Single Point of Failure: It's Time for MM to Step Away from the Center

TechFlow Selected TechFlow Selected

Single Point of Failure: It's Time for MM to Step Away from the Center

Vault, YBS (yield-generating stablecoin), and Curator are still evolving. The market is more resilient than we imagined. If you're still viewing the market through the lens of a month ago—or even a week ago—you'll fail to understand it.

Original author: Zuo Ye Wai Bo Shan

Network effects extend beyond the internet.

Water and power grids possess strong exclusivity, making them ideal for monopolistic collective operations that can either benefit or harm society as a whole. However, human social networks are inherently distributed and decentralized— even the most socially extroverted individuals struggle to know everyone.

Is crypto ultimately a network of capital, or a space for human interaction?

Satoshi clearly believed in the latter. Starting with peer-to-peer transactions, the history of the crypto industry has been one of embracing capital connections while reducing direct human interactions as funds grow and expand.

The only reasonable question is: how dense can this capital network become before it collapses?

01 Why the Market Is Recovering

Many remain trapped in the aftermath of the October 11 and November 3 crashes, wondering when synthetic stablecoins, Vaults, and yield products will recover. Yet new models like Hyperliquid’s BLP and HIP-3 are emerging rapidly, and Framework’s planned stablecoin YC is launching on Sky.

Aave has unexpectedly launched V4 along with a mobile wealth management app.

In absolute terms, the market is indeed in a recovery phase. But subjectively, projects appear to be innovating by tightly following historical trends.

In other words, market cycles have decoupled from retail activity—a phenomenon not uncommon. The fundamentals of the U.S. economy bear little relation to real-sector industries; all Trump cares about is rate cuts and stock prices. Americans and industrial players are merely components within the game.

In this cycle, believing in Bitcoin’s four-year cycle means remaining stuck in 2017—a time machine. Like Cloudflare’s flash crash, crypto infrastructure is constantly evolving.

