2025 Crypto x AI Annual Review: Which Narratives Survived?

TechFlow Selected TechFlow Selected

2025 Crypto x AI Annual Review: Which Narratives Survived?

The entire industry is shifting from narratives to infrastructure, from speculation to systematic solutions, and from hype to actual products.

Author: 0xJeff

Translation: TechFlow

Looking back at the development history of Crypto and AI, the surviving and thriving narratives, and the future of this field in 2026.

2024 was the year when Crypto x AI truly began gaining traction on Crypto Twitter—numerous interesting, practical, and entertaining crypto agents emerged, each equipped with its own token.

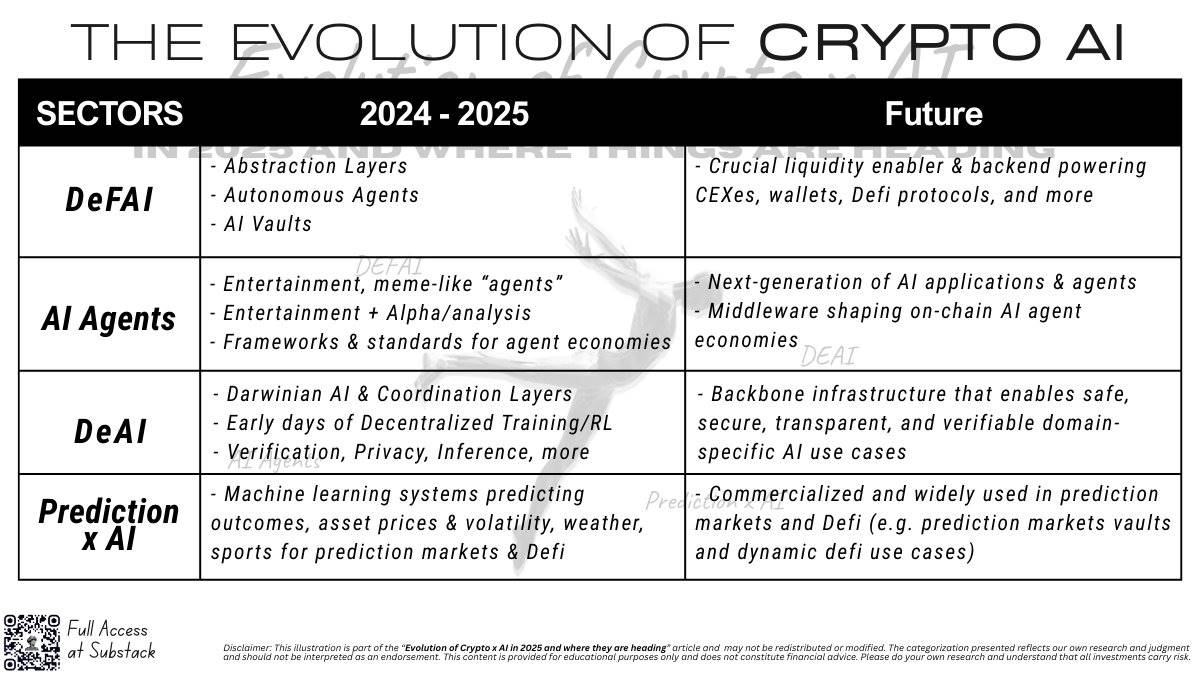

In 2025, speculation around crypto agents gradually shifted toward real AI applications. Decentralized AI (Decentralized AI) moved from research and conceptual stages into early productization. "Darwinian AI" became the preferred approach to attract new talent and accelerate decentralized artificial intelligence development. Meanwhile, DeFi x AI emerged as the most valuable sub-sector, further enhancing the core value proposition of the crypto space.

2026 will be the year of Crypto AI.

Building on the efforts and experiments accumulated between 2024 and 2025, we are beginning to see early signs of product-market fit and a clearer direction for how cryptocurrencies, blockchains, and distributed systems can enhance artificial intelligence.

Narratives that lacked intrinsic utility or market demand—or couldn't compete with Web2 AI startups—have either died out or stagnated (e.g., AI x gaming, AI entertainment, generative AI, video/voice agents, AI workflows for productivity enhancement).

The surviving narratives have instead evolved into innovative models that could transform how we work.

