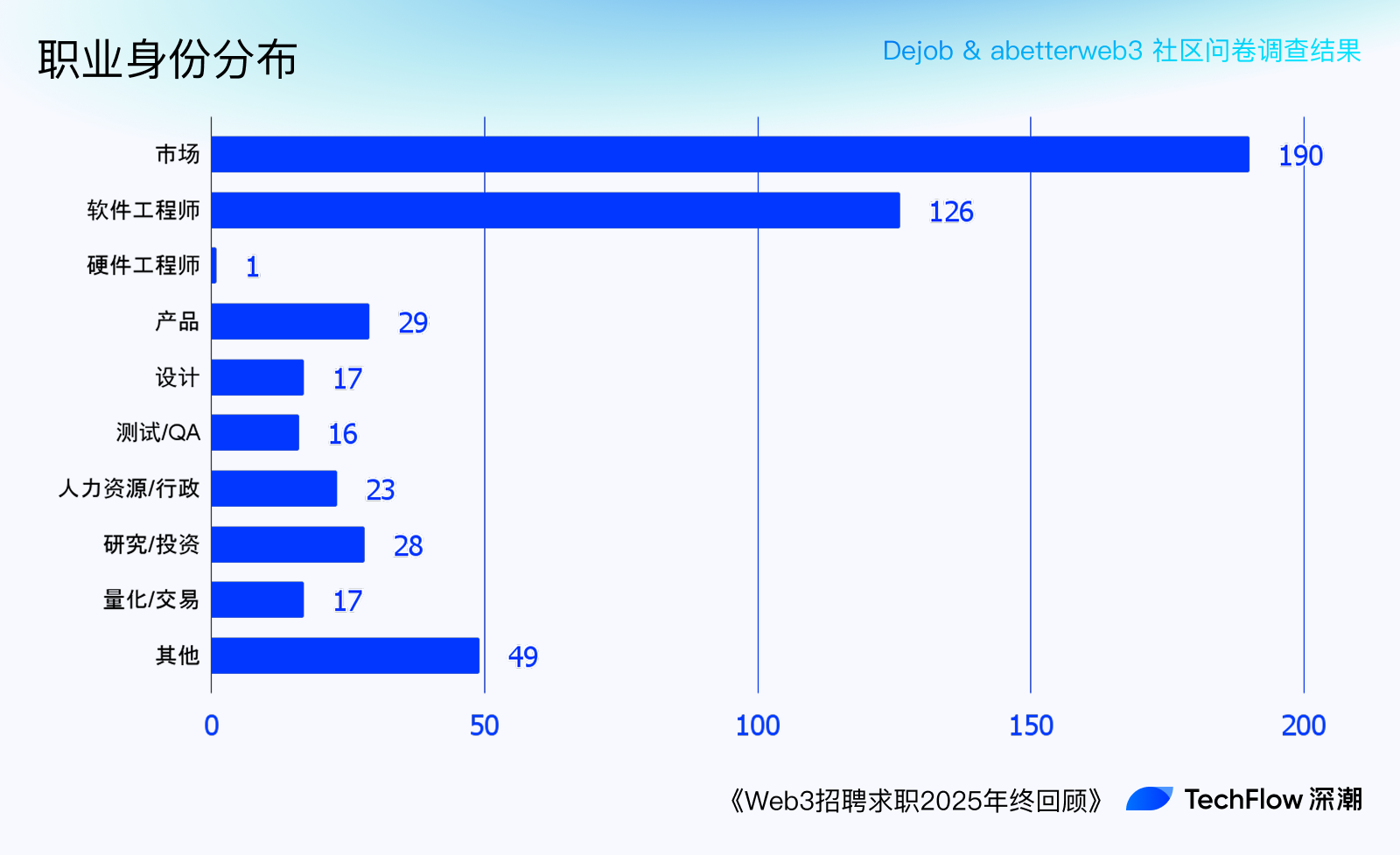

By job role, marketing positions (operations, BD, customer service, etc.) were most common, followed by developers (frontend/backend, smart contracts, blockchain, etc.). Product managers, HR, researchers, designers, and traders followed. Among “other” entries, risk control & security specialists and KOLs were frequently mentioned.

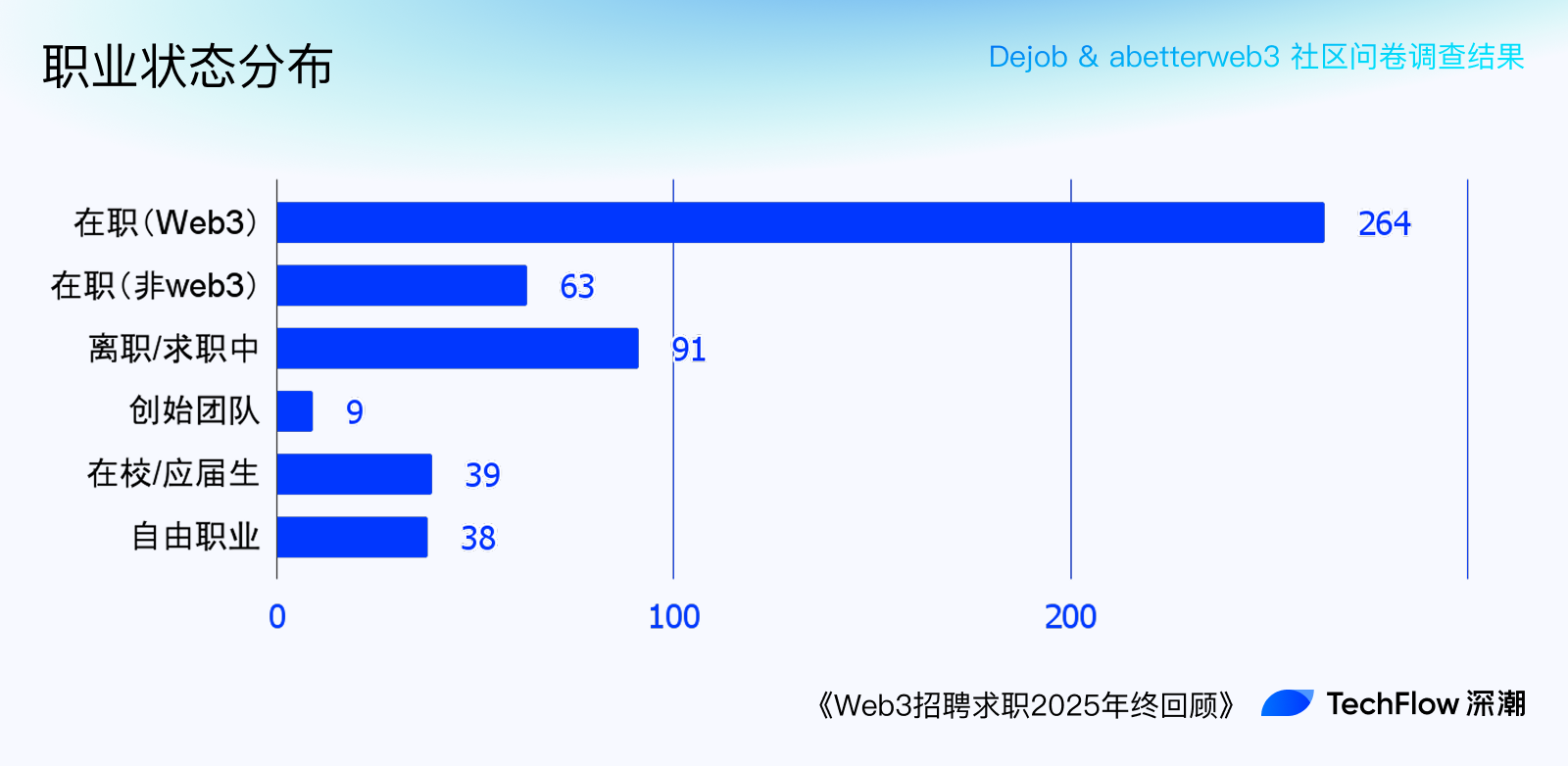

Regarding current employment status, only 52% of respondents are currently working in Web3. Over 30% are in more flexible life situations. This reflects both how market conditions and hiring freezes have affected many people, and also suggests that certain Web3 business models—such as being a KOL or trader—allow individuals to generate cash flow without needing a traditional job.

