Former a16z Partner's重磅 Tech Report: How Will AI Eat the World?

TechFlow Selected TechFlow Selected

Former a16z Partner's重磅 Tech Report: How Will AI Eat the World?

When technology truly becomes practical and accessible to all, people no longer call it "AI".

Author: Bu Shuqing

Source: Wall Street Insights

"AI is eating the world, and we haven't even seen what it looks like yet."

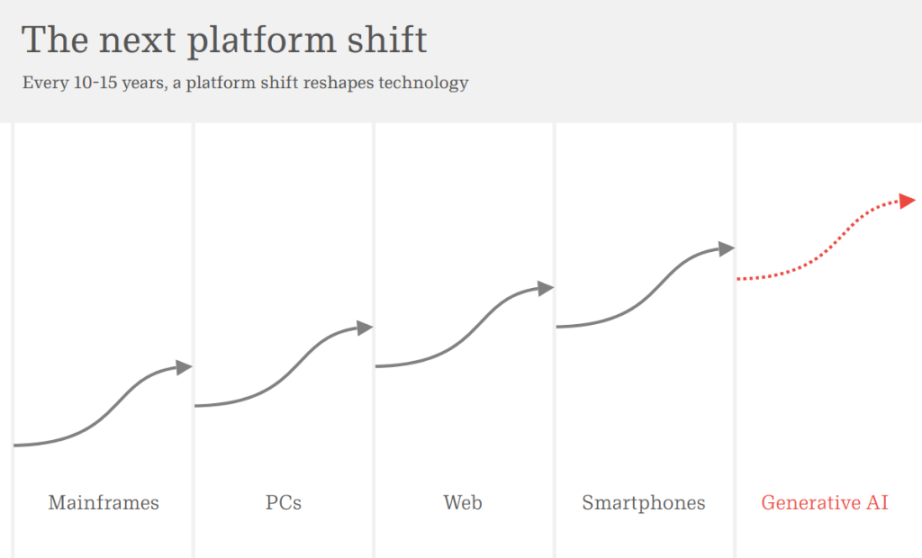

In his latest report titled "AI eats the world," renowned tech analyst and former a16z partner Benedict Evans delivers a judgment powerful enough to shake the entire technology industry: generative AI is triggering the once-every-ten-to-fifteen-years platform shift in the tech sector—and we still don’t know where it will ultimately lead.

Evans points out that from mainframes to PCs, from the internet to smartphones, the foundation of the tech industry gets completely rewritten every decade or so. The emergence of ChatGPT in 2022 may well mark the beginning of the next "fifteen-year transformation."

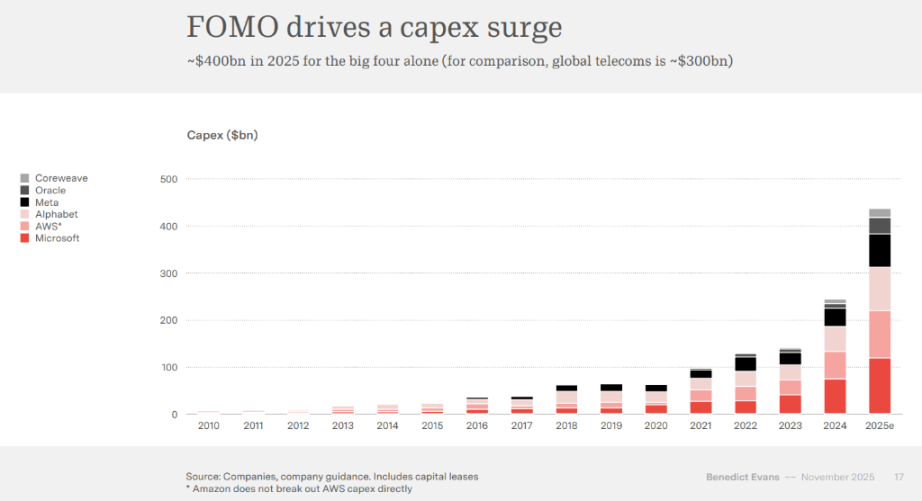

Global tech giants are rushing into an unprecedented investment race. Microsoft, Amazon AWS, Google, and Meta are expected to spend nearly $400 billion in capital expenditures in 2025—surpassing the global telecom industry’s annual investment of approximately $300 billion.

