Vaults, Yields, and the Illusion of Security: A Real-World Benchmark

TechFlow Selected TechFlow Selected

Vaults, Yields, and the Illusion of Security: A Real-World Benchmark

Most vaults are marketed as yield-generating tools. But from an economic standpoint, they are risk products.

Author: Omer Goldberg

Translation: Block unicorn

Vaults are one of those concepts in crypto that everyone assumes they understand—mainly because they appear simple. Yet simplicity is often deceptive. Beneath the surface, vaults have quietly become one of the most misunderstood yet strategically significant foundational elements across the entire ecosystem.

During DeFi Summer, a "vault" was little more than a clever UI around automated yield farming. Yearn packaged tedious, labor-intensive operations—such as switching between different yield farms or compounding governance tokens—into an almost magical experience. Deposit funds, and strategies would automatically do the rest. It was an internet-native abstraction, and it worked.

But 2025 is entirely different.

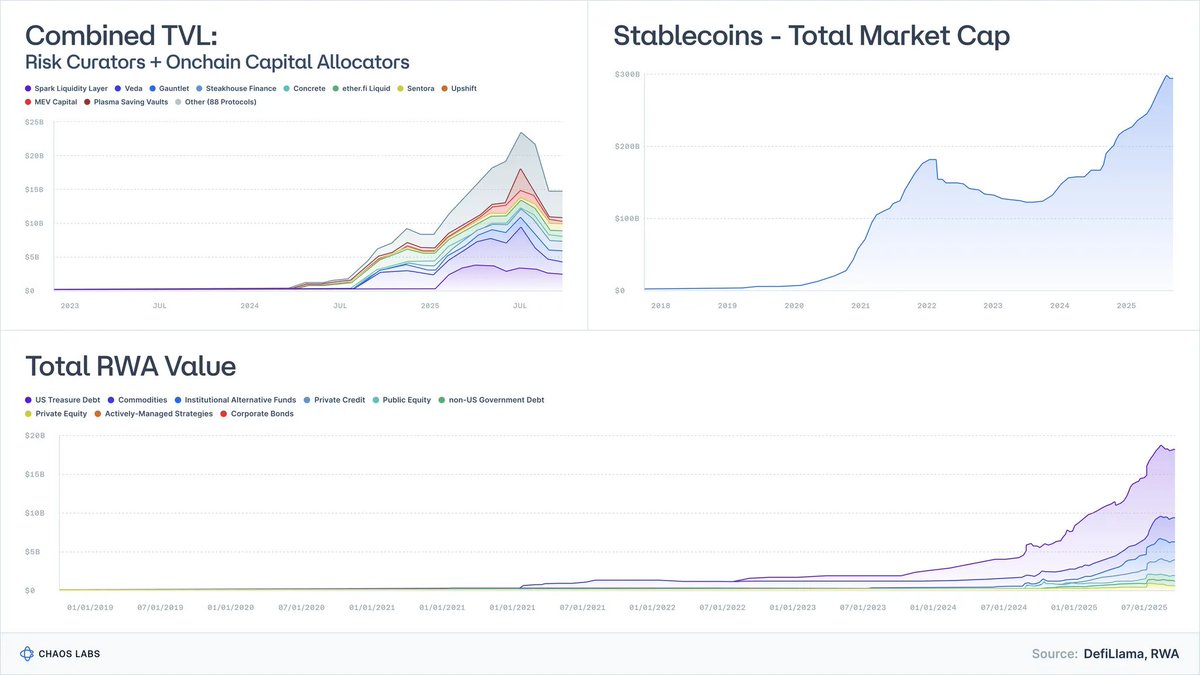

Tokenized Treasuries have evolved from multi-million-dollar experiments into nearly $9 billion in assets under management, with institutions like BlackRock, Franklin, and Société Générale now active participants.

Risk-weighted assets (RWA), excluding stablecoins, now amount to hundreds of billions of dollars.

Stablecoins themselves have surpassed $300 billion in market capitalization, with issuers becoming significantly more mature.

The industry of Risk Curators and Onchain Allocators, once barely noticed just a few years ago, is now managed by nearly a hundred firms overseeing over $20 billion in assets.

The view that vaults are merely "yield machines" is outdated. Vaults are evolving into fund wrappers—programmable analogs of money market funds, structured credit, and increasingly, hedge fund strategies.

And here lies a dangerous misconception:

Most vaults are marketed as yield tools. But economically speaking, they are risk products.

