When the market falls into extreme fear, who is buying against the trend?

TechFlow Selected TechFlow Selected

When the market falls into extreme fear, who is buying against the trend?

For active traders: In the current volatile market, consider taking small long positions near support levels and reducing positions or considering short positions near resistance levels. Always set stop-loss orders for all trades.

Author: Hotcoin Research

Crypto Market Performance

The current total market capitalization of cryptocurrencies is $3.09 trillion, with BTC accounting for 58.5%, or $1.8 trillion. The stablecoin market cap stands at $306.1 billion, increasing by 1.08% over the past seven days. Stablecoin supply has reversed its trend this week, showing positive growth again, primarily driven by Circle, with USDT holding a share of 60.31%.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: BTC dropped 0.78% over seven days, SOL fell 2.23%, SAHARA declined 12.05%, AIOZ dropped 8.09%, and PI lost 7.85%. After a downturn, the crypto market has begun recovering, though overall conditions have not broadly improved yet.

This week, net inflows into U.S. Bitcoin spot ETFs were $70.5 million; net inflows into U.S. Ethereum spot ETFs were $312 million.

Market Outlook (December 1 - December 7):

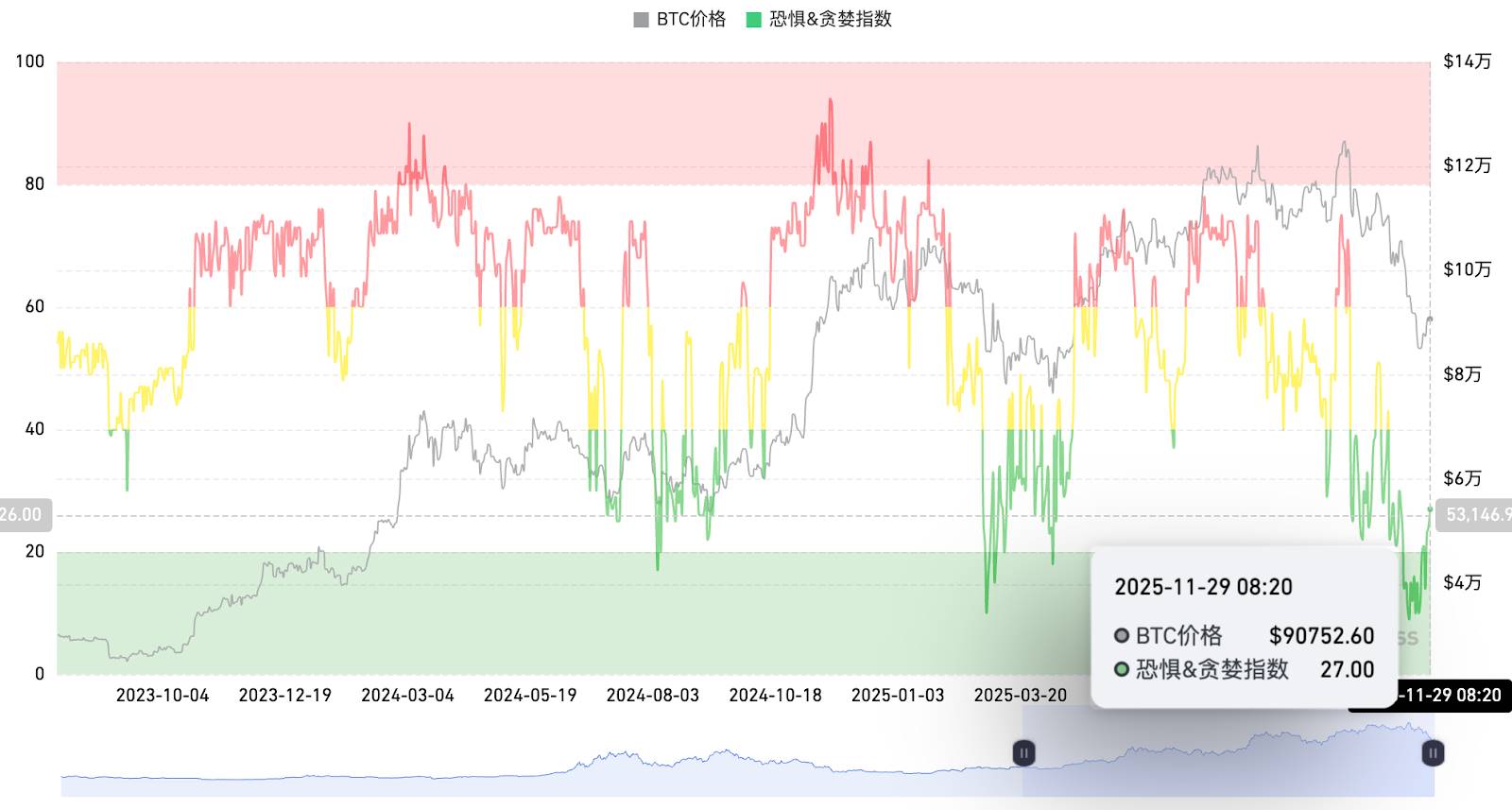

The current RSI index is 48.71 (neutral zone), the Fear & Greed Index is 27 (up from last week, still in the "fear" range), and the Altseason Index is 37 (neutral, up from last week).

BTC core range: $85,000–95,000

ETH core range: $2,800–3,300

SOL core range: $126–156

Market sentiment: The market has moved out of the "extreme fear" phase and is gradually recovering, but prices have not seen a V-shaped rebound due to the four-year cycle theory and whale sell-offs. Bitmine continues accumulating ETH, and U.S. spot ETFs saw net inflows this week. "Cathie Wood" is buying the dip on crypto-related stocks such as Coinbase and Circle. Attention is now focused on the Federal Reserve's meeting on December 10. Market expectations for rate cuts are high—rate cuts typically signal improved liquidity, potentially boosting risk assets including cryptocurrencies. Conversely, if expectations are unmet, it could trigger volatility. Current Fed fund futures indicate an 82.8% probability of a rate cut in December. Ethereum’s Fusaka upgrade is expected on December 4. SOL’s price has been under pressure following the Upbit hack in South Korea, but recent net inflows into U.S. spot ETFs have provided some price support.

For conservative investors: Periods when the market falls into the “extreme fear” zone often present ideal opportunities for long-term positioning. Consider dollar-cost averaging with small, staggered purchases near key support levels instead of rushing into large positions all at once.