"The risk of underestimating AI far outweighs the risk of over-investing," a quote from Microsoft CEO Sundar Pichai cited in the report, captures the core anxiety across the industry.

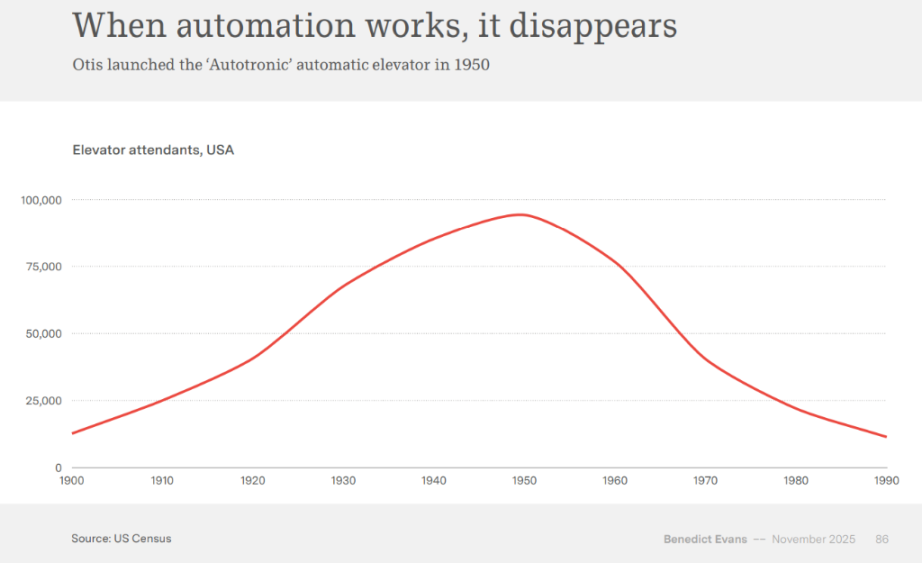

The report also references the 1956 U.S. Congressional automation report and the disappearance of elevator operators as reminders: when technology truly takes hold, it quietly becomes infrastructure and is no longer called "AI."

