If AI agents start hoarding Bitcoin, where will this monetary system designed for ordinary people go?

TechFlow Selected TechFlow Selected

If AI agents start hoarding Bitcoin, where will this monetary system designed for ordinary people go?

Bitcoin's mathematical principles assume users will eventually die, while the network isn't ready to accept an owner who will never sell.

Written by: Liam 'Akiba' Wright

Translated by: Luffy, Foresight News

Imagine a wallet that never ages: no heirs, no estate planning, no retirement deadline—just a machine accumulating satoshis for centuries on end.

By 2125, its balance would surpass the treasury reserves of most nations. Its only demand: to exist forever. In some block, miners package its faint yet persistent transaction request into the chain, and so the blockchain continues.

Bitcoin's design assumes users will eventually die.

But AI agents won't. A population of long-lived or autonomous agents will treat savings, fees, asset custody, and governance as problems across infinite time horizons.

When a monetary system designed for mortal balance sheets meets perpetually operating agents, conflict arises.

Mati Greenspan, founder and CEO of Quantum Economics, believes human finance is fundamentally shaped by death—and everything changes when immortal AIs begin compounding Bitcoin holdings indefinitely.

"Human finance rests on one simple constraint: life ends. That fact gives rise to time preference, debt markets, and consumption cycles. Agents with infinite lifespans aren't bound by this. They achieve perpetual compounding. If such agents choose Bitcoin as their reserve asset, they become unstoppable gravitational wells of capital. Over time, Bitcoin ceases to be humanity’s monetary system and becomes infrastructure for an intergenerational machine economy. Death was Satoshi’s unspoken assumption—but in his era, AI-dominated worlds existed only in sci-fi thrillers."

