Earning while slacking: exploring AI agent projects that optimize crypto workflows

TechFlow Selected TechFlow Selected

Earning while slacking: exploring AI agent projects that optimize crypto workflows

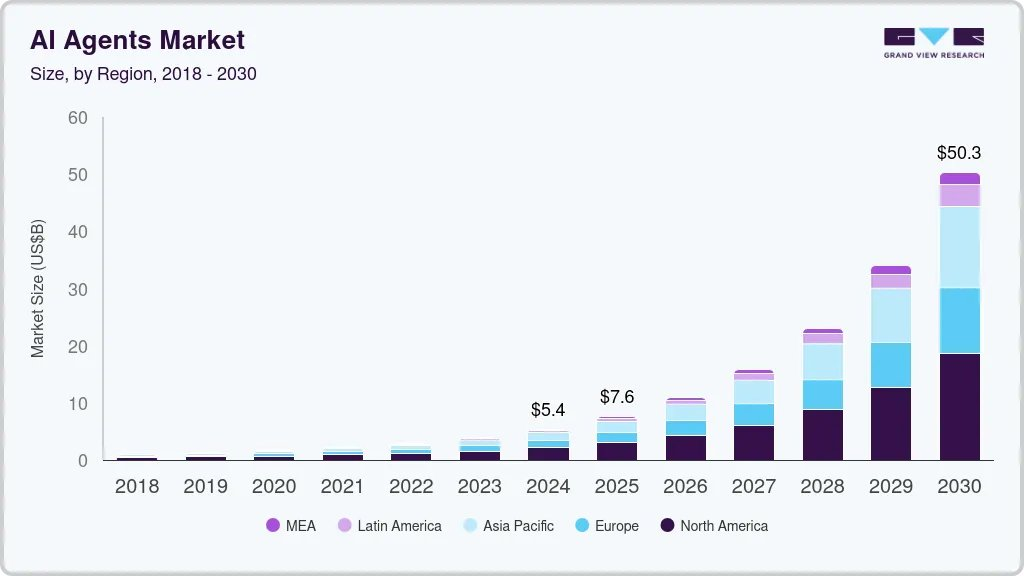

AI agents are disrupting three major sectors in the crypto space and significantly enhancing user productivity.

Author: Diego

Translation: TechFlow

Are you trading cryptocurrencies, using stablecoins for yield farming in DeFi, or placing bets on prediction markets?

Congratulations! You're part of the 99% in the crypto space—and one of the biggest beneficiaries of the AI agent revolution.

Let me be clear: AI agents can optimize your trading, yield farming, and prediction workflows, helping you earn more while giving you more free time to enjoy life.

Sounds too good to be true? Let me explain...

For context, I'm @diego_defai, a researcher focused on crypto and AI, with over 3.5 million views on X (formerly Twitter), and AI agents are my core research obsession.

In this article, we'll explore why you should integrate AI agents into your workflow and examine the top AI agent tools available today.

Three Areas Disrupted by AI Agents

AI agents are transforming three major areas in crypto, significantly boosting user efficiency:

-

Trading (spot & perpetuals)

-

Yield Farming (especially stablecoin-related)

-

Prediction Markets (e.g., Polymarket)

In these domains, AI agents offer countless advantages—from higher yields to more precise execution and analysis—greatly enhancing user experience and returns.

How Do AI Agents Actually Help Users?

Let's simplify it.