Another Fifteen-Year Shift: The Historical Pattern of Platform Transitions

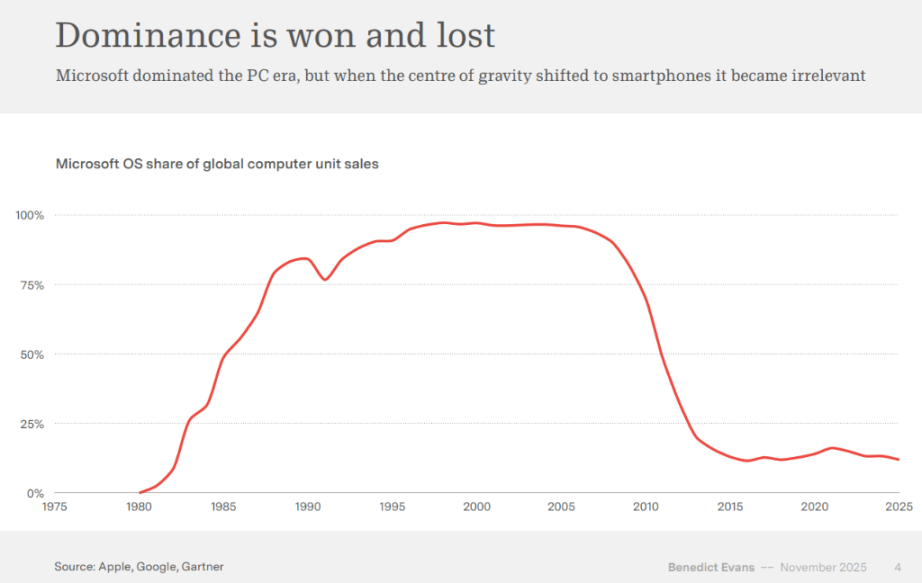

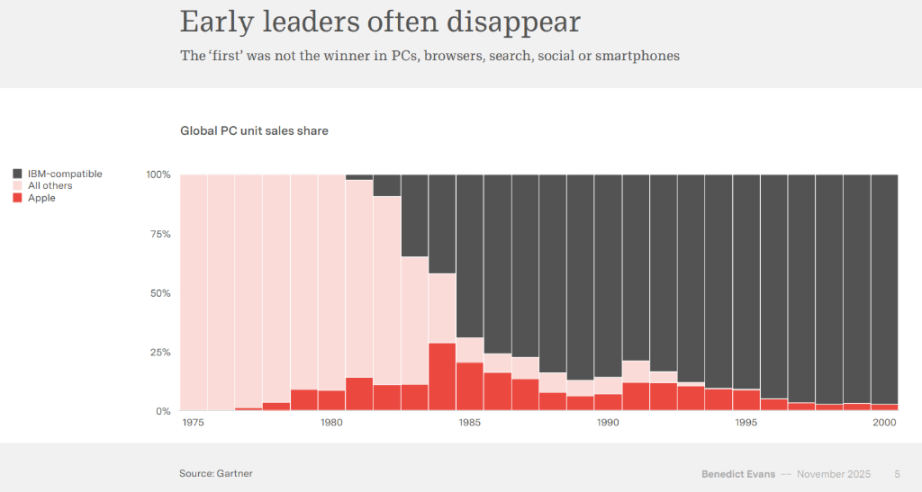

Evans notes in the report that the tech industry undergoes a platform transition roughly every ten to fifteen years—from mainframes to personal computers, from the World Wide Web to smartphones—each time reshaping the entire industry landscape. Microsoft's story illustrates the brutality of such shifts: the company once held nearly 100% market share in operating systems during the PC era, but became almost irrelevant when the center of gravity shifted to smartphones.

Data shows that Microsoft’s operating system share in global computer sales has plummeted from its peak around 2010 to less than 20% by 2025. Similarly, Apple, dominant in the early PC market, was once marginalized by IBM-compatible machines. Evans emphasizes that early leaders often disappear—an iron law of platform transitions.

Yet three years on, we still know very little about the shape of this current transition. Evans lists failed ideas from the early internet and mobile eras—America Online (AOL), Yahoo portals, Flash plugins. Now with generative AI, possibilities are equally dizzying: browser-based interfaces, agent models, voice interaction, or entirely new UI paradigms—no one truly knows the answer.

Unprecedented Investment Surge: A $400 Billion Bet

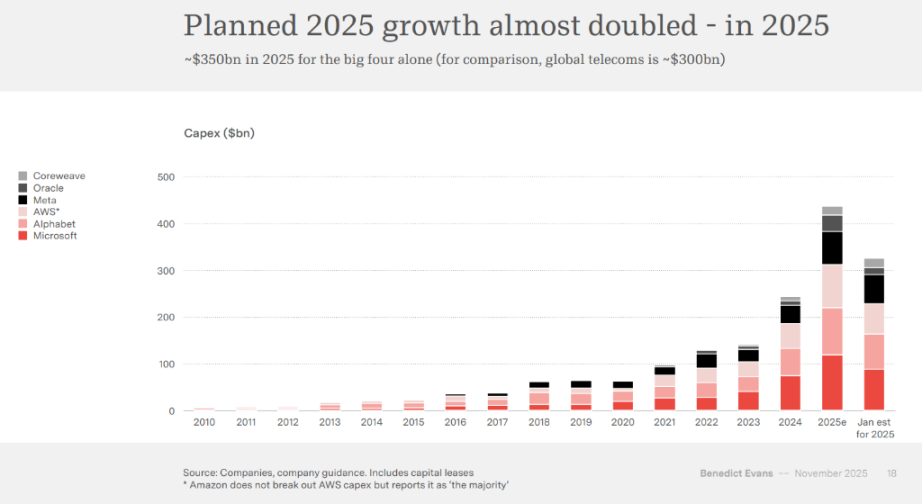

Tech giants are investing in AI infrastructure at an unprecedented scale. In 2025, capital expenditures from Microsoft, AWS, Google, and Meta are projected to reach $400 billion, compared to the global telecom industry’s annual investment of about $300 billion.