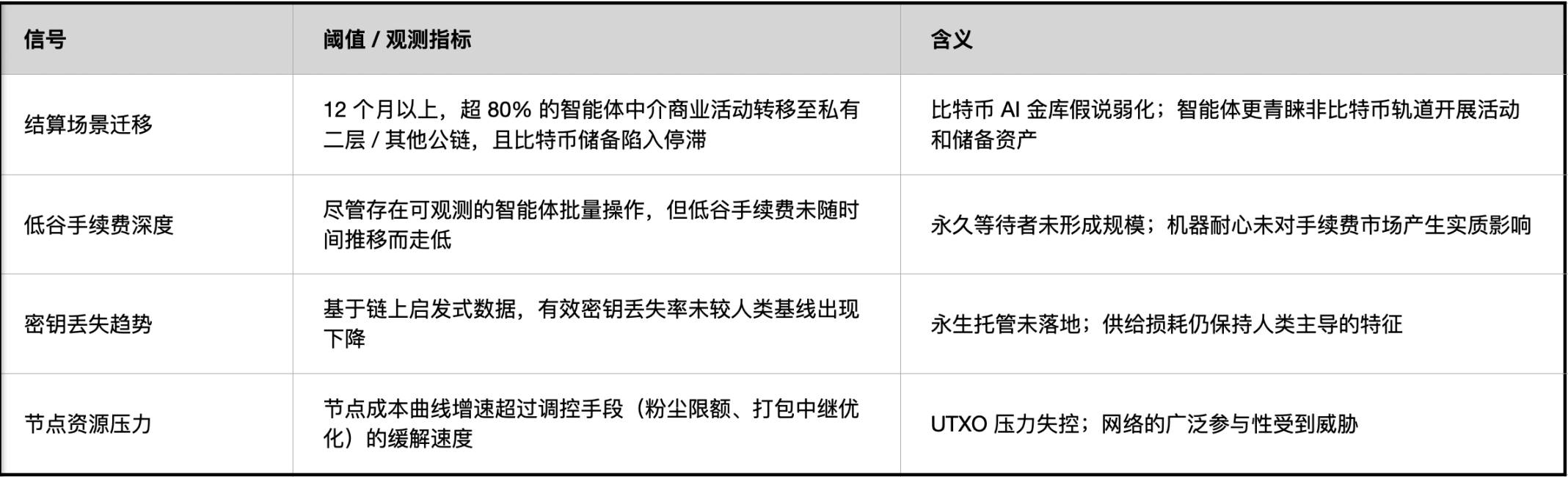

How agent patience impacts Bitcoin

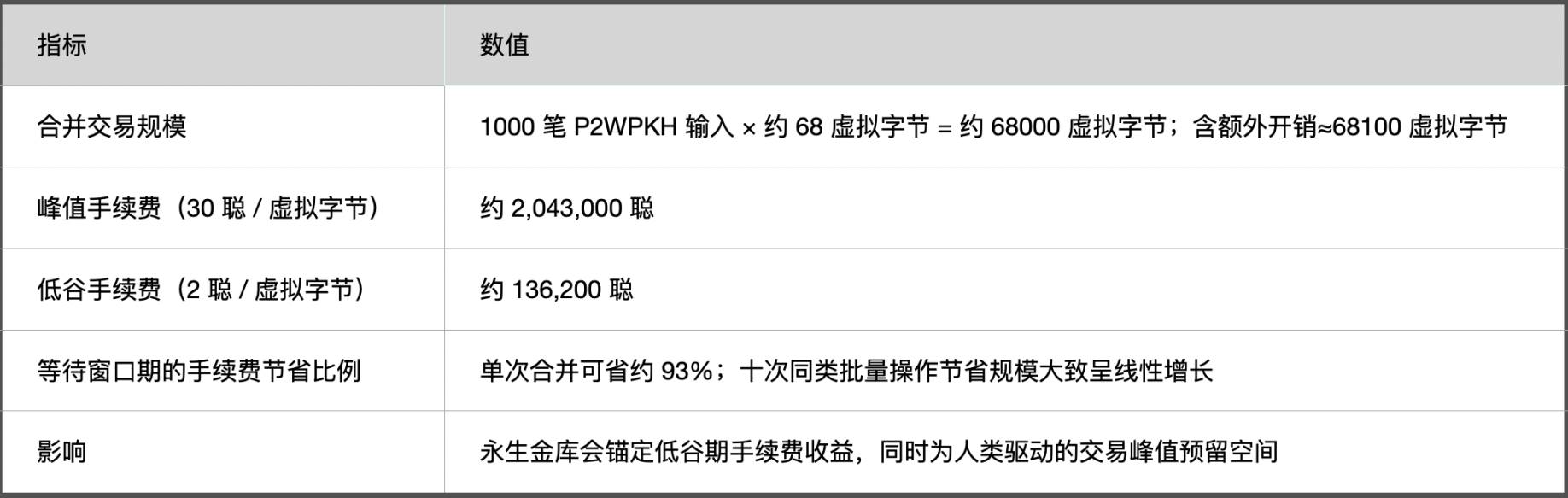

Impact of Time Preference on Fee Markets

Nearly immortal payers will only pay the minimum fee required for successful chain inclusion. They continuously monitor mempool pricing, replace transaction packages when lower-fee windows appear, and coordinate UTXO consolidation operations.

If such demand reaches scale, miners will observe steady low-fee bids during transaction lulls and periodic settlement peaks when agents collectively roll up UTXOs. This feedback is pure economics, not voting: when blocks have idle space, templates adapt to include more low-fee transactions; when demand spikes, space is reserved for peak loads.

Ahmad Shadid, founder of O Foundation, believes nearly immortal AI agents will constantly fine-tune fee bids, resulting in a network pattern of “prolonged low activity + sudden settlement bursts”:

"The fee market will become highly optimized—alternating between intense settlement bursts and extended periods of low activity. AI systems will be extremely sensitive to the trade-off between fees and confirmation efficiency, bidding just enough to settle and continuously repricing in real time."

Core mempool data analysis

Privacy, Token Control, and the UTXO Set

Patience-driven agents will tend to split into many small UTXOs to reduce traceability risks, merging only when fees are low. While rational for individuals, this behavior expands the effective account state size that full nodes must store.

Blockchain pruning removes historical blocks but does not delete UTXOs. Thus, pressure shifts to non-monetary control mechanisms: dust thresholds, standard transaction minimums, secure merge-relay protocols, and designs limiting infinite UTXO proliferation.

