Delphi Digital 2025 Market Outlook: Return of Optimism, Solana Accelerates Growth

TechFlow Selected TechFlow Selected

Delphi Digital 2025 Market Outlook: Return of Optimism, Solana Accelerates Growth

2025 will usher in a new beginning.

Author: Delphi Digital

Translation: TechFlow

In 2024, the cryptocurrency market stands at a pivotal moment: despite strong performance from Bitcoin (BTC), overall market sentiment has remained weak—until regulatory shifts toward year-end brought renewed hope.

The narrative around crypto is being rewritten, setting the stage for a fresh start in 2025 that could unify the market. Here's where things are headed.

This report offers an annual review of the market, revisits our prior forecasts, and highlights our outlook for next year’s developments.

Read the full “Markets Outlook 2025”.

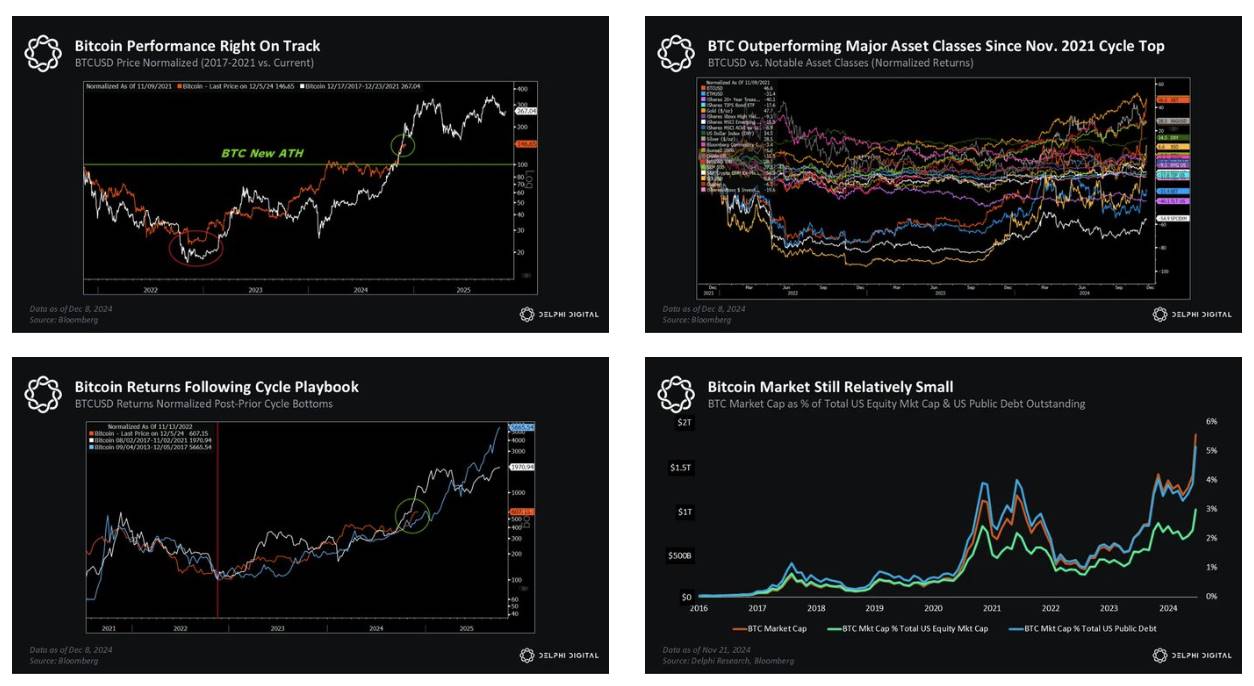

Cycle Strategy Played Out as Expected

At the end of 2022, we analyzed why bear market bottoms might already have been priced in.

Fifteen months ago, we began confidently expressing conviction in this bull cycle. Last year’s report predicted BTC would reach new highs in Q4 2024.

On a macro level, reality has aligned with our expectations.

