Death is the biggest "buyer" of cryptocurrency

TechFlow Selected TechFlow Selected

Death is the biggest "buyer" of cryptocurrency

"Only your key can give you access to your cryptocurrency."

Author: Pix

Translation: Saoirse, Foresight News

People in the cryptocurrency space often say, "Not your keys, not your coins." It sounds powerful—and it's true. But behind this statement lies a mirrored logic: "Only your keys can give you ownership of your cryptocurrency."

If no one else knows how to access your wallet, then at the moment you stop breathing, your cryptocurrency effectively ceases to exist. Of course, it doesn't literally disappear—it still sits on the blockchain ledger—but economically speaking, it's as good as burned.

So just how big is this "dead man's share"?

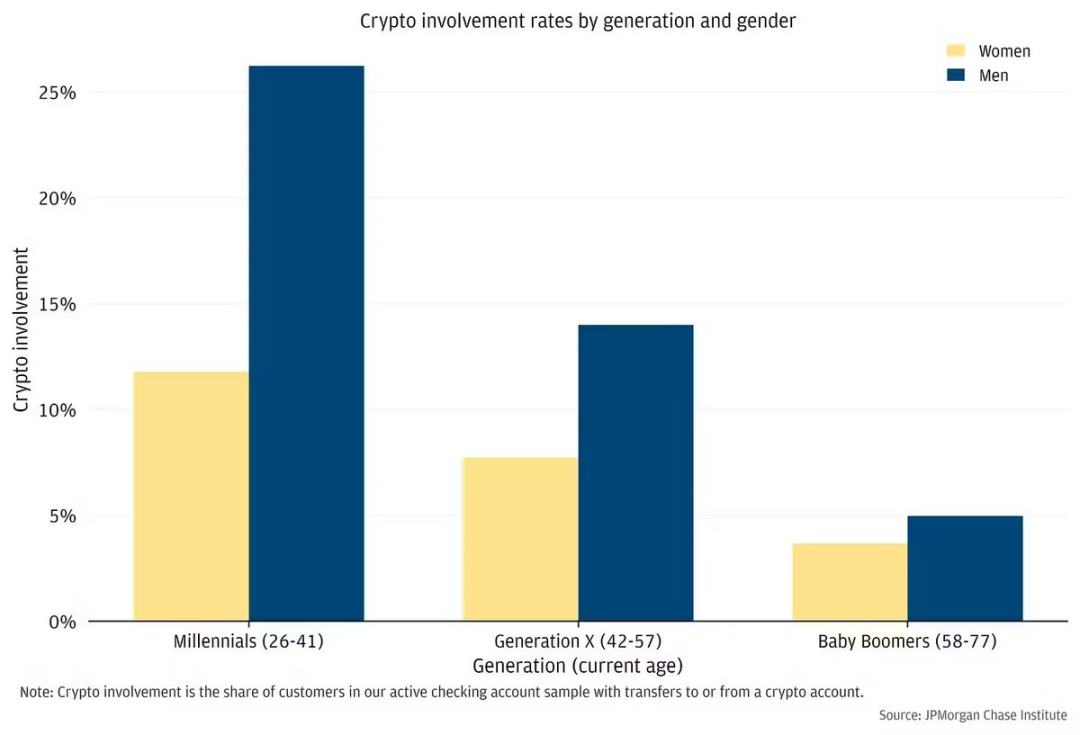

Today, most cryptocurrency holders are young, with the majority ranging from late twenties to early forties.