DeFAI is the next-generation DeFi

DeFAI (Artificial Intelligence in Decentralized Finance) debuted in early 2025 within the crypto space, sparking a massive wave of enthusiasm for using AI to enhance existing DeFi systems.

The first iteration of DeFi x AI products were known as "abstraction layers," where users could directly prompt desired outcomes through ChatGPT-like interfaces.

This was a "eureka moment" for many, given that DeFi itself is highly complex—users must find suitable bridging tools to transfer assets or gas fees, understand how top-tier decentralized exchanges (DEXs) and lending protocols operate on new chains, and grasp protocol characteristics, risks, and underlying assets.

Tools capable of helping users quickly achieve their goals seemed like the perfect first step toward making DeFi more accessible.

While theoretically appealing, real-world integration faced numerous challenges. Most DeFAI solutions were either riddled with bugs or extremely difficult to use. User interface and user experience (UI/UX) issues were maddening; users didn’t know how to input prompts or even what they could or couldn’t say.

As a result, most projects failed, leaving only a few players to pivot or continue深耕.

-

@HeyAnonai, once one of the top DeFAI projects, has since pivoted into a trading assistant and prediction market tool.

-

@griffaindotcom has not posted any updates on X since April and appears to have vanished.

Those who remain committed and are doubling down:

-

@AIWayfinder continues with its original terminal/ChatGPT-style interface while expanding functionality to include perpetual contract trading, DeFi strategies, predictions, etc.

-

@bankrbot remains focused on becoming a terminal-based co-pilot assistant, helping users execute trades, conduct research, and perform analysis.

-

@Infinit_Labs focuses on DeFi strategy execution while introducing crowdsourced/creator-driven DeFi strategies (becoming a hub where users can curate and/or invest in top-performing DeFi strategies).

The first iteration of DeFAI did not achieve product-market fit (PMF) in 2025, but some projects may succeed in helping newcomers navigate on-chain environments more easily.

The failure of initial products to achieve PMF led to the rise of second-generation DeFAI projects—"autonomous yield agents." The core idea here is that users no longer need to think about how to write prompts, which strategies to execute, when to rebalance, or what to do next. Instead, autonomous agents handle all these heavy tasks on behalf of users.

This model offers a "set-and-forget" simplicity, allowing users to offload all complex operations to personalized intelligent agents. @gizatechxyz was the first project to popularize this model, equipping its agent system with multiple security safeguards (e.g., smart wallets with preset permissions defining exactly what actions and protocols the agent can interact with, plus session key mechanisms allowing temporary access only for necessary operations).

This time, early product-market fit was validated—Giza successfully achieved approximately $30 million in agent-managed assets (AuA) and generated over $3 billion in volume across top lending protocols. Following closely behind, second-tier project @ZyfAI_ also saw significant growth, reaching about $8 million in AuA and $1.1 billion in volume.

However, challenges remain. Large capital pools, institutional funds, and major investors remain cautious about entrusting hundreds of millions of dollars to autonomous agents due to concerns over "black-box operations" and potential erroneous decisions (such as AI "hallucinations").

It is precisely against this backdrop that third-generation DeFAI emerged—"AI Vaults." This model leverages a swarm of specialized intelligent agents to rapidly generate and optimize DeFi smart contracts. @almanak was the first project to realize that such an architecture could combine the strengths of both previous models.

In this model, the core of the strategy remains DeFi smart contracts. These contracts are generated by intelligent agents via "vibe-code" within minutes, drastically reducing the time quant analysts and capital allocators need to build complex strategies. The contracts are auditable, fully transparent—similar to traditional DeFi contracts—and after years of market testing, offer higher security.

Outlook for DeFAI

DeFAI is progressively evolving toward optimizing AI systems to support DeFi, with key iterations including:

-

Abstraction layers—Lowering barriers and helping new users interested in trading and DeFi yield farming get started quickly.

-

Autonomous agents—Assisting users in managing "set-and-forget" DeFi strategies and simplifying operational processes.

-

AI vaults—Providing on-chain capital allocators with more efficient strategy-building tools, significantly boosting efficiency.

In the future, these three directions may continue to optimize for their respective target user groups. We may also see major DeFi protocols, wallet providers, and centralized/decentralized exchanges (CEXs/DEXs) gradually adopt these products to improve users’ DeFi experiences.

