The Threat of Quantum Computing: Big Trouble for Bitcoin, Little Impact on Ethereum

TechFlow Selected TechFlow Selected

The Threat of Quantum Computing: Big Trouble for Bitcoin, Little Impact on Ethereum

The demise of Bitcoin would undoubtedly create a vacuum of trust in the short term, but the needs and values fulfilled by Ethereum would not disappear as a result.

Author: David Hoffman

Translation: TechFlow

"If Bitcoin falls, cryptocurrency will fall with it."

Bitcoin supporters absolutely love this statement.

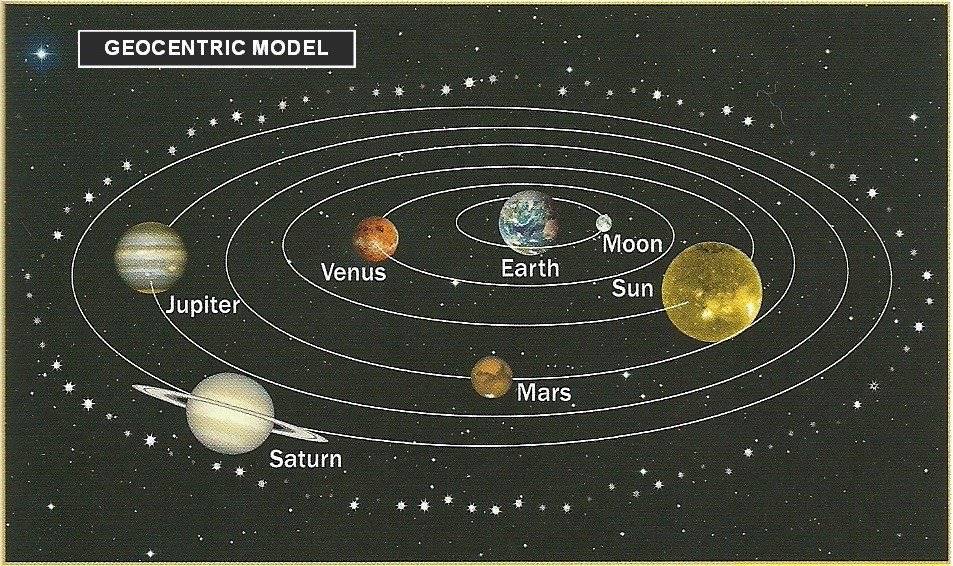

My friend Nic Carter recently revived this well-worn idea—that Bitcoin is the center of the crypto universe, and everything else is merely celestial bodies orbiting around it.

This sentiment seems to be a persistent refrain in Bitcoin circles—every so often, a Bitcoiner tweets it out in response to some new trending topic, and then other Bitcoiners rush in to like the post until it achieves "escape velocity" in popularity.

However, this broad assertion is simply wrong, and can only come from someone who views Bitcoin as the center of the crypto universe.

This Bitcoin-centric perspective is as primitive and outdated as geocentrism. To be clear, in our solar system, the other planets do not actually revolve around Earth.

From first principles, Ethereum has no technical dependence on Bitcoin. As a protocol, Ethereum is completely unaware of Bitcoin's existence.

If Bitcoin were to stop producing blocks, literally “nothing would happen” to Ethereum.

A $165 billion stablecoin market, a $65 billion decentralized finance (DeFi) ecosystem, the burning of $55 million worth of Ether (ETH) annually, countless startups, venture capital industries, and developer markets—all are unique products nurtured by Ethereum, and they would all continue operating normally the next day.

This is exactly what Ethereum was designed for.

The Threat of Quantum Computing

Last week, discussions about quantum computing posing a risk to Bitcoin resurfaced. Scott Aaronson, regarded as a leading quantum researcher, wrote on his blog Shtetl-Optimized:

Given the astonishing pace of current hardware advancements, I now believe we may have a fault-tolerant quantum computer capable of running Shor’s algorithm before the next U.S. presidential election.

This has been a topic since Bitcoin’s inception—it has long been known that the ECDSA signatures used in most early Bitcoin wallets are vulnerable to quantum attacks, meaning Bitcoin private keys could eventually be cracked by quantum computers, allowing attackers to steal the associated Bitcoin.

In his recent podcast, Nic even suggested that some of Bitcoin’s negative price performance might be related to the market already pricing in quantum risk.

The key point here is that this is entirely a problem Bitcoin must solve. Ethereum has already defended against the very type of attack that currently worries Bitcoin.

From the beginning, Ethereum has hidden public keys behind addresses (keccak-256 hashes), meaning your public key isn’t exposed until you spend, significantly reducing the attack surface for quantum attackers.

Moreover, since The Merge, Ethereum has moved to a validator model where withdrawal keys are also hidden behind hashes. More importantly, Ethereum’s roadmap explicitly plans to replace ECDSA signatures with quantum-resistant signature schemes (such as BLS variants or post-quantum cryptography alternatives) through future upgrades like Verkle Trees and EOF rearchitecting.

Ethereum’s culture has always been highly forward-looking—even sometimes appearing overly so, as other ecosystems often exploit short-term weaknesses in Ethereum via shortcuts. But when it comes to the quantum threat, Ethereum is absolutely not complacent!

Facing the quantum threat to blockchain security, Ethereum has chosen to confront the challenge head-on, fully aware that quantum computing will one day become ubiquitous.

The Default Internet Money

"If Bitcoin dies, people will never trust internet money again."

This is not true.

The death of Bitcoin would undoubtedly create a short-term vacuum of trust, but the needs and value fulfilled by Ethereum would not disappear. In fact, such an event might provide Ethereum with an opportunity to demonstrate its long-term resilience.

I truly hope Bitcoin overcomes the quantum threat, but I also believe that the demise of crypto’s “number one currency” could greatly benefit the “number two.”

Bitcoin carries a massive monetary premium, and Ethereum has its own monetary premium. If Bitcoin exits the equation, Ethereum would have a clear path to becoming the native money of the internet. From the perspective of someone focused solely on ETH’s value, Bitcoin’s collapse due to quantum threats could be the single most bullish event for ETH.

Ethereum would continue producing blocks, transferring trillions of dollars in stablecoins, hosting the world’s most resilient DeFi ecosystem, and continuously improving its economic model through ETH burns.

Therefore, while Bitcoin faces an “unimaginably huge task,” the “biggest infrastructure change in Bitcoin’s history” (as Nic Carter put it in his recent podcast), Ethereum has been thinking about these issues and preparing solutions for them for over a decade.

So, Bitcoin’s technical shortcomings are not my problem.

Thank you for your attention to this matter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News