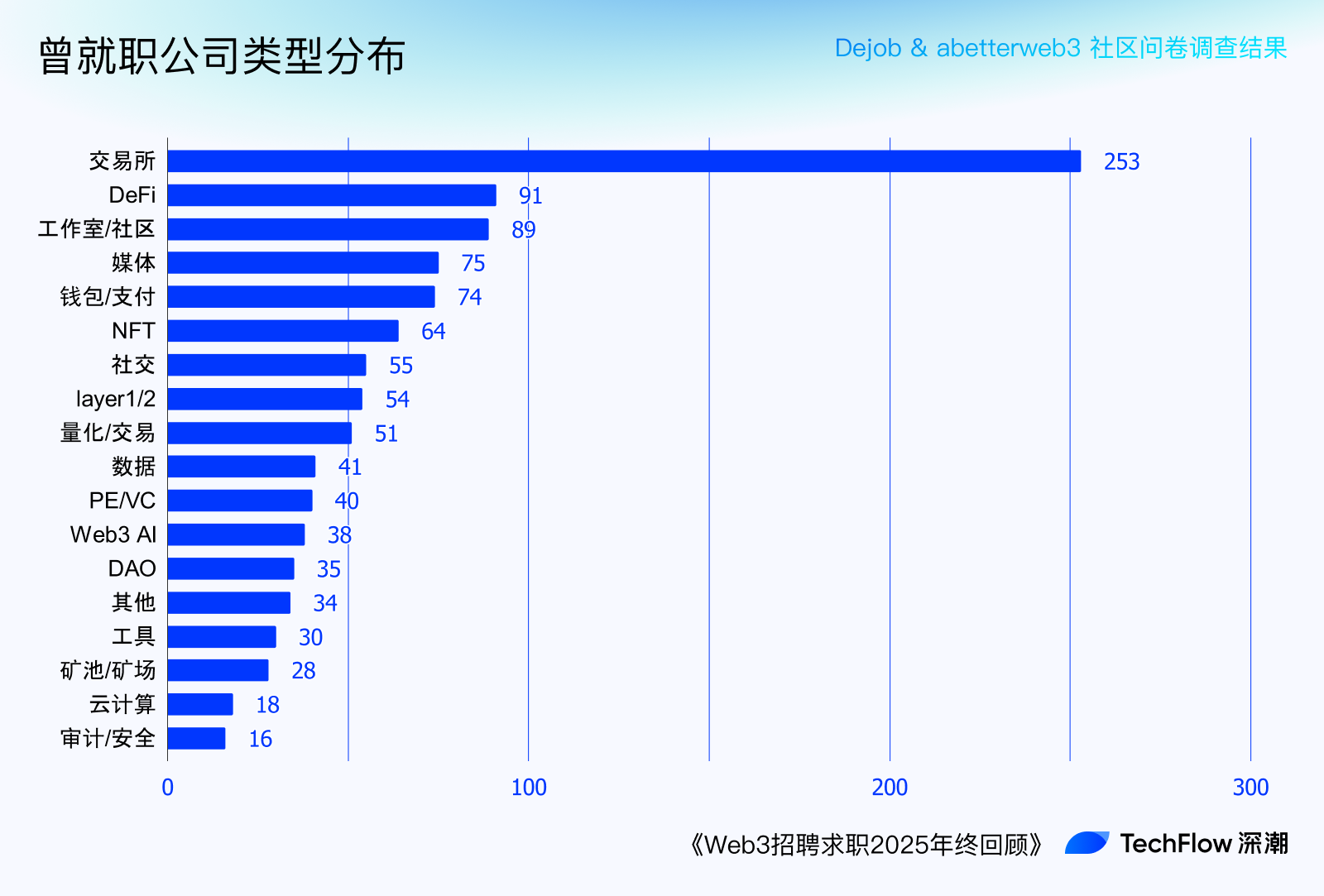

More than half reported having worked at exchanges, followed by studios/communities, DeFi, media, wallets, and other common sectors. Both talent and employers show a strong Matthew effect, concentrating heavily around exchanges. This partly reflects the current state of the industry: beyond exchanges, revenue-generating capabilities decline progressively from consumer-facing tools down to infrastructure layers.

For remote collaboration tools, Telegram was favored by most companies due to its privacy and usability—this survey was conducted within a Chinese-language vertical Web3 recruitment community. Domestic tools like Feishu and WeChat ranked second, followed by international standards such as Google Workspace, Discord, and Slack.

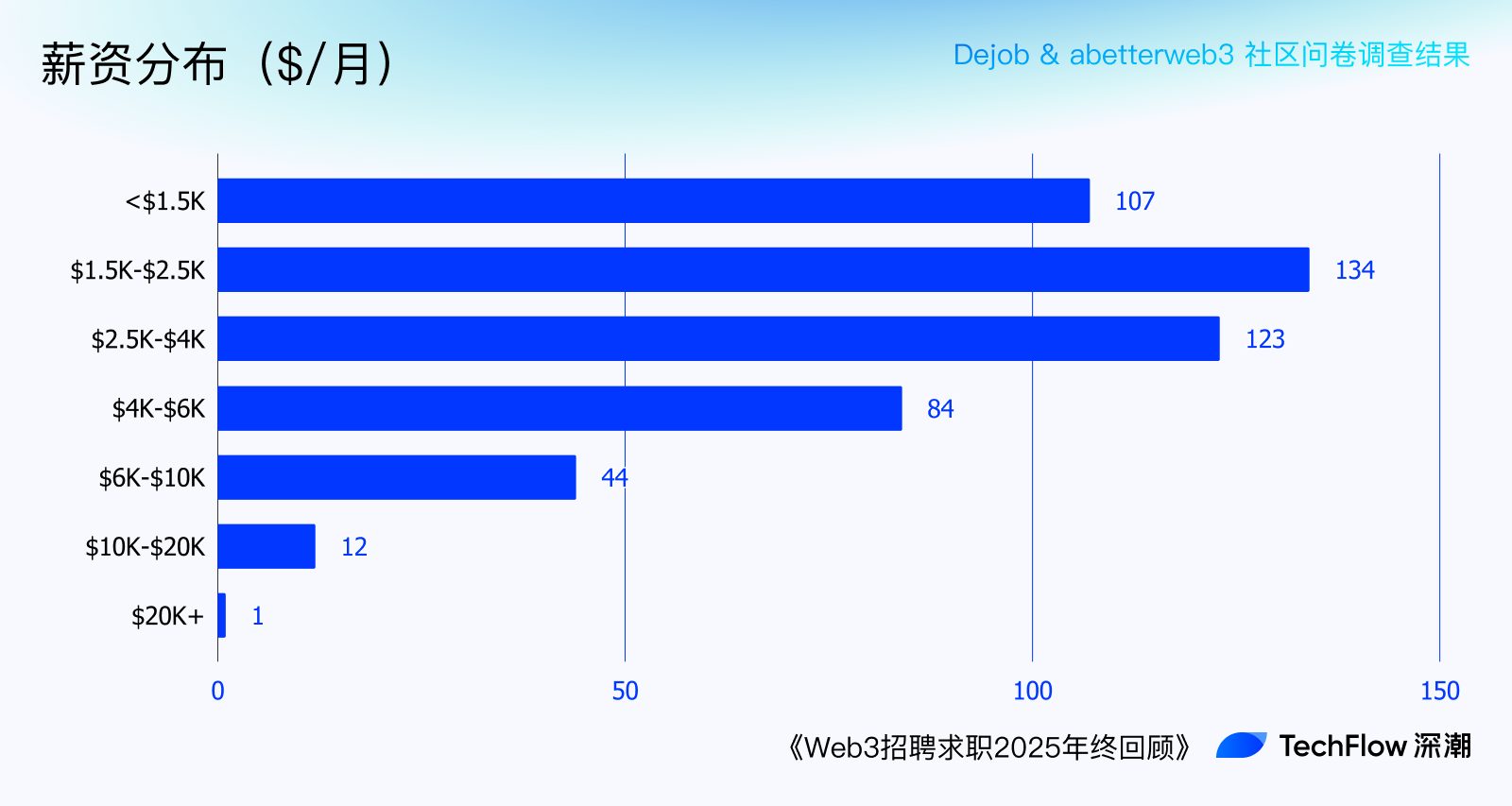

On income levels, contrary to popular myths of instant wealth, most Web3 workers earn less than top-tier internet companies and severely lack long-term incentives (tokens/equity), year-end bonuses, and layoff compensation.

Over 70% earn less than $4,000 monthly (approximately RMB 28,000). Monthly salaries of $10,000 commonly seen on Xiaohongshu are rare exceptions.

Nearly half have experienced layoffs; among them, 40% received no severance, and 21% said any compensation they received fell far short of legal requirements (e.g., N+1).

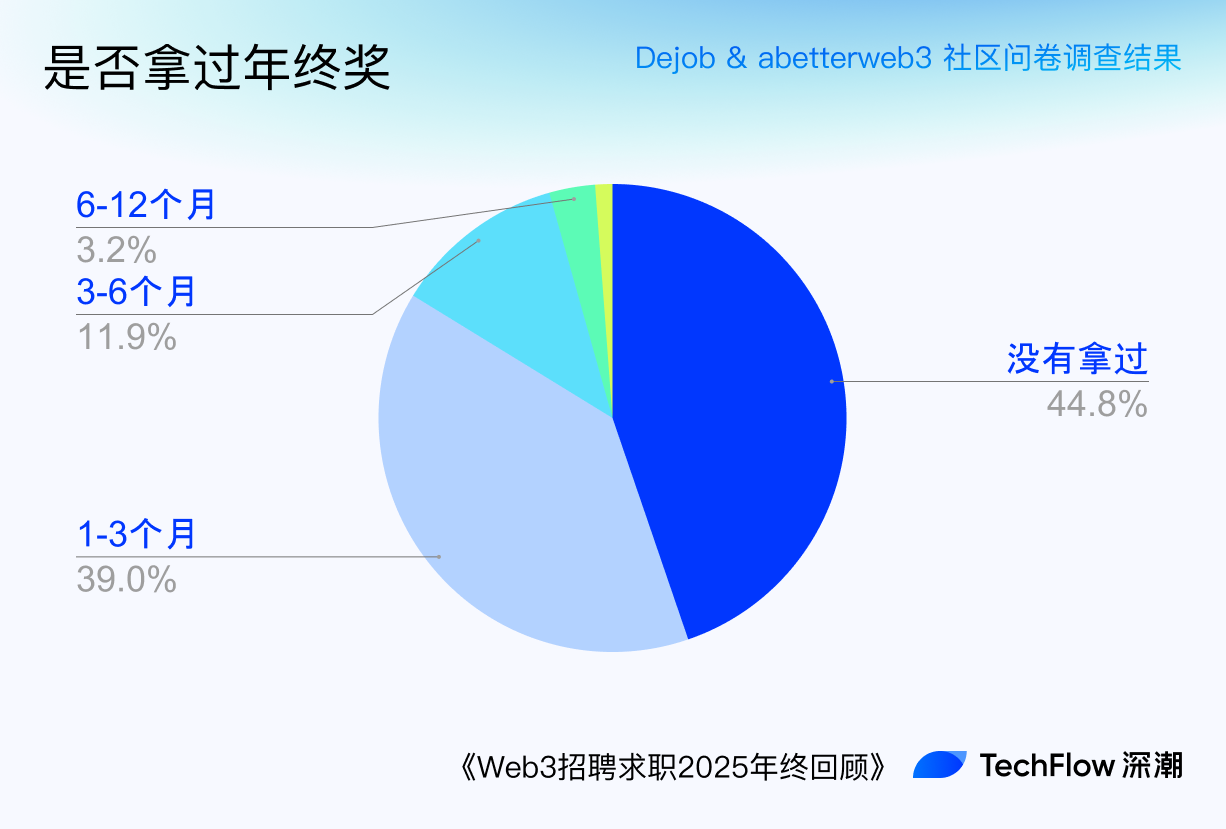

Almost half reported never receiving a year-end bonus. Among those who did, 1–3 months’ salary was typical—on par with most internet companies outside Web3.