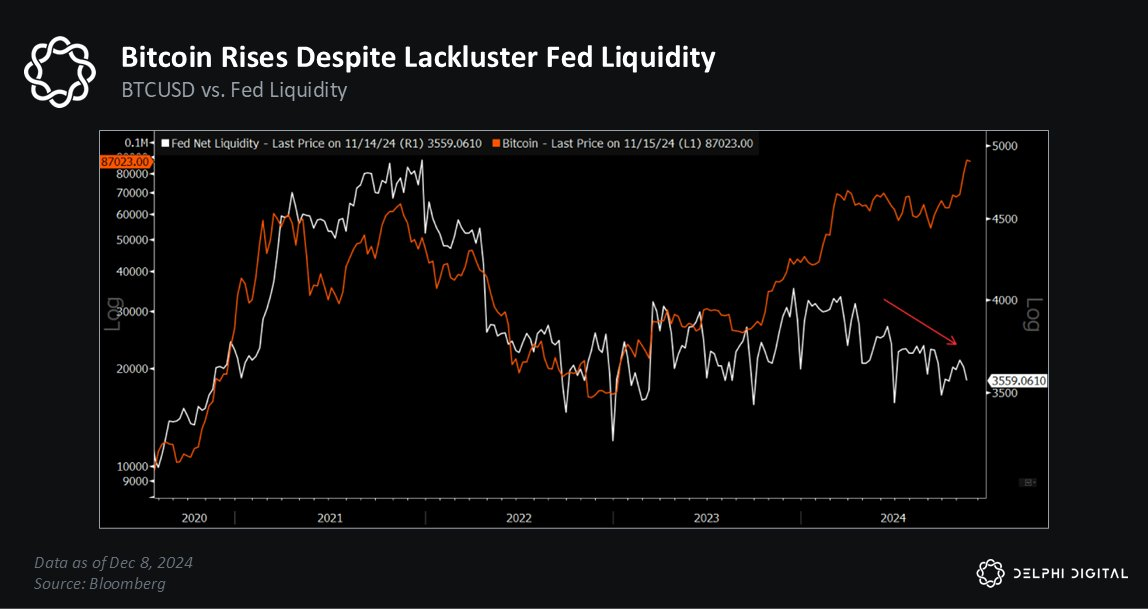

We now understand that Bitcoin halving isn't the primary driver of crypto market cycles—liquidity cycles play the key role instead.

At the end of last year, we highlighted favorable conditions for BTC to ensure a strong first-quarter performance—one of which was the surge in global liquidity seen in Q4 2023.

We also warned of elevated pullback risks from late Q1 through early Q2 2024.

The reason? We observed weakening momentum in liquidity provision from the two largest central banks globally.

BTC is up over 130% year-to-date—and it achieved this without much support from the Fed.

In fact, Fed-provided liquidity has been steadily declining over the past 9–10 months.

Return of Optimism

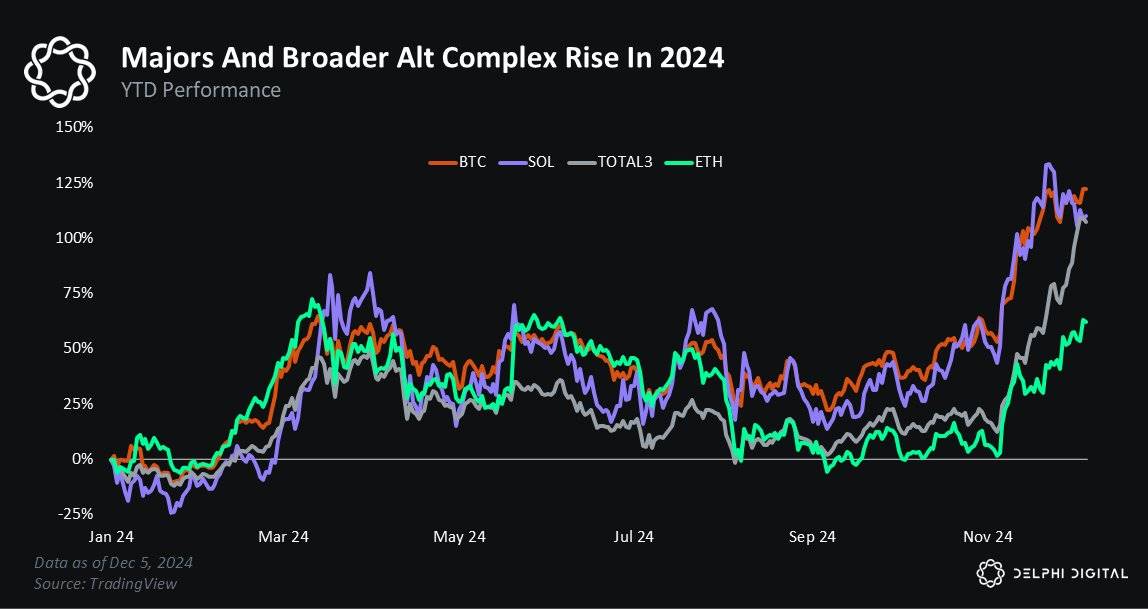

2024 has been an unusual year for the crypto market. On one hand, most major coins have recovered to their all-time highs, and the broader altcoin market has performed well.

