RMB exchange rate returns to the "6" era

TechFlow Selected TechFlow Selected

RMB exchange rate returns to the "6" era

According to a Bloomberg compilation, experts from six major international investment banks generally believe the dollar will continue weakening against major currencies, and by the end of 2026, the dollar index will decline by approximately 3%.

Author: Ba Jiuling, Wu Xiaobo Channel

The suspense wasn't great to begin with—just one final step away.

After nearly a month of anticipation around "the RMB即将 breaking through 7," analysts from Goldman Sachs delivered a key assist.

Recently, Goldman Sachs released its "2026 Global Equity Outlook." When discussing the RMB, using its Global Stock Dynamic Equilibrium Exchange Rate Model (GSDEER), Goldman calculated the fair value of the RMB, showing that the RMB is undervalued by nearly 30% against the US dollar.

However, slogans are more eye-catching than numbers. The report stated:

The degree of RMB undervaluation against the US dollar is comparable to that of the mid-2000s.

In 2000, the annual average USD/CNY exchange rate was about 8.28. After that, the RMB entered a decade-long appreciation cycle, rising to around 6.1 against the US dollar.

Goldman's assessment gave the market greater confidence in being "bullish," causing offshore RMB—already on an appreciating path—to accelerate sharply.

On the morning of December 25, the USD/offshore CNY exchange rate quickly broke above 7.0, hitting a 15-month high and officially re-entering the "6 era."

USD/CNY exchange rate trend from 2005–2025

Image source: CNBC

Meanwhile, onshore RMB touched a low of 7.0053, just a hair's breadth away from "breaking 7." The central parity rate for USD/CNY set by China Foreign Exchange Trading System also rose by 79 basis points. Now that the "shoe has dropped," we can finally ask these questions:

Why has the RMB been able to follow an independent trajectory in 2025? As the exchange rate enters the "6 era," what kind of shifts does this mean for corporate operations and personal asset allocation?

Is "Breaking 7" Short-Term or Long-Term?

Looking at the year as a whole, the RMB exchange rate has followed an unusual path.

In April this year, the RMB hit a low of 7.429, and markets were still worried about depreciation risks. Unexpectedly, by year-end, the RMB trend reversed.

This was influenced by timing.

As per tradition, near year-end, domestic export enterprises need to settle accounts with suppliers, converting the US dollars earned throughout the year into RMB for "closing the books" and paying year-end bonuses. This triggers seasonal demand for foreign exchange conversion.

As more people "need" RMB, starting from late November, the "price" of RMB began to rise steadily—aligning perfectly with the timeline.

Busy operations at a foreign trade container terminal on December 24

In addition, due to the recent "strong gains" in the RMB, export firms that previously stockpiled US dollars, aiming to avoid prolonged uncertainty and potential exchange losses, have increasingly rushed to convert their holdings—further boosting RMB appreciation.

Notably, this year’s demand is clearly stronger than in previous years.

According to data released by China's General Administration of Customs, in the first 11 months of this year, China's goods trade continued to grow, with total imports and exports reaching 41.21 trillion yuan, up 3.6% year-on-year. In the first 11 months, China's trade surplus exceeded $1 trillion for the first time.

This means some export companies hold significantly more foreign exchange income than in previous years.

Wang Qing, Chief Macro Analyst at Orient Golden Fortune, believes that as year-end approaches, increased corporate FX conversion demand is driving seasonal strength in the RMB; especially after the recent sustained appreciation of RMB against the US dollar, pent-up conversion demand from earlier high export growth may now be accelerating.

However, Huatai Futures noted in its "Huatai Futures - Foreign Exchange Annual Report: Getting Better, RMB Enters Appreciation Phase" that due to inverted interest rate differentials between China and the US, the cost-benefit ratio between holding and converting FX has become closer, leading corporate conversion strategies to become more diversified and balanced. Therefore, although this year’s year-end "conversion wave" will provide marginal support to the RMB in the short term, it does not constitute a dominant trend-driving factor.

The RMB's appreciation also benefited from favorable conditions.

In 2025, the Federal Reserve implemented three rate cuts, directly weakening the US dollar index. As of December 25, the dollar index fell 9.69% this year, dropping below the 100 mark to close at 97.97—the largest single-year decline in nearly eight years.

The Fed's third rate cut on December 10

Exchange rates operate like a seesaw. When the US dollar weakens, non-US currencies including the RMB strengthen—meaning the RMB achieved "passive appreciation."

Another contributing factor was Trump's return to power, reigniting a global "tariff war" and undermining the long-standing, rules-based global trading system.