The collapses of projects like Stream and Elixir make this clear. When the industry treats structured credit as equivalent to cash, the results are predictable: poor risk management, cascading de-peg events, and systemic fragility across lending protocols.

This article aims to reshape how we think about vaults: what they truly represent, how they map to real-world asset classes, and why "low-risk DeFi" is not a passing trend but the next frontier in global financial inclusion.

1. Vaults Are Portfolios With APIs

Strip away the UI and marketing, and the concept of a vault is simple:

A portfolio construction engine wrapped in an API.

-

Assets are deposited into the vault (stablecoins, Ethereum, risk-weighted assets).

-

Strategies execute (lending, collateralization, hedging, leverage, mining, selling volatility, underwriting credit).

-

Programmable interfaces handle deposits and withdrawals; sometimes liquidity is predictable, sometimes not.

That's all there is to a vault.

If a traditional finance professional handed you a fund prospectus, you’d immediately ask:

-

Is this cash? Credit? Equity? Or some rare asset?

-

What’s the liquidity profile—daily, weekly, quarterly?

-

In an extreme event, what happens to my principal?

Crypto completely skips these questions. We talk about annual percentage yield (APY), not risk profiles.

On a DeFi frontend, five entirely different strategies ultimately converge into the same appealing-looking card:

Vaults are gateways to anything on-chain.

Missing is the most critical part: What risks am I actually taking?

Smart contract risk? Counterparty risk? Basis risk? Leverage risk? Credit risk? Or all of the above?

In the end, this opacity comes at a cost: retail users may take on risks they don’t understand and suffer unexpected losses (potentially drawing regulatory scrutiny); institutional investors glance once and walk away, disappointed by the lack of professionalism and transparency standards.

Moreover, using yield as the sole competitive benchmark has another devastating effect on risk management: protocols and risk curators compete by taking on ever-increasing levels of risk.

As crypto enters its institutional era, this must change.

2. What Yield Are You Actually Getting? Real-World Benchmarks

To understand DeFi vault yields, we need a benchmark:

Historically, what returns have different types of risk generated in the real world?

For nearly a century, researchers have collected data on core financial asset classes.