More notably, this 2025 growth plan has nearly doubled within the year.

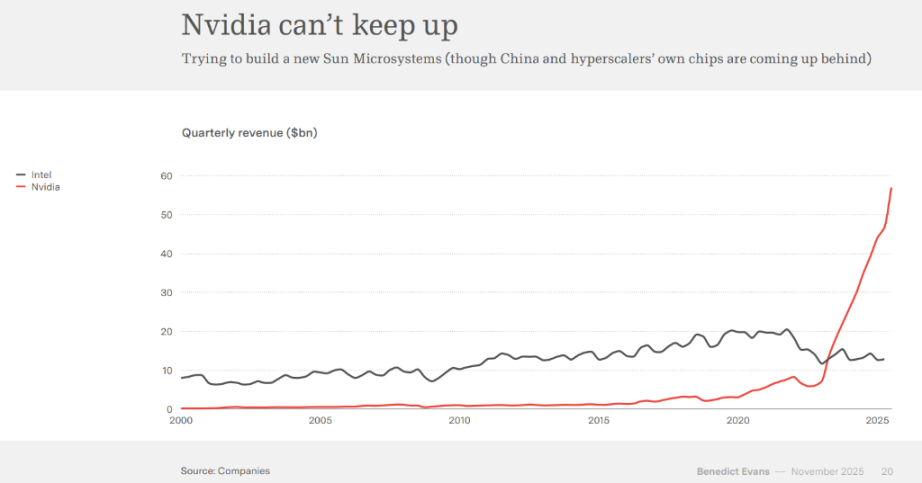

Data center construction in the U.S. is now surpassing office building development, becoming the new driver of the investment cycle. Nvidia faces supply bottlenecks due to inability to keep up with demand, and its quarterly revenue has already exceeded Intel’s cumulative totals over many years. TSMC likewise cannot or will not expand capacity quickly enough to meet Nvidia’s order demands.

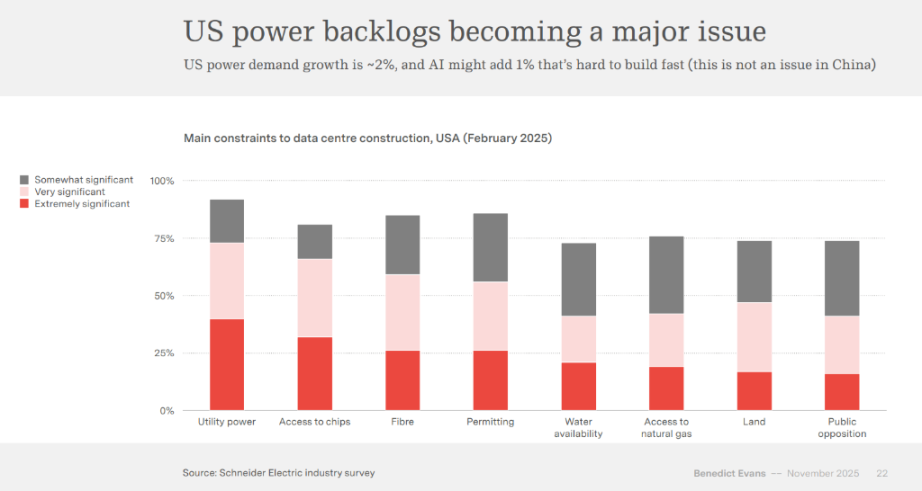

According to Schneider Electric’s industry survey, the primary constraint on U.S. data center construction is public power supply, followed by chip availability and fiber access. U.S. electricity demand is growing by about 2%, and AI could add another 1%—a manageable issue in China, but difficult to address rapidly in the U.S.

Model Convergence: Moats Disappear, AI May Be 'Commoditizing'

Despite massive investments, performance gaps among top large language models on benchmark tests are narrowing to single-digit percentage points. Evans warns:

If model performance becomes highly convergent, this means large models may be turning into commodities, and value capture will be reshuffled.