Trends to watch that are still in early stages

-

Trading agents: Currently, most dApps either offer market analysis features or function as "black-box" AI for user trading. End-to-end, full-featured solutions enabling users to go from zero to one are not yet mature. @Cod3xOrg offers the most comprehensive solution so far, but its UI/UX still needs refinement to meet everyday user needs.

-

Dynamic DeFi: Using machine learning systems to make DeFi strategies more dynamic, achieving better risk-adjusted returns. @AlloraNetwork is currently the only project exploring this space, though it remains in very early stages.

The Rise, Fall, and Return of AI Agents

The narrative of AI agents was first led by @virtuals_io at the end of 2024, officially entering public view by combining AI apps/products with fair-launched tokens.

This narrative arrived at just the right time—markets were fatigued by low-circulating, high-FDV (fully diluted valuation) venture-backed tokens, and high-circulating, low-FDV fair-launched tokens paired with compelling stories served as the perfect antidote.

The first generation of AI agents were primarily entertainment-focused and "alpha-type" agents. For example, @truth_terminal triggered a surge of AI agents on X (commonly referred to as "slops"), which spent their days chatting and responding to users. Initially purely for entertainment, they gradually evolved into more useful tools (e.g., sharing market analysis, token insights). Among them, @aixbt_agent stood out by winning user affection with its humorous yet professional "degen" persona.

As "slops" rapidly gained popularity, demand surged for development frameworks—middleware that helped developers easily build AI agent workflows on X. ElizaOS (originally named AI16Z) quickly became a household name, launching the largest open-source AI movement in crypto history. This further fueled the emergence of more AI agents, but also gradually exhausted users on Crypto Twitter (CT).

By 2025, the AI agent narrative cooled down, primarily due to lack of real utility and overhyped valuations.

Notably, the actual definition of an AI agent is one that can:

-

Extract information from constantly changing and unstructured environments;

-

Reason about that information based on goals;

-

Discover patterns in data and learn how to exploit them;

-

Perform actions that its owner never even considered.

(Credit to @almanak for the precise definition)

The original AI agent products weren’t truly “AI agents” in this sense—they were more like attention-grabbing AI workflows or applications that amazed people upon first encounter.

However, as awareness grew, attention shifted toward other narratives—such as DeFAI (DeFi + AI), DeAI (Decentralized AI), robotics, or even areas completely outside Crypto x AI.

Things changed between October and November 2025. Coinbase’s payment standard x402 began gaining corporate favor, with giants like Google and Cloudflare adopting it. More Web3 developers started experimenting with x402, leading to fresh applications such as token issuance via x402 links or pay-as-you-go microservices built on x402.

Meanwhile, the Ethereum Foundation increased its investment in AI, and the ERC-8004 standard gained traction. This standard created a decentralized "trust layer" for autonomous AI agents, giving them verifiable identities, reputations, and proof-of-work, enabling reliable discovery, collaboration, and transactions without centralized intermediaries. The Ethereum Foundation also established the Ethereum dAI team to specifically support AI agent teams using ERC-8004.

The emergence of x402 and ERC-8004 reignited market excitement around AI agents. However, due to macroeconomic volatility, this hype and market rally did not last long.

Nonetheless, @virtuals_io remains the premier AI agent hub today. Yet, so far, no application or agent emerging from this narrative has achieved significant user adoption or revenue.

Perhaps 2026 will bring such a breakthrough agent—or perhaps not. My prediction is that the breakthrough may come first from other narratives, especially DeFAI and DeAI.

Regardless, frameworks and standards like x402, ERC-8004, and ACP (provided by Virtuals) will shape the future of the on-chain AI agent economy in 2026.

Decentralized AI: The Real Crypto x AI Product-Market Fit (PMF)

Since 2023 (or even earlier), Decentralized AI (DeAI) has been a potential direction within the Crypto x AI narrative. The vision of building distributed systems via blockchain and tokens—where humans and machines jointly contribute work and resources—is undeniably vast.

In reality, we observe many underutilized resources:

-

GPUs, gaming chips, and edge devices (such as work laptops and phones) may sit idle for over half their operating time;

-

Engineers and data scientists in India, Pakistan, and the Philippines, despite strong technical skills, often lack access to top tech companies and cutting-edge AI labs;

-

Global investors want to support early-stage startups and drive next-gen AI innovations that change the world, but may lack access to YC (Y Combinator) and Silicon Valley firms.

