Market Making or Market Manipulation? Decrypting the "Secret Dealings" Between Project Teams and Market Makers

TechFlow Selected TechFlow Selected

Market Making or Market Manipulation? Decrypting the "Secret Dealings" Between Project Teams and Market Makers

This article will introduce the specific mechanisms of token market makers and potential violations based on recent Arbitrum events.

Written by: Alex

Compiled by: TechFlow

Today’s digital asset market has evolved into a massive global industry, attracting an increasing number of investors and institutions. However, as the market expands and participation grows, market stability and fairness have become increasingly important issues.

Therefore, drawing from the recent Arbitrum incident, the author explains the specific mechanisms of token market makers (MM) and potential violations, while also sharing personal views on the need for greater disclosure within this sector.

Why do crypto projects today use market makers (MM)?

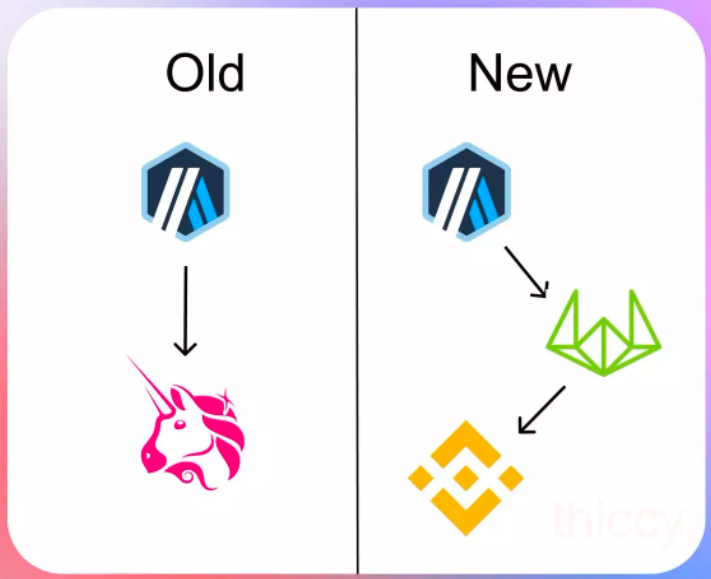

In the past, projects typically incentivized liquidity by providing tokens to on-chain pools. Today, they offer incentives to sophisticated market makers to provide liquidity on centralized exchanges (CEX).

This shift aims to improve price discovery efficiency and reduce costs for all participants.

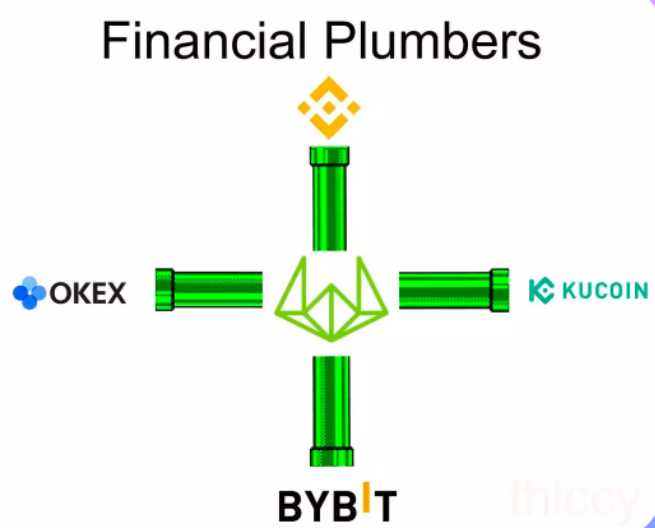

On CEXs, larger liquidity leads to more effective price discovery. Moreover, market makers can offer better bid and ask prices for buyers and sellers, making the market more attractive.

How do crypto projects incentivize market makers?