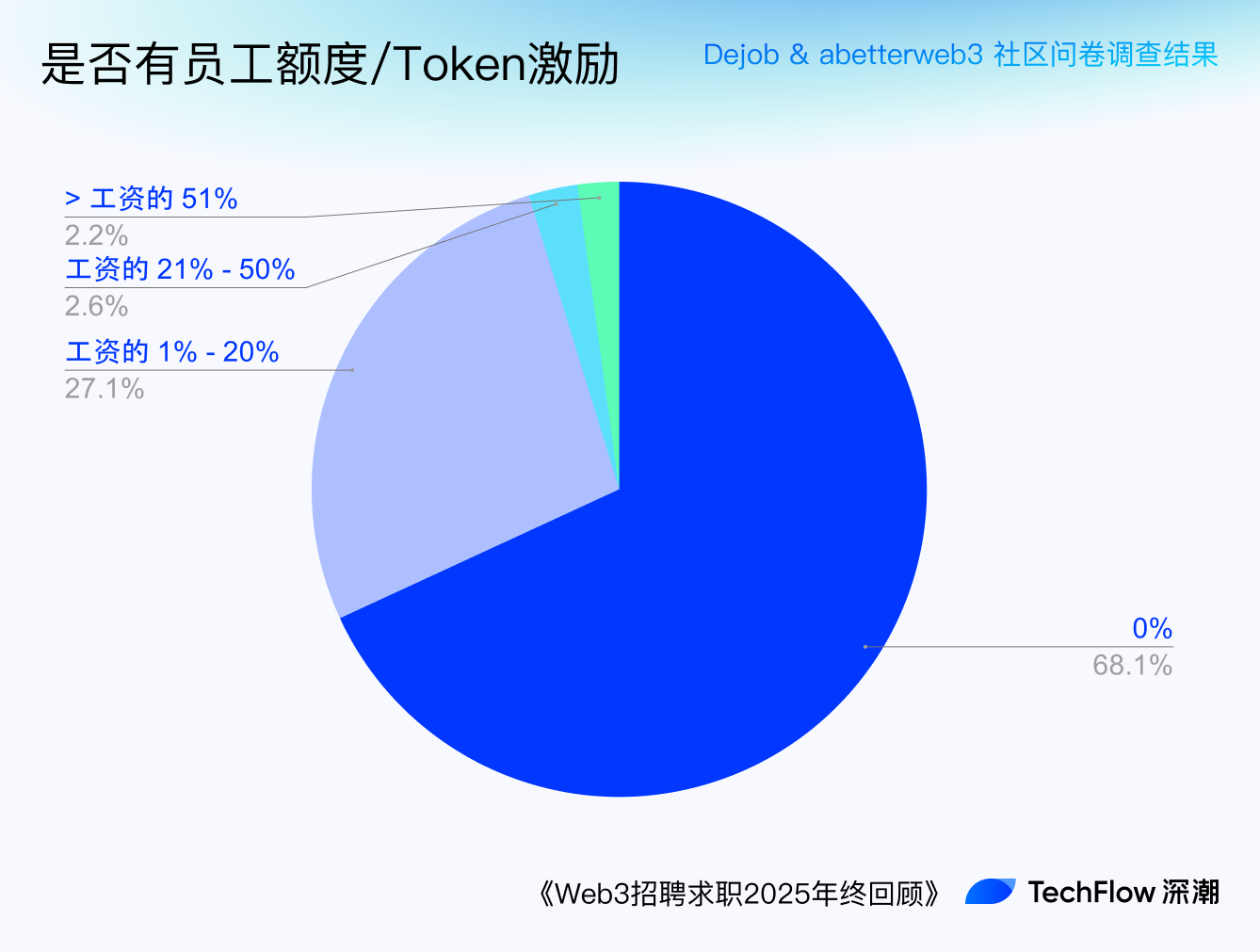

On the well-known career advancement path via token grants, nearly 70% said they had never received any. Even when granted, the value rarely exceeded 20% of their total compensation.

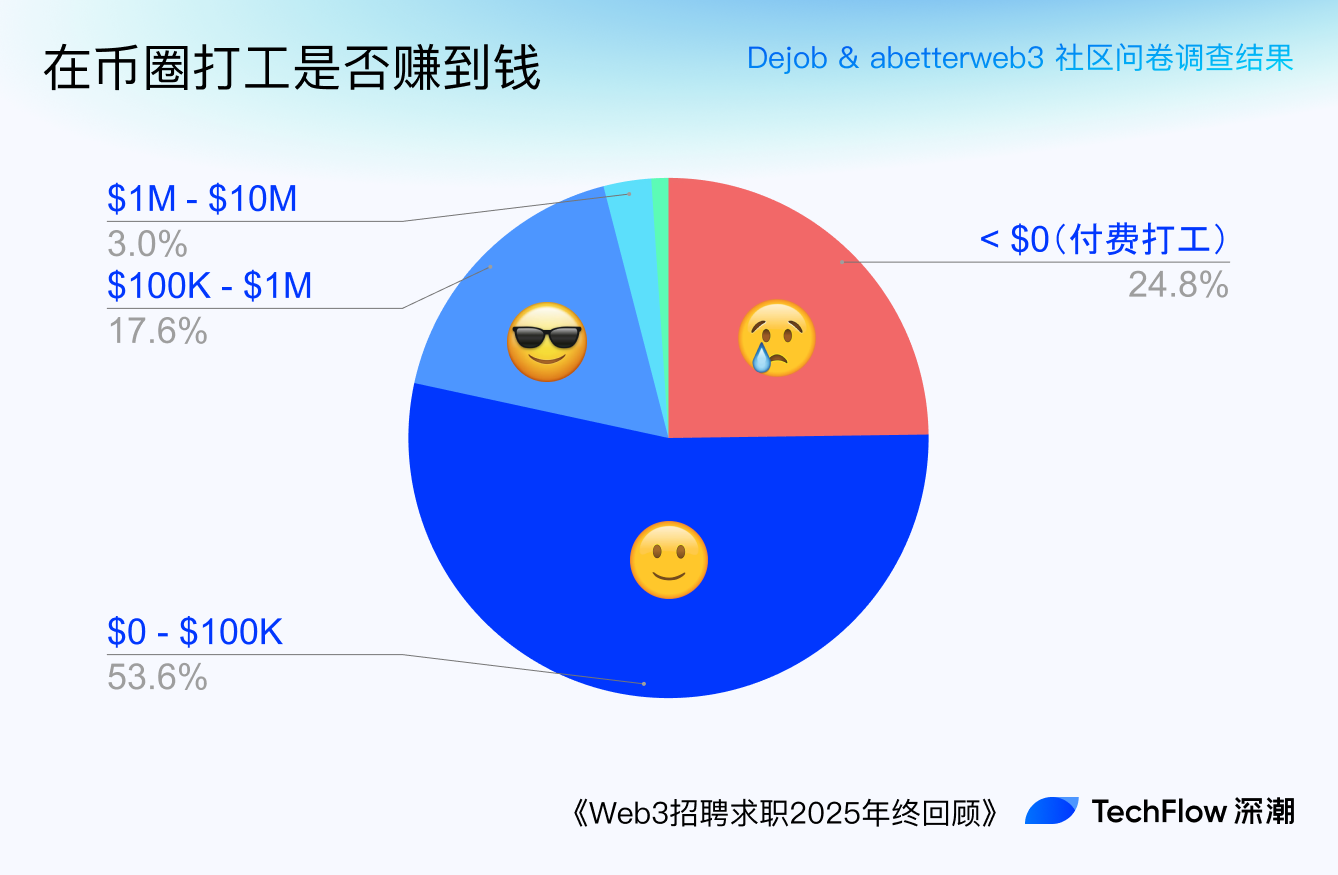

A quarter reported overall financial losses since entering crypto—essentially "paying to work." Most others accumulated around $100K (approximately RMB 700,000) in wealth.