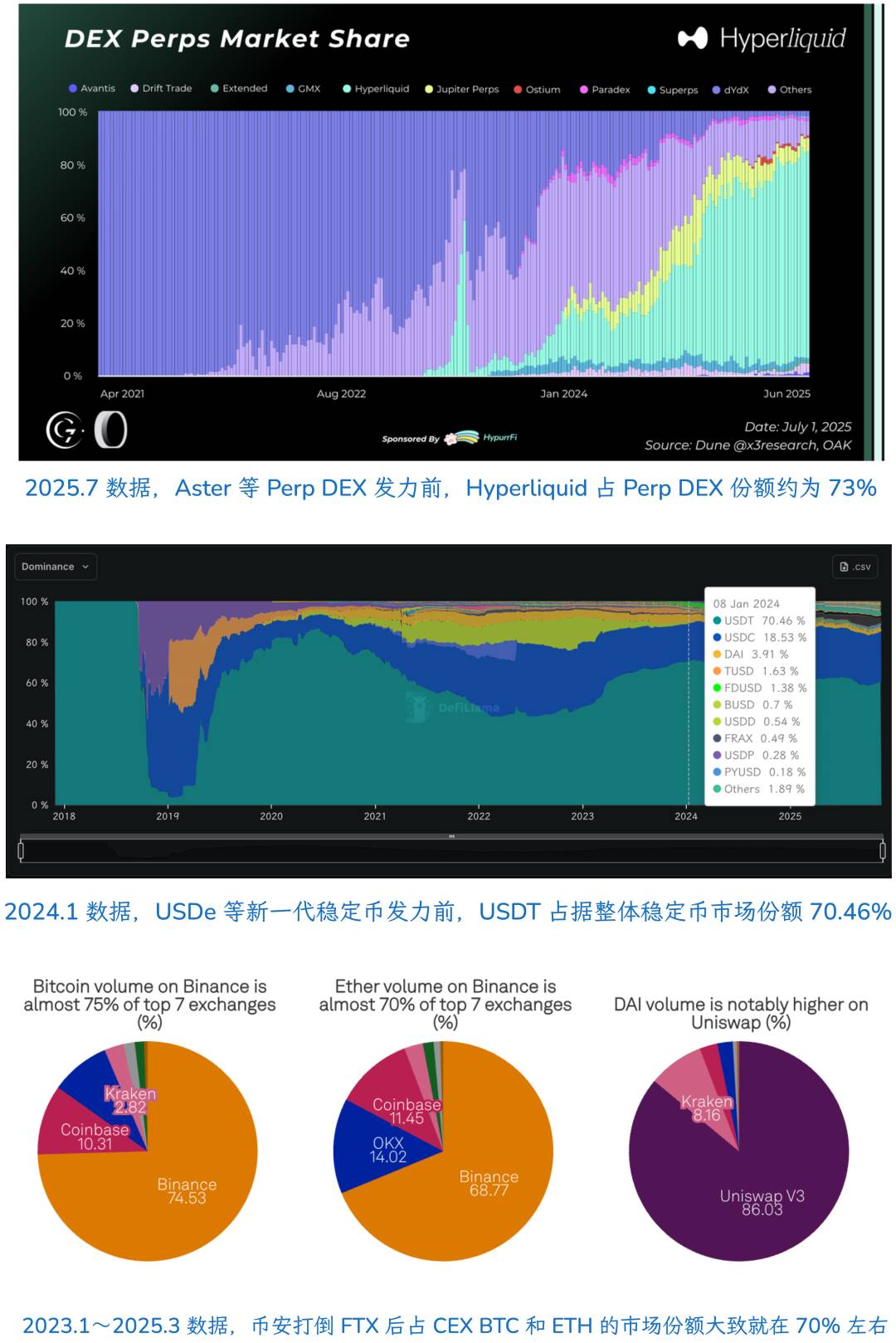

DEXs represented by Hyperliquid are truly capturing CEX market share, especially by integrating with Memes to transform token valuation, pricing, and distribution systems. The decline of CEXs is visibly underway—Kraken now valued at just $20 billion—with many CEXs pivoting to support their own DEXs.

When high FDVs disrupted Binance's pricing system in 2024, VC was already dead. Then came the era of market makers: Perp DEXs like Hyperliquid are backed by market makers, as are numerous YBS projects.

SBF came from Jane Street, Jeff from Hudson River Trading, and Variational’s founder from DCG’s market-making division.

Even during the October 11 ADL liquidations, market makers were hit first. With both risk and reward intertwined, a market structure dominated by market makers proves faster but more rigid than one led by CEXs.

Web3Port aggressively dumps tokens to manipulate prices, DWF repeatedly squeezes and manipulates markets, and even Hyperliquid’s HLP faces similar accusations. Whether centralized market makers or decentralized treasuries, any participant in the market-making system cannot escape suspicion of market manipulation.

If we label the current market structure as “recovery,” then the fact that market makers have suffered heavy losses—and thus lost their ability to manipulate—has paradoxically led to greater market stability.

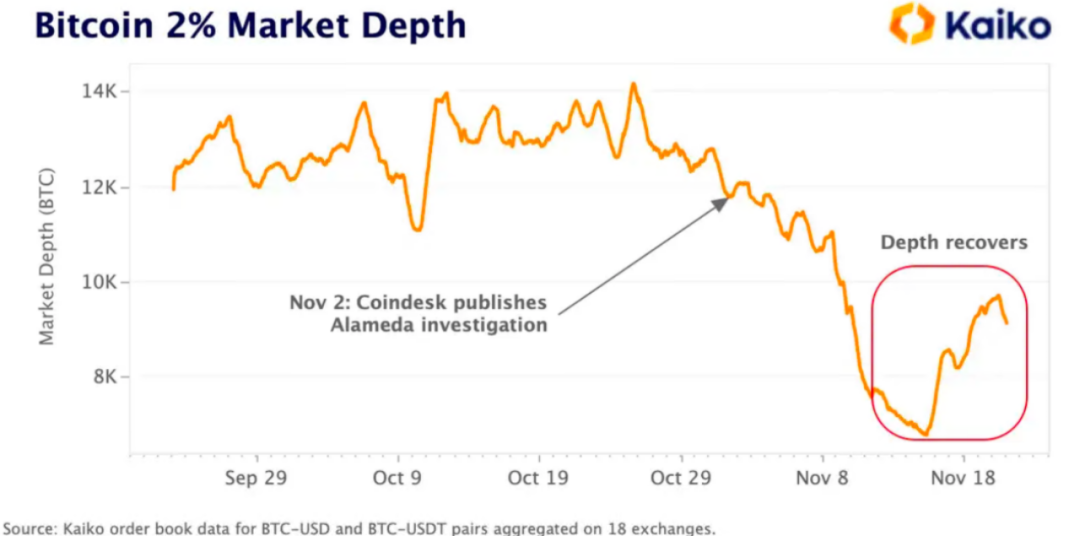

This isn’t unusual. Before FTX collapsed in 2022, rumors circulated that Alameda once held 20% of BTC market-making volume. In SBF & FTX’s biography *Going Infinite*, SBF admitted they were among the first professional firms to aggressively engage in market making.