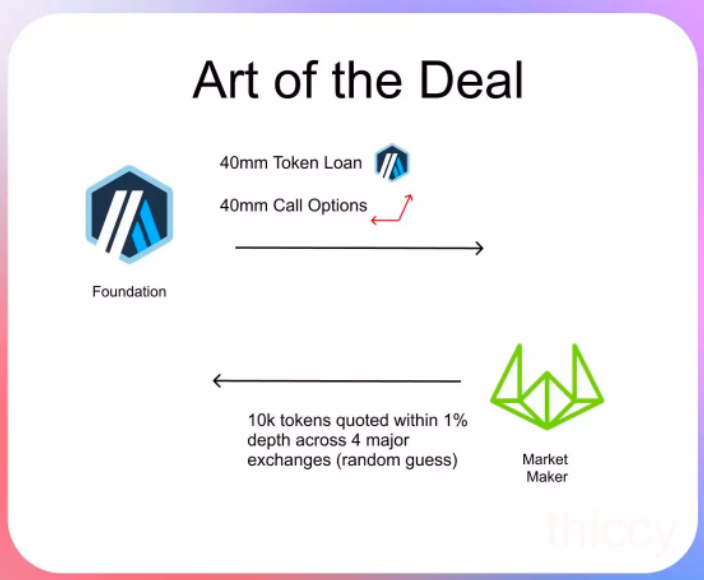

Typically, projects provide market makers with one-year token loans that include zero-cost call options. Specifically, projects lend tokens to market makers (usually 3–5), requiring them during the loan period to maintain certain market size and spread commitments.

Why do projects lend tokens to market makers?

Market makers require token loans to ensure sufficient inventory in their operations to meet potential surges in buying demand.

Additionally, market makers must execute efficient borrowing to hedge against excessive buy-side pressure when necessary.

Token loans usually carry zero or very low interest rates. While market makers need tokens to provide liquidity, they prefer not to bear significant borrowing costs.

Thus, token loans are a common incentive mechanism—they supply market makers with essential tokens to support market liquidity while reducing their cost burden.

Why grant call options to market makers?

Market makers incur costs when providing liquidity services. Projects often choose to compensate these costs using tokens rather than cash, as tokens are more liquid and operationally flexible.

However, to prevent market makers from immediately dumping tokens—which could harm market prices and investor interests—projects typically grant call options to align incentives. If the token price rises, market makers profit more, and the project benefits from the token's appreciation as well.

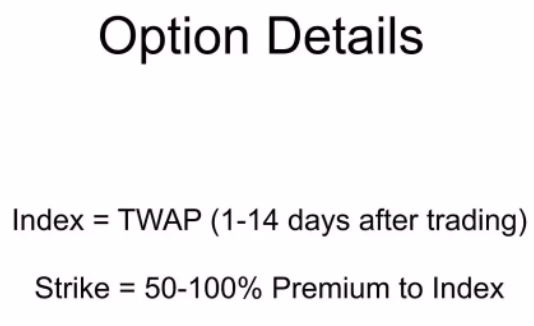

If a token hasn’t started trading yet, how is the strike price of a call option determined?

In such cases, projects typically set the call option strike price at a 50%–100% premium over the index price. Since the index price can usually be determined on-chain or via other markets, the strike price does not need to be known at the time of agreement.

This method of setting strike prices offers flexibility for both market makers and projects, helping to mitigate transaction risks. If the token price exceeds the strike price, market makers earn spread profits; if it falls below, they may simply let the option expire unexercised.

The mechanisms around token market making are not inherently malicious. The issue lies in the fact that these arrangements are often not disclosed to retail investors.

As a result, open-market participants feel disadvantaged. They may lack access to critical information about token pricing and liquidity, potentially suffering losses in trades. If projects or market makers clearly communicated such information, markets could become more transparent and fair, reducing investor losses and enhancing participant confidence.

Let’s examine the recent Arbitrum incident.