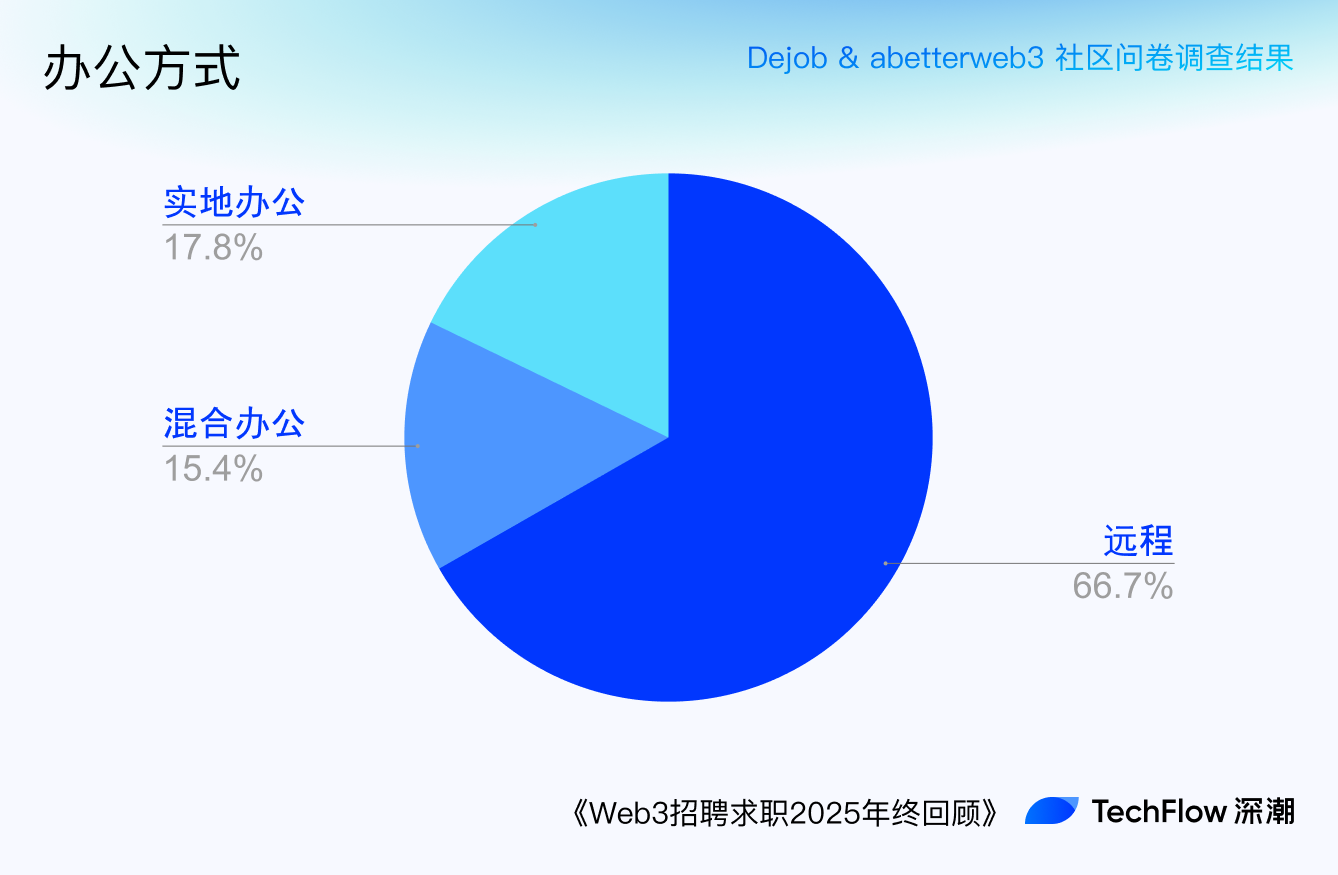

However, contrasting with these bleak income figures, Web3’s strong remote work culture offers some relief. Nearly 70% said their company supports fully remote work, and another 15% support hybrid arrangements—offices exist but attendance isn’t mandatory, or employees can work from home several days a week.

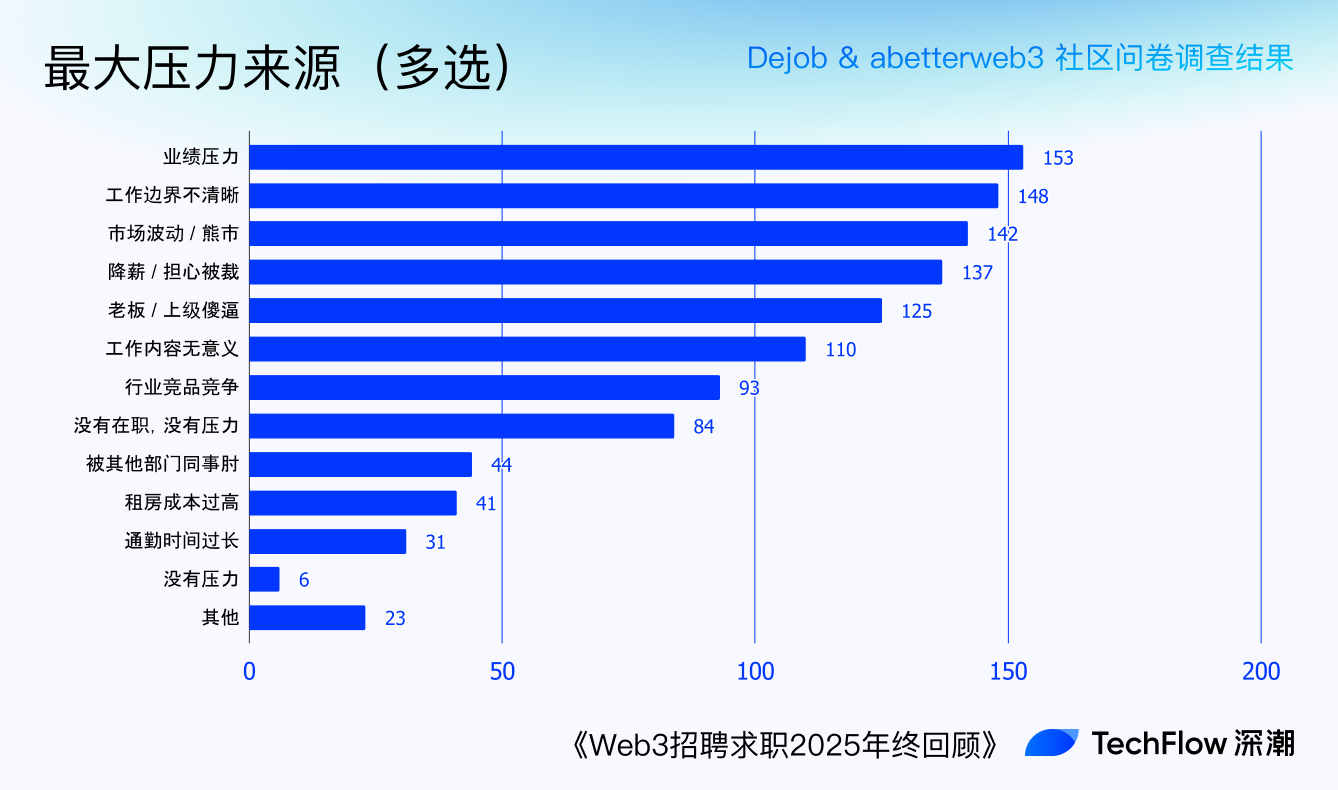

Remote work does help reduce job stress to some extent. In response to the question about biggest stressors, 31 respondents cited “long commute times.” Other top stressors included product growth pressure, blurred work boundaries, market volatility, fear of layoffs, and incompetent bosses.

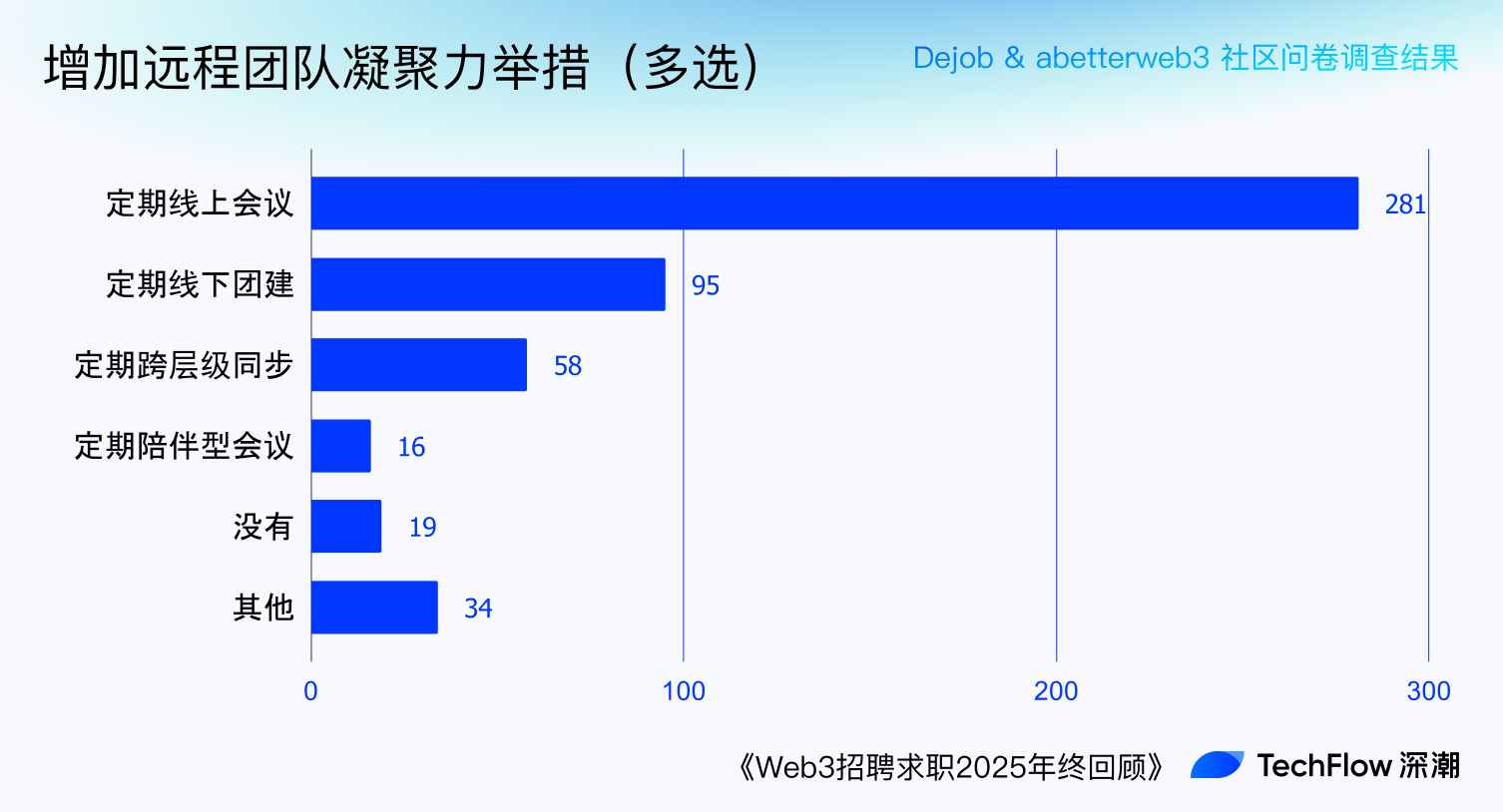

To maintain mental health and team cohesion, many companies implement measures to strengthen connections among employees.