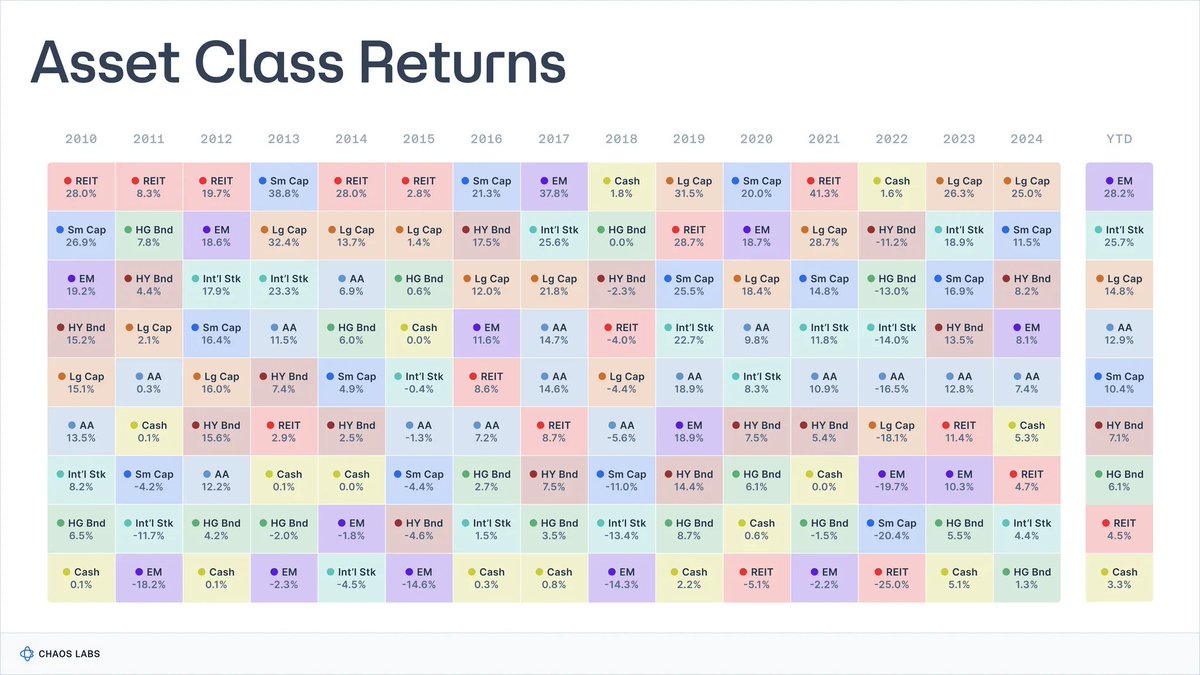

Aswath Damodaran maintains an authoritative dataset on U.S. equities, bonds, and Treasury bills going back to 1928, while the Global Investment Returns Yearbook tracks long-term returns across major countries since 1900.

Across these datasets, the picture is strikingly consistent:

-

Equities (S&P 500): ~9.9%

-

Small-cap stocks: ~11.7%

-

High-yield corporate bonds: ~7.8%

-

Investment-grade bonds: ~4.5%

-

Cash / Treasury bills: ~3.3%

-

Real estate: ~4.2%

-

Gold: ~5%

Inflation averaged about 3% during this period, so real returns were roughly 3 percentage points lower than nominal figures. These numbers aren't precise predictions for the future, but they broadly reflect long-term economic trends.

Each return comes with a set of risks and trade-offs borne by the respective holders.

2.1 Cash / Treasury Bills: Paid for Waiting

Definition

In practice, it's the closest thing to a "risk-free" benchmark in the financial system (short-term U.S. government bonds, money market funds).

Historical Return

Nominal yield around 3.3% (real yield after inflation: 0–1%).

Return source: Essentially, compensation for time value of money, with near-zero credit risk and minimal term risk.

Trade-off: Inflation silently erodes returns and purchasing power; after fees and friction, long-term real returns are close to zero.

These investments are ideal for holding cash, not for compounding wealth.

2.2 Bonds: Paid for Lending

Definition

Debt issued by governments and corporations, varying in quality. You lend capital in exchange for interest and principal repayment.

Historical Return

-

Investment-grade bonds: ~4–4.6% nominal yield;

-

High-yield bonds ("junk bonds"): ~6–8% nominal yield.

Return Sources:

-

Credit risk: Possibility of borrower default or deterioration (higher in junk bonds);

-

Term risk: Sensitivity to interest rate changes;

-

Liquidity risk, especially in non-mainstream or low-rated bonds.

Trade-off: Bond portfolios can sharply decline when rates rise (cyclical sensitivity, e.g., 2022 bond yield slump); real returns may be low or negative during inflation spikes; credit events (restructuring, default) can lead to permanent capital loss.

The term "bonds" covers a wide range of instruments with differing risk-return profiles: assessing the debtor’s economic health is key to determining actual risk exposure.

2.3 Equities: Paid for Growth Volatility

Definition

Ownership in companies. Benefit from earnings, innovation, and long-term economic growth.

Historical Return

U.S. equities (S&P 500): ~9.9–10% nominal yield, ~6.5–7% real yield.

Return Sources:

-

Business risk: Companies can fail;

-

Earnings cycle: Profits fluctuate with the economy, and dividends may contribute less to total return;

-

Volatility and drawdowns: Large daily market value swings are normal even in developed economies.

Trade-off: While global equities typically outperform bonds and cash over the long run, multi-year drawdowns of 30–50% are not unusual (e.g., Japan’s lost decades, or Europe from 2000 to 2018), especially after adjusting for inflation.

2.4 Real Estate: Income + Leverage + Local Risk

Definition

Income-producing real estate: residential, commercial, logistics, etc.

Historical Return

Long-term average nominal return for U.S. real estate indices: ~4–4.5%, real return: ~1–2%.

Return Sources:

-

Income and economic cycle risk: Revenue depends on tenants’ ability to pay rent consistently, which declines with economic cycles;

-

Local economic risk: Exposure to specific cities, regions, and industries;

-

Leverage and volatility risk: Mortgages and debt financing amplify both gains and losses;

-

Liquidity risk: Real estate and many related instruments are slow and costly to trade, especially under stress.

Trade-offs:

You can't instantly "list" property for sale; selling or refinancing takes weeks/months; even listed REITs can plunge during market stress;

Drops in interest rates, credit availability, or local demand (e.g., remote work reducing office space needs) can simultaneously hurt income and valuation;

Rolling over debt becomes expensive when rates rise or lenders tighten terms;

Portfolios are often overly concentrated in specific regions or property types.