Yet on Crypto Twitter, many spent much of the year arguing and skeptical. While Crypto Twitter often displays neurotic tendencies, the negative sentiment in 2024 contrasted sharply with positive price action.

What explains this divergence?

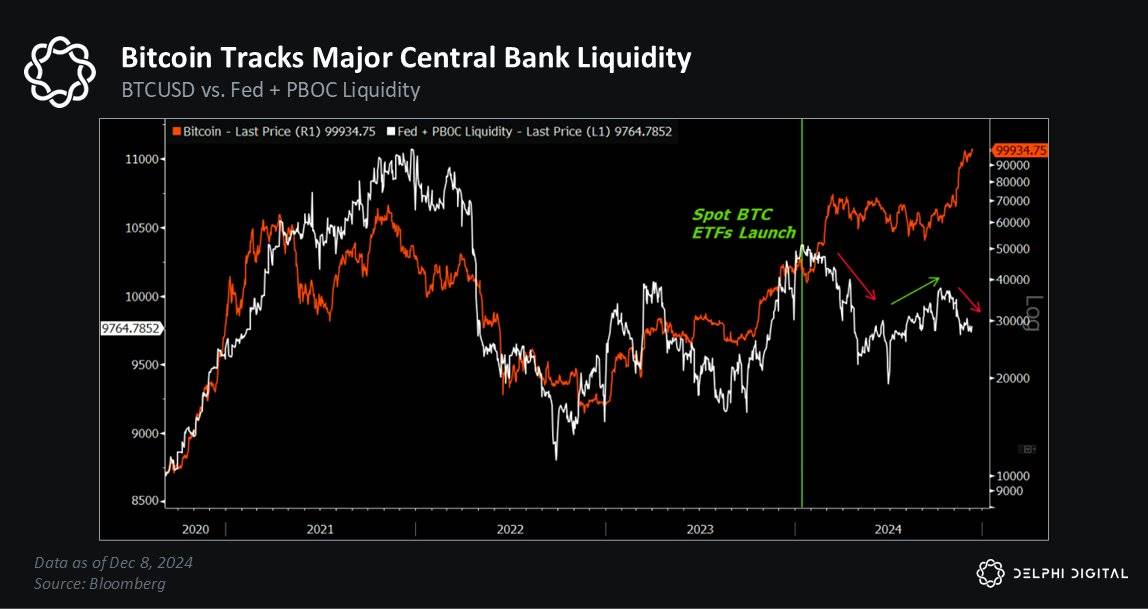

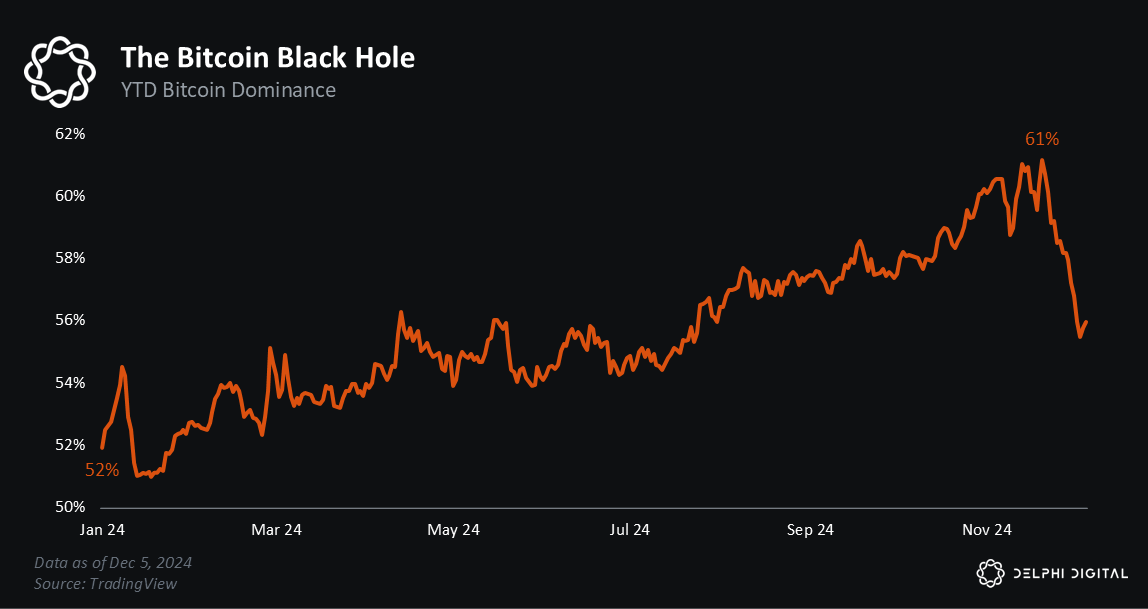

First is Bitcoin dominance: BTC is up 130% YTD, reaching its highest dominance level in three years.

Another factor behind the negativity is market dispersion: some tokens rose significantly, others slightly, but most either declined or stayed flat.

Despite BTC rising over 100%, there were still notable winners within an otherwise broadly declining market, highlighting performance divergence.