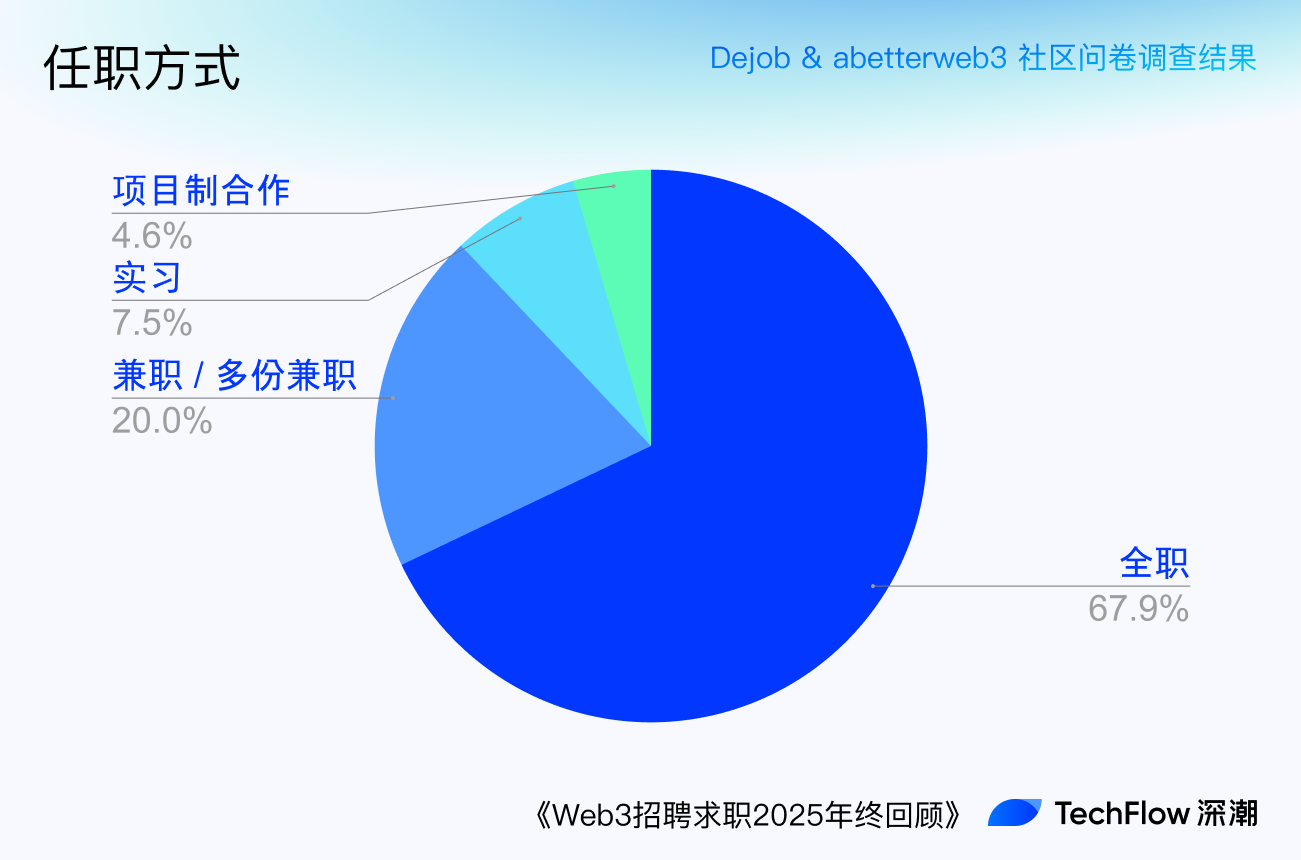

Under the combined pressure of low income and instability, many take on multiple jobs. Twenty percent of respondents reported having side gigs. This indirectly reflects the technical orientation prevalent in most Web3 companies—so long as you can solve problems and deliver results, your lifestyle and income sources are generally not restricted.

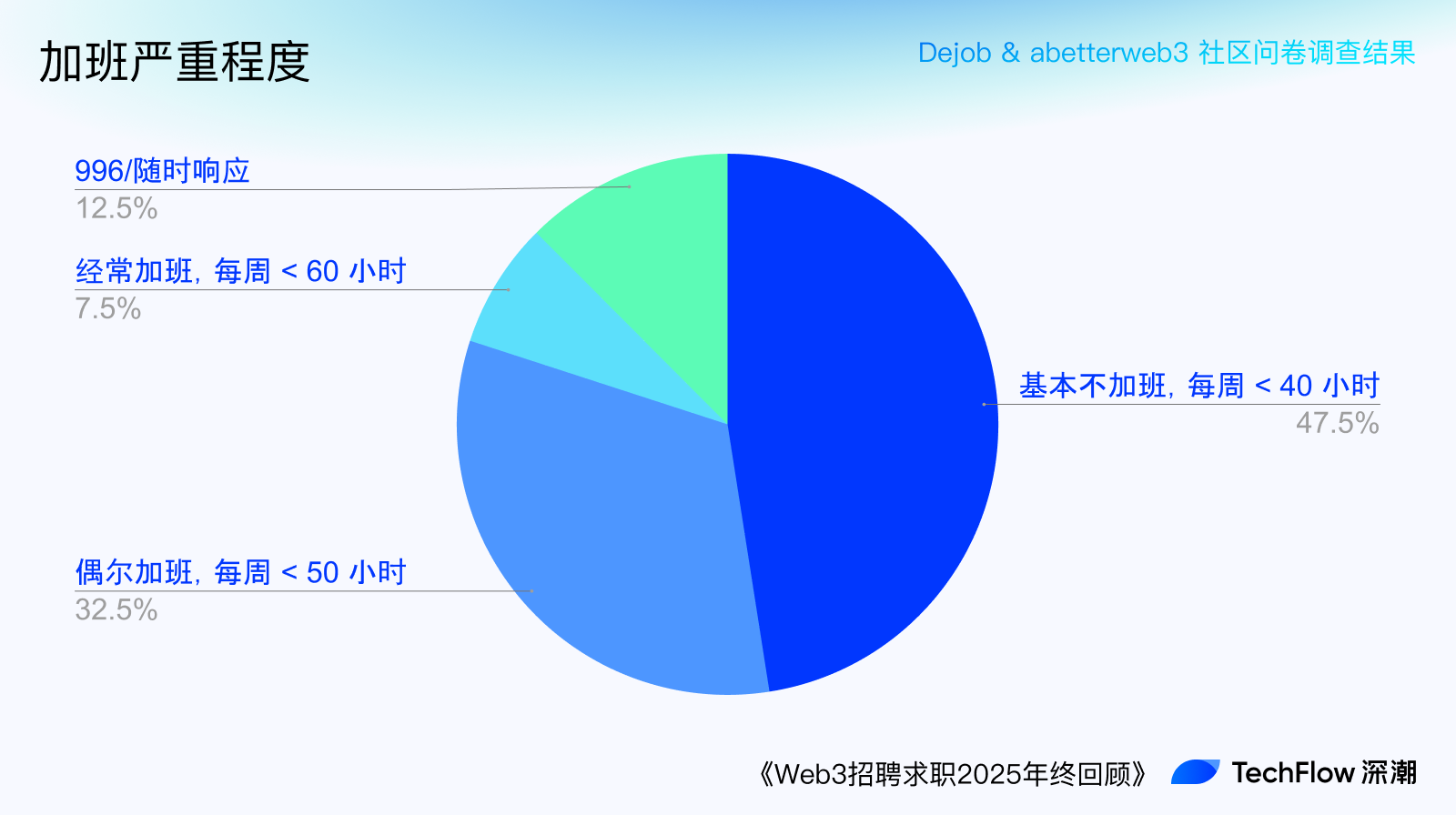

On work intensity, 80% reported working approximately 40–50 hours per week. Thus, Web3 appears less intense than many Web2 "996/007" sweatshops.