In practice, while real estate has historically been an effective inflation hedge, it's a complex, illiquid domain that cannot be traded or used as payment like cash equivalents.

2.5 Private Equity & Venture Capital: Illiquidity + Complexity Premium

Definition

Illiquid, long-duration investments in private companies and projects—buyouts, growth equity; early-stage VC or distressed/special situations.

Historical Return

-

Private equity: Net IRR around 15% in many years (but highly cyclical)

-

Venture capital: Top-quartile managers return 20–30%+

Yet data shows high variability: after fees and survivorship bias, median real returns are closer to single digits.

Return Sources:

-

Long-term illiquidity: capital locked up for 7–12 years

-

Complexity: Custom deals, governance, structures

-

Manager skill: Huge variation across managers and vintage years

-

Information asymmetry: Requires specialized channels and due diligence

-

Higher principal risk: VC heavily dependent on execution and economic cycles; high risk of capital loss.

Trade-off: Long lockups; usually no secondary market. Moreover, despite higher risk, many funds underperform public markets after fees.

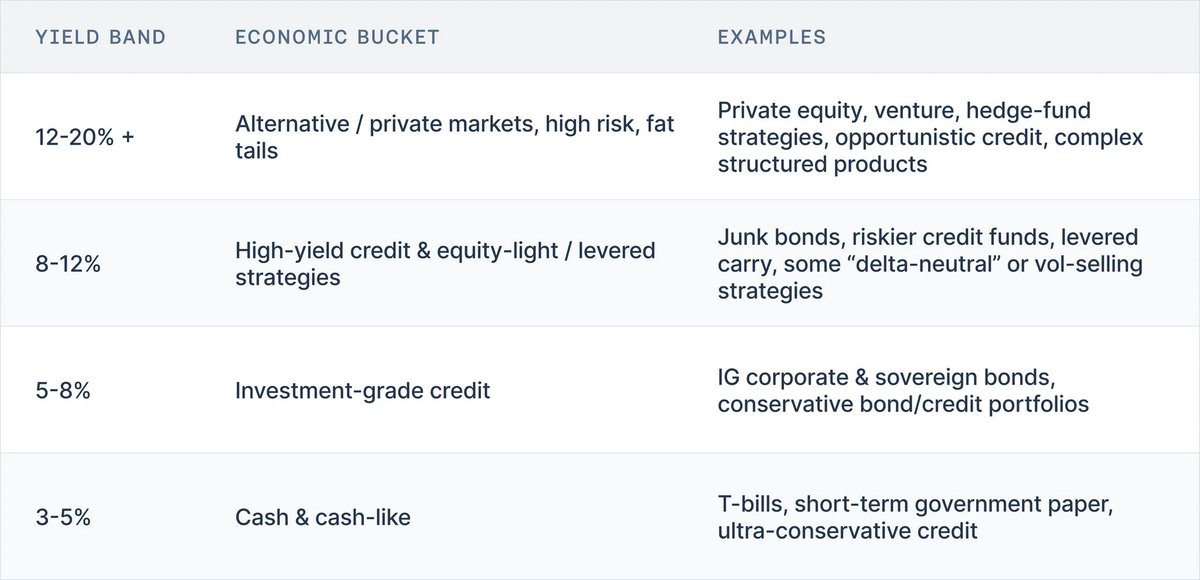

3. There’s No Free Lunch: The Yield Ladder

When you aggregate all this historical data, one simple truth emerges:

No asset class in the real world delivers high returns without commensurate high risk.

A practical way to interpret vault yields is through the yield ladder model:

-

3–5% → Cash, Treasuries, short-term government bonds, ultra-conservative credit

-

5–8% → Investment-grade bonds, conservative credit portfolios

-

8–12% → High-yield bonds, riskier credit, light equity strategies, some leveraged arbitrage

-

12–20%+ → Private equity, venture capital, hedge fund strategies, opportunistic credit, complex structured products

Over a century of market data shows this yield ladder has remained remarkably resilient through wars, hyperinflation, tech booms, and shifts in interest rate regimes.

Putting portfolios on-chain doesn’t invalidate it. So whenever you see a DeFi vault, ask yourself two questions:

-

Does the advertised risk match the advertised yield?

-

Where does the yield come from?