Image caption: BTC liquidity plummets

Image source: @KaikoData

From a market maker’s perspective, the October 11 flash crash was purely a technical crisis—or rather, the preceding trading liquidity was a technical golden age: no retail traders were involved, only market makers buying and selling among themselves.

Image caption: Liquidity drops sharply on October 11

Image source: @coinwatchdotco

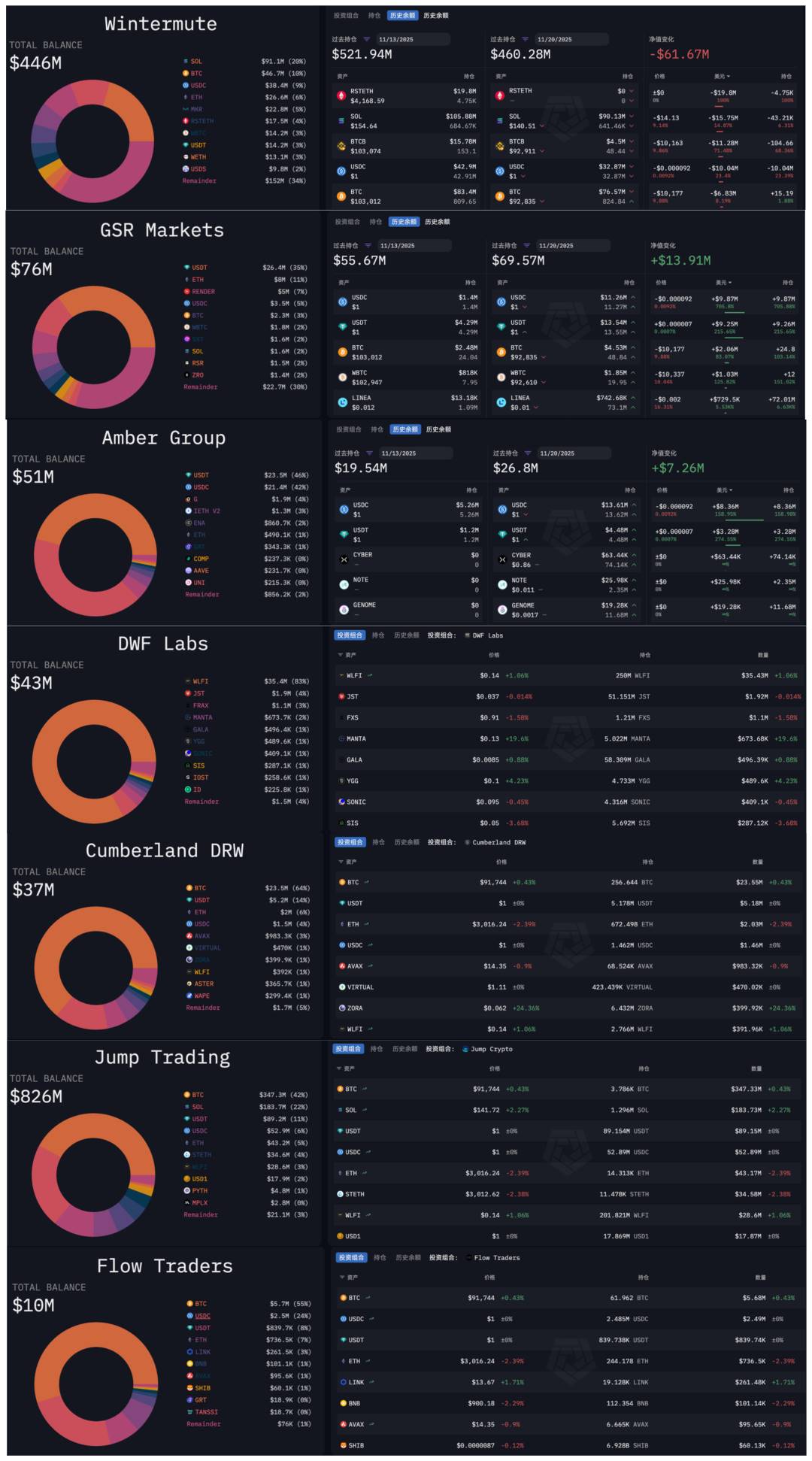

The existence of market makers isn't the problem itself. But for altcoins or newly launched TGE tokens, it means massive sell pressure. Airdrop hunters, bounty farmers, even VCs and project teams themselves, will firmly offload holdings to market makers to lock in profits.