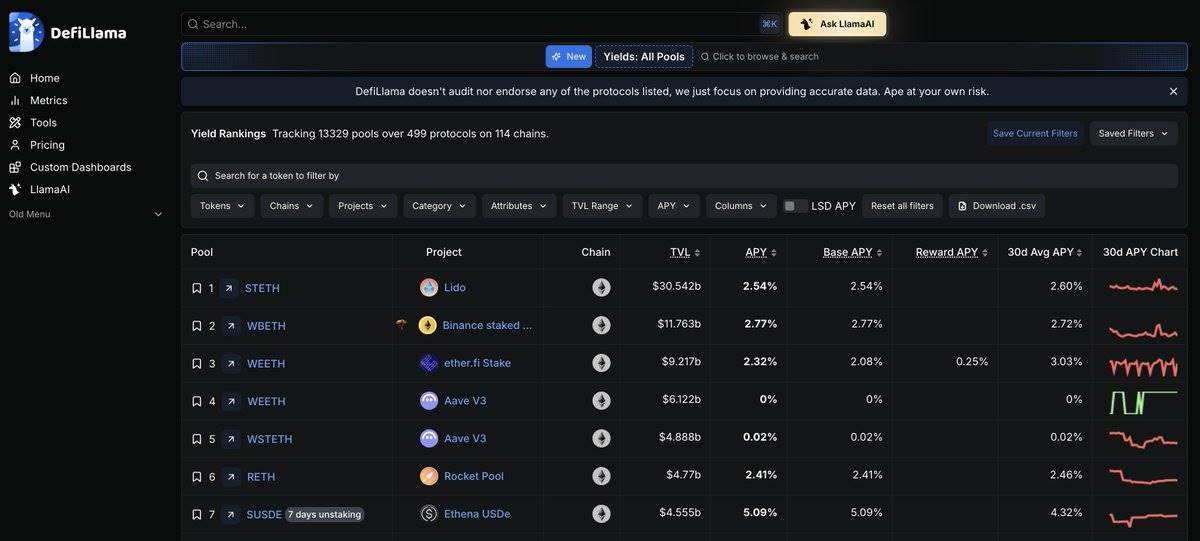

Suppose you have 10,000 USDC and want to allocate it to the most profitable DeFi yield farming opportunity.

Without an AI agent, you'd need to manually research various protocols. And since APYs change frequently, you’d have to monitor them 24/7 to stay updated.

If you’re a savvy yield farmer, you might use an APY aggregator to quickly spot opportunities. But even then, it’s far from optimal.

Now imagine a digital assistant—your AI agent—that tracks on-chain APYs in real-time and automatically moves your funds when better opportunities arise.

You no longer need to manually check APYs or personally execute transfers every time a new opportunity appears.

Today, AI agents can:

-

Earn higher APYs than humans (because they never sleep)

-

Automatically deploy assets when new opportunities emerge

-

Analyze data at a scale far beyond human capability

A human might evaluate up to 10 protocols, but an AI agent can scan 1,000 and instantly pick the best one.

This is why, with AI agents, you can achieve higher returns while having more time to "slack off" (i.e., enjoy life).

The Boring Part—They’re Also Safer

Beyond performance, AI agents significantly enhance security:

-

They interact directly with whitelisted smart contracts, avoiding risks from phishing sites, failed transactions, and malicious interfaces.

The result? Higher overall security.

Summary: Why should you use AI agents?

-

They’re more secure

-

They analyze massive amounts of data

-

They never sleep

-

They automatically deploy capital

Top AI Agents in Real-World Applications

Now that we understand why to use them, let’s explore the leading AI agents across the three key areas: yield farming, crypto trading, and prediction markets.

Yield Farming

If you're looking for optimally managed, fully passive stablecoin yields:

-

@ZyfAI: A multi-chain stablecoin agent that moves your USDC between Base and Arbitrum, delivering an average APY of around 22%.

-

@Almanak: Ideal if you love earning through airdrops. Deposit stablecoins to earn a 7% native APY plus points toward future airdrops.

-

@gizatechxyz (Arma Agent): For those who prefer predictable returns, Giza offers a fixed 15% APY.

Additionally, some agents offer passive yields on BTC and ETH:

-

@mamo: Uses $cbBTC, offering an average APY of 1–2%.

-

@gizatechxyz (Pulse Agent): Built on the @pendle_fi stack, it delivers a fixed 12% APY on ETH.

AI Agents for Traders

In trading, AI agents fall into two main categories:

-

Trading Companions: Help you analyze markets and refine decision-making.

-

Autonomous Trading Agents: Handle the entire trading process—including research, execution, and position management—on your behalf.

Trading Companions

-

@Velvet_Capital: If you like trading small-cap tokens (“shitcoins”), try their AI agent within the Velvet trading terminal.

-

@Cod3xOrg: Create your own trading agent and ask it for trade suggestions.

-

@HeyAnonai: Their HUD is a graphical overlay compatible with various trading interfaces, delivering real-time AI-powered insights.

Autonomous Trading Agents

-

@modenetwork: Offers two agents—Breakout Agent and Trend Agent. Just deposit USDC into their agent wallet and let them do the rest.

AI Agents for Prediction Markets

If you enjoy betting on prediction markets, consider these two types of AI agents:

-

Companion Agents: Assist with research and decision optimization.

-

Autonomous Agents: Place prediction bets on your behalf.

Prediction Companions

-

@polytraderAI: An AI assistant that spots arbitrage opportunities before humans by analyzing news, market sentiment, and inefficiencies.

-

@polybroapp: A research terminal providing deep AI-driven analysis across multiple prediction markets.

-

@polytaleai: Focuses on politics and sports, tracking whale activity, X platform sentiment, and news cycles to predict outcomes before others notice.

Autonomous Prediction Agents

-

@quantrix_agent: The Quantrix agent autonomously conducts research, predicts outcomes, and manages user portfolios.

-

@SemanticLayer: The first Polymarket agent, leveraging the x402 standard for autonomous trading and passive income generation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News