4. Conclusion: The Right Mental Model for Vault Yields

Beyond marketing and UI, the facts are simple:

-

Vaults are no longer automatic-compounding "farms," but portfolios with APIs;

-

Their yield is the price of the risk they underwrite;

-

Over a century of market data shows that reasonable yield ranges for given risk levels have remained surprisingly stable.

Cash-like instruments yield only single-digit nominal returns, with near-zero real returns.

Investment-grade credit yields slightly more due to duration and default risk.

High-yield credit and equities can reach high single digits or teens.

Private equity, venture capital, and hedge fund strategies are historically the only investment options that consistently deliver mid-teens or higher median returns—but they come with real risks of illiquidity, opacity, and permanent loss.

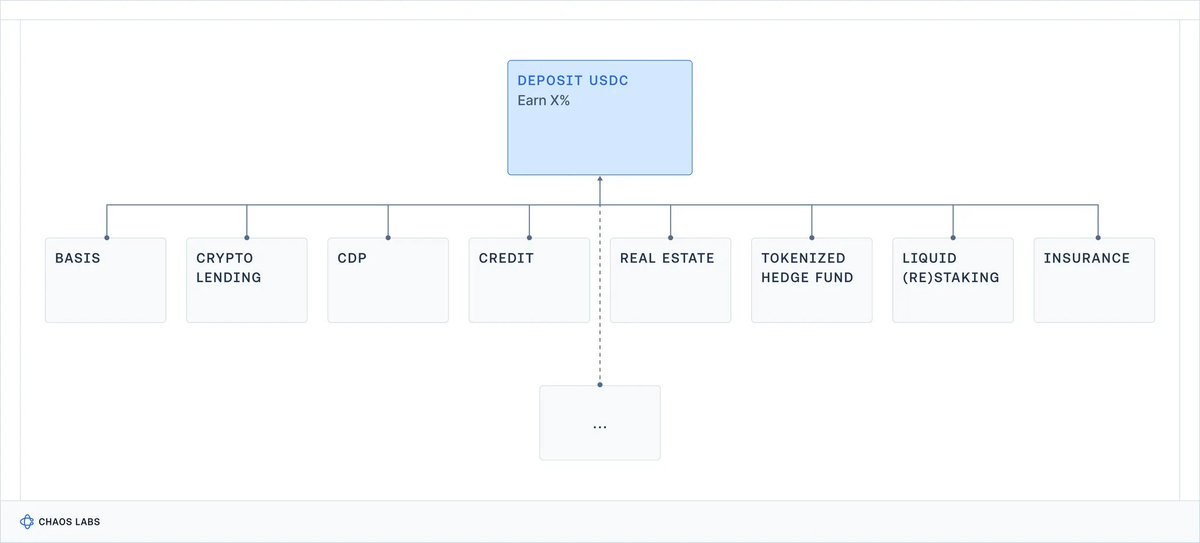

Putting these portfolios on-chain doesn’t alter the relationship between risk and return. Today on DeFi frontends, five vastly different risk tiers might all be presented in the same friendly format: “Deposit USDC, earn X% yield,” with almost no indication whether you're exposed to cash, investment-grade credit, junk credit, equities, or hedge fund risk.

For individual users, this is already bad—they might unknowingly invest in complex credit products or leveraged portfolios they don’t understand.

But it also creates systemic consequences: to stay competitive on yield, every product within a given "category" tends toward the riskiest configuration possible. Safer configurations appear "underperforming" and get ignored. Custodians and protocols that quietly take on more risk in credit, leverage, or basis get rewarded—until events like Stream or Elixir remind everyone what risks were actually taken.

Thus, the yield ladder isn’t just a teaching tool. It’s the beginning of a risk language the industry currently lacks. If we could consistently answer these two questions for every vault:

-

Which rung of the ladder does this vault sit on?

-

What risks does this yield expose me to (smart contract, credit, term, liquidity, directional)?

Then we could evaluate performance by risk tier, rather than turning the entire ecosystem into a single, undifferentiated APY race.

In the next parts of this series, we’ll apply this framework directly to crypto. First, we’ll map today’s major vaults and blowups onto the ladder to see what their yields truly tell us. Then we’ll zoom out to discuss what needs to change: labels, standards, curation practices, and system design.

In the following articles of this series, we will directly apply this framework to the cryptocurrency space. First, we’ll map today’s major vaults and collapse cases onto this framework to see exactly what their yields reflect. Then, we’ll step beyond the framework to explore what needs improvement: labeling, standards, curator practices, and system design.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News