Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long-Short Battle

TechFlow Selected TechFlow Selected

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long-Short Battle

This article will review Ethereum's recent performance, deeply analyze the current bullish and bearish factors facing Ethereum, and展望 the prospects and trends for Ethereum toward the end of this year, next year, and the medium to long term. It aims to help ordinary investors cut through the confusion, grasp the trend, and provide a useful reference for making more rational decisions during this critical turning point.

1. Introduction

This week, developers from around the globe are gathering in Buenos Aires for the annual Ethereum Developer Conference. Additionally, Ethereum is set to undergo a major upgrade codenamed "Fusaka" in December, which will increase data throughput by 8 times, enhance network security, and introduce new development tools. At the same time, rising institutional participation is driving strong capital inflows, with the RWA market poised to become a new growth engine for Ethereum.

However, due to macroeconomic uncertainties, since early October, Ethereum's price has fallen from a new high of $4,900 into a downward trend. Especially after the "October 11 crash" black swan event, ETH’s price has remained weak, recently hovering around $3,000—more than 30% below its peak. The capital that previously supported ETH’s rise is now exiting: stocks of Ethereum treasury companies (DAT) have sharply declined, holdings have turned from profit to loss, and some shareholders have sold out for cash; multiple global spot ETH ETFs have seen continuous net outflows, and traditional institutional investors are adopting a wait-and-see stance. Meanwhile, Ethereum's ecosystem has repeatedly cooled: total value locked (TVL) has dropped over 20% since October, on-chain stablecoins have suffered successive collapses and de-pegging, and DeFi protocols have faced repeated setbacks.

This article reviews Ethereum’s recent performance, deeply analyzes the current bullish and bearish factors it faces, and looks ahead at Ethereum’s prospects and trends toward year-end, next year, and the medium-to-long term. It aims to help ordinary investors cut through the fog, grasp trends, and make more rational decisions during this critical turning point.

2. Analysis of Ethereum’s Recent Performance

In Q3 this year, Ethereum’s price surged alongside rising market sentiment, climbing from around $2,500 at the end of June to nearly $4,950—a yearly high—by late August. However, in October, a combination of macro and internal market risks triggered an "epic crash." On October 11, unexpected U.S. announcements of new tariffs on China acted as a catalyst, sparking a global sell-off in risk assets and causing a sharp plunge in the crypto market. Ethereum’s price briefly crashed over 20%, dropping to a low of approximately $3,380. Although the market rebounded somewhat afterward, liquidity gradually drained away, leading to an overall downward fluctuation. As of now, ETH trades around $3,000, down more than 30% from its August peak.

Source: https://www.tradingview.com/symbols/ETHUSD

1. Tightening Macro Environment: Behind this correction, tightening macro liquidity and hawkish interest rate expectations are undeniable factors. In November, the Fed sent strong signals, cooling market expectations for a December rate cut and significantly reducing risk appetite. The crypto market’s boom in Q3 was largely driven by institutional capital chasing novelty—multiple Ethereum spot ETFs launched over summer, traditional investors rushed in, and several listed companies announced massive coin purchase plans, creating strong buying support. But in October, increasing macro uncertainty led risk-off capital to flow back into USD and U.S. Treasuries, rapidly drying up marginal liquidity for crypto markets.