For active traders: In this volatile market, consider taking small long positions near support levels and reducing exposure or going short near resistance levels. Always set stop-losses for every trade.

Understanding the Present

Reviewing the Week's Major Events

1. On November 24, CITIC Securities reported that New York Fed President Williams hinted at further rate cuts in December, shifting market expectations. Markets now believe there is a 70% chance of a Fed rate cut in December. The Fed will enter its blackout period starting November 29, during which Powell has no public appearances or media interviews scheduled. Williams’ comments may be the last official remarks influencing market expectations before the meeting;

2. On November 24, according to market data, U.S. stocks surged at the opening, with the Nasdaq up over 1.5% and the S&P 500 expanding gains to 1%, while crypto-related stocks broadly rallied;

3. On November 25, the U.S. White House is attempting to accelerate scientific research through artificial intelligence. President Trump signed an executive order launching the "Genesis Mission," requiring the Department of Energy and other research institutions to aggressively deploy AI. Michael Kratsios, Director of the Office of Science and Technology Policy, called it "the largest consolidation of federal research resources since the Apollo program";

4. On November 25, JPMorgan Chase, a major U.S. bank, closed Strike CEO Jack Mallers’ personal account, reigniting concerns in the U.S. crypto industry about a wave of "debanking";

5. On November 26, according to The Block, Cathie Wood’s Ark Invest continued buying shares of Block, Circle, and Coinbase despite falling crypto prices and overall market weakness;

6. On November 27, major cryptocurrencies rebounded noticeably overnight and into the morning. According to HTX market data, Bitcoin reclaimed $90,000 after a week, currently priced at $90,355, up 3.83% in 24 hours;

7. On November 27, Tether CEO Paolo Ardoino responded to S&P’s latest rating of Tether, saying, "We take pride in being disliked by you." He pointed out that traditional rating systems have repeatedly led investors toward eventually collapsing "investment-grade" institutions, raising global regulatory doubts about rating agencies’ independence. He stated that traditional finance resists any company escaping its "broken gravity," but Tether has built the first highly capitalized, toxic-asset-free, consistently profitable firm in the industry, exposing the fragility of the old system and unsettling those in power who resemble "the emperor with no clothes";

