Even the big short-seller has started a paid group

TechFlow Selected TechFlow Selected

Even the big short-seller has started a paid group

Real opportunities flow silently within closed circles.

By: Liam, TechFlow

Not long ago, "opening paid groups" was widely seen as a way to exploit fans. If there were a list of people least likely to "sell courses or create paid groups," Michael Burry would undoubtedly top it.

This legendary fund manager, immortalized in the movie *The Big Short*, once shunned media, refused interviews, and mocked Wall Street's emotional speculation. He rose to fame through a single bold bet against subprime mortgages—no traffic chasing, no self-promotion, and certainly no interest in monetizing retail investors.

In 2025, he launched scathing criticism against NVIDIA and the entire AI wave, calling it a new dot-com bubble, and made high-profile short bets.

Yet what no one expected was that even Michael Burry—the last person you'd imagine doing this—has now launched a paid group.

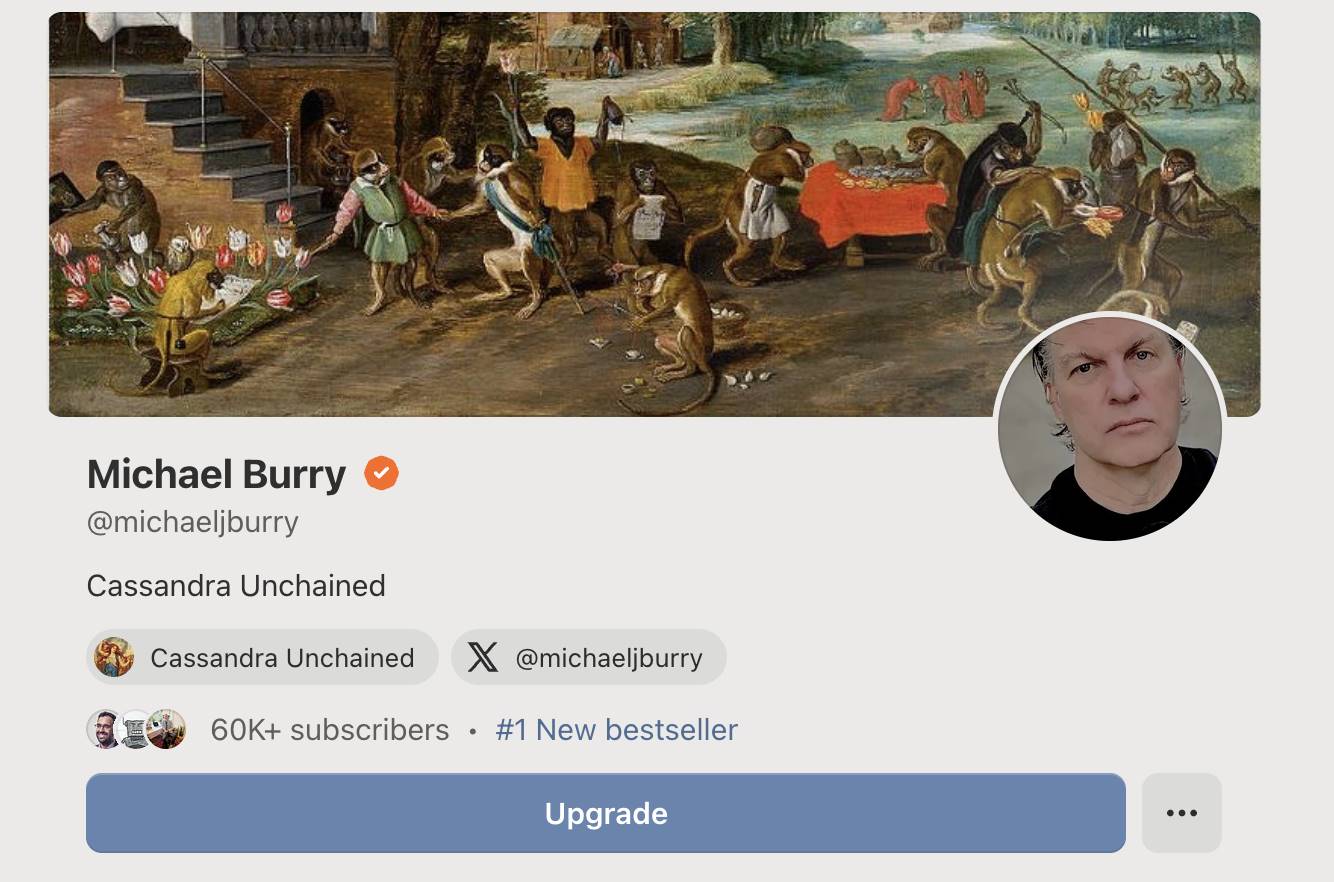

On November 24, Michael Burry announced on X the launch of his paid Substack newsletter titled *Cassandra Unchained*, priced at $379 per year. It has already attracted over 60,000 subscribers, generating more than $22.74 million in revenue.