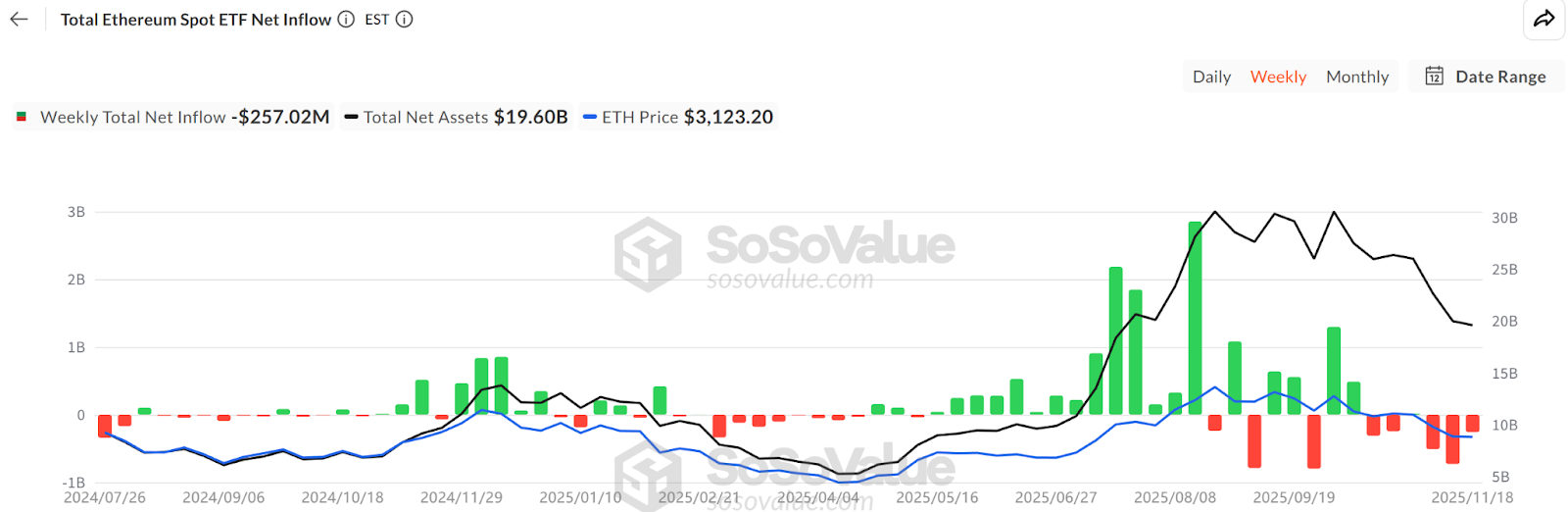

2. ETF Outflows: According to SoSoValue data, mid-November saw total holdings of Ethereum spot ETFs reach about 6.34 million ETH ($192.8 billion), representing 5.19% of ETH supply. However, fund flows have shifted from net inflows to net outflows this month, with withdrawals significantly exceeding new investments—single-day outflows reaching as high as $180 million. This stands in stark contrast to the steady daily accumulation seen in July–August. ETF investors typically adopt long-term allocations; consecutive days of net redemptions indicate weakening incremental demand for ETH via traditional finance channels. Their exit not only directly reduces buying pressure but may also amplify short-term volatility.