When trade flows become uncertain, the cost of trade settlements and supply chain financing denominated in US dollars naturally rises, further shaking confidence in the dollar as an ideal settlement currency.

Compounded by the US government's 35-day shutdown and Moody’s—one of the three major rating agencies—downgrading the US sovereign credit rating, global capital began seeking safe havens, leading to massive outflows from US dollar assets—and giving RMB and RMB-denominated assets their own moment of "value revaluation."

According to data from EPFR Global, a global fund flow tracking institution, during May–October 2025, equity funds focused on Hong Kong stocks attracted net inflows of HK$67.7 billion, completely reversing the net outflows seen in the same period of 2024.

More importantly, the RMB's appreciation stems from human factors—policy and sentiment.

On December 11, the World Bank raised its forecast for China's GDP growth by 0.4%, while the International Monetary Fund (IMF) upgraded China's 2025 GDP growth forecast by 0.2%, expecting it to reach 5%.

The simultaneous upgrade by two international institutions clearly reflects strong confidence in China’s current economic performance and long-term development potential.

Among these, stable exports have provided the most fundamental support for RMB appreciation.

On one hand, record-high trade surpluses form a solid foundation for the RMB exchange rate; on the other, the quality of exports has improved.

Data from the General Administration of Customs shows that in the first 11 months of this year, China exported integrated circuits worth 1.29 trillion RMB, up 25.6%; and vehicles worth 896.91 billion RMB, up 17.6%. This indicates that export leaders have shifted from traditional labor-intensive products to high-end manufacturing such as shipbuilding, integrated circuits, and new energy vehicles.

Export vehicles parked at port

Guan Tao, Global Chief Economist at BOC Securities, believes that enhanced export market diversification, accelerated transformation and upgrading of domestic manufacturing, and strengthened competitiveness of export goods have supported robust export growth, helping maintain and even increase China’s share in global markets.

RMB Appreciation and Personal Investment

Now let's address the most pressing question—will this round of RMB appreciation benefit or hurt A-shares?

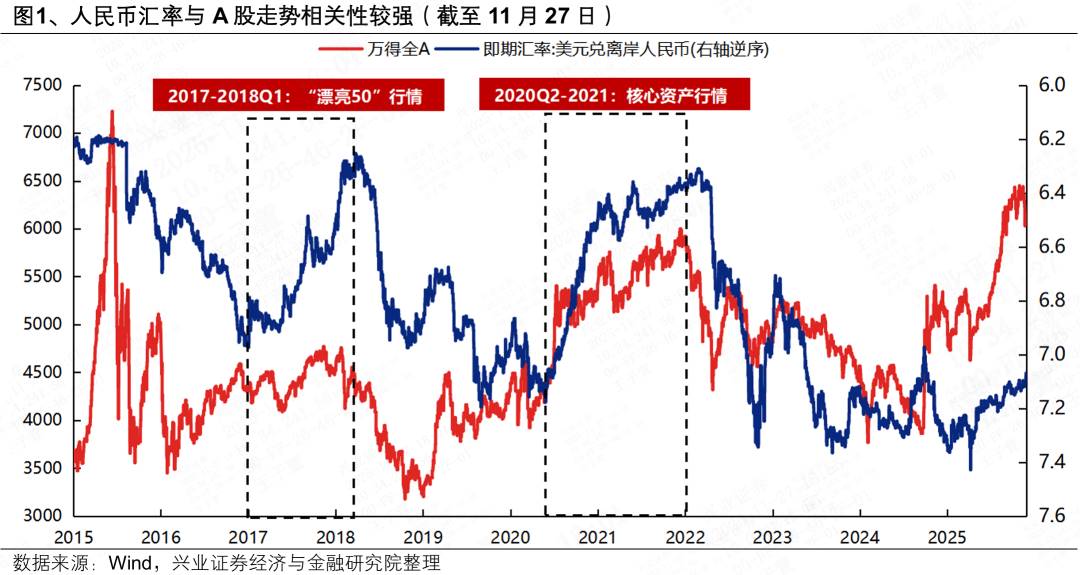

There has been extensive research over the years on how exchange rates affect A-share performance. Xingye Strategy's Zhang Qiyao team believes that since the 2015 exchange rate reform, RMB exchange rates and A-share movements have shown a significant positive correlation.

From the chart showing the correlation between RMB exchange rates and A-share trends, we can see that since 2017, the relationship has become increasingly clear.

For example, during the "Beautiful 50" rally from 2017 to Q1 2018, and the RMB appreciation phase from Q2 2020 to 2021, A-shares remained in a bull market. Correspondingly, foreign capital became a key driver behind the Chinese stock market’s rise.