On the most general benchmarks, differences between leaders have become extremely small, with leadership changing weekly. This suggests models may be becoming commoditized, especially for general-purpose use.

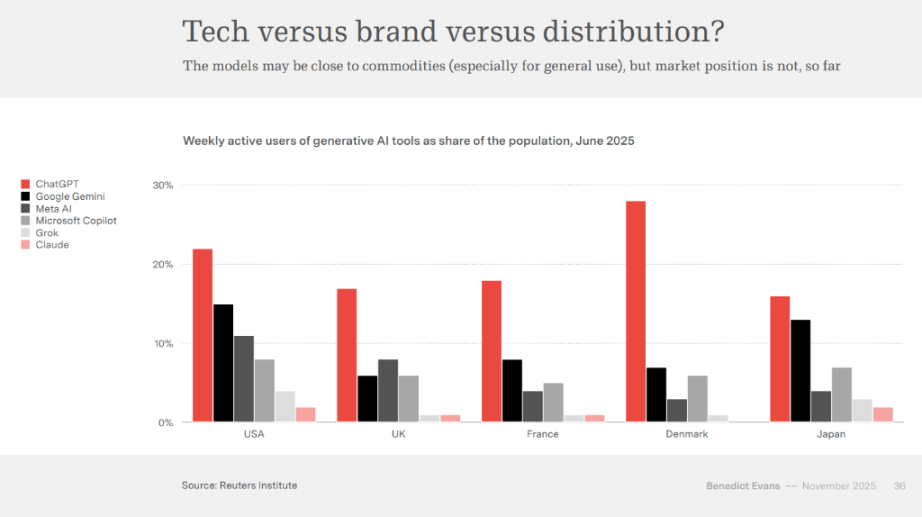

Evans notes that after three years of development, there has been more progress in science and engineering, but clarity around market structure remains lacking. While models continue improving—with more models emerging, Chinese vendors participating, open-source projects flourishing, and new technical acronyms popping up—there is no clear moat.

In his view, AI companies must find new moats in compute scale, vertical data, product experience, or distribution channels.

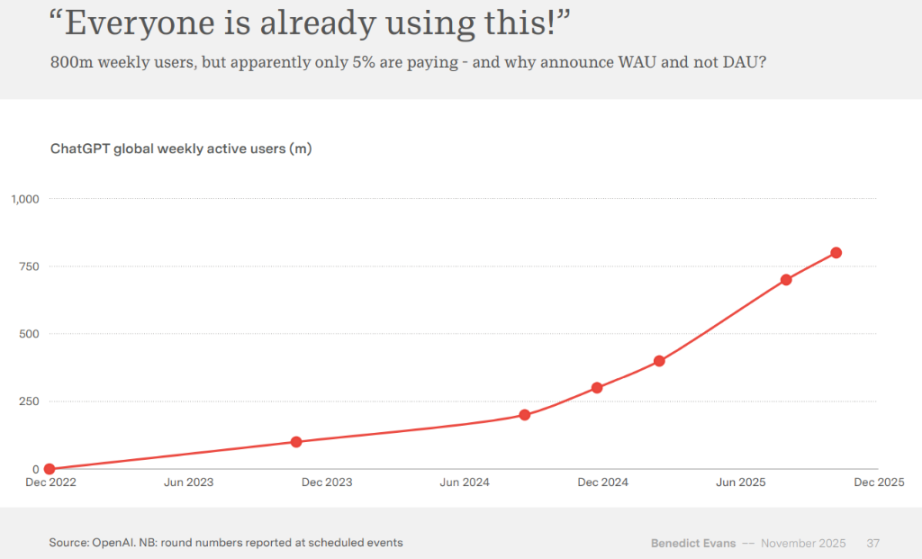

User Engagement Dilemma: ChatGPT’s 800 Million Weekly Active Users Mask Low Real Stickiness