Source: https://sosovalue.com/assets/etf/us-eth-spot

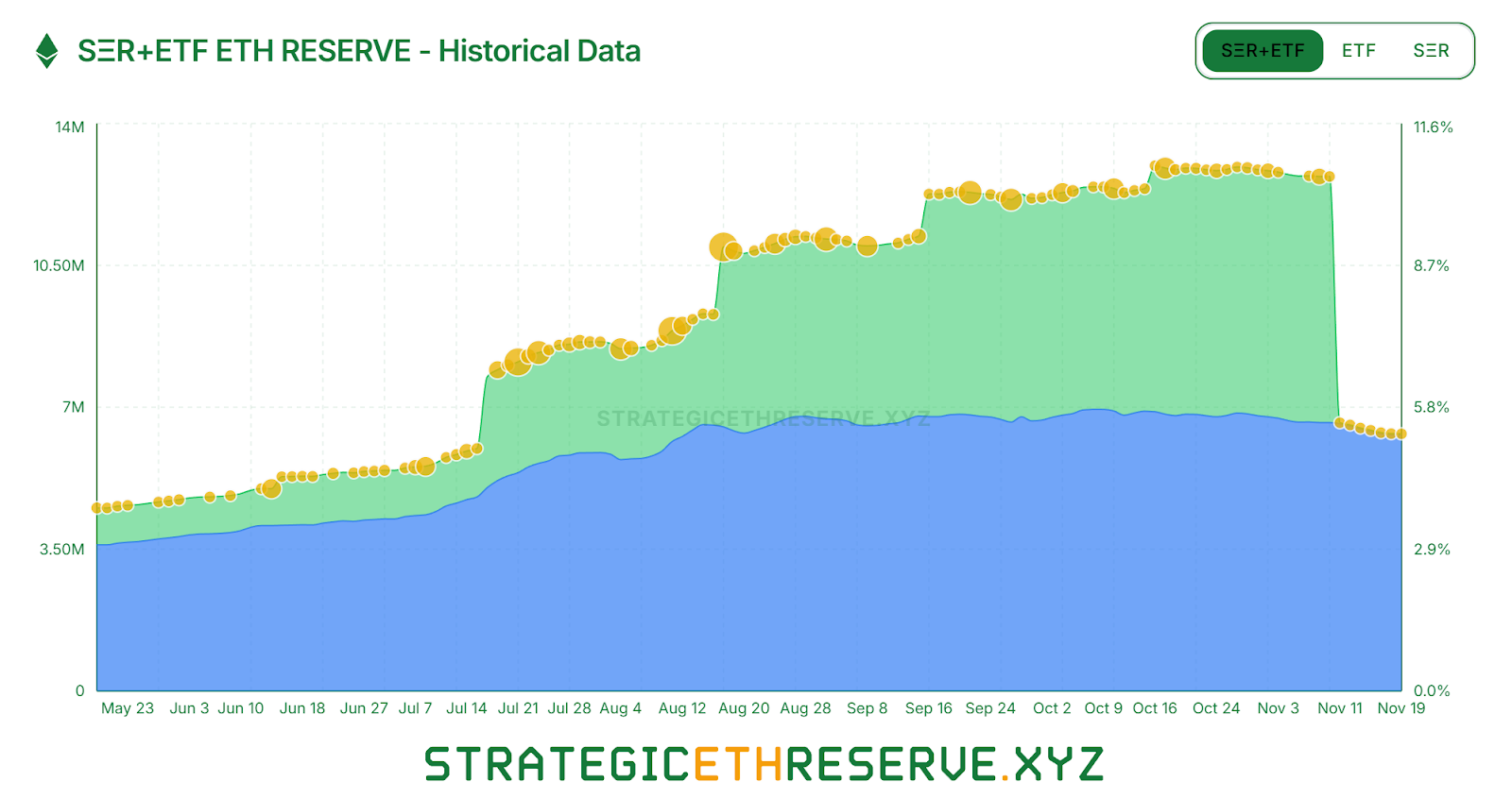

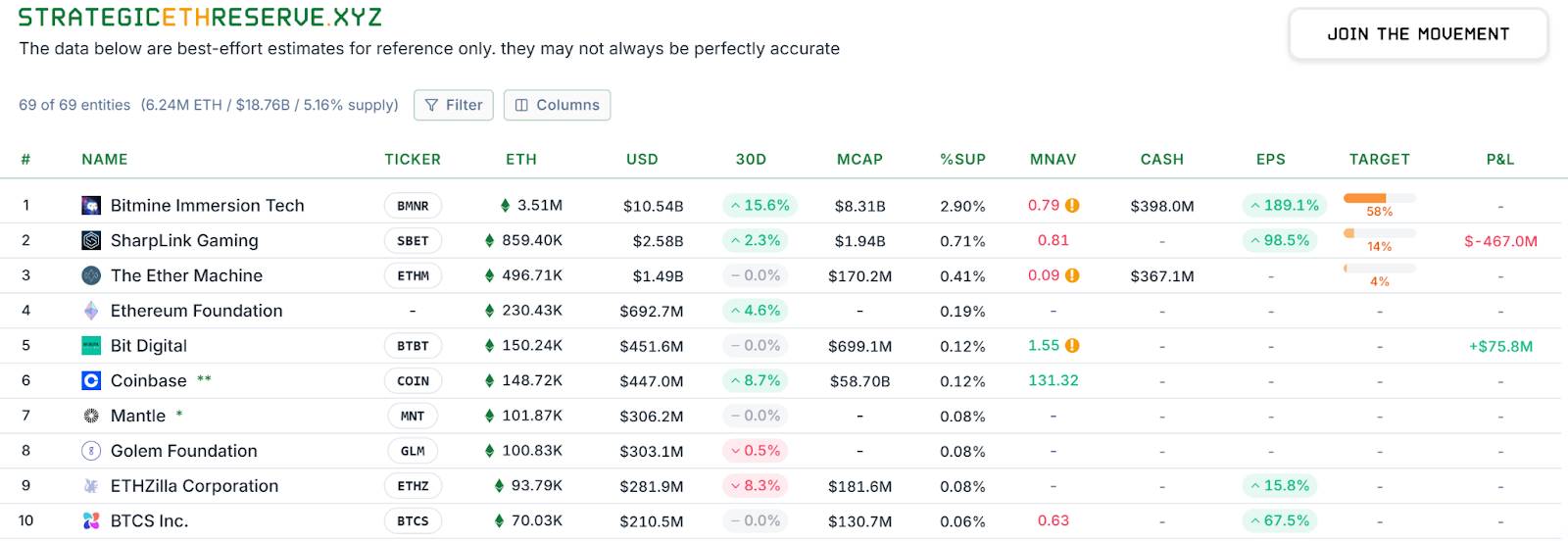

3. Shrinking DAT Company Accumulation: Divergence has emerged within the sector. By mid-November, overall DAT strategic reserves held approximately 6.24 million ETH, or 5.15% of supply, but accumulation pace has clearly slowed in recent months. Among large holders, BitMine has almost become the sole major buyer aggressively accumulating ETH—adding another 67,000 ETH just last week. Another leading firm, SharpLink, stopped buying after acquiring 19,300 ETH in mid-October, with its average cost at ~$3,609, now sitting at a floating loss. Smaller treasury firms have even been forced into survival mode: for example, "ETHZilla" sold about 40,000 ETH at the end of October to repurchase its own stock, aiming to narrow its share price discount. The treasury sector has shifted from uniform expansion to polarization: well-capitalized giants can still sustain purchases, while smaller players face liquidity constraints and debt pressures, forcing them to reduce positions and cut losses.

Source: https://www.strategicethreserve.xyz/

4. Leverage Unwinding and Selling Pressure: In secondary markets, rapid deleveraging further intensified ETH selling pressure. During the October crash, heavily leveraged large accounts such as the so-called "Big Brother Maji" were forcibly liquidated amid sustained long positions, spreading panic and undermining bullish confidence. According to Coinglass, ETH futures open interest has plunged nearly 50% from August highs, indicating fast-paced deleveraging—reflecting declining speculation and liquidity. Not only are leveraged bulls retreating, but even long-term hodlers are beginning to loosen their positions. Chain analytics firm Glassnode reported that long-term holders (holding >155 days) recently sold about 45,000 ETH per day (~$140 million), the highest level since 2021, signaling that some early adopters are taking profits at higher levels. These signs collectively show a clear weakening of bullish momentum within the market.