Somewhat similarly, Donald Trump Jr., son of former President Trump, recently launched a premium club called "Executive Branch," with a membership fee as high as $500,000.

From cryptocurrency WeChat groups to Wall Street and the White House—the world has become one giant paid group.

Even Titans Need Cash Flow

Why are so many KOLs, investors, and even celebrities—who are already financially independent and immensely wealthy—still eager to launch paid groups, memberships, and private clubs?

The seemingly contradictory answer lies in the fundamental logic of cash flow.

Trading crypto or stocks doesn't guarantee profits; most startups fail. But teaching others how to trade or guiding them through entrepreneurship? That’s always profitable.

Investing is essentially a capital expenditure. Even elite investors like Burry face uncertain returns. Markets may reward handsomely—or wipe you out. In 2022, Burry’s fund, Scion Asset Management, suffered heavy losses from shorting Tesla and other tech stocks.

In contrast, paid groups, subscriptions, and membership models generate real, positive cash flow—stable, predictable, and nearly zero marginal cost.

This isn’t a new idea. Warren Buffett loves insurance businesses precisely because they provide steady cash flow, fueling Berkshire Hathaway’s investment engine. In the digital age, knowledge monetization has become a lighter-asset version of that “insurance business.”

For trader-KOLs and investing titans operating in high-risk markets, subscription income isn’t just revenue—it’s a risk hedging tool. When portfolio volatility spikes, the stability of subscription earnings becomes especially valuable.

In short: Market value does not equal cash flow. Even the wealthy need cash flow security.

In volatile markets, smart people turn their influence into a money-printing machine.

The Art of Filtering

Kevin Kelly famously proposed the “1,000 True Fans” theory—the idea that you only need 1,000 devoted fans to make a living independently.

Paid access is the best filter.

For example, Trump Jr. set a $500,000 entry fee for his club. This threshold automatically filters out most ordinary users, leaving only high-net-worth individuals truly committed to following him.

There is a vast difference in engagement between paying and free users.

Psychological research shows that when people pay for something, they experience strong “sunk cost bias,” making them value the content far more. An investor who pays dozens of dollars monthly for Burry’s insights will naturally care much more than someone casually liking a tweet.

More importantly, payment creates a relatively homogeneous community environment.

In Trump Jr.’s $500,000 club, members share similar wealth levels and social status, fostering greater resonance and trust. This clustering effect is far more valuable than mere revenue—it builds a highly loyal core support base.

When everyone has invested real money to join, they naturally work harder to protect the group’s reputation and influence.

Even if the “group admin” suffers an investment loss, as long as subscriptions continue, their influence won’t vanish.

For instance, Oushen Shui (a Chinese property influencer) leveraged heavily in real estate, facing severe debt and cash crunch, yet still sustains his balance sheet by running paid groups, selling courses, and borrowing from fans.

A Shift in the Era

As more paid groups, private clubs, and membership circles emerge, this trend is hardly good news for ordinary people.

Those who can afford Burry’s subscription or Trump Jr.’s club already possess greater investment resources, stronger risk tolerance, and richer network capital.

Investment information is becoming increasingly stratified.

In the past, everyone browsed Twitter, read news, and chased trends at the same time—appearing to stand on the same informational starting line. But now, a classic Matthew effect is forming:

The rich not only have money—they also gain better investment advice,人脉 (networking), and earlier access to opportunities.

What about ordinary investors?

They’re left scavenging “spillover information” from public channels, making investment decisions based on outdated, second- or third-hand data.

Public information markets are gradually turning into “secondhand information pools.” Real opportunities now flow silently within closed circles.

In a sense, we’re witnessing the end of the free information era.

In the early days of Twitter, Weibo, and Zhihu, we briefly experienced an “information democratization era,” where ordinary people could instantly access insights from top minds.

But now, the elites either stay silent, reduce output, or reserve their real views for paid private spaces.

KOLs’ need for monetization is rising fast. High-quality content is steadily migrating into “closed small circles.”

Public platforms are becoming stages for exposure and traffic generation—not discussion arenas. Truly valuable judgments are withdrawing from the “public sphere.”

What’s the result?

Ordinary people hear more noise and slogans—but get none of the critical information.

This is not a healthy ecosystem.

In such a structure, information opacity inevitably breeds rampant front-running and insider trading, along with利益 collusion within exclusive circles.

If wealth gaps in the last era came from asset prices, the next era’s gap will stem from “information barriers”—winner takes all.

Perhaps years from now, looking back at 2025, we’ll realize:

The moment Burry and Trump Jr. launched their paid groups, the era of free information quietly ended.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News