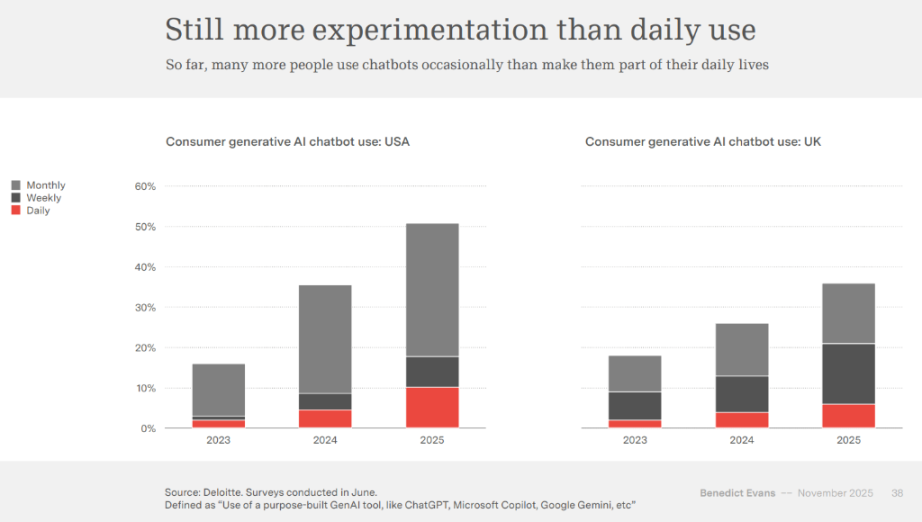

Despite claims of 800 million weekly active users, user engagement data paints a different picture. Multiple surveys show only about 10% of U.S. users interact with AI chatbots daily, while most remain in the occasional trial phase.

Deloitte’s survey data reveals that the number of people who use AI chatbots occasionally far exceeds those who use them daily.

Evans calls this a classic "engagement illusion": AI adoption is astonishingly fast, but it has not yet become an everyday tool for the masses.

He analyzes the roots of this engagement dilemma: How many use cases are obvious and easily adaptable? Who has the flexible work environment and conscious drive to optimize workflows? For everyone else, does AI need to be embedded within tools and products? This highlights a significant gap between technical capability and real-world application.

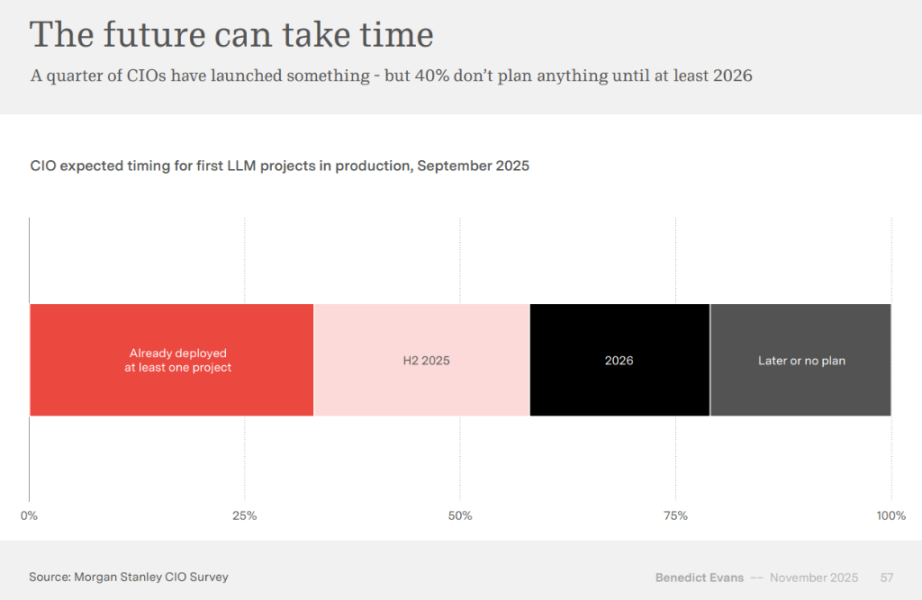

Enterprise adoption is similarly slow. The report cites multiple consulting firm surveys showing that despite high enthusiasm for AI, few projects have entered production environments.