-

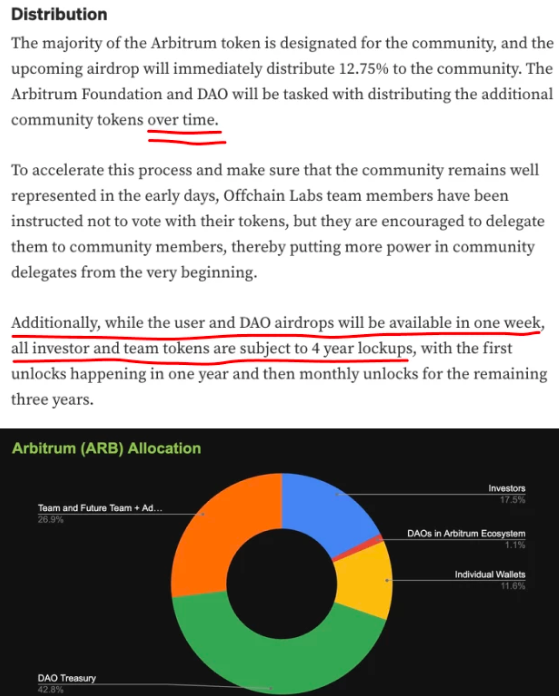

The documentation did not disclose the terms and conditions of market maker agreements, making it difficult for investors to understand market maker activities and their potential impact.

-

More importantly, the documents did not clarify whether Wintermute (the market maker) was also an investor in Arbitrum, raising concerns about conflicts of interest and moral hazard.

Retail investors based their investment decisions on the assumption stated in the documents—that only 1.275 billion tokens were available in the secondary market. But this wasn’t accurate, leading to unexpected outcomes.

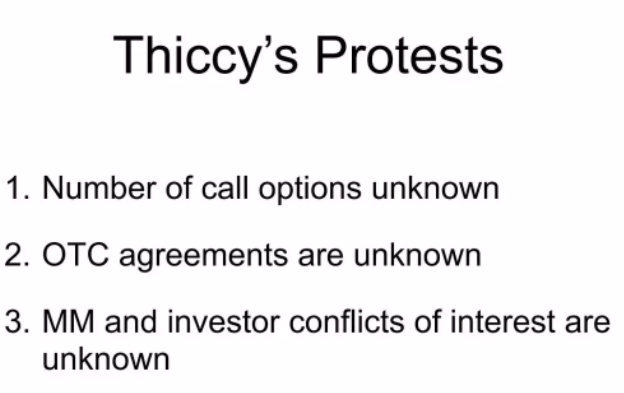

1. Unknown quantity of call options

These call options effectively increase the circulating supply of tokens, thereby affecting token price and liquidity.

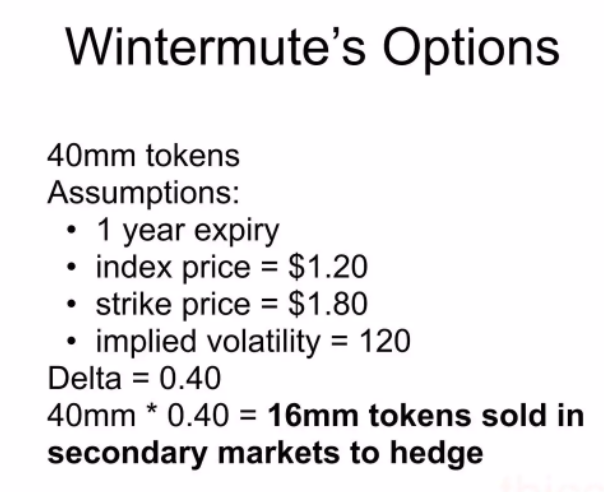

To remain market-neutral, market makers must hedge the delta of their call options by selling tokens. In doing so, they sold large quantities of tokens, effectively increasing supply—yet this data was not promptly disclosed to investors.

It is reported that Wintermute’s hedging transactions alone added at least 16 million tokens to the secondary market—one of the factors contributing to unstable token supply and price volatility.

2. Unknown OTC transaction terms

Another concern is that the foundation conducted an over-the-counter (OTC) transaction with Wintermute (the market maker), selling $10 million worth of tokens.

Yet these transactions were not disclosed to retail investors prior to execution. In fact, investors only learned about them after the trades were completed.

Moreover, the original documents did not indicate whether the foundation had the right to sell tokens within such a short timeframe.

3. Unclear distinction between investors and market makers

In the Arbitrum case, it remains unclear whether Wintermute (the market maker) was also an investor in the project.

For retail investors especially, understanding the relationship between investors and market makers is crucial. They should clearly know the role and profit sources of market makers in the market to properly assess risks and opportunities.

Here is a well-known Alameda strategy:

Retail investors were hit twice in this incident: first, they were forced to absorb additional token supply without prior notice.

