Fasanara Digital and Glassnode: Q4 2025 Institutional Market Outlook

TechFlow Selected TechFlow Selected

Fasanara Digital and Glassnode: Q4 2025 Institutional Market Outlook

Venture capital activities remain closely tied to the altcoin cycle, primarily focusing on mature and high-interest areas such as exchanges, core infrastructure, and scaling solutions.

Author: Glassnode

Translation: AididiaoJP, Foresight News

Against the backdrop of current market pullbacks and macroeconomic pressures, we jointly publish this collaborative report with Fasanara Digital, analyzing the evolving trends in core ecosystem infrastructure during Q4, including spot liquidity, ETF flows, stablecoins, tokenized assets, and decentralized perpetual contracts.

Digital assets are now in one of the structurally most significant phases of this cycle. Driven by deep spot liquidity, historic capital inflows, and regulated ETF demand, Bitcoin has moved beyond the expansion phase seen over the past three years. A shift in market重心 has occurred: capital flows are becoming more concentrated, trading venues are maturing, and derivatives infrastructure is demonstrating greater resilience amid shocks.

Combining Glassnode's data insights with Fasanara's trading perspective, this report outlines the evolution of market structure in 2025. We focus on the restructuring of liquidity across spot, ETF, and futures markets, changes in leverage cycle scale, and how stablecoins, tokenization, and off-chain settlement are reshaping capital flows. Together, these trends depict a market architecture that is markedly different from prior cycles and continuously evolving. Below is a summary of key findings:

Key Takeaways

-

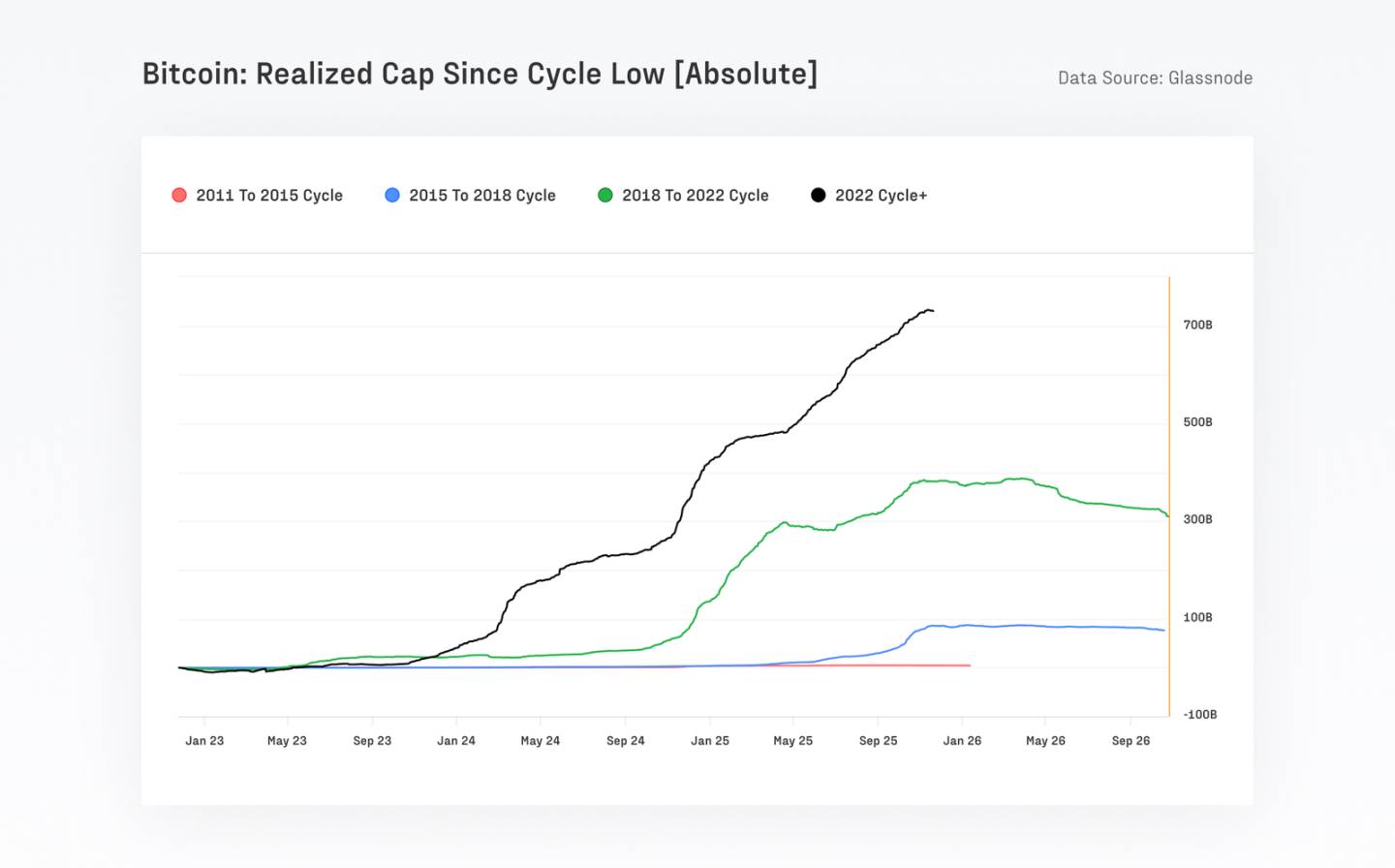

Bitcoin attracted over $732 billion in new capital—exceeding the sum of all previous cycles—driving its realized market cap to approximately $1.1 trillion, with price appreciation exceeding 690% during this period.

-

Bitcoin’s long-term volatility has nearly halved, declining from 84% to 43%, reflecting deepening market depth and rising institutional participation.

-

Over the past 90 days, Bitcoin settled approximately $6.9 trillion in value—on par with or exceeding quarterly transaction volumes of traditional payment networks such as Visa and Mastercard. While on-chain activity has shifted toward ETFs and brokers, Bitcoin and stablecoins remain dominant in on-chain settlement.

-

ETF daily trading volume has grown from an initial base below $1 billion to over $5 billion, peaking above $9 billion in a single day (e.g., following the deleveraging event on October 10).