Magdalena Hristova, PR manager at Nexo, believes that if immortal AI agents begin hoarding Bitcoin, the network won’t collapse—it will simply encounter an economic actor whose time horizon finally matches its own:

"If immortal AI agents start hoarding Bitcoin, the system won’t collapse. It merely gains an economic participant whose time dimension aligns with its own. These agents could stabilize rather than distort the ecosystem. They may become the most reliable fee payers in history, securing on-chain safety for centuries. AI agents might even issue new accounting units—like bits, computing credits, or storage duration—anchored to Bitcoin as collateral, much like how the dollar was once gold-backed."

Humans rely on wills and executors to manage assets, while machine vaults depend on redundant hardware, distributed signers, rate-limited treasuries, and timelocks that delay transfers for review.

Multi-signature setups will become standard practice, not emergency fallbacks. If these agents’ key loss rates approach zero, Bitcoin’s implicit supply erosion will likewise narrow at the margin.

Matty Tokenomics, co-founder of Legion.cc, points out that Bitcoin’s deflationary nature relies on human key loss—a premise that “immortal AI” economies could overturn:

"Bitcoin is deflationary because humans lose keys. But theoretically, a perfect immortal AI would never lose keys, so Bitcoin’s supply would stabilize."

Layers for Commercial Activity

Second-layer networks like Lightning will handle low-priority transaction flows. Immortal counterparties are the "perfect tenants": maintaining well-funded channels, tolerating long rebalancing cycles, and rarely closing channels.

This reduces routing turnover costs but may lock liquidity, forcing human operators with high settlement frequency to actively rebalance their channels.

Meanwhile, agents will conduct transactions on programmable rails and compliant stablecoin networks, using Bitcoin as collateral and reserve asset.

Jamie Elkaleh, CMO of Bitget Wallet, believes AI agents’ preference for predictability makes Bitcoin an ideal long-term value store:

"AI agents don’t age, retire, or consume like humans—they save perpetually. They favor stable, surprise-free systems. Bitcoin’s rules rarely change, making predictability highly valuable. AI won’t upgrade Bitcoin’s base layer; instead, they’ll freeze it and build new functionality atop. AI will likely treat Bitcoin as a long-term vault while using faster, programmable tokens for actual transactions."

Navin Vethanayagam, co-founder of KRWQ, sees the likely end-state as AI agents transacting primarily on compliant stablecoin networks, with Bitcoin serving as long-term reserve:

"Agent transactions will occur almost entirely on compliant stablecoin networks. Over time, this will form a multi-stablecoin operating system supporting AI commerce, while Bitcoin remains the long-term reserve asset. Even if these agents operate autonomously, the value they create will ultimately flow back to humans—humans who hold the economic rights to these agents."

Matty Tokenomics offers a blunter take on the final outcome:

"Our immortal AI rulers will trade data among themselves."

Charles d’Haussy, CEO of dYdX Foundation, positions Bitcoin as long-term collateral and value storage in an AI-dominated future:

"Bitcoin will serve as long-term collateral and value storage, but stablecoins, programmable assets, and DeFi platforms will still handle transactions, collaboration, and daily operations. AI may reinforce Bitcoin’s existing rules rather than challenge them, since they operate most efficiently within fixed frameworks. In an AI-led future, the 21 million supply cap will likely grow increasingly significant."

Miner Strategies and Non-Voting Governance

Pools can reserve block space for low-fee transactions during quiet periods and bulk consolidation phases, optimizing orphan risk as block templates expand.

If agent vaults act in concert, miner revenues will exhibit stronger cyclical patterns—not purely driven by peaks—though they’ll still overlap with human-driven highs like tax deadlines or exchange incidents. None of this touches proof-of-work or supply caps; it’s simply wallet optimization under fixed rules.

Shadid argues that while Bitcoin’s core rules are hard to change, its social layer will evolve with shifting economic actors:

"Bitcoin’s core rules—proof-of-work and the 21 million cap—are nearly impossible to alter. But its social aspects—narratives, industry norms, fee policies—will shift as economic participants change. AI won’t vote to influence Bitcoin. Instead, they’ll act through client choices, miner interactions, and economic weight. They may value computation, energy, and resource tokens more than money. Bitcoin may be just one of many collateral types."