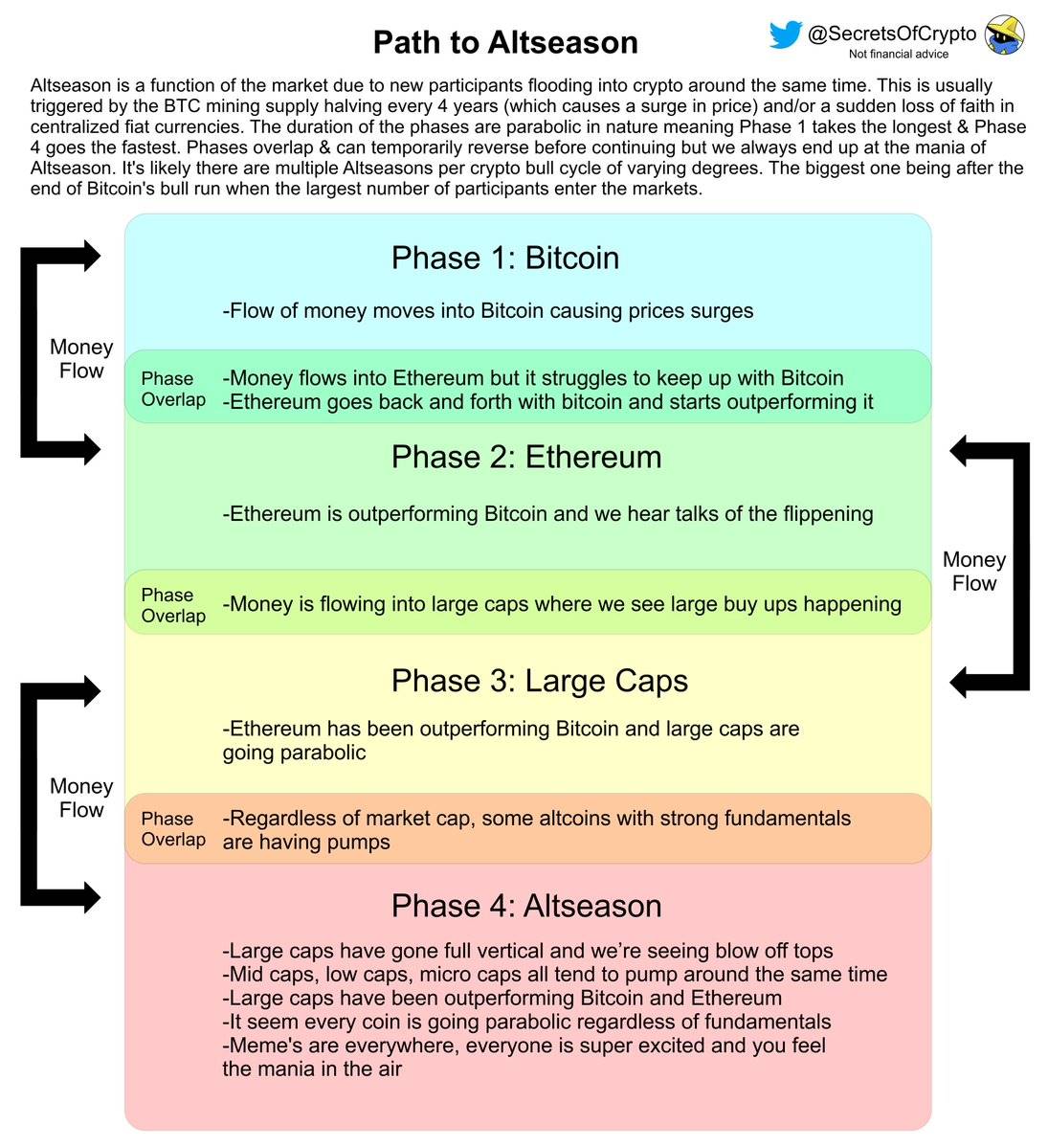

The classic “path into altseason” many expected simply didn’t materialize.

The Missing Ingredient

As we've highlighted across numerous reports over the past year, the crypto market faces significant supply-demand imbalances.