Few holders are past retirement age, making the issue of crypto loss due to death easy to overlook. Yet even so, the numbers are staggering:

-

About 60 million people die globally each year (based on a global population of approximately 8 billion);

-

There are roughly 500 million cryptocurrency holders worldwide (about 1 in every 16 people);

-

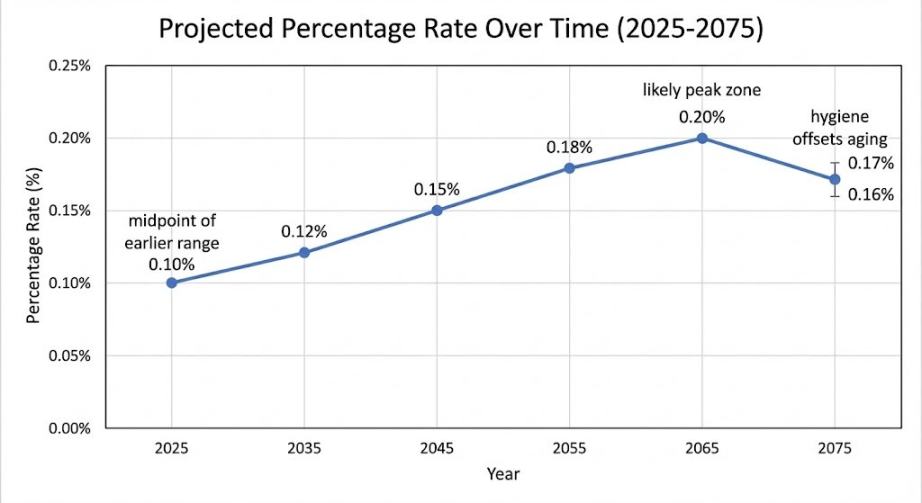

Given that crypto holders are generally younger than the global average, their mortality rate is lower—conservatively estimated at around 0.2% per year;

-

Based on this, approximately 1 million holders (500 million × 0.2%) pass away annually.

Currently, most cryptocurrencies are self-custodied, and very few holders make estate plans for them. Even if only 10% of deceased holders leave wallets inaccessible due to unknown access methods, about 100,000 wallets become unusable each year. Assuming a conservative average balance of $20,000 per lost wallet, this means roughly $2 billion worth of cryptocurrency exits circulation annually. And this figure will grow over time—as today’s young generation inevitably ages.

Percentage of total cryptocurrency supply "destroyed" annually due to death

This leaves us with a critical question: If the advantage of self-custodying cryptocurrency lies in eliminating intermediaries, how can we transfer these assets without reintroducing intermediaries?