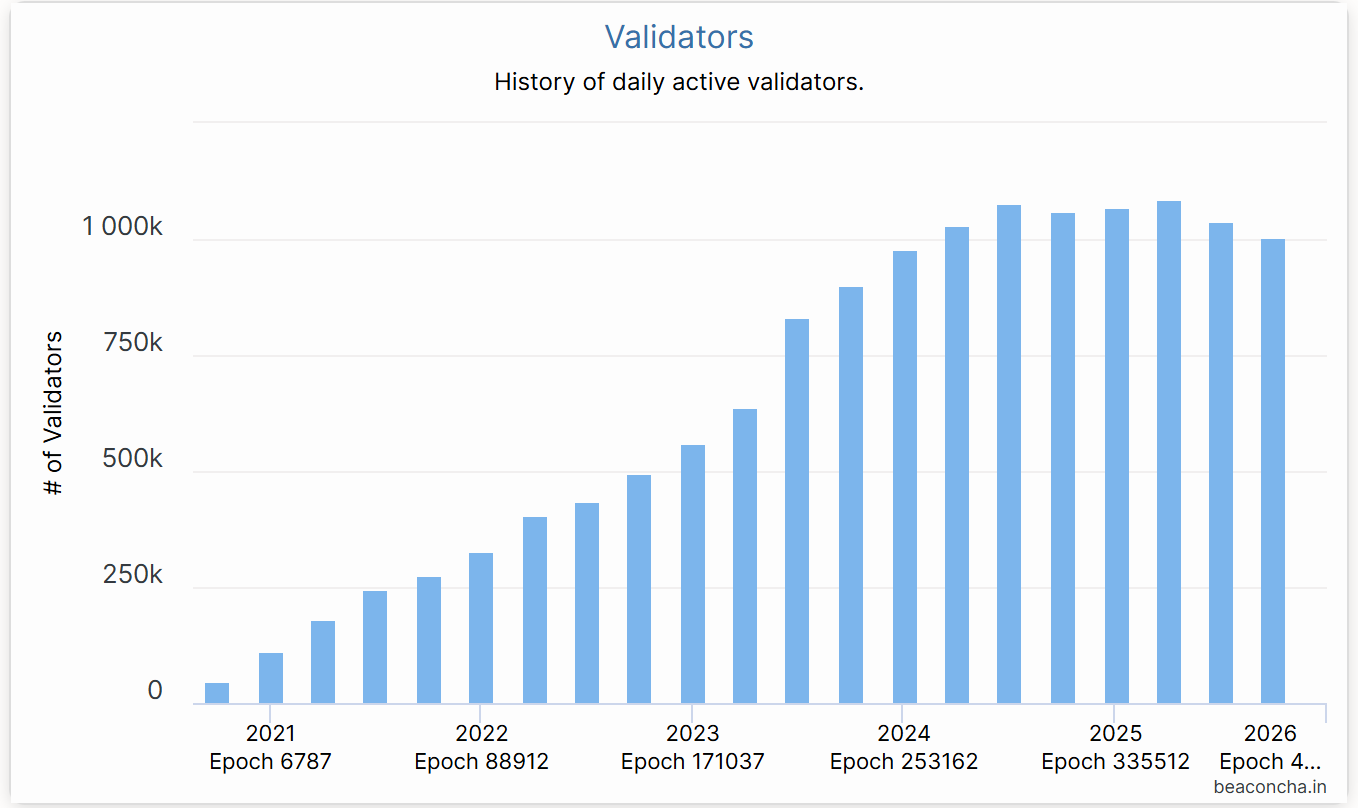

5. Decline in Ethereum Staking: Beacon Chain data shows that since July, the number of active Ethereum validators has dropped by about 10%—the first significant decline in validator size since the 2022 merge to PoS. One reason is that many node operators chose to exit staking and realize gains following ETH’s strong rally in the first half of the year, causing withdrawal queues to spike in late July, with daily ETH exits hitting record highs. Second, recent annual staking yields have dipped to around 2.9%, while on-chain lending rates have risen, squeezing arbitrage margins and weakening staking’s price support for ETH.

Source: https://beaconcha.in/

6. Stablecoin and DeFi Turmoil: Internal issues within Ethereum’s ecosystem were also exposed, further damaging investor confidence. On the day of the October 11 crash, USDe collapsed to $0.65 due to failure in its circular lending arbitrage mechanism. Though it quickly recovered close to $1, chain reactions followed. Then, decentralized stablecoins faced multiple risk events: xUSD issued by Stream protocol severely de-pegged after its underlying hedge fund imploded; shortly after, USDX, using a similar strategy, fell to $0.38 amid liquidity crisis, failing to redeem 1:1; another algorithmic stablecoin, deUSD, also broke its peg. These once-promising new stablecoins faltered under extreme conditions, exposing fragility and opacity risks in “delta-neutral” models. Their failures dealt heavy blows to DeFi. Starting mid-October, multiple lending and yield aggregation protocols reported bad debts and sharp TVL drops: Morpho had to delist a strategy after Elixir’s stablecoin pool lost all value, resulting in a ~3.6% asset shortfall; veteran lending protocol Compound faced bad debt pressure due to collapse of certain long-tail stablecoins, triggering near-liquidation crises. Balancer suffered a hacker attack at the end of October, losing over $100 million. These incidents triggered sustained outflows from DeFi. By early November, Ethereum’s on-chain TVL had dropped from a yearly high of $97.5 billion to ~$69.5 billion—erasing over $30 billion in assets in just over a month.