Then, Arbitrum attempted a stealthy fake decentralization plan, which was eventually exposed, causing the token price to drop.

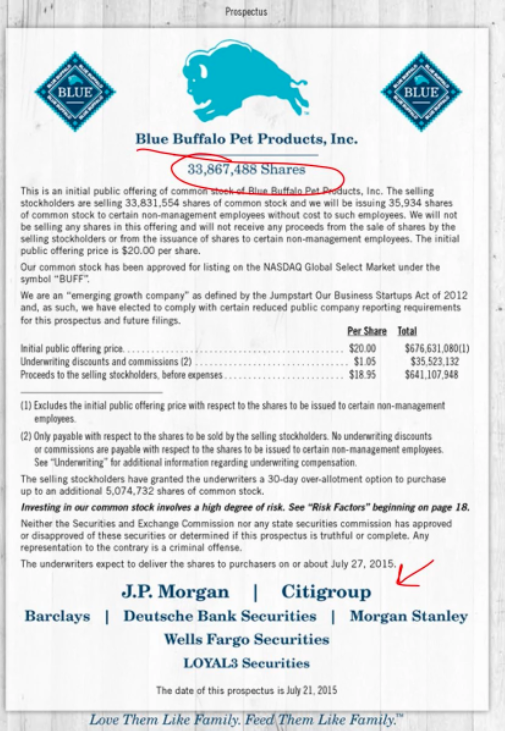

There’s a reason TradFi IPOs require prospectuses to explicitly outline the following:

-

Number of shares issued;

-

Initial public offering price;

-

Underwriters involved in the transaction;

-

Profits and commissions received by underwriters.

This information is vital for investors, as it provides comprehensive and transparent details about the company and its stock, enabling informed investment decisions.

Of course, another reason is the existence of insider trading laws. Participants holding large amounts of tokens or possessing material non-public information are required to publicly disclose their secondary market activities. This helps protect market fairness and transparency.

Yet in the cryptocurrency market, non-compliant actions sometimes occur—such as dumping large volumes of tokens onto the market. These actions often negatively impact the market and harm investors, which is unacceptable.

Transparency and fairness are critical for the development of token markets. Last week’s events caused significant damage to the industry, revealing shortcomings and loopholes in existing rules and mechanisms.

In today’s token markets, many investors and traders face challenges of information asymmetry and market uncertainty. This not only undermines investor confidence and interests but may also hinder overall market growth and innovation.

Therefore, we need stricter regulation and more transparent market rules to promote stability and reliability. Only through enhanced transparency and fairness can we attract more investors and participants into the ecosystem.

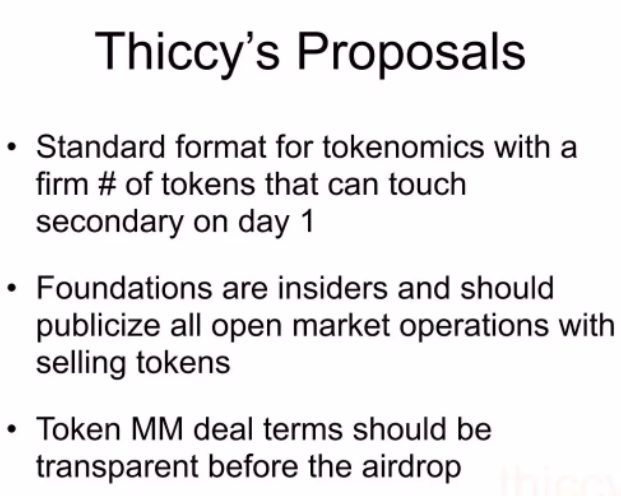

I believe we can collectively establish a social contract demanding future projects provide more transparent and open information and rules.

As investors and participants, we can take action toward this goal—for example, refusing to purchase governance tokens from projects that fail to provide adequate disclosures, or conducting more research, investigations, and oversight to safeguard market fairness and transparency.

At the same time, token issuers and market makers must also take responsibility by providing more information and disclosures to meet investor and market demands. Only through cooperation and collective effort can token markets become safer, fairer, and more reliable, creating greater opportunities and value for all participants.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News