-

Deployed: 25%

-

Plan to deploy in second half of 2025: ~30%

-

Will not deploy until at least 2026: ~40%

Current success stories remain concentrated in "absorption-stage" areas like coding assistance, marketing optimization, and customer support automation—still far from true business restructuring.

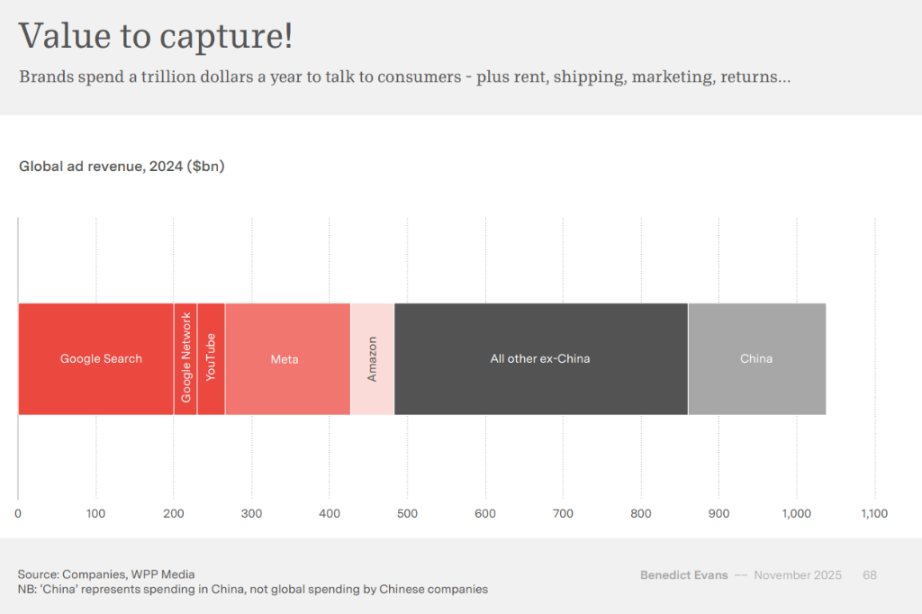

Advertising and Recommendation Systems Face Disruptive Rewriting

Evans believes the area where AI will bring the fastest and most profound changes is advertising and recommendation systems.

Traditional recommendations rely on "relevance," whereas AI can understand "user intent" itself. This implies:

The underlying mechanics of the trillion-dollar advertising market may be rewritten.

Google and Meta have already disclosed early data: AI-driven ad placements yield conversion rate improvements of 3%–14%. The cost of creative ad production—currently a $100 billion annual market—could also be reshaped by automated generation technologies.

Historical Lessons: When Automation Succeeds, It Stops Being Called 'AI'

Evans draws parallels to the 1956 U.S. Congressional report on automation, noting that each wave of automation sparks intense social debate—but eventually fades into infrastructure.

The disappearance of elevator operators, barcode-driven inventory revolutions, and the internet evolving from a "novelty" into essential infrastructure—all demonstrate:

When technology truly lands and becomes widespread, people stop calling it "AI."

Evans stresses that AI’s future is both clear and blurry: we know it will reshape industries, but not what final product forms will emerge; we know it will be ubiquitous in enterprises, but not who will dominate the value chain; we know it requires massive computing power, but not where growth will plateau.

In other words, AI is becoming the protagonist of the next fifteen-year cycle, but the script for this entire play remains unwritten.

We may be standing right on the fault line of the next technological earthquake.

The Future of Value Capture: From Network Effects to Capital Competition

For research-intensive, capital-intensive commoditized products, value capture becomes the central question. If models become commodities without strong network effects, how will model labs compete?

Evans proposes three potential paths: expanding downstream to win through scale, moving upstream to win via network effects and products, or discovering new competitive dimensions.

Microsoft’s case illustrates a shift from competition based on network effects to competition based on capital access. The company’s capital expenditure as a share of revenue has risen sharply from historical lows, reflecting a fundamental change in competitive dynamics.

OpenAI has adopted a "say yes to everything" strategy, including infrastructure deals with Oracle, Nvidia, Intel, Broadcom, and AMD; e-commerce integration; advertising; vertical datasets; and diversified expansions into application platforms, social video, and web browsers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News