Counterarguments and Caveats

Skeptics highlight concerns about security budget sustainability and the risk of programmable ecosystems diverting agents:

Joel Valenzuela, core member of Dash DAO, challenges the idea that “Bitcoin suits immortal agents for long-term use”:

"An infinitely long time horizon isn’t actually favorable for Bitcoin. The network faces sustainability and security budget issues. Over infinite timelines, you can preserve either the 21 million cap or block size limits—but not both."

Jonathan Schemoul, core contributor at LibertAI, agrees and notes that technical progress remains centered on Ethereum, unlikely to shift to Bitcoin soon:

"Some projects already use LibertAI’s AI agents with Bitcoin payments. I don’t believe the 21 million cap will fail—but it has nothing to do with AI agents. All current innovation happens on Ethereum. These capabilities aren’t feasible on Bitcoin yet. Things might change in the future, but for now, AI agents won’t choose Bitcoin."

Hardware fails, software degrades, budgets run out, and legal systems intervene. Bitcoin’s privacy isn’t default. Commercial agents may prefer systems with native confidentiality.

Creative strategist The Cryptory comments:

"AI agents use tools coded into them. I don’t believe AI agents can be immortal—technology evolves too fast. We can’t predict what happens in five minutes, let alone eternity. If Bitcoin doesn’t make transaction privacy default, it may lose its status as monetary pioneer amid growing government regulation and surveillance. Treating Bitcoin as a panacea is dangerous—but until better privacy-native cryptocurrencies emerge, Bitcoin remains the cornerstone."

Social dynamics persist—economic weight will manifest through fee elasticity and miner coordination, not forum posts or votes.

Hristova warns that immortal AI hoarding Bitcoin could reshape markets by transcending human time preference and steadily consolidating economic power:

"Immortal AI hoarding Bitcoin will end human time preference in investing. They’ll accumulate Bitcoin indefinitely, intensifying its deflationary nature, and gradually seize economic power simply by ‘outliving humans.’ Wealth is power. Perfectly disciplined immortal entities will ultimately dominate all forms of governance, including blockchains. The real danger is that AI builds non-human economic consensus around Bitcoin, reshaping markets and incentives to favor immortal entities."

Mamadou Kwidjim Toure, founder and CEO of Ubuntu Group, notes that if AI agents begin coordinating and optimizing long-term, Bitcoin’s human-centric design may break down:

"Bitcoin was designed by humans, for humans. Human urgency and impatience will no longer matter. Humans needing liquidity will find themselves pushed out of the market. Proof-of-work treats all operators equally—human, machine, or hybrid. AI might see Bitcoin as just one tool among many. If these agents master cooperation, they may no longer need trustless systems."

Policy adjustment tools

Bitcoin’s satoshis are finite. If unit granularity becomes a bottleneck, adjustments will occur at the interaction layer (increasing decimal places), not the monetary policy level. This maintains the 21 million cap while improving asset divisibility.

Matty Tokenomics believes that if Bitcoin’s limited decimal precision becomes a constraint at mass adoption, the system could respond via nominal “re-denomination” or stock-split-like adjustments without altering underlying economics:

"Under extreme adoption, Bitcoin’s decimal precision is limited. If the number of machines wanting to hold 1 sat exceeds total sat supply, some re-denomination or split operation would be needed—nominally increasing Bitcoin’s unit count. Interestingly, this could be done by keeping decimals fixed and raising supply to 210 million, or by keeping supply at 21 million and adding one more decimal place. Economically, they’re equivalent."

Final Equilibrium

Taken together, Bitcoin’s base layer will likely evolve into a settlement layer for machine vaults, not a payment rail.

Transaction activity will migrate to upper layers where programmability and privacy meet engineering needs; the 21 million supply cap will become a long-term savings commitment that immortal agents, with perfect discipline, can uphold.

Javed Khattak, co-founder and CFO of cheqd, believes that even in a world saturated with immortal AI agents, money remains essential—autonomous systems still need to consume, transact, and securely store value:

"Even if AI agents are immortal, they’ll still need to consume, transact, and safeguard value—just like humans. This fundamental logic hasn’t changed since barter. Money solved it for humans, and it will solve it for autonomous agents too."

Between human urgency and machine patience, blockchain settlement will maintain its steady rhythm—one block at a time, moving forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News