In short, demand for crypto assets hasn't kept pace with total supply growth. But why?

Excessive Token Supply

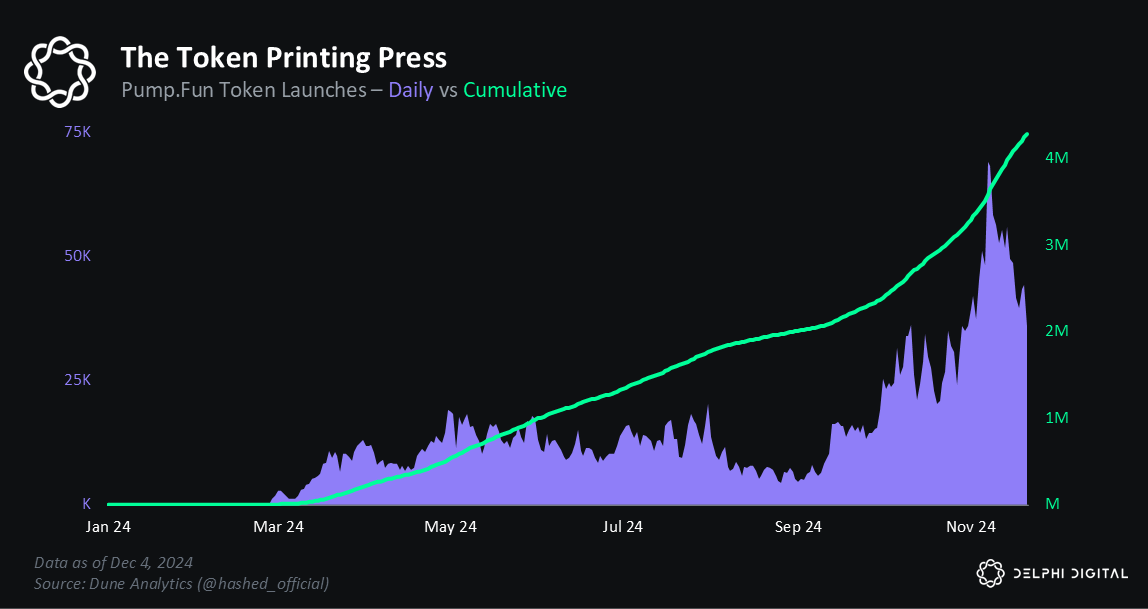

Aggregators list more than 10,000 tokens—up tenfold from around 1,500 in 2017.