Source: https://defillama.com/chain/

Overall, over the past two months, Ethereum has undergone an inside-out "double whammy": external macro tightening combined with synchronized pressure on three key sources of demand (ETFs, treasuries, on-chain capital), while internally, the ecosystem faced turbulence in stablecoins and security. Amid growing skepticism, both Ethereum’s price and market cap have come under pressure.

3. Bearish Factors: Macro Headwinds and Hidden Risks

Undeniably, the current bearish clouds hanging over Ethereum could continue pressuring ETH prices and ecosystem development in the near-to-medium term.

1. Macro Tightening and Capital Drain

The biggest current headwind stems from the macro environment. Major central banks remain cautious on rates amid unresolved inflation, dashing December rate-cut hopes and fueling risk aversion. The very forces that drove ETH upward in the first half of the year—ETF subscriptions, DAT buying, leveraged on-chain positions—are now potential sources of selling pressure. If the macro backdrop remains cold over the next six months, more institutions might indirectly reduce ETH exposure by redeeming ETFs or selling treasury company shares, leading to sustained capital outflows. Moreover, the treasury model itself carries inherent fragility: companies like BitMine currently trade at steep discounts, weakening shareholder confidence. Should financing chains break or solvency issues arise, forced ETH sales pose real risks. In short, until global liquidity turns, Ethereum will likely remain under financial headwinds.

2. Competition and Fragmentation

Other public chains such as Solana and BSC have diverted speculative capital to some extent. Additionally, the rise of cross-chain protocols and app-specific chains like Plasma, Stable, and Arc has weakened Ethereum’s appeal to developers and users. With modular blockchain concepts gaining traction, some projects are building sovereign rollups independent of Ethereum’s security. Within Layer2 itself, intense competition exists among rollups: Arbitrum and Optimism offer aggressive incentives or airdrops to capture users and traffic, potentially sparking an "L2 war." Yet L2 success doesn’t directly translate to ETH price gains—instead, it might dilute value. For instance, if certain L2s issue native tokens for fee payments, long-term demand for ETH as gas could be affected. That said, ETH remains the primary settlement asset today, so competitive impacts are limited short-term, but worth monitoring long-term.

3. Regulatory and Policy Uncertainty

Regulatory risks remain a sword of Damocles. While SEC Chair Gary Gensler stated Ethereum should not be classified as a security, any future regulatory shift could challenge Ethereum’s compliance status, dampening institutional engagement. Furthermore, global discussions on DeFi regulation are underway, potentially imposing stricter limits—or outright bans—on features like decentralized stablecoins and anonymous transactions. Such policy shifts could hinder Ethereum’s ecosystem growth. For example, if countries ban banks from staking or restrict retail access to crypto, potential capital inflows would shrink. Similarly, Europe’s MiCA regulations impose requirements on stablecoin issuance and DeFi services, raising compliance costs for Ethereum-based projects.

4. Internal Risks and Trust Rebuilding

After these shocks, restoring trust within Ethereum’s ecosystem will take time. First, repeated stablecoin de-pegging events have left DeFi users wary of high-yield products. Risk aversion is rising across the market, conservative strategies dominate, and users increasingly favor centralized platforms or mainstream stablecoins like USDT/USDC—leaving many innovative Ethereum protocols starved of liquidity and growth. Second, frequent security incidents (e.g., hacks, bugs) raise concerns about application-layer safety. Each major attack or collapse often triggers user sell-offs or withdrawals from related protocols. Going forward, risk governance will likely become a community priority, with projects strengthening reserves and insurance to rebuild trust. However, once bearish psychology sets in, investors usually need stronger positive stimuli—such as price stabilization, breakout rallies, or breakthrough applications—to re-enter.