Market makers face a dilemma: if they don’t manipulate the market, they must absorb all the junk coins; otherwise, they become lich kings, maximizing market volatility to earn profits for themselves—and occasionally allowing others to profit too.

Image caption: Holdings of major market makers

Image source: @arkham

This analysis has a major flaw: we can observe market makers’ portfolio composition and changes, but it's difficult to precisely analyze how they manipulate prices within CEXs. Data from DEXs like Hyperliquid is relatively transparent, leaving room for future analysis.

In summary, the market isn't rebounding—it's that market makers have been severely damaged, coupled with consecutive blowups of YBS projects, rendering them unable to manipulate. What we're seeing now is the operation of genuine price mechanisms.

No recovery—just honesty.

02 The 70% Law of Natural Monopoly

Within various crypto sectors, certain products have begun exhibiting characteristics of "natural monopoly." For example, EVM. By contrast, using the Bitcoin network as infrastructure has largely failed—everyone wants BTC, but no one wants to conduct P2P transactions.

Aside from die-hard supporters like Jack Dorsey who insist on using Bitcoin as a stablecoin chain, the dream of BTCFi has proven both vivid and disastrous. It's healthier for the entire industry to stop fantasizing about it.

Beyond EVM, only Binance and USDT approach the concept of "monopoly" as super products. Note that this doesn’t conflict with DEXs challenging CEXs, or innovations from USDC/USDe/YBS/Curator disrupting the space.

Super product ≠ sector

In other words, Binance and USDT are actively working against entropy. Ethereum, despite repeated self-inflicted wounds (Infinite Garden, L2 scaling → L1 scaling), and even its recent pivot toward privacy and AI, still leaves EVM as the dominant choice.

Yet the market share of Binance and USDT, and even Hyperliquid in the Perp DEX space, peaks around 70%, after which further market actions are needed to consolidate their positions.

Image caption: Market share under stable market structure

Image source: @GLC_Research @defillama @SPGlobal

Empirically speaking, under a stable market structure, the leading project typically captures about 70% of the sector’s market share. However, market conditions change over time, and currently Hyperliquid, USDT, and Binance have all dropped below 50% share.

Of course, EVM remains absolutely dominant across the broader VM landscape, with only SVM or Move VM as minor competitors—indicating a hyper-stable structure.