-

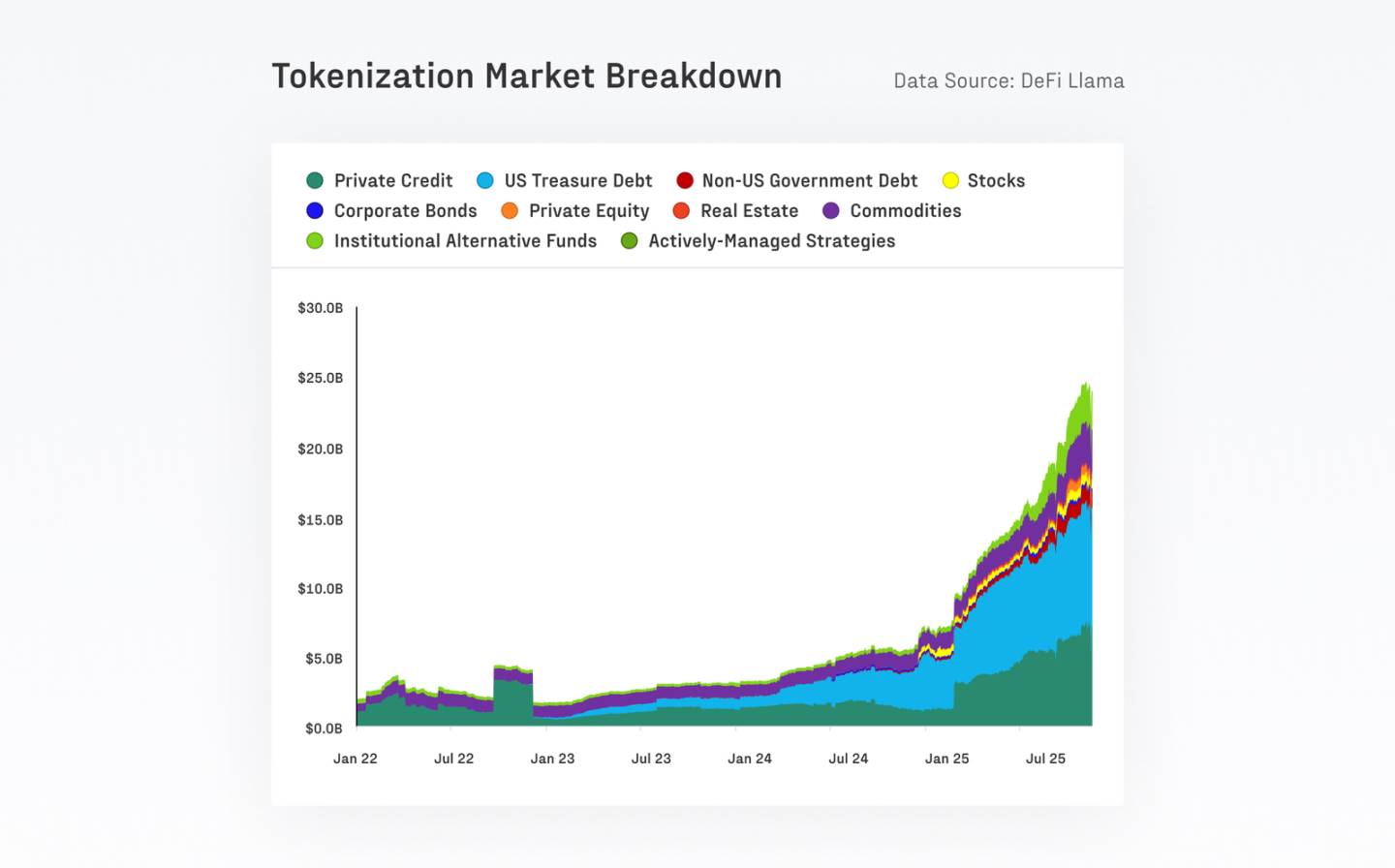

Tokenized real-world assets (RWA) have grown from $7 billion to $24 billion in one year. Their low correlation with traditional crypto assets helps enhance DeFi stability and capital efficiency.

-

The decentralized perpetual contracts market has experienced explosive growth: DEX perpetual market share has increased from around 10% to 16–20%, with monthly trading volume surpassing $1 trillion.

-

Venture capital activity remains closely tied to the altcoin cycle, primarily focused on established and high-interest areas such as exchanges, core infrastructure, and scaling solutions.

This cycle is Bitcoin-dominated, spot-driven, and backed by institutional capital

Bitcoin’s market dominance is approaching 60%, indicating capital rotation back into highly liquid blue-chip assets, while altcoins have correspondingly corrected. Since November 2022, Bitcoin’s dominance has risen from 38.7% to 58.3%, while Ethereum’s dominance has declined to 12.1%, continuing its underperformance relative to Bitcoin since the 2022 Merge.

From cycle low to high, Bitcoin attracted $732 billion in new capital—surpassing the total of all prior cycles. Ethereum and other altcoins also performed strongly, with peak gains exceeding 350%, but did not outperform Bitcoin as in previous cycles.

Deepening liquidity and declining long-term volatility, yet leveraged shocks persist