In addition, Goldman Sachs once conducted a study on US stocks, concluding that, assuming no divergence in fundamentals, a 0.1 percentage point rise in exchange rate leads to a 3%–5% increase in stock valuations.

Of course, given the complex mechanisms linking exchange rates and stock prices, we cannot claim that RMB appreciation automatically leads to individual stock or market-wide gains. But overall, various analyses suggest this round of RMB appreciation could stimulate further growth in A-shares.

However, RMB appreciation directly impacts different industries differently, thereby affecting the stock prices of related listed companies.

Offshore RMB appreciation means Chinese goods priced in local currency become more expensive in international markets, reducing price competitiveness and potentially decreasing foreign orders.

This particularly affects traditional export-oriented sectors such as home appliances and textiles, which operate on thin margins and are highly sensitive to exchange rate fluctuations—making them vulnerable to profit pressure.

On the flip side, RMB appreciation brings significant benefits to certain industries. For instance, domestic industries dependent on imports stand to gain directly.

Based on import/export data from the National Bureau of Statistics, China’s "net importing" sectors—including energy, agriculture, and materials—benefit directly from this appreciation.

At the same time, industries with large amounts of US dollar-denominated debt also benefit from RMB appreciation. Within the港股通 scope, sectors with higher proportions of short-term USD debt—such as internet, shipping, aviation, utilities, and energy—stand to gain.

Moreover, RMB appreciation also influences individual investors’ trading behaviors.

At the beginning of the year, "USD deposits" and US Treasury bonds were extremely popular. Some investors converted large amounts of RMB into USD for investment. But as the RMB appreciated sharply, USD deposits turned into "negative returns." Even with a 5% yield on US Treasuries, after factoring in exchange losses, returns are roughly equivalent to a one-year fixed deposit.

Naturally, some wonder: since the RMB is now strengthening, should they buy more USD now and hold it for future use?

For individuals, if intended for cross-border shopping, this might be a good idea—the RMB appreciation effectively gives discounts abroad, and when shopping overseas with USD payments, RMB costs are now 5%–10% cheaper than before.

But if purely speculative, caution is advised. Given the low probability of sharp RMB fluctuations, it's unwise to convert RMB into USD deposits for speculation—blindly chasing momentum increases risk.

Where Does the RMB Go After "Breaking 7"?

It's important to note that the current "appreciation" mainly refers to the RMB strengthening against the US dollar—not a broad-based strengthening across all currencies.

According to data from China Foreign Exchange Trading System, since the start of the year, the RMB exchange rate against the CFETS RMB Index, the BIS currency basket RMB Index, and the SDR currency basket RMB Index have all declined, with two of the indices falling below 100.

These three indices represent the "overall performance" of the RMB against a basket of foreign currencies.

A weakening index means that although the RMB has appreciated significantly against the US dollar, its overall value against other currencies—such as the pound, euro, and others in the basket—has actually declined.

Nevertheless, institutions including Goldman Sachs agree that with China's continued economic development and deeper RMB internationalization, "moderate appreciation" of the RMB is expected to become a long-term trend.

For example, Yuekai Securities argues that over the past two years, with low domestic inflation and high overseas inflation, the central level of the CFETS RMB Index has even shifted downward, suggesting room for catch-up appreciation in the RMB. It expects the USD/CNY rate to remain strong in 2026, with "6.8" potentially becoming a key level.

According to Bloomberg consensus, experts from six major international investment banks generally believe the US dollar will continue weakening against major currencies, projecting the dollar index to fall about 3% by the end of 2026—supporting continued passive strength in the RMB.

Still, whether the RMB continues to appreciate or experiences volatility, extreme or unexpected movements are unlikely.

The recently concluded Central Economic Work Conference has emphasized for four consecutive years the need to "maintain basic stability of the RMB exchange rate at a reasonable and balanced level."

Additionally, as the central bank stated: "The RMB's long-term exchange rate has a solid foundation. We will continue to uphold the decisive role of the market in exchange rate formation, maintain exchange rate flexibility, strengthen expectation management, guard against excessive exchange rate swings, and keep the RMB basically stable at a reasonable and balanced level."

Even Goldman Sachs said: "We expect RMB appreciation to be gradual and managed, but even so, we believe it could still outperform forward pricing."

For individual investors, the focus should not be on predicting exact exchange rate levels, but on understanding trends, aligning with industrial upgrades, and skillfully using hedging tools—seizing opportunities brought by appreciation while guarding against risks from volatility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News