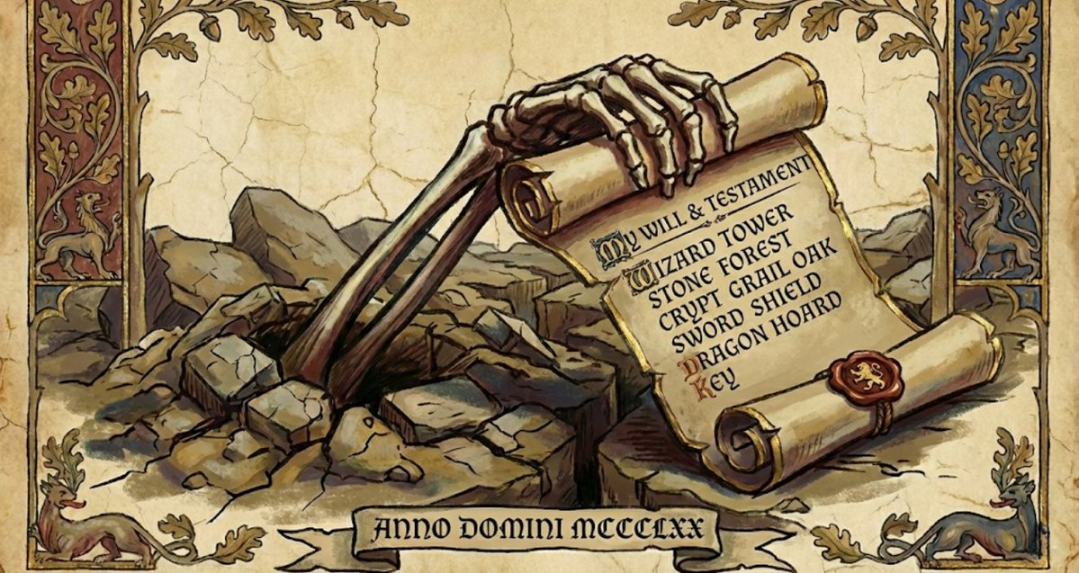

Inheriting assets never designed to be inherited

Most current solutions fall into two extremes: either simple but fragile—like storing seed phrases in bank safety deposit boxes (prone to loss or theft)—or secure but so complex that no one wants to use them in practice. Dissatisfied with both, I’ve adopted a middle-ground approach—a simple three-step inheritance method that is easy to remember, hard to crack, accessible anytime and anywhere, and remains 100% non-custodial (i.e., no reliance on third parties). Here's how it works:

Step 1: Create a dedicated single-page website

Build a single-page website using a "rare domain name" made up of 3–4 obscure words—something ordinary people wouldn’t casually type into a search bar, but personally meaningful and memorable to you. Pre-pay hosting fees for over 10 years and enable auto-renewal to ensure long-term accessibility.

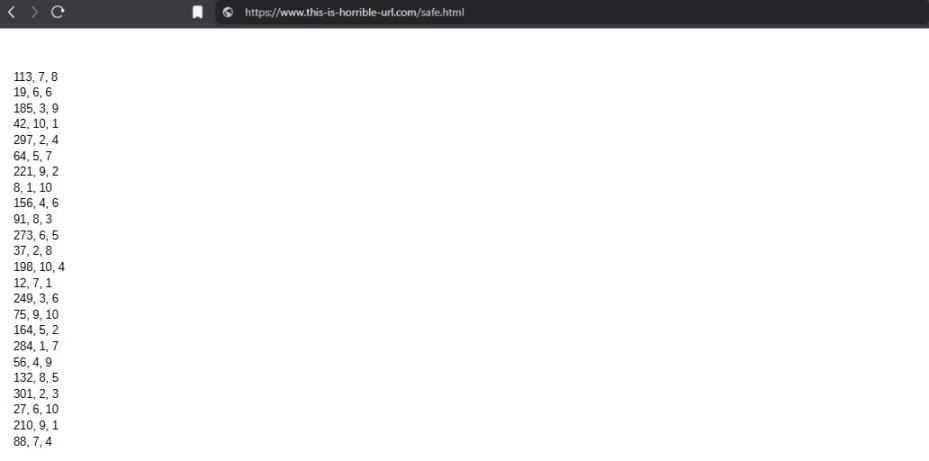

Step 2: Encrypt your seed phrase into numeric sequences

Pick a book you like, identify its most common publisher, and buy 10 copies (ensuring identical page numbering and layout across all copies). Then convert each word in your cryptocurrency wallet’s seed phrase into a numeric sequence: for each word, locate it in the book and record its position as “page number - line number - word position in line.” For example, “112, 3, 5” means “the 5th word on line 3 of page 112.” Convert all seed words this way into numerical strings.

Step 3: Upload the numeric sequences to your dedicated website

Simply publish the converted numeric sequences as a list on your dedicated website, formatted like this:

By the way, this is a real numeric sequence corresponding to an actual seed phrase linked to $500 in cryptocurrency. However, the domain name shown is fictional, and the real seed phrase is hidden within a physical book. Just one hint: I absolutely love well-written detective novels—happy treasure hunting!

I know this might seem like overkill, and some may think it’s unnecessary. But this method truly offers a balance between security and flexibility in asset inheritance. You can further enhance security—for instance, by using rare editions or custom-printed book copies to store the positional data of your seed words. Or, alternatively, skip all this complexity and simply place a hardware wallet (e.g., Ledger) and a metal plate engraved with your seed phrase into a safe deposit box. Otherwise, your cryptocurrency may ultimately end up “donated” to the blockchain—permanently locked and unusable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News