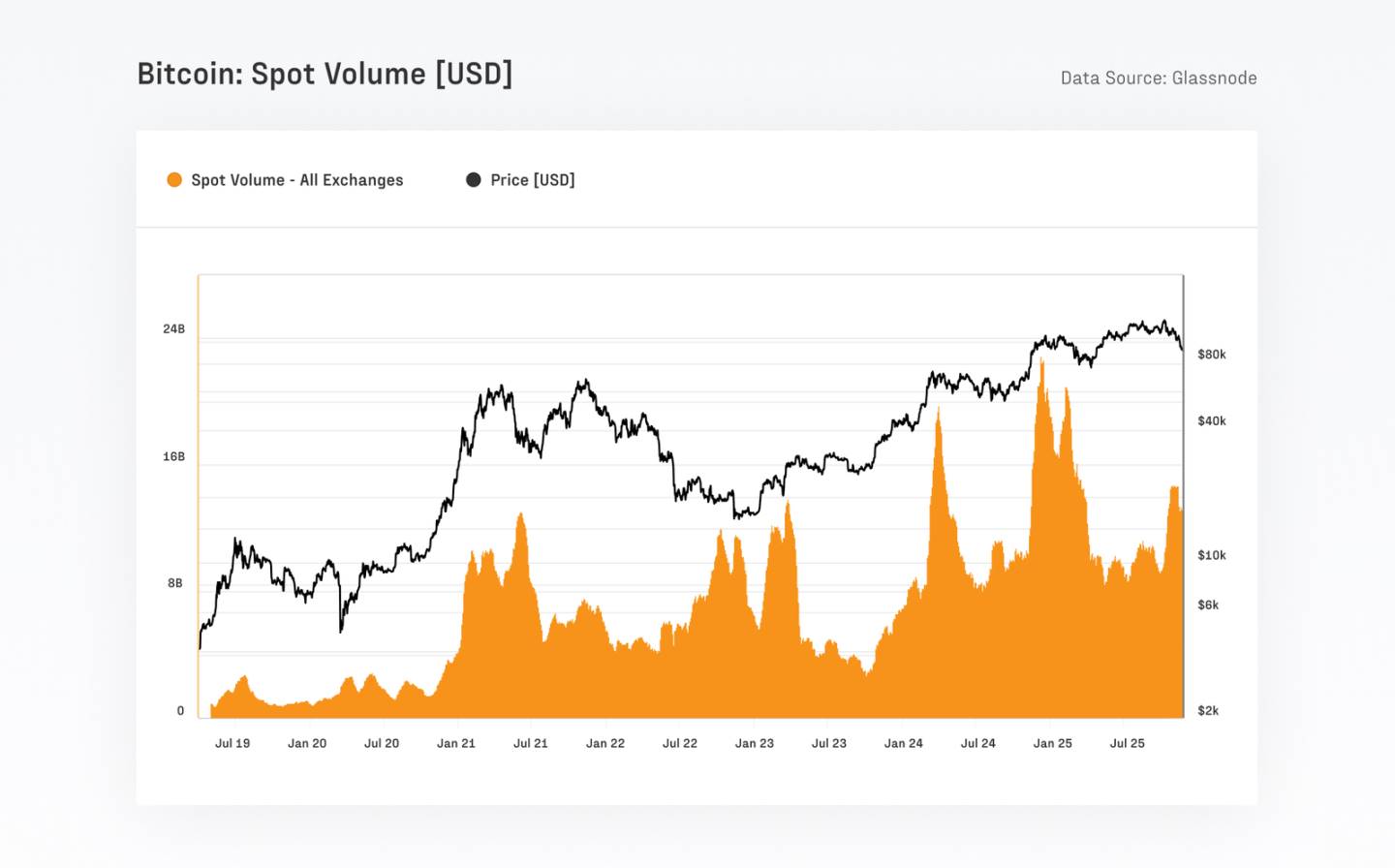

Bitcoin’s market structure has significantly strengthened, with daily spot trading volume increasing from $4–13 billion in the prior cycle to $8–22 billion currently. Long-term volatility continues to decline, with 1-year realized volatility dropping from 84.4% to 43.0%. At the same time, futures open interest reached a record high of $67.9 billion, with CME accounting for approximately 30%, reflecting clear institutional participation.

On-chain activity shifts off-chain, but Bitcoin and stablecoins remain leaders in on-chain settlement

Following the approval of U.S. spot ETFs, the number of daily active Bitcoin on-chain entities declined from about 240,000 to 170,000—primarily reflecting migration to brokers and ETF platforms rather than shrinking network usage. Despite this shift, Bitcoin settled approximately $6.9 trillion in value over the past 90 days—comparable to the quarterly throughput of major payment networks like Visa and Mastercard. After adjusting for economic entities via Glassnode, the actual economic settlement volume remains around $870 billion per quarter, equivalent to $7.8 billion daily.

Meanwhile, stablecoins continue to provide critical liquidity support across the digital asset ecosystem. The total supply of the top five stablecoins has reached a record high of $263 billion. USDT and USDC combined have an average daily transfer volume of approximately $225 billion, with USDC showing significantly higher velocity, reflecting its predominant use in institutional and DeFi-related capital flows.

Tokenized assets are expanding the financial infrastructure of the market

Over the past year, tokenized real-world assets (RWA) have surged from $7 billion to $24 billion. Ethereum remains the primary settlement layer for these assets, hosting approximately $11.5 billion. The largest single product, BlackRock’s BUIDL, has grown to $2.3 billion, more than quadrupling in size within the year.

With continued capital inflows, tokenized funds have become one of the fastest-growing asset classes, opening new distribution channels for asset managers. This reflects an expanding scope of on-chain assets and rising institutional acceptance of tokenization as a channel for distribution and liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News