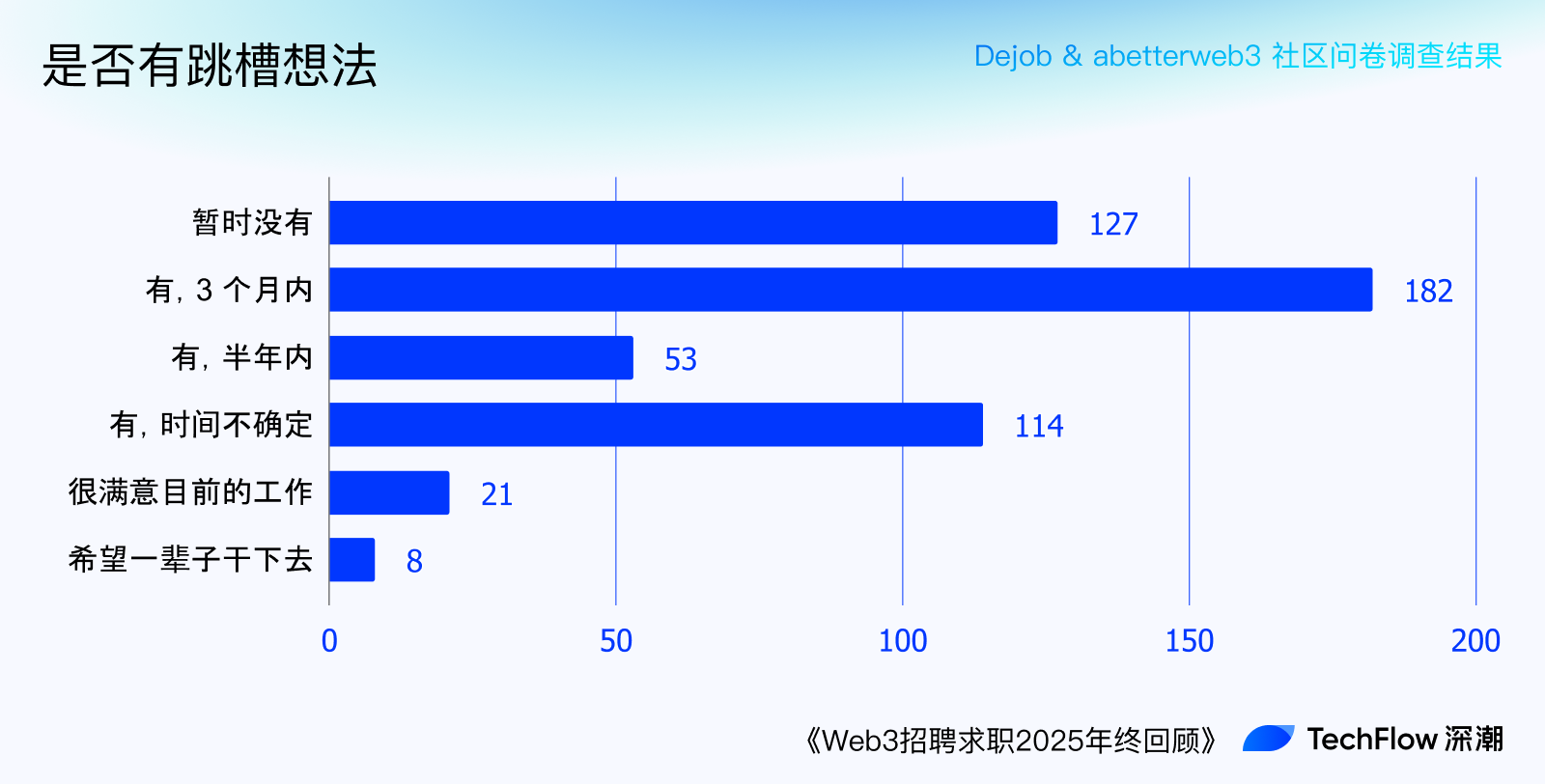

Regarding job switching, over half want to change companies, with 30% planning to do so within 3–6 months. However, about a quarter are satisfied with their current situation, and eight respondents even found a "dream company they’d like to stay with forever."

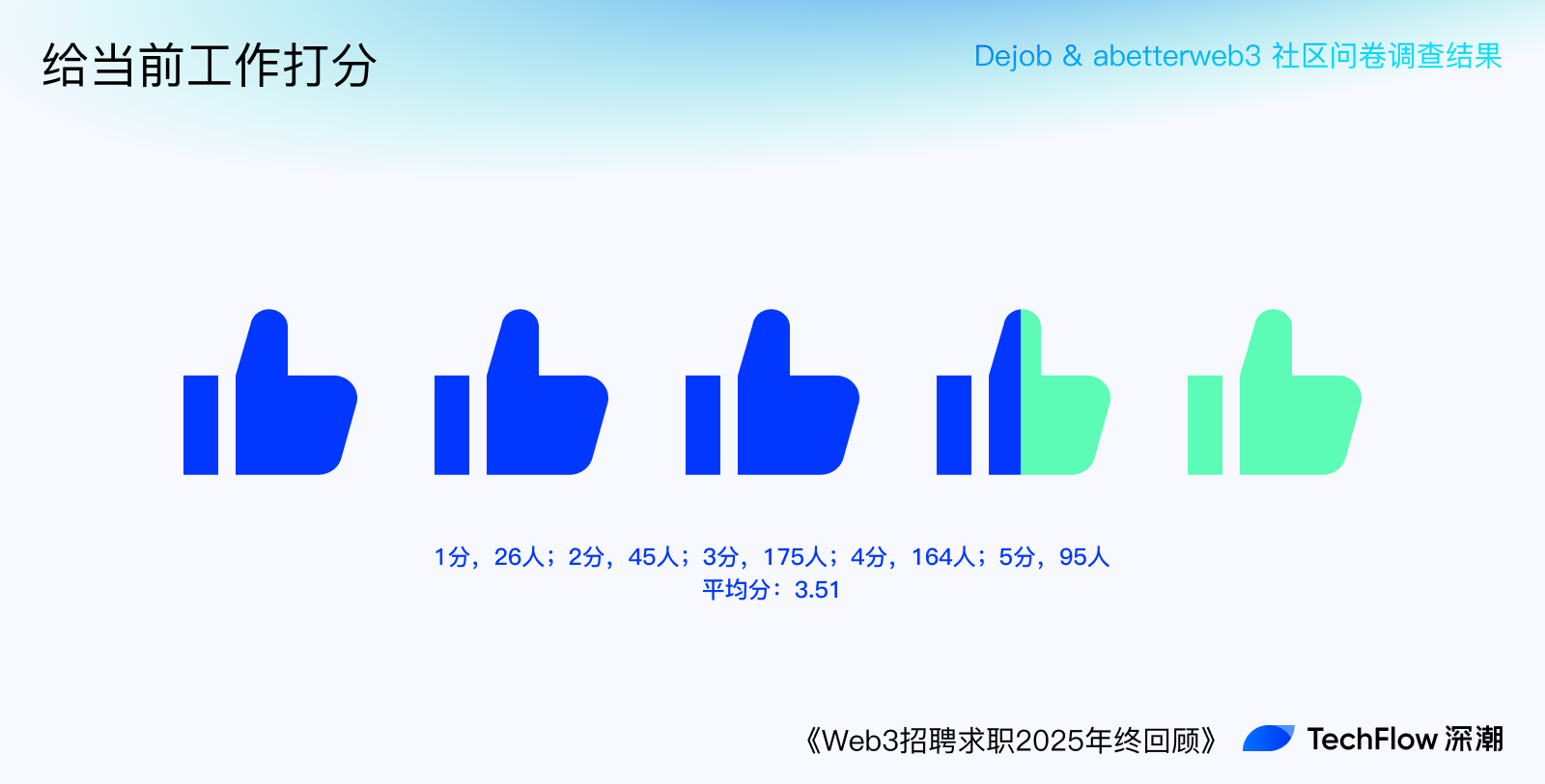

Considering factors like moderate overtime, remote options, and allowance for side jobs, many gave positive evaluations of their current roles. The average self-rating for current job satisfaction was 3.51 out of 5.

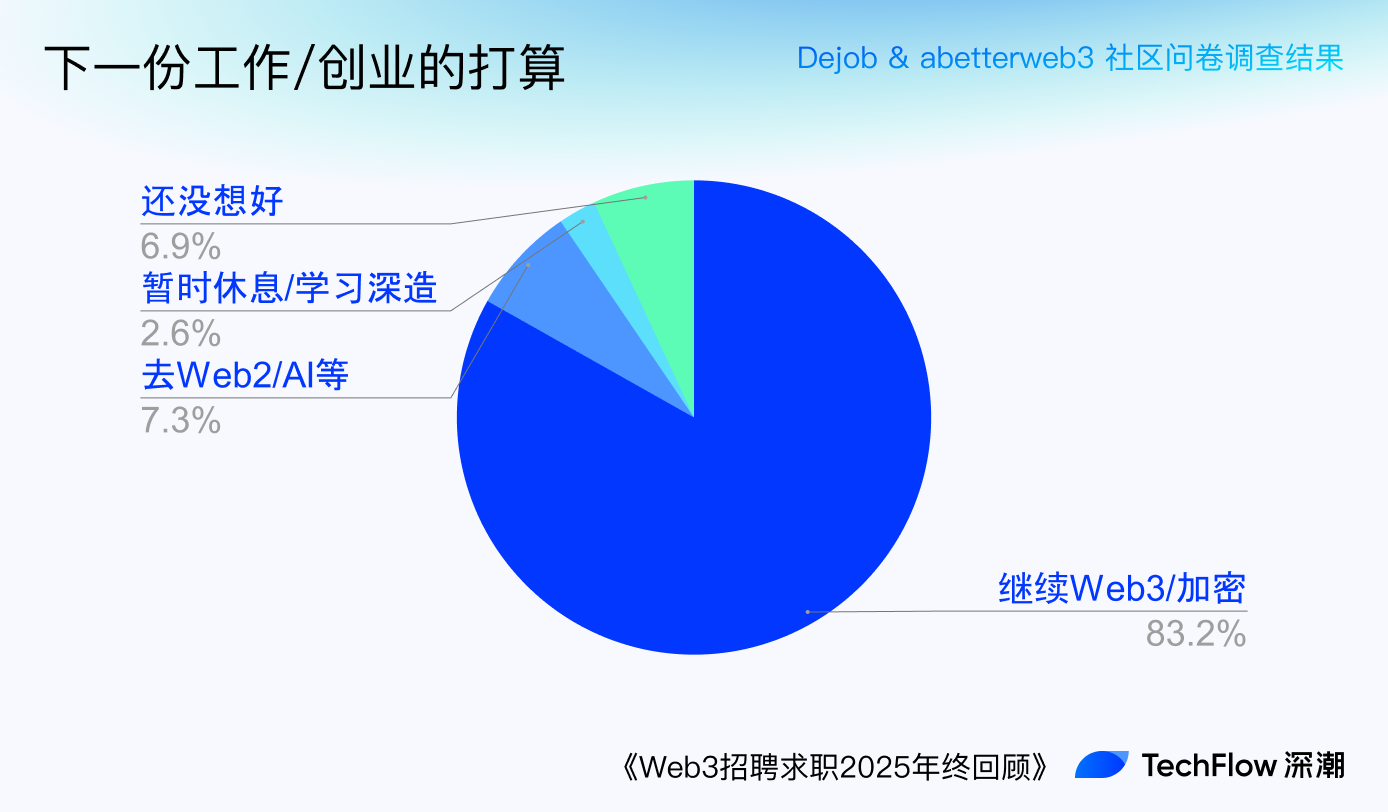

As for whether their next job will remain in crypto, over 80% chose to stay, while 7% plan to leave.