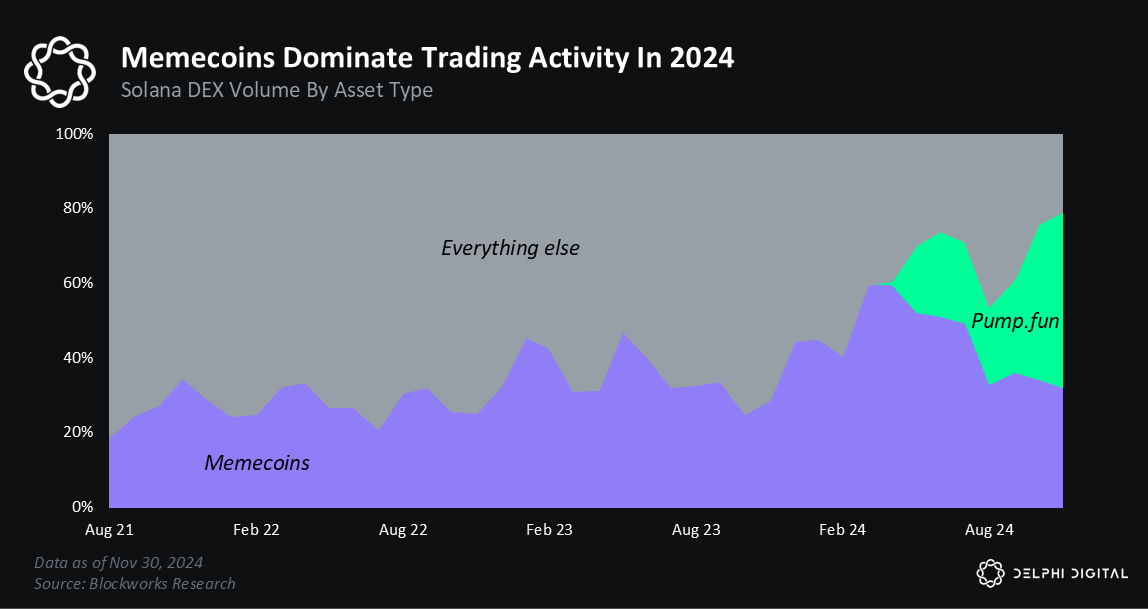

Applications like pump.fun have made token creation trivial: over 4 million tokens have been launched since January 2024 alone, including over 50,000 on Solana’s Raydium.

Will memes continue, will fundamentals return—or both?

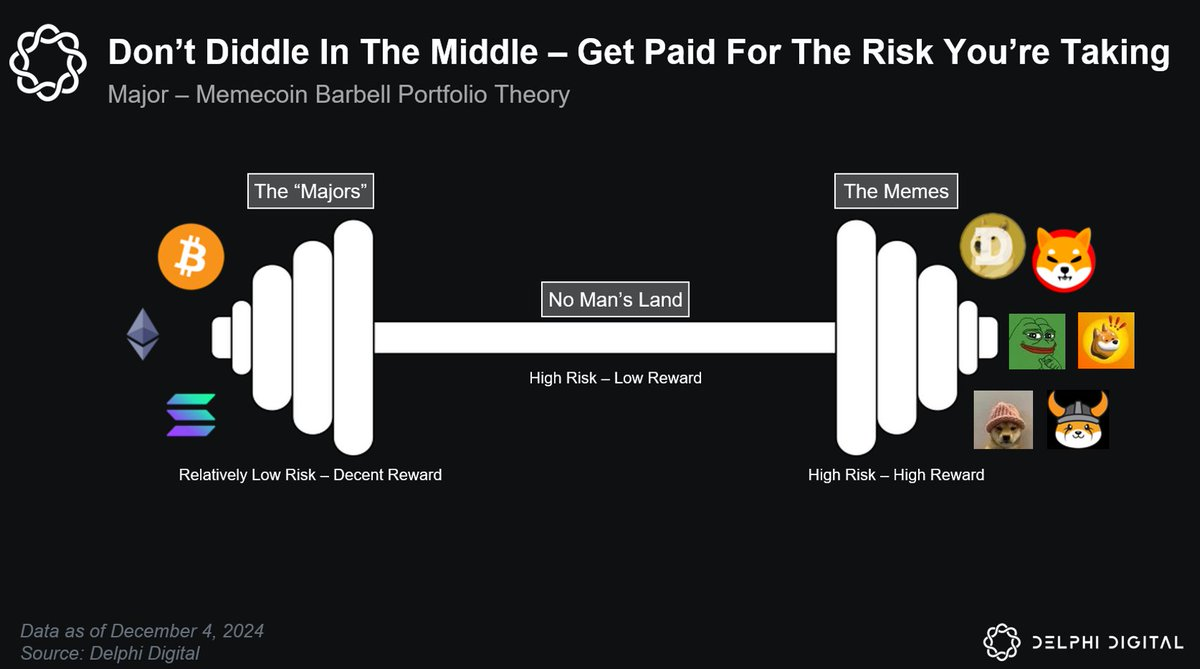

2024 saw the rise of hybrid investment strategies combining major coins with memecoins. We explored these dynamics in depth in our reports *The Dog Days of Summer* and *Attention Is All You Need*.