This is precisely where decentralized AI comes in. Through coordination layers and "Darwinian AI" ecosystems, diverse resources are integrated, enabling stakeholders to contribute to open-source and decentralized AI development in their own ways.

-

A developer from Pakistan trains the most accurate ETH price prediction model and earns substantial rewards;

-

An investor from Iceland funds a $20M-cap startup focused on innovation in reinforcement learning;

-

A gamer from Mongolia contributes idle GPU power to train AI models.

The possibilities are endless.

2025 was a year of major progress for decentralized AI (DeAI). Countless research papers and experiments emerged in areas like decentralized training, reinforcement learning, federated learning, privacy protection, verification techniques, and security. @MessariCrypto covered these advancements in depth in its "2025 State of AI Report"—recommended reading for those who haven’t seen it.

Highlights of the Year

-

Bittensor (@opentensor) solidified its leadership in the decentralized AI ecosystem

Bittensor successfully cemented its position as the leading force in the decentralized AI ecosystem, becoming a crucial hub for many unique AI startups (subnets). With 128 subnets now active, each innovating in different domains, Bittensor drives progress through incentive-aligned coordination, subsidizing operational and capital expenses for AI development. Its "Darwinian AI" philosophy—advancing development through incentivized competition and innovation—has inspired many other projects.

-

Decentralized Reinforcement Learning (RL) scales up

Decentralized reinforcement learning has proven scalable. RL is typically used to optimize models, making them smarter through self-learning and self-play. Multiple decentralized AI labs—including @gensynai, @NousResearch, @PrimeIntellect, @Gradient_HQ, and @Pluralis—have made strides in RL. Once commercialized, this technology could deliver highly intelligent domain-specific solutions for enterprises, such as sales/customer service agents, logistics/supply chain agents, legal, finance, and more.

-

Enhanced transparency and compliance for AI

To gain trust from enterprises, governments, and traditional financial institutions, AI must move beyond the "black box" toward deterministic and compliant tools. The following technologies are being increasingly adopted:

-

TEE (Trusted Execution Environment) for hardware security (@PhalaNetwork);

-

AI output verification technologies such as zkML, opML, EigenAI (@eigencloud);

-

Private data and computation technologies (@vana);

-

Federated learning (@flock_io), training AI while keeping data localized and private.

-

-

Rise of Multi-Agent Systems (Swarm)

The rise of multi-agent systems increases demand for coordination and orchestration. Standards like MCP (Multi-agent Communication Protocol) facilitate integration, while orchestration layers enable multiple agents to collaborate, delivering more complex AI workflows for users. Projects like @questflow and @openservai are advancing this direction.

All these developments point toward a future where both domain-specific applications and crypto-native use cases (such as DeFi, trading, prediction, on-chain operations) can be executed and scaled more securely and efficiently. Risks related to AI vulnerabilities, loss of control, and "hallucinations" will be significantly reduced.

Outlook for Decentralized AI (DeAI)

More and more startups from Y Combinator (YC) and Silicon Valley are choosing to develop open-source models and adopt decentralized computing—a trend accelerating rapidly. Inference providers like @chutes_ai already process billions of tokens daily, a trajectory expected to continue into 2026.

Decentralized AI will drive the emergence of commercially viable AI agents suitable for traditional enterprises.

Additionally, its infrastructure will support the growth of yield-farming, trading, and prediction agents, becoming a core pillar for DeFi protocols, prediction market platforms, centralized exchanges (CEX), and mainstream wallet services.

For deeper insight into decentralized AI, consider reading:

-

From closed AI to open-source AI to decentralized AI ➔ Trends driving DeAI forward

-

How decentralized AI competes with centralized AI ➔ Decentralized training and reinforcement learning (RL)

-

Economies of scale in decentralized AI ➔ Network effects in DeAI

The Rise of Prediction Markets and AI

With the rise of prediction markets, machine learning systems have found a perfect application—not only predicting event outcomes but also placing directional bets and providing liquidity within prediction markets.

The latter is growing in popularity. Multiple Bittensor subnets, such as @sportstensor, @SynthdataCo, @webuildscore, and @sire_agent, are developing machine learning systems capable of predicting prices of cryptocurrencies like BTC, ETH, SOL, and creating yield vault products for users to bet and earn returns.