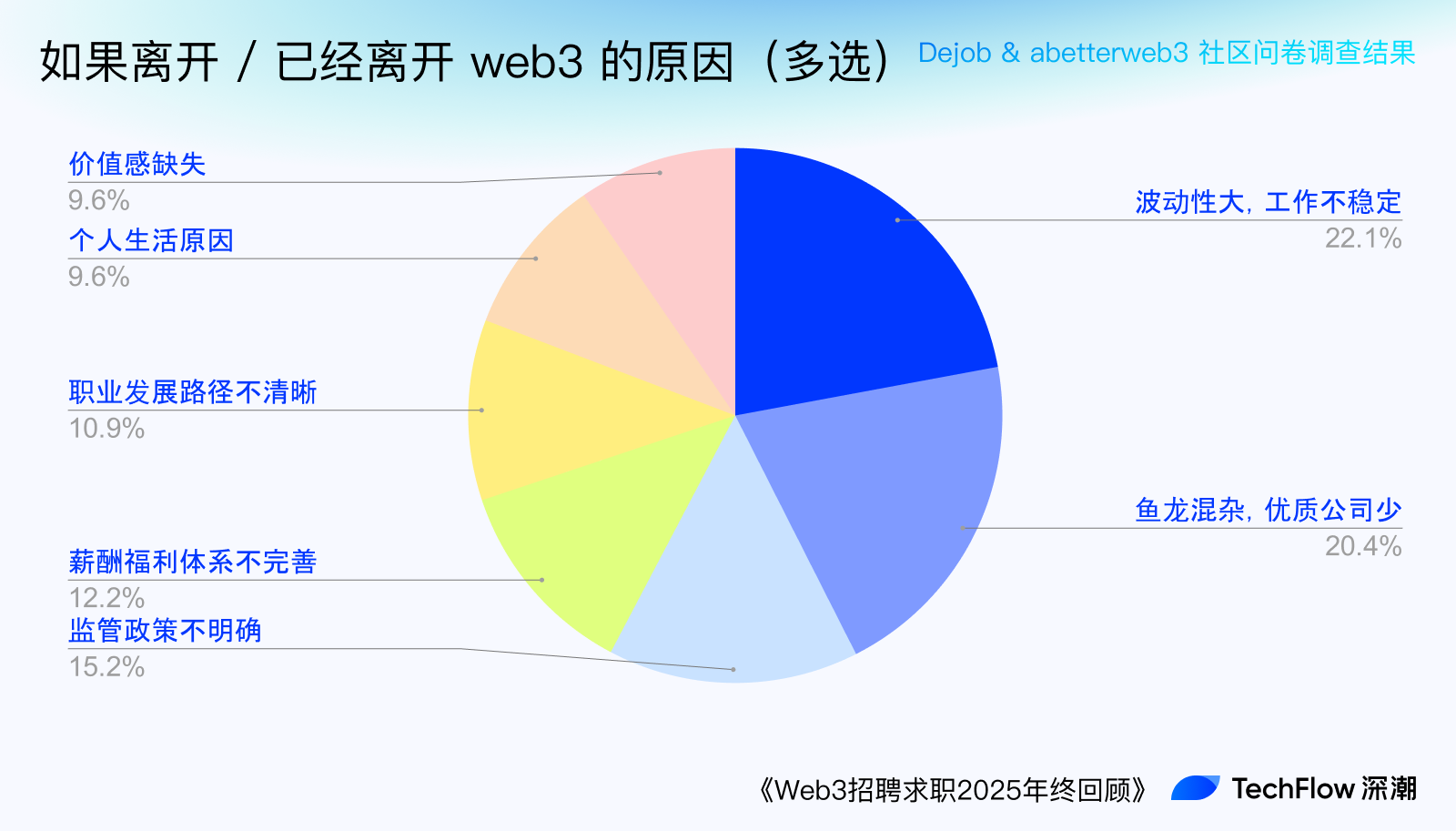

The reasons given for leaving reflect the industry’s harshest realities.

But all this hustle is ultimately aimed at early retirement. When asked "how much wealth would make you consider quitting," most selected $1M–$5M (RMB 7M–35M). This might indeed represent the upper limit achievable through employment alone. Still, 20% chose "no limit," reflecting confidence in their earning potential.

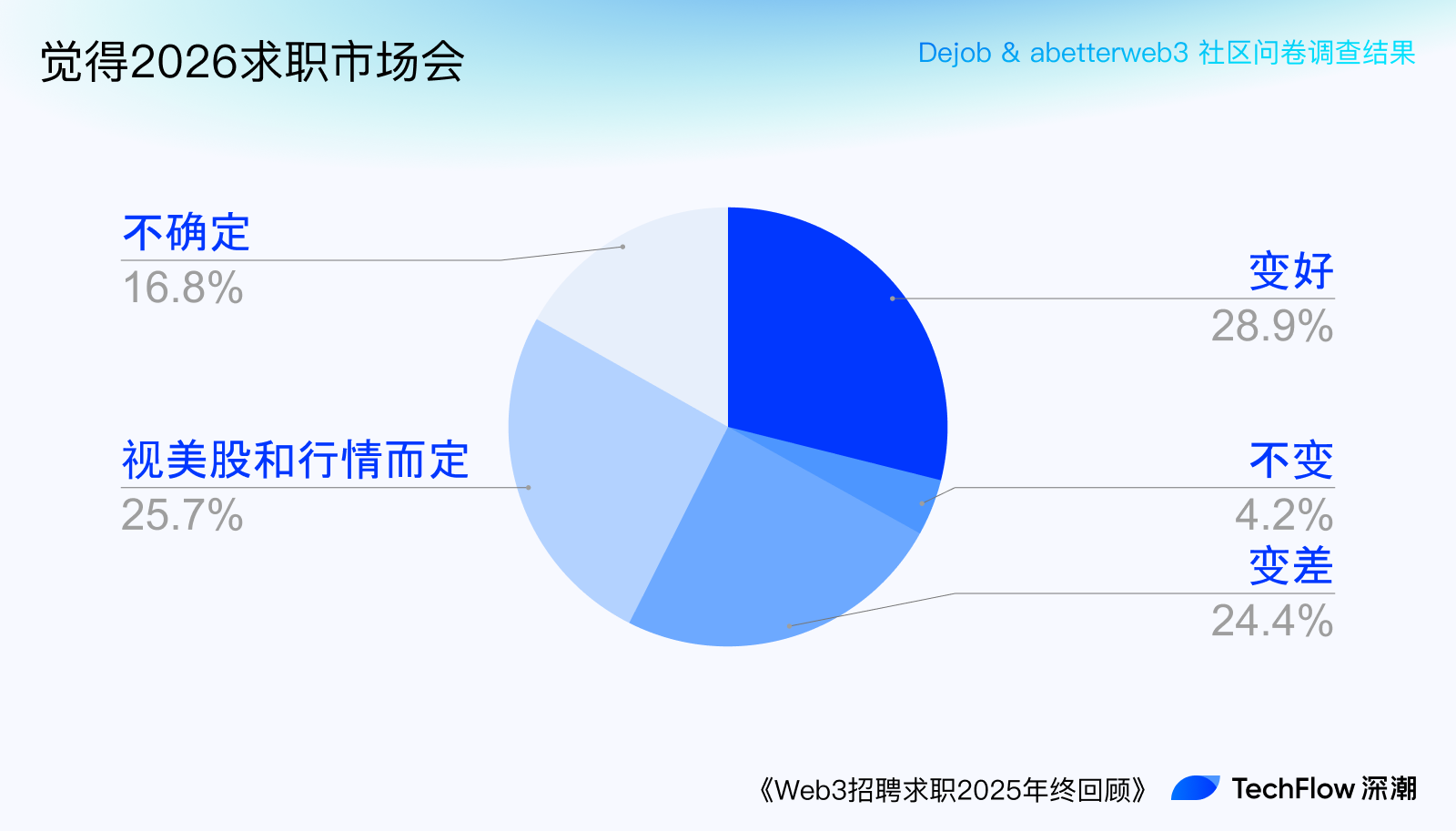

Looking ahead to the 2026 job market, only 28% believe it will improve, while most remain pessimistic or观望 (watch-and-wait).

Honest Answers Section 👀

Beyond the above questions, we added several optional ones to capture job seekers’ most candid opinions about current industry players (for entertainment only).