Will these trends persist, ushering in another memecoin-dominated year? Or has the market shifted back toward fundamentals?

The reality is more nuanced, shaped by speculative waves and evolving market behavior.

Solana Accelerates Forward

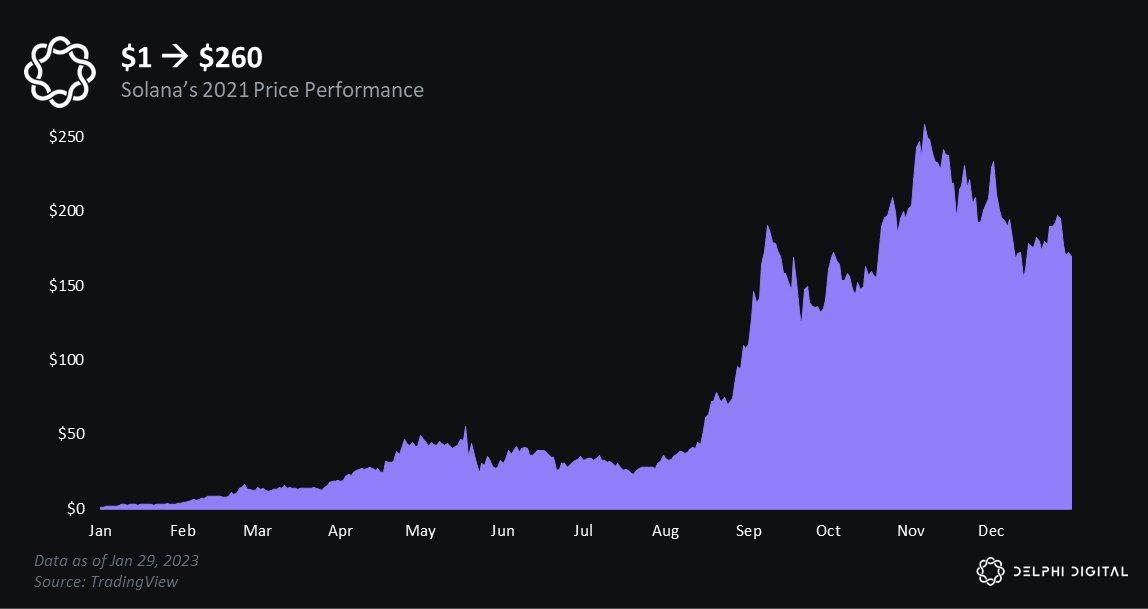

In the previous cycle, $SOL surged from $1 to $260 in just one year, driven by "Alt L1 trades" and its status as the "Sam coin."

Though the ecosystem was still nascent, it attracted teams like Jito, Drift, and Helium, who eventually became foundational to the Solana network.

