Global risk assets rebounded on Tuesday: Behind the scenes, a major change at asset management giant Vanguard

TechFlow Selected TechFlow Selected

Global risk assets rebounded on Tuesday: Behind the scenes, a major change at asset management giant Vanguard

This conservative giant, which once firmly resisted crypto assets, has finally relented, officially opening Bitcoin ETF trading access to its 8 million customers.

Author: Ye Zhen

Source: Wall Street Horizon

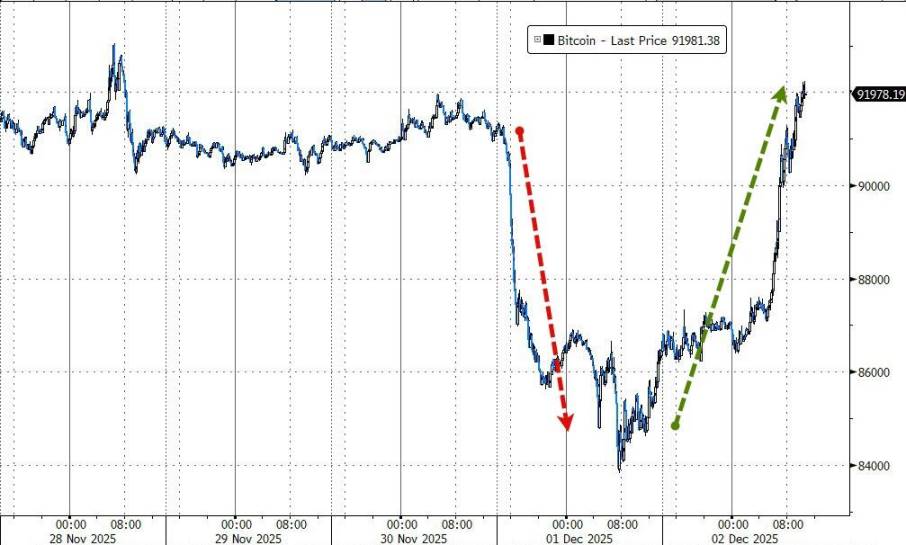

On Tuesday, cryptocurrencies like Bitcoin led a rebound in risk assets, driven by a major shift from Vanguard, the global asset management giant.

After Monday's sharp decline, Bitcoin recovered above the $90,000 mark on Tuesday, gaining over 6% for the day, while Ethereum reclaimed levels above $3,000.

Meanwhile, Trump hinted that economic advisor Kevin Hassett could be a potential candidate for Fed chair, and Japanese government bond auctions stabilized, putting slight downward pressure on U.S. Treasury yields and the dollar index. This eased market liquidity concerns and fueled a broad rally in global risk assets.

Vanguard confirmed on Tuesday that clients can now purchase third-party crypto ETFs and mutual funds—such as BlackRock's iShares Bitcoin Trust ETF—through its brokerage platform. This marks the first time the asset manager, known for its conservative investment philosophy, has opened cryptocurrency investment channels to its 8 million self-directed brokerage clients.

Eric Balchunas, an analyst at Bloomberg, noted this is a classic "Vanguard effect." On the first trading day after Vanguard’s announcement, Bitcoin surged during U.S. market open, and BlackRock’s IBIT saw over $1 billion in trading volume within 30 minutes of opening, showing even conservative investors want to “add some spice” to their portfolios.

Vanguard had previously firmly rejected involvement in cryptocurrencies, viewing digital assets as too speculative and volatile to align with its core principle of long-term balanced portfolio construction. The current reversal reflects mounting demand from retail and institutional investors, as well as growing concern about missing out on rapidly expanding market opportunities.

As BlackRock reaps massive success from its Bitcoin ETF, Vanguard’s softening stance on this emerging asset class—despite its adherence to "Boglehead" principles—could have far-reaching implications for future capital flows.

Vanguard’s Major Shift: From Resistance to Openness

The key driver behind this turnaround in market sentiment is a change in stance by Vanguard, the world’s second-largest asset manager. According to Bloomberg, starting Tuesday, Vanguard allows clients with brokerage accounts to buy and trade ETFs and mutual funds that primarily hold cryptocurrencies, such as BlackRock’s IBIT.

This decision represents a clear compromise. Since January 2024, when the U.S. approved spot Bitcoin ETFs, Vanguard had refused to offer these products on its platform, citing excessive volatility and speculation in digital assets as incompatible with long-term investing. However, as Bitcoin ETFs attracted tens of billions of dollars—and despite drawdowns, BlackRock’s IBIT still maintains around $70 billion in assets—persistent client demand, from both retail and institutions, forced Vanguard to shift its position.

Additionally, Vanguard’s current CEO Salim Ramji, formerly an executive at BlackRock and a long-time advocate of blockchain technology, is seen as an internal catalyst for this policy change. Vanguard executive Andrew Kadjeski stated that crypto ETFs have now withstood market volatility and their management processes have matured.

Still, Vanguard remains cautious: it explicitly states it has no plans to launch its own cryptocurrency investment products, and leveraged or inverse crypto products remain excluded from the platform.

Redefining the Two-Giant Rivalry

Vanguard’s move brings back into focus its three-decade rivalry with BlackRock. As described in the book *ETF Global Investing 101*, the two firms represent fundamentally different investment philosophies and business models.

BlackRock embodies the "craft." Founder Larry Fink was a top-tier bond trader, and BlackRock’s original mission was "to do better trading." Its core strengths lie in its powerful risk management system "Aladdin" and its comprehensive product suite. iShares, BlackRock’s ETF arm, offers over 400 ETFs covering global asset classes. For BlackRock, ETFs are tools to meet client trading needs and build portfolios, so it does not reject any asset class. Whether promoting ESG investing to mitigate "climate risk," or launching the first spot Bitcoin ETF (IBIT reached $10 billion in assets within seven weeks—far exceeding Vanguard’s expectations and breaking GLD’s gold ETF record which took three years), BlackRock consistently positions itself as the best "pickaxe seller" in the market.

Vanguard upholds the "philosophy." Although founder John Bogle has passed away, his principles remain Vanguard’s soul: the best long-term choice for investors is holding broad-market index funds, and Vanguard’s mission is to minimize costs to the extreme. Thanks to its unique "mutual ownership" structure, Vanguard charges extremely low fees and offers only about 80 ETFs, mostly focused on broad-market indices like VOO and VTI. Its client base primarily consists of fee-sensitive, long-term investors and financial advisors.

The contrast between the two companies is starkly evident in their approach to spot Bitcoin ETFs. BlackRock filed its application as early as June 2023, and its IBIT ETF surpassed $10 billion in assets just seven weeks after launch—three years faster than the gold ETF GLD achieved the same. In contrast, Vanguard only began allowing clients to trade third-party crypto products this week.

The market is pragmatic. As Vanguard’s share of the U.S. ETF market continues to close in on—and potentially surpass—BlackRock’s, spot Bitcoin ETFs have become a critical variable. Faced with BlackRock’s significant first-mover advantage in crypto assets and strong client demand for diversified portfolios, Vanguard has finally opened the door on the trading front.

Although Vanguard’s policy adjustment on crypto comes late, the potential demand from its 8 million self-directed clients cannot be underestimated. This shift may not only affect short-term capital flows but could also reshape the long-term competitive landscape between the two giants. TechFlow

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News