In sum, Ethereum is currently in a grinding phase marked by internal and external challenges. Waning macro liquidity, industry competition, regulatory pressure, and internal ecosystem issues may continue suppressing ETH performance in the short term. Resolving these negatives requires time and sufficient bullish catalysts. During this process, the market may endure further pain and volatility.

4. Bullish Factors: Upgrade Momentum and Fundamental Support

Despite recent turmoil, Ethereum’s foundational strength as the largest public chain ecosystem remains intact, demonstrating resilience in network effects, technical infrastructure, and value consensus over the long term.

1. Network Effects and Ecosystem Resilience

- Active Development and Innovation: Ethereum continues to lead in active developer count and project volume, with constant emergence of new apps and standards. During DevConnect, key developments drew attention: Vitalik reaffirmed Ethereum’s principles of “trustless neutrality and self-custody”; account abstraction and privacy protection became focal topics.

- Layer2 Ecosystem Still Emerging: Despite recent TVL setbacks, second-layer networks like Arbitrum, Optimism, and Base maintain relatively high user activity and transaction volumes, showing that on-chain demand persists in low-cost environments. After the Fusaka upgrade, lower data publishing costs will make Rollup economics more sustainable, attracting more users and projects to deploy on Ethereum L2s—ultimately feeding value back to the mainnet.

- Ethereum’s Security and Decentralization: Total staked ETH exceeds 35 million—over 20% of supply—providing robust PoS security. Even with a slight drop in validators, new institutional node operators are filling the gap. More traditional institutions are expected to hold and stake ETH for stable returns, creating a lasting capital reservoir for Ethereum.

- Fee Burning Keeps ETH Deflationary: EIP-1559 fee burning maintains deflationary dynamics, potentially amplifying ETH’s price elasticity and giving it characteristics akin to a “digital inflation hedge.”

Clearly, Ethereum’s powerful network effects (developers + users + capital) and maturing economic model form the core rationale behind long-term investor confidence.

2. Major Upgrades and Improvements

- Fusaka Upgrade: Scaling and Cost Reduction: The Fusaka upgrade is considered Ethereum’s boldest scaling effort to date. Scheduled to activate on mainnet on December 4, its highlight is PeerDAS (Peer Data Availability Sampling)—a technique where each node stores only ~1/8 of transaction data, with the rest verified via random sampling and reconstruction. This dramatically reduces storage and bandwidth demands per node. Consequently, Ethereum blocks could carry up to 8x more data blobs, slashing data submission costs for L2 Rollups. In short, Fusaka will expand capacity and lower gas fees, directly benefiting Layer2 networks like Arbitrum and Optimism—and their users.

- Other Key Enhancements: Beyond PeerDAS, the upgrade includes several improvements: blob economic model adjustments, anti-DoS hardening to limit extreme transactions and block sizes, and new tools for users and developers; EIP-7951 natively supports P-256 elliptic curve signatures, improving compatibility with hardware wallets and mobile devices; CLZ instruction optimizations improve contract algorithms.

If executed smoothly, Fusaka could become another milestone after the 2022 Merge and 2023 Shanghai upgrade—bringing Ethereum closer to its vision of becoming a global settlement layer and laying technical groundwork for the next growth cycle.

3. New Application Trends and Value Consensus

- Rising On-Chain Utility: As Ethereum improves performance and lowers fees, previously promising but cost-prohibitive applications may regain momentum. Blockchain gaming, social networks, and supply chain finance—platforms requiring frequent microtransactions—will be more inclined to adopt upgraded Ethereum or its L2s as foundational layers.

- Ongoing DeFi Innovation: Protocols like Sky (formerly MakerDAO) are aggressively integrating compliant assets—expanding into stablecoin lending, treasury investments, and inter-protocol settlements through sub-projects Spark, Grove, and Keel. Leading DEX Uniswap recently passed a community vote to enable protocol fees, charging 0.15% on select pools to build its treasury. This marks DeFi protocols exploring sustainable revenue models, empowering governance tokens, and indirectly revitalizing Ethereum’s network vitality. Meanwhile, Aave plans to launch V4 with cross-chain functionality and refined risk controls. Once market conditions improve, more advanced and secure DeFi 2.0 systems could attract a new wave of user return.