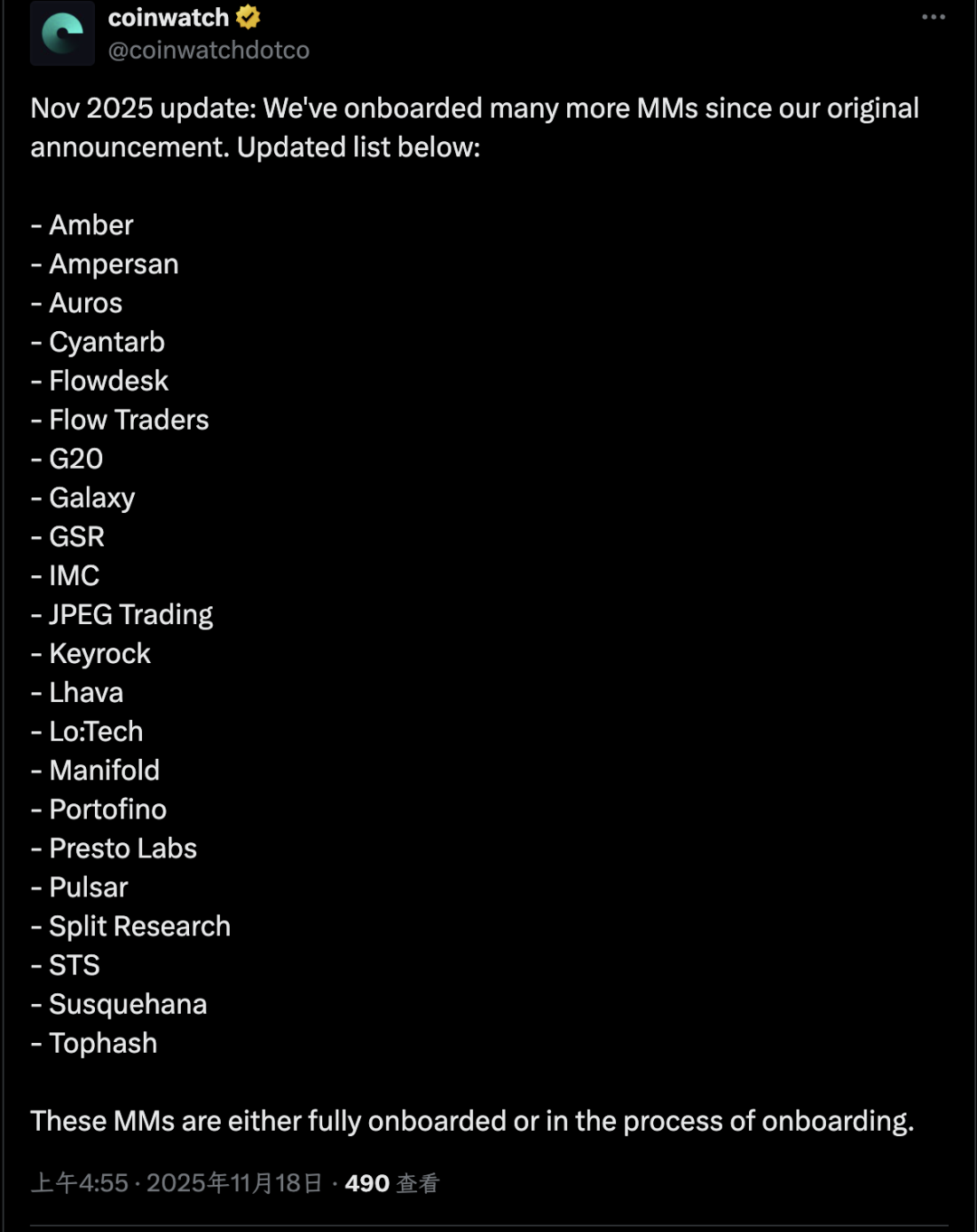

Image caption: Major market makers

Image source: @coinwatchdotco

Re-examining market makers from this angle: we know there are at most around 20 dominant market makers, and prior to October 11 they held dominant positions—but they never achieved natural monopoly status. Even if forcibly maintained, their dominance is now waning.

So how will the next stage of market structure evolve?

03 Transition Underway

-

If you walk the traditional finance path, your valuation will be constrained by traditional financial models

-

If you follow the fintech internet company path, your valuation will be limited by internet-scale metrics

-

To become a $5 trillion player like AI, you must forge a valuation model unique to crypto—not defined by any existing industry

Recently, the market feels strange. Solana, once a pioneer in RWA and institutional adoption, suddenly has its foundation chair Lily Liu calling to revive cypherpunk dreams. Combined with Ethereum’s return to L1 scaling and the previously mentioned focus on privacy—from Zcash to boundless applications—the narrative is shifting.

Crypto appears to be rediscovering its own technical logic and valuation framework—one increasingly independent from market makers. Even institutional involvement now means “crypto projects using institutional capital for DeFi,” rather than “selling DeFi to institutions.”

In one sentence: eliminate MM internally, break free from institutions externally.

Even OGs must adapt to the new era. DAT, co-signed by Li Lin and Xiao Feng, died before launch—following the collapse of Chinese VCs, the influence of big-name OGs is also fading into history.

Crypto is reclaiming its original dreams—at the cost of shedding parasitic systems.

Looking at mature markets like the U.S., A16Z is part of the capital market ecosystem, but Chinese VCs are not. Only governments, SOEs (state-owned capital groups), and internet companies (previously) had real money.

Mapping this onto the position of Chinese VCs in Web3: they lack the capacity to participate in market pricing and distribution. Market makers and CEXs once filled that role, but since October 11, the trend toward on-chain evolution has become increasingly clear.

On-chain ≠ decentralized.

Take Hyperliquid as a typical example: it’s transparent on-chain, yet neither physically node-distributed nor economically decentralized in token design.

Even state-owned enterprise reforms in reality aren’t simply about selling old assets for new ones—they involve investing in new industries to obtain tickets to a new world.

From this perspective, market makers share a key similarity with Memes: liquidity without values. They profit immensely through extreme nihilistic PvP, yet cannot serve as the industry’s dominant force.

Dreams and long-term technological commitment—Vitalik does too much, MM too little. A more balanced approach is needed.

Conclusion

At its core, this article was written for myself. Theoretically, the market should have stagnated after October 11 and November 3. Yet declining TVL hasn’t stopped DeFi innovation and self-repair—something I couldn’t understand for a long time.

Vaults, YBS (yield-bearing stablecoins), and Curators are still evolving. The market is more resilient than we imagine. If you still view it through mindsets from a month—or even a week—ago, you’ll fail to comprehend what’s happening.

In the post-MM-dominated era, the balance between crypto values and product profitability will redefine valuation logic.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News