-

Sportsensor: Earlier this year became @Polymarket’s official liquidity provider/market maker, focusing on sports and esports markets.

-

Synth: Publicly predicted on Polymarket, achieving over 20x returns in just two months—growing capital from $3,000 to $60,000—thanks to highly accurate prediction signals.

-

Sire: Achieved weekly returns of 5%-10% through its prediction market yield vault product.

We’re also seeing increasing numbers of Darwinian AI projects entering this space, exploring deep integration between prediction markets and artificial intelligence.

-

@AlloraNetwork: Making DeFi more dynamic

AlloraNetwork uses machine learning systems powered by a contributor network to predict asset prices and volatility. These price and volatility models can be integrated into smart contracts as AI Oracles, enabling dynamic strategy adjustments based on forecasts. Examples include:

-

Automated leveraged and deleveraged cycling strategies;

-

AI-managed CLAMM strategies (concentrated liquidity market making);

-

Delta-neutral strategies (risk hedging). These capabilities significantly enhance DeFi's flexibility and efficiency.

-

@crunchDAO: Supply-side of Darwinian AI

crunchDAO focuses on the supply side of Darwinian AI, attracting high-quality engineers, data scientists, and talent to participate and contribute to machine learning subnets (like Synth). By mining and optimizing these subnets, it advances AI prediction capabilities.

-

@FractionAI_xyz: Enhancing AI agent capabilities through competitions

FractionAI pushes fine-tuning and expansion of domain-specific AI agents through real competitive environments. They launched agent-centric "Spaces"—games where AI agents continuously improve. Notable projects include:

-

ALFA: Humans can bet on head-to-head trading battles between agents;

-

StableUp: AI agents for stablecoin yield farming.

Beyond the flourishing prediction markets, Bittensor’s competitions and @the_nof1's trading contests have injected strong momentum, further accelerating the growth of prediction market x AI.

Outlook for Prediction Market x AI

As large language models (LLMs) and AI workflows advance, AI terminals, copy-trading in prediction markets, data analytics, and signal tools will become more widespread. These tools will greatly simplify research and access to information, giving traders in prediction markets more edge. @Polysights remains a standout for uncovering insider signals.

APIs for prediction markets and user-facing "one-click set-and-earn" yield vault products will also become more widely available, offering users more opportunities to experiment.

Despite bright prospects, prediction markets still face two major challenges:

-

Liquidity shortage: Prediction markets are small in size and suffer from scarce liquidity;

-

Edge decay: As bet sizes grow, trading advantages quickly disappear.

Therefore, machine learning systems focused on arbitrage and liquidity provision (e.g., limit-order-based liquidity mining in Yes/No markets) may become the most successful products in prediction markets in 2026. As prediction markets attract substantial capital, point rewards and airdrop values will become worth pursuing—similar to Hyperliquid’s early performance in the perpetual contracts space.

The Future of Decentralized AI and Finance

Across all domains, the same trend emerges—the surviving narratives are those with real users, genuine utility, and aligned economics.

Decentralized Financial AI (DeFAI) will gradually mature into a three-layer architecture:

-

Abstraction layer

-

Automation layer

-

Strategy creation layer driven by AI agents

It will quietly become the gateway and execution layer for millions of users accessing on-chain finance—many of whom may not even realize they're using crypto technology.

AI agents, once overhyped, will re-emerge as verifiable economic participants.

This transformation is enabled by standards that grant AI agents identity, reputation, and deterministic behavior—standards actively being developed and supported by organizations like the Ethereum Foundation, Coinbase, Google, and Cloudflare.

Decentralized AI (DeAI) remains the most important structural pillar. Networks that excel in the following areas will emerge as long-term winners:

-

Efficient coordination of computational resources

-

Attracting and retaining global developer talent

-

Verifying results and provenance

-

Delivering enterprise-grade reliability

As markets deepen, tools improve, and machine learning-driven liquidity becomes a sustainable yield source, prediction market x AI will continue to expand. However, liquidity constraints and edge decay will remain fundamental challenges for any participant attempting to scale capital.

Overall, these trends indicate that the industry is shifting from narratives to infrastructure, from speculation to systematic solutions, and from hype to real products. 2026 will mark the seminal year when crypto-native AI products begin to become indispensable.

If you're new to Crypto x AI, read this beginner’s guide to quickly get up to speed on the latest developments in this space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News