- Growing Recognition and Clearer Policies: Gradual approval of U.S. ETFs, Hong Kong opening retail trading, and strong stablecoin demand in emerging markets all provide growth opportunities for Ethereum. Particularly in high-inflation countries (e.g., Argentina, Turkey), stablecoins and payment apps on Ethereum are becoming vital tools for inflation hedging and cross-border remittances—demonstrating real-world utility and gradually strengthening global value consensus around ETH.

In summary, despite short-term setbacks, Ethereum’s long-term fundamental support remains solid, and its core position in the global blockchain landscape remains unshaken. These bullish factors won’t instantly reverse market trends, but like seeds beneath snow, they could rapidly sprout when conditions turn favorable.

5. Outlook and Conclusion

Based on the above analysis, we offer the following outlook on Ethereum’s future trajectory:

Short Term (before year-end): Ethereum is likely to remain in a weak consolidation phase, showing signs of range-bound bottoming, but without significant rebounds. The Fusaka upgrade, though a positive development, is already priced in and unlikely to single-handedly reverse the downtrend. However, given ETH’s rapid drop of over 30% from its peak—technically oversold—and rising profit-taking pressure among shorts—the room for further downside is relatively limited. Assuming no new major macro shocks (e.g., surprise rate hikes), investor sentiment may slightly recover, allowing ETH to slowly climb toward $3,500 by year-end for consolidation. Note that year-end liquidity tends to tighten, so any rebound lacking strong volume support may struggle to break $3,500—a key resistance level.

Medium Term (through 2024 to first half of 2025): We expect Ethereum to undergo a prolonged consolidation phase in early 2024, gradually strengthening from the second half onward. Specifically, ETH may continue to fluctuate in Q1 2025, with tax-loss harvesting and institutional rebalancing around earnings season possibly disturbing the market in January. However, conditions may shift around mid-year: if falling inflation prompts Fed rate cuts and marginal improvement in global liquidity, risk assets including ETH could rebound. Combined with improved risk appetite post-U.S. midterm elections, ETH may enter a new uptrend, rising to the $4,500–$5,000 range.

Long Term (end of 2025 and beyond): Looking further ahead, Ethereum remains well-positioned to hit new highs in the next full bull cycle, cementing its role as a “global value settlement layer.” From late 2025 to 2026, if macro conditions are favorable and blockchain adoption scales broadly, ETH could target the $6,000–$8,000 range. This projection rests on several pillars: First, following Fusaka, continued upgrades like Verkle trees, PBS proposals, and full sharding will keep enhancing performance and lowering costs. These technological dividends will attract vast new applications and users, providing solid value support. Second, Ethereum’s network effect accelerates like a snowball: more users attract more developers, which brings more assets and apps, reinforcing the cycle. Long-term, Ethereum could become the foundational network supporting trillions of dollars in economic activity, making future demand for ETH (for gas, collateral, and value storage) far exceed today’s levels. Moreover, ETH’s nature as a productive asset (earn yield via staking) holds unique appeal for institutions. Once regulatory frameworks mature, large pension funds and sovereign wealth funds allocating to ETH could become commonplace—just as they do with real estate and equities today—bringing massive new capital inflows and elevating ETH to a higher valuation center.

Conclusion: As a cornerstone of the crypto world, Ethereum has weathered multiple bull and bear cycles, each time emerging stronger amid skepticism. The battle between bullish and bearish forces will eventually resolve, and time will side with technology and intrinsic value. After completing its self-renewal and enduring market trials, a more robust Ethereum may once again stand at the center of the stage in the coming years, writing a new chapter of brilliance.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, transforms professional analysis into practical tools for your investment journey. Through our “Weekly Insights” and “Deep Dive Reports,” we unpack market dynamics. Our exclusive series “Top Pick Coins” (powered by AI + expert screening) helps you identify promising assets and reduce trial-and-error costs. Every week, our analysts engage with you live, explaining hot topics and forecasting trends. We believe that warm, consistent support paired with expert guidance empowers more investors to navigate market cycles and seize Web3’s value opportunities.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate strictly within a sound risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News