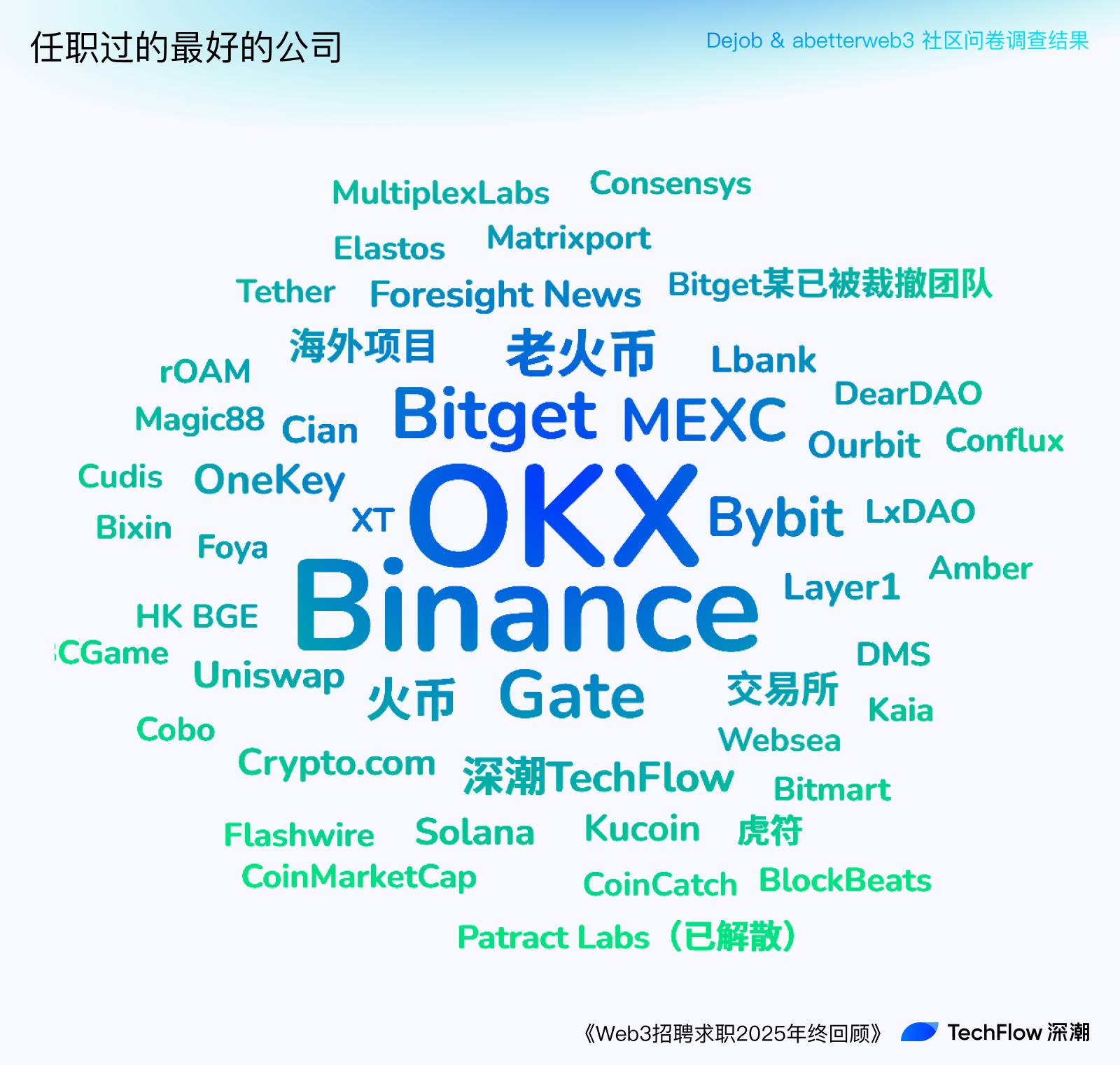

In response to "The best crypto company in your mind," the top ten were:

-

OKX(26), Binance(23), Bitget(10), Gate(9), MEXC(7), Bybit(6), Former Huobi under Li Lin(5), Huobi(4), TechFlow(3), OneKey(3)

Surprisingly, some disbanded teams were mentioned, including Li Lin-era Huobi, a now-defunct Bitget team, and the dissolved Consensus Lab. Perhaps dream companies deserve lifelong nostalgia.

For "The worst crypto company in your mind," the top ten were:

-

Gate(43), Bitget(13), OKX(12), MEXC(8), Huobi(7), Binance(5), WEEX(5), CoinW(2), Kucoin(2), Lbank(1)

Some exchanges appear on both best and worst lists. This may indicate their vast internal divisions and complex personnel structures, where work experiences vary drastically across departments and leadership styles.

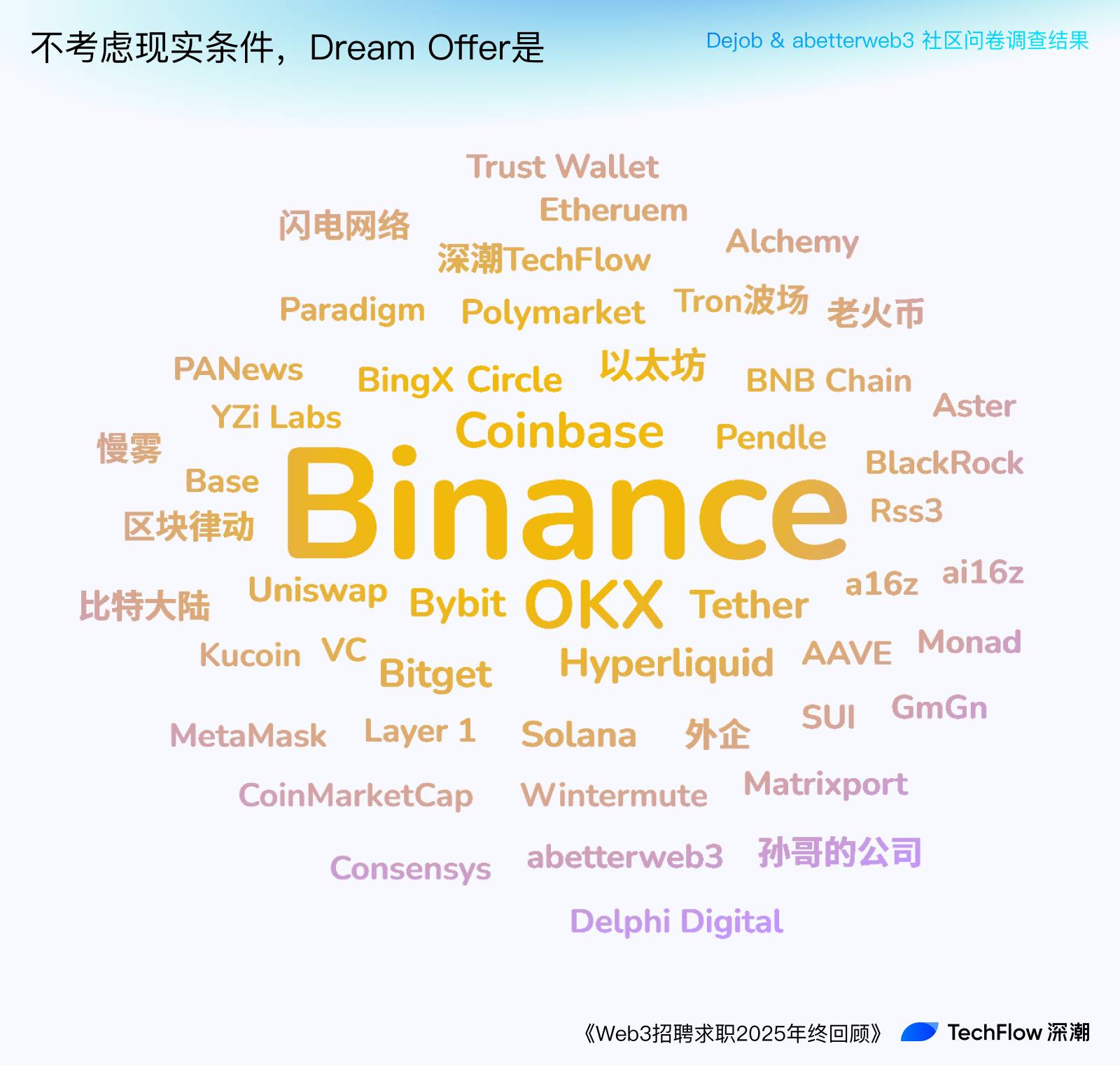

When asked "Which company would you most want to join, regardless of real-world constraints," the top ten were:

-

Binance(177), OKX(50), Coinbase(25), Hyperliquid(11), Bybit(11), Bitget(10), Tether(10), Circle(6), Solana(5), Ethereum(5)

Binance, as the industry leader, unsurprisingly ranked first. Acting as the "Tencent of crypto," Binance enjoys both external prestige and strong credibility within the industry, serving as a golden resume booster and genuinely advancing careers. Hyperliquid, a non-exchange entity, making the top 10 reflects its strong community and growing demand for non-exchange products. Beyond leading exchanges, the increased presence of foreign companies and overseas infra names hints at candidates’ preference for Western firms and disappointment with Chinese teams.

On the question "Which job in crypto do you think earns the most?," high-frequency keywords included:

-

Trader(85), KOL(68), BD(47), Exchange(32), Quant(32), Project(27), Developer(20), Contract(17), Market Maker(16), Tech(14)

Traders ranked first, likely because recent volatile markets have taught many that no matter the company or role, personal trading might yield better returns. KOLs came second, possibly due to access to project pre-launch tokens, informational advantages, or the ability to influence specific assets for profit. Pure technical roles distant from markets were also mentioned, perhaps because to non-developers, “tech” is seen as an essential component for “super individuals” to leap forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News