8. On November 27, according to DL News, South Korean financial regulators urged Bithumb to suspend its Tether trading services, which allowed customers to trade Bitcoin and nine major altcoins using USDT. However, these ten assets remain tradable in the Korean won (KRW) market;

9. On November 27, South Korea’s largest crypto exchange Upbit disclosed detecting abnormal withdrawals at 4:42 AM, resulting in approximately 54 billion KRW (about $36 million) worth of Solana-based digital assets being transferred to unknown external wallets. Upbit will cover all customer losses;

10. On November 28, official news stated that YZi Labs Management Ltd., a significant shareholder of CEA Industries Inc. (Nasdaq: BNC), filed a preliminary consent statement with the U.S. SEC seeking written shareholder approval to expand the board with experienced and highly qualified directors.

Macroeconomic Overview

1. On November 26, initial U.S. jobless claims for the week ending November 22 were 216,000, below the expected 225,000;

2. On November 28, according to the Fed funds futures, the probability of a 25-basis-point rate cut in December is 82.8%.

ETF

Data shows that between November 24 and November 28, U.S. Bitcoin spot ETFs had net inflows of $70.5 million. As of November 28, GBTC (Grayscale) has seen cumulative outflows of $24.971 billion, currently holding $15.21 billion in assets, while IBIT (BlackRock) holds $70.611 billion. The total market cap of U.S. Bitcoin spot ETFs is $119.682 billion.

U.S. Ethereum spot ETFs had net inflows of $312 million.

Anticipating the Future

Event Preview

1. Bitcoin MENA will take place from December 8 to 9 at the Abu Dhabi National Exhibition Centre (ADNEC);

2. Solana Breakpoint 2025 will be held in Abu Dhabi from December 11 to 13.

Project Updates

1. Aster Stage 3 airdrop checker opens on December 1, 2025, with airdrop redemption beginning December 15;

2. FTX’s fourth round of compensation is expected to launch in January 2026, with eligibility confirmation likely closing in December;

3. Spain’s Ministry of Economy and Digital Transformation announced it will implement the EU’s Markets in Crypto-Assets Regulation (MiCA) at the national level in December 2025. All 27 EU member states must fully implement MiCA by July 2026;

4. Sonnet BioTherapeutics, a U.S.-listed company, has postponed its shareholder vote to December 2, planning to merge with Rorschach I LLC to form Hyperliquid Strategies and advance its HYPE reserve strategy;

5. Aztec’s AZTEC token sale is scheduled for December 2–6, 2025, supported by Uniswap’s newly launched Continuous Clearing Auction (CCA) protocol. CCA is a customizable protocol for launching liquidity and issuing tokens on Uniswap v4, co-designed with Aztec, which provides a ZK Passport module enabling private and verifiable participation. The sale starts at a fully diluted valuation (FDV) of $350 million, approximately 75% lower than the implied network valuation from the latest equity financing.

Key Events

1. December 3: U.S. ADP employment change (in thousands) for November will be released;

2. December 4: U.S. initial jobless claims (in thousands) for the week ending November 29 will be announced;

3. December 5: U.S. core PCE price index year-on-year rate for September will be published.

Token Unlocks

1. Audiera (BEAT) will unlock 21.25 million tokens on December 1, valued at approximately $20.26 million, representing 2.12% of circulating supply;

2. Lagrange (LA) will unlock 12.7 million tokens on December 4, valued at around $5 million, or 1.27% of circulating supply;

3. MYX Finance (MYX) will unlock 30.37 million tokens on December 6, worth about $77.5 million, equal to 3.04% of circulating supply;

4. Jito (JTO) will unlock 11.31 million tokens on December 7, valued at approximately $5.47 million, or 1.13% of circulating supply.

About Us

Hotcoin Research, as the core research arm of Hotcoin Exchange, is dedicated to turning professional analysis into practical tools for your investment strategy. Through our "Weekly Insights" and "Deep Dive Reports," we dissect market trends. With our exclusive column "Top Picks" (powered by AI + expert screening), we help you identify promising assets and reduce trial-and-error costs. Each week, our analysts also host live streams to discuss hot topics and forecast trends. We believe that warm, consistent support combined with professional guidance can help more investors navigate market cycles and seize value opportunities in Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News