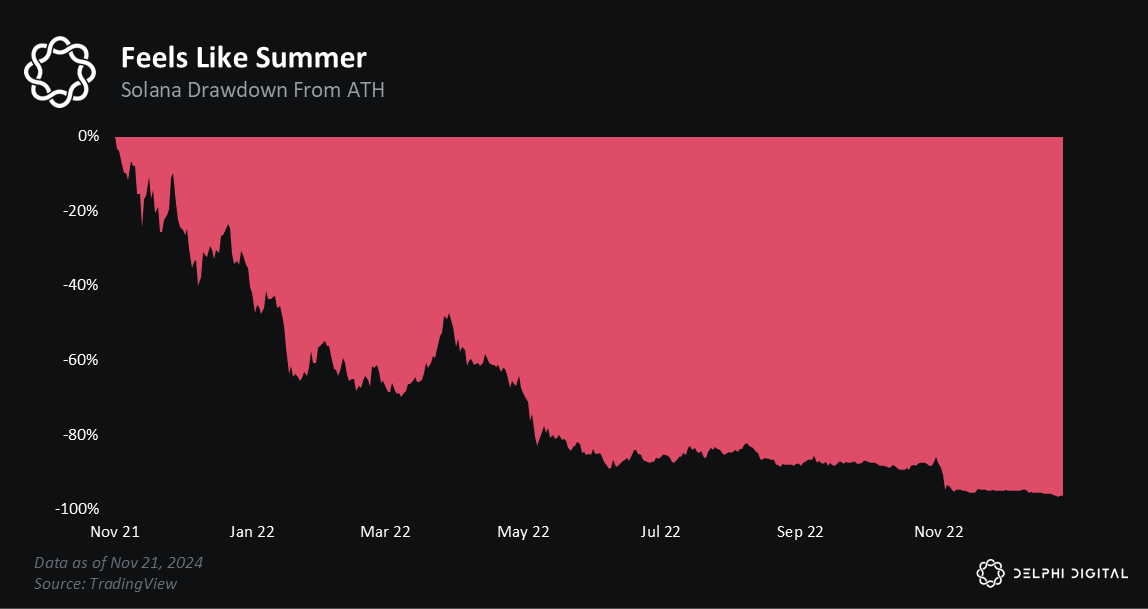

However, Solana pursued rapid growth too aggressively. By 2022, the phoenix fell due to FTX fraud, the bear market, and growing concerns about chain stability.

From peak to trough, SOL dropped 96%.

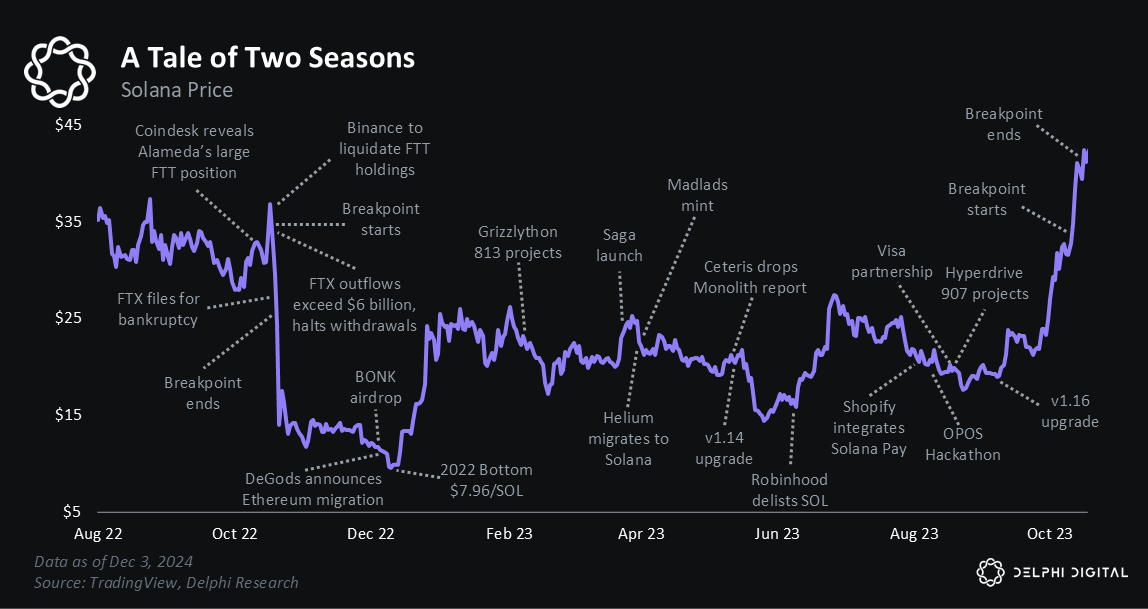

On Christmas Day 2022, 'Bonk' airdropped half its supply to the Solana community. At the time, SOL traded at $11, amid deeply pessimistic sentiment.

Yet $BONK sparked hope. Days later, SOL bottomed at $8, closing out a brutal year.

From the ashes, Solana began its rebirth in 2023. Core teams that endured 2022 doubled down.

@DriftProtocol, @jito_sol, and @TensorFdn focused on serving loyal users. Backed by steady innovation, Solana gradually regained strength.

Looking ahead to 2025, several questions remain unanswered:

-

Has SOL finished repricing?

-

Will memecoins lose steam?

-

Can Base capture market share?

-

Will Ethereum fight back?

While these concerns are valid, they miss the bigger picture. Solana’s 2025 story rests on two core beliefs that will determine its trajectory:

-

Solana data suggests SOLETH is undergoing repricing. Underlying activity reveals strong fundamentals, implying room for further outperformance relative to ETH.

-

Leadership and culture: Solana’s sustained innovation and thriving ecosystem give it a unique leadership position in crypto.

We view 2024 as a turning point for the industry.

While we can't predict exactly what 2025 holds, our analysts are already mapping potential opportunities and risks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News